Global Advanced Wound Dressing Market Forecast

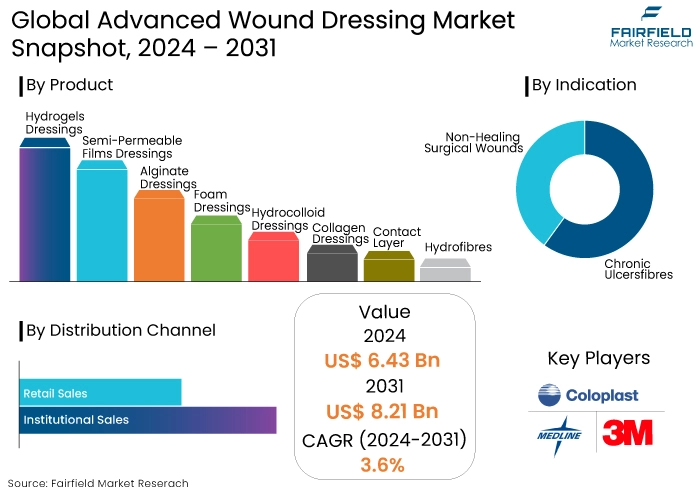

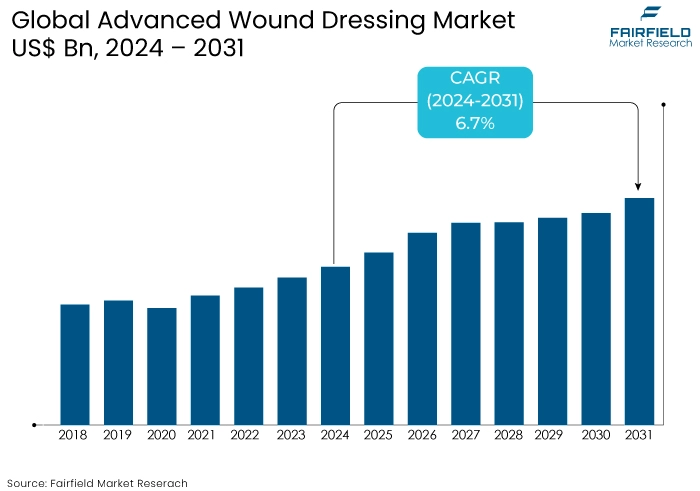

- The advanced wound dressing market is projected to reach a value of US$8.21 Bn by 2031 showing significant growth from the US$6.43 Bn achieved in 2024.

- The market for advanced wound dressing is projected to exhibit a CAGR of 3.6% during the forecast period from 2024 to 2031.

Advanced Wound Dressing Market Insights

- Recent high-tech innovations in bioactive and smart dressings is one of the prominent driving elements for the market.

- The advancements in wound care that improves patient outcomes caters to the market’s growth.

- The increasing prevalence of chronic wounds globally is expected to sustain high demand for advanced wound dressings fueling advanced wound dressing market

- New product safety and efficacy regulations aid remains another key driver for market growth.

- Expanding product portfolios strengthen market positions of key market players in the industry.

- Technological advancements and product innovation drives the market forward.

- Increasing prevalence of chronic wounds drives the demand for market.

- The integration of smart technologies in the wound care aids the market’s demand over the forecast period.

A Look Back and a Look Forward - Comparative Analysis

The advanced wound dressing market has experienced significant growth leading up to 2023, driven by increasing incidences of chronic wounds, an aging population, and increasing awareness of advanced wound care products.

During the historic period from 2019 to 2023, the market was characterized by steady advancements in dressing technologies including hydrocolloids, foam dressings, and alginates, which offered improved healing outcomes and patient comfort.

The demand was further fuelled by the growing prevalence of diabetes and obesity leading to many cases of diabetic foot ulcers and pressure ulcers.

Post-2024, the market is expected to continue its upward trajectory propelled by innovations such as bioactive dressings, antimicrobial dressings, and the integration of smart technology into wound care solutions.

Regulatory approvals and the expansion of healthcare infrastructure in emerging markets are likely to drive market growth. Additionally, the increasing adoption of telemedicine and home healthcare will contribute to high demand for advanced wound care products.

Key Growth Determinants

- Increasing Prevalence of Chronic Wounds

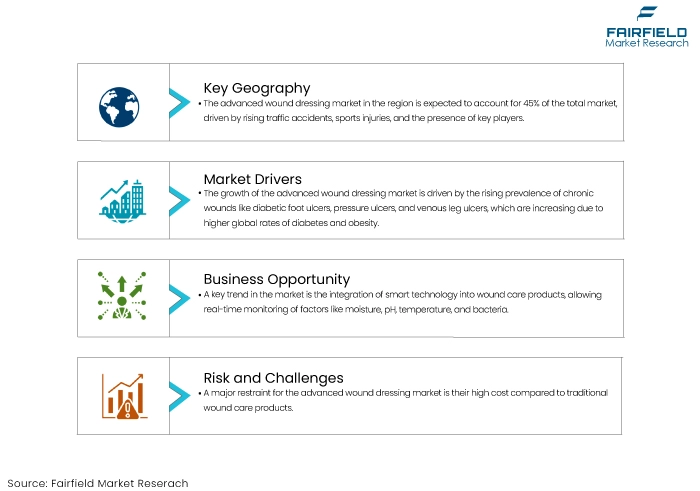

One of the primary growth drivers for the advanced wound dressing market is the increasing prevalence of chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers. As global rates of diabetes and obesity continue to climb, so too does the incidence of these chronic conditions.

Chronic wounds are often complex and difficult to heal, necessitating advanced wound care solutions that promote faster healing and reduce the risk of infection. Advanced wound dressings, which include hydrocolloids, alginates, and foam dressings are designed to maintain a moist wound environment.

The increasing number of patients with chronic wounds has led to increased demand for specialized products driving market growth as healthcare providers seek more effective treatments to manage this expanding patient population.

- Technological Advancements and Product Innovation

Ongoing technological advancements and innovations in product development are significantly driving the advanced wound dressing market. Manufacturers are continually investing in research and development to create effective and user-friendly wound care products.

Innovations such as bioactive dressings, which incorporate materials like growth factors, collagen, and silver have enhanced the healing process by actively promoting tissue regeneration and reducing bacterial load. Also, the development of smart dressings that can monitor wound conditions and deliver targeted therapies is revolutionizing wound care by providing more personalized and efficient treatment options.

Advancements improve patient outcomes and attract healthcare providers and patients looking for cutting-edge solutions thereby propelling market growth.

- Growing Adoption of Home Healthcare and Telemedicine

The increasing adoption of home healthcare and telemedicine services is another key driver of the advanced wound dressing market. As healthcare systems worldwide face pressure to reduce costs and manage resources more efficiently, there is a growing trend toward providing care outside of traditional hospital settings.

Advanced wound dressings are particularly well-suited for home use as they are designed to be easy to apply and manage by patients. The rise of telemedicine enables healthcare professionals to monitor wound healing remotely and adjust treatment plans as needed further supporting the use of advanced wound dressings in home settings.

The shift toward home-based care is expected to drive demand for advanced wound care products contributing to the market's expansion.

Key Growth Barriers

- High Cost of Advanced Wound Dressings

One of the significant restraints for the advanced wound dressing market is the high cost associated with these products. Advanced wound dressings, which include hydrocolloids, bioactive dressings and antimicrobial options are often significantly expensive than traditional wound care products.

The high cost can be a barrier to widespread adoption particularly in low- and middle-income countries where healthcare budgets are limited and out-of-pocket patient expenses can be prohibitive.

Even in more developed markets, the cost factor can limit the use of advanced dressings in healthcare systems focused on cost containment and efficiency. Insurance coverage and reimbursement policies may also vary potentially limiting access to these advanced products for some patients.

The high cost thus acts as a significant restraint potentially slowing market growth as it limits the accessibility and affordability of these advanced wound care solutions.

- Lack of Awareness and Skilled Professionals

Another key restraint for the advanced wound dressing market is the need for more awareness and specialized knowledge among healthcare providers and patients. Despite the benefits of advanced wound care products, their adoption can be limited by insufficient training and awareness among healthcare professionals.

The effective use of advanced dressings often requires a deep understanding of wound healing processes and the specific needs of different wound types, which may only be prevalent in some healthcare settings.

Patients may also need to be fully informed about the advantages of advanced wound dressings, leading to reluctance or inability to seek out these solutions. This gap in knowledge and expertise can hinder the broader adoption of advanced wound care products, restraining market growth.

Advanced Wound Dressing Market Trends and Opportunities

- Integration of Smart Technology in Wound Care

A prominent trend in the market is the integration of smart technology into wound care products. Smart dressings are designed to monitor wound conditions in real time providing critical data on factors such as moisture levels, pH, temperature, and bacterial presence.

The technologies allow for precise and timely interventions enabling healthcare providers to tailor treatments based on each patient's specific needs. For instance, a smart dressing might alert clinicians to the early signs of infection, allowing for prompt treatment that could prevent complications and improve healing outcomes. This trend is driven by the broader adoption of digital health technologies and the increasing demand for personalized medicine.

As the healthcare industry shifts toward more data-driven and patient-centric approaches, smart wound dressings are becoming an attractive option. It offers the potential to improve patient outcomes, reduce hospital readmissions, and lower overall healthcare costs by enabling effective management of chronic and acute wounds.

The integration of smart technology aligns with the increasing trend of telemedicine as data from smart dressings can be transmitted to healthcare providers remotely facilitating continuous monitoring and reducing the need for in-person visits.

The said trend is expected to gain further momentum as technological advancements make smart dressings more accessible and affordable. This trend is driving significant innovation within the advanced wound dressing market.

- Expansion in Emerging Markets

The expansion into emerging markets presents a significant opportunity for growth in the advanced wound dressing market. Countries in regions such as Asia-Pacific, Latin America, and parts of Africa are experiencing rapid economic growth, increasing healthcare investments, and improving healthcare infrastructure.

The said factors create a fertile environment for the adoption of advanced wound care solutions, particularly as the burden of chronic diseases such as diabetes and cardiovascular conditions continues to rise in the regions.

In many emerging markets, traditional wound care practices are still prevalent. However, there is a growing recognition of the benefits of advanced wound dressings in improving patient outcomes and reducing the long-term costs associated with chronic wounds.

As awareness increases, so does the demand for more effective wound care solutions. Additionally, governments and international health organizations are increasingly focused on improving healthcare standards in these regions, which includes the promotion of advanced wound care products.

Companies in the advanced wound dressing industry have the opportunity to establish a strong presence in these markets by tailoring their products to meet local needs and preferences. Strategic partnerships with local distributors and healthcare institutions can facilitate market entry and expansion enabling companies to tap into the growing demand for advanced wound care in emerging markets.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario plays a critical role in shaping the advanced wound dressing market, influencing product development, approval, and commercialization. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have established stringent guidelines to ensure the safety and efficacy of advanced wound care products.

The regulations mandate rigorous clinical testing, quality control, and documentation, which can lengthen the time-to-market for new products and ensure that only high-quality, effective dressings reach consumers.

Recent regulatory trends have also focused on the approval of innovative products such as bioactive and antimicrobial dressings, which offer enhanced healing properties. The fast-track approval processes for products that address unmet medical needs particularly for chronic and hard-to-heal wounds are encouraging innovation in the market. The increasing emphasis on evidence-based practice is driving manufacturers to invest more in clinical trials and real-world evidence to support their product claims.

Fairfield’s Ranking Board

Segments Covered in the Report

- Foam Dressings Segment to Exhibit Substantial Growth

The foam dressings segment is projected to experience a substantial growth rate during the forecast period. Foam dressings consist of a hydrophilic polyurethane polymer that has a high capacity for absorbing liquids.

The foam facilitates the absorption of moisture, which assists in preserving the integrity of the tissue. The rising incidence of burns and trauma in the United States is anticipated to drive the expansion of this particular category.

Foams are mostly employed for the prevention and treatment of exudation in burn injuries. Consequently, the rising number of such accidents is anticipated to drive the expansion of this segment in the advanced wound dressing market.

- Chronic Ulcers Segment Held Largest Market Share of 69%

Vascular ulcers including venous and arterial ulcers, diabetic ulcers, and pressure ulcers are distinct forms of chronic ulcers. Healthcare providers often utilize advanced treatments such as negative pressure wound therapy, engineered skin, growth factors, and extracellular matrices to treat chronic wounds.

Chronic ulcers segment accumulated almost 69% of the advanced wound dressing market share in 2023 and continues to accumulate significant share in the future period. It has evolved into a distinct specialization, contributing to the increase in market share throughout the projected timeframe by promoting attention to treating chronic ulcers.

Regional Analysis

- North America Maintains Primacy in the Advanced Wound Dressing Market

The market for advanced wound dressing in the region is expected to be driven by factors such as the rising number of traffic accidents, sports injuries, and the presence of influential players in the region. This region is projected to account for 45% share of the total market.

The market in the region is anticipated to be propelled by the availability of a sufficient number of proficient specialists and a well-established healthcare infrastructure during the projected timeframe.

Followed by North America, Asia Pacific is projected to exhibit a CAGR of 5.1% in the market. Anticipated growth is expected to be boosted by the inclusion of developing nations such as China, India, and Japan.

The surge in demand for advanced wound dressings in these countries can be related to the burgeoning medical tourism business in the region. Moreover, the increasing elderly population in this area is anticipated to propel the advanced wound dressing sector.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the advanced wound dressing market is characterized by the presence of several key players including Smith & Nephew, 3M, Mölnlycke Health Care, and ConvaTec.

A few leading players and new entrants are focusing on niche segments such as bioactive dressings and smart technology integration to differentiate themselves and capture market share.

Strategic mergers, acquisitions, and partnerships are common as companies seek to expand their product offerings and geographic reach. Intense competition is driving innovation with firms investing hugely in research and development to develop next-generation wound care products that offer superior healing outcomes and patient comfort.

Key Market Companies

- 3M

- Coloplast Corp.

- Medline Industries

- Smith & Nephew

- ConvaTec Group PLC

- Derma Sciences (Integra LifeSciences)

- Ethicon (Johnson & Johnson)

- Baxter International

- Molnlycke Heath Care AB

- Medtronic

Recent Industry Developments

- September 2023

MiMedx Group, Inc. introduced EPIEFFECT, a new product in their collection of innovative wound care treatments.

- December 2022

MiMedx Group, Inc. obtained exclusive global rights to Turn Therapeutics' PermaFusion, a unique antimicrobial technology platform which allows MiMedx to produce biologic products specifically designed for wound healing and surgical recovery purposes.

An Expert’s Eye

- Continuous innovation in bioactive and smart dressings is crucial for advancing wound care and improving patient outcomes.

- The increasing prevalence of chronic wounds globally is expected to sustain high demand for advanced wound dressings, driving advanced would dressing market

- Stringent regulatory requirements ensure product safety and efficacy though they can slow down the introduction of new technologies.

- The industry is seeing consolidation as key players acquire niche companies to expand their product portfolios and strengthen market positions.

Global Advanced Wound Dressing Market is Segmented as-

By Product

- Hydrogels Dressings

- Semi-Permeable Films Dressings

- Alginate Dressings

- Foam Dressings

- Hydrocolloid Dressings

- Collagen Dressings

- Contact Layer

- Super Absorbent Dressings

- Hydrofibres

By Indication

- Chronic Ulcers

- Non-Healing Surgical Wounds

By Distribution Channel

- Institutional Sales

- Retail Sales

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

1. Executive Summary

1.1. Global Advanced Wound Dressing Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Price Analysis, 2019 - 2023

3.1. Global Average Price Analysis, by Product, US$ Per Unit, 2019 - 2023

3.2. Prominent Factor Affecting Advanced Wound Dressing Prices

3.3. Global Average Price Analysis, by Region, US$ Per Unit

4. Global Advanced Wound Dressing Market Outlook, 2019 - 2031

4.1. Global Advanced Wound Dressing Market Outlook, by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Hydrogels Dressings

4.1.1.1.1. Antimicrobial Hydrogel Dressings

4.1.1.1.2. Non Antimicrobial Hydrogel Dressings

4.1.1.2. Semi-Permeable Films Dressings

4.1.1.2.1. Semi-Permeable Films Dressings

4.1.1.2.1.1. Antimicrobial Bordered Film Dressings

4.1.1.2.1.2. Antimicrobial Non Bordered Film Dressings

4.1.1.2.2. Semi-Permeable Films Dressings

4.1.1.2.2.1. Non Antimicrobial Bordered Film Dressings

4.1.1.2.2.2. Non Antimicrobial Non Bordered Film Dressings

4.1.1.3. Alginate Dressings

4.1.1.3.1. Antimicrobial Alginate Dressings

4.1.1.3.2. Non Antimicrobial Alginate Dressings

4.1.1.4. Foam Dressings

4.1.1.4.1. Antimicrobial Foam Dressings

4.1.1.4.1.1. Antimicrobial Bordered Foam Dressings

4.1.1.4.1.2. Antimicrobial Non Bordered Foam Dressings

4.1.1.4.2. Non Antimicrobial Foam Dressings

4.1.1.4.2.1. Non Antimicrobial Bordered Foam Dressings

4.1.1.4.2.2. Non Antimicrobial Non Bordered Foam Dressings

4.1.1.5. Hydrocolloid Dressings

4.1.1.5.1. Antimicrobial Hydrocolloid Dressings

4.1.1.5.2. Non Antimicrobial Hydrocolloid Dressings

4.1.1.6. Collagen Dressing

4.1.1.6.1. Antimicrobial Collagen Dressing

4.1.1.6.2. Non Antimicrobial Collagen Dressing

4.1.1.7. Contact Layer

4.1.1.7.1. Antimicrobial Wound Contact Layers

4.1.1.7.2. Non Antimicrobial Wound Contact Layers

4.1.1.8. Super Absorbent Dressings

4.1.1.8.1. Antimicrobial Super Absorbent Dressings

4.1.1.8.2. Non Antimicrobial Super Absorbent Dressings

4.1.1.9. Hydrofibres

4.1.1.9.1. Antimicrobial Hydrogel Dressings

4.1.1.9.2. Non Antimicrobial Hydrogel Dressings

4.2. Global Advanced Wound Dressing Market Outlook, by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Chronic Ulcers

4.2.1.1.1. Venous Leg Ulcers

4.2.1.1.2. Diabetic Foot Ulcers

4.2.1.1.3. Pressure Ulcers

4.2.1.2. Non-Healing Surgical Wounds

4.2.1.2.1. Traumatic Wounds

4.2.1.2.2. Burn Cases

4.3. Global Advanced Wound Dressing Market Outlook, by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Institutional Sales

4.3.1.1.1. Hospitals

4.3.1.1.2. Clinics

4.3.1.1.3. Ambulatory Surgical Centers

4.3.1.1.4. Long Term Care Centers

4.3.1.2. Retail Sales

4.3.1.2.1. Hospital Pharmacies

4.3.1.2.2. Retail Pharmacies

4.3.1.2.3. Online Sales

4.4. Global Advanced Wound Dressing Market Outlook, by Region, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. North America

4.4.1.2. Europe

4.4.1.3. Asia Pacific

4.4.1.4. Latin America

4.4.1.5. Middle East & Africa

5. North America Advanced Wound Dressing Market Outlook, 2019 - 2031

5.1. North America Advanced Wound Dressing Market Outlook, by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Hydrogels Dressings

5.1.1.1.1. Antimicrobial Hydrogel Dressings

5.1.1.1.2. Non Antimicrobial Hydrogel Dressings

5.1.1.2. Semi-Permeable Films Dressings

5.1.1.2.1. Semi-Permeable Films Dressings

5.1.1.2.1.1. Antimicrobial Bordered Film Dressings

5.1.1.2.1.2. Antimicrobial Non Bordered Film Dressings

5.1.1.2.2. Semi-Permeable Films Dressings

5.1.1.2.2.1. Non Antimicrobial Bordered Film Dressings

5.1.1.2.2.2. Non Antimicrobial Non Bordered Film Dressings

5.1.1.3. Alginate Dressings

5.1.1.3.1. Antimicrobial Alginate Dressings

5.1.1.3.2. Non Antimicrobial Alginate Dressings

5.1.1.4. Foam Dressings

5.1.1.4.1. Antimicrobial Foam Dressings

5.1.1.4.1.1. Antimicrobial Bordered Foam Dressings

5.1.1.4.1.2. Antimicrobial Non Bordered Foam Dressings

5.1.1.4.2. Non Antimicrobial Foam Dressings

5.1.1.4.2.1. Non Antimicrobial Bordered Foam Dressings

5.1.1.4.2.2. Non Antimicrobial Non Bordered Foam Dressings

5.1.1.5. Hydrocolloid Dressings

5.1.1.5.1. Antimicrobial Hydrocolloid Dressings

5.1.1.5.2. Non Antimicrobial Hydrocolloid Dressings

5.1.1.6. Collagen Dressing

5.1.1.6.1. Antimicrobial Collagen Dressing

5.1.1.6.2. Non Antimicrobial Collagen Dressing

5.1.1.7. Contact Layer

5.1.1.7.1. Antimicrobial Wound Contact Layers

5.1.1.7.2. Non Antimicrobial Wound Contact Layers

5.1.1.8. Super Absorbent Dressings

5.1.1.8.1. Antimicrobial Super Absorbent Dressings

5.1.1.8.2. Non Antimicrobial Super Absorbent Dressings

5.1.1.9. Hydrofibres

5.1.1.9.1. Antimicrobial Hydrogel Dressings

5.1.1.9.2. Non Antimicrobial Hydrogel Dressings

5.2. North America Advanced Wound Dressing Market Outlook, by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Chronic Ulcers

5.2.1.1.1. Venous Leg Ulcers

5.2.1.1.2. Diabetic Foot Ulcers

5.2.1.1.3. Pressure Ulcers

5.2.1.2. Non-Healing Surgical Wounds

5.2.1.2.1. Traumatic Wounds

5.2.1.2.2. Burn Cases

5.3. North America Advanced Wound Dressing Market Outlook, by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Institutional Sales

5.3.1.1.1. Hospitals

5.3.1.1.2. Clinics

5.3.1.1.3. Ambulatory Surgical Centers

5.3.1.1.4. Long Term Care Centers

5.3.1.2. Retail Sales

5.3.1.2.1. Hospital Pharmacies

5.3.1.2.2. Retail Pharmacies

5.3.1.2.3. Online Sales

5.4. North America Advanced Wound Dressing Market Outlook, by Country, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. U.S. Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

5.4.1.2. U.S. Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

5.4.1.3. U.S. Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

5.4.1.4. Canada Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

5.4.1.5. Canada Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

5.4.1.6. Canada Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Advanced Wound Dressing Market Outlook, 2019 - 2031

6.1. Europe Advanced Wound Dressing Market Outlook, by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Hydrogels Dressings

6.1.1.1.1. Antimicrobial Hydrogel Dressings

6.1.1.1.2. Non Antimicrobial Hydrogel Dressings

6.1.1.2. Semi-Permeable Films Dressings

6.1.1.2.1. Semi-Permeable Films Dressings

6.1.1.2.1.1. Antimicrobial Bordered Film Dressings

6.1.1.2.1.2. Antimicrobial Non Bordered Film Dressings

6.1.1.2.2. Semi-Permeable Films Dressings

6.1.1.2.2.1. Non Antimicrobial Bordered Film Dressings

6.1.1.2.2.2. Non Antimicrobial Non Bordered Film Dressings

6.1.1.3. Alginate Dressings

6.1.1.3.1. Antimicrobial Alginate Dressings

6.1.1.3.2. Non Antimicrobial Alginate Dressings

6.1.1.4. Foam Dressings

6.1.1.4.1. Antimicrobial Foam Dressings

6.1.1.4.1.1. Antimicrobial Bordered Foam Dressings

6.1.1.4.1.2. Antimicrobial Non Bordered Foam Dressings

6.1.1.4.2. Non Antimicrobial Foam Dressings

6.1.1.4.2.1. Non Antimicrobial Bordered Foam Dressings

6.1.1.4.2.2. Non Antimicrobial Non Bordered Foam Dressings

6.1.1.5. Hydrocolloid Dressings

6.1.1.5.1. Antimicrobial Hydrocolloid Dressings

6.1.1.5.2. Non Antimicrobial Hydrocolloid Dressings

6.1.1.6. Collagen Dressing

6.1.1.6.1. Antimicrobial Collagen Dressing

6.1.1.6.2. Non Antimicrobial Collagen Dressing

6.1.1.7. Contact Layer

6.1.1.7.1. Antimicrobial Wound Contact Layers

6.1.1.7.2. Non Antimicrobial Wound Contact Layers

6.1.1.8. Super Absorbent Dressings

6.1.1.8.1. Antimicrobial Super Absorbent Dressings

6.1.1.8.2. Non Antimicrobial Super Absorbent Dressings

6.1.1.9. Hydrofibres

6.1.1.9.1. Antimicrobial Hydrogel Dressings

6.1.1.9.2. Non Antimicrobial Hydrogel Dressings

6.2. Europe Advanced Wound Dressing Market Outlook, by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Chronic Ulcers

6.2.1.1.1. Venous Leg Ulcers

6.2.1.1.2. Diabetic Foot Ulcers

6.2.1.1.3. Pressure Ulcers

6.2.1.2. Non-Healing Surgical Wounds

6.2.1.2.1. Traumatic Wounds

6.2.1.2.2. Burn Cases

6.3. Europe Advanced Wound Dressing Market Outlook, by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Institutional Sales

6.3.1.1.1. Hospitals

6.3.1.1.2. Clinics

6.3.1.1.3. Ambulatory Surgical Centers

6.3.1.1.4. Long Term Care Centers

6.3.1.2. Retail Sales

6.3.1.2.1. Hospital Pharmacies

6.3.1.2.2. Retail Pharmacies

6.3.1.2.3. Online Sales

6.4. Europe Advanced Wound Dressing Market Outlook, by Country, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Germany Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.2. Germany Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.3. Germany Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.4. U.K. Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.5. U.K. Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.6. U.K. Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.7. France Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.8. France Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.9. France Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.10. Italy Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.11. Italy Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.12. Italy Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.13. Turkey Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.14. Turkey Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.15. Turkey Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.16. Russia Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.17. Russia Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.18. Russia Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.19. Rest of Europe Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.20. Rest of Europe Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.1.21. Rest of Europe Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Advanced Wound Dressing Market Outlook, 2019 - 2031

7.1. Asia Pacific Advanced Wound Dressing Market Outlook, by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Hydrogels Dressings

7.1.1.1.1. Antimicrobial Hydrogel Dressings

7.1.1.1.2. Non Antimicrobial Hydrogel Dressings

7.1.1.2. Semi-Permeable Films Dressings

7.1.1.2.1. Semi-Permeable Films Dressings

7.1.1.2.1.1. Antimicrobial Bordered Film Dressings

7.1.1.2.1.2. Antimicrobial Non Bordered Film Dressings

7.1.1.2.2. Semi-Permeable Films Dressings

7.1.1.2.2.1. Non Antimicrobial Bordered Film Dressings

7.1.1.2.2.2. Non Antimicrobial Non Bordered Film Dressings

7.1.1.3. Alginate Dressings

7.1.1.3.1. Antimicrobial Alginate Dressings

7.1.1.3.2. Non Antimicrobial Alginate Dressings

7.1.1.4. Foam Dressings

7.1.1.4.1. Antimicrobial Foam Dressings

7.1.1.4.1.1. Antimicrobial Bordered Foam Dressings

7.1.1.4.1.2. Antimicrobial Non Bordered Foam Dressings

7.1.1.4.2. Non Antimicrobial Foam Dressings

7.1.1.4.2.1. Non Antimicrobial Bordered Foam Dressings

7.1.1.4.2.2. Non Antimicrobial Non Bordered Foam Dressings

7.1.1.5. Hydrocolloid Dressings

7.1.1.5.1. Antimicrobial Hydrocolloid Dressings

7.1.1.5.2. Non Antimicrobial Hydrocolloid Dressings

7.1.1.6. Collagen Dressing

7.1.1.6.1. Antimicrobial Collagen Dressing

7.1.1.6.2. Non Antimicrobial Collagen Dressing

7.1.1.7. Contact Layer

7.1.1.7.1. Antimicrobial Wound Contact Layers

7.1.1.7.2. Non Antimicrobial Wound Contact Layers

7.1.1.8. Super Absorbent Dressings

7.1.1.8.1. Antimicrobial Super Absorbent Dressings

7.1.1.8.2. Non Antimicrobial Super Absorbent Dressings

7.1.1.9. Hydrofibres

7.1.1.9.1. Antimicrobial Hydrogel Dressings

7.1.1.9.2. Non Antimicrobial Hydrogel Dressings

7.2. Asia Pacific Advanced Wound Dressing Market Outlook, by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Chronic Ulcers

7.2.1.1.1. Venous Leg Ulcers

7.2.1.1.2. Diabetic Foot Ulcers

7.2.1.1.3. Pressure Ulcers

7.2.1.2. Non-Healing Surgical Wounds

7.2.1.2.1. Traumatic Wounds

7.2.1.2.2. Burn Cases

7.3. Asia Pacific Advanced Wound Dressing Market Outlook, by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Institutional Sales

7.3.1.1.1. Hospitals

7.3.1.1.2. Clinics

7.3.1.1.3. Ambulatory Surgical Centers

7.3.1.1.4. Long Term Care Centers

7.3.1.2. Retail Sales

7.3.1.2.1. Hospital Pharmacies

7.3.1.2.2. Retail Pharmacies

7.3.1.2.3. Online Sales

7.4. Asia Pacific Advanced Wound Dressing Market Outlook, by Country, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. China Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.1.2. China Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.1.3. China Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.1.4. Japan Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.1.5. Japan Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.1.6. Japan Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.1.7. South Korea Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.1.8. South Korea Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.1.9. South Korea Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.1.10. India Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.1.11. India Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.1.12. India Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.1.13. Southeast Asia Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.1.14. Southeast Asia Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.1.15. Southeast Asia Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.1.16. Rest of Asia Pacific Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.1.17. Rest of Asia Pacific Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.1.18. Rest of Asia Pacific Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Advanced Wound Dressing Market Outlook, 2019 - 2031

8.1. Latin America Advanced Wound Dressing Market Outlook, by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Hydrogels Dressings

8.1.1.1.1. Antimicrobial Hydrogel Dressings

8.1.1.1.2. Non Antimicrobial Hydrogel Dressings

8.1.1.2. Semi-Permeable Films Dressings

8.1.1.2.1. Semi-Permeable Films Dressings

8.1.1.2.1.1. Antimicrobial Bordered Film Dressings

8.1.1.2.1.2. Antimicrobial Non Bordered Film Dressings

8.1.1.2.2. Semi-Permeable Films Dressings

8.1.1.2.2.1. Non Antimicrobial Bordered Film Dressings

8.1.1.2.2.2. Non Antimicrobial Non Bordered Film Dressings

8.1.1.3. Alginate Dressings

8.1.1.3.1. Antimicrobial Alginate Dressings

8.1.1.3.2. Non Antimicrobial Alginate Dressings

8.1.1.4. Foam Dressings

8.1.1.4.1. Antimicrobial Foam Dressings

8.1.1.4.1.1. Antimicrobial Bordered Foam Dressings

8.1.1.4.1.2. Antimicrobial Non Bordered Foam Dressings

8.1.1.4.2. Non Antimicrobial Foam Dressings

8.1.1.4.2.1. Non Antimicrobial Bordered Foam Dressings

8.1.1.4.2.2. Non Antimicrobial Non Bordered Foam Dressings

8.1.1.5. Hydrocolloid Dressings

8.1.1.5.1. Antimicrobial Hydrocolloid Dressings

8.1.1.5.2. Non Antimicrobial Hydrocolloid Dressings

8.1.1.6. Collagen Dressing

8.1.1.6.1. Antimicrobial Collagen Dressing

8.1.1.6.2. Non Antimicrobial Collagen Dressing

8.1.1.7. Contact Layer

8.1.1.7.1. Antimicrobial Wound Contact Layers

8.1.1.7.2. Non Antimicrobial Wound Contact Layers

8.1.1.8. Super Absorbent Dressings

8.1.1.8.1. Antimicrobial Super Absorbent Dressings

8.1.1.8.2. Non Antimicrobial Super Absorbent Dressings

8.1.1.9. Hydrofibres

8.1.1.9.1. Antimicrobial Hydrogel Dressings

8.1.1.9.2. Non Antimicrobial Hydrogel Dressings

8.2. Latin America Advanced Wound Dressing Market Outlook, by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Chronic Ulcers

8.2.1.1.1. Venous Leg Ulcers

8.2.1.1.2. Diabetic Foot Ulcers

8.2.1.1.3. Pressure Ulcers

8.2.1.2. Non-Healing Surgical Wounds

8.2.1.2.1. Traumatic Wounds

8.2.1.2.2. Burn Cases

8.3. Latin America Advanced Wound Dressing Market Outlook, by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Institutional Sales

8.3.1.1.1. Hospitals

8.3.1.1.2. Clinics

8.3.1.1.3. Ambulatory Surgical Centers

8.3.1.1.4. Long Term Care Centers

8.3.1.2. Retail Sales

8.3.1.2.1. Hospital Pharmacies

8.3.1.2.2. Retail Pharmacies

8.3.1.2.3. Online Sales

8.4. Latin America Advanced Wound Dressing Market Outlook, by Country, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Brazil Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

8.4.1.2. Brazil Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

8.4.1.3. Brazil Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

8.4.1.4. Mexico Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

8.4.1.5. Mexico Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

8.4.1.6. Mexico Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

8.4.1.7. Argentina Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

8.4.1.8. Argentina Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

8.4.1.9. Argentina Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

8.4.1.10. Rest of Latin America Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

8.4.1.11. Rest of Latin America Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

8.4.1.12. Rest of Latin America Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Advanced Wound Dressing Market Outlook, 2019 - 2031

9.1. Middle East & Africa Advanced Wound Dressing Market Outlook, by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Hydrogels Dressings

9.1.1.1.1. Antimicrobial Hydrogel Dressings

9.1.1.1.2. Non Antimicrobial Hydrogel Dressings

9.1.1.2. Semi-Permeable Films Dressings

9.1.1.2.1. Semi-Permeable Films Dressings

9.1.1.2.1.1. Antimicrobial Bordered Film Dressings

9.1.1.2.1.2. Antimicrobial Non Bordered Film Dressings

9.1.1.2.2. Semi-Permeable Films Dressings

9.1.1.2.2.1. Non Antimicrobial Bordered Film Dressings

9.1.1.2.2.2. Non Antimicrobial Non Bordered Film Dressings

9.1.1.3. Alginate Dressings

9.1.1.3.1. Antimicrobial Alginate Dressings

9.1.1.3.2. Non Antimicrobial Alginate Dressings

9.1.1.4. Foam Dressings

9.1.1.4.1. Antimicrobial Foam Dressings

9.1.1.4.1.1. Antimicrobial Bordered Foam Dressings

9.1.1.4.1.2. Antimicrobial Non Bordered Foam Dressings

9.1.1.4.2. Non Antimicrobial Foam Dressings

9.1.1.4.2.1. Non Antimicrobial Bordered Foam Dressings

9.1.1.4.2.2. Non Antimicrobial Non Bordered Foam Dressings

9.1.1.5. Hydrocolloid Dressings

9.1.1.5.1. Antimicrobial Hydrocolloid Dressings

9.1.1.5.2. Non Antimicrobial Hydrocolloid Dressings

9.1.1.6. Collagen Dressing

9.1.1.6.1. Antimicrobial Collagen Dressing

9.1.1.6.2. Non Antimicrobial Collagen Dressing

9.1.1.7. Contact Layer

9.1.1.7.1. Antimicrobial Wound Contact Layers

9.1.1.7.2. Non Antimicrobial Wound Contact Layers

9.1.1.8. Super Absorbent Dressings

9.1.1.8.1. Antimicrobial Super Absorbent Dressings

9.1.1.8.2. Non Antimicrobial Super Absorbent Dressings

9.1.1.9. Hydrofibres

9.1.1.9.1. Antimicrobial Hydrogel Dressings

9.1.1.9.2. Non Antimicrobial Hydrogel Dressings

9.2. Middle East & Africa Advanced Wound Dressing Market Outlook, by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Chronic Ulcers

9.2.1.1.1. Venous Leg Ulcers

9.2.1.1.2. Diabetic Foot Ulcers

9.2.1.1.3. Pressure Ulcers

9.2.1.2. Non-Healing Surgical Wounds

9.2.1.2.1. Traumatic Wounds

9.2.1.2.2. Burn Cases

9.3. Middle East & Africa Advanced Wound Dressing Market Outlook, by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Institutional Sales

9.3.1.1.1. Hospitals

9.3.1.1.2. Clinics

9.3.1.1.3. Ambulatory Surgical Centers

9.3.1.1.4. Long Term Care Centers

9.3.1.2. Retail Sales

9.3.1.2.1. Hospital Pharmacies

9.3.1.2.2. Retail Pharmacies

9.3.1.2.3. Online Sales

9.4. Middle East & Africa Advanced Wound Dressing Market Outlook, by Country, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. GCC Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.4.1.2. GCC Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.4.1.3. GCC Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.4.1.4. South Africa Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.4.1.5. South Africa Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.4.1.6. South Africa Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.4.1.7. Egypt Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.4.1.8. Egypt Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.4.1.9. Egypt Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.4.1.10. Nigeria Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.4.1.11. Nigeria Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.4.1.12. Nigeria Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.4.1.13. Rest of Middle East & Africa Advanced Wound Dressing Market by Product, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.4.1.14. Rest of Middle East & Africa Advanced Wound Dressing Market by Indication, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.4.1.15. Rest of Middle East & Africa Advanced Wound Dressing Market by Distribution Channel, Value (US$ Mn) and Volume (Million Units), 2019 - 2031

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. Product vs Material Heatmap

10.2. Manufacturer vs Material Heatmap

10.3. Company Market Share Analysis, 2024

10.4. Competitive Dashboard

10.5. Company Profiles

10.5.1. Ethicon Inc. (Sub. of Johnson & Johnson)

10.5.1.1. Company Overview

10.5.1.2. Product Portfolio

10.5.1.3. Financial Overview

10.5.1.4. Business Strategies and Development

10.5.2. Smith & Nephew Plc

10.5.2.1. Company Overview

10.5.2.2. Product Portfolio

10.5.2.3. Financial Overview

10.5.2.4. Business Strategies and Development

10.5.3. ConvaTec Group Plc

10.5.3.1. Company Overview

10.5.3.2. Product Portfolio

10.5.3.3. Financial Overview

10.5.3.4. Business Strategies and Development

10.5.4. Coloplast A/S

10.5.4.1. Company Overview

10.5.4.2. Product Portfolio

10.5.4.3. Financial Overview

10.5.4.4. Business Strategies and Development

10.5.5. 3M

10.5.5.1. Company Overview

10.5.5.2. Product Portfolio

10.5.5.3. Financial Overview

10.5.5.4. Business Strategies and Development

10.5.6. BSN medical GmbH

10.5.6.1. Company Overview

10.5.6.2. Product Portfolio

10.5.6.3. Financial Overview

10.5.6.4. Business Strategies and Development

10.5.7. B. Braun Melsungen AG

10.5.7.1. Company Overview

10.5.7.2. Product Portfolio

10.5.7.3. Financial Overview

10.5.7.4. Business Strategies and Development

10.5.8. Mölnlycke Health Care

10.5.8.1. Company Overview

10.5.8.2. Product Portfolio

10.5.8.3. Financial Overview

10.5.8.4. Business Strategies and Development

10.5.9. Medline Industries Inc

10.5.9.1. Company Overview

10.5.9.2. Product Portfolio

10.5.9.3. Financial Overview

10.5.9.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Indication Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |