Global Agriculture Drone Market Forecast

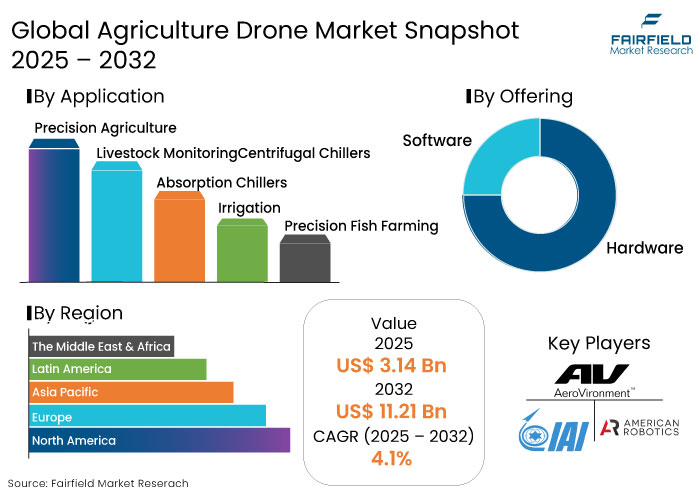

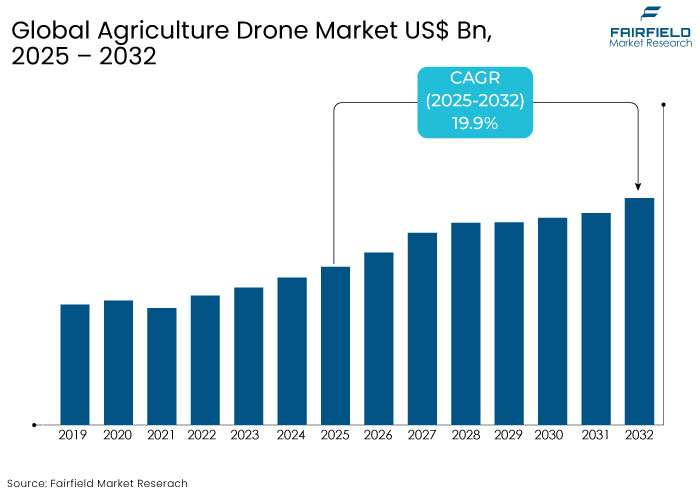

- The agriculture drone market is projected to reach a size of US$ 11.21 Bn by 2032 from US$ 3.14 Bn estimated in 2025.

- The market for agriculture drones is likely to witness a significant CAGR of 19.9% from 2025 to 2032.

Agriculture Drone Market Insights

- Drones are becoming essential tools for precision agriculture, improving farm efficiency.

- Governments worldwide are investing in agricultural technology, including drones, to support small-scale farmers and enhance agricultural productivity.

- The DaaS model is gaining traction, offering small and medium-sized farmers affordable drone services.

- Novel imaging technologies are transforming crop management, further bolstering market growth.

- Development of autonomous drone systems equipped with GPS and AI-powered analytics is enhancing agricultural operations' precision, efficiency, and scalability.

- With drone technology becoming more affordable, its adoption is surging rapidly in rural areas.

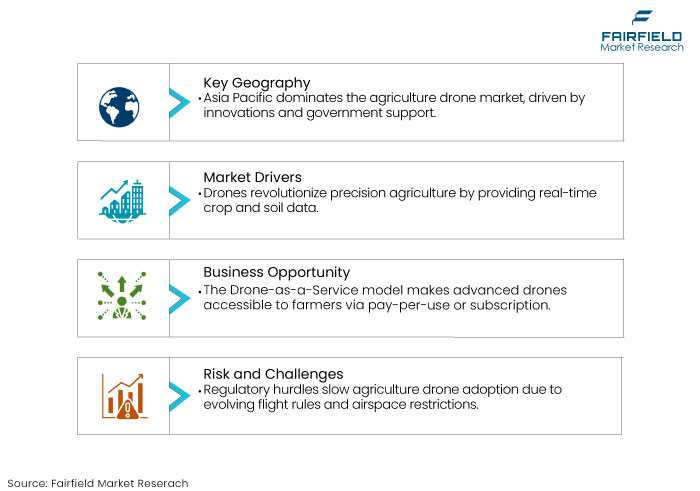

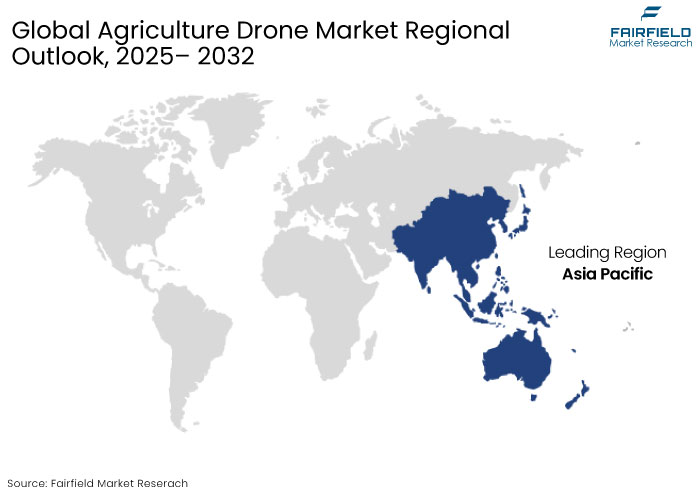

- Asia Pacific is projected to lead in terms of the global market share owing to rapid innovations in agricultural practices.

- Cameras dominate the component segment of the market with a substantial share in 2025.

- Based on offering, the hardware segment is likely to lead the market for agriculture drones.

Key Growth Determinants

- Innovations in Precision Agriculture

Precision agriculture has emerged as a game-changer in the farming industry, and drones play a pivotal role in its evolution. With increasing adoption of drones equipped with unique sensors and imaging systems, farmers can collect real-time, high-resolution data on crop health, soil conditions, and environmental factors.

Drones enable farmers to make data-driven decisions, enhancing crop yields and reducing resource wastage. Its ability to monitor vast fields efficiently without manual labor has made it indispensable for modern farming. As precision agriculture becomes more widespread, demand for agriculture drones rises, driving market growth.

By offering farmers actionable insights and increasing operational efficiency, drones help optimize inputs like water, fertilizers, and pesticides, leading to cost savings and sustainable farming practices. With precision agriculture set to rise further, the agriculture drone market will likely continue to revolutionize the farming industry.

- Rising Demand for Sustainable Farming Practices

Sustainable farming is becoming immensely critical as the global population rises and environmental concerns increase. Agriculture drones are emerging as an essential tool in promoting sustainable farming practices.

Drones help reduce the environmental impact of farming by efficiently monitoring crop health and optimizing resource usage. These reduce water consumption, pesticide use, and fertilizer waste by enabling precision irrigation, targeted pesticide application, and soil analysis. It helps conserve resources but also lowers farming costs and increases productivity.

Farmers are pressured to adopt eco-friendly practices as consumers increasingly demand sustainably produced food. Using drones in farming is a vital part of this shift toward sustainability. As demand for green farming practices rises, the agriculture drone market is set to skyrocket.

Key Growth Barriers

- Regulatory Challenges and Operational Limitations

Despite the rising popularity of agriculture drones, regulatory challenges continue to restrain the market. In various countries, drone regulations are still in their infancy, with rules surrounding flight permissions, no-fly zones, and airspace management causing delays in drone adoption.

Farmers may face difficulties navigating these regulations, leading to operational constraints on how, where, and when drones can be used. Compliance with safety and privacy laws can require additional paperwork, approvals, and ongoing oversight, which can be time-consuming and complex.

In some regions, local governments are still working on updating laws to address the specific needs of agriculture drones. These regulatory hurdles can prevent quick and seamless integration of drone technology into the farming ecosystem, ultimately slowing the agriculture drone market's growth potential.

Agriculture Drone Market Trends and Opportunities

- Expansion of Drone-as-a-Service (DaaS) Model

Emergence of the Drone-as-a-Service (DaaS) model presents an exciting opportunity for the agriculture drone market, especially for small and medium-sized farmers who may not be able to afford the high upfront costs of purchasing drones. With DaaS, drone service providers offer their technology and expertise on a pay-per-use or subscription basis, giving farmers access to state-of-the-art equipment without the burden of ownership.

The model allows farmers to use drones for specific tasks such as crop monitoring, soil analysis, and pest control. It also enables them to improve their farming practices without significant financial commitment.

The DaaS model is likely to drive wide adoption of drone technology, especially in regions where smallholder farmers dominate. As demand for these services increases, DaaS platforms will continue to surge, providing a more accessible and cost-effective way to leverage drone technology in agriculture.

- Development of Novel Multi-spectral and Thermal Imaging Drones

One of the most transformative opportunities in the agriculture drone market is the development of drones equipped with unique multi-spectral and thermal imaging technology. These drones allow farmers to monitor crop health and growth at a granular level.

Multi-spectral cameras capture light beyond the visible spectrum, allowing farmers to detect issues like nutrient deficiencies, water stress, or pest infestations that would otherwise go unnoticed by the naked eye. Thermal imaging can reveal temperature variations across the field, helping to identify irrigation problems or detect areas requiring more attention.

The level of precision enables farmers to make more informed decisions about when and how to treat their crops, improving yields and reducing resource usage. As this technology becomes more affordable and accessible, it will likely offer a significant opportunity to enhance crop management practices, making farming even more efficient and sustainable.

Segments Covered in the Report

- Hardware Components to Lead Amid Precision Agriculture Trends

Hardware is the dominant offering, holding a significant share of the market. Hardware components play an essential role in ensuring that drones can perform various tasks, from crop monitoring and pesticide spraying to soil analysis and irrigation management.

Integration of high-resolution cameras, multispectral sensors, and thermal imaging has made these drones invaluable for precision agriculture. These are providing farmers with real-time insights into crop health, soil conditions, and field performance.

As agricultural practices become more technology-driven, the hardware segment is poised to dominate the agriculture drone market. It is set to help in enabling farmers to improve yields, reduce costs, and make data-driven decisions.

- Agriculturists Seek Cameras to Assess Crop Health in Real Time

Cameras, particularly high-resolution and multispectral cameras, play a critical role in enabling drones to capture detailed images and data essential for precision agriculture. Such high-end cameras provide farmers with the ability to monitor crop health, identify stress areas, and assess plant vigor, allowing for more informed decision-making.

Integrating multispectral and thermal cameras has revolutionized how agriculturalists approach crop management. Such cameras capture images in various light spectrums, such as near-infrared and red-edge, which are vital for assessing crop health, detecting diseases, and identifying issues like nutrient deficiencies or pest infestations.

Cameras are the cornerstone of precision farming, offering real-time, actionable insights that were once time-consuming and costly to gather. As technology continues to evolve, the role of cameras will only become more critical, further solidifying their dominance in the agriculture drone market.

Regional Analysis

- Asia Pacific to Dominate Amid Need to Enhance Crop Yields

Asia Pacific dominates the agriculture drone market, driven by several significant factors, including rapid innovations in farming practices. Its enhanced crop efficiency and strong government initiatives to modernize farming techniques are also projected to augment growth.

In FY24, the Government of India allocated 1.9% of the total Union Budget to the agricultural sector, focusing on assisting small and marginal farmers through initiatives like the PM KISAN Yojana. In recent years, agriculture drones have gained substantial traction in India due to their ability to improve efficiency, increase crop yields, reduce operational costs, and enhance precision in farming practices.

The Indian Council of Agricultural Research (ICAR) has been actively promoting the use of drones in agriculture. It also includes establishing the Center for Precision and Farming Technologies to integrate this technology into the sector further.

- North America Sees Entry of Commercial Agricultural Enterprises

North America’s success is attributable to multiple government efforts and expenditures to enhance the agriculture drone market. The Department of Transportation (DOT) and the Federal Aviation Administration (FAA) have enacted advantageous laws to facilitate commercial and small unmanned aerial systems by abolishing the pilot license requirement.

The U.S. possesses a substantial and extensive clientele managed by commercial agricultural enterprises running vast tracts of land across the country. The presence of appropriate manufacturing firms in the U.S. and Canada elucidates North America's preeminence in the global market.

In September 2023, documents with the U.S. Federal Communications Commission (FCC) indicated that DJI Drones, a leading China-based manufacturer of drone technology, had registered two new agricultural drones. The company finalized the registration documentation to introduce two new Agras agricultural drones, the T50 and T25, to the U.S. market.

Fairfield’s Competitive Landscape Analysis

The agriculture drone market is highly competitive, with several players striving to meet the rising demand for unique agricultural solutions. Key market leaders include DJI, Parrot, and AeroVironment, which are known for their cutting-edge drone technology and precision farming capabilities.

Companies offer a range of drones equipped with high-resolution cameras, multispectral sensors, and GPS systems that enable farmers to monitor crop health, improve yields, and reduce operational costs. As the market rises, there is a surging focus on innovation, with new and existing players investing in research and development to create drones with improved functionalities. Partnerships between drone manufacturers and agricultural research institutions, such as the Indian Council of Agricultural Research (ICAR), are helping to accelerate adoption.

Key Market Companies

- AeroVironment, Inc.

- America Robotics

- Israel Aerospace Industries

- Parrot Drones

- Microdrones

- PrecisionHawk

- AgEagle Aerial Systems, Inc.

- Trimble Inc.

- DJI

- Yamaha Motor Corp.

Recent Industry Developments

- In April 2024, DJI announced the worldwide release of its two agricultural drones, the Agras T50 and Agras T25, alongside an enhanced SmartFarm application.

- In September 2024, Trimble Inc. announced the introduction of its Trimble APX RTX portfolio, designed for direct georeferencing solutions specific to UAV mapping, revealed at INTERGEO 2024.

Global Agriculture Drone Market is Segmented as-

By Offering

- Hardware

- Fixed Wing

- Rotary Wing

- Hybrid Wing

- Software

By Component

- Cameras

- Batteries

- Navigation Systems

By Application

- Precision Agriculture

- Livestock Monitoring

- Smart Greenhouse

- Irrigation

- Precision Fish Farming

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

1. Executive Summary

1.1. Global Agriculture Drone Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Agriculture Drone Market Outlook, 2019 - 2032

3.1. Global Agriculture Drone Market Outlook, by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Hardware

3.1.1.1.1. Fixed Wing

3.1.1.1.2. Rotary Wing

3.1.1.1.3. Hybrid Wing

3.1.1.2. Software

3.1. Global Agriculture Drone Market Outlook, by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Cameras

3.1.1.2. Batteries

3.1.1.3. Navigation Systems

3.2. Global Agriculture Drone Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Precision Agriculture

3.2.1.2. Livestock Monitoring

3.2.1.3. Smart Greenhouse

3.2.1.4. Irrigation

3.2.1.5. Precision Fish Farming

3.3. Global Agriculture Drone Market Outlook, by Region, Value (US$ Bn) and Volume (Units), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Agriculture Drone Market Outlook, 2019 - 2032

4.1. North America Agriculture Drone Market Outlook, by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Hardware

4.1.1.1.1. Fixed Wing

4.1.1.1.2. Rotary Wing

4.1.1.1.3. Hybrid Wing

4.1.1.2. Software

4.2. North America Agriculture Drone Market Outlook, by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Cameras

4.2.1.2. Batteries

4.2.1.3. Navigation Systems

4.2.1.4. Others

4.3. North America Agriculture Drone Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Precision Agriculture

4.3.1.2. Livestock Monitoring

4.3.1.3. Smart Greenhouse

4.3.1.4. Irrigation

4.3.1.5. Precision Fish Farming

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Agriculture Drone Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. U.S. Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1.2. U.S. Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1.3. U.S. Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1.4. Canada Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1.5. Canada Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1.6. Canada Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Agriculture Drone Market Outlook, 2019 - 2032

5.1. Europe Agriculture Drone Market Outlook, by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Hardware

5.1.1.1.1. Fixed Wing

5.1.1.1.2. Rotary Wing

5.1.1.1.3. Hybrid Wing

5.1.1.2. Software

5.2. Europe Agriculture Drone Market Outlook, by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Cameras

5.2.1.2. Batteries

5.2.1.3. Navigation Systems

5.3. Europe Agriculture Drone Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Precision Agriculture

5.3.1.2. Livestock Monitoring

5.3.1.3. Smart Greenhouse

5.3.1.4. Irrigation

5.3.1.5. Precision Fish Farming

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Agriculture Drone Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Germany Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.2. Germany Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.3. Germany Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.4. U.K. Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.5. U.K. Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.6. U.K. Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.7. France Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.8. France Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.9. France Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.10. Italy Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.11. Italy Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.12. Italy Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.13. Turkey Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.14. Turkey Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.15. Turkey Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.16. Russia Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.17. Russia Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.18. Russia Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.19. Rest of Europe Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.20. Rest of Europe Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.21. Rest of Europe Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Agriculture Drone Market Outlook, 2019 - 2032

6.1. Asia Pacific Agriculture Drone Market Outlook, by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Hardware

6.1.1.1.1. Fixed Wing

6.1.1.1.2. Rotary Wing

6.1.1.1.3. Hybrid Wing

6.1.1.2. Software

6.2. Asia Pacific Agriculture Drone Market Outlook, by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Cameras

6.2.1.2. Batteries

6.2.1.3. Navigation Systems

6.3. Asia Pacific Agriculture Drone Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Precision Agriculture

6.3.1.2. Livestock Monitoring

6.3.1.3. Smart Greenhouse

6.3.1.4. Irrigation

6.3.1.5. Precision Fish Farming

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Agriculture Drone Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. China Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.2. China Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.3. China Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.4. Japan Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.5. Japan Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.6. Japan Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.7. South Korea Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.8. South Korea Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.9. South Korea Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.10. India Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.11. India Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.12. India Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.13. Southeast Asia Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.14. Southeast Asia Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.15. Southeast Asia Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.16. Rest of Asia Pacific Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.17. Rest of Asia Pacific Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.18. Rest of Asia Pacific Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Agriculture Drone Market Outlook, 2019 - 2032

7.1. Latin America Agriculture Drone Market Outlook, by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Hardware

7.1.1.1.1. Fixed Wing

7.1.1.1.2. Rotary Wing

7.1.1.1.3. Hybrid Wing

7.1.1.2. Software

7.2. Latin America Agriculture Drone Market Outlook, by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Cameras

7.2.1.2. Batteries

7.2.1.3. Navigation Systems

7.3. Latin America Agriculture Drone Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Precision Agriculture

7.3.1.2. Livestock Monitoring

7.3.1.3. Smart Greenhouse

7.3.1.4. Irrigation

7.3.1.5. Precision Fish Farming

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Agriculture Drone Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Brazil Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.2. Brazil Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.3. Brazil Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.4. Mexico Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.5. Mexico Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.6. Mexico Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.7. Argentina Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.8. Argentina Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.9. Argentina Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.10. Rest of Latin America Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.11. Rest of Latin America Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.12. Rest of Latin America Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Agriculture Drone Market Outlook, 2019 - 2032

8.1. Middle East & Africa Agriculture Drone Market Outlook, by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Hardware

8.1.1.1.1. Rotary Wing

8.1.1.1.2. Fixed Wing

8.1.1.1.3. Hybrid Wing

8.1.1.2. Software

8.2. Middle East & Africa Agriculture Drone Market Outlook, by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Cameras

8.2.1.2. Batteries

8.2.1.3. Navigation Systems

8.3. Middle East & Africa Agriculture Drone Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Precision Agriculture

8.3.1.2. Livestock Monitoring

8.3.1.3. Smart Greenhouse

8.3.1.4. Irrigation

8.3.1.5. Precision Fish Farming

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Agriculture Drone Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. GCC Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.2. GCC Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.3. GCC Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.4. South Africa Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.5. South Africa Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.6. South Africa Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.7. Egypt Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.8. Egypt Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.9. Egypt Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.10. Nigeria Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.11. Nigeria Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.12. Nigeria Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.13. Rest of Middle East & Africa Agriculture Drone Market by Offering, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.14. Rest of Middle East & Africa Agriculture Drone Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.15. Rest of Middle East & Africa Agriculture Drone Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by Component Heat Map

9.2. Company Market Share Analysis, 2025

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. AeroVironment, Inc.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. America Robotics

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Israel Aerospace Industries

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Parrot Drones

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Microdrones

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. PrecisionHawk

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. AgEagle Aerial Systems, Inc.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Trimble Inc.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. DJI

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Yamaha Motor Corp.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

10. Appendix

10.1. Research Componentology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Offering Coverage |

|

|

Component Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2023), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |