Global Aneurysm Clips Market Forecast

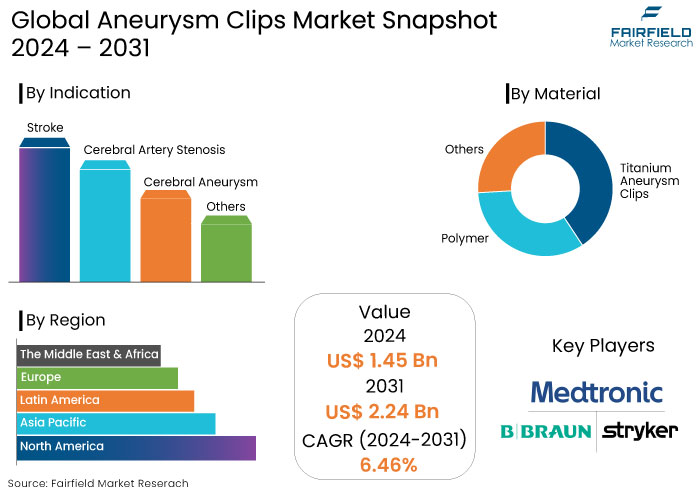

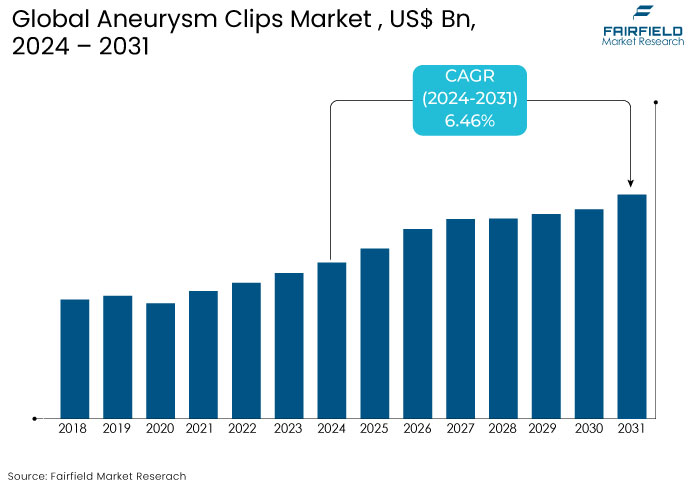

- The aneurysm clips market is projected to value at US$2.24 Bn by 2031, showing significant growth from the US$1.45 Bn achieved in 2024.

- The market is projected to exhibit a CAGR of 6.46% during the forecast period from 2024 to 2031.

Aneurysm Clips Market Insights

- The rising incidence of aneurysms particularly cerebral and abdominal aortic aneurysms drives demand for aneurysm clips.

- Titanium aneurysm clips dominate the market with an 81.96% share.

- Stroke segment leads the market with a 57.12% revenue share.

- Advancements in diagnostic imaging technologies like MRI and CT scans enable earlier detection of aneurysms.

- North America market accounted for 26.46% of revenue in 2023.

- Innovations in design and manufacturing processes contribute to aneurysm clips market growth.

- Biocompatible and durable alloys, bioactive coatings, 3D printing, and integration of robotics enhance the efficacy and safety of these devices.

- Public health campaigns and educational initiatives increase awareness of aneurysm-related health issues.

- Increased healthcare infrastructure enhances patient access to specialized treatments particularly in emerging economies.

A Look Back and a Look Forward - Comparative Analysis

The aneurysm clips market analysis has presented notable fluctuations in growth trends from pre-2023 to the projected post-2024 period. Prior to 2023, the market was characterized by a steady growth rate, driven by increasing awareness of aneurysm-related health issues and advancements in surgical techniques.

The market is projected to expand at a CAGR of 6.46% from 2024 to 2031 indicating a shift in dynamics. This decline can be attributed to the rising preference for minimally invasive procedures such as endovascular coiling, which offer low risks and quick recovery times compared to traditional clipping methods. Several factors are fueling market trends during this period.

The aging population is a significant driver as older individuals are more susceptible to aneurysms leading to increased demand for treatment options. Additionally, advancements in medical technology and the introduction of innovative products such as bioengineered clips are enhancing surgical outcomes and patient safety.

The increasing prevalence of lifestyle-related risk factors such as hypertension and smoking, continues to elevate the incidence of aneurysms sustaining a baseline demand for aneurysm clips despite the competitive pressures from alternative treatments.

Key Growth Determinants

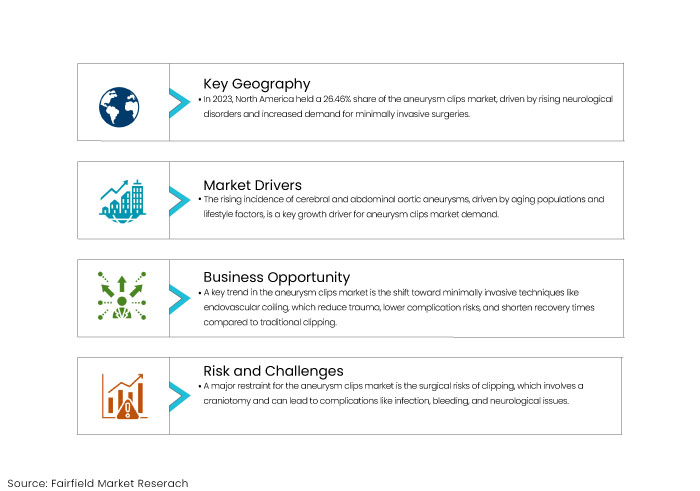

- Increasing Incidence of Aneurysms

The increasing incidence of aneurysms, particularly cerebral and abdominal aortic aneurysms is a primary growth driver for the aneurysm clips market demand. Factors such as aging population, lifestyle-related health issues, and genetic predispositions contribute to this trend. As individuals age, the risk of developing aneurysms increases, necessitating surgical interventions.

According to epidemiological studies, the prevalence of cerebral aneurysms ranges from 1.5% to 5% in the general population with high rates observed in individuals with risk factors like hypertension and smoking. This growing patient demographic leads to an increased demand for surgical solutions including aneurysm clips.

Advancements in diagnostic imaging technologies such as MRI and CT scans enable earlier detection of aneurysms further driving the need for effective treatment options.

- Technological Advancements

Technological advancements in design and manufacturing processes contribute to the aneurysm clips market growth. Innovations in materials such as the development of biocompatible and durable alloys, have improved the efficacy and safety of these devices. For instance, the introduction of bioactive coatings enhances the healing process and reduces the risk of complications, making these clips more appealing to surgeons and patients alike.

Advancements in manufacturing techniques, such as 3D printing, allow for the customization of aneurysm clips tailored to individual patient anatomies, which enhances surgical outcomes. The integration of robotics and minimally invasive surgical techniques also plays a crucial role in this growth.

- Growing Awareness and Healthcare Access

Growing awareness of aneurysm-related health issues and improved access to healthcare services are significant drivers for the aneurysm clips market expansion. Public health campaigns and educational initiatives have increased awareness of the symptoms and risks associated with aneurysms leading to more individuals seeking medical evaluation and treatment. This has resulted in a higher diagnosis rate, which subsequently drives demand for surgical interventions, including the use of aneurysm clips.

The expansion of healthcare infrastructure particularly in emerging economies enhances patient access to specialized treatments. Increased investments in healthcare facilities and advancements in telemedicine enable patients in remote areas to receive timely diagnoses and referrals for surgical procedures.

Key Growth Barriers

- High Surgical Risks and Complications

One of the significant restraints affecting the aneurysm clips market sales is the inherent surgical risks and complications associated with the clipping procedure. Aneurysm clipping typically requires a craniotomy, which involves opening the skull to access the aneurysm directly. This invasive nature of the procedure can lead to various complications, including infection, bleeding, and neurological deficits.

The risk of complications can deter both patients and healthcare providers from opting for this surgical intervention, especially when alternative treatments such as endovascular coiling, present lower risks. Additionally, the need for postoperative monitoring and potential follow-up surgeries can further complicate patient outcomes.

- Stringent Regulatory Compliance

Another critical restraint for the aneurysm clips market revenue is the stringent regulatory compliance that manufacturers must navigate. Regulatory bodies, such as the FDA in the United States and the EMA in Europe, impose rigorous standards for the approval of medical devices, including aneurysm clips. These regulations require extensive clinical trials to demonstrate the safety and efficacy of new products, which can be time-consuming and costly.

The lengthy approval processes can delay the introduction of innovative products to the market hindering manufacturers' ability to respond quickly to emerging trends and patient needs. Furthermore, compliance with these regulations often necessitates significant investment in research and development, which can be a barrier for small companies.

Aneurysm Clips Market Trends and Opportunities

- Shift Toward Minimally Invasive Procedures

A significant trend shaping the aneurysm clips market concentration is the shift toward minimally invasive surgical techniques. As healthcare providers increasingly prioritize patient safety and recovery times, there is a growing preference for procedures that reduce trauma and enhance outcomes.

Traditional aneurysm clipping, which involves a craniotomy, is being complemented by less invasive alternatives, such as endovascular coiling. This technique allows surgeons to access the aneurysm through small incisions, significantly lowering the risk of complications and shortening recovery periods.

The development of advanced imaging technologies and improved surgical instruments has facilitated this transition, enabling more precise and effective interventions. This trend also encourages manufacturers to innovate and develop new products that align with the growing preference for less invasive solutions, ultimately driving advancements in the market.

- Expansion in Emerging Markets

The expansion in emerging markets presents several aneurysm clips market opportunities for growth. Countries in regions such as Asia Pacific, Latin America, and parts of Africa are witnessing rapid improvements in healthcare infrastructure and increased investments in medical technology.

As these regions develop, there is a rising demand for advanced medical devices, including aneurysm clips, driven by a growing awareness of health issues and an increase in disposable incomes.

The prevalence of risk factors associated with aneurysms, such as hypertension and diabetes, is on the rise in these markets, further fueling the need for effective treatment options.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape significantly influences the aneurysm clips market primarily through stringent compliance requirements that manufacturers must meet. In the United States, for instance, the FDA mandates that all manufacturers and distributors register their establishments and adhere to rigorous standards outlined in 21 CFR, Part 807.

This includes conducting extensive clinical trials to demonstrate the safety and efficacy of new products before they can be marketed. Such requirements can delay product launches and increase development costs posing challenges for companies looking to innovate and expand their offerings.

The introduction of advanced materials such as cobalt and titanium has necessitated additional regulatory scrutiny to ensure biocompatibility and safety. These innovations enhance the performance of aneurysm clips, they also require manufacturers to navigate complex regulatory pathways, which can be resource-intensive.

On the positive side, regulatory support for innovative medical devices is one of the market trends that foster the growth by encouraging the development of next-generation aneurysm clips designed for minimally invasive procedures. This shift not only improves patient outcomes but also aligns with regulatory trends favoring safer, more effective treatment options.

Segments Covered in the Report

- Titanium Aneurysm Clips Dominate the Market

The titanium aneurysm clips segment held a commanding market share in 2023 and is projected to expand at a CAGR of 7.41% during the forecast period. Their inertness, durability, high tensile strength, and lightweight nature contribute to their popularity.

As per the aneurysm clips market update, titanium clips are compatible with imaging techniques like MRI, CT, and X-rays, ensuring effective closure of delicate vessels during procedures. This non-reactivity and minimal interference with scans further solidify titanium aneurysm clips as the preferred choice in surgical applications, driving their segment growth in the market.

- Stroke Segment Dominated the Market with 57.12% of the Total Market Share

As per the aneurysm clips market forecast, the stroke segment led the market with 57.12% share in 2023, driven by increasing stroke prevalence, hypertension, and various neurological disorders. According to the CDC, one in six people will experience a stroke in their lifetime, with over 795,000 strokes occurring annually in the U.S globally.

Strokes rank as the second leading cause of death worldwide causing around 140,000 deaths each year in the United States. The increasing incidence of strokes influenced by unhealthy lifestyles, hypertension, and aging populations is expected to propel the market growth.

Regional Analysis

- North America Market to Account for 26.46% Share

North America aneurysm clips market accounted for 26.46% market share in 2023, driven by the rising incidence of neurological disorders and growing demand for minimally invasive surgeries. The CDC reports that over 795,000 people in the United States experience strokes annually with 87% classified as ischemic.

Various organizations such as the Bee Foundation, are actively promoting awareness and research to reduce cerebral aneurysm fatalities. This combination of increasing stroke prevalence and proactive initiatives is expected to significantly boost the market growth in the region.

- Asia Pacific Aneurysm Clips Market to Lead the Market

Asia Pacific market is projected to experience the significant growth during the forecast period driven by increasing disease burdens, a rising elderly population, and unhealthy lifestyles among youth.

A ResearchGate article from April 2020 highlights obesity rates among adults in ASEAN countries: Cambodia at 50.20%, Indonesia at 28%, Laos at 20.9%, Malaysia at 15.4%, Singapore at 44.1%, Myanmar at 8.4%, Vietnam at 2.53%, Thailand at 12.7%, and Brunei Darussalam 29.5%. Notably, obesity rates are high among female across these nations.

Fairfield’s Competitive Landscape Analysis

The aneurysm clips market is driven by an increasing prevalence of cerebrovascular diseases and advancements in surgical technologies. Major competitors such as Medtronic, Stryker, and Johnson & Johnson dominate, focusing on product innovation and quality improvements. The market faces challenges from alternative treatment modalities like endovascular techniques. However, strategic collaborations and a growing emphasis on minimally invasive procedures are shaping competition, leading to significant growth opportunities in the neurosurgery sector.

The market faces challenges from alternative treatment modalities like endovascular techniques. However, strategic collaborations and a growing emphasis on minimally invasive procedures are shaping competition, leading to significant growth opportunities in the neurosurgery sector.

Key Market Companies

- Medtronic

- B. Braun (Aesculap Division)

- Stryker Corporation

- Johnson & Johnson (Ethicon)

- Codman Neuro (a subsidiary of Johnson & Johnson)

- Terumo Corporation

- Integra LifeSciences

- Aesculap AG

- Mizuho Medical Co., Ltd.

- Surgical Specialties Corporation

- Adeor Medical AG

- Rebstock Medical GmbH

Recent Industry Developments

- July 2023

MicroVention introduced a new aneurysm clip made from nitinol alloy in 2023, offering improved performance and corrosion resistance. This material's flexibility and strength allow it to better adapt to brain structures, enhancing the clip's ability to securely occlude aneurysms. This innovation represents a significant advancement in neurosurgery, promising improved outcomes for patients with cerebral aneurysms.

- June 2022

India Medtronic Private Limited has launched the fourth-generation flow diverter, PipelineTM Vantage with Shield Technology, for the endovascular treatment of brain aneurysms. The device has enhanced design features for both the delivery system and implant, allowing physicians to deliver, deploy, and treat brain aneurysms with greater ease and reliability. The device promotes cell growth in the inner lining of the target blood vessel.

An Expert’s Eye

- Asia Pacific's aneurysm clips market is projected to expand at significant rate due to increasing disease burdens.

- Regulatory bodies like the FDA and EMA impose rigorous standards for the approval of medical devices, requiring extensive clinical trials.

- Healthcare providers prioritize patient safety and recovery times leading to a preference for procedures that reduce trauma and enhance outcomes.

- Rising demand for advanced medical devices including aneurysm clips is driven by health awareness and increased disposable incomes.

Global Aneurysm Clips Market is Segmented as-

By Material

- Titanium Aneurysm Clips

- Polymer

- Others

By Indication

- Stroke

- Cerebral Artery Stenosis

- Cerebral Aneurysm

- Others

By Region

- North America

- Asia Pacific

- Latin America

- Europe

- The Middle East & Africa

1. Executive Summary

1.1. Global Aneurysm Clips Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. PESTLE Analysis

3. Global Aneurysm Clips Market Outlook, 2019 - 2031

3.1. Global Aneurysm Clips Market Outlook, by Material Type, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Titanium Alloy

3.1.1.2. Cobalt Chromium Alloy

3.2. Global Aneurysm Clips Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Saccular Aneurysms

3.2.1.2. Fusiform Aneurysms

3.3. Global Aneurysm Clips Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Hospitals

3.3.1.2. Neurology Centers

3.4. Global Aneurysm Clips Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Aneurysm Clips Market Outlook, 2019 - 2031

4.1. North America Aneurysm Clips Market Outlook, by Material Type, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Titanium Alloy

4.1.1.2. Cobalt Chromium Alloy

4.2. North America Aneurysm Clips Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Saccular Aneurysms

4.2.1.2. Fusiform Aneurysms

4.3. North America Aneurysm Clips Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Hospitals

4.3.1.2. Neurology Centers

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Aneurysm Clips Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

4.4.1.2. U.S. Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

4.4.1.3. U.S. Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

4.4.1.4. Canada Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

4.4.1.5. Canada Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

4.4.1.6. Canada Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Aneurysm Clips Market Outlook, 2019 - 2031

5.1. Europe Aneurysm Clips Market Outlook, by Material Type, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Titanium Alloy

5.1.1.2. Cobalt Chromium Alloy

5.2. Europe Aneurysm Clips Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Saccular Aneurysms

5.2.1.2. Fusiform Aneurysms

5.3. Europe Aneurysm Clips Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Neurology Centers

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Aneurysm Clips Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

5.4.1.2. Germany Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.3. Germany Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.4. U.K. Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

5.4.1.5. U.K. Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.6. U.K. Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.7. France Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

5.4.1.8. France Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.9. France Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.10. Italy Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

5.4.1.11. Italy Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.12. Italy Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.13. Turkey Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

5.4.1.14. Turkey Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.15. Turkey Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.16. Russia Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

5.4.1.17. Russia Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.18. Russia Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.19. Rest of Europe Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

5.4.1.20. Rest of Europe Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.21. Rest of Europe Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Aneurysm Clips Market Outlook, 2019 - 2031

6.1. Asia Pacific Aneurysm Clips Market Outlook, by Material Type, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Titanium Alloy

6.1.1.2. Cobalt Chromium Alloy

6.2. Asia Pacific Aneurysm Clips Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Saccular Aneurysms

6.2.1.2. Fusiform Aneurysms

6.3. Asia Pacific Aneurysm Clips Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Neurology Centers

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Aneurysm Clips Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. China Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

6.4.1.2. China Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.3. China Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.4. Japan Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

6.4.1.5. Japan Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.6. Japan Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.7. South Korea Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

6.4.1.8. South Korea Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.9. South Korea Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.10. India Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

6.4.1.11. India Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.12. India Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.13. Southeast Asia Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

6.4.1.14. Southeast Asia Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.15. Southeast Asia Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.16. Rest of Asia Pacific Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

6.4.1.17. Rest of Asia Pacific Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.18. Rest of Asia Pacific Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Aneurysm Clips Market Outlook, 2019 - 2031

7.1. Latin America Aneurysm Clips Market Outlook, by Material Type, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Titanium Alloy

7.1.1.2. Cobalt Chromium Alloy

7.2. Latin America Aneurysm Clips Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Saccular Aneurysms

7.2.1.2. Fusiform Aneurysms

7.3. Latin America Aneurysm Clips Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Neurology Centers

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Aneurysm Clips Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

7.4.1.2. Brazil Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.3. Brazil Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.4. Mexico Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

7.4.1.5. Mexico Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.6. Mexico Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.7. Argentina Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

7.4.1.8. Argentina Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.9. Argentina Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.10. Rest of Latin America Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

7.4.1.11. Rest of Latin America Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.12. Rest of Latin America Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Aneurysm Clips Market Outlook, 2019 - 2031

8.1. Middle East & Africa Aneurysm Clips Market Outlook, by Material Type, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Titanium Alloy

8.1.1.2. Cobalt Chromium Alloy

8.2. Middle East & Africa Aneurysm Clips Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Saccular Aneurysms

8.2.1.2. Fusiform Aneurysms

8.3. Middle East & Africa Aneurysm Clips Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Neurology Centers

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Aneurysm Clips Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

8.4.1.2. GCC Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.3. GCC Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.4. South Africa Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

8.4.1.5. South Africa Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.6. South Africa Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.7. Egypt Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

8.4.1.8. Egypt Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.9. Egypt Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.10. Nigeria Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

8.4.1.11. Nigeria Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.12. Nigeria Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.13. Rest of Middle East & Africa Aneurysm Clips Market by Material Type, Value (US$ Bn), 2019 - 2031

8.4.1.14. Rest of Middle East & Africa Aneurysm Clips Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.15. Rest of Middle East & Africa Aneurysm Clips Market by End User, Value (US$ Bn), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Product vs Indication Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Aesculap USA (B.Braun)

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. KLS Martin Group

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. AS Medizintechnik GmbH

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. ADCA - Indústria e Comércio de Material Cirúrgico Ltda

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Ortho-Medical GmbH

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Peter LAZIC GmbH

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Adeor Medical AG

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Rebstock Instruments GmbH

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Others

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Material Coverage |

|

|

Indication Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |