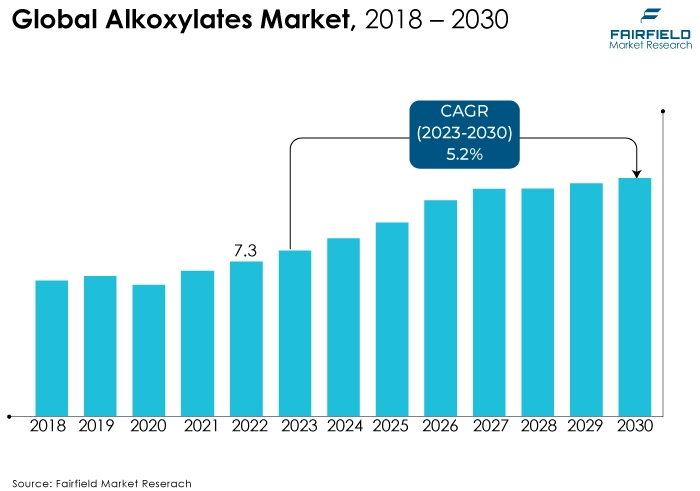

Global Alkoxylates Market Forecast

- The alkoxylates market size likely to rise high at a CAGR of 5.2% during 2023 - 2030

- Alkoxylates market valuation projected to reach from US$7.3 Bn in 2022 to US$10.4 Bn in 2030

Quick Report Digest

- Owing to numerous applications in numerous end-use industries, including oil & and gas, personal care, consumer goods, agrochemicals, and others, alkoxylate demand has seen a substantial rise during the forecast period.

- The market may in the approaching years be driven by the simplicity of raw material availability and the appropriateness of alkoxylates in various end-use industries.

- The important market trends are the rise in living standards, the boosting effects of beauty and personal care goods on self-esteem, and the quick movement in customer preferences towards high-end and cosmetic products.

- The fatty acid ethoxylates type segment is anticipated to keep a strong position. The properties of fatty acid ethoxylates include viscosity regulators, antistatic additives, dispersants, and emulsifiers.

- The global surfactant application segment is anticipated to keep a prominent position. Different alkoxylate-based surfactants are used in many industrial fields.

- The worldwide personal care end-user segment is anticipated to keep a leading position. The need for natural and synthetic ethoxylates has increased, attributing to the factors such as the growing population, changing lifestyles, and increased attention on the personal care and beauty care sector.

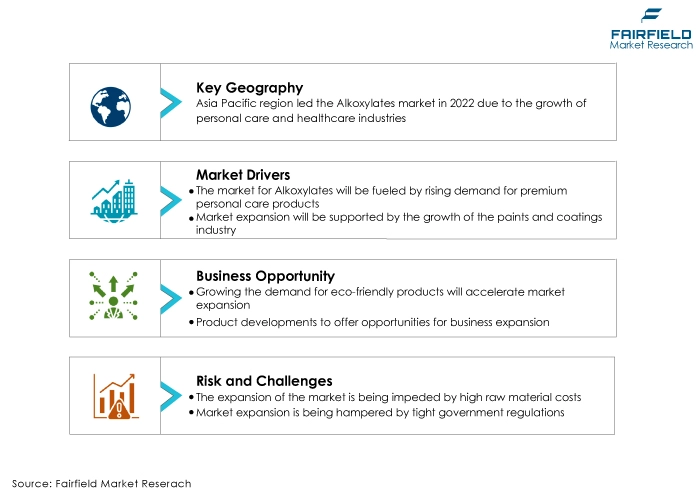

- The Asia Pacific region remained the dominating region in the global market. The oil and gas industry in the area is well-established, and there has been a surge in demand for alkoxylates.

A Look Back and a Look Forward - Comparative Analysis

The market for Alkoxylates has grown in popularity owing to the factors like the rising spending on self-care premium products. For instance, the personal care sector is estimated to be worth €80 billion at 2021 retail sales prices, according to a Cosmetics Europe article from that year. The lauryl alcohol ethoxylate is provided by VENUS ETHOXYETHERS PVT.LTD. It is used in the formulation of a variety of skin and personal care products, including shampoo, creams, lotions, liquid detergents, and solubilizers for fragrances, among others, as an emulsifying and cleansing agent.

Due to their low or absent amounts of volatile organic compounds, natural and biodegradable ethoxylate products have seen a boom in popularity as consumers become more conscious of the need for environmentally friendly products. As customers' spending power has increased in favour of pricey alkoxylate items, businesses have focused more on boosting the manufacturing capacity of natural and ecologically friendly products. These elements will give the market profitable prospects.

Key Growth Determinants

- Increased Demand for Eco-friendly Products, and Sustainable Energy Solutions

Due to their low/zero levels of volatile organic compounds, products made with biodegradable and natural ethoxylates are becoming more and more popular as consumers become more environmentally conscious.

A surge in consumers' spending power for pricey alkoxylate products has also encouraged businesses to focus more on boosting the manufacturing of natural and environmentally friendly goods.

Further, ethoxylate and alkoxylate are frequently used as corrosion & and scale inhibitors to prevent scale development in pipelines and other drilling equipment. The increase in global energy demand has sparked an upsurge in crude oil exploration and drilling activity in oil-rich countries.

- Rising Adoption Across Oil and Gas Industry

The market for alkoxylates is anticipated to develop in the future due to the rising demand for oil and gas. In the oil and gas industry, alkoxylates are utilised as co-emulsifiers and corrosion inhibitors as oil and gas demand rises, so will the market for alkoxylates.

The International Energy Agency, an independent intergovernmental organisation with headquarters in Paris, estimates that the average daily rise in world oil demand will be 5.3 million barrels, reaching 96.2 million barrels in August 2021. In addition, the demand for petrol climbed globally in 2021 by 3.6%, and by 2024 it is anticipated to grow by 7%. In the light of this, the market for alkoxylates is expanding due to the rising need for oil and gas.

- Rise in Uptake by Personal Care Industry

The market for alkoxylates is expected to gain significantly from the soaring demand across personal care brands, considering the perceived benefit of improved quality of life, and the benefits of beauty and personal care on social interaction and self-esteem.

L'Oreal estimates predict that the income from the worldwide beauty and personal care business will reach US$784.6 Bn in 2025. In 2022, the United States brought in US$87.13 Bn from the worldwide beauty and personal care market. China came in second with US$55.3 Bn in sales, and Japan came in third with US$38.5 Bn. Additionally, Germany was the top-ranked country in Europe with over US$17 Bn.

Major Growth Barriers

- Uncertainty in Raw Material Prices

Trade obstacles, geopolitical considerations, and raw material costs that are highly volatile could limit market revenue growth. The impact of these factors, including supply-chain disruptions and rising commodity prices, is already felt strongly by local enterprises. These interruptions have also had a significant negative impact on surfactant manufacturers, one of the key suppliers to the home and personal care sector.

Additionally, higher taxes levied on compounds like alkoxylates will be detrimental to the industry. The main impact is that the industry is importing more downstream goods from other nations, including alcohol ethoxylate, driving up the cost of import duties.

- Stringent Government Regulations

Strict regulatory regulations on the usage of nonylphenol may impede commercial expansion. Additionally, some alkoxylates have a dangerous character, necessitating appropriate caution during the manufacturing process.

In reaction, rising crude oil prices have increased the cost of ethoxylation, placing too much pressure on product price margins. The alkoxylates market growth is being hampered by these concerns throughout the forecasted timeframe.

Key Trends and Opportunities to Look at

- Product Innovation

A key trend in the alkoxylates market is product innovation. Major players in the alkoxylates market are concentrating on creating novel and cutting-edge solutions to improve their competitiveness. For instance, the novel dispersing agent OXITIVE 8000 was introduced in June 2022 by a US-based surfactant and specialty chemical manufacturer, Oxiteno. By lowering viscosity, the new agent increases pigment load and tinting strength.

- Shift Toward Environmentally Sustainable Products

Concerns about the toxicity of some ethoxylates are getting worse. The creation of eco-friendly ethoxylate products should be the manufacturers' top priority. The primary replacement for these hazardous ethoxylates is alcohol ethoxylates.

Non-ionic surfactants in the alcohol ethoxylates class are manufactured and utilised all over the world. The performance properties of AE are favourable in several applications. The adoption of hazardous ethoxylates is subject to tight laws in many nations. In these nations, alkoxylates have a chance to dominate the market.

- Popularity of Low Rinse Detergents

Across various applications, there is a significant rise in the need for low-rinse detergent. Low-rinse detergents are becoming more and more common since they resist hardness, do not ionize in solution, and have no electrical charge.

Market players are trying to create low-rinse products like methyl ester alkoxylates since they produce little foam, which also helps to save water. Since alkoxylates are non-ionic surfactants most of the time, demand for them is rising along with the desire for non-rinse detergents.

How Does the Regulatory Scenario Shape this Industry?

Since some alkoxylates are dangerous, producers are very careful when carrying out the production process, which finally leaves way for more options. Government rules governing the use and sale of chemicals are quite strict. For instance, nonylphenol ethoxylates have been discovered to harm human health and as a result, have been outlawed by numerous regulatory bodies, including the European Union and the Canadian government.

However, the results of screening carried out by the Canadian government in November 2022 indicate that the Poly (alkoxylates/ethers) Group of substances are harmless to human health at levels of exposure considered in the screening assessment and that these substances are not entering the environment at harmful levels.

Fairfield’s Ranking Board

Top Segments

- Fatty Acid Ethoxylates will Surge Ahead Through 2030

Fatty acid ethoxylates were the biggest revenue producer in 2022. By ethoxylating fatty acids including oleic acid, lauric acid, stearic acid, and coconut fatty acid, fatty acid ethoxylates are created. The fatty acid ethoxylate is also a non-ionic surfactant that has high foam capabilities, solubility, and chemical stability. As a result of these attributes, it is broadly adopted in a variety of end-use industries and has good detergency properties.

In addition, the projection period has seen growth for the alkyl phenol ethoxylates, sorbitan ester ethoxylates, and glycerin alkoxylates. This is explained by the fact that other kinds of alkoxylates have expanded in response to the rising demand for consumer goods, agrochemicals, and the oil and gas industry.

- Surfactants Continue to Represent the Most Attractive Application Segment

The surfactant application segment had the most income in 2022. Surfactants, which are surface active agents, are used in a wide range of end-use industries. They also aid in lowering the surface tension between water and the surface. In laundry and other personal care products, surfactants serve as fundamental cleaning agents.

In addition, fatty alcohol ethoxylate is a non-ionic surfactant primarily utilised in household and commercial laundry detergents. The detergents, stabilizers, and wetting agents have also experienced significant growth during the projection period.

In the oil and gas sector, alkoxylate derivatives are stabilizers. As a result, the demand for natural and synthetic detergents has increased, and the global population is expanding. These factors have also increased the standard of living.

- Personal Care Industry’s Appetite for Alkoxylates Soars

The end-use industry for personal care had the highest revenue in 2022. Alkoxylate plays a vital role in boosting the potential sales of the personal care and beauty care business in the personal care section, which includes a variety of skincare products.

Alkoxylate is widely used to make cosmetics, lotions, creams, and other items since it is recognised as a good source of preservatives and biocide. During the projection period, the agrochemicals, paints & and coatings, and other end-user segments are also likely to show higher adoption potential.

Decyl alcohol ethoxylate, and other alcohol alkoxylate agrochemical chemicals are used as herbicide adjuvants in crop protection products to increase the effectiveness of the active ingredients and enhance overall performance. In the next years, these variables are anticipated to accelerate market expansion generally.

Regional Frontrunners

Asia Pacific Extends the Largest Revenue Share to Global Market

The market for alkoxylates in the Asia Pacific region is expected to grow at the greatest CAGR during the forecast period. Alkoxylates are utilised for corrosion protection applications in the oil and gas industry in the wake of the increased demand for a wide variety of consumer goods. Alkoxylate sales in industrial sectors are predicted to rise as a result.

Alkoxylates have seen substantial expansion in the agrochemical industry in India. For instance, the India Brand Equity Foundation reported in January 2021 that the country's agrochemicals industry is anticipated to grow at an 8% CAGR to reach US$3.7 Bn by FY22 and US$4.7 Bn by FY25.

North America Benefits from Investments in Pharma and Agriculture Industries

Throughout the predicted period, it is also expected that the North American region will continue to dominate. The market for alkoxylates in the region is witnessing significant expansion in revenue, predominantly owing to sales performance across countries like the US, and Canada.

The increasing population, the expansion of the chemical manufacturing industry, the expansion of the agricultural sector, and government initiatives and investments in the pharmaceutical industry are major drivers of growth in the North American area. These factors have paved the way for the expansion of the alkoxylates market.

Fairfield’s Competitive Landscape Analysis

The global alkoxylates market is a consolidated market with fewer major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Alkoxylates Space?

- IMCD Group

- Stepan Company

- Solvay

- PCC Group

- Clariant AG

- Akzo

- Dow

- Indorama Ventures Public Company Limited

- Croda International Plc

- Schärer and Schläpfer AG

- Lamberti S.p.A

- BASF SE

- Eastman Chemical Company

- Huntsman International LLC

- VENUS ETHOXYETHERS PVT.LTD.

Significant Company Developments

Capacity Expansions

- June 2023: Beginning in the second quarter of 2023, BASF will expand its alkoxylation capabilities in Ludvig Port, Germany, and Antwerp, Belgium. Customers in Europe will especially benefit from the investment, which will result in capacity improvements of more than 150,000 tonnes annually.

- April 2022: To meet rising demand across a variety of quickly expanding end markets, including pharmaceuticals, industrial and institutional cleaning solutions, and home and personal care, Dow (NYSE: DOW) announced plans to increase its global alkoxylation capacity in the U.S. and Europe.

- December 2022: By acquiring a property on Singapore's Jurong Island, Nouryon declared that their alkoxylation footprint has been increased throughout Southeast Asia. By acquiring the facility, Nouryon will be better able to meet rising regional customer demand in important end sectors like agriculture and food, natural resources, and paints and coatings.

- October 2021: The Stepan Company disclosed plans to construct and run a new alkoxylation unit at its current Pasadena, Texas, location. A key surfactant technology for the agricultural, oilfield, construction, and domestic end-use markets is alkoxylates.

Merger and Acquisition

- September 2022: Stepan Company declared that it has reached a deal to buy PerformanX Specialty Chemicals, LLC's surfactant business and related assets.

An Expert’s Eye

Demand and Future Growth

The market for alkoxylates is expanding because of the rising demand for these substances in sectors like personal care, detergents, agrochemicals, and oilfield chemicals. Alkoxylates are highly sought-after in various industries due to their adaptability and performance-improving qualities. The performance and qualities of alkoxylates are also the subject of ongoing study and development.

During the projection period, new possibilities are predicted to arise from the development of novel alkoxylate compounds and innovations in production techniques. However, the market's expansion may be hampered by erratic raw material prices and strict governmental controls.

Supply Side of the Market

According to our analysis, alkoxylates are substances created through the alkoxylation of fatty hydrophobes with ethylene oxide, propylene oxide, and butylene oxide. China was the world's top exporter of chemicals in 2021, according to Statista, with exports valued at almost US$106 Bn. The US came in a distant second with exports worth more than US$56 Bn.

Furthermore, according to the European Chemical Industry Council, global sales rose from €3,494 Bn in 2020 to €4,026 Bn in 2021, a 15.2% increase. The chemical industry in the EU27 comes in second in terms of overall sales with 14.7%, while the United States comes in third with 10.9%. Over the past ten years, the competitive environment has substantially transformed on a global scale. The US, Japan, and largely emerging nations from Asia currently rank in the top 10 in terms of sales, after the EU27.

Global Alkoxylates Market is Segmented as Below:

By Product Type:

- Ethoxylates

- Propaxylates

- EO/PO Copolymer

- Glycerine Alkoxylates

- Polysorbates

- Tristyrylphenol Alkoxylates

- Fatty Acid Alkoxylates

- Fatty Amine/Polyamine Alkoxylates

- Miscellaneous (Castor Oil Alkoxylates, etc.)

By Application:

- Solubilizer/Surfactant

- Demulsifier

- Antifoam Agent

- Cleaning Agent

- Wetting and Leveling Agent

- Miscellaneous

By End-use Industry:

- Personal Care

- Paper and Pulp

- Textile

- Ceramics

- Agrochemicals

- Oil and Gas

- Paints and Coatings

- Miscellaneous

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & and Africa

1. Executive Summary

1.1. Global Alkoxylates Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Alkoxylates Market Outlook, 2018 - 2030

3.1. Global Alkoxylates Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Ethoxylates

3.1.1.2. Propaxylates

3.1.1.3. EO/PO Copolymer

3.1.1.4. Glycerine Alkoxylates

3.1.1.5. Polysorbates

3.1.1.6. Tristyrylphenol Alkoxylates

3.1.1.7. Fatty Acid Alkoxylates

3.1.1.8. Fatty Amine/Polyamine Alkoxylates

3.1.1.9. Misc. (Castor Oil Alkoxylates, etc.)

3.2. Global Alkoxylates Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Solubilizer/Surfactant

3.2.1.2. Demulsifier

3.2.1.3. Antifoam Agent

3.2.1.4. Cleaning Agent

3.2.1.5. Wetting and Leveling Agent

3.2.1.6. Misc.

3.3. Global Alkoxylates Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Personal Care

3.3.1.2. Paper and Pulp

3.3.1.3. Textile

3.3.1.4. Ceramics

3.3.1.5. Agrochemicals

3.3.1.6. Oil and Gas

3.3.1.7. Paints and Coatings

3.3.1.8. Misc.

3.4. Global Alkoxylates Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Alkoxylates Market Outlook, 2018 - 2030

4.1. North America Alkoxylates Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Ethoxylates

4.1.1.2. Propaxylates

4.1.1.3. EO/PO Copolymer

4.1.1.4. Glycerine Alkoxylates

4.1.1.5. Polysorbates

4.1.1.6. Tristyrylphenol Alkoxylates

4.1.1.7. Fatty Acid Alkoxylates

4.1.1.8. Fatty Amine/Polyamine Alkoxylates

4.1.1.9. Misc. (Castor Oil Alkoxylates, etc.)

4.2. North America Alkoxylates Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Solubilizer/Surfactant

4.2.1.2. Demulsifier

4.2.1.3. Antifoam Agent

4.2.1.4. Cleaning Agent

4.2.1.5. Wetting and Leveling Agent

4.2.1.6. Misc.

4.3. North America Alkoxylates Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Personal Care

4.3.1.2. Paper and Pulp

4.3.1.3. Textile

4.3.1.4. Ceramics

4.3.1.5. Agrochemicals

4.3.1.6. Oil and Gas

4.3.1.7. Paints and Coatings

4.3.1.8. Misc.

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Alkoxylates Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

4.4.1.4. Canada Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Alkoxylates Market Outlook, 2018 - 2030

5.1. Europe Alkoxylates Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Ethoxylates

5.1.1.2. Propaxylates

5.1.1.3. EO/PO Copolymer

5.1.1.4. Glycerine Alkoxylates

5.1.1.5. Polysorbates

5.1.1.6. Tristyrylphenol Alkoxylates

5.1.1.7. Fatty Acid Alkoxylates

5.1.1.8. Fatty Amine/Polyamine Alkoxylates

5.1.1.9. Misc. (Castor Oil Alkoxylates, etc.)

5.2. Europe Alkoxylates Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Solubilizer/Surfactant

5.2.1.2. Demulsifier

5.2.1.3. Antifoam Agent

5.2.1.4. Cleaning Agent

5.2.1.5. Wetting and Leveling Agent

5.2.1.6. Misc.

5.3. Europe Alkoxylates Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Personal Care

5.3.1.2. Paper and Pulp

5.3.1.3. Textile

5.3.1.4. Ceramics

5.3.1.5. Agrochemicals

5.3.1.6. Oil and Gas

5.3.1.7. Paints and Coatings

5.3.1.8. Misc.

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Alkoxylates Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Alkoxylates Market Outlook, 2018 - 2030

6.1. Asia Pacific Alkoxylates Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Ethoxylates

6.1.1.2. Propaxylates

6.1.1.3. EO/PO Copolymer

6.1.1.4. Glycerine Alkoxylates

6.1.1.5. Polysorbates

6.1.1.6. Tristyrylphenol Alkoxylates

6.1.1.7. Fatty Acid Alkoxylates

6.1.1.8. Fatty Amine/Polyamine Alkoxylates

6.1.1.9. Misc. (Castor Oil Alkoxylates, etc.)

6.2. Asia Pacific Alkoxylates Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Solubilizer/Surfactant

6.2.1.2. Demulsifier

6.2.1.3. Antifoam Agent

6.2.1.4. Cleaning Agent

6.2.1.5. Wetting and Leveling Agent

6.2.1.6. Misc.

6.3. Asia Pacific Alkoxylates Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Personal Care

6.3.1.2. Paper and Pulp

6.3.1.3. Textile

6.3.1.4. Ceramics

6.3.1.5. Agrochemicals

6.3.1.6. Oil and Gas

6.3.1.7. Paints and Coatings

6.3.1.8. Misc.

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Alkoxylates Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Alkoxylates Market Outlook, 2018 - 2030

7.1. Latin America Alkoxylates Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Ethoxylates

7.1.1.2. Propaxylates

7.1.1.3. EO/PO Copolymer

7.1.1.4. Glycerine Alkoxylates

7.1.1.5. Polysorbates

7.1.1.6. Tristyrylphenol Alkoxylates

7.1.1.7. Fatty Acid Alkoxylates

7.1.1.8. Fatty Amine/Polyamine Alkoxylates

7.1.1.9. Misc. (Castor Oil Alkoxylates, etc.)

7.2. Latin America Alkoxylates Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Solubilizer/Surfactant

7.2.1.2. Demulsifier

7.2.1.3. Antifoam Agent

7.2.1.4. Cleaning Agent

7.2.1.5. Wetting and Leveling Agent

7.2.1.6. Misc.

7.3. Latin America Alkoxylates Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Personal Care

7.3.1.2. Paper and Pulp

7.3.1.3. Textile

7.3.1.4. Ceramics

7.3.1.5. Agrochemicals

7.3.1.6. Oil and Gas

7.3.1.7. Paints and Coatings

7.3.1.8. Misc.

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Alkoxylates Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Alkoxylates Market Outlook, 2018 - 2030

8.1. Middle East & Africa Alkoxylates Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Ethoxylates

8.1.1.2. Propaxylates

8.1.1.3. EO/PO Copolymer

8.1.1.4. Glycerine Alkoxylates

8.1.1.5. Polysorbates

8.1.1.6. Tristyrylphenol Alkoxylates

8.1.1.7. Fatty Acid Alkoxylates

8.1.1.8. Fatty Amine/Polyamine Alkoxylates

8.1.1.9. Misc. (Castor Oil Alkoxylates, etc.)

8.2. Middle East & Africa Alkoxylates Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Solubilizer/Surfactant

8.2.1.2. Demulsifier

8.2.1.3. Antifoam Agent

8.2.1.4. Cleaning Agent

8.2.1.5. Wetting and Leveling Agent

8.2.1.6. Misc.

8.3. Middle East & Africa Alkoxylates Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Personal Care

8.3.1.2. Paper and Pulp

8.3.1.3. Textile

8.3.1.4. Ceramics

8.3.1.5. Agrochemicals

8.3.1.6. Oil and Gas

8.3.1.7. Paints and Coatings

8.3.1.8. Misc.

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Alkoxylates Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Alkoxylates Market Product Type, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Alkoxylates Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Alkoxylates Market End-use Industry, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Application vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. IMCD Group

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Stepan Company

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Solvay

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. PCC Group

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Clariant AG.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Lamberti S.p.A

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. DOW

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Indorama Ventures Public Company Limited.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Schärer and Schläpfer AG

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Croda International Plc

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. BASF SE

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Eastman Chemical Company

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Huntsman International LLC

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Akzo

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. VENUS ETHOXYETHERS PVT.LTD.

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Application Coverage |

|

|

End-use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |