Global 3D Cell Cultures Market Forecast

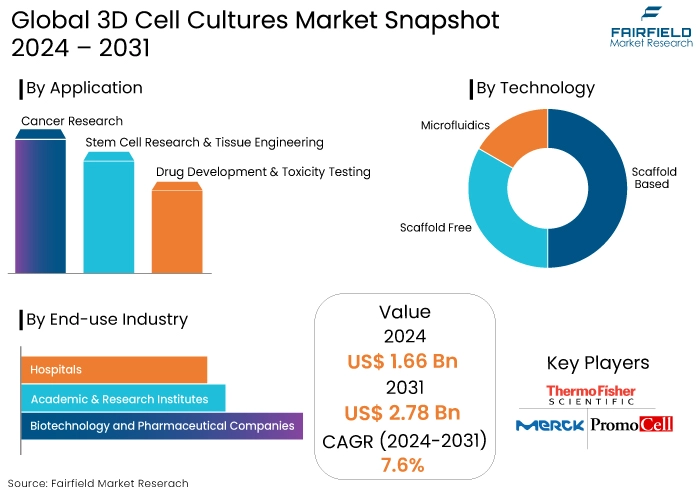

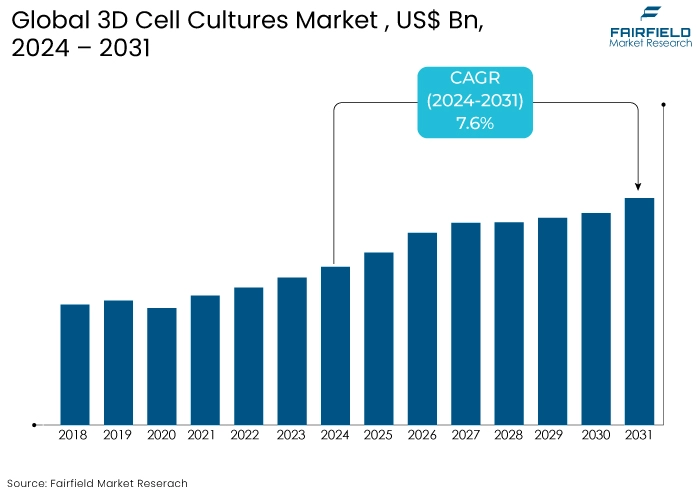

- The 3D cell cultures market is projected to reach a size of US$2.78 Bn by 2031, exhibiting significant growth from the US$1.66 Bn achieved in 2024.

- The market for 3D cell cultures is projected experience a significant expansion rate, with an estimated CAGR of 7.6% from 2024 to 2031.

3D Cell Cultures Market Insights

- The growing acceptance of 3D cultures by regulatory bodies drives the growth of the 3D cell cultures market over the forecast period.

- The adoption of 3D cell cultures in drug discovery and preclinical testing is a major market driving factor.

- High demand for 3D cell cultures in animal testing aids the research & developments activities in the industry.

- The advancements in tissue engineering and regenerative medicine aids the market’s growth.

- The increasing demand of 3D cell cultures for cancer research applications is one of the major market driving elements.

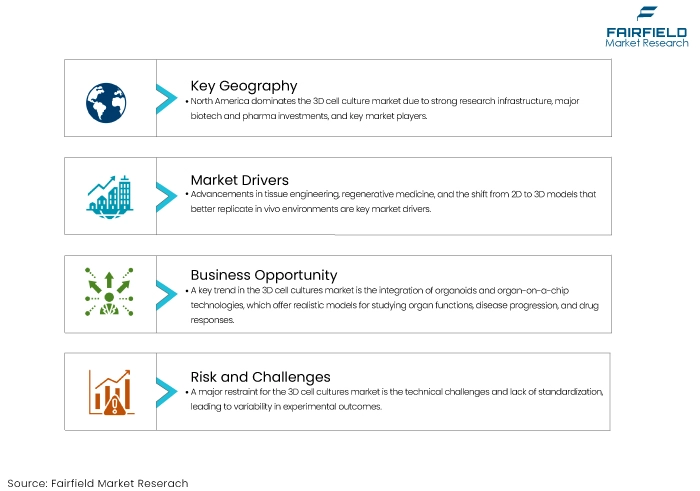

- North America region leads the global 3D cell cultures market.

- Integration of organoids and organ-on-a-chip technologies caters to boost the market’s revenue over the forecast period.

- The scaffold-based technology dominates the global market accounting for 48% of the total market share

A Look Back and a Look Forward - Comparative Analysis

The 3D cell cultures market experienced significant growth during the historical period from 2019 to 2023, driven by the increasing demand for more physiologically relevant models in drug discovery and development.

Key drivers included advancements in tissue engineering, regenerative medicine, and the shift from traditional 2D cultures to more sophisticated 3D models that better mimic in vivo environments.

Post-2024, the market for 3D cell cultures is expected to accelerate, with an anticipated CAGR of over 7.6%. Ongoing innovations in bio printing, organ-on-a-chip technologies, and the increasing adoption of 3D cultures in cancer research, personalized medicine, and toxicology testing will fuel this growth.

The market could also see expanded use in drug and high-throughput screening applications, supported by regulatory bodies’ increasing recognition of 3D models as more reliable predictors of human responses.

Collaborations between academic institutions and biopharmaceutical companies are likely to drive further advancements and market penetration. The Asia-Pacific region is expected to witness the highest growth due to rising research activities and government funding.

Key Growth Determinants

- Advancements in Tissue Engineering and Regenerative Medicine

One of the primary growth drivers for the 3D cell cultures market is the rapid progress in tissue engineering and regenerative medicine.

Traditional 2D cell cultures often fail to replicate the complex, three-dimensional architecture of human tissues, which limits their utility in developing effective treatments.

3D cell cultures provide a more accurate representation of human organs and tissues, enabling researchers to create more realistic models of disease states. This has opened new avenues for developing advanced therapies, including tissue grafts, organoids, and regenerative treatments that can be tailored to individual patients.

As the demand for personalized medicine continues to rise, the need for sophisticated 3D culture systems that can mimic the in vivo environment will drive further market growth.

- Increased Use in Drug Discovery and Development

Another significant growth driver is the expanding application of 3D cell cultures in drug discovery and development. Pharmaceutical companies are increasingly adopting 3D cell culture technologies to improve the predictability and efficiency of their drug screening processes.

Unlike 2D cultures, which often fail to predict the toxicity and efficacy of drugs accurately, 3D models offer a more reliable platform for testing potential therapeutics. This significantly reduces the likelihood of late-stage drug failures, thereby reassuring the industry about the efficiency of the drug development pipeline.

As regulatory agencies like the FDA begin to recognize the superiority of 3D cultures over traditional methods, their adoption in preclinical testing is expected to increase, further propelling 3D cell cultures market growth.

- Growing Demand for Cancer Research Applications

The rising prevalence of cancer and the need for more effective treatments have also fuelled the demand for 3D cell cultures. Cancer is a highly complex disease that involves multiple cell types and interactions within a 3D microenvironment.

Traditional 2D cultures often fail to replicate these complexities, leading to less effective research outcomes. 3D cell cultures, on the other hand, provide a more accurate model for studying tumour biology, metastasis, and drug resistance.

As cancer research continues to be a priority for healthcare systems worldwide, the potential of 3D cell culture models to revolutionize our understanding of cancer biology is expected to drive further 3D cell cultures market expansion.

Key Growth Barriers

- Technical Challenges and Standardization Issues

One of the significant restraints for the 3D cell cultures market is the technical challenges and need for standardization in 3D cell culture methods.

While 3D cultures offer a more accurate representation of in vivo conditions, they also introduce greater variability in experimental outcomes due to differences in culture techniques, materials, and conditions.

Such variability can complicate data interpretation and reduce the reproducibility of results, making it difficult for researchers to draw consistent conclusions across studies.

The lack of standardized protocols and guidelines for 3D cell culture practices can lead to inconsistencies in how experiments are conducted and reported, which hinders the ability to compare data across different studies and limits the broader adoption of 3D cell culture technologies in research and industry settings.

- High Cost and Complex Implementation

One of the primary restraints for the growth of the 3D cell cultures market is the high cost associated with developing and maintaining these systems.

Compared to traditional 2D cultures, 3D cell culture systems require specialized equipment, materials, and expertise, leading to higher operational costs.

The complexity of setting up and maintaining 3D cultures, particularly in scaling them for large-scale experiments, can be challenging for many laboratories, especially smaller research institutions with limited budgets.

The cost of acquiring and training personnel skilled in 3D cell culture techniques further adds to the overall expenses. These financial and logistical barriers can deter widespread adoption, particularly in emerging markets with more pronounced budget constraints.

3D Cell Cultures Market Trends and Opportunities

- Integration of Organoids and Organ-on-a-Chip Technologies

A significant trend in the 3D cell cultures market is the integration of organoids and organ-on-a-chip technologies.

Organoids are miniaturized, three-dimensional structures that mimic the organization and function of human organs. These models provide a more realistic environment for studying complex biological processes, such as organ development, disease progression, and drug responses.

The convergence of organoids with organ-on-a-chip technologies, which incorporate microfluidic systems to simulate blood flow and other physiological conditions, is revolutionizing biomedical research. This trend is particularly impactful in personalized medicine, where patient-derived organoids can test drug responses and tailor treatments to individual patients.

The ability to model human organs with high fidelity in a controlled environment also accelerates drug discovery, reduces reliance on animal testing, and enhances preclinical studies' predictive power.

As these technologies advance, they are expected to become a cornerstone of the 3D cell cultures market, driving innovation and expanding applications across various fields, including oncology, neurology, and toxicology.

- Expansion in Regenerative Medicine and Transplantation

The growing field of regenerative medicine presents a significant opportunity for the 3D cell cultures market. Regenerative medicine focuses on repairing or replacing damaged tissues and organs through the use of stem cells, tissue engineering, and other advanced techniques.

3D cell cultures play a crucial role in this field by providing a platform for developing and testing new therapies. 3D cultures can be used to create tissue grafts or organoids that replicate human organs’ structure and function, offering potential solutions for conditions that currently lack effective treatments.

3D cell cultures can be instrumental in transplantation research, where they can be used to grow organ-like structures that could one day be transplanted into patients. As the demand for organ transplants continues to outpace supply, the ability to engineer functional tissues and organs in the lab represents a transformative opportunity.

The above said potential, coupled with advances in stem cell research and bio printing technologies, positions the 3D cell cultures market to make significant contributions to the future of medicine, particularly in areas where traditional treatments have been insufficient.

As research progresses, the commercial applications of 3D cultures in regenerative medicine are likely to expand, offering substantial market growth opportunities.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario is increasingly shaping the 3D cell cultures market by providing frameworks that recognize the superiority of 3D models over traditional 2D cultures in preclinical testing and drug development. Regulatory agencies, such as the U.S.

Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are beginning to acknowledge 3D cell cultures, including organoids and organ-on-a-chip systems, as more accurate and reliable models for predicting human drug responses.

The push for more ethical research practices and the demand for alternative methods to animal testing are driving regulatory bodies to support the adoption of 3D cell cultures. As these models gain regulatory endorsement, they are likely to become a standard part of the drug approval process, encouraging pharmaceutical companies to invest more in 3D culture technologies.

The evolving regulatory landscape is expected to accelerate innovation and market growth by facilitating faster and more cost-effective drug development.

Fairfield’s Ranking Board

Segments Covered in the Report

- Scaffold-Based Technology Dominates the Market Accounting for 48% Of The Total Market Share

Based on technology, the 3D cell cultures market is further classified into Scaffold-Based, Scaffold-Free, Bioreactors, and Microfluidics, where the scaffold-based technology segment dominates the market.

The segment is subdivided into hydrogels, polymeric scaffolds, micro patterned surface microplates, and nanofiber-based scaffolds.

The expansion of this segment is expected to be driven by factors such as the growing use of scaffold-based cultures in tissue engineering and regenerative medicine applications, advancements in scaffold materials and construction techniques, and increased research funding and collaboration.

Hydrogels are employed as scaffolds in 3D cell culture model studies to include pharmacological and mechanical cues that mimic the natural extracellular matrix.

- Stem Cell Research and Tissue Engineering Segment Leads the Market with 32% of the Market Share

Based on application, the 3D cell cultures market is further segmented into cancer research, stem cell research and tissue engineering, and drug development and toxicity testing. The stem cell research and tissue engineering segment held the largest market share, a testament to the industry's innovative spirit.

The segment's growth is primarily driven by the rising demand for biopharmaceuticals, which may be attributed to the effectiveness of therapies such as cell and gene therapy, as well as the increase in approvals resulting from innovation. This emphasis on innovation should inspire confidence in the industry's future.

The cancer research segment is projected to have the highest Compound Annual Growth Rate (CAGR) over the forecast period. The increasing occurrence of cancer and the advantages provided by 3D culture models in cancer research are anticipated to propel the growth of this segment.

The benefits of 3D media in modifying cell proliferation and morphology, capturing phenotypic heterogeneity and providing flexibility further strengthen the case for expanding this market.

Regional Analysis

- North America Takes the Charge in the 3D Cell Cultures Market

North America is the dominant regional market for 3D cell cultures, driven by a combination of robust research infrastructure, significant investments in the biotechnology and pharmaceutical sectors, and a strong presence of leading market players.

The United States, in particular, is at the forefront of adopting advanced 3D cell culture technologies, fueled by extensive funding from government agencies such as the National Institutes of Health (NIH) and private sector investments.

The region's strong focus on innovative research, particularly in drug discovery, cancer research, and regenerative medicine, has created a thriving market for 3D cell cultures. North America benefits from a favourable regulatory environment that supports the adoption of 3D cell cultures in preclinical testing and drug development.

Regulatory agencies like the FDA are increasingly recognizing 3D models as superior alternatives to traditional 2D cultures, further boosting market growth. The presence of well-established academic institutions and research centers accelerates the development and commercialization of 3D culture technologies, solidifying North America's leadership position in the global market.

Fairfield’s Competitive Landscape Analysis

The presence of several key players, including Thermo Fisher Scientific, Corning Incorporated, Merck KGaA, and Lonza Group characterizes the competitive landscape of the 3D cell cultures market. The market is also witnessing increasing competition from emerging players and startups focusing on niche applications like organoids and organ-on-a-chip technologies.

Strategic mergers, acquisitions, and partnerships are expected as companies seek to expand their technological capabilities and market reach. Investments in research and development are high, with companies striving to introduce advanced 3D culture platforms that offer enhanced accuracy and scalability, thus intensifying the market's competitive dynamics.

Key Market Companies

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- PromoCell GmbH

- Lonza

- Corning Incorporated

- Avantor, Inc.

- Tecan Trading AG

- REPROCELL Inc.

- CN Bio Innovations Ltd

- Lena Biosciences

Recent Industry Developments

- September 2023 -

Curi Bio unveiled the introduction of two platforms, Nautilus and Stringray, to toaid researchers in conducting electrophysiological experiments on 2D or 3D cell cultures.

- July 2023 -

REPROCELL Inc. and Vernal Biosciences formed a cooperation to provide large-scale mRNA services for clinical and research purposes in Japan.

An Expert’s Eye

- The growing acceptance of 3D cultures by regulatory bodies is seen as a game-changer, likely to accelerate their adoption in drug discovery and preclinical testing.

- 3D cell cultures are praised for reducing the need for animal testing, aligning with the global shift towards more ethical research practices.

- Experts believe that 3D cell cultures represent the future of in vitro research, offering more accurate models for studying human diseases and drug responses.

- High costs and technical complexities remain significant barriers, though advancements in automation and standardization are expected to address these issues.

Global 3D Cell Cultures Market is Segmented as-

By Technology

- Scaffold Based

- Scaffold Free

- Microfluidics

By Application

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

By End-use Industry

- Biotechnology and Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

1. Executive Summary

1.1. Global 3D Cell Cultures Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global 3D Cell Cultures Market Outlook, 2019-2031

3.1. Global 3D Cell Cultures Market Outlook, by Product, Value (US$ Mn), 2019-2031

3.1.1. Key Highlights

3.1.1.1. Scaffold Free 3D Cell Culture

3.1.1.2. Scaffold Based 3D Cell Culture

3.1.1.2.1. Hydrogel based 3D cell culture

3.1.1.2.2. Polymeric Hard Material Based 3D cell Culture

3.2. Global 3D Cell Cultures Market Outlook, by Application, Value (US$ Mn), 2019-2031

3.2.1. Key Highlights

3.2.1.1. Drug Discovery

3.2.1.2. Tissue Regeneration & Regenerative Medicines

3.2.1.3. Cancer Research

3.2.1.4. Stem Cell Technology

3.2.1.5. Others

3.3. Global 3D Cell Cultures Market Outlook, by End User, Value (US$ Mn), 2019-2031

3.3.1. Key Highlights

3.3.1.1. Biotechnology and Pharmaceuticals Industries

3.3.1.2. Academic Research Institutes

3.3.1.3. Hospital Laboratories

3.3.1.4. Contract Research Organization

3.4. Global 3D Cell Cultures Market Outlook, by Region, Value (US$ Mn), 2019-2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America 3D Cell Cultures Market Outlook, 2019-2031

4.1. North America 3D Cell Cultures Market Outlook, by Product, Value (US$ Mn), 2019-2031

4.1.1. Key Highlights

4.1.1.1. Scaffold Free 3D Cell Culture

4.1.1.2. Scaffold Based 3D Cell Culture

4.1.1.2.1. Hydrogel based 3D cell culture

4.1.1.2.2. Polymeric Hard Material Based 3D cell Culture

4.2. North America 3D Cell Cultures Market Outlook, by Application, Value (US$ Mn), 2019-2031

4.2.1. Key Highlights

4.2.1.1. Drug Discovery

4.2.1.2. Tissue Regeneration & Regenerative Medicines

4.2.1.3. Cancer Research

4.2.1.4. Stem Cell Technology

4.2.1.5. Others

4.3. North America 3D Cell Cultures Market Outlook, by End User, Value (US$ Mn), 2019-2031

4.3.1. Key Highlights

4.3.1.1. Biotechnology and Pharmaceuticals Industries

4.3.1.2. Academic Research Institutes

4.3.1.3. Hospital Laboratories

4.3.2. Contract Research Organization

4.4. North America 3D Cell Cultures Market Outlook, by Country, Value (US$ Mn), 2019-2031

4.4.1. Key Highlights

4.4.1.1. U.S. 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

4.4.1.2. U.S. 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

4.4.1.3. U.S. 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

4.4.1.4. Canada 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

4.4.1.5. Canada 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

4.4.1.6. Canada 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

4.4.2. Market Attractiveness Analysis

5. Europe 3D Cell Cultures Market Outlook, 2019-2031

5.1. Europe 3D Cell Cultures Market Outlook, by Product, Value (US$ Mn), 2019-2031

5.1.1. Key Highlights

5.1.1.1. Scaffold Free 3D Cell Culture

5.1.1.2. Scaffold Based 3D Cell Culture

5.1.1.2.1. Hydrogel based 3D cell culture

5.1.1.2.2. Polymeric Hard Material Based 3D cell Culture

5.2. Europe 3D Cell Cultures Market Outlook, by Application, Value (US$ Mn), 2019-2031

5.2.1. Key Highlights

5.2.1.1. Drug Discovery

5.2.1.2. Tissue Regeneration & Regenerative Medicines

5.2.1.3. Cancer Research

5.2.1.4. Stem Cell Technology

5.2.1.5. Others

5.3. Europe 3D Cell Cultures Market Outlook, by End User, Value (US$ Mn), 2019-2031

5.3.1. Key Highlights

5.3.1.1. Biotechnology and Pharmaceuticals Industries

5.3.1.2. Academic Research Institutes

5.3.1.3. Hospital Laboratories

5.3.1.4. Contract Research Organization

5.3.2. Market Attractiveness Analysis

5.4. Europe 3D Cell Cultures Market Outlook, by Country, Value (US$ Mn), 2019-2031

5.4.1. Key Highlights

5.4.1.1. Germany 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

5.4.1.2. Germany 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

5.4.1.3. Germany 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

5.4.1.4. U.K. 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

5.4.1.5. U.K. 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

5.4.1.6. U.K. 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

5.4.1.7. France 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

5.4.1.8. France 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

5.4.1.9. France 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

5.4.1.10. Italy 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

5.4.1.11. Italy 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

5.4.1.12. Italy 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

5.4.1.13. Turkey 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

5.4.1.14. Turkey 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

5.4.1.15. Turkey 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

5.4.1.16. Russia 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

5.4.1.17. Russia 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

5.4.1.18. Russia 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

5.4.1.19. Rest of Europe 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

5.4.1.20. Rest of Europe 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

5.4.1.21. Rest of Europe 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

5.4.2. Market Attractiveness Analysis

6. Asia Pacific 3D Cell Cultures Market Outlook, 2019-2031

6.1. Asia Pacific 3D Cell Cultures Market Outlook, by Product, Value (US$ Mn), 2019-2031

6.1.1. Key Highlights

6.1.1.1. Scaffold Free 3D Cell Culture

6.1.1.2. Scaffold Based 3D Cell Culture

6.1.1.2.1. Hydrogel based 3D cell culture

6.1.1.2.2. Polymeric Hard Material Based 3D cell Culture

6.2. Asia Pacific 3D Cell Cultures Market Outlook, by Application, Value (US$ Mn), 2019-2031

6.2.1. Key Highlights

6.2.1.1. Drug Discovery

6.2.1.2. Tissue Regeneration & Regenerative Medicines

6.2.1.3. Cancer Research

6.2.1.4. Stem Cell Technology

6.2.1.5. Others

6.3. Asia Pacific 3D Cell Cultures Market Outlook, by End User, Value (US$ Mn), 2019-2031

6.3.1. Key Highlights

6.3.1.1. Biotechnology and Pharmaceuticals Industries

6.3.1.2. Academic Research Institutes

6.3.1.3. Hospital Laboratories

6.3.1.4. Contract Research Organization

6.3.2. Market Attractiveness Analysis

6.4. Asia Pacific 3D Cell Cultures Market Outlook, by Country, Value (US$ Mn), 2019-2031

6.4.1. Key Highlights

6.4.1.1. China 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

6.4.1.2. China 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

6.4.1.3. China 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

6.4.1.4. Japan 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

6.4.1.5. Japan 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

6.4.1.6. Japan 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

6.4.1.7. South Korea 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

6.4.1.8. South Korea 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

6.4.1.9. South Korea 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

6.4.1.10. India 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

6.4.1.11. India 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

6.4.1.12. India 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

6.4.1.13. Southeast Asia 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

6.4.1.14. Southeast Asia 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

6.4.1.15. Southeast Asia 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

6.4.1.16. Rest of Asia Pacific 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

6.4.1.17. Rest of Asia Pacific 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

6.4.1.18. Rest of Asia Pacific 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

6.4.2. Market Attractiveness Analysis

7. Latin America 3D Cell Cultures Market Outlook, 2019-2031

7.1. Latin America 3D Cell Cultures Market Outlook, by Product, Value (US$ Mn), 2019-2031

7.1.1. Key Highlights

7.1.1.1. Scaffold Free 3D Cell Culture

7.1.1.2. Scaffold Based 3D Cell Culture

7.1.1.2.1. Hydrogel based 3D cell culture

7.1.1.2.2. Polymeric Hard Material Based 3D cell Culture

7.2. Latin America 3D Cell Cultures Market Outlook, by Application, Value (US$ Mn), 2019-2031

7.2.1. Key Highlights

7.2.1.1. Drug Discovery

7.2.1.2. Tissue Regeneration & Regenerative Medicines

7.2.1.3. Cancer Research

7.2.1.4. Stem Cell Technology

7.2.1.5. Others

7.3. Latin America 3D Cell Cultures Market Outlook, by End User, Value (US$ Mn), 2019-2031

7.3.1. Key Highlights

7.3.1.1. Biotechnology and Pharmaceuticals Industries

7.3.1.2. Academic Research Institutes

7.3.1.3. Hospital Laboratories

7.3.1.4. Contract Research Organization

7.3.2. Market Attractiveness Analysis

7.4. Latin America 3D Cell Cultures Market Outlook, by Country, Value (US$ Mn), 2019-2031

7.4.1. Key Highlights

7.4.1.1. Brazil 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

7.4.1.2. Brazil 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

7.4.1.3. Brazil 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

7.4.1.4. Mexico 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

7.4.1.5. Mexico 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

7.4.1.6. Mexico 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

7.4.1.7. Argentina 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

7.4.1.8. Argentina 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

7.4.1.9. Argentina 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

7.4.1.10. Rest of Latin America 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

7.4.1.11. Rest of Latin America 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

7.4.1.12. Rest of Latin America 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

7.4.2. Market Attractiveness Analysis

8. Middle East & Africa 3D Cell Cultures Market Outlook, 2019-2031

8.1. Middle East & Africa 3D Cell Cultures Market Outlook, by Product, Value (US$ Mn), 2019-2031

8.1.1. Key Highlights

8.1.1.1. Scaffold Free 3D Cell Culture

8.1.1.2. Scaffold Based 3D Cell Culture

8.1.1.2.1. Hydrogel based 3D cell culture

8.1.1.2.2. Polymeric Hard Material Based 3D cell Culture

8.2. Middle East & Africa 3D Cell Cultures Market Outlook, by Application, Value (US$ Mn), 2019-2031

8.2.1. Key Highlights

8.2.1.1. Drug Discovery

8.2.1.2. Tissue Regeneration & Regenerative Medicines

8.2.1.3. Cancer Research

8.2.1.4. Stem Cell Technology

8.2.1.5. Others

8.3. Middle East & Africa 3D Cell Cultures Market Outlook, by End User, Value (US$ Mn), 2019-2031

8.3.1. Key Highlights

8.3.1.1. Biotechnology and Pharmaceuticals Industries

8.3.1.2. Academic Research Institutes

8.3.1.3. Hospital Laboratories

8.3.1.4. Contract Research Organization

8.3.2. Market Attractiveness Analysis

8.4. Middle East & Africa 3D Cell Cultures Market Outlook, by Country, Value (US$ Mn), 2019-2031

8.4.1. Key Highlights

8.4.1.1. GCC 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

8.4.1.2. GCC 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

8.4.1.3. GCC 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

8.4.1.4. South Africa 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

8.4.1.5. South Africa 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

8.4.1.6. South Africa 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

8.4.1.7. Egypt 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

8.4.1.8. Egypt 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

8.4.1.9. Egypt 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

8.4.1.10. Nigeria 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

8.4.1.11. Nigeria 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

8.4.1.12. Nigeria 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

8.4.1.13. Rest of Middle East & Africa 3D Cell Cultures Market by Product, Value (US$ Mn), 2019-2031

8.4.1.14. Rest of Middle East & Africa 3D Cell Cultures Market by Application, Value (US$ Mn), 2019-2031

8.4.1.15. Rest of Middle East & Africa 3D Cell Cultures Market by End User, Value (US$ Mn), 2019-2031

8.4.2. Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Product vs By Application Heat map

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Merck KGaA (Sigma-Aldrich Corporation)

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Thermo Fisher Scientific, Inc.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Corning Incorporated.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Becton.Dickinson and Company

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. 3D Biotek LLC.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Lonza Group.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. InSphero AG.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Synthecon, Inc

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Nanofiber Solutions, Inc

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Greiner Group A

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Technology Coverage |

|

|

Application Coverage |

|

|

End-use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |