Global Animal Genetics Market Forecast

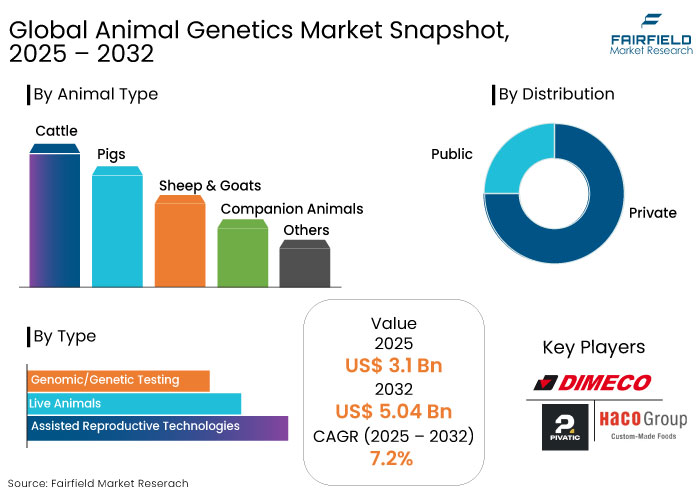

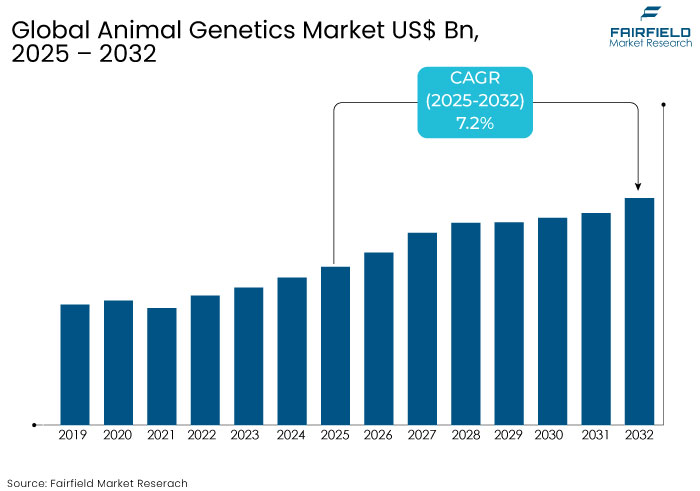

- The animal genetics market is projected to reach US$ 5.04 Bn by 2032 from US$ 3.1 Bn in 2025.

- The market for animal genetics is set to showcase a CAGR of 7.2% from 2025 to 2032.

Animal Genetics Market Insights

- Novel technologies like CRISPR gene editing and genomic sequencing are revolutionizing livestock breeding.

- Precision breeding technology developments are allowing for targeted genetic modifications in livestock.

- Increasing protein consumption in emerging economies such as India and China fuels demand for high-yield livestock.

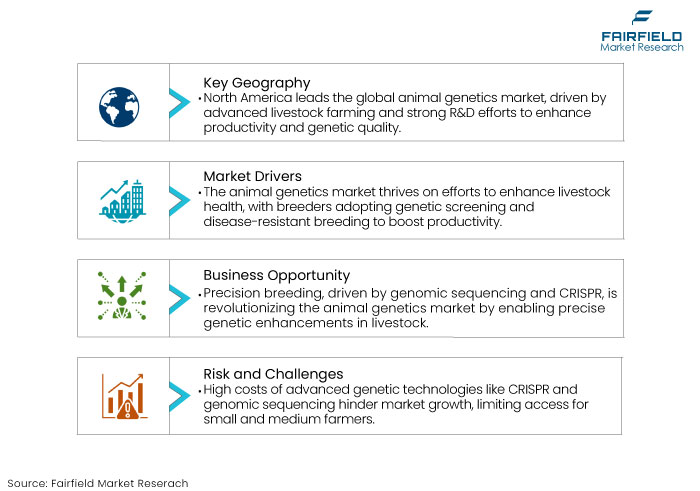

- Rising focus on livestock health and disease resistance is boosting market growth.

- North America is set to lead the global market, accounting for 35% of the total share in 2025.

- Assisted reproductive technologies are likely to dominate by type with a 52% share in 2025.

- Based on animal type, the cattle segment is projected to lead with 45% of share in 2025.

- Rising demand for ethical and environment-friendly farming practices encourages genetic innovations.

Key Growth Determinants

- Rising Focus on Livestock Health and Productivity

Rising emphasis on improving livestock health and productivity is a key driver for the animal genetics market. Farmers and breeders are increasingly adopting genetic screening and disease-resistant breeding programs to reduce livestock mortality rates and improve herd performance.

Diseases pose significant challenges to livestock farming, and genetic developments offer a proactive approach to mitigating risks. Governments and private organizations also support initiatives promoting sustainable agriculture and genetic research to enhance livestock quality.

-

Innovations in Genetic Technologies to Augment Demand

The development of cutting-edge technologies like CRISPR gene editing, genomic sequencing, and cloning has revolutionized the animal genetics market. These developments enable precise genetic modifications to enhance desirable traits, such as increased milk production, leaner meat, and disease resistance.

Companies and research institutions are investing heavily in research and development to come up with innovative solutions that address the challenges of traditional breeding methods. CRISPR technology allows scientists to introduce or delete specific genes, improving livestock efficiency while minimizing resource use. Such breakthroughs help increase productivity and ensure ethical breeding practices.

Key Growth Barriers

- High Costs of Novel Genetic Technologies to Restrict Adoption

The rising costs associated with unique genetic technologies, such as CRISPR gene editing, genomic sequencing, and other precision breeding methods, present a significant barrier to the global animal genetics market. These technologies have shown great promise in enhancing livestock productivity and disease resistance. However, the initial investment required for research, development, and implementation can be prohibitive for small and medium-sized farmers.

Animal Genetics Market Trends and Opportunities

- Innovations in Precision Breeding Technologies

One of the most transformative opportunities in the animal genetics market lies in the continued developments in precision breeding technologies. Precision breeding, powered by genomic sequencing and gene editing technologies like CRISPR, enables breeders to make targeted improvements in livestock genetics with unprecedented accuracy.

It leads to significant gains in disease resistance, growth rates, milk production, and meat quality while minimizing the adverse effects associated with traditional breeding methods. With consumers demanding healthier, more sustainable food options, precision breeding can help meet these needs by enhancing livestock health, productivity, and resilience.

- Rising Demand for Sustainable and Ethical Animal Farming Practices

Sustainability has become a key focus in agriculture, and the animal genetics market stands to benefit from the growing push toward more ethical and environmentally friendly farming practices. As consumers increasingly prioritize sustainability in their purchasing decisions, genetic innovations that improve the efficiency and resilience of livestock are becoming essential. Breeding animals that are better adapted to changing climates or have reduced environmental footprints will help mitigate the impact of livestock farming on the environment.

Segment Covered in the Report

- Cattle to Lead Amid Skyrocketing Demand for Dairy Products

By animal type, the cattle segment is projected to lead the animal genetics market. This is attributed to the rising global demand for dairy and meat products, driven by population growth and changing dietary preferences. Breeding genetically superior cattle has become a priority for farmers and producers seeking to boost productivity, improve disease resistance, and enhance the quality of milk and meat.

Novel genetic technologies, such as artificial insemination, embryo transfer, and genomic testing, have revolutionized cattle breeding, enabling precise selection of desirable traits. Such innovations allow breeders to achieve higher milk yields, better feed conversion rates, and enhanced adaptability to environmental changes.

- Assisted Reproductive Technologies to Dominate through 2032

Assisted reproductive technologies (ARTs) are set to emerge as the dominant type segment in the animal genetics market, accounting for almost 52% of the total share in 2025. Growing demand for unique reproductive solutions to enhance cattle breeding efficiency and drive genetic improvement has been a key factor behind this growth.

The segment continues to gain significant traction, offering sustainable solutions for meeting the high demand for superior-quality livestock products. With a focus on precision and efficiency, assisted reproductive technologies are transforming animal breeding practices, making them more productive and predictable.

Regional Analysis

- North America to Witness Several Genetic Research Activities

North America dominates the global animal genetics market, driven by rising adoption of unique livestock farming practices. Robust research and development initiatives and a strong focus on enhancing the region's livestock productivity and genetic quality are set to push demand.

The U.S. emerged as the largest contributor to the animal genetics market in North America. The country's leadership can be attributed to its expansive cattle industry, cutting-edge genetic research and development capabilities, and significant investments in biotechnology and breeding programs. The region's innovations in animal genetics and sustained focus on innovation ensure North America's continued dominance in the market.

- Asia Pacific to See High Demand for Protein-rich Diets

The animal genetics market in Asia Pacific is projected to rise at a CAGR of 7.1% from 2025 to 2032. The robust growth is driven by rising demand for protein-rich diets fueled by population growth and increasing disposable income, particularly in emerging economies like China and India.

India is anticipated to record the highest CAGR in the region during the forecast period. The country’s growth is attributed to its substantial cattle population, rapid urbanization, and rising income levels, which have amplified demand for protein-rich foods. Institutions like the Indian Veterinary Research Institute (IVRI) drive innovation by focusing on germplasm preservation, artificial insemination, and immunogenetics.

Fairfield’s Competitive Landscape Analysis

The animal genetics market is highly competitive, with key players focusing on innovation, strategic partnerships, and regional developments to maintain their global position. Leading companies such as Genus PLC, CRV Holding B.V., Hendrix Genetics, and Zoetis Inc. dominate the market through innovations in genetic research, artificial insemination technologies, and embryo transfer solutions.

Companies are heavily investing in research and development to create cutting-edge technologies, including CRISPR-based gene editing and genomic testing. Mergers and acquisitions like Paine Schwartz Partners’ stake in Hendrix Genetics have accelerated innovation and growth.

Key Market Companies

- DIMECO

- Pivatic Oy

- HACO

- Dallan S.p.A.

- DANOBAT GROUP

- Wuxi Qingyuan Laser Technology Co. Ltd

- Produtech S.R.L

Recent Industry Developments

- In September 2024, Zoetis and Danone S.A. launched a collaborative business development strategy to promote sustainable dairy farm practices through genetic innovations for healthier cattle.

- In November 2024, Gemini Genetics launched the U.K.'s first pet cloning clinic, offering owners the opportunity to clone their beloved cats and dogs for £40,000 per clone.

Global Animal Genetics Market is Segmented as-

By Animal Type

- Cattle

- Pigs

- Sheep & Goats

- Companion Animals

- Others

By Type

- Assisted Reproductive Technologies

- Live Animals

- Genomic/Genetic Testing

By Distribution

- Private

- Public

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Animal Genetics Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Economic Overview

2.6.1. World Economic Projections

2.7. PESTLE Analysis

3. Global Animal Genetics Market Outlook, 2019 - 2032

3.1. Global Animal Genetics Market Outlook, by Animal Type, Value (US$ Bn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Cattle

3.1.1.2. Pigs

3.1.1.3. Sheep & Goats

3.1.1.4. Companion Animals

3.1.1.5. Others

3.2. Global Animal Genetics Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Assisted Reproductive Technologies

3.2.1.2. Live Animals

3.2.1.3. Genomic/ Genetic Testing

3.3. Global Animal Genetics Market Outlook, by Distribution, Value (US$ Bn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Private

3.3.1.2. Public

3.4. Global Animal Genetics Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Animal Genetics Market Outlook, 2019 - 2032

4.1. North America Animal Genetics Market Outlook, by Animal Type, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Cattle

4.1.1.2. Pigs

4.1.1.3. Sheep & Goats

4.1.1.4. Companion Animals

4.1.1.5. Others

4.2. North America Animal Genetics Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Assisted Reproductive Technologies

4.2.1.2. Live Animals

4.2.1.3. Genomic/ Genetic Testing

4.3. North America Animal Genetics Market Outlook, by Distribution, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Private

4.3.1.2. Public

4.3.2. Attractiveness Analysis

4.4. North America Animal Genetics Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. U.S. Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

4.4.1.2. U.S. Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

4.4.1.3. U.S. Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

4.4.1.4. Canada Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

4.4.1.5. Canada Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

4.4.1.6. Canada Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

5. Europe Animal Genetics Market Outlook, 2019 - 2032

5.1. Europe Animal Genetics Market Outlook, by Animal Type, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Cattle

5.1.1.2. Pigs

5.1.1.3. Sheep & Goats

5.1.1.4. Companion Animals

5.1.1.5. Others

5.2. Europe Animal Genetics Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Assisted Reproductive Technologies

5.2.1.2. Live Animals

5.2.1.3. Genomic/ Genetic Testing

5.3. Europe Animal Genetics Market Outlook, by Distribution, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Private

5.3.1.2. Public

5.3.2. Attractiveness Analysis

5.4. Europe Animal Genetics Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Germany Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

5.4.1.2. Germany Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

5.4.1.3. Germany Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

5.4.1.4. U.K. Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

5.4.1.5. U.K. Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

5.4.1.6. U.K. Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

5.4.1.7. France Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

5.4.1.8. France Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

5.4.1.9. France Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

5.4.1.10. Italy Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

5.4.1.11. Italy Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

5.4.1.12. Italy Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

5.4.1.13. Türkiye Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

5.4.1.14. Türkiye Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

5.4.1.15. Türkiye Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

5.4.1.16. Russia Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

5.4.1.17. Russia Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

5.4.1.18. Russia Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

5.4.1.19. Rest of Europe Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

5.4.1.20. Rest of Europe Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

5.4.1.21. Rest of Europe Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

6. Asia Pacific Animal Genetics Market Outlook, 2019 - 2032

6.1. Asia Pacific Animal Genetics Market Outlook, by Animal Type, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Cattle

6.1.1.2. Pigs

6.1.1.3. Sheep & Goats

6.1.1.4. Companion Animals

6.1.1.5. Others

6.2. Asia Pacific Animal Genetics Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Assisted Reproductive Technologies

6.2.1.2. Live Animals

6.2.1.3. Genomic/ Genetic Testing

6.3. Asia Pacific Animal Genetics Market Outlook, by Distribution, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Private

6.3.1.2. Public

6.3.2. Attractiveness Analysis

6.4. Asia Pacific Animal Genetics Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. China Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

6.4.1.2. China Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

6.4.1.3. China Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

6.4.1.4. Japan Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

6.4.1.5. Japan Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

6.4.1.6. Japan Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

6.4.1.7. South Korea Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

6.4.1.8. South Korea Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

6.4.1.9. South Korea Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

6.4.1.10. India Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

6.4.1.11. India Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

6.4.1.12. India Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

6.4.1.13. Southeast Asia Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

6.4.1.14. Southeast Asia Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

6.4.1.15. Southeast Asia Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

6.4.1.16. Rest of Asia Pacific Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

6.4.1.17. Rest of Asia Pacific Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

6.4.1.18. Rest of Asia Pacific Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

7. Latin America Animal Genetics Market Outlook, 2019 - 2032

7.1. Latin America Animal Genetics Market Outlook, by Animal Type, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Cattle

7.1.1.2. Pigs

7.1.1.3. Sheep & Goats

7.1.1.4. Companion Animals

7.1.1.5. Others

7.2. Latin America Animal Genetics Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Assisted Reproductive Technologies

7.2.1.2. Live Animals

7.2.1.3. Genomic/ Genetic Testing

7.3. Latin America Animal Genetics Market Outlook, by Distribution, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Private

7.3.1.2. Public

7.3.2. Attractiveness Analysis

7.4. Latin America Animal Genetics Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Brazil Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

7.4.1.2. Brazil Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

7.4.1.3. Brazil Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

7.4.1.4. Mexico Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

7.4.1.5. Mexico Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

7.4.1.6. Mexico Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

7.4.1.7. Argentina Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

7.4.1.8. Argentina Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

7.4.1.9. Argentina Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

7.4.1.10. Rest of Latin America Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

7.4.1.11. Rest of Latin America Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

7.4.1.12. Rest of Latin America Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

8. Middle East & Africa Animal Genetics Market Outlook, 2019 - 2032

8.1. Middle East & Africa Animal Genetics Market Outlook, by Animal Type, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Cattle

8.1.1.2. Pigs

8.1.1.3. Sheep & Goats

8.1.1.4. Companion Animals

8.1.1.5. Others

8.2. Middle East & Africa Animal Genetics Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Assisted Reproductive Technologies

8.2.1.2. Live Animals

8.2.1.3. Genomic/ Genetic Testing

8.3. Middle East & Africa Animal Genetics Market Outlook, by Distribution, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Private

8.3.1.2. Public

8.3.2. Attractiveness Analysis

8.4. Middle East & Africa Animal Genetics Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. GCC Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

8.4.1.2. GCC Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

8.4.1.3. GCC Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

8.4.1.4. South Africa Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

8.4.1.5. South Africa Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

8.4.1.6. South Africa Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

8.4.1.7. Egypt Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

8.4.1.8. Egypt Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

8.4.1.9. Egypt Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

8.4.1.10. Nigeria Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

8.4.1.11. Nigeria Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

8.4.1.12. Nigeria Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

8.4.1.13. Rest of Middle East & Africa Animal Genetics Market by Animal Type, Value (US$ Bn), 2019 - 2032

8.4.1.14. Rest of Middle East & Africa Animal Genetics Market by Type, Value (US$ Bn), 2019 - 2032

8.4.1.15. Rest of Middle East & Africa Animal Genetics Market by Distribution, Value (US$ Bn), 2019 - 2032

9. Competitive Landscape

9.1. By Animal Type vs by Type Heatmap

9.2. Company Market Share Analysis, 2025

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. DIMECO

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Pivatic Oy

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. HACO

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Dallan S.p.A.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. DANOBAT GROUP

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Wuxi Qingyuan Laser technology Co. Ltd

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Produtech s.r.l

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Animal Type Coverage |

|

|

Type Coverage |

|

|

Distribution Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2023), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |