Global Anime Merchandising Market Forecast

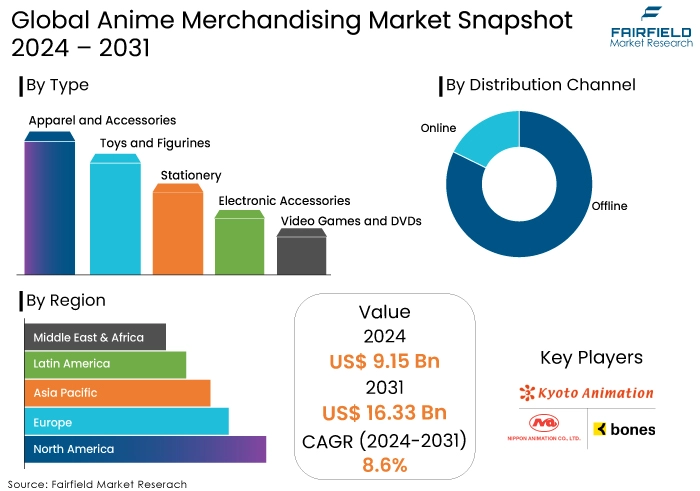

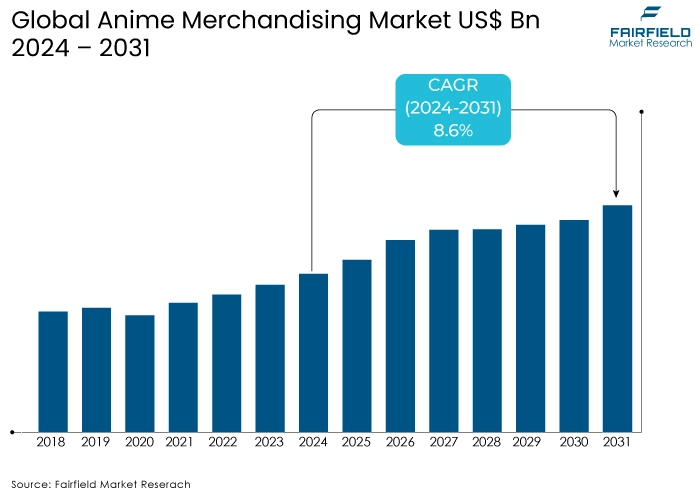

- The approximately US$9.15 Bn anime merchandising market size (2024) is expected to reach a valuation of US$16.33 Bn by the end of 2031.

- The anime merchandising market revenue is likely to expand at a CAGR of 8.6% during 2024-2031.

Anime Merchandising Market Insights

- Anime merchandising has expanded rapidly due to global anime popularity, driven by streaming, social media, and localization.

- Continued growth is expected, fuelled by metaverse, AR, and mainstream integration, but challenges like supply chain issues and economic factors persist.

- IP protection, consumer safety, and fair competition are crucial, but navigating complex regulations is challenging.

- Global fandom expansion, digital platforms, and merchandise diversification are key growth areas.

- IP infringement, counterfeiting, economic downturns, and consumer spending fluctuations are major challenges.

- Sustainability focus and experiential retail are emerging trends, offering growth opportunities.

- Apparel and accessories dominate, with toys, stationery, electronics, and video games showing potential.

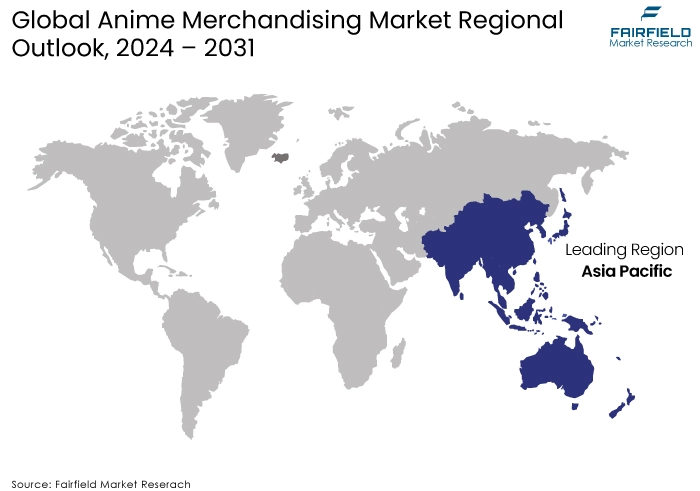

- Asia Pacific leads, with North America also showing significant growth.

- Intense competition exists among studios, manufacturers, and retailers, with focus on brand loyalty, innovation, and partnerships.

- The anime merchandising market is dynamic, with growth potential, challenges, and opportunities shaped by global trends and competition.

A Look Back and a Look Forward - Comparative Analysis

The anime merchandising market experienced substantial growth, driven by the increasing popularity of anime globally. Factors such as the rise of streaming platforms, the expansion of social media, and the localization of anime content contributed to a wider audience. This growth was reflected in the diversification of merchandise, from traditional figures and plushies to apparel, home goods, and digital collectibles.

While specific data for post-2024 is limited, the trend suggests continued growth. The market is expected to be influenced by factors such as the metaverse, augmented reality experiences, and the increasing integration of anime into mainstream culture. Additionally, the expansion of anime into new demographics and regions will likely drive further market expansion. However, challenges such as supply chain disruptions and economic uncertainties could impact growth rates.

How is Regulatory Scenario Shaping this Industry?

The regulatory environment significantly impacts the anime merchandising market. Intellectual property (IP) protection is paramount, ensuring original content is safeguarded and licensed merchandise is legitimate. Copyright and trademark laws protect anime characters, storylines, and branding, preventing counterfeit products.

Consumer protection regulations also play a crucial role. Safety standards for products, especially toys and collectibles, are essential. Fair competition laws prevent anti-competitive practices, ensuring a level playing field for businesses. Additionally, regulations around advertising, labeling, and product information impact how merchandise is marketed and sold.

While these regulations can increase operational costs, they also build consumer trust, protect businesses from unfair competition, and maintain industry standards. However, navigating a complex regulatory landscape can be challenging, requiring businesses to stay updated on evolving laws and standards.

Key Growth Determinants

Global Expansion of Anime Fandom

The anime fandom has transcended geographical boundaries, becoming a truly global phenomenon. The availability of anime content on streaming platforms has been instrumental in introducing the genre to new audiences. As the fanbase grows in regions beyond Asia, demand for merchandise also increases. This expansion creates opportunities for merchandising companies to cater to diverse cultural preferences and tastes, driving the growth of the anime merchandising market.

Growth of Digital Platforms and E-commerce

The rise of digital platforms has revolutionized the anime merchandising industry. Online stores and e-commerce platforms provide unprecedented access to a global customer base. Additionally, social media and influencer marketing have become powerful tools for promoting anime merchandise. Digital platforms also facilitate the sale of limited edition and exclusive items, creating a sense of urgency and driving consumer demand.

Diversification of Merchandise

The anime merchandising market has evolved beyond traditional products like figures and plushies. There is a growing demand for lifestyle and fashion items featuring anime characters and designs. Collaborations with fashion brands and retailers have expanded the reach of anime merchandise, attracting a wider audience. Moreover, the integration of technology, such as augmented reality and virtual reality, offers new opportunities for innovative and interactive merchandise.

Key Growth Barriers

IP Rights, and Counterfeiting

The anime merchandising market faces significant challenges due to intellectual property (IP) infringement and counterfeiting. Unauthorized production and distribution of merchandise can erode revenue for legitimate businesses and damage the reputation of anime franchises. Protecting IP rights requires substantial investments in legal and enforcement measures, which can hinder market growth. Additionally, the rapid rise of e-commerce platforms has made it easier for counterfeit products to reach consumers, further complicating the issue.

Economic Fluctuations, and Consumer Spending

The anime merchandising market is susceptible to economic downturns. As discretionary spending decreases during economic recessions, consumers tend to prioritize essential goods over non-essential items like merchandise. This can lead to reduced sales and profitability for businesses in the industry. Furthermore, fluctuating exchange rates can impact the cost of production and distribution, affecting pricing and overall market competitiveness.

Anime Merchandising Market Trends and Opportunities

Increased Focus on Sustainability

The anime merchandising industry is increasingly prioritizing sustainability. Consumers are becoming more conscious of environmental impact, and businesses are responding by adopting eco-friendly practices. This trend involves using recycled materials, reducing packaging, and supporting ethical sourcing. Additionally, there's a growing interest in sustainable fashion and lifestyle products featuring anime characters, aligning with consumer values.

Expansion into Experiential Retail

The anime merchandising market presents a significant opportunity for experiential retail. Creating immersive physical stores that offer fans unique experiences can drive sales and foster brand loyalty. Interactive elements, such as augmented reality, virtual reality, and character meet-and-greets, can attract customers and create shareable moments. Moreover, pop-up stores and limited-time events can generate excitement and exclusivity, boosting sales and brand awareness.

Market Segmentation

Apparel and Accessories Maintain a Dominant Share by Type

The apparel and accessories segment is dominated by casual wear such as t-shirts, hoodies, and jackets featuring anime characters or designs. Accessories like hats, bags, and keychains are also popular. This category has seen significant growth due to collaborations with fashion brands, expanding the appeal beyond traditional anime fans.

Toys and Figurines Creating Demand

Action figures and collectible figurines are the core of the toys and figurines segment. These products often feature high-quality sculpts and articulation, catering to both children and adult collectors. Additionally, plushies and keychains are popular, especially among younger fans. This category benefits from the release of new anime series and movies, driving demand for related merchandise.

Rapid Growth Expected in the Stationery Items Segment

Stationery items such as notebooks, pens, and pencil cases with anime designs are dominant in this segment. Character-themed stickers, bookmarks, and postcards also contribute to the category's growth. This segment primarily targets students and young adults who are fans of anime. Collaborations with stationery brands can help expand the reach of anime merchandise.

Demand Surge Poised in Electronic Accessories

This segment primarily includes phone cases, earphones, and power banks featuring anime characters or designs. While still a growing category, it has the potential for significant expansion with the increasing use of smartphones and other electronic devices. Collaborations with electronics brands can help introduce anime merchandise to a wider audience.

The Video Games and DVDs Segment to Emerge Lucrative

Anime-based video games and DVDs are core to this segment. Action, adventure, and role-playing games are popular genres. DVD releases of anime series and movies continue to be a significant source of revenue, although streaming services are impacting this segment in the anime merchandising market. Exclusive merchandise bundled with video games or DVDs can drive sales.

Regional Analysis

Asia Pacific to be at the Forefront

The Asia Pacific region, particularly Japan, South Korea, and China, is the undisputed dominant market for anime merchandising. Japan, as the birthplace of anime, boasts a massive and dedicated fanbase. The country has a well-established infrastructure for anime production, distribution, and merchandising. Additionally, the otaku culture in Japan fosters a strong demand for anime-related products.

South Korea, and China have also emerged as significant markets, driven by the increasing popularity of anime content. These countries have large youth populations with a growing disposable income, making them attractive for anime merchandise.

North America Represents the Dominant Regional Market

While Asia Pacific dominates the overall market, North America, especially the United States, has witnessed substantial growth in anime merchandise sales. The localization of anime content and the expansion of streaming platforms have contributed to a wider audience.

The region has a strong consumer culture and a thriving pop culture industry, which has helped to mainstream anime and its associated merchandise. The presence of anime conventions and dedicated retail stores in North America further supports the expansion of the anime merchandising market.

Fairfield’s Competitive Landscape Analysis

The anime merchandising market is highly competitive, with a mix of anime studios, merchandise manufacturers, and retailers vying for market share. Key players include established anime studios with strong IP portfolios, large-scale merchandise manufacturers, and online retailers.

Smaller niche players focus on specific anime genres or target demographics. Intense competition is driven by factors such as brand loyalty, product innovation, distribution channels, and pricing strategies. Collaborations and licensing deals have become crucial to gain a competitive edge.

Key Market Players

- Kyoto Animation Co.

- Bones Inc.

- Nippon Animation

- Madhouse Inc.

- Toei Animation Co.

- Production I.G

- Sunrise Inc.

- Anime International Company (ACI)

- A.Works, Inc.

- Pierrot Co., Ltd.

- Studio Ghibli

- VIZ Media

- Aniplex of America

- Funimation

Recent Industry Developments

- In March 2024, Arbitrum, and Azuki have teamed up to create AnimeChain, a web3 platform centered around anime. This initiative aims to captivate anime enthusiasts by offering a diverse range of content, games, merchandise, and NFTs.

- In February 2024, 33 Inc., a leading entertainment marketing agency, has forged a partnership with MyAnimeList, a prominent anime and manga community platform. The collaboration seeks to leverage their combined strengths to enhance anime marketing and fan engagement.

- The anime industry is increasingly exploring the metaverse. Virtual fashion shows, digital collectibles, and interactive experiences are becoming common. Companies are investing in developing virtual worlds and avatars to connect with fans on a new level.

- Many anime merchandise companies are adopting sustainable practices. This includes using eco-friendly materials, reducing packaging waste, and supporting ethical sourcing. Such initiatives align with growing consumer demand for environmentally conscious products.

Global Anime Merchandising Market is Segmented as-

By Type

- Apparel and Accessories

- Toys and Figurines

- Stationery

- Electronic Accessories

- Video Games and DVDs

- Others

By Distribution Channel

- Online

- Own E-commerce

- General E-commerce

- Cross-border E-commerce

- Offline

- Specialty Stores

- General Supermarkets

- Convenience Stores

- Events

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Anime Merchandising Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. PESTLE Analysis

3. Price Analysis, 2018 - 2023

3.1. Global Average Price Analysis, by Type, US$ Per Unit, 2018 - 2023

3.2. Prominent Factor Affecting Anime Merchandising Prices

3.3. Global Average Price Analysis, by Region, US$ Per Unit

4. Global Anime Merchandising Market Outlook, 2018 - 2031

4.1. Global Anime Merchandising Market Outlook, by Type, Value (US$ Bn), 2018 - 2031

4.1.1. Key Highlights

4.1.1.1. Apparel and Accessories

4.1.1.2. Toys and Figurines

4.1.1.3. Stationery

4.1.1.4. Electronic Accessories

4.1.1.5. Video Games and DVDs

4.1.1.6. Others

4.2. Global Anime Merchandising Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2031

4.2.1. Key Highlights

4.2.1.1. Online

4.2.1.1.1. Own e-commerce

4.2.1.1.2. General e-commerce

4.2.1.1.3. Cross-border e-commerce

4.2.1.2. Offline

4.2.1.2.1. Specialty Stores

4.2.1.2.2. General Supermarkets

4.2.1.2.3. Convenience Stores

4.2.1.2.4. Events

4.3. Global Anime Merchandising Market Outlook, by Region, Value (US$ Bn), 2018 - 2031

4.3.1. Key Highlights

4.3.1.1. North America

4.3.1.2. Europe

4.3.1.3. Asia Pacific

4.3.1.4. Latin America

4.3.1.5. Middle East & Africa

5. North America Anime Merchandising Market Outlook, 2018 - 2031

5.1. North America Anime Merchandising Market Outlook, by Type, Value (US$ Bn), 2018 - 2031

5.1.1. Key Highlights

5.1.1.1. Apparel and Accessories

5.1.1.2. Toys and Figurines

5.1.1.3. Stationery

5.1.1.4. Electronic Accessories

5.1.1.5. Video Games and DVDs

5.1.1.6. Others

5.2. North America Anime Merchandising Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2031

5.2.1. Key Highlights

5.2.1.1. Online

5.2.1.1.1. Own e-commerce

5.2.1.1.2. General e-commerce

5.2.1.1.3. Cross-border e-commerce

5.2.1.2. Offline

5.2.1.2.1. Specialty Stores

5.2.1.2.2. General Supermarkets

5.2.1.2.3. Convenience Stores

5.2.1.2.4. Events

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. North America Anime Merchandising Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

5.3.1. Key Highlights

5.3.1.1. U.S. Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

5.3.1.2. U.S. Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

5.3.1.3. Canada Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

5.3.1.4. Canada Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Anime Merchandising Market Outlook, 2018 - 2031

6.1. Europe Anime Merchandising Market Outlook, by Type, Value (US$ Bn), 2018 - 2031

6.1.1. Key Highlights

6.1.1.1. Apparel and Accessories

6.1.1.2. Toys and Figurines

6.1.1.3. Stationery

6.1.1.4. Electronic Accessories

6.1.1.5. Video Games and DVDs

6.1.1.6. Others

6.2. Europe Anime Merchandising Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2031

6.2.1. Key Highlights

6.2.1.1. Online

6.2.1.1.1. Own e-commerce

6.2.1.1.2. General e-commerce

6.2.1.1.3. Cross-border e-commerce

6.2.1.2. Offline

6.2.1.2.1. Specialty Stores

6.2.1.2.2. General Supermarkets

6.2.1.2.3. Convenience Stores

6.2.1.2.4. Events

6.2.2. Attractiveness Analysis

6.3. Europe Anime Merchandising Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

6.3.1. Key Highlights

6.3.1.1. Germany Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

6.3.1.2. Germany Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

6.3.1.3. U.K. Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

6.3.1.4. U.K. Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

6.3.1.5. France Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

6.3.1.6. France Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

6.3.1.7. Italy Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

6.3.1.8. Italy Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

6.3.1.9. Turkey Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

6.3.1.10. Turkey Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

6.3.1.11. Russia Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

6.3.1.12. Russia Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

6.3.1.13. Rest of Europe Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

6.3.1.14. Rest of Europe Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Anime Merchandising Market Outlook, 2018 - 2031

7.1. Asia Pacific Anime Merchandising Market Outlook, by Type, Value (US$ Bn), 2018 - 2031

7.1.1. Key Highlights

7.1.1.1. Apparel and Accessories

7.1.1.2. Toys and Figurines

7.1.1.3. Stationery

7.1.1.4. Electronic Accessories

7.1.1.5. Video Games and DVDs

7.1.1.6. Others

7.2. Asia Pacific Anime Merchandising Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2031

7.2.1. Key Highlights

7.2.1.1. Online

7.2.1.1.1. Own e-commerce

7.2.1.1.2. General e-commerce

7.2.1.1.3. Cross-border e-commerce

7.2.1.2. Offline

7.2.1.2.1. Specialty Stores

7.2.1.2.2. General Supermarkets

7.2.1.2.3. Convenience Stores

7.2.1.2.4. Events

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Asia Pacific Anime Merchandising Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

7.3.1. Key Highlights

7.3.1.1. China Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

7.3.1.2. China Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

7.3.1.3. Japan Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

7.3.1.4. Japan Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

7.3.1.5. South Korea Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

7.3.1.6. South Korea Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

7.3.1.7. India Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

7.3.1.8. India Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

7.3.1.9. Southeast Asia Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

7.3.1.10. Southeast Asia Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

7.3.1.11. Rest of Asia Pacific Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

7.3.1.12. Rest of Asia Pacific Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Anime Merchandising Market Outlook, 2018 - 2031

8.1. Latin America Anime Merchandising Market Outlook, by Type, Value (US$ Bn), 2018 - 2031

8.1.1. Key Highlights

8.1.1.1. Apparel and Accessories

8.1.1.2. Toys and Figurines

8.1.1.3. Stationery

8.1.1.4. Electronic Accessories

8.1.1.5. Video Games and DVDs

8.1.1.6. Others

8.2. Latin America Anime Merchandising Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2031

8.2.1. Key Highlights

8.2.1.1. Online

8.2.1.1.1. Own e-commerce

8.2.1.1.2. General e-commerce

8.2.1.1.3. Cross-border e-commerce

8.2.1.2. Offline

8.2.1.2.1. Specialty Stores

8.2.1.2.2. General Supermarkets

8.2.1.2.3. Convenience Stores

8.2.1.2.4. Events

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Latin America Anime Merchandising Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

8.3.1. Key Highlights

8.3.1.1. Brazil Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

8.3.1.2. Brazil Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

8.3.1.3. Mexico Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

8.3.1.4. Mexico Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

8.3.1.5. Argentina Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

8.3.1.6. Argentina Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

8.3.1.7. Rest of Latin America Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

8.3.1.8. Rest of Latin America Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Anime Merchandising Market Outlook, 2018 - 2031

9.1. Middle East & Africa Anime Merchandising Market Outlook, by Type, Value (US$ Bn), 2018 - 2031

9.1.1. Key Highlights

9.1.1.1. Apparel and Accessories

9.1.1.2. Toys and Figurines

9.1.1.3. Stationery

9.1.1.4. Electronic Accessories

9.1.1.5. Video Games and DVDs

9.1.1.6. Others

9.2. Middle East & Africa Anime Merchandising Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2031

9.2.1. Key Highlights

9.2.1.1. Online

9.2.1.1.1. Own e-commerce

9.2.1.1.2. General e-commerce

9.2.1.1.3. Cross-border e-commerce

9.2.1.2. Offline

9.2.1.2.1. Specialty Stores

9.2.1.2.2. General Supermarkets

9.2.1.2.3. Convenience Stores

9.2.1.2.4. Events

9.2.2. BPS Analysis/Market Attractiveness Analysis

9.3. Middle East & Africa Anime Merchandising Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

9.3.1. Key Highlights

9.3.1.1. GCC Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

9.3.1.2. GCC Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

9.3.1.3. South Africa Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

9.3.1.4. South Africa Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

9.3.1.5. Egypt Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

9.3.1.6. Egypt Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

9.3.1.7. Nigeria Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

9.3.1.8. Nigeria Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

9.3.1.9. Rest of Middle East & Africa Anime Merchandising Market by Type, Value (US$ Bn), 2018 - 2031

9.3.1.10. Rest of Middle East & Africa Anime Merchandising Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. Company Market Share Analysis, 2023

10.2. Competitive Dashboard

10.3. Company Profiles

10.3.1. GOOD SMILE COMPANY

10.3.1.1. Company Overview

10.3.1.2. Product Portfolio

10.3.1.3. Financial Overview

10.3.1.4. Business Strategies and Development

10.3.2. Production I.G Inc.

10.3.2.1. Company Overview

10.3.2.2. Product Portfolio

10.3.2.3. Financial Overview

10.3.2.4. Business Strategies and Development

10.3.3. Studio Ghibli Inc.

10.3.3.1. Company Overview

10.3.3.2. Product Portfolio

10.3.3.3. Financial Overview

10.3.3.4. Business Strategies and Development

10.3.4. Toei Animation Co. Ltd.

10.3.4.1. Company Overview

10.3.4.2. Product Portfolio

10.3.4.3. Financial Overview

10.3.4.4. Business Strategies and Development

10.3.5. Bones Inc.

10.3.5.1. Company Overview

10.3.5.2. Product Portfolio

10.3.5.3. Financial Overview

10.3.5.4. Business Strategies and Development

10.3.6. Kyoto Animation Co. Ltd.

10.3.6.1. Company Overview

10.3.6.2. Product Portfolio

10.3.6.3. Financial Overview

10.3.6.4. Business Strategies and Development

10.3.7. Ufotable Co. Ltd.

10.3.7.1. Company Overview

10.3.7.2. Product Portfolio

10.3.7.3. Financial Overview

10.3.7.4. Business Strategies and Development

10.3.8. Bandai Namco Group

10.3.8.1. Company Overview

10.3.8.2. Product Portfolio

10.3.8.3. Financial Overview

10.3.8.4. Business Strategies and Development

10.3.9. JND STUDIOS

10.3.9.1. Company Overview

10.3.9.2. Product Portfolio

10.3.9.3. Financial Overview

10.3.9.4. Business Strategies and Development

10.3.10. SNAIL SHELL

10.3.10.1. Company Overview

10.3.10.2. Product Portfolio

10.3.10.3. Financial Overview

10.3.10.4. Business Strategies and Development

10.3.11. Others

10.3.11.1. Company Overview

10.3.11.2. Product Portfolio

10.3.11.3. Financial Overview

10.3.11.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |