Global Active Wound Care Market Forecast

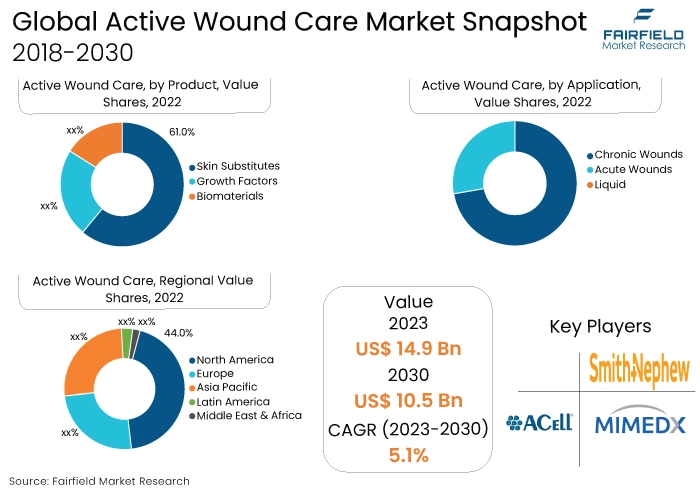

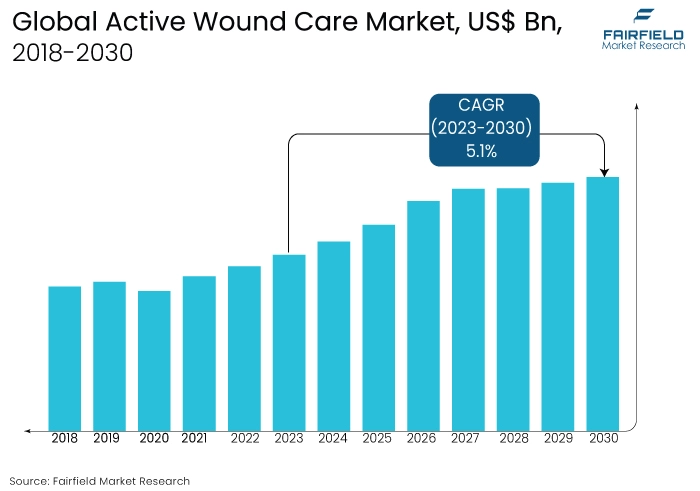

- Global active wound care market size to reach US$14.9 Bn in 2030 from US$10.5 Bn recorded in 2023

- Market for active wound care solutions to exhibit a CAGR of 5.1% during 2023-2030

Quick Report Digest

- One notable development observed in the active wound care industry is the continuous incorporation of technological advancements. Telemedicine applications, intelligent dressings, and connected devices are revolutionising wound management by facilitating individualised patient care and accelerating the healing process via real-time monitoring.

- A discernible pattern can be observed in the growing prevalence of bioactive wound care products. Bioactive dressings and topical agents, which comprise either natural or synthetic compounds, are becoming increasingly well-liked due to their capacity to stimulate wound healing, mitigate infections, and improve overall recovery.

- The market is being significantly influenced by the increasing focus on sustainable wound care practices. Eco-friendly materials and production processes are being given priority by manufacturers and healthcare providers, reflecting a more extensive dedication to environmental accountability within the healthcare industry.

- In wound care, the active adoption of telemedicine is a significant trend. The integration of digital wound assessment tools, virtual consultations, and remote patient monitoring is becoming crucial in optimising wound care services and increasing accessibility, particularly for patients residing in remote regions.

- It is projected that skin substitutes will hold the largest market share in 2022. Due to their effectiveness in promoting wound closure, infection prevention, and tissue regeneration, skin substitutes are the preferred option. Increasing rates of chronic wounds contribute to the expansion of this market segment within the active wound care industry.

- Chronic wounds are anticipated to supplant acute wounds as the dominant market segment in 2022. Prolonged healing periods associated with chronic wounds, an ageing population, and an increase in the incidence of diabetes all contribute to the sustained demand for specialised active wound care products designed to address these particular healthcare challenges.

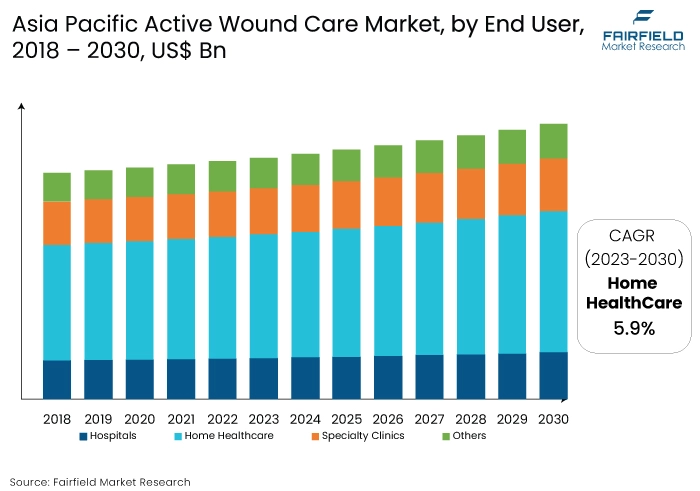

- In 2022, hospitals are anticipated to hold the largest market share among healthcare settings. Active wound care is predominantly conducted in hospitals due to the sophisticated infrastructure, controlled environment, and qualified healthcare professionals that are readily accessible. On the contrary, home healthcare is increasingly being adopted owing to its practicality and economical nature.

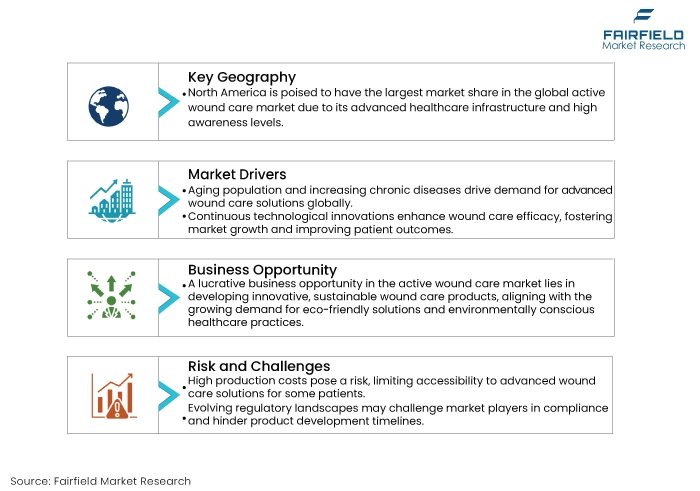

- It is anticipated that North America will have the highest market penetration worldwide. High levels of awareness and sophisticated healthcare infrastructure in the region contribute to the extensive implementation of active wound care. Surgical wound care, chronic wound management, and trauma care are all applications.

- Asia Pacific is positioned to experience the most rapid expansion of market penetration. The adoption of active wound care solutions is propelled by the prevalence of chronic diseases, rising disposable income, and increased healthcare awareness. Significant expansion is anticipated in the region regarding applications including post-surgical wound management and diabetic wound care.

A Look Back and a Look Forward - Comparative Analysis

Due to technological advancements and a growing emphasis on patient-centric wound management, the global active wound care market is presently undergoing dynamic expansion. As the market for advanced wound care products experiences an increase in demand, bioactive solutions and intelligent technologies are gaining ground.

The current landscape is being influenced by telemedicine applications, technologically advanced dressings, and sustainable wound care practices. The market is experiencing further growth due to the increase in chronic diseases and the geriatric population. Both healthcare providers and consumers are beginning to acknowledge the effectiveness of these solutions in facilitating expedited and more streamlined wound healing.

In the last ten years, the market for active wound care has experienced substantial changes. Throughout history, the wound care industry has witnessed a transition from conventional methods to the implementation of specialised products, including skin substitutes, growth factors, and biomaterials.

The proliferation of chronic wounds and the expansion of knowledge regarding wound healing mechanisms have both played a role in the advancement of precise and inventive treatment approaches. This historical development established the groundwork for the present technologically advanced and diversified market environment.

Moving forward, the active wound care market is anticipated to experience consistent expansion, propelled by continuous research and development, expanding healthcare infrastructure, and rising awareness regarding sophisticated wound care alternatives. The future market dynamics will probably be characterised by the amalgamation of artificial intelligence, personalised medicine methodologies, and ongoing product innovation.

As the global burden of chronic diseases and an ageing population increase, it is anticipated that the demand for effective and efficient wound care solutions will rise. Geographic expansion is expected to occur in the market, specifically in areas where healthcare systems are still in the process of developing, which will further propel the market's overall growth trajectory.

Key Growth Determinants

- Technological Intervention in Wound Care Sector

The perpetual quest for technological advancement serves as a fundamental catalyst that propels the active wound care industry. Technological advancements, including telemedicine applications, smart dressings, and connected wound care devices, are significantly transforming the field of wound management. These advancements optimise the efficacy of medical interventions by providing individualised attention and continuous monitoring.

The incorporation of Artificial Intelligence (AI) into the processes of wound assessment and treatment planning contributes to the expansion of the market by offering healthcare practitioners significant insights that can enhance patient outcomes. The market expands as the industry further adopts state-of-the-art technologies, motivated by the prospect of enhanced therapeutic results and more efficient healthcare procedures.

- Rising Prevalence of Chronic Disorders

The increasing incidence of chronic diseases on a global scale, specifically diabetes and vascular disorders, is a substantial fact propelling the need for active wound care solutions. Complex wounds frequently result from chronic conditions, necessitating the use of sophisticated and specialised wound care products. In response to this escalating healthcare challenge, the market provides customised remedies, including growth factors and bioactive dressings, which foster expedited recovery.

The global increase in the elderly population further amplifies the prevalence of chronic wounds, thereby generating an ongoing need for efficacious interventions in wound care. The convergence of this demographic pattern and the escalating prevalence of chronic ailments situates the market as an essential participant in tackling the healthcare requirements of these demographic groups.

- Growing Demographic Consumer Base

Activity-related wound care is significantly impacted by the demographic transition toward an ageing population. The ageing population on a global scale contributes to an elevated vulnerability to chronic ailments and impedes the rate of wound healing. The demographic trend stimulates the market for specialised wound care products that cater to the specific requirements of elderly patients, such as growth factors and skin substitutes.

The geriatric population not only increases the prevalence of chronic wounds but also underscores the criticality of sophisticated wound care interventions to facilitate expedited recovery and mitigate complications. The market continues to expand as healthcare systems adjust to the needs of an ageing population, primarily motivated by the necessity to deliver efficient wound care for the aged.

Major Growth Barriers

- Higher Investments

The significant impediment to the growth of the active wound care market is the exorbitant expense incurred for sophisticated wound care products. Notwithstanding their effectiveness, the financial implications of these specialised solutions for healthcare systems and patients may impede their pervasive adoption and accessibility, especially in settings with limited resources.

- Limited Availability

One notable market limitation pertains to the restricted reimbursement policies that are in place for specific active wound care products. The limited availability of coverage, and reimbursement for advanced wound care treatments could impede their extensive implementation, thereby affecting healthcare providers and patients alike and constraining the market's capacity for greater accessibility and utilisation.

Key Trends and Opportunities to Look at

- Increased Adoption of Telemedicine

The utilisation of telemedicine in the field of wound care has experienced tremendous expansion, primarily propelled by its effectiveness and availability. The global adoption of this trend is increasing, with developed regions such as North America, and Europe taking the lead.

Smith & Nephew and Teladoc Health have formed strategic alliances to improve remote wound monitoring. Brands will probably utilise telemedicine platforms to facilitate remote consultations, real-time wound assessment, and seamless patient engagement, thereby guaranteeing broad accessibility and individualised care.

- Focus on Environmentally Favourable Solutions

Consistent growth has been observed in the demand for sustainable wound care practices, which reflects the worldwide trend toward environmentally favourable healthcare solutions. This phenomenon is gaining significant traction in developed regions, with Europe being a prominent adopter.

Prominent entities such as Molnlycke Health Care prioritise the development of sustainable products. Brands will probably utilise energy-efficient manufacturing processes, environmentally friendly packaging, and biodegradable materials to appeal to consumer preferences and support the cause of eco-conscious healthcare.

- Technological Trends Like Smart Dressings

Prominent examples of technological advancements in wound healing include connected device, and intelligent dressings, which are reshaping the industry. This trend is prevalent throughout the world, with Asia Pacific, and North America leading the way.

Smith & Nephew, and 3M invest in the research and development of intelligent wound care solutions. Brands will probably utilise data-driven insights, cloud computing, and IoT integration to improve the effectiveness of their products, patient outcomes, and overall competitiveness in the market.

How Does the Regulatory Scenario Shape this Industry?

Regulatory frameworks are of utmost importance in the active wound care market as they guarantee the safety, effectiveness, and compliance with industry standards of products. Using the 510(k) clearance procedure, the Food and Drug Administration (FDA) ensures regulatory compliance for wound care products in the US.

The European market is regulated by the Medicines and Healthcare Products Regulatory Agency (MHRA) and the European Medicines Agency (EMA), which enforce the Medical Devices Regulation (MDR) of the European Union. These organisations establish rigorous standards that impact market dynamics through their guidance on product development and market entry tactics.

In response to region-specific developments, such as the implementation of MDR in Europe, businesses have been compelled to conform to stricter standards. Adherence to regulatory standards influences market entry and competitiveness in addition to ensuring patient safety. To comply with industry standards and obtain market sanction, stakeholders are required to navigate dynamic frameworks amidst evolving regulatory environments.

Fairfield’s Ranking Board

Top Segments

- Skin Substitutes Retain Dominance

Out of the three segments mentioned—growth factors, biomaterials, and skin substitutes—skin substitutes are projected to hold the most market share. The versatility of skin substitutes in areas such as tissue regeneration, wound closure, and infection prevention propels their demand. The segment characterised by effective skin substitutes for facilitating efficient healing, particularly in the case of chronic wounds, is positioned at the vanguard of the active wound care market.

Although skin substitutes currently hold a larger market share, growth factors are anticipated to demonstrate the most rapid expansion. The growing acknowledgment of the role that growth factors play in promoting angiogenesis, tissue repair, and cell proliferation contributes to their increasing prevalence.

The expansion of knowledge regarding the biological processes involved in wound healing because of ongoing research and development, is anticipated to propel the Growth Factors sector forward. This is primarily due to the rising need for sophisticated and biologically active wound care products.

- Chronic Wounds to Generate the Maximum Demand

Regarding acute and chronic wounds, it is anticipated that the chronic wounds segment will hold the largest market share. Sustained demand for specialised wound care solutions is driven by the prevalence of chronic conditions, including diabetes and vascular diseases.

The prevalence of complex pathologies, and extended healing times for chronic wounds motivates the development of active wound care products designed to address the unique challenges associated with these persistent conditions.

Even though chronic wounds hold the largest market share, Acute Wounds is anticipated to expand at the quickest rate. Irrespective of the circumstances, acute lesions, which frequently arise from traumatic incidents or surgical procedures, necessitate prompt and efficacious interventions.

The growing need for active wound care solutions is driven by the rapid onset, and relatively brief healing periods of acute wounds. This places this market segment in a favourable position to experience accelerated growth in response to the urgent healthcare demands.

- Hospitals Represent the Leading Consumer Segment

Except for specialty clinics, home healthcare, and hospitals, it is expected that the hospital segment will hold the most substantial portion of the market. Hospitals function as primary centres for active wound care, providing a regulated setting, sophisticated infrastructure, and proficient healthcare personnel.

The significance of wound management in a hospital environment, specifically in intricate cases and surgical procedures, enhances the prominence of this sector within the market.

Despite hospitals holding the largest market share, home healthcare is anticipated to experience the most rapid growth. Enhanced wound care technologies, and growing focus on patient-centred care contribute to the effectiveness of wound management in the home environment.

As patients seek more accessible and individualised healthcare solutions in the comfort of their own homes, decentralised wound care is the fastest-growing segment due to the cost-effectiveness and convenience of home healthcare services.

Regional Frontrunners

North America’s Leadership Prevails on the Back of Extensive Healthcare Spending

With the highest potential market share, North America is positioned to dominate the worldwide active wound care industry. The main factors contributing to this are the region's firmly established healthcare infrastructure, significant rates of advanced technology adoption, and substantial investment in research and development.

North America's dominance is further bolstered by the substantial investments in healthcare and the presence of key market participants. Furthermore, the escalating prevalence of chronic diseases, and the expansion of the elderly demographic serve to reinforce North America's dominant status on the international market by driving the demand for active wound care products.

Asia Pacific Attains the Status of a High-Potential Market

It is anticipated that the Asia Pacific region will experience the most rapid growth in the worldwide active wound care market. Increasing awareness of sophisticated healthcare solutions, rising healthcare expenditures, and expanding access to healthcare in developing economies are all contributors to this expansion.

In conjunction with an ageing population, the prevalence of chronic diseases drives the demand for active wound care products. Furthermore, the continuous advancements in healthcare infrastructure and the implementation of innovative technologies are factors that contribute to the heightened expansion of the active wound care market in the Asia Pacific area.

Fairfield’s Competitive Landscape Analysis

The current pricing framework significantly influences the competitive environment, wherein differentiation strategies assume a pivotal function. Organisations that provide innovative, cost-effective solutions are likely to prosper. The impact of pricing on long-term growth will persist, as participants in the market strive to strike a nuanced equilibrium between profitability and affordability.

Significant market forces that influence competition are an emphasis on geographical expansion, personalised medicine strategies, and sustainability. Analysis of the supply chain demonstrates that agile and resilient supply networks are crucial for mitigating risks and guaranteeing product availability. In general, the active wound care market presents prospects for growth through approaches that prioritise the needs and interests of customers, strategic partnerships, and technological progress.

Who are the Leaders in the Global Active Wound Care Space?

- Smith & Nephew

- MiMedx

- Tissue Regenix

- Organogenesis Inc.

- Acell Inc.

- Integra Life Sciences

- Solsys Medical

- Osiris Therapeutics Inc.

- Cytori Therapeutics Inc.

- Human BioSciences

- Wright Medical Group N.V.

Significant Industry Developments

New Product Launch

- April 2023: Kerecis introduced the MariGenShield, a device that combines a silicone contact layer and a fish-skin graft to address the management of intricate and persistent incisions.

- July 2022: Tides Medical introduced ArtacentAC. It is a tri-layer skin substitute utilised in surgical applications such as diabetic foot ulcers, chronic wounds, burns, and Mohs surgery. This skin substitute is two times denser and three times more potent than conventional dual-layer wound care products, which facilitates application to wound sites.

An Expert’s Eye

Demand and Future Growth

Long-term growth prospects for the active wound care market are bolstered by technological advancements, an ageing population, and a rising prevalence of chronic diseases. The increasing need for efficacious wound management solutions, particularly when considering chronic ailments such as diabetes, augurs well for those involved in the industry.

With the ongoing global expansion of healthcare awareness, both patients and practitioners are coming to acknowledge the criticality of advanced wound care in enhancing overall outcomes. In the coming years, technological advancements, including the incorporation of telemedicine and intelligent dressings, are anticipated to be significant contributors to the robust market demand.

Supply Side of the Market

Although the market offers promising prospects, industry participants encounter a significant obstacle in the form of the exorbitant expenses linked to sophisticated wound care products. The potential adverse effects of the financial strain on healthcare systems and patients may impede the extensive availability and integration of the product, thereby constraining the expansion of the market.

Achieving a harmonious equilibrium between cost-effectiveness and innovation will be pivotal for market participants in confronting this challenge. Furthermore, the ever-changing regulatory environments and standards of compliance may present obstacles, underscoring the criticality of industry participants possessing agility and adaptability to maintain long-term prosperity.

Global Active Wound Care Market is Segmented as Below:

By Product:

- Skin Substitutes

- Growth Factors

- Biomaterials

By Automation:

- Chronic Wounds

- Acute Wounds

By End User:

- Hospitals

- Home Healthcare

- Specialty Clinics

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Active Wound Care Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Active Wound Care Market Outlook, 2018 - 2030

3.1. Global Active Wound Care Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Skin Substitutes

3.1.1.2. Growth Factors

3.1.1.3. Biomaterials

3.2. Global Active Wound Care Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Cancer

3.2.1.2. Immunology

3.2.1.3. Cardiovascular Diseases

3.3. Global Active Wound Care Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Hospitals

3.3.1.2. Dental Clinics

3.3.1.3. Research Institutes

3.4. Global Active Wound Care Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Active Wound Care Market Outlook, 2018 - 2030

4.1. North America Active Wound Care Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Skin Substitutes

4.1.1.2. Growth Factors

4.1.1.3. Biomaterials

4.2. North America Active Wound Care Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Chronic Wounds

4.2.1.2. Acute Wounds

4.3. North America Active Wound Care Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Hospitals

4.3.1.2. Home Healthcare

4.3.1.3. Specialty Clinics

4.3.1.4. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Active Wound Care Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

4.4.1.4. Canada Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Active Wound Care Market Outlook, 2018 - 2030

5.1. Europe Active Wound Care Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Skin Substitutes

5.1.1.2. Growth Factors

5.1.1.3. Biomaterials

5.2. Europe Active Wound Care Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Chronic Wounds

5.2.1.2. Acute Wounds

5.3. Europe Active Wound Care Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Home Healthcare

5.3.1.3. Specialty Clinics

5.3.1.4. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Active Wound Care Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.4. U.K. Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.7. France Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

5.4.1.8. France Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.9. France Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.10. Italy Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

5.4.1.11. Italy Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.12. Italy Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.13. Turkey Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

5.4.1.14. Turkey Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.15. Turkey Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.16. Russia Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

5.4.1.17. Russia Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.18. Russia Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.19. Rest of Europe Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

5.4.1.20. Rest of Europe Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.21. Rest of Europe Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Active Wound Care Market Outlook, 2018 - 2030

6.1. Asia Pacific Active Wound Care Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Skin Substitutes

6.1.1.2. Growth Factors

6.1.1.3. Biomaterials

6.2. Asia Pacific Active Wound Care Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Chronic Wounds

6.2.1.2. Acute Wounds

6.3. Asia Pacific Active Wound Care Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Home Healthcare

6.3.1.3. Specialty Clinics

6.3.1.4. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Active Wound Care Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.4. Japan Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.7. South Korea Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

6.4.1.8. South Korea Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.10. India Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

6.4.1.11. India Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.12. India Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.13. Southeast Asia Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

6.4.1.14. Southeast Asia Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.15. Southeast Asia Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Active Wound Care Market Outlook, 2018 - 2030

7.1. Latin America Active Wound Care Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Skin Substitutes

7.1.1.2. Growth Factors

7.1.1.3. Biomaterials

7.2. Latin America Active Wound Care Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

7.2.1.1. Chronic Wounds

7.2.1.2. Acute Wounds

7.3. Latin America Active Wound Care Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Home Healthcare

7.3.1.3. Specialty Clinics

7.3.1.4. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Active Wound Care Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.4. Mexico Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.7. Argentina Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

7.4.1.8. Argentina Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.9. Argentina Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.10. Rest of Latin America Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

7.4.1.11. Rest of Latin America Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.12. Rest of Latin America Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Active Wound Care Market Outlook, 2018 - 2030

8.1. Middle East & Africa Active Wound Care Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Skin Substitutes

8.1.1.2. Growth Factors

8.1.1.3. Biomaterials

8.2. Middle East & Africa Active Wound Care Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Chronic Wounds

8.2.1.2. Acute Wounds

8.3. Middle East & Africa Active Wound Care Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Home Healthcare

8.3.1.3. Specialty Clinics

8.3.1.4. Others

8.4. Middle East & Africa Active Wound Care Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.4. South Africa Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.7. Egypt Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

8.4.1.8. Egypt Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.9. Egypt Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.10. Nigeria Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

8.4.1.11. Nigeria Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.12. Nigeria Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Active Wound Care Market by Product, Value (US$ Mn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Active Wound Care Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Active Wound Care Market End User, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End User vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Smith & Nephew

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. MiMedx

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Tissue Regenix

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Organogenesis Inc.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Acell Inc.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Integra Life Sciences

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Solsys Medical

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Osiris Therapeutics Inc.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

v9.5.8.3. Business Strategies and Development

9.5.9. Cytori Therapeutics Inc.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Human BioSciences

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Automation Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |