Global 3D Printing Polymer Material Market Forecast

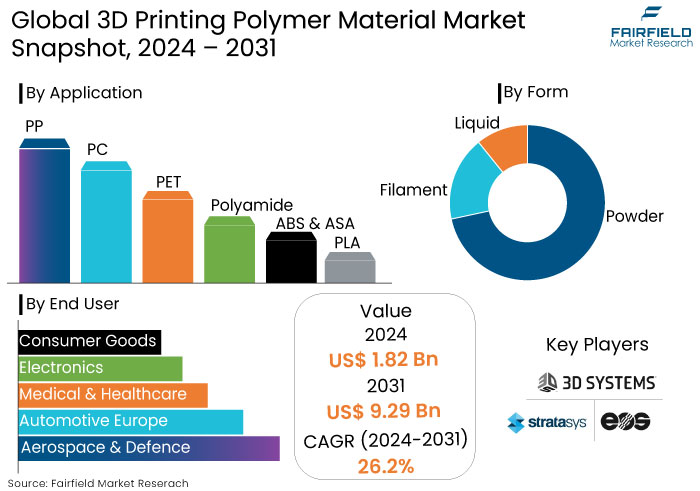

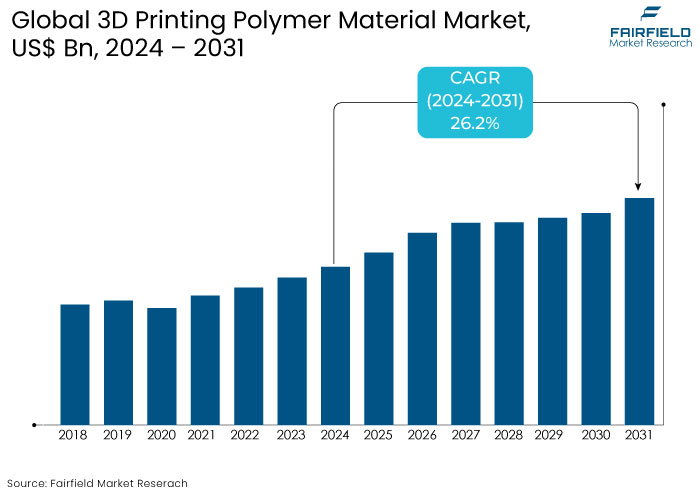

- The 3D printing polymer material market is likely to be valued at US$9.29 Bn by 2031, showing significant growth from the US$1.82 Bn achieved in 2024.

- The market for 3D printing polymer material is anticipated to showcase a significant expansion rate, with an estimated CAGR of 26.2% from 2024 to 2031.

3D Printing Polymer Material Market Insights

- Increasing adoption across industries like healthcare, automotive, and aerospace drives the 3D printing polymer material market.

- PLA is the leading polymer due to its ease of use, cost-effectiveness, and environmental friendliness.

- High-performance materials like PEEK and polyamide are gaining traction for demanding applications requiring durability and heat resistance.

- Rising focus on bio-based and recyclable polymers is shaping market dynamics in response to environmental regulations.

- Innovations in 3D printing technologies, such as multi-material printing, are enhancing material versatility.

- North America and Asia Pacific dominate the market due to advanced manufacturing capabilities and expanding industrial applications.

- Biocompatible polymers are driving growth in the healthcare sector for applications like prosthetics, implants, and surgical tools.

- The ability to produce personalized, on-demand products is a key driver for market across multiple sectors.

A Look Back and a Look Forward - Comparative Analysis

The 3D market printing polymer material market fueled by the factors such as increasing adoption across industries including automotive, aerospace, healthcare, and consumer goods. Also, the versatility of polymer materials, including PLA, ABS, PETG, and advanced engineering polymers like PEEK and nylon, made them popular choices for both prototyping and end use applications.

Technological advancements in 3D printing hardware and software further boosted market growth by improving precision and reducing costs. The demand for lightweight and sustainable materials also spurred innovation in bio-based and recyclable polymers. However, the market faced challenges such as high material costs and limited awareness in certain regions, which restricted its full potential.

The market is anticipated to witness a surge driven by innovations in material science and increasing industrial adoption of 3D printing for mass production over the forecast period. Developing high-performance polymer composites with enhanced strength, heat resistance, and durability will expand applications in sectors like aerospace and automotive.

Sustainability will be crucial, with bio-based and biodegradable polymers gaining traction. The healthcare industry is expected to be a significant growth driver, leveraging biocompatible polymers for personalized medical devices and implants.

Expanding 3D printing technologies, such as multi-material printing and faste production speeds, will further enhance market dynamics, positioning 3D printing polymers as critical enablers of advanced manufacturing.

Key Growth Determinants

- Rise in Customization and On-Demand Manufacturing

The rise in demand for customization and on-demand manufacturing is a crucial driver for the 3D printing polymer material market. The ability of 3D printing to produce highly personalized products, such as custom-fit medical devices and tailored consumer goods has revolutionized traditional manufacturing models.

The trend is particularly prominent in the healthcare industry, where polymers are used to create patient-specific implants and prosthetics. On-demand manufacturing eliminates the need for large inventories, reducing waste and costs while enhancing production flexibility.

The said approach is increasingly being adopted in industries like automotive and consumer electronics, where rapid prototyping and small-batch production are essential. The growing emphasis on personalization and sustainability reinforces the demand for polymer materials, ensuring continued market growth.

- Growing Adoption Across Industries

The increasing adoption of 3D printing technology across industries such as automotive, aerospace, healthcare, and consumer goods is a primary growth driver for the 3D printing polymer material market. In the automotive sector, lightweight polymers produce durable and efficient components, helping manufacturers reduce vehicle weight and improve fuel efficiency.

Aerospace companies leverage high-performance polymers like PEEK and polyamide to create complex, lightweight parts that meet stringent industry standards. In healthcare, biocompatible polymers are being utilized for personalized implants, prosthetics, and surgical tools.

The consumer goods sector benefits from cost-effective prototyping and customized product designs enabled by 3D printing. Multi-industry adoption of polymer materials for diverse applications fuels demand, ensuring sustained market growth.

Key Growth Barriers

- Limited Material Diversity for Functional Applications

The diversity of polymer materials for functional 3D printing applications remains limited, restraining the 3D printing polymer material market growth potential despite significant advancements,

While materials like PLA, ABS, and PETG dominate the market for prototyping and low-load applications, options for high-strength, temperature-resistant, or biocompatible polymers are still relatively scarce and costly. Also, industries such as aerospace, automotive, and healthcare require materials with precise mechanical, thermal, and chemical properties, which are not always achievable with current polymer offerings.

Compatibility issues with specific 3D printing technologies can limit the usability of advanced polymers, creating challenges for manufacturers seeking to expand their material options. These limitations hinder the adoption of 3D printing in demanding applications, slowing the market growth.

- High Material Costs of 3D Printing Polymers to Hinder Sales

The elevated costs of 3D printing polymer materials significantly impede the market growth. Advanced polymer materials like PEEK, polyamide, and carbon fiber-reinforced polymers are highly sought for their superior properties, such as heat resistance, durability, and lightweight characteristics.

The cost of high-performance polymers like PEEK can be 5-10 times higher than standard materials such as PLA or ABS. The price disparity restricts widespread adoption, particularly in regions with limited budgets for research and development or where traditional manufacturing remains dominant. The complex processes required to produce specialized polymers contribute to their high costs, creating a barrier for entry-level users and smaller-scale applications.

3D Printing Polymer Material Market Trends and Opportunities

- Growing Focus on Sustainable and Bio-Based Polymers Remains a Key Trend

One of the most significant trends in the 3D printing polymer material market is the increasing emphasis on sustainable and bio-based polymers. With growing environmental awareness and regulatory pressure to reduce carbon footprints, industries are seeking eco-friendly alternatives to traditional petroleum-based polymers.

Bio-based polymers, such as polylactic acid (PLA), derived from renewable resources like corn starch or sugarcane are gaining traction due to their biodegradability and lower environmental impact. These materials align with the global push for sustainability, particularly in regions like Europe, where strict environmental regulations encourage the adoption of green technologies.

Companies are investing significantly in research and development to create recyclable or compostable polymers that do not compromise performance. Innovations in chemically recyclable polymers enable material reuse without quality degradation, reducing waste. This trend enhances the environmental appeal of 3D printing and attracts eco-conscious consumers and businesses, positioning the market for long-term growth.

- Expansion in Healthcare and Bio Printing Applications

The healthcare industry presents a transformative opportunity for the 3D printing polymer material market, particularly with the advent of bioprinting and personalized medical devices.

Polymers used in 3D printing offer unique advantages in creating patient-specific solutions, such as custom implants, prosthetics, and surgical tools.

Biocompatible polymers like polycaprolactone (PCL) and bio-inks have opened new avenues for tissue engineering and organ printing, revolutionizing medical treatments. As healthcare providers increasingly adopt 3D printing for rapid prototyping and manufacturing, the demand for advanced polymer materials is surging. The global shift toward minimally invasive procedures and personalized medicine drives the need for lightweight, durable, and biocompatible 3D-printed solutions.

Investments in research and development to develop innovative polymers tailored for healthcare applications, such as antimicrobial properties or enhanced biocompatibility, will create lucrative opportunities for market players. The growing integration of 3D printing in healthcare ensures sustained demand for high-performance polymers, positioning it as a key growth segment.

How Does Regulatory Scenario Shape the Industry?

The regulatory landscape is critical in shaping the growth and direction of the 3D printing polymer material market. Governments and industry bodies across the globe are implementing standards and guidelines to address environmental, safety, and quality concerns associated with polymer materials.

The European Union’s Circular Economy Action Plan emphasizes sustainability, driving the adoption of recyclable and bio-based polymers in 3D printing. These regulations encourage manufacturers to develop eco-friendly alternatives, reducing reliance on petroleum-based polymers and minimizing waste.

In healthcare, regulatory frameworks such as the FDA’s 3D Printing Guidance influence the use of biocompatible polymers for medical devices and implants. Strict guidelines on safety and performance ensure that 3D-printed medical products meet rigorous quality standards, fostering innovation in high-grade polymer materials.

Industries like aerospace and automotive face compliance requirements for material performance under extreme conditions, pushing manufacturers to develop advanced polymers with enhanced durability and thermal resistance. On the other hand, complex certification processes and compliance costs can act as barriers for smaller companies.

Segments Covered in the Report

- PLA Polymer Type Takes the Lead with its Simplified Printing Process

Polylactic acid (PLA) dominates the 3D printing polymer material market. PLA stands out as the dominant polymer type, especially in fused deposition modelling (FDM) 3D printing. PLA is a biodegradable thermoplastic aliphatic polyester derived from renewable resources like corn starch or sugarcane.

PLA extrudes at relatively low temperatures and exhibits minimal warping, eliminating the necessity for a heated print bed, which simplifies the printing process and enhances accessibility. The material offers excellent surface quality and can capture intricate details, making it suitable for prototypes, educational models, and decorative items.

As a biodegradable polymer, PLA aligns with the growing demand for sustainable materials in manufacturing. Its origin from renewable resources further enhances its appeal to environmentally conscious users. PLA's advantages in terms of ease of use, surface finish, and environmental friendliness have solidified its position as the leading polymer in the 3D printing sector.

- Filament Form Dominates the Market Due to its Extensive Use in FDM

Filament is the dominant form in the 3D printing polymer material market, primarily due to its extensive use in Fused Deposition Modelling (FDM), the most widely adopted 3D printing technology. Filaments are widely compatible with FDM printers, which are affordable, accessible, and popular among hobbyists, educational institutions, and industrial users.

Filament materials such as PLA, ABS, PETG, and polyamide (nylon) are available in diverse grades, offering options for different printing needs ranging from prototyping to functional parts. Filament-based printing is straightforward and user-friendly, making it ideal for entry-level users and small businesses.

The spool format simplifies handling, storage, and feeding into the printer, contributing to its widespread adoption. Filaments are generally more cost-effective and easier to source than powders or liquids. The material's affordability has contributed to its popularity across consumer goods, education, and small-scale manufacturing sectors.

A range of polymers is available in filament form, including PLA, ABS, PETG, and high-performance materials like PEEK and polycarbonate. Such versatility makes it suitable for automotive, healthcare, and aerospace applications.

Recent advancements in filament technology, such as composite filaments infused with carbon fibres or metal particles, have expanded its applications in high-performance industries, further reinforcing its dominance.

Regional Analysis

- North America Tops the Market with Early Adoption of Additive Manufacturing Technology

North America holds a substantial share of the 3D printing polymer materials market, driven by the early adoption of additive manufacturing technologies across various industries. The region's advanced manufacturing infrastructure and robust research and development capabilities have facilitated the integration of 3D printing in sectors such as aerospace, automotive, and healthcare.

The United States, in particular, has been at the forefront, with significant investments in 3D printing technologies and materials. The presence of key industry players and a strong emphasis on innovation contribute to the region's dominance. Supportive government initiatives and funding for advanced manufacturing have further propelled market growth.

- Asia Pacific to Witness Notable Growth

Asia Pacific is experiencing rapid growth in the 3D printing polymer materials market, attributed to the expansion of manufacturing sectors and the increasing adoption of advanced technologies. Countries like China, Japan, and South Korea are leading this growth, leveraging 3D printing for prototyping and production in industries such as automotive, consumer electronics, and healthcare.

China's significant manufacturing base and government support for innovation have positioned it as a key player in the market. The region's focus on industrial automation and the development of customized products are driving the demand for 3D printing polymer materials.

Fairfield’s Competitive Landscape Analysis

The 3D printing polymer material market is highly competitive, with key players focusing on innovation, product diversification, and strategic partnerships. Leading companies such as BASF SE, Stratasys Ltd., Evonik Industries, 3D Systems Corporation, and Arkema SA dominate the market. These companies offer a wide range of polymer materials like PLA, ABS, polyamides, and high-performance polymers.

Emerging players are leveraging advancements in material science, including bio-based and recyclable polymers, to address growing sustainability demands. Collaborations like BASF’s partnerships with 3D printing companies for material innovation are driving the market forward. While leading players focus on industrial applications, small companies cater to niche markets like healthcare and customized consumer goods, intensifying competition and fostering innovation across the industry.

Key Market Companies

- 3D Systems

- Stratasys

- BASF

- Solvay S.A.

- Arkema S.A.

- Evonik Industries

- EOS GmbH

- Heraeus

- EPLUS 3D

- Kumovis

- TLC KoreaKuraray Europe GmbH

Recent Industry Developments

- In September 2023, 3D Systems Corporation has launched new polymer materials aimed at enhancing the capabilities of 3D printing technologies, focusing on durability and application-specific requirements.

- In November 2023, Stratasys Ltd. has entered into strategic partnerships to drive material innovation, expanding its portfolio. It is to include a wide range of polymer materials suitable for various additive manufacturing applications.

An Expert’s Eye

- The growing demand for sustainable and bio-based polymers aligns with global environmental goals.

- The healthcare industry is seen as a transformative segment, leveraging biocompatible polymers for personalized implants and medical devices.

- High-performance polymers like PEEK and polyamide are expected to drive innovation for demanding applications in the aerospace and automotive sectors.

- The ability to create customized, on-demand parts is fueling the adoption of 3D printing polymers across industries.

Global 3D Printing Polymer Material Market is Segmented as-

By Polymer

- PP

- PC

- PET

- Polyamide

- ABS & ASA

- High Performance Polymers

- PLA

By Form

- Powder

- Filament

- Liquid

By End User

- Aerospace & Defence

- Automotive

- Medical & Healthcare

- Electronics

- Consumer Goods

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global 3D Printing Polymer Material Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global 3D Printing Polymer Material Market Outlook, 2019 - 2031

3.1. Global 3D Printing Polymer Material Market Outlook, by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. PP

3.1.1.2. PC

3.1.1.3. PET

3.1.1.4. Polyamide

3.1.1.5. ASA

3.1.1.6. Polymers

3.1.1.7. PLA

3.2. Global 3D Printing Polymer Material Market Outlook, by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Powder

3.2.1.2. Filament

3.2.1.3. Liquid

3.3. Global 3D Printing Polymer Material Market Outlook, by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Aerospace & Defence

3.3.1.2. Automotive

3.3.1.3. Medical & Healthcare

3.3.1.4. Electronics

3.3.1.5. Consumer Goods

3.4. Global 3D Printing Polymer Material Market Outlook, by Region, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America 3D Printing Polymer Material Market Outlook, 2019 - 2031

4.1. North America 3D Printing Polymer Material Market Outlook, by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. PP

4.1.1.2. PC

4.1.1.3. PET

4.1.1.4. Polyamide

4.1.1.5. ASA

4.1.1.6. Polymers

4.1.1.7. PLA

4.2. North America 3D Printing Polymer Material Market Outlook, by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Powder

4.2.1.2. Filament

4.2.1.3. Liquid

4.3. North America 3D Printing Polymer Material Market Outlook, by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Aerospace & Defence

4.3.1.2. Automotive

4.3.1.3. Medical & Healthcare

4.3.1.4. Electronics

4.3.1.5. Consumer Goods

4.4. North America 3D Printing Polymer Material Market Outlook, by Country, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

4.4.1.2. U.S. 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

4.4.1.3. U.S. 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

4.4.1.4. Canada 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

4.4.1.5. Canada 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

4.4.1.6. Canada 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe 3D Printing Polymer Material Market Outlook, 2019 - 2031

5.1. Europe 3D Printing Polymer Material Market Outlook, by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. PP

5.1.1.2. PC

5.1.1.3. PET

5.1.1.4. Polyamide

5.1.1.5. ASA

5.1.1.6. Polymers

5.1.1.7. PLA

5.2. Europe 3D Printing Polymer Material Market Outlook, by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Powder

5.2.1.2. Filament

5.2.1.3. Liquid

5.3. Europe 3D Printing Polymer Material Market Outlook, by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Aerospace & Defence

5.3.1.2. Automotive

5.3.1.3. Medical & Healthcare

5.3.1.4. Electronics

5.3.1.5. Consumer Goods

5.4. Europe 3D Printing Polymer Material Market Outlook, by Country, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.2. Germany 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.3. Germany 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.4. U.K. 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.5. U.K. 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.6. U.K. 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.7. France 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.8. France 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.9. France 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.10. Italy 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.11. Italy 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.12. Italy 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.13. Turkey 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.14. Turkey 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.15. Turkey 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.16. Russia 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.17. Russia 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.18. Russia 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.19. Rest of Europe 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.20. Rest of Europe 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.1.21. Rest of Europe 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific 3D Printing Polymer Material Market Outlook, 2019 - 2031

6.1. Asia Pacific 3D Printing Polymer Material Market Outlook, by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. PP

6.1.1.2. PC

6.1.1.3. PET

6.1.1.4. Polyamide

6.1.1.5. ASA

6.1.1.6. Polymers

6.1.1.7. PLA

6.2. Asia Pacific 3D Printing Polymer Material Market Outlook, by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Powder

6.2.1.2. Filament

6.2.1.3. Liquid

6.3. Asia Pacific 3D Printing Polymer Material Market Outlook, by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Aerospace & Defence

6.3.1.2. Automotive

6.3.1.3. Medical & Healthcare

6.3.1.4. Electronics

6.3.1.5. Consumer Goods

6.4. Asia Pacific 3D Printing Polymer Material Market Outlook, by Country, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. China 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.1.2. China 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.1.3. China 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.1.4. Japan 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.1.5. Japan 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.1.6. Japan 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.1.7. South Korea 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.1.8. South Korea 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.1.9. South Korea 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.1.10. India 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.1.11. India 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.1.12. India 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.1.13. Southeast Asia 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.1.14. Southeast Asia 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.1.15. Southeast Asia 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.1.16. Rest of Asia Pacific 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.1.17. Rest of Asia Pacific 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.1.18. Rest of Asia Pacific 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America 3D Printing Polymer Material Market Outlook, 2019 - 2031

7.1. Latin America 3D Printing Polymer Material Market Outlook, by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

7.1.1. Key PP

7.1.2. PC

7.1.3. PET

7.1.4. Polyamide

7.1.5. ASA

7.1.6. Polymers

7.1.7. PLA

7.2. Latin America 3D Printing Polymer Material Market Outlook, by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

7.2.1. Powder

7.2.2. Filament

7.2.3. Liquid

7.3. Latin America 3D Printing Polymer Material Market Outlook, by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Aerospace & Defence

7.3.1.2. Automotive

7.3.1.3. Medical & Healthcare

7.3.1.4. Electronics

7.3.1.5. Consumer Goods

7.4. Latin America 3D Printing Polymer Material Market Outlook, by Country, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

7.4.1.2. Brazil 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

7.4.1.3. Brazil 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

7.4.1.4. Mexico 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

7.4.1.5. Mexico 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

7.4.1.6. Mexico 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

7.4.1.7. Argentina 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

7.4.1.8. Argentina 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

7.4.1.9. Argentina 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

7.4.1.10. Rest of Latin America 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

7.4.1.11. Rest of Latin America 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

7.4.1.12. Rest of Latin America 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa 3D Printing Polymer Material Market Outlook, 2019 - 2031

8.1. Middle East & Africa 3D Printing Polymer Material Market Outlook, by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. PP

8.1.1.2. PC

8.1.1.3. PET

8.1.1.4. Polyamide

8.1.1.5. ASA

8.1.1.6. Polymers

8.1.1.7. PLA

8.2. Middle East & Africa 3D Printing Polymer Material Market Outlook, by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Powder

8.2.1.2. Filament

8.2.1.3. Liquid

8.3. Middle East & Africa 3D Printing Polymer Material Market Outlook, by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Aerospace & Defence

8.3.1.2. Automotive

8.3.1.3. Medical & Healthcare

8.3.1.4. Electronics

8.3.1.5. Consumer Goods

8.4. Middle East & Africa 3D Printing Polymer Material Market Outlook, by Country, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.4.1.2. GCC 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.4.1.3. GCC 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.4.1.4. South Africa 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.4.1.5. South Africa 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.4.1.6. South Africa 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.4.1.7. Egypt 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.4.1.8. Egypt 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.4.1.9. Egypt 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.4.1.10. Nigeria 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.4.1.11. Nigeria 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.4.1.12. Nigeria 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.4.1.13. Rest of Middle East & Africa 3D Printing Polymer Material Market by Polymer, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.4.1.14. Rest of Middle East & Africa 3D Printing Polymer Material Market by Form, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.4.1.15. Rest of Middle East & Africa 3D Printing Polymer Material Market by End User, Value (US$ Bn) and Volume (Kilo Ton), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. by End User vs by Form Heat map

9.2. Manufacturer vs by Form Heat map

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. 3D Systems

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Stratasys

9.5.3. BASF

9.5.4. Solvay S.A.

9.5.5. Arkema S.A.

9.5.6. Evonik Industries

9.5.7. EOS GmbH

9.5.8. Heraeus

9.5.9. EPLUS 3D

9.5.10. Kumovis

9.5.11. TLC KoreaKuraray Europe GmbH

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

|

2023 |

|

2019 - 2023 |

|

2024 - 2031 |

Value: US$ Billion |

|

REPORT FEATURES |

DETAILS |

|

Polymer Coverage |

|

|

Form Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |