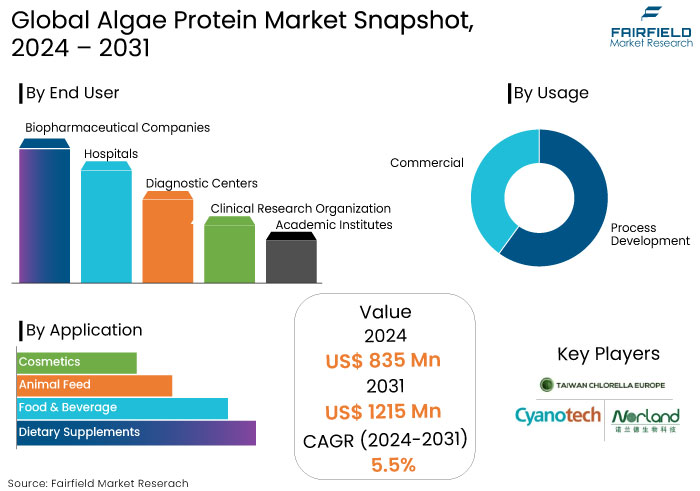

Global Algae Protein Market Forecast

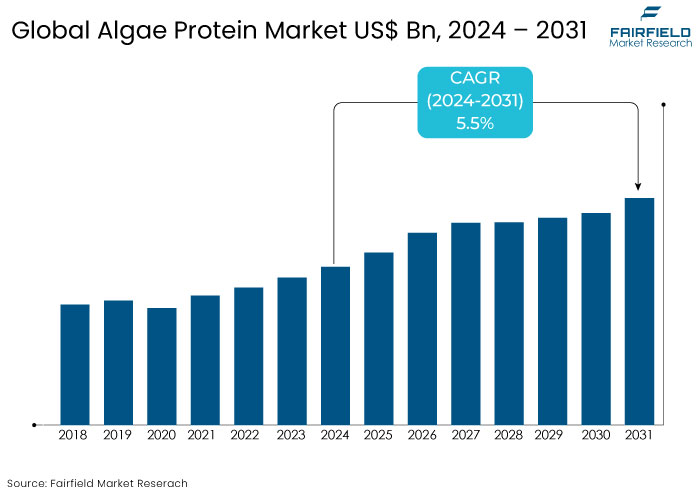

- The algae protein market is projected to reach a valuation of US$1215 Mn by 2031, showing significant growth from the US$835 Mn achieved in 2024.

- The market for algae protein is expected to record an expansion rate with an estimated CAGR of 5.5% from 2024 to 2031.

Algae Protein Market Insights

- Algae protein is recognized for its high nutritional value containing up to 60-70% protein by weight and essential vitamins, minerals, and antioxidants.

- Algae can be cultivated with minimal land and water making it a sustainable protein alternative to traditional livestock farming.

- The shift toward plant-based diets and growing consumer health consciousness drive increased demand for algae protein products.

- Algae protein is gaining traction in various sectors including dietary supplements, food & beverages, cosmetics, and animal feed.

- Companies invest in research and development to create innovative algae-based products, enhancing flavor and texture to appeal to mainstream consumers.

- Evolving regulations provide clear pathways for approving algae-derived products, facilitating market entry for new offerings.

- Increased efforts to educate consumers about the benefits of algae protein are crucial for overcoming misconceptions and driving acceptance.

- Advances in cultivation and extraction technologies are improving the efficiency and cost-effectiveness of algae protein production.

A Look Back and a Look Forward - Comparative Analysis

The algae protein market has been experiencing significant growth, driven by increasing demand for plant-based protein sources and a growing awareness of the health benefits associated with algae.

Pre-2023, the market was primarily fueled by the rising trend toward vegetarian and vegan diets and the shift away from animal-based proteins due to health, environmental, and ethical concerns. This period saw a surge in product innovations including protein powders, bars, and supplements derived from various algae species like spirulina and chlorella.

Post-2024, the market is expected to witness accelerated growth as consumer awareness continues to expand particularly regarding algae proteins' sustainability and nutritional profile. Advances in cultivation techniques and extraction processes will enhance product availability and reduce costs making algae protein accessible to broad audience.

Increased investments in research and development are likely to lead to new applications in food, beverages, and nutraceuticals. Regulatory support for plant-based protein sources and collaborations between algae producers and food manufacturers will further expand the market.

Key Growth Determinants

- Increasing Health Consciousness Among Consumers

Algae is a smart protein source for a healthy lifestyle and food for life. Consumers globally are becoming health-conscious driving the algae protein market.

The global population increasingly focuses on obtaining additional nutritional values from various food sources. Consumers expect all the major nutrients such as protein, vitamins, and minerals to be present in their preferred food.

Algae protein is a rare source containing all the essential amino acids required for a healthy lifestyle. Protein powders or shakes made with plant-based protein sourced from algae meet our body’s demands for protein and better nutritional balance.

Organic blue-green algae including spirulina, chlorella, and aphanizomenon flos aquae (AFA), are considered superfoods because of their high concentrations of complete protein, vitamins, amino acids, omega-3, and other essential fatty acids. AFA naturally contains biologically active chlorophyll than other known foods. Chlorella and spirulina comprise 70 percent protein and contain over 65 vitamins, minerals, and enzymes.

- Increasing Demand for Plant-Based Proteins

The global shift toward healthy lifestyles and sustainable diets significantly drives the demand for plant-based proteins including algae. As consumers become health-conscious, they seek alternatives to animal-based proteins often associated with health risks such as cholesterol and saturated fats.

Algae protein, derived from various species like spirulina and chlorella is rich in essential amino acids, vitamins, and minerals making it a nutrient-dense option. This trend is amplified by the rise of vegetarianism and veganism with consumers opting for plant-based diets for ethical and environmental reasons.

As the awareness of the environmental impact of livestock farming grows, algae protein is being recognized for its sustainability as it requires fewer resources and produces lower greenhouse gas emissions.

The increasing popularity of algae-based protein supplements and food products is expected to propel market growth as manufacturers innovate to incorporate algae protein into snacks, beverages, and nutritional supplements.

Key Growth Barriers

- Limited Consumer Awareness and Acceptance

Another significant restraint affecting the algae protein market is the need for more consumer awareness and acceptance of algae-derived products. While algae protein offers numerous health benefits, many consumers need to become more familiar with it, leading to hesitancy in trying new food items that contain this ingredient.

Misconceptions about algae-based products' taste, texture, and overall palatability can further hinder acceptance. Unlike more traditional protein sources, algae are still relatively niche in mainstream diets, which can slow their adoption.

Marketing and educational efforts to inform consumers about the nutritional advantages of algae protein are essential for fostering acceptance. Market growth may be stunted without robust awareness campaigns and tastings to encourage trial.

As the industry matures, increasing focus on consumer education and innovative product development will be crucial to overcoming this barrier and driving great acceptance of algae protein as a viable dietary option.

- High Production Costs

One of the primary growth restraints for the algae protein market is the high production costs associated with cultivating and processing algae. Despite the numerous benefits of algae as a protein source, the technology and infrastructure required for large-scale production can be expensive.

Factors such as the need for specialized cultivation systems, climate-controlled environments, and precise nutrient management contribute to the overall costs.

Extraction processes for isolating protein from algae can be complex and energy-intensive further driving up expenses. As a result, algae protein products often carry a premium price tag, making them less competitive against more established protein sources like soy and whey, which can limit market penetration, especially in cost-sensitive segments and regions.

Algae Protein Market Trends and Opportunities

- Development of Functional Food Products

One of the most transformative opportunities in the algae protein market is the development of functional food products. As consumers increasingly seek foods that provide health benefits beyond essential nutrition, algae protein can be an ingredient in functional snacks, beverages, and supplements.

With its rich nutrient profile of essential amino acids, somega-3 fatty acids, vitamins, and antioxidants, algae protein is ideal for formulations targeting health-conscious consumers, athletes, and individuals with specific dietary needs.

Innovating around flavours and product formats can help overcome consumer hesitancy and expand market reach. Collaborations with food manufacturers to create algae-infused products such as protein bars, smoothies, and ready-to-eat meals can drive market growth.

As consumer interest in health and wellness continues to rise, the potential for algae protein in functional foods offers a promising pathway for growth and differentiation in a competitive landscape.

- Innovation in Cultivation and Production Techniques

The algae protein market also holds significant opportunities for innovation in cultivation and production techniques. Developing efficient and scalable cultivation methods can reduce costs and improve yield as technology advances.

Innovations such as photo bioreactors, closed-loop systems, and improved genetic strains of algae can enhance production efficiency and product quality. Exploring new extraction methods that maximize protein yield while minimizing energy consumption can further strengthen the economic viability of algae protein.

Investing in research and development to improve these processes can position companies to meet the growing demand for sustainable protein sources effectively. Advancements in technology could lead to breakthroughs in creating algae protein products with unique functional properties paving the way for new applications in food, nutraceuticals, and pharmaceuticals.

As the industry evolves, staying at the forefront of innovation will be vital in capturing market share and driving long-term growth.

How Does Regulatory Scenario Shapes this Industry?

The regulatory scenario plays a crucial role in shaping the algae protein market by establishing guidelines that govern algae-derived products' cultivation, processing, labelling, and safety.

Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) are increasingly focusing on ensuring the safety and quality of algae protein products. These regulations help build consumer confidence and promote market growth by ensuring that products meet specific safety standards.

Regulatory frameworks evolve to accommodate novel foods and ingredients like algae protein as the demand for plant-based proteins rises. Countries are beginning to implement clear pathways to approve new algae-based products, which can facilitate fast market entry for innovative offerings.

Stringent regulatory requirements may pose challenges as companies must navigate complex approval processes and provide comprehensive safety data. Policies promoting sustainability and environmental practices are likely to favour algae protein as a sustainable alternative to conventional protein sources.

Segments Covered in the Report

- Microalgae Dominates Source Segmentation with its Exceptionally High Protein Content

Microalgae, such as spirulina and chlorella are recognized for their exceptionally high protein content, often exceeding 60% by weight. They also provide a complete amino acid profile, essential fatty acids, vitamins, and minerals making them highly attractive for health-conscious consumers and athletes seeking nutrient-dense protein sources. The concentrated nutritional benefits position microalgae as a preferred choice in supplements, functional foods, and beverages.

Microalgae can be cultivated efficiently than seaweed requiring less space and fewer resources. They can grow significantly in controlled environments such as photo bioreactors, and can be produced year-round, regardless of environmental conditions. This efficiency allows for high yields and consistent product availability contributing to their popularity in the protein market.

Consumer trends favouring plant-based and sustainable protein sources have propelled microalgae into the spotlight. The increasing demand for alternative proteins driven by rising health awareness and environmental concerns further supports the microalgae-derived products.

- Dietary Supplements Lead the Application Segment with 45% of the Market Share

The robust market position for dietary supplements is propelled by the rising consumer demand for natural and plant-based protein supplements and the heightened emphasis on holistic health and wellness.

Proteins from algae, particularly spirulina and chlorella, are esteemed for their substantial protein content, comprehensive nutritional profile, and bioavailability, rendering them a favoured component in the dietary supplement sector.

The prevalence of algae-based dietary supplements is chiefly due to their capacity to offer a comprehensive source of protein and vital vitamins, minerals, antioxidants, and omega-3 fatty acids.

Consumers aiming to improve their nutritional intake progressively opt for algae supplements to bolster immune health, energy levels, and general wellness. Algae protein supplements are extensively utilized by athletes, fitness enthusiasts, and those adhering to vegetarian or vegan diets, augmenting their demand.

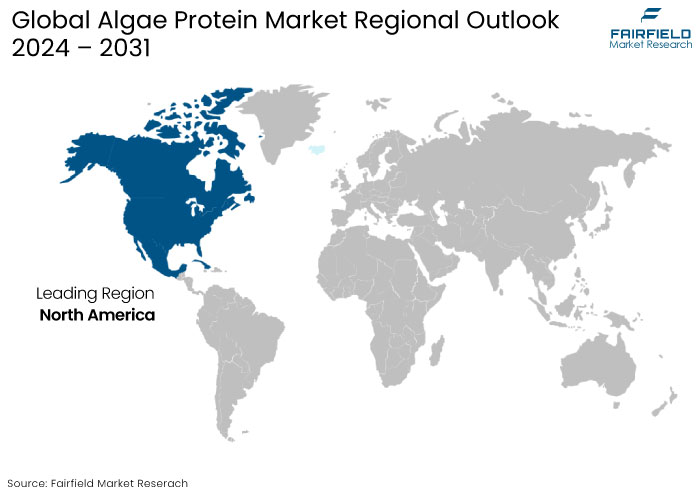

Regional Analysis

- North America Algae Protein Market Maintains Primacy

North America market is witnessing substantial expansion driven by heightened consumer awareness of health and wellbeing alongside growing demand for sustainable and plant-based protein sources.

The increasing trend of veganism and the rising popularity of functional foods has enhanced the demand for algal proteins across various food and beverage applications. Consequently, North America is among the foremost regions in producing and consuming algal protein products.

The U.S. algal protein market is anticipated to expand at a steady CAGR over the forecast period. The industry exhibits elevated adoption rates of plant-based and alternative proteins, bolstered by a significant emphasis on nutritional supplements and health foods. Consumers progressively pursue superior, comprehensive protein sources driving the market for algal proteins from spirulina and chlorella.

The dietary supplement sector commands a significant market share propelled by the nation's extensive nutraceutical industry and consumer inclination towards natural and sustainable protein alternatives. Furthermore, the increasing inclination toward individualized nutrition and clean-label products prompts producers to integrate algal proteins into various product compositions.

- Europe to Stand Out in the Market

Europe algae protein market is poised for growth, projected to expand at a CAGR of 4.9% from 2024 to 2031. This market growth is driven by strict regulations advocating for sustainable and eco-friendly food production. Health-conscious consumers across the continent are increasingly turning to algae proteins, viewing them as a prime option for dietary supplements and diverse food applications.

Leading economies in Europe are Germany, the UK, and France which are amplifying investments in research and development to enhance algae cultivation and protein extraction techniques. The European Union’s commitment to sustainability and backing for alternative protein initiatives are further propelling the commercialization of algae protein across various sectors, including food, beverages, and animal feed.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the algae protein market is characterized by a mix of established players and emerging companies focused on innovation and sustainability. Key players include Nutraceutical (spirulina), Algenol, and Cyanotech Corporation, which dominate the market with high-quality algae protein products. These companies invest significantly in research and development to enhance cultivation techniques and product formulations, targeting dietary supplements, food & beverages, and animal feed applications.

Emerging start-ups are also entering the market, leveraging advancements in biotechnology to develop novel algae strains and extraction methods. Strategic partnerships and collaborations are common and aim to expand distribution channels and improve product offerings. The competitive landscape is evolving driven by consumer demand for sustainable, nutritious protein sources and innovations in algae cultivation and processing technologies.

Key Market Companies

- Tianjin Norland Biotech Co. Ltd.

- Cyanotech Corporation

- Taiwan Chlorella Manufacturing Company Ltd.

- B.N. Bio-engineering Co. Ltd.

- NB Laboratories

- Far East Microalgae Industries Co. Ltd.

- Sun Chlorella Corporation

- Fuqing King Dnarmsa Spirulina Co. Ltd.

- Algenol Biotech

- Gong Bih Enterprise Co. Ltd.

Recent Industry Developments

- June 2024 -

Brevel, Ltd., a firm focused on microalgae protein, launched its inaugural commercial facility, which covers 27,000 square feet (about 2,500 square meters). It is designed to manufacture significant volumes of microalgae protein powder, addressing the burgeoning worldwide alternative protein industry.

- February 2022 -

Clariant, a prominent specialty chemical manufacturer, announced the launch of a unique range of 100% bio-based products. Vita bio-based surfactants and polyethylene glycols (PEGs) are being introduced as part of the company's initiative to promote an environmentally sustainable bio-economy and meet the increasing demand for bio-based chemicals.

An Expert’s Eye

- Algae protein offers a rich nutrient profile, making it a valuable addition to plant-based diets due to its high protein content and essential amino acids.

- Industry analysts emphasize the sustainability of algae cultivation, noting its low resource requirements and ability to grow in non-arable land, making it an eco-friendly protein source.

- Consumer education is crucial to overcoming misconceptions and improving acceptance of mainstream diets.

- Algae protein's versatility allows for applications across various sectors, including dietary supplements, food & beverages, and animal feed, broadening its market reach.

Global Algae Protein Market is Segmented as-

By Source

- Microalgae

- Spirulina

- Chlorella

- Seaweed

By Application

- Dietary Supplements

- Food & Beverage

- Animal Feed

- Cosmetics

By Region

- North America

- Europe

- Latin America

- Asia Pacific

- The Middle East and Africa

1. Executive Summary

1.1. Global Algae Protein Market Snapshot

1.2. Key Market Trends

1.3. Future Projections

1.4. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.1.1. Driver A

2.2.1.2. Driver B

2.2.1.3. Driver C

2.2.2. Restraints

2.2.2.1. Restraint 1

2.2.2.2. Restraint 2

2.2.3. Market Opportunities Matrix

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Pre-covid and Post-covid Scenario

2.5.2. Supply Impact

2.5.3. Demand Impact

2.6. Technology Landscape

2.7. Key Regulations

2.7.1. FDA Regulations

2.7.2. Import/Export Regulations

2.8. Economic Analysis

2.9. PESTLE

3. Production Output and Trade Statistics, 2019 - 2023

3.1. Regional Production Statistics

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East & Africa

3.2. Trade Statistics

4. Price Trends Analysis and Future Projects, 2019 - 2031

4.1. Key Highlights

4.2. Prominent Factors Affecting Prices

4.3. By Application

4.4. By Region

5. Global Algae Protein Market Outlook, 2019 - 2031

5.1. Global Algae Protein Market Outlook, by Source, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Microalgae

5.1.1.1.1. Spirulina

5.1.1.1.2. Chlorella

5.1.1.2. Seaweed

5.2. Global Algae Protein Market Outlook, by Application, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Dietary Supplements

5.2.1.2. Food & Beverage

5.2.1.3. Animal Feed

5.2.1.4. Cosmetics

5.2.1.5. Misc.

5.3. Global Algae Protein Market Outlook, by Region, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. North America

5.3.1.2. Europe

5.3.1.3. Asia Pacific

5.3.1.4. Latin America

5.3.1.5. Middle East & Africa

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. North America Algae Protein Market Outlook, 2019 - 2031

6.1. North America Algae Protein Market Outlook, by Source, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Microalgae

6.1.1.1.1. Spirulina

6.1.1.1.2. Chlorella

6.1.1.2. Seaweed

6.2. North America Algae Protein Market Outlook, by Application, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Dietary Supplements

6.2.1.2. Food & Beverage

6.2.1.3. Animal Feed

6.2.1.4. Cosmetics

6.2.1.5. Misc.

6.3. North America Algae Protein Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. U.S.

6.3.1.2. Canada

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Algae Protein Market Outlook, 2019 - 2031

7.1. Europe Algae Protein Market Outlook, by Source, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Microalgae

7.1.1.1.1. Spirulina

7.1.1.1.2. Chlorella

7.1.1.2. Seaweed

7.2. Europe Algae Protein Market Outlook, by Application, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Dietary Supplements

7.2.1.2. Food & Beverage

7.2.1.3. Animal Feed

7.2.1.4. Cosmetics

7.2.1.5. Misc.

7.3. Europe Algae Protein Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Germany

7.3.1.2. France

7.3.1.3. U.K.

7.3.1.4. Italy

7.3.1.5. Spain

7.3.1.6. Russia

7.3.1.7. Rest of Europe

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Algae Protein Market Outlook, 2019 - 2031

8.1. Asia Pacific Algae Protein Market Outlook, by Source, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Microalgae

8.1.1.1.1. Spirulina

8.1.1.1.2. Chlorella

8.1.1.2. Seaweed

8.2. Asia Pacific Algae Protein Market Outlook, by Application, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Dietary Supplements

8.2.1.2. Food & Beverage

8.2.1.3. Animal Feed

8.2.1.4. Cosmetics

8.2.1.5. Misc.

8.3. Asia Pacific Algae Protein Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Southeast Asia

8.3.1.6. Rest of Asia Pacific

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Algae Protein Market Outlook, 2019 - 2031

9.1. Latin America Algae Protein Market Outlook, by Source, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Microalgae

9.1.1.1.1. Spirulina

9.1.1.1.2. Chlorella

9.1.1.2. Seaweed

9.2. Latin America Algae Protein Market Outlook, by Application, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Dietary Supplements

9.2.1.2. Food & Beverage

9.2.1.3. Animal Feed

9.2.1.4. Cosmetics

9.2.1.5. Misc.

9.3. Latin America Algae Protein Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Brazil

9.3.1.2. Mexico

9.3.1.3. Rest of Latin America

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Algae Protein Market Outlook, 2019 - 2031

10.1. Middle East & Africa Algae Protein Market Outlook, by Source, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. Microalgae

10.1.1.1.1. Spirulina

10.1.1.1.2. Chlorella

10.1.1.2. Seaweed

10.2. Middle East & Africa Algae Protein Market Outlook, by Application, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. Dietary Supplements

10.2.1.2. Food & Beverage

10.2.1.3. Animal Feed

10.2.1.4. Cosmetics

10.2.1.5. Misc.

10.3. Middle East & Africa Algae Protein Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. GCC

10.3.1.2. South Africa

10.3.1.3. Rest of Middle East & Africa

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Company Market Share Analysis, 2021

11.2. Competitive Dashboard

11.3. Company Profiles

11.3.1. AlgaEnergy

11.3.1.1. Company Overview

11.3.1.2. Product Portfolio

11.3.1.3. Financial Overview

11.3.1.4. Business Strategies and Development

(*Note: Above details would be available for below list of companies based on availability)

11.3.2. Heliae Development LLC

11.3.3. ENERGYbits Inc.

11.3.4. E.I.D. - Parry (India) Limited.

11.3.5. Earthrise Nutritionals, LLC (DIC Corporation)

11.3.6. Far East Bio-Tec Co., Ltd. (FEBICO)

11.3.7. Roquette Klötze GmbH & Co. KG

11.3.8. Corbion N.V.

11.3.9. Allmicroalgae

11.3.10. Duplaco BV

11.3.11. AlgoSource SA

11.3.12. Cyanotech Corporation

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2023 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Source Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Market Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |