Global 3D Printed Medical Implant Market Forecast

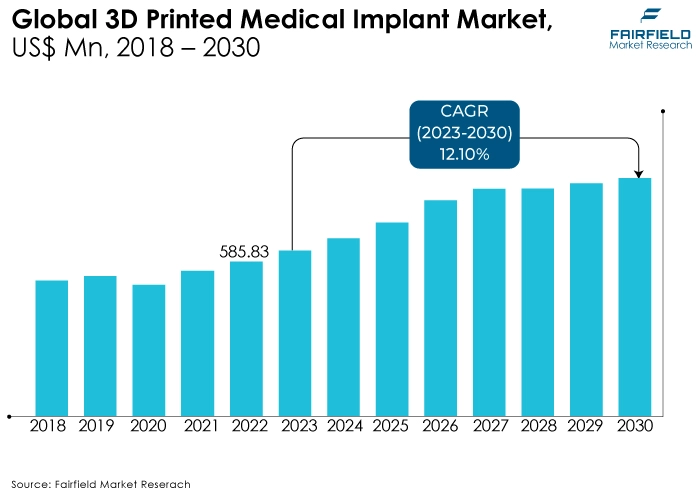

- The US$585.8 Mn 3D printed medical implants market 2023 expects revenue of around US$1,511.1 Mn in 2030

- Global market for 3D printed medical implants to expand at a CAGR of 12.1% during 2023 - 2030

Quick Report Digest

- The 3D printed medical implant market has experienced substantial growth, reflecting a surge in adoption across various medical specialties. The market's size is expanding as 3D printing technology continues to revolutionise the production of patient-specific implants.

- One of the defining trends in the market is the emphasis on customisation and patient-specific implant solutions. 3D printing enables the creation of implants tailored to individual patient anatomies, enhancing treatment outcomes and reducing the risk of complications.

- Advancements in 3D printing materials, particularly biocompatible options, have played a pivotal role in expanding the application of 3D printed medical implants. Researchers and manufacturers are focusing on materials that not only meet structural requirements but also promote optimal integration with the patient's body.

- The orthopedic segment stands out as a major beneficiary of 3D printing technology. Customised implants for joint replacements, spinal surgeries, and orthopedic trauma are increasingly prevalent, with 3D printing offering unparalleled precision and adaptability.

- The dental industry is witnessing a paradigm shift with the adoption of 3D printed medical implants. From dental crowns and bridges to complex maxillofacial reconstructions, 3D printing is revolutionising dental prosthetics, providing efficient and aesthetically pleasing solutions.

- The regulatory landscape governing 3D printed medical implants is evolving. The market is responding with a focus on adherence to regulatory standards and the establishment of industry-wide guidelines to ensure the safety and efficacy of printed implants.

- Collaborations between medical institutions, research organisations, and 3D printing companies are on the rise. These partnerships aim to advance research, refine printing techniques, and accelerate the development of innovative medical implant solutions.

- 3D printing technology offers cost-effective and time-efficient solutions for medical implant production. Manufacturers are leveraging the benefits of on-demand printing, reducing lead times and optimising the overall cost of producing customised implants.

- The 3D printed medical implant market is expanding globally, with increased accessibility in both developed and developing regions. Efforts are being made to make this cutting-edge technology available to a wider range of healthcare providers, ensuring a more inclusive approach to patient care.

A Look Back and a Look Forward - Comparative Analysis

The market for 3D printed medical implants is now expanding rapidly due to the development of additive manufacturing technology and the growing need for individualised healthcare solutions. The use of 3D printing in orthopedics, dentistry, and other medical specialties has increased due to its capacity to create complex, individualised implants that are suited to each patient's needs. The market is currently growing because of the investments made by major players in R&D, innovation, and product portfolio growth. Additionally, partnerships between healthcare organisations and 3D printing companies, as well as governmental clearances, are propelling the market's expansion.

The market for 3D printed medical implants has gradually evolved over time, driven by advancements in technology and a greater level of acceptance among the medical community. Prototyping and experimental uses were the main emphasis of early adoption; but, as the technology developed and proved effective, it began to be used in regular medical procedures. The market's current state was made possible by the historical expansion, which shows how the benefits of 3D printed medical implants were widely recognised after initial mistrust.

The future of the 3D printed medical implant market holds immense promise, poised for exponential growth. Anticipated technological advancements, such as improved biocompatible materials and faster printing processes, will enhance efficiency and expand the scope of applications. Increasing integration of artificial intelligence in design processes and rising collaborations between medical professionals and 3D printing experts will lead to more sophisticated and tailored solutions.

Additionally, as regulatory frameworks become more accommodating, the market is likely to witness a surge in innovative implant designs, offering patients safer and more effective treatment options. The 3D printed medical implant market is positioned for sustained expansion, revolutionising patient care through personalised and advanced medical solutions.

Key Growth Determinants

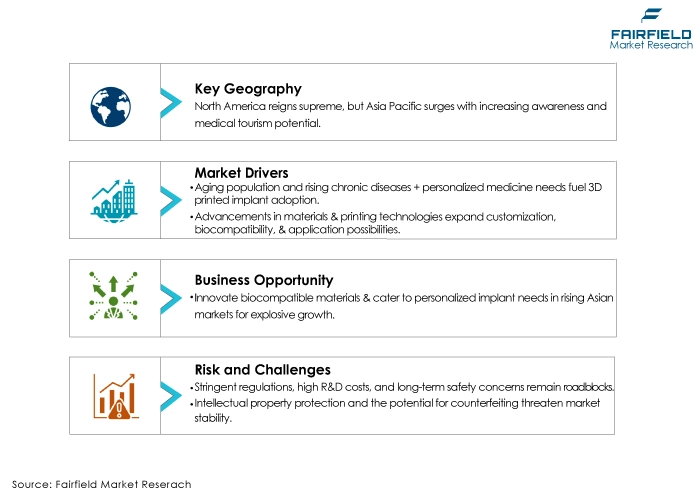

- Advancements in Additive Manufacturing Technologies that Enhance Implant Precision and Complexity

The market for medical implants made via additive manufacturing is expanding at a rapid pace thanks in large part to the ongoing development of these technologies. The printing techniques have been improved through ongoing research and development, enabling the fabrication of implants with previously unheard-of precision and complexity.

Improved layering techniques, biocompatible materials, and high-resolution printing are some of the innovations that help create implants that closely resemble real anatomical features. This increased accuracy not only makes the implants more successful overall but also makes it possible for medical personnel to provide specialised care for complicated medical problems. The market is seeing a spike in demand for 3D printed implants across a range of medical specialties as technology continues to progress.

- Customisation and Personalisation Trends

The increasing use of 3D printed medical implants is largely due to the growing emphasis on customised healthcare solutions. Conventional manufacturing techniques frequently find it difficult to satisfy each patient's specific, varied needs. Nonetheless, 3D printing makes it possible to create implants that are unique to each patient's anatomical needs. This degree of customisation lowers the chance of problems, increases patient satisfaction, and improves treatment outcomes.

There is a growing need for 3D printed medical implants in orthopedics, craniofacial reconstruction, and other specialised medical sectors as surgeons and healthcare professionals realise more and more the advantages of customising implants to the patient's unique anatomy.

- Rising Incidence of Chronic Diseases, and Orthopedic Disorders

The global increase in the prevalence of orthopedic illnesses and chronic diseases is a major factor driving the market for 3D printed medical implants. Implants are sometimes required for pain relief and functional rehabilitation in conditions such as osteoarthritis, osteoporosis, and severe injuries. By allowing the creation of implants according to each patient's specifications and the distinct qualities of the affected location, 3D printing technology provides a flexible remedy.

Better biocompatibility and functionality are becoming more and more necessary for implants as the world's population ages and the prevalence of chronic illnesses rises. This demographic trend places 3D printed medical implants as a key element in the therapy paradigm for a variety of medical diseases, as does the technology's capacity to meet individual patient needs.

Major Growth Barriers

- Regulatory Challenges, and Certification Hurdles

The market for 3D printed medical implants is severely constrained by the complex regulatory environment that surrounds medical products. Longer approval durations are frequently the result of rigorous certification procedures and the requirement for compliance with numerous international standards.

Successfully navigating these regulatory obstacles is a barrier to entrance for both established businesses and up-and-coming firms. The intricate process of guaranteeing safety, effectiveness, and quality requirements may impede the swift commercialisation of 3D printed medical implants, hence restricting the market's potential growth and delaying the assimilation of novel solutions into conventional healthcare procedures.

- Material Limitations and Biocompatibility Concerns Pose Technical Constraints

The market for 3D printed medical implants is yet significantly constrained by material constraints, even in the face of technological breakthroughs. While a large variety of biocompatible materials are available for 3D printing, it can still be difficult to find the right combination of robustness, longevity, and biocompatibility for some uses.

It is a challenging effort to make sure 3D printed implants don't cause problems or negative reactions while yet meeting the strict requirements for long-term implantation. The introduction of innovative implant solutions is slowed down and the market's overall growth is hindered by research and development constraints caused by biocompatibility issues and the requirement for comprehensive material testing.

Key Trends and Opportunities to Look at

- Personalised Implants Gaining Traction

The market for 3D printed medical implants is expanding significantly in response to the trend toward customised healthcare solutions. The growing popularity of this approach is being driven by patients' increasing demand for implants that are specifically matched to their unique anatomy.

To design accurate implants that are tailored to each patient, companies are investing in cutting-edge imaging tools and software. Innovative tailored implants are being developed thanks to notable partnerships between medical facilities and 3D printing businesses. Brands are taking advantage of this trend to gain a competitive advantage and increase their market presence, particularly in North America and Europe.

- Expansion of 3D Printing Materials and Technologies

The creation and application of various 3D printing materials and technologies are booming in the industry. The development of biocompatible and bioresorbable materials, along with the ability to print many materials at once, characterise this movement. To promote broad adoption, businesses are aggressively funding research to improve material qualities and printing processes.

Important firms are expanding their material portfolios through strategic alliances and acquisitions. Globally, this trend is picking up steam, and businesses in Asia-Pacific are leading the way. This presents chances for brands to expand into new regions and diversify their product lines.

- The Rise of Point-of-Care 3D Printing for Implants

Point-of-care 3D printing for medical implants is becoming more and more popular, particularly in distant and emergencies. The delivery of healthcare is being revolutionised by the capacity to quickly make implants on-site utilising portable 3D printers. Businesses are creating more portable and intuitive 3D printers, which is driving the uptake of this trend in a variety of geographical areas.

The use of point-of-care 3D printing in field hospitals and ambulances is one noteworthy development. It is anticipated that brands will benefit from this trend by providing scalable and easily accessible point-of-care solutions, meeting the increasing demand for prompt and personalised medical interventions worldwide.

How Does the Regulatory Scenario Shape this Industry?

The quality, safety, and effectiveness of these cutting-edge medical solutions are guaranteed by the regulatory environment, which has a substantial impact on the 3D printed medical implant market. The establishment and enforcement of standards are crucially dependent on regulatory authorities like the European Medicines Agency (EMA), the US Food and Drug Administration (FDA), and other international equivalents.

By use of guidance publications such as "Technical Considerations for Additive Manufactured Medical Devices," the FDA establishes qualification standards. In a similar vein, the EMA offers standards regarding the safety and quality of medical items that are 3D printed. Market access is affected by regional developments, such as the Medical Device Regulation (MDR) of the European Union.

Adherence to these laws is crucial for access to the market, prompting firms to allocate resources toward extensive testing and documentation. Ongoing regulatory updates and international harmonisation efforts ensure a standardised and safe environment for the 3D printed medical implant market (FDA, "Technical Considerations for Additive Manufactured Medical Devices," 2017; European Medicines Agency, "3D Printing/Additive Manufacturing of Medicinal Products," 2017).

Fairfield’s Ranking Board

Top Segments

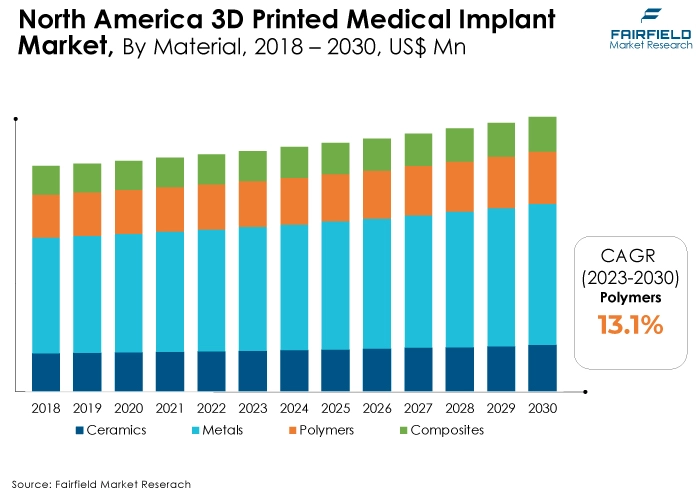

- Metals Dominate the 3D printed medical implant market

The largest segment in the 3D printed medical implant market is metals. Advances in metal 3D printing technology have revolutionised the production of medical implants, especially in orthopedics and other critical applications. The ability to create complex geometries, precise structures, and customised implants tailored to individual patients' needs has accelerated the adoption of metal-based 3D printing. The demand for durable and biocompatible materials, coupled with the expanding applications in orthopedic surgeries, positions metals as the frontrunners in the rapid evolution of the 3D printed medical implant market.

Polymers are the fastest-growing material segment in the 3D printed medical implant market, driven by their versatility, biocompatibility, and ability to replicate complex structures with high precision. The versatility of polymers in 3D printing allows for the creation of a wide range of medical implants, particularly in applications like dentistry and hearing aids. The cost-effectiveness, lightweight nature, and ability to produce intricate designs make polymer-based 3D printing a significant player in the market. As technology continues to advance, the polymer segment witnesses substantial growth, catering to the increasing demand for affordable and customised medical implants across various healthcare applications.

- Dentistry Leading the 3D printed medical implant market

The largest growing segment in the 3D printed medical implant market is within dentistry. The dental application of 3D printed implants has gained immense traction due to the technology's ability to produce highly accurate and customised dental solutions. From crowns and bridges to dental implants, 3D printing offers efficiency, precision, and patient-specific designs. The dental industry's embrace of digital dentistry, coupled with the increasing demand for aesthetically pleasing and functional dental solutions, positions dentistry as the largest growing segment within the 3D printed medical implant market. The transformative impact on dental practices contributes significantly to market expansion.

The fastest-growing segment in the 3D printed medical implant market is within orthopedic applications. The demand for customised and precisely tailored implants for orthopedic surgeries, including joint replacements, is witnessing unprecedented growth. 3D printing technology allows for intricate designs that match the patient's anatomy, resulting in improved outcomes, reduced recovery times, and enhanced patient satisfaction. The continuous advancements in materials and printing techniques further contribute to the rapid adoption of 3D printed implants in the orthopedic field, making it the forefront runner in terms of growth within the market.

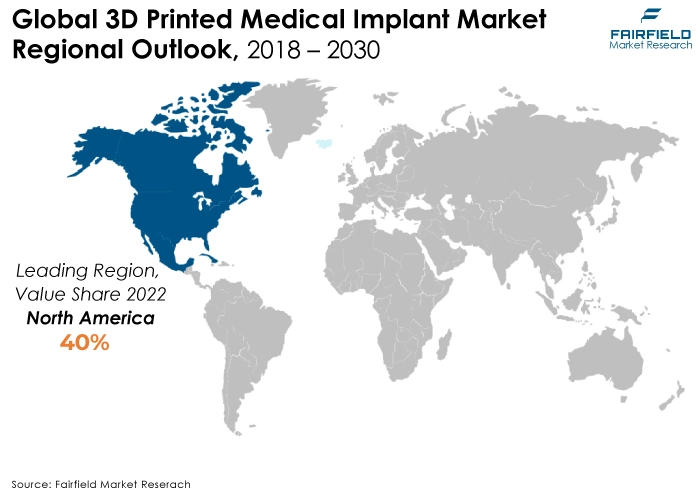

Regional Outlook

North America Dominating the Market with Technological Advancements in the Global 3D printed medical implant market

North America commands a large 40-45% market share, demonstrating its supremacy in the 3D printed medical implant market. The region's excellent healthcare infrastructure, substantial R&D, and early and enthusiastic adoption of cutting-edge medical innovations are largely responsible for its leadership position. The US, in particular, makes substantial investments in healthcare innovation, which greatly contributes to the region's market share.

North America's importance as a major driver of market expansion is shown by the predicted CAGR of 17-19%. North America is leading the way in the field of 3D printed medical implants due to improvements in technology and payment rules. As a result, the region remains a focal point for major market players, emphasising innovation and market penetration to maintain and expand their share in this dynamic and rapidly evolving market.

Asia Pacific as a Fastest Growing Market Fueled by Rising Healthcare Investments

Asia Pacific, with a projected CAGR of 25-28%, is the region with the fastest rate of growth for 3D printed medical implants. Increased spending on healthcare, an aging population, and a rising need for cutting-edge medical treatments are driving this expansion. Important contributors include China, and India, whose healthcare infrastructure has advanced significantly. With an estimated 20-25% of the global market, the area plays a crucial part in the 3D printed medical implant market's steady rise worldwide.

The adoption of breakthrough medical technologies is being propelled by a rise in disposable money and increased awareness. Asia Pacific's dynamic market landscape provides a fertile ground for market players to establish a strong presence, capitalise on burgeoning opportunities, and contribute significantly to the evolving narrative of 3D printed medical implants in the region.

Fairfield’s Competitive Landscape Analysis

The market for 3D printed medical implants is booming, with well-established heavyweights like Medtronic, and Stryker competing against agile upstarts like MedShape, and BioArchitects. The environment is shaped by collaborations and M&A activities, like as J&J's acquisition of EIT but material players like Stratasys, and EOS supply the framework.

The dynamism is increased by growing regional players like China's growing Implant Technologies. All things considered, there is intense competition because of the rush for customised implants, cutting-edge materials, and regulatory clearances, which is propelling the market's quick development.

Who are the Leaders in Global 3D Printed Medical Implant Space?

- Cerhum SA

- Oxford Performance Materials Inc.

- Straumann Group

- MedShape, Inc.

- Renovis Surgical Technologies, Inc.

- BioArchitects

- 3D Medical Manufacturing, Inc.

- EOS GmbH

- Stratasys Ltd.

- Emerging Implant Technologies GmbH

Significant Company Developments

New Product Launch:

- August 2023: Medtronic: Launched the PEAK Spinal System, a next-generation 3D printed titanium interbody spacer with advanced surface technology for faster fusion and improved bone growth.

Partnership:

- July 2023: Stryker: Partnered with Materialise, a leading medtech software company, to develop and commercialise 3D printed cervical interbody fusion devices with innovative bone ingrowth features.

M&A:

- June 2023: Emerging Implant Technologies (EIT): Acquired by Johnson & Johnson, expanding J&J's portfolio of interbody spine implants and strengthening its presence in the minimally invasive surgery market.

Collaboration:

- May 2023: Renishaw: Partnered with the University of Manchester's Biomaterials & Medical Implants Group to research and develop novel biocompatible materials for 3D printed medical implants.

Regional Expansion:

- March 2023: EOS GmbH: Opened a new technology center in India, aiming to cater to the growing demand for 3D printing solutions in the Asia Pacific region.

Product Differentiation:

- December 2022: Oxford Performance Materials: Introduced ENHANCE®, a revolutionary biocompatible PEEK filament for 3D printing, offering superior strength and wear resistance for orthopedic implants.

An Expert’s Eye

Demand and Future Growth

The market for medical implants made via 3D printing will rise significantly. The need for individualised and cutting-edge healthcare solutions is fueled by the increased incidence of chronic diseases and an aging population. Demand in orthopedics, dentistry, and other medical specialties is rising as 3D printing technology advances and offers more precision and personalisation.

Future expansion is expected to be fueled by continued technology advancements, increased material capacities, and the incorporation of artificial intelligence. The market for 3D printed medical implants is well-positioned to address changing healthcare demands and is showing signs of significance and sustainability.

Supply Side of the Market

According to our analysis, The long-term health of the 3D printed medical implant market depends on ongoing technology advancements, ongoing research and development expenditures, and changing regulatory environments. Industry participants may face difficulties with material developments and regulatory compliance. The current robust demand-supply dynamics are fueled by the growing desire for individualised healthcare solutions.

The pricing scheme strikes a compromise between market acceptance and technology expenses. Competitive factors like material diversification and AI integration will impact long-term growth. A robust and effective supply chain is essential. In this dynamic and attractive sector, there are several chances to meet unmet medical needs, stimulate innovation, and navigate shifting consumer preferences.

Global 3D Printed Medical Implant is Segmented as Below:

By Material

- Ceramics

- Metals

- Polymers

- Composites

By Application

- Hearing Aids

- Dentistry

- Orthopaedic

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global 3D Printed Medical Implant Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global 3D Printed Medical Implant Market Outlook, 2018 - 2030

3.1. Global 3D Printed Medical Implant Market Outlook, By Material, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Ceramics

3.1.1.2. Metals

3.1.1.3. Polymers

3.1.1.4. Composites

3.2. Global 3D Printed Medical Implant Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Hearing Aids

3.2.1.2. Dentistry

3.2.1.3. Orthopaedic

3.2.1.4. Others

3.3. Global 3D Printed Medical Implant Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America 3D Printed Medical Implant Market Outlook, 2018 - 2030

4.1. North America 3D Printed Medical Implant Market Outlook, By Material, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Ceramics

4.1.1.2. Metals

4.1.1.3. Polymers

4.1.1.4. Composites

4.2. North America 3D Printed Medical Implant Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Hearing Aids

4.2.1.2. Dentistry

4.2.1.3. Orthopaedic

4.2.1.4. Others

4.3. North America 3D Printed Medical Implant Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

4.3.1.2. U.S. 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

4.3.1.3. Canada 3D Printed Medical Implant Market By Material, Value (US$ Mn), 2018 - 2030

4.3.1.4. Canada 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe 3D Printed Medical Implant Market Outlook, 2018 - 2030

5.1. Europe 3D Printed Medical Implant Market Outlook, By Material, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Ceramics

5.1.1.2. Metals

5.1.1.3. Polymers

5.1.1.4. Composites

5.2. Europe 3D Printed Medical Implant Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Hearing Aids

5.2.1.2. Dentistry

5.2.1.3. Orthopaedic

5.2.1.4. Others

5.3. Europe 3D Printed Medical Implant Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

5.3.1.2. Germany 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

5.3.1.3. U.K. 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

5.3.1.4. U.K. 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

5.3.1.5. France 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

5.3.1.6. France 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

5.3.1.7. Italy 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

5.3.1.8. Italy 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

5.3.1.9. Turkey 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

5.3.1.10. Turkey 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

5.3.1.11. Russia 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

5.3.1.12. Russia 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

5.3.1.13. Rest of Europe 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

5.3.1.14. Rest of Europe 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific 3D Printed Medical Implant Market Outlook, 2018 - 2030

6.1. Asia Pacific 3D Printed Medical Implant Market Outlook, By Material, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Ceramics

6.1.1.2. Metals

6.1.1.3. Polymers

6.1.1.4. Composites

6.2. Asia Pacific 3D Printed Medical Implant Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Hearing Aids

6.2.1.2. Dentistry

6.2.1.3. Orthopaedic

6.2.1.4. Others

6.3. Asia Pacific 3D Printed Medical Implant Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

6.3.1.2. China 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

6.3.1.3. Japan 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

6.3.1.4. Japan 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

6.3.1.5. South Korea 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

6.3.1.6. South Korea 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

6.3.1.7. India 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

6.3.1.8. India 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

6.3.1.9. Southeast Asia 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

6.3.1.10. Southeast Asia 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

6.3.1.13. Detection System Market Capacity, Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America 3D Printed Medical Implant Market Outlook, 2018 - 2030

7.1. Latin America 3D Printed Medical Implant Market Outlook, By Material, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Ceramics

7.1.1.2. Metals

7.1.1.3. Polymers

7.1.1.4. Composites

7.2. Latin America 3D Printed Medical Implant Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Hearing Aids

7.2.1.2. Dentistry

7.2.1.3. Orthopaedic

7.2.1.4. Others

7.3. Latin America 3D Printed Medical Implant Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

7.3.1.2. Brazil 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

7.3.1.3. Mexico 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

7.3.1.4. Mexico 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

7.3.1.5. Argentina 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

7.3.1.6. Argentina 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

7.3.1.7. Rest of Latin America 3D Printed Medical Implant Market By Material, Value (US$ Mn), 2018 - 2030

7.3.1.8. Rest of Latin America 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa 3D Printed Medical Implant Market Outlook, 2018 - 2030

8.1. Middle East & Africa 3D Printed Medical Implant Market Outlook, By Material, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Ceramics

8.1.1.2. Metals

8.1.1.3. Polymers

8.1.1.4. Composites

8.2. Middle East & Africa 3D Printed Medical Implant Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Hearing Aids

8.2.1.2. Dentistry

8.2.1.3. Orthopaedic

8.2.1.4. Others

8.3. Middle East & Africa 3D Printed Medical Implant Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

8.3.1.2. GCC 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

8.3.1.3. South Africa 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

8.3.1.4. South Africa 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

8.3.1.5. Egypt 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

8.3.1.6. Egypt 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

8.3.1.7. Nigeria 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

8.3.1.8. Nigeria 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa 3D Printed Medical Implant Market by Material, Value (US$ Mn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa 3D Printed Medical Implant Market by Application, Value (US$ Mn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Capacity vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Cerhum SA,

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Oxford Performance Materials Inc

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Straumann Group

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. MedShape, Inc.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Renovis

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Surgical Technologies, Inc

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. BioArchitects

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. 3D Medical Manufacturing, Inc.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. EOS GmbH, Stratasys Ltd.,

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Emerging Implant Technologies GmbH

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Material Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |