Global Aged Care Market Forecast

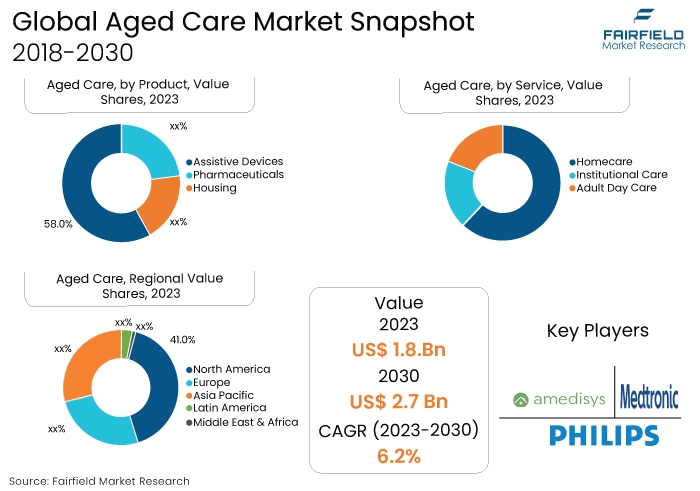

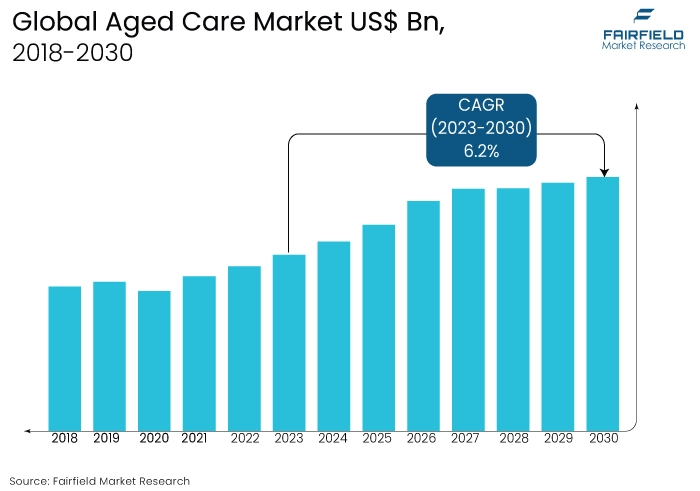

- The approximately US$1.8 Bn market for aged care (2023) poised to reach US$2.7 Bn in revenue by 2030

- Global aged care market size set to witness a CAGR of 6.2% between 2023 and 2030

Quick Report Digest

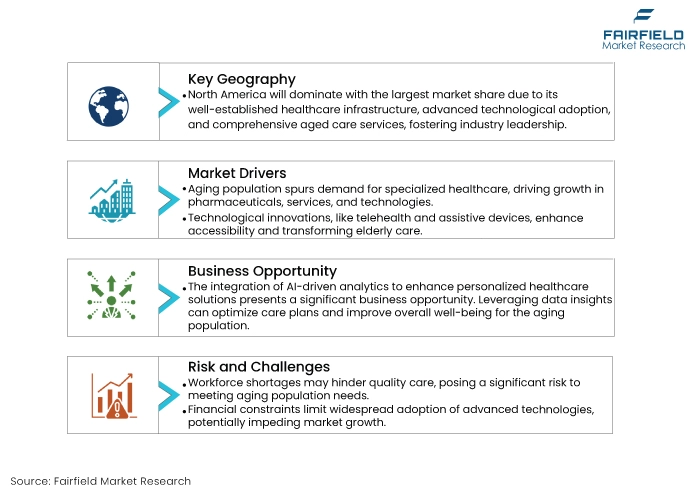

- In the geriatric care industry, the incorporation of cutting-edge technologies, including wearable health technology and artificial intelligence, is a prevalent trend. These technologies revolutionise the geriatric healthcare sector by enabling personalised care plans, real-time health monitoring, and predictive analytics.

- Telehealth solutions for healthcare delivery from a distance are experiencing rapid growth. Telemedicine, remote monitoring, and virtual consultations are increasingly recognised as essential elements that improve the convenience and accessibility of medical services for the elderly, particularly in areas that are geographically isolated.

- A notable development entails a fundamental change in perspective towards the implementation of preventive healthcare approaches. There is a growing trend in the market towards proactive health management, whereby personalised preventive care strategies are being adopted to improve the general wellbeing of the elderly.

- There is currently a notable increase in the utilisation of sophisticated assistive devices within the geriatric care industry. These devices, which range from wearable health technologies to smart home solutions, empower the elderly by promoting safety and independence and addressing the changing requirements of an ageing population.

- It is anticipated that the pharmaceutical sector will hold the largest market share in 2022. The geriatric population's high incidence of chronic diseases drives the need for pharmaceutical interventions, medications, and healthcare supplements; thus, this demographic is a pillar in the aged care industry.

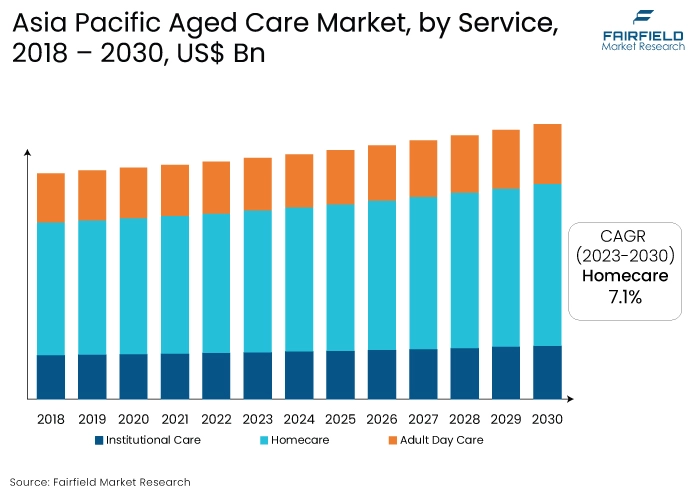

- In terms of the adult day care, homecare, and institutional care segments, homecare is anticipated to hold the lead in 2022. In conjunction with technological advancements in home-based healthcare, the increasing preference for ageing in place is a significant factor in the expansion of the homecare market.

- Diabetes is anticipated to hold the largest market share among health segments in 2022. The urgency for tailored care and management strategies for the ageing population is emphasized by the worldwide diabetes pandemic, which propels diabetes care to the vanguard of the market.

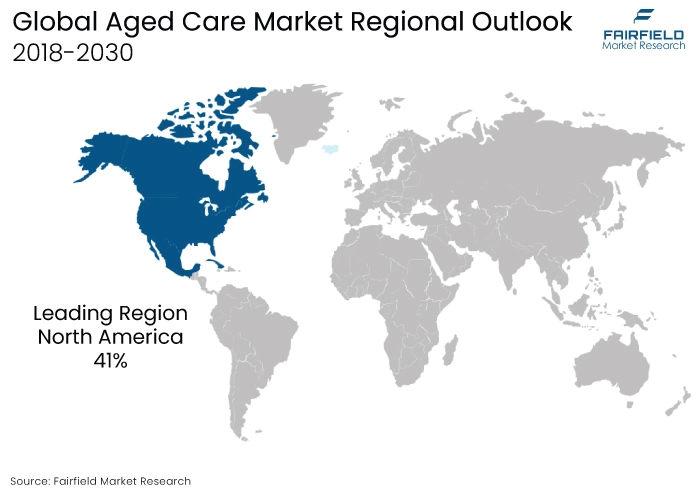

- North America is positioned to achieve the highest level of market penetration on a global scale. North America is a centre for geriatric care services due to its advanced technological adoption and well-established healthcare infrastructure. Comprehensive healthcare services, AI-driven analytics, and innovative telehealth solutions are some of the applications.

- It is expected that the Asia Pacific region will experience the most rapid expansion in market penetration. As a result of a swiftly ageing population, increased healthcare awareness, and government initiatives, the Asia Pacific region is emerging as a key growth area for elderly care. Prospects encompass the advancement of infrastructure, technological progress, and the creation of novel care models to bolster healthcare services for the geriatric.

A Look Back and a Look Forward - Comparative Analysis

Under the present market conditions, the worldwide geriatric care industry is undergoing substantial expansion driven by ever-evolving trends. The demand for innovative healthcare solutions, including telehealth services, advanced assistive devices, and personalised healthcare strategies, is growing due to the geriatric population and increased awareness of healthcare issues.

Pharmaceutical interventions, specifically those designed to treat prevalent chronic diseases among the elderly, hold a substantial market share. Homecare services experience significant expansion due to the growing preference of elderly individuals to age in the convenience of their residences.

Over time, the geriatric care industry has transformed, shifting its focus from conventional institutional care to a more varied sector that includes home care and cutting-edge healthcare technologies. A defining trend, the transition to preventive and personalised healthcare demonstrates the industry's responsiveness to emergent demands. Pharmaceutical innovations and the integration of technology have been instrumental in determining the historical course of the market.

Anticipating the future, the market scenario predicts ongoing growth, with the Asia Pacific region assuming a preeminent position in terms of market penetration. The imperative for specialised care is underscored by the high incidence of diabetes and other chronic ailments, which propels the pharmaceutical sector.

Technological advances, particularly those about telehealth and artificial intelligence, have the potential to revolutionise the provision of care for the geriatric by rendering it more accessible and customised to meet the unique requirements of everyone. Considering the ongoing evolution of the global aged care market, effective collaboration among policymakers, technology developers, healthcare providers, and the elderly will be critical for assuring sustainable growth and an enhanced quality of life for this demographic.

Key Growth Determinants

- Significant Ageing Population

The geriatric population is a significant market catalyst, propelling the worldwide elderly care industry towards unparalleled expansion. The ageing of global populations has generated a growing need for all-encompassing healthcare solutions that are customised to address the unique requirements of the geriatric.

The escalation of chronic diseases due to this demographic transition underscores the critical need for innovative pharmaceuticals, assistive technologies, and healthcare provisions. The profound ramifications of an ageing population transcend conventional healthcare, stimulating advancements in telehealth, homecare, and personalised health management, which consequently propel the growth of the market.

- Swift Progressions in Healthcare Sector

The swift progressions in healthcare technology serve as a critical catalyst, fundamentally altering the domain of elderly care. The amalgamation of intelligent assistive devices, telehealth services, and artificial intelligence enables healthcare providers to provide the geriatric with services that are more individualised, efficient, and accessible.

In addition to augmenting diagnostic and therapeutic capacities, these technologies enable remote monitoring, preventive healthcare, and an overall enhancement of health. Market expansion is fuelled by the expanding synergy between healthcare and technology, which generates opportunities for novel solutions that address the specific healthcare requirements of the geriatric population.

- Widening Accessibility Options

Enhanced accessibility and a surge in healthcare consciousness serve as catalysts for the growth of the elderly care market. As recognition of the significance of proactive health management increases, individuals are more likely to actively pursue and embrace preventive healthcare measures.

The improvement in healthcare literacy, and government initiatives collectively contribute to the expansion of healthcare services, medication availability, and assistive device accessibility. Increased accessibility not only caters to the changing requirements of the ageing demographic but also stimulates market expansion through the promotion of a more involved and knowledgeable approach to care for the elderly.

Major Growth Barriers

- Impending Financial Forecast

The elderly care industry is substantially impeded by financial limitations. Healthcare systems worldwide are experiencing significant strain due to the increasing expenses linked to advanced healthcare technologies, pharmaceuticals, and personalised care solutions.

The potential for the market to expand more broadly and inclusively is impeded by the implementation of comprehensive and accessible geriatric care, which is complicated by insufficient funding and resource allocation.

- Higher Service Fees

A significant impediment to the market is the dearth of competent healthcare practitioners and geriatric care-specialised caregivers. The increasing need for care for the elderly surpasses the supply of qualified personnel, resulting in difficulties in delivering high-quality care.

Inadequate labour forces impede the sector's capacity to address the varied and growing demands of an ageing demographic, thereby constraining the overall growth of the market.

Key Trends and Opportunities to Look at

- Expansion of Telehealth Applications

The convenience and accessibility of telehealth are stimulating its exponential expansion. Its widespread adoption is preponderant in North America, despite its international prominence. Notable entities such as Teladoc Health and Amwell have experienced significant expansion.

Brands are anticipated to capitalise on this development through strategic alliances, investments in user-friendly platforms, and improvements to remote monitoring capabilities to expand their service offerings and market presence in the burgeoning telehealth industry.

- Growing Focus on Wearable Technology

As the prevalence of wearable health technologies increases, healthcare is undergoing a revolution. In Europe, Asia Pacific, and North America, this trend is pervasive. Apple, Fitbit, and Samsung, among others, are leaders in the industry by introducing novel functionalities.

To capture a greater portion of the market, it is anticipated that brands will capitalise on this trend by emphasizing health-centric attributes, integrating data with healthcare providers, and developing seamless user experiences.

- Demand for Personalised Healthcare Within International Space

There is a significant increase in the demand for personalised healthcare solutions on a global scale, particularly in Europe, and North America. In this industry, IBM Watson Health and Siemens Healthineers are innovation leaders.

Brands are positioned to capitalise on this trend through strategic investments in AI-powered analytics, genomic medicine, and customised care plans. By providing individualised services to address the varied care requirements of the elderly, they can carve out a market niche.

How Does the Regulatory Scenario Shape this Industry?

The global market for senior care is governed by a multifaceted regulatory framework that differs geographically. The Centers for Medicare & Medicaid Services (CMS) regulate and supervise geriatric care services on a comprehensive scale within the United States. An additional way in which the Affordable Care Act (ACA) has affected market dynamics is through its promotion of preventive services and emphasis on value-based care.

The European Union has enacted directives and guidelines concerning the quality of social services and healthcare for the elderly. The Aged Care Quality and Safety Commission in Australia plays a significant role in ensuring adherence to quality standards.

Market participants may be substantially influenced by region-specific regulatory modifications, including revisions to reimbursement policies or the implementation of fresh care standards. As a result, their service offerings and strategies may be adjusted to conform to the ever-evolving regulatory demands.

Fairfield’s Ranking Board

Top Segments

- Antibiotics to be the Top Products Category

Antibiotics are anticipated to hold the most significant market share within the senior care sector. The increasing incidence of chronic diseases among the elderly demographic has generated a significant and ongoing need for pharmaceutical interventions, supplements, and medications.

The ongoing advancement of sophisticated pharmaceuticals to tackle diverse health issues establishes this sector as a fundamental component in delivering all-encompassing and specialised healthcare for the geriatric.

Pharmaceuticals, housing, and assistive devices are all segments; however, it is expected that the assistive devices sector will expand at the quickest rate. The proliferation of assistive devices and growing recognition of their benefits are catalysts for the implementation of technological innovations that improve the quality of life for the elderly.

The ageing population's changing requirements are being met by a steady stream of innovative assistive devices, including wearable health devices and smart home technologies. As a result, this market segment is leading in terms of market penetration and expansion.

- Demand will be the Maximum in Institutional Care

The market share of institutional care is anticipated to be the largest in the geriatric care sector. Institutional care facilities have gained prominence due to the requirements for round-the-clock medical supervision and the demand for comprehensive and specialised healthcare services.

Because ageing populations necessitate more extensive healthcare interventions, assisted living facilities and nursing homes are examples of institutional care establishments that play a crucial role in meeting the varied healthcare requirements of the elderly.

Homecare is anticipated to experience the most rapid growth rate among adult daycare, institutional care, and home care. The rising prevalence of homecare services can be attributed to the development of sophisticated home-based healthcare technologies and the trend toward ageing in place.

In conjunction with technological advancements that facilitate remote monitoring and healthcare provision, the demand for autonomy and individualised attention positions home care as the sector that holds the greatest promise for swift expansion and acceptance in the coming years.

- Notable Application Identified in Diabetes Care

Among the various health segments that are considered, such as cardiovascular, respiratory, cancer, kidney, and heart diseases, diabetes is projected to hold the largest market share. The increasing prevalence of diabetes worldwide, specifically among the elderly demographic, drives the need for specialised healthcare interventions, medications, and management strategies. As a result, diabetes care has emerged as a substantial market segment within the geriatric care sector.

Neurological disorders are positioned to witness the most rapid expansion among the health sectors. The rising demand for specialised care is a result of the increasing prevalence of conditions such as Alzheimer's and Parkinson's disease, as well as developments in diagnostic technologies and therapeutic interventions.

With the increasing recognition and comprehension of neurological disorders, it is anticipated that this sector will experience rapid expansion. In this regard, groundbreaking therapies and assistance services will be pivotal in influencing the trajectory of geriatric care in the coming years.

Regional Frontrunners

Global Market Revenue Remains Concentrated in North America

North America is positioned to hold the largest market share in the worldwide elderly care sector. The area is distinguished by its sophisticated healthcare infrastructure, considerable geriatric care consciousness, and substantial elderly population.

In conjunction with a firmly established healthcare system, robust government support positions North America as the market leader. Additionally, technological advancements and a growing trend toward home-based healthcare contribute to the region's comprehensive geriatric care offerings, thereby strengthening its market share leadership.

Asia Pacific Expects Fastest Expansion in Revenue Through 2030

Asia Pacific is anticipated to witness the most rapid expansion of the worldwide senior care market. Particularly in Japan, and China, the region's geriatric population is ageing at an accelerated rate, which increases the demand for novel and diverse elderly care solutions.

The rapid expansion of the market can be attributed to a combination of government initiatives, increased healthcare spending, and a growing awareness of the health requirements of the elderly.

With the progression of technology and the enhancement of healthcare infrastructure, the Asia Pacific region has become a hub for significant expansion, offering extensive prospects for market participants to tackle the changing requirements of the geriatric population.

Fairfield’s Competitive Landscape Analysis

The pricing framework presently in place for geriatric care is influenced by the intricacy of pharmaceutical interventions, healthcare services, and advanced assistive devices. With the increase in demand, the adoption of cost-effective technologies, efficient healthcare delivery models, and government reimbursement policies are expected to exert an influence on pricing dynamics.

Prominent trends that propel competition within the realm of business include an emphasis on strategic alliances, personalised healthcare solutions, and technological innovation. It is anticipated that organisations capable of providing all-encompassing, cutting-edge, and economically viable services will attain a competitive advantage.

Who are the Leaders in the Global Aged Care Space?

- Koninklijke Philips N.V.

- Amedisys

- ECON Healthcare Group

- Encompass Health Corporation

- EXTENDICARE

- LHC Group, Inc.

- Medtronic

- ORPEA GROUPE

- Prolific

- ElderCareCanada

An Expert’s Eye

Demand and Future Growth

The ageing of the global population is anticipated to be a significant factor in the market's sustained expansion of senior care services. The escalating incidence of chronic illnesses among the elderly guarantees an ongoing need for pharmaceutical products, specialised medical services, and cutting-edge assistive technologies.

Furthermore, the increasing inclination towards individualised and proactive healthcare solutions corresponds with the changing requirements of the geriatric population, thereby generating opportunities for sustained market growth.

Long-term market expansion is anticipated to be propelled by the need for all-encompassing, easily accessible, and technologically sophisticated geriatric care services, as individuals strive to preserve a superior standard of living during their later years.

Supply Side of the Market

Amidst an upsurge in market demand, stakeholders in the industry encounter obstacles about supply, predominantly in the form of labour force deficiencies. The potential lack of adequately trained healthcare professionals and aged care specialists may impede the sector's capacity to address the ever-growing and varied requirements of the geriatric demographic. To tackle this challenge, it is imperative to make strategic investments in education and training initiatives that cultivate a proficient labour force capable of providing superior geriatric care services.

Global Aged Care Market is Segmented as Below:

By Product Type:

- Pharmaceuticals

- Housing

- Assistive Devices

By Service:

- Institutional Care

- Homecare

- Adult Day Care

By Application:

- Heart Diseases

- Cancer

- Kidney Diseases

- Diabetes

- Osteoporosis

- Neurological

- Respiratory

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Aged Care Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Aged Care Market Outlook, 2018 - 2030

3.1. Global Aged Care Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Pharmaceuticals

3.1.1.2. Housing

3.1.1.3. Assistive Devices

3.2. Global Aged Care Market Outlook, by Service, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Cancer

3.2.1.2. Immunology

3.2.1.3. Cardiovascular Diseases

3.3. Global Aged Care Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Heart Diseases

3.3.1.2. Cancer

3.3.1.3. Kidney Diseases

3.3.1.4. Diabetes

3.3.1.5. Osteoporosis

3.3.1.6. Neurological

3.3.1.7. Respiratory

3.3.1.8. Others

3.4. Global Aged Care Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Aged Care Market Outlook, 2018 - 2030

4.1. North America Aged Care Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Pharmaceuticals

4.1.1.2. Housing

4.1.1.3. Assistive Devices

4.2. North America Aged Care Market Outlook, by Service, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Institutional Care

4.2.1.2. Homecare

4.2.1.3. Adult Day Care

4.3. North America Aged Care Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Heart Diseases

4.3.1.2. Cancer

4.3.1.3. Kidney Diseases

4.3.1.4. Diabetes

4.3.1.5. Osteoporosis

4.3.1.6. Neurological

4.3.1.7. Respiratory

4.3.1.8. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Aged Care Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Aged Care Market Service, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Aged Care Market Application, Value (US$ Mn), 2018 - 2030

4.4.1.4. Canada Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Aged Care Market Service, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Aged Care Market Application, Value (US$ Mn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Aged Care Market Outlook, 2018 - 2030

5.1. Europe Aged Care Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Pharmaceuticals

5.1.1.2. Housing

5.1.1.3. Assistive Devices

5.2. Europe Aged Care Market Outlook, by Service, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Institutional Care

5.2.1.2. Homecare

5.2.1.3. Adult Day Care

5.3. Europe Aged Care Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Heart Diseases

5.3.1.2. Cancer

5.3.1.3. Kidney Diseases

5.3.1.4. Diabetes

5.3.1.5. Osteoporosis

5.3.1.6. Neurological

5.3.1.7. Respiratory

5.3.1.8. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Aged Care Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Aged Care Market Service, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Aged Care Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.4. U.K. Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Aged Care Market Service, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Aged Care Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.7. France Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.8. France Aged Care Market Service, Value (US$ Mn), 2018 - 2030

5.4.1.9. France Aged Care Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.10. Italy Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.11. Italy Aged Care Market Service, Value (US$ Mn), 2018 - 2030

5.4.1.12. Italy Aged Care Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.13. Turkey Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.14. Turkey Aged Care Market Service, Value (US$ Mn), 2018 - 2030

5.4.1.15. Turkey Aged Care Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.16. Russia Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.17. Russia Aged Care Market Service, Value (US$ Mn), 2018 - 2030

5.4.1.18. Russia Aged Care Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.19. Rest of Europe Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.20. Rest of Europe Aged Care Market Service, Value (US$ Mn), 2018 - 2030

5.4.1.21. Rest of Europe Aged Care Market Application, Value (US$ Mn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Aged Care Market Outlook, 2018 - 2030

6.1. Asia Pacific Aged Care Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Pharmaceuticals

6.1.1.2. Housing

6.1.1.3. Assistive Devices

6.2. Asia Pacific Aged Care Market Outlook, by Service, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Institutional Care

6.2.1.2. Homecare

6.2.1.3. Adult Day Care

6.3. Asia Pacific Aged Care Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Heart Diseases

6.3.1.2. Cancer

6.3.1.3. Kidney Diseases

6.3.1.4. Diabetes

6.3.1.5. Osteoporosis

6.3.1.6. Neurological

6.3.1.7. Respiratory

6.3.1.8. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Aged Care Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Aged Care Market Service, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Aged Care Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.4. Japan Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Aged Care Market Service, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Aged Care Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.7. South Korea Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.8. South Korea Aged Care Market Service, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Aged Care Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.10. India Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.11. India Aged Care Market Service, Value (US$ Mn), 2018 - 2030

6.4.1.12. India Aged Care Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.13. Southeast Asia Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.14. Southeast Asia Aged Care Market Service, Value (US$ Mn), 2018 - 2030

6.4.1.15. Southeast Asia Aged Care Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Aged Care Market Service, Value (US$ Mn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Aged Care Market Application, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Aged Care Market Outlook, 2018 - 2030

7.1. Latin America Aged Care Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Pharmaceuticals

7.1.1.2. Housing

7.1.1.3. Assistive Devices

7.2. Latin America Aged Care Market Outlook, by Service, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Institutional Care

7.2.1.2. Homecare

7.2.1.3. Adult Day Care

7.3. Latin America Aged Care Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Heart Diseases

7.3.1.2. Cancer

7.3.1.3. Kidney Diseases

7.3.1.4. Diabetes

7.3.1.5. Osteoporosis

7.3.1.6. Neurological

7.3.1.7. Respiratory

7.3.1.8. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Aged Care Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Aged Care Market Service, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Aged Care Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.4. Mexico Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Aged Care Market Service, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Aged Care Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.7. Argentina Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

7.4.1.8. Argentina Aged Care Market Service, Value (US$ Mn), 2018 - 2030

7.4.1.9. Argentina Aged Care Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.10. Rest of Latin America Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

7.4.1.11. Rest of Latin America Aged Care Market Service, Value (US$ Mn), 2018 - 2030

7.4.1.12. Rest of Latin America Aged Care Market Application, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Aged Care Market Outlook, 2018 - 2030

8.1. Middle East & Africa Aged Care Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Pharmaceuticals

8.1.1.2. Housing

8.1.1.3. Assistive Devices

8.2. Middle East & Africa Aged Care Market Outlook, by Service, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Institutional Care

8.2.1.2. Homecare

8.2.1.3. Adult Day Care

8.3. Middle East & Africa Aged Care Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Heart Diseases

8.3.1.2. Cancer

8.3.1.3. Kidney Diseases

8.3.1.4. Diabetes

8.3.1.5. Osteoporosis

8.3.1.6. Neurological

8.3.1.7. Respiratory

8.3.1.8. Others

8.4. Middle East & Africa Aged Care Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Aged Care Market Service, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Aged Care Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.4. South Africa Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Aged Care Market Service, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Aged Care Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.7. Egypt Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.8. Egypt Aged Care Market Service, Value (US$ Mn), 2018 - 2030

8.4.1.9. Egypt Aged Care Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.10. Nigeria Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.11. Nigeria Aged Care Market Service, Value (US$ Mn), 2018 - 2030

8.4.1.12. Nigeria Aged Care Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Aged Care Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Aged Care Market Service, Value (US$ Mn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Aged Care Market Application, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Application vs Service Heatmap

9.2. Manufacturer vs Service Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Koninklijke Philips N.V.

9.5.1.1. Company Overview

9.5.1.2. Product Type Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Amedisys

9.5.2.1. Company Overview

9.5.2.2. Product Type Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. ECON Healthcare Group

9.5.3.1. Company Overview

9.5.3.2. Product Type Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Encompass Health Corporation

9.5.4.1. Company Overview

9.5.4.2. Product Type Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. EXTENDICARE

9.5.5.1. Company Overview

9.5.5.2. Product Type Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. LHC Group, Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Type Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Medtronic

9.5.7.1. Company Overview

9.5.7.2. Product Type Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. ORPEA GROUPE

9.5.8.1. Company Overview

9.5.8.2. Product Type Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Prolifico

9.5.9.1. Company Overview

9.5.9.2. Product Type Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. ElderCareCanada

9.5.10.1. Company Overview

9.5.10.2. Product Type Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Service Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |