Global Animal Parasiticides Market Forecast

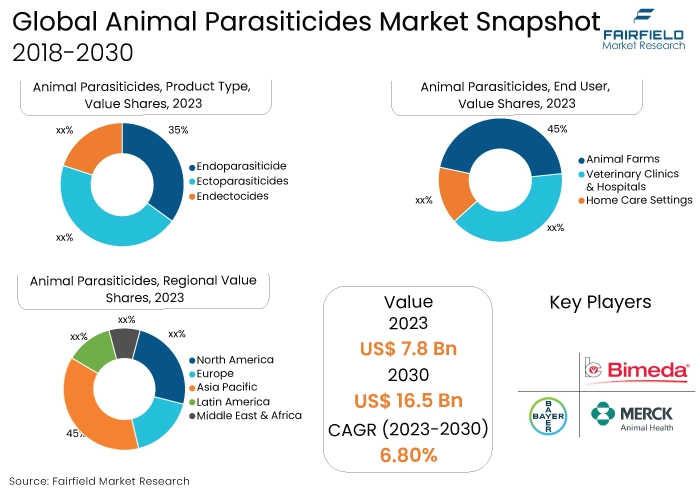

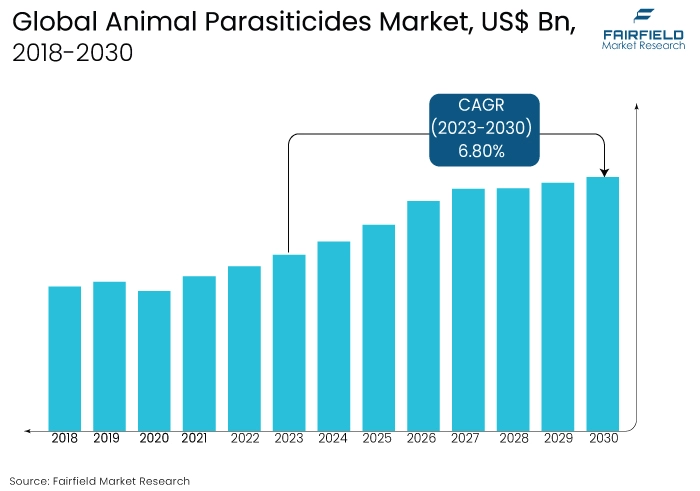

- Global animal parasiticides market size to reach US$16.5 Bn in 2030 from US$7.8 Bn in 2023

- Animal parasiticides market revenue anticipates a CAGR of 6.80% during 2023-2030

Quick report Digest

- The global animal parasiticides market continues its upward trajectory, driven by increasing pet ownership and a growing emphasis on preventive healthcare for both companion animals and livestock.

- Ongoing research and development efforts lead to the introduction of innovative formulations and delivery methods, enhancing the efficacy of parasiticides.

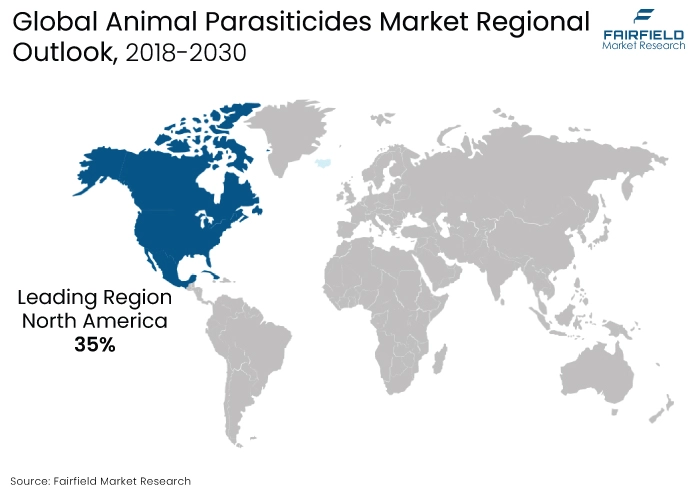

- Market dynamics vary across regions, with North America, and Europe leading in terms of market share, while Asia Pacific demonstrates substantial growth potential.

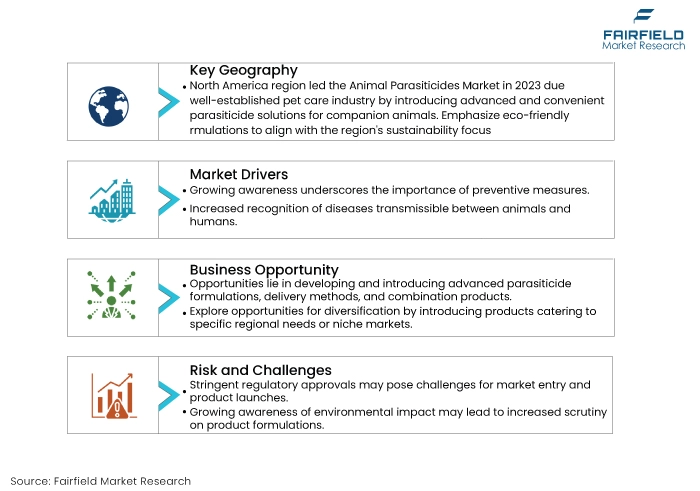

- Stringent regulatory approvals and compliance standards shape market entry, emphasizing the importance of safety and efficacy in parasiticide products.

- Rising awareness of environmental impact underscores the need for eco-friendly parasiticide formulations, influencing consumer preferences and market strategies.

- Intense market competition among key players prompts strategies such as pricing adjustments, product differentiation, and collaborations to gain a competitive edge.

- Despite overall market growth, challenges persist in consumer education about the significance of parasiticide use, presenting opportunities for awareness campaigns and educational initiatives.

- The market is poised for sustained growth, with opportunities lying in the development of sustainable solutions, expansion into emerging markets, and customisation of products to meet diverse regional needs.

A Look Back and a Look Forward - Comparative Analysis

The global animal parasiticides market is experiencing robust growth in the present landscape. The surge in pet ownership, coupled with an increasing awareness of zoonotic diseases, has propelled the demand for effective parasiticides for both companion animals and livestock. Technological advancements in veterinary medicine have led to the introduction of innovative formulations and delivery methods, enhancing the overall efficacy of parasiticide products.

Regional variations in market dynamics are evident, with North America, and Europe leading in terms of market share, driven by well-established pet care industries and stringent regulatory environments. Additionally, the Asia Pacific region demonstrates significant growth potential, fuelled by a booming pet market and a rising emphasis on animal health in agricultural practices.

The historical trajectory of the animal parasiticides market reflects a steady evolution driven by changing consumer attitudes and advancements in veterinary science. Over the past decade, there has been a notable shift in focus from reactive to preventive healthcare for animals.

Increasing pet ownership and the recognition of the economic importance of livestock health have been pivotal factors in shaping the market. Regulatory developments, technological innovations, and a growing understanding of the environmental impact of parasiticides have marked key milestones in the market's historical journey.

The future outlook for the animal parasiticides market appears promising, with sustained growth anticipated. Opportunities lie in the development of sustainable and eco-friendly solutions, tapping into emerging markets with a rising middle class and disposable incomes, and customising products to meet specific regional needs.

Continued technological advancements will likely drive the introduction of novel parasiticides, maintaining the market's momentum. As consumer awareness grows and preventive healthcare gains prominence, the market is expected to witness a continued upward trajectory, supported by a dynamic interplay of factors shaping the future of animal parasiticides.

Key Growth Determinants

- Growing Pet Ownership Rates

Pet ownership stands as a primary driver fuelling the expansion of the global animal parasiticides market. With an increasing number of households adopting companion animals, there is a heightened awareness of the need for preventive healthcare.

The emotional attachment between pet owners and their animals has led to a surge in demand for parasiticides to protect pets from fleas, ticks, worms, and other parasites. This trend is particularly prominent in developed regions like North America, and Europe, where pets are considered integral members of families.

The rise in pet ownership not only boosts the market for companion animal parasiticides but also influences product innovation as consumers seek convenient, safe, and effective solutions for their pets' wellbeing.

- Emphasis on Preventive Healthcare

The growing emphasis on preventive healthcare for animals is a significant market driver. Veterinarians and pet owners alike recognise the importance of proactively managing parasitic infestations to avoid the development of diseases and ensure overall health. This shift from reactive to preventive healthcare has resulted in an increased demand for parasiticides that offer long-lasting protection.

Products with extended efficacy periods, such as monthly spot-on treatments or collars, align with this trend, providing convenience for pet owners while contributing to the overall health and longevity of animals.

Similarly, in the livestock sector, farmers are increasingly adopting preventive measures to maintain the health and productivity of their herds, driving the demand for effective endoparasiticides and ectoparasiticides.

- Rising Awareness of Zoonotic Diseases

The heightened awareness of zoonotic diseases, which can be transmitted between animals and humans, serves as a critical driver for the animal parasiticides market. As people become more cognizant of the potential health risks associated with parasites in animals, there is a growing emphasis on controlling and preventing parasitic infestations.

Zoonoses such as Lyme disease, and certain types of tapeworm infections underscore the interconnectedness of animal and human health. This awareness has led to increased veterinary consultations, where professionals recommend and prescribe parasiticides to mitigate the risk of zoonotic diseases.

The market thus experiences a surge in demand for products that effectively target a broad spectrum of parasites, promoting not only animal health but also public health on a global scale.

Major Growth Barriers

- Regulatory Challenges

The animal parasiticides market faces significant restraint due to stringent regulatory challenges. The process of gaining approvals for new products is time-consuming and costly. Regulatory scrutiny is intensified as authorities prioritise the safety and efficacy of parasiticides, necessitating compliance with evolving standards. This impedes the timely introduction of innovative solutions, impacting market entry and potential advancements in the field.

- Environmental Concerns

Environmental considerations pose a notable restraint on the animal parasiticides market. The heightened awareness of the ecological impact of certain formulations has led to increased scrutiny and demand for eco-friendly alternatives.

Concerns about residues in water bodies and their effects on non-target species contribute to a shift in consumer preferences. This environmental consciousness influences product development and marketing strategies, impacting the adoption of parasiticides with perceived ecological risks.

Key Trends and Opportunities to Look at

- Sustainable Formulations

The trend towards eco-friendly and sustainable parasiticide formulations is growing globally. Consumers increasingly prioritise products with minimal environmental impact. Companies are investing in research to develop biodegradable and responsibly sourced ingredients.

This trend is gaining popularity in North America, and Europe, where environmental consciousness is high. Key players are emphasizing sustainability in their corporate strategies, leveraging eco-friendly formulations as a market differentiator.

- Telemedicine in Veterinary Care

Telemedicine is revolutionising veterinary care, allowing remote consultations and advice on parasiticide usage. This trend has gained prominence during the global shift towards digital healthcare solutions.

Companies are investing in telehealth platforms, enhancing accessibility to veterinary advice. Its adoption is widespread in North America and is gaining traction in Asia Pacific. Leading brands are incorporating telemedicine as part of comprehensive pet care solutions, enhancing customer engagement and service efficiency.

- Customised Parasiticides for Developing Markets

As pet ownership rises in emerging markets, there's a demand for customised parasiticides to address unique regional challenges. Companies are adapting formulations to suit diverse climates and pet populations. This trend is particularly evident in Latin America, and Asia Pacific.

Key developments involve localised marketing strategies, and partnerships with regional distributors. Brands are likely to leverage these tailored solutions to gain market share in regions with evolving consumer preferences and specific parasiticide needs.

How Does the Regulatory Scenario Shape this Industry?

The animal parasiticides market is significantly influenced by a complex regulatory framework that varies across regions, impacting product development, approval processes, and market access. In the United States, the Environmental Protection Agency (EPA) oversees the registration and regulation of parasiticides.

The Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) is a key legislation guiding the registration and use of these products. Compliance with FIFRA ensures the safety and efficacy of animal parasiticides, shaping the market landscape.

In the European Union, the European Medicines Agency (EMA) plays a crucial role in regulating veterinary medicinal products, including parasiticides. The Veterinary Medicinal Products Regulation (Regulation (EU) 2019/6) establishes a centralised authorisation process for veterinary medicines, ensuring consistent standards across member states. Compliance with these regulations is essential for market entry and sustained success in the European market.

These regulatory entities and frameworks guide companies in navigating the dynamic landscape of the animal parasiticides market. For instance, adherence to the evolving guidelines ensures consumer trust and market acceptance.

Failure to comply with regulatory standards can lead to product recalls, financial losses, and damage to brand reputation. The influence of these regulatory bodies underscores the need for continuous monitoring of guidelines and proactive adaptation to ensure compliance and sustained market presence.

Fairfield’s Ranking Board

Top Segments

- Ectoparasiticides Continue to be Dominant

Ectoparasiticides stand as the supporters within the product segment due to their efficacy in combating external parasites like fleas, ticks, and mites. These parasites pose significant threats to the health and well-being of both livestock, and companion animals. Ectoparasiticides work by targeting and eliminating these pests before they can cause harm or transmit diseases.

The prevalence of ectoparasites in various animal populations underscores the consistent demand for ectoparasiticides. Livestock, such as cattle and sheep, often suffer from infestations that can lead to economic losses for farmers through decreased productivity and potential transmission of diseases.

Similarly, companion animals like dogs and cats are susceptible to infestations, which can cause discomfort and pose health risks to both the animals and their owners. Given their effectiveness in controlling infestations and preventing the spread of diseases, ectoparasiticides enjoy high demand across different animal types and geographic regions. Their role in safeguarding animal health and ensuring productivity further solidifies their dominance in the product segment.

Endectocides are swiftly emerging as the fastest-growing category within the animal parasiticides market. These multifaceted formulations offer a broader spectrum of protection by targeting both endoparasites (internal parasites) and ectoparasites. This comprehensive approach makes endectocides increasingly preferred for parasite control in various animal types and across diverse end-user settings.

The convenience and efficiency of endectocides contribute significantly to their rising adoption. By offering integrated protection against a wide range of parasites, endectocides streamline parasite management practices for animal owners, veterinarians, and agricultural professionals alike. This comprehensive approach not only simplifies treatment regimens but also enhances the effectiveness of parasite control efforts.

Moreover, the versatility of endectocides makes them suitable for use in different animal species, including livestock and companion animals. Their efficacy against both internal and external parasites addresses multiple health concerns simultaneously, making them an attractive choice for comprehensive parasite management strategies.

- Livestock Animals Will Surge Ahead Throughout the Forecast Period

Livestock animals stand as the dominant category within the animal parasiticides market, commanding a significant share of market demand. This dominance is primarily driven by the critical role of parasiticides in addressing parasitic infestations in agricultural settings. Livestock such as cattle, sheep, and poultry are particularly susceptible to a range of parasitic infections, including worms, ticks, and mites.

The demand for parasiticides in livestock animals remains consistently high due to the substantial economic losses inflicted by parasitic infestations in the agricultural sector. These infestations can lead to reduced productivity, compromised animal welfare, and increased healthcare costs for farmers and producers.

There is thus the continuous need for effective parasiticide solutions to mitigate these risks and safeguard the health and productivity of livestock populations. Livestock parasiticides encompass a wide range of products tailored to address specific parasite species, and infection patterns prevalent in different livestock species.

These products play a vital role in disease prevention, treatment, and control strategies employed by farmers and veterinarians to maintain the health and productivity of livestock herds and flocks. Companion animals, including dogs and cats, are experiencing the fastest growth in demand for parasiticides within the market. This growth is fuelled by several factors, including the rising trend of pet ownership globally and increasing awareness about the importance of preventive healthcare measures for companion animals.

As more households embrace pets as integral members of their families, there is a growing emphasis on ensuring the health and wellbeing of these animals. Parasite control is recognised as a critical aspect of preventive healthcare for companion animals, given the potential risks posed by parasites to their health and the health of their human companions.

The increasing awareness among pet owners about the importance of regular parasite prevention and treatment drives the demand for parasiticides tailored for companion animals. Products such as spot-on treatments, oral medications, and collars offer convenient and effective solutions for controlling fleas, ticks, heartworms, and other parasites commonly encountered by dogs and cats.

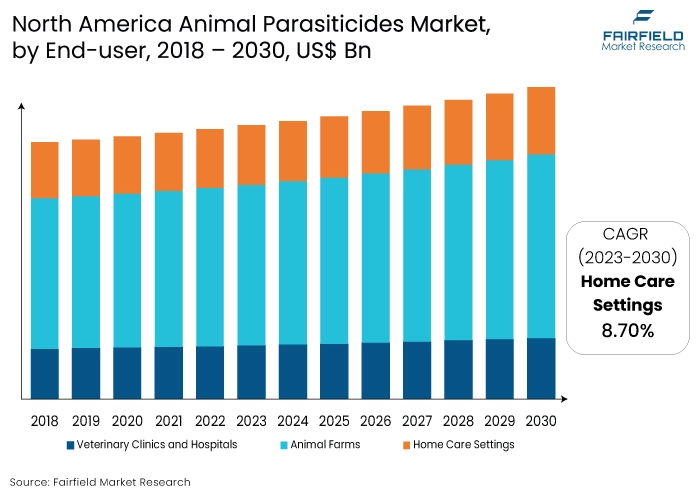

- Demand Maximum from Veterinary Clinics and Hospitals

Veterinary clinics and hospitals emerge as the dominant end users in the animal parasiticides market, wielding substantial influence over market dynamics. These facilities serve as pivotal points of access for a wide range of animal healthcare services, including the prescription, administration, and monitoring of parasiticides.

Veterinary professionals play a central role in diagnosing parasitic infections, prescribing appropriate parasiticides, and providing comprehensive treatment and preventive care to animals under their care. As trusted sources of expertise and guidance, veterinary clinics and hospitals hold sway over the choices, and decisions made regarding parasite control measures for both livestock and companion animals.

The reliance on veterinary clinics and hospitals for access to specialised veterinary care and prescription medications underscores their significance as key contributors to the animal parasiticides market. Their comprehensive approach to animal healthcare, coupled with their ability to tailor treatment regimens to individual patient needs, cements their position as dominant end users within the market.

Home care settings are experiencing rapid growth as an end users of animal parasiticides, driven by several factors shaping consumer behavior and preferences. Advancements in veterinary medicine, coupled with the availability of over-the-counter parasiticides, have empowered pet owners to take proactive measures to manage their pets' health and well-being at home.

Pet owners are increasingly embracing a preventive approach to pet healthcare, recognising the importance of regular parasite prevention and treatment in maintaining their pets' health. The convenience and accessibility of over-the-counter parasiticides enable pet owners to address parasite control needs promptly and effectively without the need for a veterinary prescription.

Furthermore, the growing emphasis on the human-animal bond and the integral role pets play in households have heightened awareness about the importance of pet health and wellness. As a result, pet owners are willing to invest in high-quality parasiticides and other healthcare products to ensure the health and vitality of their beloved companions.

Regional Frontrunners

Primacy of North America Remains Intact

North America commands the largest share of the global animal parasiticides market. The region's well-established pet care industry, and heightened awareness of preventive healthcare contribute to its dominance. Trends in North America showcase a preference for advanced parasiticides, with consumers increasingly opting for convenient and effective solutions.

Veterinary clinics and hospitals play a pivotal role in driving product recommendations. Established market players in North America leverage R&D to introduce innovative formulations, maintaining a significant market share contribution.

Asia Pacific Eyes Promising Prospects with Burgeoning Pet Population

Asia Pacific is poised to witness substantial growth in animal parasiticides sales throughout the forecast period. The region's burgeoning pet population, increasing disposable incomes, and shifting cultural focus on companion animal care are key drivers of this anticipated growth. As urbanisation accelerates, pet ownership becomes more prevalent, driving the demand for parasiticides.

Additionally, a growing awareness of zoonotic diseases further fuels the need for effective parasite control measures. Market players in Asia Pacific are strategically positioned to capitalise on this growth trajectory by offering cost-effective and innovative solutions tailored to the diverse needs of the region's consumers.

With a rising number of veterinary clinics, and an evolving regulatory landscape, Asia Pacific emerges as a focal point for global animal parasiticides sales, reflecting the region's dynamic market dynamics and significant contribution to the overall industry expansion.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the animal parasiticides market is characterised by key players such as Bayer, Zoetis, and Vetoquinol, who continually innovate and expand their product portfolios. Strategic collaborations, research initiatives, and product launches underscore industry dynamism. Market leaders focus on meeting evolving consumer needs while adhering to stringent quality and safety standards.

Who are the Leaders in Global Animal Parasiticides?

- Bayer AG

- Bimeda Animal Health

- Boehringer Ingelheim International GmbH

- Elanco Animal Health Incorporated

- Merck Animal Health

- Norbrook

- PetIQ Inc.

- Vetoquinol SA

- Virbac

- Zoetis

Significant Company Developments

New Product Launch

- In September 2022, a joint effort by the British Veterinary Association (BVA), the British Small Animal Veterinary Association (BSAVA), and the British Veterinary Zoological Society (BVZS) resulted in the formulation of a comprehensive five-point plan. The purpose of this plan is to guide veterinary professionals in the responsible use of parasiticide products for dogs and cats.

- In April 2022, Vetoquinol made a noteworthy announcement regarding Felpreva, a cutting-edge advancement in feline parasite protection. This innovative solution is now available for prescription by veterinarians in the United Kingdom market. The revelation follows the grant of marketing authorisation by the Veterinary Medicines Directorate (VMD) in November 2021.

An Expert’s Eye

Demand and Future Growth

The animal parasiticides market is experiencing escalating demand due to heightened awareness of animal health and a surge in pet ownership. Collaborative efforts by veterinary associations, exemplified by the five-point plan in the UK, underscore responsible product use.

Innovations such as Vetoquinol's Felpreva indicate a promising future, supported by expanding technological capabilities. The anticipated growth is driven by a growing global pet population and the ongoing evolution of the veterinary parasiticides landscape, positioning the market for sustained expansion.

Supply Side of the Market

According to our analysis, the supply side of the animal parasiticides market is adapting to heightened demand with increased production and strategic partnerships. Major industry players, including Bayer, Zoetis, and Vetoquinol, are actively expanding their product portfolios and collaborating on research and development initiatives.

Innovations in formulation and delivery methods are enhancing product efficacy. Stringent regulatory compliance and adherence to quality standards are integral to ensuring a reliable and safe supply chain. This concerted effort aims to meet the growing market demands while maintaining high standards of product safety and effectiveness.

Global Animal Parasiticides Market is Segmented as Below:

By Product Type:

- Endoparasiticides

- Ectoparasiticides

- Endectocides

By Animal Type

- Livestock Animals

- Companion Animals

By End User

- Animal Farms

- Veterinary Clinics and Hospitals

- Home Care Settings

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Animal Parasiticides Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Animal Parasiticides Market Outlook, 2018 - 2030

3.1. Global Animal Parasiticides Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Endoparasiticides

3.1.1.2. Ectoparasiticides

3.1.1.3. Endectocides

3.2. Global Animal Parasiticides Market Outlook, by Animal Type, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Livestock Animals

3.2.1.2. Companion Animals

3.3. Global Animal Parasiticides Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Animal Farms

3.3.1.2. Veterinary Clinics and Hospitals

3.3.1.3. Home Care Settings

3.4. Global Animal Parasiticides Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Animal Parasiticides Market Outlook, 2018 - 2030

4.1. North America Animal Parasiticides Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Endoparasiticides

4.1.1.2. Ectoparasiticides

4.1.1.3. Endectocides

4.2. North America Animal Parasiticides Market Outlook, by Animal Type, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Livestock Animals

4.2.1.2. Companion Animals

4.3. North America Animal Parasiticides Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Animal Farms

4.3.1.2. Veterinary Clinics and Hospitals

4.3.1.3. Home Care Settings

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Animal Parasiticides Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

4.4.1.4. U.S. Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

4.4.1.7. Canada Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

4.4.1.8. Canada Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Animal Parasiticides Market Outlook, 2018 - 2030

5.1. Europe Animal Parasiticides Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Endoparasiticides

5.1.1.2. Ectoparasiticides

5.1.1.3. Endectocides

5.2. Europe Animal Parasiticides Market Outlook, by Animal Type, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Livestock Animals

5.2.1.2. Companion Animals

5.3. Europe Animal Parasiticides Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Animal Farms

5.3.1.2. Veterinary Clinics and Hospitals

5.3.1.3. Home Care Settings

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Animal Parasiticides Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.4. Germany Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

5.4.1.7. U.K. Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.8. U.K. Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

5.4.1.9. France Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.10. France Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

5.4.1.11. France Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.12. France Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

5.4.1.13. Italy Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.14. Italy Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

5.4.1.15. Italy Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.16. Italy Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

5.4.1.17. Turkey Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.18. Turkey Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

5.4.1.19. Turkey Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.20. Turkey Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

5.4.1.21. Russia Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.22. Russia Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

5.4.1.23. Russia Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.24. Russia Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

5.4.1.25. Rest of Europe Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

5.4.1.26. Rest of Europe Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

5.4.1.27. Rest of Europe Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.28. Rest of Europe Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Animal Parasiticides Market Outlook, 2018 - 2030

6.1. Asia Pacific Animal Parasiticides Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Endoparasiticides

6.1.1.2. Ectoparasiticides

6.1.1.3. Endectocides

6.2. Asia Pacific Animal Parasiticides Market Outlook, by Animal Type, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Livestock Animals

6.2.1.2. Companion Animals

6.3. Asia Pacific Animal Parasiticides Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Animal Farms

6.3.1.2. Veterinary Clinics and Hospitals

6.3.1.3. Home Care Settings

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Animal Parasiticides Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.4. China Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

6.4.1.7. Japan Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.8. Japan Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.10. South Korea Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

6.4.1.11. South Korea Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.12. South Korea Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

6.4.1.13. India Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.14. India Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

6.4.1.15. India Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.16. India Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

6.4.1.17. Southeast Asia Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.18. Southeast Asia Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

6.4.1.19. Southeast Asia Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.20. Southeast Asia Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

6.4.1.21. Rest of Asia Pacific Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

6.4.1.22. Rest of Asia Pacific Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

6.4.1.23. Rest of Asia Pacific Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.24. Rest of Asia Pacific Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Animal Parasiticides Market Outlook, 2018 - 2030

7.1. Latin America Animal Parasiticides Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Endoparasiticides

7.1.1.2. Ectoparasiticides

7.1.1.3. Endectocides

7.2. Latin America Animal Parasiticides Market Outlook, by Animal Type, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Livestock Animals

7.2.1.2. Companion Animals

7.3. Latin America Animal Parasiticides Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Animal Farms

7.3.1.2. Veterinary Clinics and Hospitals

7.3.1.3. Home Care Settings

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Animal Parasiticides Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.4. Brazil Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

7.4.1.7. Mexico Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.8. Mexico Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

7.4.1.9. Argentina Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

7.4.1.10. Argentina Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

7.4.1.11. Argentina Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.12. Argentina Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

7.4.1.13. Rest of Latin America Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

7.4.1.14. Rest of Latin America Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

7.4.1.15. Rest of Latin America Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.16. Rest of Latin America Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Animal Parasiticides Market Outlook, 2018 - 2030

8.1. Middle East & Africa Animal Parasiticides Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Endoparasiticides

8.1.1.2. Ectoparasiticides

8.1.1.3. Endectocides

8.2. Middle East & Africa Animal Parasiticides Market Outlook, by Animal Type, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Livestock Animals

8.2.1.2. Companion Animals

8.3. Middle East & Africa Animal Parasiticides Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Animal Farms

8.3.1.2. Veterinary Clinics and Hospitals

8.3.1.3. Home Care Settings

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Animal Parasiticides Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.4. GCC Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

8.4.1.7. South Africa Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.8. South Africa Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

8.4.1.9. Egypt Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.10. Egypt Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

8.4.1.11. Egypt Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.12. Egypt Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

8.4.1.13. Nigeria Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.14. Nigeria Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

8.4.1.15. Nigeria Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.16. Nigeria Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

8.4.1.17. Rest of Middle East & Africa Animal Parasiticides Market by Product Type, Value (US$ Mn), 2018 - 2030

8.4.1.18. Rest of Middle East & Africa Animal Parasiticides Market Animal Type, Value (US$ Mn), 2018 - 2030

8.4.1.19. Rest of Middle East & Africa Animal Parasiticides Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.20. Rest of Middle East & Africa Animal Parasiticides Market End Use, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End User vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Bayer AG

9.5.1.1. Company Overview

9.5.1.2. Product Type Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Bimeda Animal Health

9.5.2.1. Company Overview

9.5.2.2. Product Type Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Boehringer Ingelheim International GmbH

9.5.3.1. Company Overview

9.5.3.2. Product Type Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Elanco Animal Health Incorporated

9.5.4.1. Company Overview

9.5.4.2. Product Type Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Merck Animal Health

9.5.5.1. Company Overview

9.5.5.2. Product Type Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Norbrook

9.5.6.1. Company Overview

9.5.6.2. Product Type Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. PetIQ Inc.

9.5.7.1. Company Overview

9.5.7.2. Product Type Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Vetoquinol SA

9.5.8.1. Company Overview

9.5.8.2. Product Type Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Virbac

9.5.9.1. Company Overview

9.5.9.2. Product Type Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Zoetis

9.5.10.1. Company Overview

9.5.10.2. Product Type Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Others

9.5.11.1. Company Overview

9.5.11.2. Product Type Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Animal Type Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |