Global Antibacterial Drugs Market Forecast

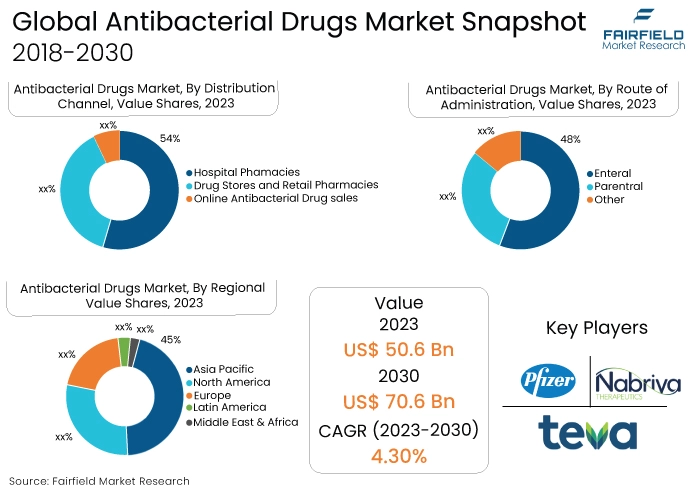

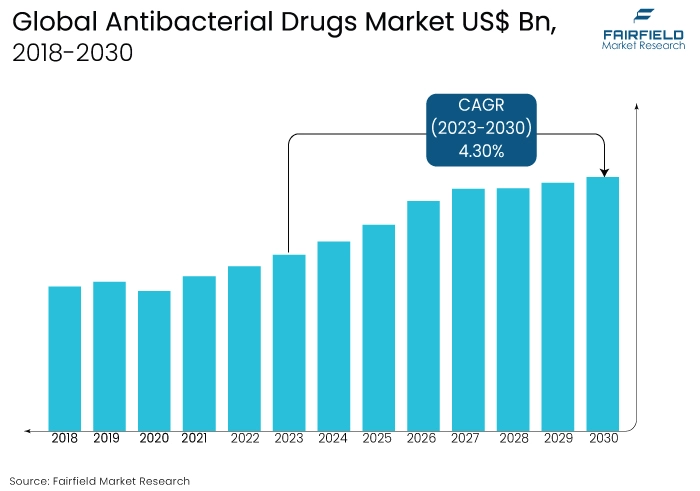

- The global antibacterial drugs market size to reach US$70.6 Bn in 2030, up from US$50.6 Bn achieved in 2023

- Antibacterial drugs market revenue projects a stable CAGR of 4.3% between 2023 and 2030

Quick Report Digest

- The antibacterial drugs market is a critical segment within the pharmaceutical industry, driven by the global burden of infectious diseases. Antibacterial drugs play a pivotal role in combating bacterial infections, and the market is witnessing sustained growth due to the increasing prevalence of antibiotic-resistant strains and the continual emergence of infectious diseases.

- The global antibacterial drugs market is experiencing significant expansion, with a projected CAGR of 4.3% from 2023 to 2032. Factors such as population growth, urbanisation, and increased healthcare awareness contribute to the rising demand for effective antibacterial drugs.

- Infectious diseases, ranging from common respiratory infections to life-threatening conditions, continue to drive the demand for antibacterial drugs. Market growth is fueled by the need to address a broad spectrum of bacterial pathogens, including both Gram-positive and Gram-negative bacteria.

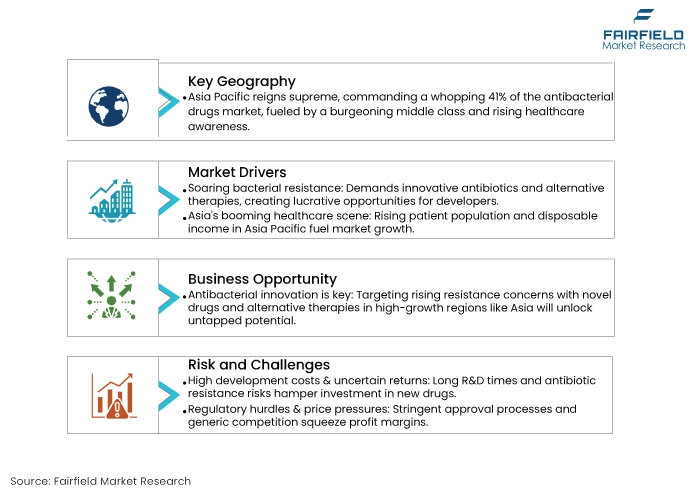

- The emergence of antibiotic-resistant bacteria is a major driver for innovation in the antibacterial drugs market. Market players are investing in research and development to create novel drugs that combat resistant strains, addressing a critical healthcare challenge globally.

- The market encompasses a variety of drug classes, including beta-lactams, fluoroquinolones, tetracyclines, and others. The development of new formulations, such as combination therapies and sustained-release formulations, is a notable trend aimed at enhancing efficacy and patient compliance.

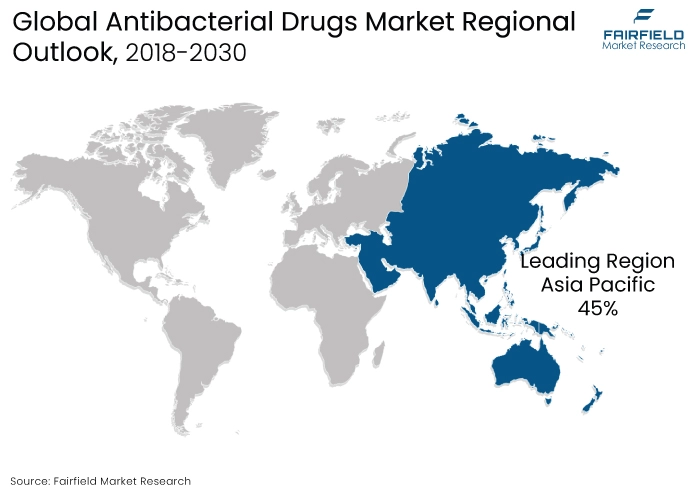

- North America and Europe dominate the antibacterial drugs market, attributed to advanced healthcare infrastructure, high prevalence of infectious diseases, and strong investments in research and development. However, Asia-Pacific is emerging as a key growth region, driven by increasing healthcare expenditure and a higher incidence of infectious diseases.

- The market is highly competitive, with leading pharmaceutical companies engaging in strategic partnerships, acquisitions, and product launches. Key players are focused on developing innovative antibacterial drugs, addressing unmet medical needs, and staying ahead in the race against antibiotic resistance.

- Stringent regulatory frameworks govern the development and approval of antibacterial drugs. Compliance with regulatory standards and obtaining approvals from health authorities are crucial for market players to ensure the safety and efficacy of their products.

- Challenges in the antibacterial drugs market include the high cost of drug development, regulatory hurdles, and the constant evolution of bacterial resistance. However, opportunities lie in the development of targeted therapies, precision medicine approaches, and collaborations to address global health challenges.

A Look Back and a Look Forward - Comparative Analysis

The increasing predominance of bacterial illnesses and growing consciousness about the significance of antimicrobial treatments are propelling the substantial expansion of the global antibacterial drugs market. Prominent figures in the pharmaceutical sector are devoted to research and development, as seen by the introduction of novel antibacterial medications with improved effectiveness and fewer adverse effects.

As drug-resistant bacterial strains proliferate, there is an increasing need for new antibiotics, which is what is driving this market. Additionally, the COVID-19 pandemic and other continuing worldwide health issues have highlighted how urgently better antibacterial therapies are needed, which is driving market expansion even more.

The market for antibacterial drugs has seen notable developments in treatment strategies and drug discovery during the last ten years. The historical trend indicates a shift from traditional antibiotics to more specialised and focused therapies. The landscape has been altered by increased funding in research and governmental policies to encourage the development of antibiotics.

Antibacterial medication discovery has advanced due to obstacles including antibiotic resistance and regulatory barriers. Historical patterns point to a move toward customised medicine that emphasizes effectiveness and precision in the treatment of bacterial infections.

The market for antibacterial drugs is expected to rise further, with a focus on immunotherapies, precision medicine, and cutting-edge therapeutic approaches. It is anticipated that developments in genetics and biotechnology will be crucial in customising antibacterial therapies to the unique characteristics of each patient. Research institutes and pharmaceutical corporations working together will probably speed up the creation of ground-breaking antibiotics.

Moreover, finding new antibacterial agents may be possible through the use of artificial intelligence in drug discovery procedures. The market for antibacterial drugs looks bright, despite obstacles like economic factors and complicated regulations. This is because the market is committed to tackling the changing nature of infectious diseases.

Key Growth Determinants

- Increasing Prevalence of Drug-Resistant Bacterial Infections

The market for antibacterial drugs is expanding due in large part to the rising prevalence of drug-resistant bacterial illnesses. New and more effective antibacterial medications have to be developed because the overuse and abuse of antibiotics have led to the formation of resistant strains over time.

There is an increased need for novel therapeutic options due to the rise of extensively drug-resistant tuberculosis and multi-drug-resistant bacteria like Methicillin-resistant Staphylococcus aureus (MRSA). Because of this, pharmaceutical companies are forced to spend money on research and development in order to solve this serious global health issue, which is driving the growth of the antibacterial drugs market.

- Advancements in Antibacterial Drug Development Technologies

Technological developments in medication discovery, especially in the area of antibiotics, are a major factor propelling the market expansion. The process of finding new drugs has been greatly accelerated by innovations in structural biology, computational biology, and high-throughput screening. With the aid of these tools, researchers can more effectively identify possible drug candidates, maximise their effectiveness, and reduce side effects.

Targeted and precision medicine approaches have been made possible by the additional revolution in antibacterial agent design brought about by the development of synthetic biology and gene editing tools. The ongoing development of these technologies propels market expansion by quickening the pace of medication discovery and improving the general efficacy of antibacterial therapies.

- Increasing R&D Investments

The pharmaceutical industry, governments, and private organisations are investing more in research and development, which is driving the growth of the antibacterial drugs market. Stakeholders are devoting significant resources to antibacterial drug research projects in recognition of the pressing need for new antibiotics.

Academic and corporate collaboration is being fostered by programs including government subsidies, public-private partnerships, and incentives for antimicrobial research. By making these efforts, we want to restock the antibiotic pipeline and address the problems caused by bacterial resistance. In addition to encouraging innovation in the industry, funding R&D guarantees a consistent supply of novel, potent antibacterial medications, which propels market expansion and sustainability.

Major Growth Barriers

- Rising Concerns Regarding Antibiotic Resistance, and Regulatory Hurdles

The market for antibacterial drugs faces many obstacles, the most important of which are the growing worries about antibiotic resistance and the corresponding regulatory barriers. Stricter requirements for the clearance of novel antibacterial medications have been implemented by regulatory bodies in response to the growing global awareness of antimicrobial resistance.

Complying with these regulations necessitates conducting lengthy clinical trials and careful safety evaluations, which prolongs the medication development process. Additionally, pharmaceutical businesses face a conundrum that impedes the growth of the market: the concern of contributing to the spread of antibiotic resistance. Concerns about resistance and navigating the intricate regulatory environment continue to be major challenges for those involved in the antibacterial drug market.

- Limited Financial Incentives and Return on Investment

The market for antibacterial drugs is constrained by economic factors, particularly the meager financial rewards and low return on investment linked to antibiotic research. Antibiotic prescriptions are frequently for brief periods, which affects their profitability in contrast to chronic conditions, which have long-term markets.

A shorter product lifespan presents challenges for pharmaceutical businesses seeking to recover the significant investments needed for research and development. Investment in the development of antibacterial drugs is discouraged by the absence of financial incentives and the possibility of low market returns. This unfavourable financial situation produces a perilous situation that hinders the advancement and innovation required to meet the growing menace of bacterial illnesses.

Key Trends and Opportunities to Look at

- Rise of Personalised Medicine in Antibacterial Treatments

Personalised medicine, which adjusts treatments based on unique patient characteristics, is a prominent trend that the antibacterial drugs market is currently experiencing. This strategy makes use of advances in genetics and diagnostics to enable focused antibacterial treatments. Due to its ability to maximise therapy efficacy and minimise adverse effects, this approach is becoming more and more popular worldwide.

Major corporations are allocating resources towards diagnostic technologies, which facilitate the identification of certain bacterial strains and their antibiotic susceptibility. Innovation is being driven by partnerships between pharmaceutical and diagnostic companies, with brands positioned to take advantage of patient-specific data to create and sell antibacterial medications that are tailored to each individual. Though this trend is more common in developed areas, rising awareness and the development of infrastructure in emerging countries are encouraging its global spread.

- Growing Embrace of Combination Therapies, and Drug Combinations

The growing use of combination therapy and medication combinations to effectively combat resistant bacterial strains is a notable development in the antibacterial drugs market. Combination medicines have synergistic effects and lower the chance of resistance development, while monotherapies struggle with resistance. This strategy is becoming more and more common in a variety of countries, and major corporations are investigating strategic alliances and acquisitions as a means of expanding their lines of antibacterial drugs.

One prominent area of focus is the creation of innovative drug combos and fixed-dose combinations, to offer brands comprehensive and efficient defenses against a range of bacterial diseases. Opportunities for market expansion and distinction are presented by this movement, which represents a paradigm shift in treatment procedures.

- AI Integration in Antibacterial Drug Discovery

In the market for antibacterial drugs, Artificial Intelligence (AI) integration into drug discovery procedures is a game-changing development. Artificial Intelligence systems speed up the drug discovery process by analysing large datasets, forecasting drug interactions, and identifying promising candidates. Major corporations are investing in AI-driven platforms for the development of antibacterial drugs, a trend that is becoming more and more well-known worldwide.

Data-driven strategies are becoming more prevalent, as seen by the increasing number of partnerships between AI technology providers and pharmaceutical companies. AI is expected to be used by brands for lead optimisation, target identification, and predictive modeling, which will expedite the creation of new antibacterial medications. AI in medication research not only speeds up innovation but also improves the accuracy and efficacy of antibacterial treatments, offering significant market growth potential.

How Does the Regulatory Scenario Shape this Industry?

The antibacterial pharmaceuticals sector is shaped by several factors, including market accessibility, approval processes, and medication development, all of which are significantly impacted by the regulatory environment. The European Medicines Agency (EMA), the US Food and Drug Administration (FDA), and the World Health Organization (WHO) all enforce strict standards to ensure the efficacy and safety of antibacterial drugs.

The FDA's Qualified Infectious Disease Product (QIDP) designation and the Generating Antibiotic Incentives Now (GAIN) Act can speed up the research and approval of antibacterial agents. Cooperative research to combat antibiotic resistance is encouraged by the Innovative Medicines Initiative (IMI) and other EU projects.

Region-specific changes in regulations, such as the European Medicines Agency's adaptations to address public health emergencies, demonstrate the dynamic nature of the regulatory environment and its direct impact on the antibacterial drugs market. These regulatory frameworks guide industry practices and stimulate innovation to address evolving public health challenges.

Fairfield’s Ranking Board

Top Segments

- Penicillin to be the Largest Antibacterial Drug Class

The largest growing segment in the antibacterial drugs market by drug class is penicillin. The first family of antibiotics to be identified, penicillin is still extensively used to treat a broad range of infections, including those brought on by listeria, clostridium, staphylococci, and streptococci. They function by either blocking the production of the cell wall or the peptidoglycan layer from forming. These medications are the first line of treatment for infections such as pharyngitis, skin infections, bronchial cough, gonorrhoea, and ear fungus.

The fastest-growing segment in the antibacterial drugs market by drug class is Carbapenems. With an increasing prevalence of multidrug-resistant bacterial infections, the demand for potent antibiotics like Carbapenems has surged.

These antibiotics are often considered a last resort for severe infections, and their effectiveness against resistant strains propels their rapid adoption. The continuous evolution of bacterial resistance patterns and the critical need for effective treatments in complex infections contribute significantly to the swift growth of the Carbapenems segment in the antibacterial drugs market.

- Branded Antibiotics Retain Dominance

The largest growing segment in the antibacterial drugs market is within Branded Antibiotics. Despite the increasing popularity of generic alternatives, branded antibiotics continue to dominate the market due to their established efficacy, brand recognition, and continuous innovations by pharmaceutical companies. Investments in research and development, coupled with strategic marketing efforts, position branded antibiotics as the cornerstone of antibacterial therapy.

The demand for novel formulations, targeted therapies, and proprietary combinations sustains the growth of this segment, as healthcare providers seek advanced solutions to combat evolving bacterial infections. The perceived reliability and trust associated with branded antibiotics contribute to their sustained prominence in the market.

The fastest-growing segment in the antibacterial drugs market is within Generic Antibiotics. As patent protection expires for branded antibiotics, the market witnesses a surge in demand for cost-effective generic alternatives.

Generic antibiotics offer comparable efficacy at a lower cost, making them increasingly attractive to healthcare providers and patients. The growing focus on healthcare affordability, coupled with the rise in antibiotic-resistant infections, propels the rapid adoption of generic antibiotics. Their accessibility and widespread use in various healthcare settings contribute significantly to the unparalleled growth of this segment in response to global health challenges.

- Enteral Route of Administration Most Widely Preferred

The largest growing segment in the antibacterial drugs market is within the Enteral route of administration. Oral and rectal administration methods, collectively known as enteral administration, dominate the market due to their convenience, patient compliance, and suitability for a wide range of antibiotic formulations.

The ease of administration, coupled with advancements in oral drug delivery technologies, positions enteral antibiotics as the preferred choice for both healthcare providers and patients. The consistent demand for oral antibiotics, especially in treating less severe infections and for long-term therapies, establishes enteral administration as the largest and continually expanding segment in the antibacterial drugs market.

The fastest-growing segment in the antibacterial drugs market is within the Parenteral route of administration. Parenteral administration, through injections and infusions, offers rapid and direct delivery of antibiotics into the bloodstream, ensuring swift therapeutic action.

The increasing prevalence of severe and life-threatening infections, coupled with the demand for immediate and potent treatment options, propels the rapid adoption of parenteral antibiotics. Advances in drug formulations and administration technologies further contribute to the accelerated growth of this segment, addressing critical medical conditions with urgency and precision.

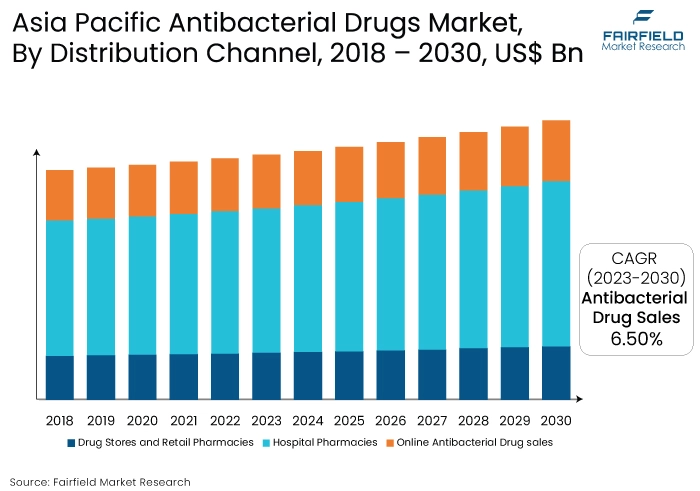

- Hospital Pharmacies Dominate Distribution of Antibacterial Drugs

Hospital pharmacies dominate the distribution channel for antibacterial drugs due to their role as key healthcare providers and the primary source of medications for inpatient and outpatient care. Hospitals have direct access to a wide range of antibacterial drugs and often purchase them in bulk to meet the demand for various medical conditions, including infections.

Additionally, hospital pharmacies have specialised staff trained to manage and administer antibiotics, ensuring proper usage and adherence to treatment protocols. This dominance is further reinforced by the preference of healthcare professionals to prescribe antibacterial drugs directly from hospital pharmacies, emphasising their central role in patient care.

Online antibacterial drug sales are the fastest-growing distribution channel in the market due to the increasing adoption of e-commerce platforms for purchasing medications. This trend is driven by factors such as convenience, accessibility, and the growing preference for online shopping, especially in the wake of the COVID-19 pandemic.

Consumers appreciate the ease of ordering antibacterial drugs online, avoiding the need to visit physical pharmacies. Additionally, online platforms often offer a wider range of products, competitive pricing, and doorstep delivery, further fueling the growth of online sales in the antibacterial drug market.

Regional Frontrunners

Asia Pacific Remains the Largest Revenue Contributor

Asia Pacific demonstrates its dominance in the market for antibacterial drugs, taking an astonishing 45% of the total. The region's strong economic growth, growing middle-class population, and increased emphasis on healthcare awareness all contribute to its dominant position. Asia Pacific is becoming the global leader in the development of antibacterial drugs as infectious diseases continue to rise.

The region's expanding healthcare infrastructure and dynamic pharmaceutical environment position it as a major driver of the market's overall expansion. Asia Pacific is a pharmaceutical hub that is shaping and influencing the trajectory of the worldwide antibacterial medication landscape, with an expected CAGR of 5.0-5.5%.

Latin America Showcases High Potential with an Estimated 4.5-5.0% CAGR

antibacterial drugs market data indicates that Latin America is the fastest-growing continent, with a projected CAGR of 4.5% to 5.0%. This market has significant potential. Rising healthcare costs, fast urbanisation, and a growing population are the main drivers of the region's 3.4% market share.

Antibacterial medicine sales in Latin America are expected to rise due to the region's changing landscape and increased healthcare consciousness. The dynamic healthcare environments and growing market demand in the region attract industry participants, thus those looking to take advantage of the continent's substantial growth potential should seriously consider forming strategic collaborations and investments inside Latin America.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the antibacterial drugs market is marked by intense research and development activities, fostering innovation among key pharmaceutical companies. Established players continually invest in new drug formulations and therapeutic modalities to address bacterial resistance.

Strategic collaborations, mergers, and acquisitions are prevalent, enhancing market penetration. Notable companies such as Pfi r, GlaxoSmithKline, and Novartis dominate while emerging biotech firms contribute to a diverse ecosystem. The focus on precision medicine, combination therapies, and technological advancements underscores the competitive dynamism shaping the antibacterial drugs market.

Who are the Leaders in Global Antibacterial Drugs Space?

- AbbVie, Inc.

- Pfizer Inc.

- Novartis AG

- Merck & Co., Inc.

- Teva Pharmaceutical Industries Ltd.

- Lupin Pharmaceuticals, Inc.

- Viatris, Inc.

- Melinta Therapeutics LLC

- Cipla, Inc.

- Shionogi & Co., Ltd.

- KYORIN Pharmaceutical Co., Ltd.

- GSK plc

- Nabriva Therapeutics PLC

Significant Industry Developments

New Product Development:

- Oct 2023: Entasis Therapeutics announces phase 3 trial initiation for ETX0282, a novel antibiotic targeting multi-drug resistant (MDR) gram-negative bacteria.

- Sep 2023: Shionogi & Co. reports positive phase 2 trial results for S-775138, a broad-spectrum antibiotic effective against gram-positive and gram-negative bacteria.

- Jul 2023: Alnylam Pharmaceuticals unveils ALZ-801, a potential first-in-class RNAi therapeutic targeting bacterial virulence factors for treating pneumonia.

Partnerships, Agreements & Collaborations:

- Oct 2023: Merck & Co. partners with Evotec to develop new antibiotics aimed at combating drug-resistant infections.

- Sep 2023: GSK and Entasis Therapeutics enter a strategic alliance to advance ETX0282 for treating MDR infections.

- Aug 2023: BARDA invests $228 million in Cenix BioScience to develop novel antibiotic CX-011 for combatting carbapenem-resistant Acinetobacter baumannii.

Regulatory & Market Approvals:

- Oct 2023: FDA approves Spero Therapeutics' Xilosteel (Plazomicin) Injection for the treatment of complicated urinary tract infections (cUTI).

- Sep 2023: EMA grants orphan drug designation to Entasis Therapeutics' ETX0282 for treating MDR gram-negative bacterial infections.

- Aug 2023: WHO adds three new antibiotics to its Essential Medicines List to combat rising antibiotic resistance.

An Expert’s Eye

Demand and Future Growth

Several variables are combining to generate a significant increase in demand for antibacterial drugs in the market. A strong market demand is fueled by factors such as the rising incidence of drug-resistant bacterial infections, an ageing population, and increased global awareness of infectious diseases.

Research and innovation are driven by the pressing demand for new and efficient antibiotics as well as improvements in drug development methods. The market is anticipated to increase steadily in the near future, especially in areas like Asia Pacific, which has the highest growth rate and the largest market share.

The industry's future is expected to be shaped by the emergence of customised medicine, the incorporation of artificial intelligence in drug research, and the continuous endeavors to counteract antibiotic resistance, guaranteeing a dynamic and resilient antibacterial drugs market in the years to come.

Supply Side of the Market

According to our analysis, The antibacterial drugs market's supply side is distinguished by an ongoing commitment to innovation and development. To fulfill the increased need for antibacterial therapies that work, pharmaceutical companies are actively involved in research and development.

The efficiency of the drug discovery process is increased by technological advancements in drug development, such as high-throughput screening and computational biology. A varied portfolio of antibacterial medications is a result of strategic alliances, acquisitions, and cooperation within the sector.

The supply side is still dynamic, focusing on treating newly emerging infectious diseases and thwarting antibiotic resistance, despite obstacles like economic factors and regulatory difficulties. Artificial intelligence's integration with medication discovery further expedites and accelerates the development of novel antibacterial agents, ensuring a resilient and responsive supply side poised to meet the evolving needs of the antibacterial drugs market.

Global Antibacterial Drugs Market is Segmented as Below:

By Drug Class

- Cephalosporin

- Penicillin

- Fluoroquinolone

- Macrolides

- Carbapenems

- Aminoglycosides

- Sulfonamides

- 7-ACA

- Others

By Type

- Branded Antibiotics

- Generic Antibiotics

By Route of Administration

- Enteral

- Parentral

- Other

By Distribution Channel

- Hospital Pharmacies

- Drug Stores and Retail Pharmacies

- Online Antibacterial Drug Sales

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Antibacterial Drugs Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Antibacterial Drugs Market Outlook, 2018 - 2030

3.1. Global Antibacterial Drugs Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Branded Antibiotics

3.1.1.2. Generic Antibiotics

3.2. Global Antibacterial Drugs Market Outlook, by Drug Class, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.2. Cephalosporin

3.2.3. Penicillin

3.2.4. Fluoroquinolone

3.2.5. Macrolides

3.2.6. Carbapenems

3.2.7. Aminoglycosides

3.2.8. Sulfonamides

3.2.9. 7-ACA

3.2.10. Others

3.3. Global Antibacterial Drugs Market Outlook, by Route of Administration, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.2. Enteral

3.3.3. Parentral

3.3.4. Other

3.4. Global Antibacterial Drugs Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights Snacks

3.4.2. Hospital Phamacies

3.4.3. Drug Stores and Retail Pharmacies

3.4.4. Online Antibacterial Drug sales

3.5. Global Antibacterial Drugs Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Antibacterial Drugs Market Outlook, 2018 - 2030

4.1. North America Antibacterial Drugs Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Branded Antibiotics

4.1.1.2. Generic Antibiotics

4.2. North America Antibacterial Drugs Market Outlook, by Drug Class, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.2. Cephalosporin

4.2.3. Penicillin

4.2.4. Fluoroquinolone

4.2.5. Macrolides

4.2.6. Carbapenems

4.2.7. Aminoglycosides

4.2.8. Sulfonamides

4.2.9. 7-ACA

4.2.10. Others

4.3. North America Antibacterial Drugs Market Outlook, by Route of Administration, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.2. Enteral

4.3.3. Parentral

4.3.4. Other

4.4. North America Antibacterial Drugs Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.2. Hospital Phamacies

4.4.3. Drug Stores and Retail Pharmacies

4.4.4. Online Antibacterial Drug sales

4.4.5. BPS Analysis/Market Attractiveness Analysis

4.5. North America Antibacterial Drugs Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

4.5.1.2. U.S. Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

4.5.1.3. U.S. Antibacterial Drugs Market by Route of Administration, Value (US$ Mn), 2018 - 2030

4.5.1.4. U.S. Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

4.5.1.5. Canada Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

4.5.1.6. Canada Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

4.5.1.7. Canada Antibacterial Drugs Market by Route of Administration, Value (US$ Mn), 2018 - 2030

4.5.1.8. Canada Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Antibacterial Drugs Market Outlook, 2018 - 2030

5.1. Europe Antibacterial Drugs Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Top Load

5.1.1.2. Side Load

5.1.1.3. Wrap Around

5.2. Europe Antibacterial Drugs Market Outlook, by Drug Class, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Semi-automatic

5.2.1.2. Automatic

5.3. Europe Antibacterial Drugs Market Outlook, by Route of Administration, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.2. Enteral

5.3.3. Parentral

5.3.4. Other

5.4. Europe Antibacterial Drugs Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.2. Hospital Phamacies

5.4.3. Drug Stores and Retail Pharmacies

5.4.4. Online Antibacterial Drug sales

5.4.5. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Antibacterial Drugs Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

5.5.1.2. Germany Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

5.5.1.3. Germany Antibacterial Drugs Market By Route of Administration, Value (US$ Mn), 2018 - 2030

5.5.1.4. Germany Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

5.5.1.5. U.K. Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

5.5.1.6. U.K. Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

5.5.1.7. U.K. Antibacterial Drugs Market by Route of Administration, Value (US$ Mn), 2018 - 2030

5.5.1.8. U.K. Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

5.5.1.9. France Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

5.5.1.10. France Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

5.5.1.11. France Antibacterial Drugs Market By Route of Administration, Value (US$ Mn), 2018 - 2030

5.5.1.12. France Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

5.5.1.13. Italy Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

5.5.1.14. Italy Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

5.5.1.15. Italy Antibacterial Drugs Market by Route of Administration, Value (US$ Mn), 2018 - 2030

5.5.1.16. Italy Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

5.5.1.17. Turkey Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

5.5.1.18. Turkey Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

5.5.1.19. Turkey Antibacterial Drugs Market by Route of Administration, Value (US$ Mn), 2018 - 2030

5.5.1.20. Turkey Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

5.5.1.21. Russia Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

5.5.1.22. Russia Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

5.5.1.23. Russia Antibacterial Drugs Market by Route of Administration, Value (US$ Mn), 2018 - 2030

5.5.1.24. Russia Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

5.5.1.25. Rest of Europe Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

5.5.1.26. Rest of Europe Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

5.5.1.27. Rest of Europe Antibacterial Drugs Market by Route of Administration, Value (US$ Mn), 2018 - 2030

5.5.1.28. Rest of Europe Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Antibacterial Drugs Market Outlook, 2018 - 2030

6.1. Asia Pacific Antibacterial Drugs Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Branded Antibiotics

6.1.1.2. Generic Antibiotics

6.2. Asia Pacific Antibacterial Drugs Market Outlook, by Drug Class, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.2. Cephalosporin

6.2.3. Penicillin

6.2.4. Fluoroquinolone

6.2.5. Macrolides

6.2.6. Carbapenems

6.2.7. Aminoglycosides

6.2.8. Sulfonamides

6.2.9. 7-ACA

6.2.10. Others

6.3. Asia Pacific Antibacterial Drugs Market Outlook, by Route of Administration, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.2. Enteral

6.3.3. Parentral

6.3.4. Other

6.4. Asia Pacific Antibacterial Drugs Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.2. Hospital Phamacies

6.4.3. Drug Stores and Retail Pharmacies

6.4.4. Online Antibacterial Drug sales

6.4.5. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Antibacterial Drugs Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

6.5.1.2. China Antibacterial Drugs Market By Drug Class, Value (US$ Mn), 2018 - 2030

6.5.1.3. China Antibacterial Drugs Market By Route of Administration, Value (US$ Mn), 2018 - 2030

6.5.1.4. China Antibacterial Drugs Market By Distribution Channel, Value (US$ Mn), 2018 - 2030

6.5.1.5. Japan Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

6.5.1.6. Japan Antibacterial Drugs Market By Drug Class, Value (US$ Mn), 2018 - 2030

6.5.1.7. Japan Antibacterial Drugs Market By Route of Administration, Value (US$ Mn), 2018 - 2030

6.5.1.8. Japan Antibacterial Drugs Market By Distribution Channel, Value (US$ Mn), 2018 - 2030

6.5.1.9. South Korea Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

6.5.1.10. South Korea Antibacterial Drugs Market By Drug Class, Value (US$ Mn), 2018 - 2030

6.5.1.11. South Korea Antibacterial Drugs Market By Route of Administration, Value (US$ Mn), 2018 - 2030

6.5.1.12. South Korea Antibacterial Drugs Market By Distribution Channel, Value (US$ Mn), 2018 - 2030

6.5.1.13. India Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

6.5.1.14. India Antibacterial Drugs Market By Drug Class, Value (US$ Mn), 2018 - 2030

6.5.1.15. India Antibacterial Drugs Market By Route of Administration, Value (US$ Mn), 2018 - 2030

6.5.1.16. India Antibacterial Drugs Market By Distribution Channel, Value (US$ Mn), 2018 - 2030

6.5.1.17. Southeast Asia Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

6.5.1.18. Southeast Asia Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

6.5.1.19. Southeast Asia Antibacterial Drugs Market by Route of Administration, Value (US$ Mn), 2018 - 2030

6.5.1.20. Southeast Asia Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Antibacterial Drugs Market by Route of Administration, Value (US$ Mn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Antibacterial Drugs Market Outlook, 2018 - 2030

7.1. Latin America Antibacterial Drugs Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Branded Antibiotics

7.1.1.2. Generic Antibiotics

7.2. Latin America Antibacterial Drugs Market Outlook, by Drug Class, Value (US$ Mn), 2018 - 2030

7.2.1. Cephalosporin

7.2.2. Penicillin

7.2.3. Fluoroquinolone

7.2.4. Macrolides

7.2.5. Carbapenems

7.2.6. Aminoglycosides

7.2.7. Sulfonamides

7.2.8. 7-ACA

7.2.9. Others

7.3. Latin America Antibacterial Drugs Market Outlook, by Route of Administration, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.2. Enteral

7.3.3. Parentral

7.3.4. Other

7.4. Latin America Antibacterial Drugs Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.2. Hospital Phamacies

7.4.3. Drug Stores and Retail Pharmacies

7.4.4. Online Antibacterial Drug sales

7.4.5. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Antibacterial Drugs Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

7.5.1.2. Brazil Antibacterial Drugs Market By Drug Class, Value (US$ Mn), 2018 - 2030

7.5.1.3. Brazil Antibacterial Drugs Market by Route of Administration, Value (US$ Mn), 2018 - 2030

7.5.1.4. Brazil Antibacterial Drugs Market By Distribution Channel, Value (US$ Mn), 2018 - 2030

7.5.1.5. Mexico Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

7.5.1.6. Mexico Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

7.5.1.7. Mexico Antibacterial Drugs Market by Route of Administration, Value (US$ Mn), 2018 - 2030

7.5.1.8. Mexico Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

7.5.1.9. Argentina Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

7.5.1.10. Argentina Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

7.5.1.11. Argentina Antibacterial Drugs Market by Route of Administration, Value (US$ Mn), 2018 - 2030

7.5.1.12. Argentina Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

7.5.1.13. Rest of Latin America Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

7.5.1.14. Rest of Latin America Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

7.5.1.15. Rest of Latin America Antibacterial Drugs Market by Route of Administration, Value (US$ Mn), 2018 - 2030

7.5.1.16. Rest of Latin America Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Antibacterial Drugs Market Outlook, 2018 - 2030

8.1. Middle East & Africa Antibacterial Drugs Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Branded Antibiotics

8.1.1.2. Generic Antibiotics

8.2. Middle East & Africa Antibacterial Drugs Market Outlook, by Drug Class, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.2. Cephalosporin

8.2.3. Penicillin

8.2.4. Fluoroquinolone

8.2.5. Macrolides

8.2.6. Carbapenems

8.2.7. Aminoglycosides

8.2.8. Sulfonamides

8.2.9. 7-ACA

8.2.10. Others

8.3. Middle East & Africa Antibacterial Drugs Market Outlook, by Route of Administration, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.2. Enteral

8.3.3. Parentral

8.3.4. Other

8.4. Middle East & Africa Antibacterial Drugs Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.2. Hospital Phamacies

8.4.3. Drug Stores and Retail Pharmacies

8.4.3.1. Online Antibacterial Drug sales

8.4.4. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Antibacterial Drugs Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

8.5.1.2. GCC Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

8.5.1.3. GCC Antibacterial Drugs Market by Route of Administration, Value (US$ Mn), 2018 - 2030

8.5.1.4. GCC Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

8.5.1.5. South Africa Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

8.5.1.6. South Africa Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

8.5.1.7. South Africa Antibacterial Drugs Market by Route of Administration, Value (US$ Mn), 2018 - 2030

8.5.1.8. South Africa Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

8.5.1.9. Egypt Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

8.5.1.10. Egypt Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

8.5.1.11. Egypt Antibacterial Drugs Market by Route of Administration, Value (US$ Mn), 2018 - 2030

8.5.1.12. Egypt Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

8.5.1.13. Nigeria Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

8.5.1.14. Nigeria Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

8.5.1.15. Nigeria Antibacterial Drugs Market by Route of Administration, Value (US$ Mn), 2018 - 2030

8.5.1.16. Nigeria Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

8.5.1.17. Rest of Middle East & Africa Antibacterial Drugs Market by Type, Value (US$ Mn), 2018 - 2030

8.5.1.18. Rest of Middle East & Africa Antibacterial Drugs Market by Drug Class, Value (US$ Mn), 2018 - 2030

8.5.1.19. Rest of Middle East & Africa Antibacterial Drugs Market by Route of Administration, Value (US$ Mn), 2018 - 2030

8.5.1.20. Rest of Middle East & Africa Antibacterial Drugs Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Route of Administration vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. AbbVie, Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Pfizer Inc.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Mpack Group

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Novartis AG

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Merck & Co., Inc.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Teva Pharmaceutical Industries Ltd.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Lupin Pharmaceuticals, Inc.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Viatris, Inc.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Melinta Therapeutics LLC

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Business Strategies and Development

9.5.10. Cipla, Inc.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Shionogi & Co., Ltd.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. KYORIN Pharmaceutical Co., Ltd.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. GSK plc

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Nabriva Therapeutics PLC

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Drug Class Coverage |

|

|

Type Coverage |

|

|

Route of Administration Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |