Global Agrochemicals Market Forecast

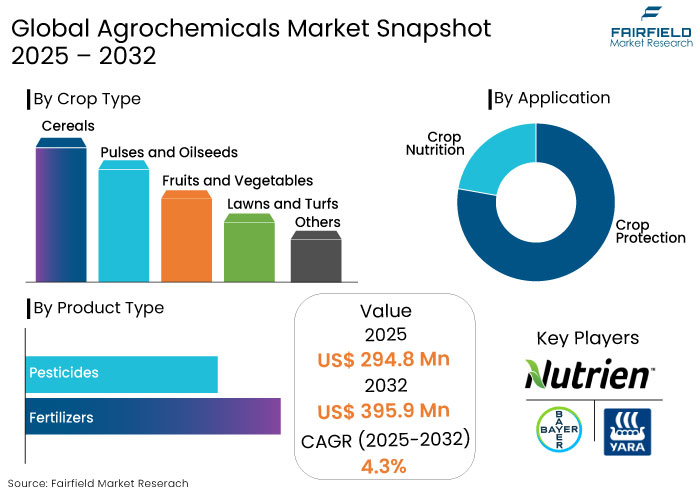

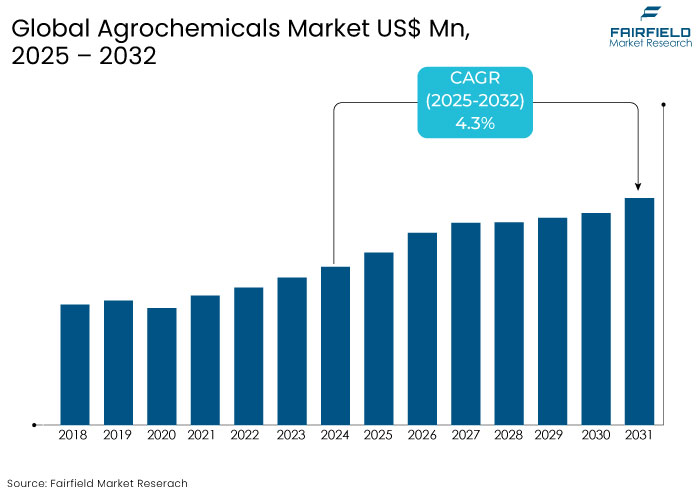

- The agrochemicals market is projected to reach a size of US$395.9 Mn by 2032 from US$294.8 Mn obtained in 2025.

- The market for agrochemicals is expected report a CAGR of 4.3% from 2025 to 2032.

Agrochemicals Market Insights

- Fertilizers, particularly nitrogen-based, dominate the market, driven by their critical role in enhancing crop yields. Bio-based agrochemicals are gaining traction as regulatory frameworks encourage sustainable farming practices.

- Precision agriculture tools and digital farming technologies are transforming the market by optimizing application efficiency.

- Asia Pacific and Latin America are emerging as high-growth markets due to increasing food demand and government support.

- Strict bans on harmful chemicals like glyphosate and neonicotinoids are reshaping product offerings.

- Agrochemical demand is rising to counter the adverse effects of climate change on crop productivity.

- Increased focus on innovation is driving the development of eco-friendly and high-performance agrochemicals.

A Look Back and a Look Forward - Comparative Analysis

The agrochemicals market demonstrated steady growth during the historical period from 2019 to 2024, driven by increasing global food demand and shrinking arable land. Crop protection chemicals, particularly herbicides and insecticides, gained traction as farmers sought to protect crops from pests and weeds. Regulatory advancements and technological innovations also supported market expansion during this period.

The market is projected to experience accelerated growth over the forecast period, driven by innovations in bio-based agrochemicals and the adoption of sustainable farming practices. The crop protection segment is likely to witness higher growth due to increased demand for eco-friendly pesticides and herbicides. Advanced nutrient formulations in fertilizers will address environmental concerns and promote precision agriculture.

Emerging markets in Africa and Southeast Asia will play a pivotal role in sustaining growth, supported by government subsidies and infrastructure development in agriculture.

Key Growth Determinants

- Growing Pest and Disease Infestations Due to Climate Change

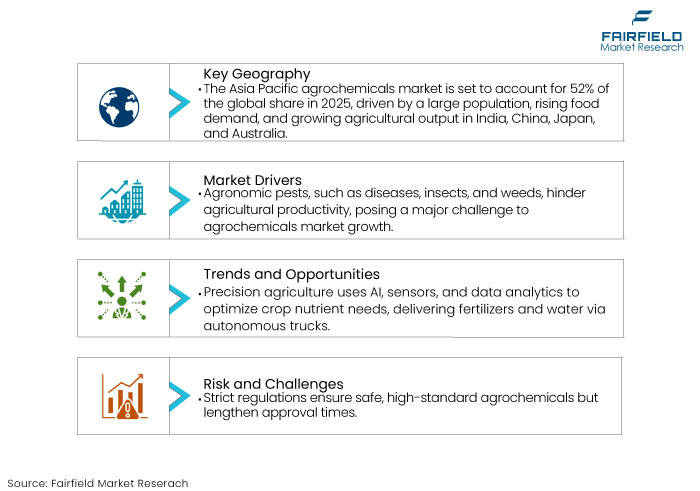

The proliferation of agronomic pests, including diseases, insects, and weeds, poses a significant threat to agricultural productivity and global food output. This factor remains a key barrier for agrochemicals market growth.

Climate change effects have worsened the situation, altering the ecosystem and resulting in new challenges for pest management in leading farming systems. The alteration in precipitation patterns and increasing temperatures need the development of innovative and efficient chemicals for crop protection.

A change in precipitation patterns that increases humidity and moisture can precipitate fungal epidemics in crops such as rice and wheat, necessitating more advanced fungicides. Elevated CO2 concentrations can increase aphid populations on soybean plants, necessitating improved pesticides and integrated pest management approaches.

Weeds, animal pests, and illnesses significantly contribute to these losses. Pests typically diminish global yields by 20-40%, resulting in an economic loss of approximately USD 300 billion worldwide.

-

Increasing Global Food Demand Remains a Key Driver

The global population is projected to exceed 10 billion by 2050, creating immense pressure on agricultural systems to produce more food. With finite arable land and escalating food demand, agrochemicals and crop protection products have become indispensable.

Fertilizers, particularly nitrogen-based variants, are critical in replenishing soil nutrients and enhancing crop productivity. These products enable farmers to achieve higher yields per unit of land, a necessity given the constraints on expanding agricultural areas.

Developing regions, such as Asia Pacific, are experiencing rapid urbanization, further reducing the availability of farmland. Governments and private stakeholders have invested significantly in fertilizer distribution networks and subsidization programs to support smallholder farmers in countries like India and China.

Crop protection chemicals like pesticides and herbicides play a vital role in safeguarding yields. Pests, weeds, and diseases threaten up to 40% of global crop production annually, and the increasing reliance on agrochemicals has been pivotal in mitigating these losses. Thus, the need for sustainable yet effective agrochemical solutions continues to drive market growth globally.

Key Growth Barriers

- Stringent Regulatory Policies to Constrain Market Growth

Stringent regulatory frameworks necessitate the development of comprehensive environmental, health, and safety profiles for each new agrochemical product, which must adhere to these profiles for safety and efficacy. Such laws guarantee the circulation of items with high standards; nonetheless, they contribute to prolonged approval durations.

The lengthy and intricate method postpones the market introduction of novel products, elevating expenses for producers required to perform studies, trials, and compliance activities.

In Europe, plant protection goods undergo an authorization process by Regulation No. (EC) 1107/2009 delineates the approval duration for active chemicals and the EU-level authorization for plant protection products.

The outcome would entail comprehensively evaluating the product's safety, efficacy, and environmental effects. Issuing a regulation that either grants or denies approval for the initial authorization of an active substance, safeness, or synergists significantly restricts agrochemicals market growth.

- Expanding Share of Organic Fertilizers May Impede Demand

The market for organic food in developing nations has been swiftly growing due to increased awareness of the significance of compliance with health standards, food safety, environmental protection, and animal welfare.

The consumption of organic food is experiencing an increasing trend in popularity. The anticipated increase in demand for nutritious and safe food is expected to propel the organic food sector and enhance the utilization of bio fertilizers. Also, the growth of the organic fertilizer business will counteract the increase in the global market in the upcoming decade, which eventually hampers the market share of agrochemicals globally.

Agrochemicals Market Trends and Opportunities

- Utilization of Agrochemicals in Precision Agriculture Boosts Sales

The subsequent instruments of precision agriculture assist farmers in assessing the nutrient requirements of crops. Precision farming integrates data analytics, artificial intelligence, and sensor systems to ascertain the precise quantities of fertilizer and water needed by plants at specific times, utilizing autonomous trucks for the targeted delivery of nutrients.

Fertilizers are essential for enhancing soil productivity. Excessive fertilizing, however, can result in severe consequences for soil health. In 2022, researchers at Imperial College London developed an innovative predictive testing kit.

The kit enables farmers to ascertain the current levels of ammonia and nitrate in the soil and potential future concentrations influenced by climatic conditions. It can assist in customizing the fertilizer to specific soil and crop requirements, eventually aiding farmers in their farm produce.

- Advancements in Research by the Agricultural and Chemical Sectors

Research has revealed that insecticides and pesticides facilitate accelerated crop development. Creating synthetic pesticides to expedite planting and growing has greatly enhanced the agrochemicals market growth. Several agricultural experts believe utilizing organic fertilizers is one of the most effective methods to enhance crop yields.

Agriculturalists have an obligation to optimize the utilization of their resources. Organizations exert substantial effort to procure seeds and fertilizers of the utmost quality. Such advancements in research by the agriculture and chemical sectors present profitable opportunities for the growth of the market throughout the forecast period.

How Does Regulatory Scenario Shape the Industry?

The regulatory environment plays a crucial role in shaping the agrochemicals market, balancing agricultural productivity with environmental and health concerns. Governments and international organizations have introduced stringent regulations governing agrochemical production, distribution, and application to minimize ecological and human health risks.

Regulatory frameworks in regions like the European Union emphasize sustainability, encouraging the use of bio-based and organic agrochemicals. The EU’s Green Deal and Farm to Fork Strategy aim to reduce chemical pesticide use by 50% by 2030.

In emerging economies, regulatory bodies are focusing on improving product standards and combating counterfeit agrochemicals to ensure safe usage. At the same time, governments are incentivizing innovations in sustainable agrochemical solutions through research and development subsidies and certification programs.

The evolving regulations challenge traditional manufacturers to adapt while fostering opportunities for eco-friendly and precision agriculture solutions. Consequently, reshaping the market toward sustainability and innovation.

Segments Covered in the Report

- Fertilizers Being Essential in Promoting Plant Growth Accounts for a Notable Market Share

Fertilizers constitute a substantial segment of the market, driven by the increasing demand for food production to support a growing global population.Nitrogenous Fertilizers, such as urea and ammonium nitrate, are extensively used to enhance soil fertility and boost agricultural productivity. Their application improves crop yields, making them indispensable in modern farming practices.

Fertilizers, particularly nitrogen-based types, will continue to dominate the agrochemicals market over the forecast period. Their essential role in enhancing crop productivity positions them as a cornerstone in meeting the escalating global food demand.

As per reports, in 2022-2023, India's estimated urea consumption was 35.73 million metric tons, reflecting a 4.5% increase from the previous year, which shows the dominance of fertilizers in the agrochemicals market

- Cereals Crop Type Dominates with 48% of the Market Share

Cereal crop type leads the market share with a 48% market share owing to the increasing consumption of cereals and grains, including rice, wheat, rye, corn, oats, sorghum, and barley in diverse locations. Agrochemicals are primarily utilized for cereals in Asia Pacific and North America, attributed to the extensive growth of wheat and corn in nations such as China and the United States.

Non-ionic surfactants, in conjunction with agrochemicals, are predominantly advised for cereals and grains. Reports indicate that worldwide grain use for 2025 is expected to increase relative to prior years. Global cereal stocks are projected to increase by 2025, which indicates a consistent provision of cereals to satisfy demand.

The increasing demand for cereals underscores the necessity of enhancing agricultural production, which may result in a growing application of agrochemicals to maximize yields and satisfy global needs.

Regional Analysis

- Asia Pacific’s Dominance Prevails in Agrochemicals Market

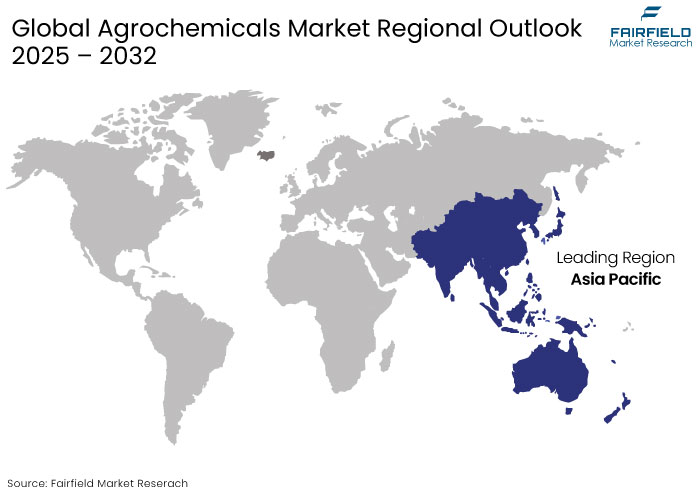

Asia Pacific agrochemicals market accounts for 52% of total market share in 2025, ascribed to the substantial population, escalating food consumption, and increased agricultural output, especially in nations such as India, China, Japan, and Australia.

According to Baojing Gu, a researcher from the University of Melbourne and Zhejiang, China significantly influences pesticide utilization. It represents approximately 30% of global pesticide and fertilizer usage and provides over 90% of the world's technical raw material requirements.

China is a prominent player in the global fertilizer and pesticide sector, serving as a leading user, exporter, and manufacturer of these agricultural products. The nation's significant utilization of fertilizers and agrochemicals is propelled by its substantial agricultural production, which is essential for satisfying the needs of an expanding populace.

As the need for food grains and other agricultural goods escalates, so does the necessity for fertilizers and agrochemicals.

- North America Agrochemicals Market Emerges Lucrative

The presence of numerous agrochemical firms makes North American one of the notably growing regions in the market. Owing to rigorous environmental restrictions, North America is anticipated to become the foremost market for organic agrochemicals, encompassing bio-fertilizers and bio-pesticides.

The expanding dairy sector and conducive climatic conditions for crops like corn and maize have been the primary catalysts for the market in this region. The existence of agrochemical manufacturers in the U.S. substantially influences the market by diminishing reliance on foreign agrochemical imports. It enables farmers and enterprises in the agricultural industry to obtain items within their local market.

The increasing consumer inclination towards organically produced foods compels corporations to concentrate on creating bio-based, environmentally sustainable agrochemical goods, such as organo-modified siloxanes, modified vegetable oils, and methylated seed oil.

Fairfield’s Competitive Landscape Analysis

The agrochemicals market is highly competitive, dominated by multinational corporations and regional players. Key industry leaders include Bayer AG, BASF SE, Syngenta AG, Corteva Agriscience, and FMC Corporation.

Companies focus on extensive research and development to innovate bio-based and sustainable agrochemical solutions, aligning with strict regulatory norms and environmental concerns. Strategic mergers, acquisitions, and partnerships have strengthened market positions. Regional players in Asia Pacific and Latin America leverage cost advantages to effectively serve local markets.

Digital agriculture platforms and precision farming innovations are becoming critical differentiators, enabling companies to offer integrated solutions that optimize agrochemical usage and improve farm productivity.

Key Market Companies

- Bayer AG

- YARA International ASA

- BASF SE

- Israel Chemicals Ltd.

- Nutrien Ltd.

- FMC Corporation

- The Mosaic Company

- Fengro Industries Corp.

- PhosAgro

- DowDuPont Inc.

- OCI N.V.

- Fertilizantes Heringer S.A.

- WinHarvest Pty Ltd

- Syngenta AG

- K+S KALI GmbH

- Saudi Arabia Fertilizer Company (SAFCO)

- Jordan Abyad Fertilizers and Chemicals Company

Recent Industry Developments

- In March 2024, Yara India introduced 'Kissan ka Sachcha Yaar' and introduced FarmCare 2.0, an application intended to assist farmers by providing real-time weather information, soil management recommendations, and optimized fertilizer application.

- In April 2024, UPL announced the successful acquisition of Corteva Agriscience's global Mancozeb fungicide business, excluding China, Japan, South Korea, the UK, Switzerland, and EU member states.

An Expert’s Eye

- Growing consensus on the need for sustainable and bio-based agrochemicals to align with regulatory trends and environmental goals.

- Precision agriculture and digital tools are increasingly seen as transformative, enabling efficient agrochemical usage and enhanced crop productivity.

- Analysts highlight the significant growth potential in emerging economies due to increased government subsidies and expanding agricultural infrastructure.

- A trend of mergers and acquisitions is viewed as a strategy to expand portfolios and address changing market dynamics.

Global Agrochemicals Market is Segmented as-

By Product Type

- Fertilizers

- Nitrogen Based

- Potassium Based

- Phosphorous Based

- Others

- Pesticides

- Insecticides

- Fungicides

- Herbicides

- Bactericides

- Others

By Crop Type

- Cereals

- Pulses and Oilseeds

- Fruits and Vegetables

- Lawns and Turfs

- Others

By Application

- Crop Protection

- Foliar Spray

- Soil Treatment

- Seed Treatment

- Crop Nutrition

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Agrochemicals Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Agrochemicals Market Outlook, 2019 - 2032

3.1. Global Agrochemicals Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Fertilizers

3.1.1.1.1. Nitrogen Based

3.1.1.1.2. Potassium Based

3.1.1.1.3. Phosphorous based

3.1.1.1.4. Others

3.1.1.2. Pesticides

3.1.1.2.1. Insecticides

3.1.1.2.2. Fungicides

3.1.1.2.3. Herbicides

3.1.1.2.4. Bactericides

3.1.1.2.5. Others

3.1.1.3. Others (Soil Conditioners, acidifying agents, etc.)

3.2. Global Agrochemicals Market Outlook, by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Cereals

3.2.1.2. Pulses and Oilseeds

3.2.1.3. Fruits and Vegetables

3.2.1.4. Lawns and Turfs

3.2.1.5. Others

3.3. Global Agrochemicals Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Crop Protection

3.3.1.1.1. Foliar Spray

3.3.1.1.2. Soil Treatment

3.3.1.1.3. Seed Treatment

3.3.1.2. Crop Nutrition

3.4. Global Agrochemicals Market Outlook, by Region, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Agrochemicals Market Outlook, 2019 - 2032

4.1. North America Agrochemicals Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Fertilizers

4.1.1.1.1. Nitrogen Based

4.1.1.1.2. Potassium Based

4.1.1.1.3. Phosphorous-based

4.1.1.1.4. Others

4.1.1.2. Pesticides

4.1.1.2.1. Insecticides

4.1.1.2.2. Fungicides

4.1.1.2.3. Herbicides

4.1.1.2.4. Bactericides

4.1.1.2.5. Others

4.1.1.3. Others (Soil Conditioners, acidifying agents, etc.)

4.2. North America Agrochemicals Market Outlook, by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Cereals

4.2.1.2. Pulses and Oilseeds

4.2.1.3. Fruits and Vegetables

4.2.1.4. Lawns and Turfs

4.2.1.5. Others

4.3. North America Agrochemicals Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Crop Protection

4.3.1.1.1. Foliar Spray

4.3.1.1.2. Soil Treatment

4.3.1.1.3. Seed Treatment

4.3.1.2. Crop Nutrition

4.4. North America Agrochemicals Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. U.S. Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1.2. U.S. Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1.3. U.S. Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1.4. Canada Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1.5. Canada Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1.6. Canada Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Agrochemicals Market Outlook, 2019 - 2032

5.1. Europe Agrochemicals Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Fertilizers

5.1.1.1.1. Nitrogen Based

5.1.1.1.2. Potassium Based

5.1.1.1.3. Phosphorous-based

5.1.1.1.4. Others

5.1.1.2. Pesticides

5.1.1.2.1. Insecticides

5.1.1.2.2. Fungicides

5.1.1.2.3. Herbicides

5.1.1.2.4. Bactericides

5.1.1.2.5. Others

5.1.1.3. Others (Soil Conditioners, acidifying agents etc.)

5.2. Europe Agrochemicals Market Outlook, by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Cereals

5.2.1.2. Pulses and Oilseeds

5.2.1.3. Fruits and Vegetables

5.2.1.4. Lawns and Turfs

5.2.1.5. Others

5.3. Europe Agrochemicals Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Crop Protection

5.3.1.1.1. Foliar Spray

5.3.1.1.2. Soil Treatment

5.3.1.1.3. Seed Treatment

5.3.1.2. Crop Nutrition

5.4. Europe Agrochemicals Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Germany Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.2. Germany Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.3. Germany Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.4. U.K. Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.5. U.K. Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.6. U.K. Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.7. France Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.8. France Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.9. France Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.10. Italy Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.11. Italy Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.12. Italy Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.13. Turkey Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.14. Turkey Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.15. Turkey Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.16. Russia Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.17. Russia Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.18. Russia Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.19. Rest of Europe Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.20. Rest of Europe Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.21. Rest of Europe Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Agrochemicals Market Outlook, 2019 - 2032

6.1. Asia Pacific Agrochemicals Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Fertilizers

6.1.1.1.1. Nitrogen Based

6.1.1.1.2. Potassium Based

6.1.1.1.3. Phosphorous-based

6.1.1.1.4. Others

6.1.1.2. Pesticides

6.1.1.2.1. Insecticides

6.1.1.2.2. Fungicides

6.1.1.2.3. Herbicides

6.1.1.2.4. Bactericides

6.1.1.2.5. Others

6.1.1.3. Others (Soil Conditioners, acidifying agents etc.)

6.2. Asia Pacific Agrochemicals Market Outlook, by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Cereals

6.2.1.2. Pulses and Oilseeds

6.2.1.3. Fruits and Vegetables

6.2.1.4. Lawns and Turfs

6.2.1.5. Others

6.3. Asia Pacific Agrochemicals Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Crop Protection

6.3.1.1.1. Foliar Spray

6.3.1.1.2. Soil Treatment

6.3.1.1.3. Seed Treatment

6.3.1.2. Crop Nutrition

6.4. Asia Pacific Agrochemicals Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. China Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.2. China Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.3. China Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.4. Japan Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.5. Japan Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.6. Japan Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.7. South Korea Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.8. South Korea Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.9. South Korea Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.10. India Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.11. India Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.12. India Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.13. Southeast Asia Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.14. Southeast Asia Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.15. Southeast Asia Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.16. Rest of Asia Pacific Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.17. Rest of Asia Pacific Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.18. Rest of Asia Pacific Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Agrochemicals Market Outlook, 2019 - 2032

7.1. Latin America Agrochemicals Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.1.1. Fertilizers

7.1.1.1. Nitrogen Based

7.1.1.2. Potassium Based

7.1.1.3. Phosphorous-based

7.1.1.4. Others

7.1.2. Pesticides

7.1.2.1. Insecticides

7.1.2.2. Fungicides

7.1.2.3. Herbicides

7.1.2.4. Bactericides

7.1.2.5. Others

7.1.3. Others (Soil Conditioners, acidifying agents etc.)

7.2. Latin America Agrochemicals Market Outlook, by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.2.1. Cereals

7.2.2. Pulses and Oilseeds

7.2.3. Fruits and Vegetables

7.2.4. Lawns and Turfs

7.2.5. Others

7.3. Latin America Agrochemicals Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.1. Key Highlights

7.3.2. Crop Protection

7.3.2.1. Foliar Spray

7.3.2.2. Soil Treatment

7.3.2.3. Seed Treatment

7.3.3. Crop Nutrition

7.4. Latin America Agrochemicals Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Brazil Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.2. Brazil Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.3. Brazil Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.4. Mexico Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.5. Mexico Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.6. Mexico Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.7. Argentina Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.8. Argentina Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.9. Argentina Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.10. Rest of Latin America Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.11. Rest of Latin America Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.12. Rest of Latin America Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Agrochemicals Market Outlook, 2019 - 2032

8.1. Middle East & Africa Agrochemicals Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Fertilizers

8.1.1.1.1. Nitrogen Based

8.1.1.1.2. Potassium Based

8.1.1.1.3. Phosphorous-based

8.1.1.1.4. Others

8.1.1.2. Pesticides

8.1.1.2.1. Insecticides

8.1.1.2.2. Fungicides

8.1.1.2.3. Herbicides

8.1.1.2.4. Bactericides

8.1.1.2.5. Others

8.1.1.3. Others (Soil Conditioners, acidifying agents etc.)

8.2. Middle East & Africa Agrochemicals Market Outlook, by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Cereals

8.2.1.2. Pulses and Oilseeds

8.2.1.3. Fruits and Vegetables

8.2.1.4. Lawns and Turfs

8.2.1.5. Others

8.3. Middle East & Africa Agrochemicals Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Crop Protection

8.3.1.1.1. Foliar Spray

8.3.1.1.2. Soil Treatment

8.3.1.1.3. Seed Treatment

8.3.1.2. Crop Nutrition

8.4. Middle East & Africa Agrochemicals Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. GCC Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.2. GCC Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.3. GCC Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.4. South Africa Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.5. South Africa Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.6. South Africa Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.7. Egypt Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.8. Egypt Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.9. Egypt Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.10. Nigeria Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.11. Nigeria Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.12. Nigeria Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.13. Rest of Middle East & Africa Agrochemicals Market by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.14. Rest of Middle East & Africa Agrochemicals Market by Crop Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.15. Rest of Middle East & Africa Agrochemicals Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. by Application vs by Crop Type Heat map

9.2. Manufacturer vs by Crop Type Heat map

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Bayer AG

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. YARA International ASA

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. BASF SE

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Israel Chemicals Ltd.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Nutrien Ltd.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. FMC Corporation

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. The Mosaic Company

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Fengro Industries Corp.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. PhosAgro

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. DowDuPont Inc.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. OCI N.V.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Fertilizantes Heringer S.A.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. WinHarvest Pty Ltd

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Syngenta AG

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. K+S KALI GmbH

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

9.5.16. Saudi Arabia Fertilizer Company (SAFCO)

9.5.16.1. Company Overview

9.5.16.2. Product Portfolio

9.5.16.3. Financial Overview

9.5.16.4. Business Strategies and Development

9.5.17. Jordan Abyad Fertilizers and Chemicals Company

9.5.17.1. Company Overview

9.5.17.2. Product Portfolio

9.5.17.3. Financial Overview

9.5.17.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Crop Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |