Global Aesthetic Lasers and Energy Devices Market Forecast

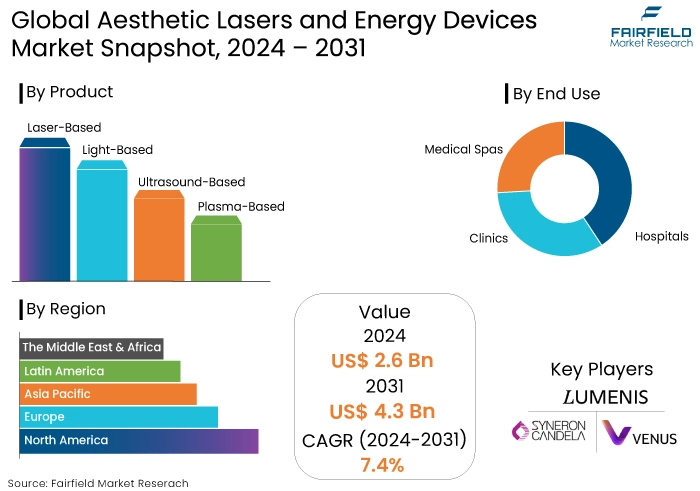

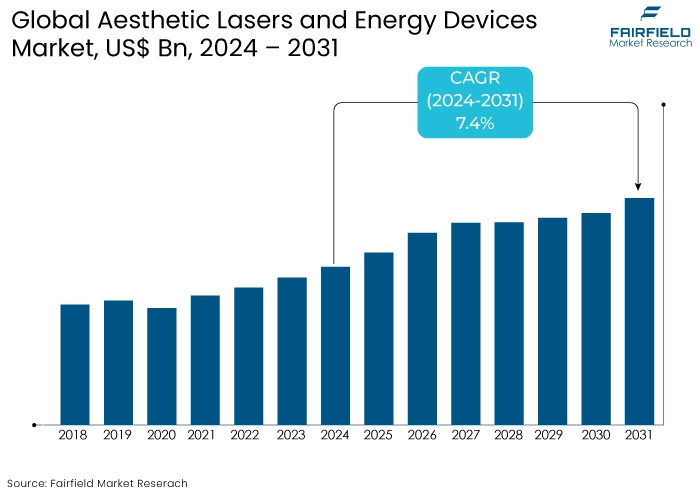

- The global aesthetic lasers and energy devices market is projected to value at US$4.3 Bn by 2031 showing significant growth from the US$2.6 Bn achieved in 2024.

- The market is anticipated to exhibit a CAGR of 7.4% during the forecast period from 2024 to 2031.

Aesthetic Lasers and Energy Devices Market Insights

- Young demographics and millennials prioritize aesthetic treatments that fit into their busy lifestyles driving market growth.

- The aging population and changing demographics are fueling aesthetic lasers and energy devices market

- The rising popularity of customized treatment plans is a significant trend influencing the market share of aesthetic lasers and energy delays.

- The integration of artificial intelligence and personalized treatment plans enables practitioners to tailor procedures to individual patient needs resulting in better outcomes.

- Technological advancements in aesthetic lasers and energy devices are revolutionizing treatment options and improving efficacy and safety.

- The laser resurfacing devices segment emerged as the market leader in 2022.

- Favorable reimbursement policies for aesthetic procedures in regions like North America stimulate demand for advanced aesthetic devices.

- The energy-based technology segment captured the largest share of the market in 2022 due to its widespread application in skin treatments globally.

- Regulatory bodies like the FDA and EMA impose stringent safety and efficacy standards for aesthetic devices.

A Look Back and a Look Forward - Comparative Analysis

The aesthetic lasers and energy devices market experienced significant growth pre-2023, with a notable expansion, reaching CAGR of 6.3% from 2019 to 2023. This growth is fueled by increasing consumer awareness and demand for non-invasive cosmetic procedures.

Factors such as advancements in technology, growing geriatric population, and rising disposable incomes have fueled market growth. The market is projected to expand at a CAGR of 7.4% during the period from 2024 to 2031.

Market trends influencing this growth include the rising popularity of customized treatment plans, the introduction of innovative devices, and the expansion of non-surgical options like vaginal rejuvenation. Additionally, the increasing acceptance of aesthetic procedures in various cultures and the rise of medical tourism are expected to further propel market expansion.

The convergence of technological advancements and heightened consumer interest in personal aesthetics positions the market for continued growth in the coming years making it a dynamic sector within the healthcare industry.

Key Growth Determinants

- Increasing Demand for Non-Invasive Procedures

The increasing preference for non-invasive aesthetic procedures is a primary driver for the aesthetic lasers and energy devices market expansion. With consumers becoming aware of the risks associated with surgical interventions, there has been a notable shift toward safe, less and invasive options.

Procedures such as laser hair removal, skin resurfacing, and body contouring have gained popularity due to their minimal recovery times and effective results. This trend is particularly evident among young demographics and millennials who prioritize aesthetic treatments that fit into their busy lifestyles. The ability to achieve desired outcomes without the need for extensive downtime appeals to a broader audience, driving market growth.

- Technological Advancements in Aesthetic Laser and Energy Devices

Technological advancements in aesthetic lasers and energy devices are significantly propelling market growth. Innovations such as fractional laser technology, radiofrequency devices, and high-intensity focused ultrasound (HIFU) have revolutionized treatment options, improving efficacy and safety. These advancements not only enhance the precision of procedures but also minimize side effects and recovery times, attracting more consumers to aesthetic treatments.

The integration of artificial intelligence and personalized treatment plans enables practitioners to tailor procedures to individual patient needs resulting in better outcomes and higher patient satisfaction rates. As manufacturers invest in research and development to create cutting-edge devices with enhanced features, the competitive landscape intensifies leading to more options for consumers.

- Aging Population and Changing Demographics

The aging population is a significant growth driver for the aesthetic lasers and energy devices market growth. As individuals age, they often seek solutions to address skin concerns such as wrinkles, sagging skin, and pigmentation issues. The desire to maintain a youthful appearance and boost self-confidence drives demand for aesthetic treatments among old adults.

The rise in disposable income and changing societal norms regarding beauty and self-care have led to increased acceptance of aesthetic procedures across various age groups including younger demographics.

Broadening of the target audience creates new opportunities for market expansion. Moreover, as more men and women in their 30s and 40s embrace preventive measures and early interventions, the market sees a shift in consumer behavior toward proactive aesthetic treatments.

Key Growth Barriers

- High Cost of Treatments

One of the significant restraints for the aesthetic lasers and energy devices market is the high cost of treatments associated with these advanced technologies. Aesthetic procedures often require substantial financial investment, which can deter potential consumers, especially in regions with lower disposable incomes.

The initial costs of purchasing and maintaining sophisticated laser and energy devices can also be prohibitive for clinics and practitioners leading to high prices for end users. This financial barrier can limit access to these treatments particularly among middle-income individuals who may prioritize essential healthcare over cosmetic procedures.

While some patients may be willing to invest in aesthetic treatments, the lack of insurance coverage for elective procedures further exacerbates the issue making it less feasible for many.

- Social Stigma Associated with Cosmetic Treatments

Another notable restraint impacting the aesthetic lasers and energy devices market revenue is the social stigma associated with cosmetic treatments. Despite growing acceptance of aesthetic procedures, many individuals still face societal pressures and negative perceptions regarding the use of cosmetic enhancements. This stigma can lead to hesitance among potential consumers who may fear judgment or criticism from peers and family members.

In some cultures, undergoing aesthetic treatments is viewed as a sign of vanity or insecurity, which can deter individuals from seeking these services. Also, the portrayal of cosmetic procedures in media and popular culture can contribute to misconceptions about their safety and efficacy further complicating public perception.

Aesthetic Lasers and Energy Devices Market Trends and Opportunities

- Rising Popularity of Customized Treatment Plans

A significant trend influencing aesthetic lasers and energy devices market is the increasing demand for customized treatment plans. As consumers become informed about their aesthetic options, they are seeking personalized solutions tailored to their specific needs and preferences. This shift is driven by advancements in technology that allow practitioners to create individualized treatment protocols based on a patient’s unique skin type, concerns, and desired outcomes.

The integration of artificial intelligence and machine learning in aesthetic devices enables more precise assessments and treatment recommendations. Clinics and practitioners that adopt this personalized approach are likely to attract a broader clientele as patients feel valued and understood.

- Expansion in Emerging Markets

Expansion in emerging markets is a key opportunity for the market players in regions like Asia-Pacific, Latin America, and parts of Africa. As disposable incomes rise and urbanization increases in these areas, many individuals are gaining access to aesthetic treatments that were previously considered luxury services.

The growing middle class in countries such as India and China is increasingly prioritizing personal appearance and wellness leading to a surge in demand for aesthetic procedures. The evolving healthcare infrastructure in these regions is facilitating the introduction of advanced aesthetic technologies making them accessible to a large population.

As awareness of aesthetic treatments grows fueled by social media and beauty influencers, the market is likely to see a significant uptick in consumer interest.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape plays a crucial role in shaping the aesthetic lasers and energy devices market growth. Regulatory bodies such as the FDA in the United States and the Europe Medicines Agency (EMA) in Europe impose stringent safety and efficacy standards for aesthetic devices. These regulations ensure that products meet high safety benchmarks before they can be marketed, which can delay product launches but ultimately enhance consumer trust in these technologies.

The complexity of the approval process can impact market dynamics. Devices that receive timely approvals can gain a competitive edge, while those facing regulatory hurdles may struggle to enter the market. Favorable reimbursement policies for aesthetic procedures in regions like North America further stimulate the demand for aesthetic lasers and energy devices.

In developing countries, evolving regulatory frameworks are beginning to support the introduction of aesthetic devices, which is expected to expand market opportunities. As regulations become more accommodating, the market is likely to see an influx of new players and technologies enhancing competition and innovation in the aesthetic lasers and energy devices sector.

Segments Covered in the Report

- Laser-Based Devices Dominates Market

Based on the product, the market is segmented into laser-based, light-based, ultrasound-based, and plasma-based devices. Among these, laser-based devices dominate the market. Laser-based devices are the leading product type in the market.

Devices are widely used in various aesthetic procedures such as hair removal, skin resurfacing, and tattoo removal contributing to their leading position in the market. Other categories include light-based, radiofrequency-based, and ultrasound-based devices. Laser-based devices generally hold the significant market share due to their effectiveness and versatility in aesthetic treatments.

- Clinics Continue to Lead the Market

The clinics segment leads the market because these facilities are highly specialized in offering aesthetic procedures. These have the expertise and equipment necessary for a wide range of treatments and attract many patients seeking cosmetic enhancements.

Clinics are focused on aesthetic treatments and tend to have high adoption rates of advanced laser and energy devices than hospitals and medical spas.

Regional Analysis

- North America Takes the Charge in the Market

North America aesthetic lasers and energy devices market stands as a pivotal center for technological advancements. The ongoing innovation in these technologies continually draws the attention of both medical practitioners and patients eager for state-of-the-art solutions in cosmetic procedures.

With its robust market dynamics, North America aesthetic laser and energy devices market is expected to be valued at around US$ 680 Mn in 2024. This figure is projected to surge to an impressive US$1001.5 Mn by the close of 2031 reflecting a growing demand for effective and advanced cosmetic treatments across the region.

Fairfield’s Competitive Landscape Analysis

The aesthetic lasers and energy devices market is characterized by rapid technological advancements and a growing demand for non-invasive procedures. Key players include Cynosure, Alma Lasers, and Cutera, which focus on innovative product development and strategic partnerships.

Increasing consumer awareness and rising disposable incomes drive market growth, while regulatory challenges and high equipment costs remain significant barriers. Competitive strategies involve enhancing product portfolios and expanding into emerging markets.

Key Market Companies

- Allergan plc (AbbVie Inc.)

- Mentor Worldwide LLC (Johnson & Johnson)

- Alma Lasers (Fosun Pharmaceutical Co., Ltd.)

- Bausch Health Companies Inc.

- Merz Pharma

- Hologic, Inc.

- Novartis AG

- Cutera Inc.

- Lumenis Ltd.

- Syneron Candela

- Cynosure (A division of Hologic Inc.)

- Lutronic Corporation

- Venus Concept Ltd.

- El.En. S.p.A.

- Solta Medical Inc.

- Lynton Lasers Ltd.

Recent Industry Developments

- April 2024

AVAVA™, an innovative aesthetics company, has launched MIRIA™, a breakthrough energy modality that caters to various clinical conditions. MIRIA offers comprehensive customized therapies for all skin types and concerns, with unique FDA-approved energy levels and a novel Focal Point Technology™ paired with an innovative imaging modality. The device allows for the treatment of both superficial and deeper layers simultaneously, providing a comfortable procedure with minimal social downtime and superb results tailored to individual needs.

- March 2024

Reveal Lasers LLC has launched the AlloraPro Laser Workstation, a state-of-the-art device designed for permanent hair reduction and skin rejuvenation treatments. The device uses 755nm Alexandrite and 1064nm Nd:YAG wavelengths for fast and permanent hair reduction. It has six ergonomic handpieces, a 30mm spot size, and can target vascular lesions, pigmented lesions, and photorejuvenation. The device's intuitive user interface allows providers to customize treatments for each patient, and its 25% larger spot size enhances treatment efficiency.

An Expert’s Eye

- The complexity of the approval process can impact market dynamics.

- Evolvong regulatory frameworks in developing countries are supporting the introduction of aesthetic devices, expanding market opportunities.

- Rising disposable incomes and urbanization in emerging markets are increasing access to aesthetic treatments.

- The growing middle class in countries like India and China is prioritizing personal appearance and wellness, leading to a surge in demand for aesthetic procedures.

- Evolving healthcare infrastructure in these several regions is facilitating the introduction of advanced aesthetic technologies.

Global Aesthetic Lasers and Energy Devices Market is Segmented as-

By Product

- Laser-Based

- Light-Based

- Ultrasound-Based

- Plasma-Based

By End Use

- Hospitals

- Clinics

- Medical Spas

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Aesthetic Lasers and Energy Devices Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. PESTLE Analysis

3. Global Aesthetic Lasers and Energy Devices Market Outlook, 2019 - 2031

3.1. Global Aesthetic Lasers and Energy Devices Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Laser Based

3.1.1.1.1. Ablative Fractional Lasers

3.1.1.1.1.1. CO2 Lasers

3.1.1.1.1.2. Erbium Lasers

3.1.1.1.2. Non-Ablative Fractional Lasers

3.1.1.1.2.1. Nd: YAG Laser

3.1.1.1.2.2. Er: Glass Laser

3.1.1.1.2.3. Other Laser

3.1.1.2. Intense Pulse Light

3.1.1.3. RF Based

3.1.1.4. Ultrasound Based

3.2. Global Aesthetic Lasers and Energy Devices Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Body Shaping

3.2.1.2. Hair Removal

3.2.1.3. Facial & Skin Treatment

3.2.1.4. Tattoo Removal

3.2.1.5. Vascular Treatment

3.2.1.6. Intimate Wellness

3.2.1.7. Scars and Striae

3.3. Global Aesthetic Lasers and Energy Devices Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Hospital

3.3.1.2. Cosmetic Clinics

3.3.1.3. Home Based Settings

3.3.1.4. Beauty Centers & Spas

3.4. Global Aesthetic Lasers and Energy Devices Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Aesthetic Lasers and Energy Devices Market Outlook, 2019 - 2031

4.1. North America Aesthetic Lasers and Energy Devices Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Laser Based

4.1.1.1.1. Ablative Fractional Lasers

4.1.1.1.1.1. CO2 Lasers

4.1.1.1.1.2. Erbium Lasers

4.1.1.1.2. Non-Ablative Fractional Lasers

4.1.1.1.2.1. Nd: YAG Laser

4.1.1.1.2.2. Er: Glass Laser

4.1.1.1.2.3. Other Laser

4.1.1.2. Intense Pulse Light

4.1.1.3. RF Based

4.1.1.4. Ultrasound Based

4.2. North America Aesthetic Lasers and Energy Devices Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Body Shaping

4.2.1.2. Hair Removal

4.2.1.3. Facial & Skin Treatment

4.2.1.4. Tattoo Removal

4.2.1.5. Vascular Treatment

4.2.1.6. Intimate Wellness

4.2.1.7. Scars and Striae

4.3. North America Aesthetic Lasers and Energy Devices Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Hospital

4.3.1.2. Cosmetic Clinics

4.3.1.3. Home Based Settings

4.3.1.4. Beauty Centers & Spas

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Aesthetic Lasers and Energy Devices Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

4.4.1.2. U.S. Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

4.4.1.3. U.S. Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

4.4.1.4. Canada Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

4.4.1.5. Canada Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

4.4.1.6. Canada Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Aesthetic Lasers and Energy Devices Market Outlook, 2019 - 2031

5.1. Europe Aesthetic Lasers and Energy Devices Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Laser Based

5.1.1.1.1. Ablative Fractional Lasers

5.1.1.1.1.1. CO2 Lasers

5.1.1.1.1.2. Erbium Lasers

5.1.1.1.2. Non-Ablative Fractional Lasers

5.1.1.1.2.1. Nd: YAG Laser

5.1.1.1.2.2. Er: Glass Laser

5.1.1.1.2.3. Other Laser

5.1.1.2. Intense Pulse Light

5.1.1.3. RF Based

5.1.1.4. Ultrasound Based

5.2. Europe Aesthetic Lasers and Energy Devices Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Body Shaping

5.2.1.2. Hair Removal

5.2.1.3. Facial & Skin Treatment

5.2.1.4. Tattoo Removal

5.2.1.5. Vascular Treatment

5.2.1.6. Intimate Wellness

5.2.1.7. Scars and Striae

5.3. Europe Aesthetic Lasers and Energy Devices Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Hospital

5.3.1.2. Cosmetic Clinics

5.3.1.3. Home Based Settings

5.3.1.4. Beauty Centers & Spas

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Aesthetic Lasers and Energy Devices Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.2. Germany Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.3. Germany Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.4. U.K. Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.5. U.K. Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.6. U.K. Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.7. France Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.8. France Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.9. France Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.10. Italy Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.11. Italy Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.12. Italy Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.13. Turkey Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.14. Turkey Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.15. Turkey Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.16. Russia Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.17. Russia Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.18. Russia Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.19. Rest of Europe Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.20. Rest of Europe Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.21. Rest of Europe Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Aesthetic Lasers and Energy Devices Market Outlook, 2019 - 2031

6.1. Asia Pacific Aesthetic Lasers and Energy Devices Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Laser Based

6.1.1.1.1. Ablative Fractional Lasers

6.1.1.1.1.1. CO2 Lasers

6.1.1.1.1.2. Erbium Lasers

6.1.1.1.2. Non-Ablative Fractional Lasers

6.1.1.1.2.1. Nd: YAG Laser

6.1.1.1.2.2. Er: Glass Laser

6.1.1.1.2.3. Other Laser

6.1.1.2. Intense Pulse Light

6.1.1.3. RF Based

6.1.1.4. Ultrasound Based

6.2. Asia Pacific Aesthetic Lasers and Energy Devices Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Body Shaping

6.2.1.2. Hair Removal

6.2.1.3. Facial & Skin Treatment

6.2.1.4. Tattoo Removal

6.2.1.5. Vascular Treatment

6.2.1.6. Intimate Wellness

6.2.1.7. Scars and Striae

6.3. Asia Pacific Aesthetic Lasers and Energy Devices Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Hospital

6.3.1.2. Cosmetic Clinics

6.3.1.3. Home Based Settings

6.3.1.4. Beauty Centers & Spas

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Aesthetic Lasers and Energy Devices Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. China Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

6.4.1.2. China Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

6.4.1.3. China Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.4. Japan Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

6.4.1.5. Japan Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

6.4.1.6. Japan Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.7. South Korea Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

6.4.1.8. South Korea Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

6.4.1.9. South Korea Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.10. India Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

6.4.1.11. India Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

6.4.1.12. India Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.13. Southeast Asia Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

6.4.1.14. Southeast Asia Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

6.4.1.15. Southeast Asia Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.16. Rest of Asia Pacific Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

6.4.1.17. Rest of Asia Pacific Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

6.4.1.18. Rest of Asia Pacific Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Aesthetic Lasers and Energy Devices Market Outlook, 2019 - 2031

7.1. Latin America Aesthetic Lasers and Energy Devices Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Laser Based

7.1.1.1.1. Ablative Fractional Lasers

7.1.1.1.1.1. CO2 Lasers

7.1.1.1.1.2. Erbium Lasers

7.1.1.1.2. Non-Ablative Fractional Lasers

7.1.1.1.2.1. Nd: YAG Laser

7.1.1.1.2.2. Er: Glass Laser

7.1.1.1.2.3. Other Laser

7.1.1.2. Intense Pulse Light

7.1.1.3. RF Based

7.1.1.4. Ultrasound Based

7.2. Latin America Aesthetic Lasers and Energy Devices Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Body Shaping

7.2.1.2. Hair Removal

7.2.1.3. Facial & Skin Treatment

7.2.1.4. Tattoo Removal

7.2.1.5. Vascular Treatment

7.2.1.6. Intimate Wellness

7.2.1.7. Scars and Striae

7.3. Latin America Aesthetic Lasers and Energy Devices Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Hospital

7.3.1.2. Cosmetic Clinics

7.3.1.3. Home Based Settings

7.3.1.4. Beauty Centers & Spas

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Aesthetic Lasers and Energy Devices Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

7.4.1.2. Brazil Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

7.4.1.3. Brazil Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.4. Mexico Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

7.4.1.5. Mexico Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

7.4.1.6. Mexico Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.7. Argentina Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

7.4.1.8. Argentina Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

7.4.1.9. Argentina Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.10. Rest of Latin America Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

7.4.1.11. Rest of Latin America Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

7.4.1.12. Rest of Latin America Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Aesthetic Lasers and Energy Devices Market Outlook, 2019 - 2031

8.1. Middle East & Africa Aesthetic Lasers and Energy Devices Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Laser Based

8.1.1.1.1. Ablative Fractional Lasers

8.1.1.1.1.1. CO2 Lasers

8.1.1.1.1.2. Erbium Lasers

8.1.1.1.2. Non-Ablative Fractional Lasers

8.1.1.1.2.1. Nd: YAG Laser

8.1.1.1.2.2. Er: Glass Laser

8.1.1.1.2.3. Other Laser

8.1.1.2. Intense Pulse Light

8.1.1.3. RF Based

8.1.1.4. Ultrasound Based

8.2. Middle East & Africa Aesthetic Lasers and Energy Devices Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Body Shaping

8.2.1.2. Hair Removal

8.2.1.3. Facial & Skin Treatment

8.2.1.4. Tattoo Removal

8.2.1.5. Vascular Treatment

8.2.1.6. Intimate Wellness

8.2.1.7. Scars and Striae

8.3. Middle East & Africa Aesthetic Lasers and Energy Devices Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Hospital

8.3.1.2. Cosmetic Clinics

8.3.1.3. Home Based Settings

8.3.1.4. Beauty Centers & Spas

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Aesthetic Lasers and Energy Devices Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

8.4.1.2. GCC Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

8.4.1.3. GCC Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.4. South Africa Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

8.4.1.5. South Africa Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

8.4.1.6. South Africa Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.7. Egypt Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

8.4.1.8. Egypt Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

8.4.1.9. Egypt Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.10. Nigeria Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

8.4.1.11. Nigeria Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

8.4.1.12. Nigeria Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.13. Rest of Middle East & Africa Aesthetic Lasers and Energy Devices Market by Product Type, Value (US$ Bn), 2019 - 2031

8.4.1.14. Rest of Middle East & Africa Aesthetic Lasers and Energy Devices Market by Application, Value (US$ Bn), 2019 - 2031

8.4.1.15. Rest of Middle East & Africa Aesthetic Lasers and Energy Devices Market by End User, Value (US$ Bn), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Product vs Indication Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Hologic Inc. (Cynosure, Inc.)

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Lumenis

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Syneron Medical Ltd.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Lynton Lasers Ltd

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. EL.EN. S.p.A. (Deka Mela S.r.l.)

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Fotona

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Cutera, Inc.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Lutronic Corporation

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Others

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |