Global Aerosol Cans Market Forecast

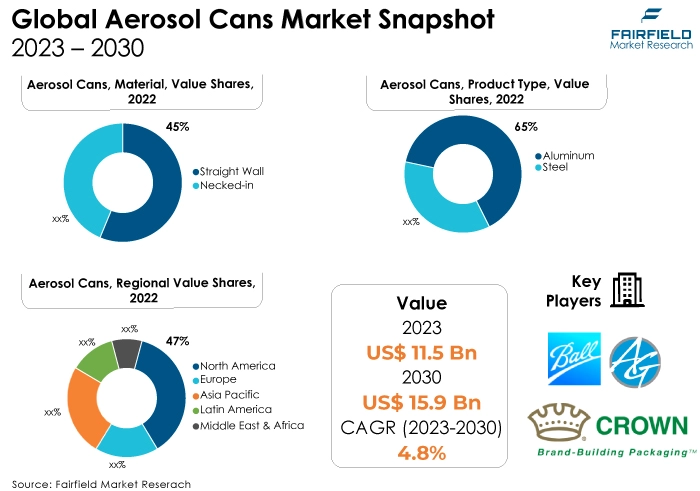

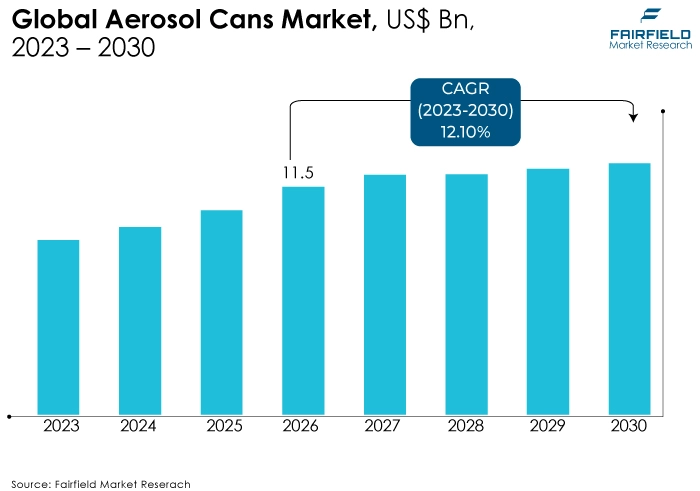

- Aerosol cans market size to jump from US$11.5 Bn in 2023 to US$15.9 Bn by 2030

- Market revenue expects a CAGR of 4.8%.between 2023 and 2030

Quick Report Digest

- The aerosol cans market is growing due to increasing demand for convenient packaging, innovations in aerosol technology, and a focus on sustainability. Consumer preferences for on-the-go products, coupled with advancements in eco-friendly packaging, contribute to the market's expansion across various industries, including personal care and household products.

- Another major market trend expected to fuel the growth of the aerosol cans market is the rapidly expanding personal care industry. The market is also predicted to profit from the expanding worldwide household products and automotive industries.

- Aluminum is growing in the aerosol cans market due to its lightweight, corrosion-resistant nature and excellent barrier properties, ensuring product integrity. Additionally, aluminum cans are recyclable, aligning with environmental concerns. The material's versatility and positive attributes contribute to its increasing popularity in the aerosol cans market.

- Straight Wall material is growing in the aerosol cans market due to its versatile and efficient cylindrical design. Offering simplicity, cost-effectiveness, and compatibility with various materials, straight-wall cans are preferred for personal care, household, and automotive products. This design caters to both manufacturers and consumers, driving its increasing popularity.

- Personal care applications are growing in the aerosol cans market due to the widespread use of aerosol packaging in products like deodorants, hairsprays, and shaving creams. The convenience, precision, and hygienic application provided by aerosol cans align with consumer preferences, driving increased demand in the personal care sector.

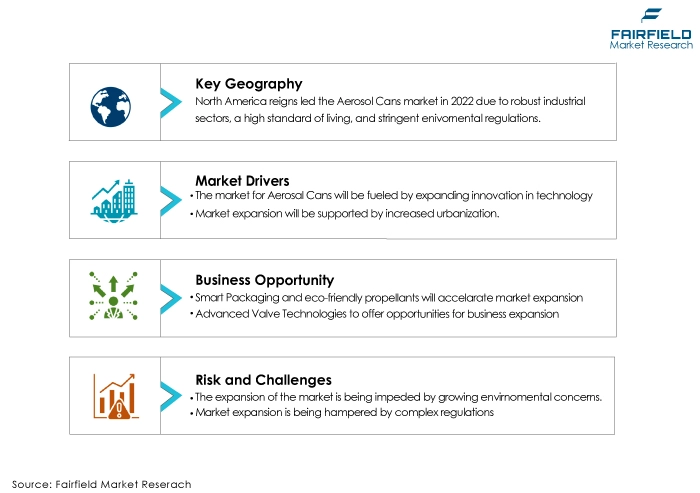

- Expanding innovation in technology is driving the aerosol cans market by enhancing product performance, sustainability, and consumer experience. Innovations in smart packaging, eco-friendly fuels, and advanced valve technologies meet evolving consumer demands, ensuring the competitiveness of aerosol cans across various industries and contributing to market growth.

- North America is growing in the aerosol cans market due to robust industrial sectors, a high standard of living, and stringent environmental regulations. The region's economic strength, combined with consumer preferences for convenient and sustainable packaging, positions North America as a dominant market for aerosol cans, fostering continuous growth.

- The Asia Pacific region is experiencing high growth in the aerosol cans market due to rapid urbanisation, increasing disposable incomes, and a growing middle-class population. These factors, along with advancements in technology and the entry of multinational companies, contribute to elevated demand for aerosol-packaged products, propelling market growth.

A Look Back and a Look Forward - Comparative Analysis

The aerosol cans market is experiencing growth due to increasing demand across various industries, including personal care, household products, and automotive. Consumer preferences for convenient packaging, coupled with innovations in aerosol technology, drive market expansion. Additionally, rising awareness of sustainable packaging solutions is fostering the development of eco-friendly aerosol cans, contributing to the overall growth of the market.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of major applications such as automotive, food, and paints. However, in some applications, the demand for aerosol cans has increased, including in personal care and household products.

The future of the aerosol cans market looks promising, driven by ongoing advancements in aerosol technology, heightened emphasis on sustainable packaging, and increasing demand from diverse industries. Innovations such as smart aerosol packaging and the development of eco-friendly materials are expected to play a pivotal role. Additionally, expanding applications in healthcare and pharmaceuticals are anticipated to contribute to sustained market growth. As environmental concerns rise, the industry is likely to witness further developments in recyclable and reusable aerosol packaging solutions.

Key Growth Determinants

- Expanding Innovation in Technology

Expanding innovation in technology is a key driver of the aerosol cans market as advancements continuously improve the efficiency, safety, and environmental sustainability of aerosol packaging. Ongoing research and development efforts focus on enhancing valve and propellant technologies, ensuring precise and controlled dispensing of products. Innovations also target eco-friendly solutions, addressing environmental concerns and regulatory requirements.

Advanced materials, such as improved can coatings and recyclable components, contribute to sustainability. Additionally, smart aerosol packaging with features like digital displays and sensor technologies is emerging, providing consumers with enhanced product experiences. These technological developments not only meet evolving consumer expectations for convenience and safety but also position aerosol cans as versatile and competitive solutions across various industries.

- Increased Urbanisation Rates

Increased urbanisation is a significant driver of the aerosol cans market due to the changing consumer dynamics in urban areas. Urban populations often lead fast-paced lifestyles, emphasizing convenience and efficiency. Aerosol cans align with these preferences, offering portable, easy-to-use packaging for various products, including personal care, household, and automotive items.

The compact nature of aerosol cans fits well with limited storage spaces in urban dwellings. Moreover, urban consumers are more likely to adopt innovative and technologically advanced products, contributing to the market's growth. The urban lifestyle's influence on consumer behavior fosters the demand for on-the-go, time-saving solutions, making aerosol packaging a preferred choice and driving its prominence in urbanised regions worldwide.

- Increasing Environmental Considerations

The increasing emphasis on environmental considerations is a major driver of the aerosol cans market. As environmental awareness grows, there is a heightened demand for sustainable and eco-friendly packaging solutions. In response, the aerosol cans industry is innovating to reduce its environmental impact. Manufacturers are developing recyclable materials, eco-friendly fuels, and sustainable packaging options. These efforts align with consumer preferences for environmentally conscious products and contribute to a positive brand image.

Additionally, stringent environmental regulations and corporate sustainability goals are prompting businesses to adopt greener practices, driving the market toward more sustainable aerosol packaging solutions that meet both regulatory requirements and consumer expectations for environmentally responsible products.

Major Growth Barriers

- Growing Environmental Concerns

They are growing environmental concerns present challenges to the aerosol cans market as consumers increasingly prioritise eco-friendly options. The industry faces pressure to minimise the environmental impact of aerosol packaging, addressing issues related to fuels, materials, and recycling. Adapting to sustainable practices requires substantial investments in research and development, potentially raising production costs.

Moreover, negative perceptions regarding the environmental footprint of aerosol cans may influence consumer choices, posing a challenge to market growth. To stay competitive, companies must navigate these concerns by implementing environmentally conscious practices and communicating their commitment to sustainability effectively.

- Complex Regulations

Complex regulations pose challenges to the aerosol cans market due to stringent standards governing fuels, materials, and safety. Adhering to diverse and evolving regulations demands significant resources and expertise, increasing compliance costs for manufacturers. The complexity may hinder innovation and product development, impacting market competitiveness.

Ensuring that aerosol products meet varying global and regional standards requires continuous monitoring and adaptation, placing an administrative burden on companies. Navigating this regulatory landscape is crucial for industry players to avoid legal issues, maintain product safety, and uphold consumer trust, contributing to the challenges faced by the aerosol cans market.

Key Trends and Opportunities to Look at

Rapid Adoption of Advanced Valve Technologies

Advanced valve technologies are revolutionising dispensing processes across industries. From precise medical dosing to controlled application of adhesives, these innovations offer greater accuracy, enhanced control, and significant reduction in waste. The realm of advanced valve technologies is brimming with innovations that are transforming the way fluids are dispensed across various industries.

Precise Dosing

Traditional valves often struggle with inconsistencies, leading to inaccurate amounts dispensed. Microfluidic valves, for example, utilise miniature channels and precise actuation mechanisms to deliver tiny, controlled volumes of fluids. This is particularly crucial in applications like pharmaceuticals, where even slight variations in dosage can have significant consequences.

Enhanced Control

Imagine dispensing adhesives with pinpoint accuracy or controlling the flow rate of a delicate chemical reaction. Advanced valves are making this a reality. Shear thinning valves, for instance, adjust the viscosity of a fluid based on the applied pressure, enabling smooth and controlled dispensing of even thick materials.

Minimizing Waste

Waste reduction is a major focus, both for economic and environmental reasons. Self-cleaning valves can eliminate the issue of residual material clogging the mechanism, ensuring consistent performance and preventing wasted product. Additionally, some valves boast features like automatic shut-off mechanisms that eliminate dripping or accidental discharge, minimising material loss.

How Does the Regulatory Scenario Shape this Industry?

The aerosol cans market is subject to various global and regional regulatory frameworks aiming to ensure product safety, environmental sustainability, and compliance. In the United States, the Environmental Protection Agency (EPA) regulates aerosol propellants under the Clean Air Act, while the Consumer Product Safety Commission (CPSC) oversees labeling and safety standards.

In the European Union, regulations such as REACH and CLP address chemical safety and classification. The Globally Harmonized System (GHS) provides international standards for aerosol labeling. Additionally, regional changes, like the European Single-Use Plastics Directive, impact the use of certain materials. Compliance with these regulations influences the market by shaping product formulations, packaging materials, and manufacturing processes to align with environmental and safety standards, ensuring market access and consumer trust.

Fairfield Market Research

Top Segments

- Aluminum Material Category Continues to Dominate

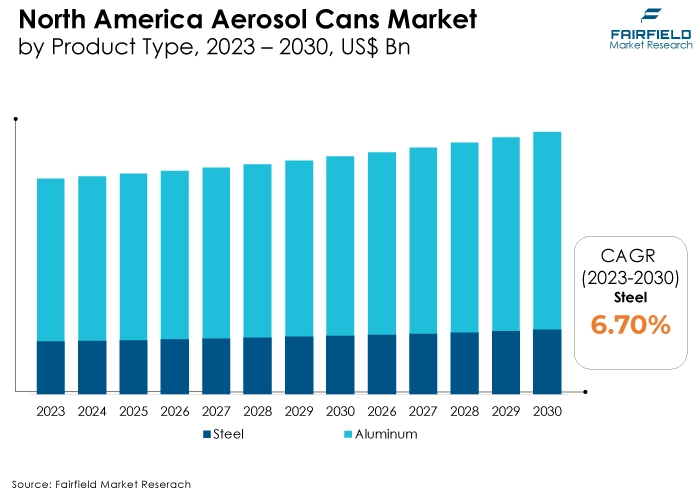

Aluminum has captured the largest market share in the aerosol cans market due to its advantageous properties. Aluminum aerosol cans are lightweight, corrosion-resistant, and possess excellent barrier properties, preserving the integrity of the packaged products. They are also recyclable, aligning with growing environmental concerns and sustainability preferences among consumers.

Moreover, aluminum offers a visually appealing surface for branding and printing. The material's versatility, combined with its positive environmental profile and consumer-friendly attributes, has contributed to its dominance in the aerosol cans market across various industries such as personal care, household, and automotive.

The steel product type is experiencing the highest CAGR in the aerosol cans market due to its unique attributes. Steel aerosol cans provide robustness, durability, and resistance to external factors, making them suitable for a wide range of applications, including industrial, automotive, and household products.

Additionally, advancements in steel manufacturing processes have led to lighter and more cost-effective steel aerosol cans. The material's strength, recyclability, and evolving production technologies contribute to its increasing popularity, driving its growth at a high CAGR within the aerosol cans market.

- Straight Material Continues to Surge Ahead

The straight wall material has captured the largest market share in the aerosol cans market due to its versatility and suitability for various applications. Straight Wall cans, often made from materials like aluminum or steel, offer a classic and efficient cylindrical design that accommodates diverse products, from personal care items to automotive products.

The straightforward construction allows for easy manufacturing and labeling, making it a preferred choice for both consumers and manufacturers. The simplicity, cost-effectiveness, and compatibility with different materials contribute to the dominance of straight-wall cans in the aerosol cans market.

The necked-in material is experiencing the highest CAGR the aerosol cans market due to its specialised design benefits. Necked-in cans offer precision in dispensing and controlled product release, making them ideal for applications like personal care and pharmaceuticals.

The narrower neck design enhances spray accuracy and minimises waste, catering to consumer preferences for efficient and targeted product application. As demand grows for precision in aerosol products, the unique attributes of necked-in cans contribute to their increasing popularity, resulting in the highest CAGR within the aerosol cans market.

- Personal Care Applications Take the Lead

The prsonal care application has captured the largest market share in the aerosol cans market due to the widespread use of aerosol products in categories like deodorants, hairsprays, and shaving creams. Aerosol cans offer convenient, precise, and controlled dispensing, aligning with consumer preferences for these personal care products.

Additionally, the aerosol format ensures hygienic and efficient application. The versatility of aerosol packaging, coupled with the demand for on-the-go products in the personal care sector, has propelled the dominance of personal care applications, contributing to the largest market share within the aerosol cans market.

The automotive application is experiencing the in CAGR in the aerosol cans market due to several factors. Automotive aerosol products, such as paints, lubricants, and cleaners, cater to the industry's maintenance and customisation needs. The convenience, precision, and portability offered by aerosol packaging are particularly advantageous in automotive applications.

As consumers and professionals alike seek efficient and easy-to-use solutions for automotive maintenance, the demand for aerosol cans in this sector is rising, contributing to the highest CAGR within the aerosol cans market.

Regional Outlook

North America Witnesses a Flourishing Trend of Eco-Friendly Packaging

North America has captured the largest market share in the aerosol cans market owing to several factors. The region's robust industrial and manufacturing sectors, coupled with a high standard of living, contribute to a substantial demand for aerosol-packaged products across various applications.

Additionally, stringent environmental regulations have spurred innovation in eco-friendly aerosol packaging solutions, driving market growth. The presence of key players and technological advancements further bolster the aerosol cans market in North America. Consumer preferences for convenient and versatile packaging also play a role. Overall, a combination of strong economic conditions, regulatory initiatives, and consumer behavior has positioned North America as a dominant market for aerosol cans.

Asia Pacific Received Strong Tailwinds from the Thriving Personal Care Industry

The Asia Pacific region is experiencing the highest CAGR in the aerosol cans market due to several key factors. Rapid urbanisation, increasing disposable incomes, and a burgeoning middle-class population have elevated consumer demand for aerosol-packaged products across diverse applications. The region's expanding manufacturing sector, coupled with rising awareness of personal care and household products, contributes to the growth.

Additionally, the adoption of innovative technologies and the entry of multinational companies further fuel the aerosol cans market in Asia Pacific. This dynamic combination of demographic trends, and market factors, position the region for substantial growth in the aerosol cans market.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the aerosol cans market is characterised by key players such as Ball Corporation, Crown Holdings, Ardagh Group, and others. Companies focus on innovations in smart packaging, sustainable materials, and precision dispensing technologies to gain a competitive edge.

Strategic partnerships, mergers, and acquisitions contribute to market consolidation. Meeting stringent environmental regulations and adapting to changing consumer preferences are critical factors influencing the competitive dynamics of the aerosol cans market.

Who are the Leaders in the Global Aerosol Cans Space?

- Crown Holdings, Inc.

- Ball Corporation

- Ardagh Group

- CCL Container

- Exal Corporation

- Nampak Ltd.

- ITW Sexton

- TUBEX Group

- Impress Group

- DS Containers, Inc.

- Bharat Containers

- Casablanca Group

- Technocan

- Euro Asia Packaging Company

- Massilly Group

- Linhardt GmbH & Co. KG

Significant Company Developments

New Product Launch

- December 2022: Trivium Packaging has committed financial support to the United Kingdom Aerosol Recycling Initiative, initiated by Alupro, an aluminum packaging recycling company. This initiative employs a three-phase strategy, aiming to educate consumers about optimal recycling practices, establish a baseline recycling rate, and outline a roadmap for achieving improved rates in aerosol recycling. The primary objective is to enhance awareness and participation in aerosol recycling across the United Kingdom.

- July 2022: Jamestrong Packaging, a manufacturer specialising in food and aerosol cans, has invested US$6 million in the expansion of its aerosol can factory. The focus of this investment is to augment the production of slugs used in aerosol cans at its Taree, New South Wales facility. This expansion is a response to the growing demand for products and aims to boost local production, simultaneously creating new employment opportunities through the establishment of a casting plant.

An Expert’s Eye

Demand and Future Growth

An increase in consumer demand for food is driving the market. The aerosol cans market is experiencing robust demand driven by consumer preferences for convenient packaging, innovation in aerosol technology, and a focus on sustainable practices. The market's future growth is anticipated as it expands into new applications, particularly in healthcare and pharmaceuticals.

The continual development of eco-friendly aerosol solutions and advancements in smart packaging technologies contribute to its resilience. Additionally, the increasing urbanisation, changing consumer lifestyles, and a global emphasis on product safety and compliance are expected to fuel sustained growth in the aerosol cans market.

Supply Side of the Market

The demand-supply dynamics in the aerosol cans market are influenced by increasing consumer demand for convenience and sustainable packaging. Current pricing structures reflect the cost of materials, manufacturing, and innovations in technology. The pricing will likely influence long-term growth by aligning with consumer preferences for eco-friendly options and regulatory compliance.

Major trends driving competition include innovations in smart packaging, sustainable materials, and precision dispensing technologies. The supply chain analysis involves the sourcing of raw materials, manufacturing processes, and distribution networks. Integration of sustainable practices and advancements in supply chain efficiency will be crucial for market players to stay competitive and meet evolving consumer expectations for environmentally conscious and convenient packaging solutions.

Global Aerosol Cans Market is Segmented as Below:

By Product Type:

- Aluminum

- Steel

By Material:

- Straight Wall

- Necked-in

By Application:

- Personal Care

- Household Products

- Automotive

- Food

- Paints

- Medical

- Misc

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Aerosol Cans Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Aerosol Cans Market Outlook, 2018 - 2030

3.1. Global Aerosol Cans Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Aluminum

3.1.1.2. Steel

3.2. Global Aerosol Cans Market Outlook, by Material, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Straight Wall

3.2.1.2. Necked-in

3.3. Global Aerosol Cans Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Personal Care

3.3.1.2. Household Products

3.3.1.3. Automotive

3.3.1.4. Food

3.3.1.5. Paints

3.3.1.6. Medical

3.3.1.7. Misc

3.4. Global Aerosol Cans Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Aerosol Cans Market Outlook, 2018 - 2030

4.1. North America Aerosol Cans Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Aluminum

4.1.1.2. Steel

4.2. North America Aerosol Cans Market Outlook, by Material, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Straight Wall

4.2.1.2. Necked-in

4.3. North America Aerosol Cans Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Personal Care

4.3.1.2. Household Products

4.3.1.3. Automotive

4.3.1.4. Food

4.3.1.5. Paints

4.3.1.6. Medical

4.3.1.7. Misc

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Aerosol Cans Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

4.4.1.4. Canada Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Aerosol Cans Market Outlook, 2018 - 2030

5.1. Europe Aerosol Cans Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Aluminum

5.1.1.2. Steel

5.2. Europe Aerosol Cans Market Outlook, by Material, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Straight Wall

5.2.1.2. Necked-in

5.3. Europe Aerosol Cans Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Personal Care

5.3.1.2. Household Products

5.3.1.3. Automotive

5.3.1.4. Food

5.3.1.5. Paints

5.3.1.6. Medical

5.3.1.7. Misc

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Aerosol Cans Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.4. U.K. Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.7. France Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.8. France Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

5.4.1.9. France Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.10. Italy Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.11. Italy Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

5.4.1.12. Italy Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.13. Turkey Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.14. Turkey Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

5.4.1.15. Turkey Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.16. Russia Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.17. Russia Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

5.4.1.18. Russia Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.19. Rest of Europe Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.20. Rest of Europe Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

5.4.1.21. Rest of Europe Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Aerosol Cans Market Outlook, 2018 - 2030

6.1. Asia Pacific Aerosol Cans Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Aluminum

6.1.1.2. Steel

6.2. Asia Pacific Aerosol Cans Market Outlook, by Material, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Straight Wall

6.2.1.2. Necked-in

6.3. Asia Pacific Aerosol Cans Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Personal Care

6.3.1.2. Household Products

6.3.1.3. Automotive

6.3.1.4. Food

6.3.1.5. Paints

6.3.1.6. Medical

6.3.1.7. Misc

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Aerosol Cans Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.4. Japan Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.7. South Korea Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.8. South Korea Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.10. India Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.11. India Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

6.4.1.12. India Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.13. Southeast Asia Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.14. Southeast Asia Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

6.4.1.15. Southeast Asia Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Aerosol Cans Market Outlook, 2018 - 2030

7.1. Latin America Aerosol Cans Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Aluminum

7.1.1.2. Steel

7.2. Latin America Aerosol Cans Market Outlook, by Material, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Straight Wall

7.2.1.2. Necked-in

7.3. Latin America Aerosol Cans Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Personal Care

7.3.1.2. Household Products

7.3.1.3. Automotive

7.3.1.4. Food

7.3.1.5. Paints

7.3.1.6. Medical

7.3.1.7. Misc

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Aerosol Cans Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.4. Mexico Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.7. Argentina Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

7.4.1.8. Argentina Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

7.4.1.9. Argentina Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.10. Rest of Latin America Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

7.4.1.11. Rest of Latin America Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

7.4.1.12. Rest of Latin America Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Aerosol Cans Market Outlook, 2018 - 2030

8.1. Middle East & Africa Aerosol Cans Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Aluminum

8.1.1.2. Steel

8.2. Middle East & Africa Aerosol Cans Market Outlook, by Material, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Straight Wall

8.2.1.2. Necked-in

8.3. Middle East & Africa Aerosol Cans Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Personal Care

8.3.1.2. Household Products

8.3.1.3. Automotive

8.3.1.4. Food

8.3.1.5. Paints

8.3.1.6. Medical

8.3.1.7. Misc

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Aerosol Cans Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.4. South Africa Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.7. Egypt Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.8. Egypt Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

8.4.1.9. Egypt Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.10. Nigeria Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.11. Nigeria Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

8.4.1.12. Nigeria Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Aerosol Cans Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Aerosol Cans Market Material, Value (US$ Mn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Aerosol Cans Market Application, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Application vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Crown Holdings, Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Ball Corporation

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Ardagh Group

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. CCL Container

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Exal Corporation

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Nampak Ltd.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. ITW Sexton

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. TUBEX Group

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Impress Group

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. DS Containers, Inc.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Bharat Containers

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Casablanca Group

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Technocan

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Euro Asia Packaging Company

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Massilly Group

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Material Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |