Antibody Testing Market Forecast

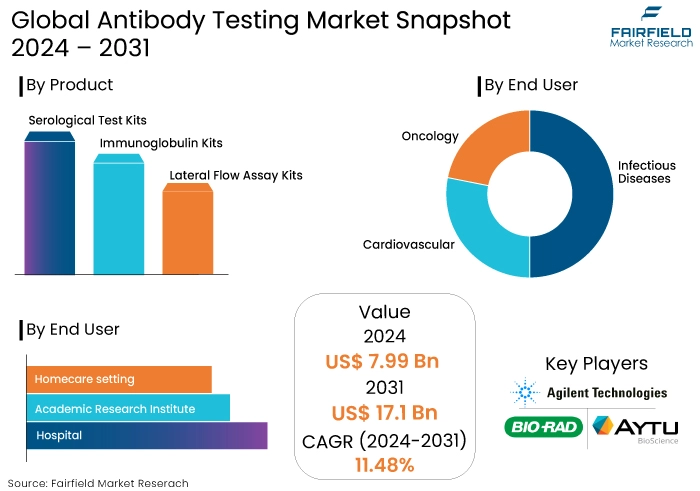

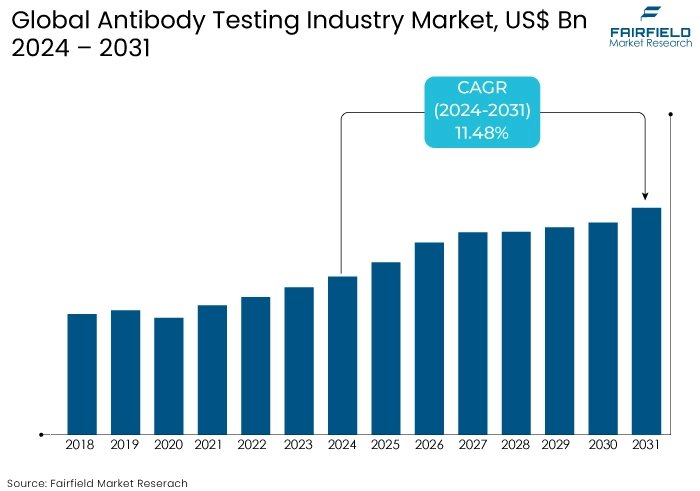

- Antibody testing market size is poised to reach US$17.1 Bn in 2031, up from US$7.99 Bn attained in 2024.

- Global market for antibody testing is projected to witness a CAGR of 11.48% during the period from 2024-2031.

Antibody Testing Market Insights

- Anticipated surges in chronic illnesses, such as cancer, infectious diseases, and autoimmune disorders, are expected to result in a heightened demand for immunoassays to detect and track these medical conditions.

- Anticipated is the utilization of antibody tests to facilitate the provision of efficacious healthcare treatments.

- The increasing incidence of autoimmune diseases, infectious diseases, and cancer is driving the demand for antibody testing market.

- Rapid advancements in immunoassay techniques, such as ELISA, and flow cytometry are enhancing test accuracy and speed.

- Increasing numbers of biotechnology and pharmaceutical businesses are allocating resources to R&D endeavours to create testing methodologies that are fast, precise, and sensitive.

- Early detection of diseases through antibody testing can lead to better treatment outcomes and reduced healthcare costs, which drives the development of sensitive and specific antibody tests.

- antibody testing is being used in areas such as allergy diagnosis, drug development, and transplantation beyond infectious diseases and autoimmune disorders, which is creating new opportunities for market growth.

- Anticipated advancements such as automated testing systems and point-of-care testing are expected to enhance the calibre of patient services.

- Public health awareness efforts are projected to encourage the implementation of routine health screening programs and are anticipated to increase the need for antibody testing equipment.

- Antibody testing is essential for monitoring and developing treatments, such as customized medicine and immunotherapy, to provide high-quality treatment for patients.

A Look Back and a Look Forward - Comparative Analysis

The antibody testing market experienced substantial growth pre-2023, driven by several factors. One of the primary drivers was the COVID-19 pandemic, which spurred an unprecedented demand for serological tests to detect antibodies against the virus.

The need for widespread screening, vaccine efficacy studies, and population immunity assessments fueled this demand. Technological advancements, increased healthcare awareness, and significant investments in research and development further propelled the market. Leading players expanded their portfolios and enhanced production capacities to meet the surging demand, contributing to market growth.

The antibody testing market is anticipated to continue its upward trajectory, albeit at a moderated pace compared to the pandemic peak. The market is expected to be driven by ongoing needs for monitoring immunity levels, especially in light of emerging infectious diseases and potential future pandemics.

The increasing prevalence of chronic diseases and autoimmune disorders will also sustain the demand for antibody tests. Furthermore, advancements in diagnostic technologies, such as multiplex assays and point-of-care testing, will enhance the accessibility and accuracy of antibody testing, fostering market expansion.

Importantly, regulatory support and strategic collaborations among key stakeholders will play a crucial role in stimulating growth and ensuring the market remains robust in the coming years, providing stability and confidence to all involved.

Key Growth Determinants

- Rising Prevalence of Chronic and Autoimmune Diseases

The increasing prevalence of chronic and autoimmune diseases is a significant growth driver for the antibody testing market. Conditions such as rheumatoid arthritis, lupus, and multiple sclerosis involve immune system dysregulation, where antibody testing is crucial in diagnosis and management.

As the global burden of these diseases rises, so does the demand for accurate and reliable antibody tests. Additionally, advancements in understanding the immunological aspects of various chronic conditions have led to developing more sophisticated antibody tests, further driving market growth.

The growing awareness among healthcare providers and patients about the importance of early and accurate diagnosis also contributes to the increased adoption of antibody testing in managing chronic and autoimmune diseases.

- Technological Advancements in Diagnostic Testing

Technological advancements have been a pivotal driver of growth in the antibody testing market. Innovations such as high-throughput platforms, multiplex assays, and point-of-care testing devices have significantly improved the accuracy, speed, and convenience of antibody tests.

High-throughput platforms enable large-scale testing, essential during health crises like the COVID-19 pandemic. Multiplex assays allow simultaneous detection of multiple antibodies, providing comprehensive immune profiles.

Point-of-care devices, in particular, offer rapid results, enhancing their utility in various settings, including remote and resource-limited areas. These technological improvements not only increase the adoption of antibody tests but also expand their applications in clinical diagnostics, epidemiological studies, and personalized medicine.

Key Growth Barriers

- High Costs and Limited Accessibility

The antibody testing market holds significant potential for growth despite the challenges. The high cost of testing and limited accessibility, particularly in low- and middle-income countries, are vital restraints that, if addressed, could unlock this potential.

Advanced antibody tests, especially those involving sophisticated technologies like multiplex assays and high-throughput platforms, can be expensive to develop, produce, and administer. These costs can be prohibitive for widespread adoption, especially in healthcare systems with constrained budgets.

The infrastructure required to support these advanced testing methods, including specialized equipment and trained personnel, often must be improved in resource-limited settings. This disparity in access can hinder the overall market growth, as large segments of the global population may not benefit from these diagnostic advancements.

- Regulatory and Compliance Challenges

Overcoming regulatory and compliance challenges is crucial for the growth of the antibody testing market. By addressing these restraints, we can pave the way for the introduction of innovative testing solutions and ensure the market's growth potential is not limited.

The development and approval of new diagnostic tests are subject to stringent regulatory requirements, which can be time-consuming and costly. Variations in regulatory frameworks across different regions add complexity for manufacturers aiming for global market penetration.

The need for continuous compliance with evolving standards and guidelines can strain resources and slow down the introduction of innovative testing solutions. These regulatory hurdles can delay market entry and limit the availability of new antibody tests, affecting the market's growth potential.

Ensuring that tests meet accuracy, reliability, and safety standards while navigating diverse regulatory landscapes remains a considerable challenge for the industry.

Antibody Testing Market Trends and Opportunities

- Integration of Artificial Intelligence and Machine Learning

Integrating artificial intelligence (AI) and machine learning (ML) in antibody testing represents a significant trend shaping the market. AI and ML technologies enhance antibody tests' efficiency, accuracy, and predictive capabilities. These technologies can analyse large datasets generated from antibody tests to identify patterns and correlations that may not be apparent through traditional methods. For instance,

AI algorithms can improve the interpretation of complex antibody responses, enabling more precise differentiation between past infections and vaccine-induced immunity. Also, AI-driven platforms can streamline the development of new antibody tests by predicting the efficacy of different test designs, optimizing protocols, and accelerating clinical validation processes.

Incorporating AI and ML can also facilitate personalized medicine by tailoring antibody testing to individual patient profiles, thereby improving disease diagnosis and management. As these technologies evolve, their integration into antibody testing will drive innovation, enhance test performance, and ultimately contribute to better healthcare outcomes.

- Expansion into Emerging Markets

Expanding into emerging markets presents a significant opportunity for growth in the antibody testing market.

Emerging markets, particularly in Asia Pacific, Latin America, and Africa, are experiencing increasing healthcare investments, improved healthcare infrastructure, and growing awareness about advanced diagnostic tools. These regions have a high burden of infectious and chronic diseases, underscoring the need for robust diagnostic solutions, including antibody testing.

Companies strategically entering these markets can tap into the rising demand for healthcare services and diagnostics. This expansion can be facilitated by adapting antibody tests to meet local needs, such as developing cost-effective, easy-to-use, and portable testing solutions suitable for resource-limited settings.

Partnerships with local healthcare providers, governments, and organizations can enhance market penetration and distribution channels. Companies can significantly expand their customer base and drive market growth by addressing specific challenges and leveraging the growing healthcare infrastructure in emerging markets.

The untapped potential in these regions represents a lucrative opportunity for companies willing to invest in tailored strategies and localized solutions.

How is Regulatory Scenario Shaping this Industry?

The regulatory landscape is significantly shaping the antibody testing market, primarily by setting stringent standards and guidelines that manufacturers must adhere to.

Regulatory bodies like the FDA, EMA, and other international health authorities have implemented rigorous approval processes to ensure antibody tests' accuracy, reliability, and safety.

Companies are making substantial investments in research and development to meet the stringent standards set by regulatory bodies. This commitment is leading to the development of more advanced and precise testing methodologies.

Regulatory frameworks encourage transparency and standardization across different markets, facilitating more straightforward global trade and adopting these tests. Navigating these regulations requires significant investment in compliance and quality assurance processes. While rules aim to protect public health and ensure test efficacy, they drive market competitiveness and technological advancements.

Fairfield’s Ranking Board

Segments Covered in the Report

- Serological Test Kits Segment Holds the Key Market Share

By the year 2034, it is anticipated that serological test kits will hold a market share of 40% in the antibody testing market. Several advantages are connected to serology testing, such as the possibility of patient participation and the rapid turnaround time.

In addition, it is anticipated that the growing prevalence of diseases will lead to an increase in the utilization of serological test kits, characterized by their swiftness and accuracy.

- Infectious Diseases Segment Dominates Exhibiting Significant Market Share

It is anticipated that infectious diseases will account for 28% of the total revenue generated by the global market. The human body's immune system is comprised of antibodies, which act as a defense mechanism and usually contribute to the prevention of diseases.

Climate change is responsible for the rise in the number of infectious diseases that are found all over the world. Beginning in 2024 and continuing through 2034, the demand for antibody test kits is anticipated to increase due to the growing burden of infectious disease prevalence.

Regional Analysis

- North America to Record Remarkable Growth

North America antibody testing market is anticipated to have relatively faster growth than other regions, owing to the fact that there is a growing demand for improved and efficient alternatives to traditional diagnostic methods.

It is anticipated that the rapidly expanding infrastructure that is supported by research institutions and the government will be a driving force behind the expansion of the global market for diagnostic antibodies.

- Asia Pacific to Exhibit Stable Growth

Asia Pacific is anticipated to experience a higher penetration of diagnostic antibodies due to the rapidly growing patient pool and the rising demand for relatively faster diagnostic alternatives. This is even though the level of awareness regarding antibody diagnostics and infrastructure, which includes advanced laboratories and expertise, needs to be higher in developing nations than in developed countries.

Fairfield’s Competitive Landscape Analysis

The antibody testing market is highly competitive, featuring a mix of established pharmaceutical companies, diagnostic test manufacturers, and innovative biotech firms. Key players operating in the market include Abbott Laboratories, Roche Diagnostics, Thermo Fisher Scientific, and Siemens Healthineers, all of which offer a diverse range of antibody tests.

Leading companies leverage advanced technologies and extensive distribution networks to maintain market dominance. Emerging firms, such as Bio-Rad Laboratories and OraSure Technologies, contribute to the competitive dynamics by introducing innovative, cost-effective testing solutions.

Strategic partnerships, mergers, and acquisitions are common as companies strive to expand their product portfolios and global reach. Continuous innovation and regulatory approvals remain critical for maintaining a competitive edge in this rapidly evolving market.

Key Market Companies

- Aytu BioScience, Inc.

- Agilent Technologies, Inc.

- Boehringer Ingelheim International GmbH

- Bio-Rad Laboratories, Inc.

- Abcam plc.

- Hoffmann-La Roche Ltd.

- Abbott

Recent Industry Developments

- In September 2023, Abbott has developed antibody tests using their Alinity and ARCHITECT platforms, which offer high-throughput processing capabilities. These platforms facilitate large-scale testing and provide reliable results quickly.

- In August 2023, Siemens Healthineers has partnered with Bio-Rad to enhance their antibody testing capabilities. This collaboration aims to integrate Bio-Rad’s high-quality control products with Siemens’ diagnostic platforms, ensuring improved accuracy and reliability of antibody tests.

An Experts Eye

- Experts predict robust growth in the antibody testing market due to increasing awareness about immune response monitoring and the ongoing need for effective disease surveillance.

- Advancements in testing technologies, including rapid and high-throughput assays, are enhancing the accuracy and speed of antibody detection, contributing to market expansion.

- Rising public awareness about the benefits of antibody testing, particularly in understanding individual and population-level immunity, is fostering market growth.

- The competitive landscape is intensifying, with numerous players entering the market and driving innovation to gain a competitive edge.

Antibody Testing Market is Segmented as -

By Product

- Serological Test Kits

- Immunoglobulin Kits

- Lateral Flow Assay Kits

By Indication

- Infectious Diseases

- Cardiovascular

- Oncology

By End User

- Hospital

- Academic Research Institute

- Homecare setting

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Antibody Testing Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Antibody Testing Market Outlook, 2019 - 2031

3.1. Global Antibody Testing Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Serological Test Kits

3.1.1.1.1. Serological Assay Test Kits

3.1.1.1.2. Serological Rapid Assay Kits

3.1.1.2. Immunoglobulin Kits

3.1.1.2.1. Immunoglobulin Assay Test Kits

3.1.1.2.2. Immunoglobulin Rapid Assay Kits

3.1.1.3. Lateral Flow Assay Kits

3.1.1.3.1. Lateral Flow Assay Test Kits

3.1.1.3.2. Lateral Flow Rapid Assay Kits

3.1.1.4. Chemical and Reagents

3.1.1.5. Consumables

3.2. Global Antibody Testing Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Pregnancy

3.2.1.2. Cardiovascular Diseases

3.2.1.3. Autoimmune Diseases

3.2.1.4. Infectious Diseases

3.2.1.5. Oncology

3.2.1.6. Endocrine Diseases

3.2.1.7. Diabetes

3.2.1.8. Others

3.3. Global Antibody Testing Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Hospitals

3.3.1.2. Academic and Research Institutes

3.3.1.3. Diagnostic Laboratories

3.3.1.4. Biopharmaceutical Companies

3.3.1.5. Homecare Settings

3.4. Global Antibody Testing Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Antibody Testing Market Outlook, 2019 - 2031

4.1. North America Antibody Testing Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Serological Test Kits

4.1.1.1.1. Serological Assay Test Kits

4.1.1.1.2. Serological Rapid Assay Kits

4.1.1.2. Immunoglobulin Kits

4.1.1.2.1. Immunoglobulin Assay Test Kits

4.1.1.2.2. Immunoglobulin Rapid Assay Kits

4.1.1.3. Lateral Flow Assay Kits

4.1.1.3.1. Lateral Flow Assay Test Kits

4.1.1.3.2. Lateral Flow Rapid Assay Kits

4.1.1.4. Chemical and Reagents

4.1.1.5. Consumables

4.2. North America Antibody Testing Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Pregnancy

4.2.1.2. Cardiovascular Diseases

4.2.1.3. Autoimmune Diseases

4.2.1.4. Infectious Diseases

4.2.1.5. Oncology

4.2.1.6. Endocrine Diseases

4.2.1.7. Diabetes

4.2.1.8. Others

4.3. North America Antibody Testing Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Hospitals

4.3.1.2. Academic and Research Institutes

4.3.1.3. Diagnostic Laboratories

4.3.1.4. Biopharmaceutical Companies

4.3.1.5. Homecare Settings

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Antibody Testing Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

4.4.1.2. U.S. Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

4.4.1.3. U.S. Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

4.4.1.4. Canada Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

4.4.1.5. Canada Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

4.4.1.6. Canada Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Antibody Testing Market Outlook, 2019 - 2031

5.1. Europe Antibody Testing Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Serological Test Kits

5.1.1.1.1. Serological Assay Test Kits

5.1.1.1.2. Serological Rapid Assay Kits

5.1.1.2. Immunoglobulin Kits

5.1.1.2.1. Immunoglobulin Assay Test Kits

5.1.1.2.2. Immunoglobulin Rapid Assay Kits

5.1.1.3. Lateral Flow Assay Kits

5.1.1.3.1. Lateral Flow Assay Test Kits

5.1.1.3.2. Lateral Flow Rapid Assay Kits

5.1.1.4. Chemical and Reagents

5.1.1.5. Consumables

5.2. Europe Antibody Testing Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Pregnancy

5.2.1.2. Cardiovascular Diseases

5.2.1.3. Autoimmune Diseases

5.2.1.4. Infectious Diseases

5.2.1.5. Oncology

5.2.1.6. Endocrine Diseases

5.2.1.7. Diabetes

5.2.1.8. Others

5.3. Europe Antibody Testing Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Academic and Research Institutes

5.3.1.3. Diagnostic Laboratories

5.3.1.4. Biopharmaceutical Companies

5.3.1.5. Homecare Settings

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Antibody Testing Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.2. Germany Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.3. Germany Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.4. U.K. Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.5. U.K. Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.6. U.K. Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.7. France Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.8. France Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.9. France Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.10. Italy Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.11. Italy Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.12. Italy Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.13. Turkey Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.14. Turkey Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.15. Turkey Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.16. Russia Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.17. Russia Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.18. Russia Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.19. Rest of Europe Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.20. Rest of Europe Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.21. Rest of Europe Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Antibody Testing Market Outlook, 2019 - 2031

6.1. Asia Pacific Antibody Testing Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Serological Test Kits

6.1.1.1.1. Serological Assay Test Kits

6.1.1.1.2. Serological Rapid Assay Kits

6.1.1.2. Immunoglobulin Kits

6.1.1.2.1. Immunoglobulin Assay Test Kits

6.1.1.2.2. Immunoglobulin Rapid Assay Kits

6.1.1.3. Lateral Flow Assay Kits

6.1.1.3.1. Lateral Flow Assay Test Kits

6.1.1.3.2. Lateral Flow Rapid Assay Kits

6.1.1.4. Chemical and Reagents

6.1.1.5. Consumables

6.2. Asia Pacific Antibody Testing Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Pregnancy

6.2.1.2. Cardiovascular Diseases

6.2.1.3. Autoimmune Diseases

6.2.1.4. Infectious Diseases

6.2.1.5. Oncology

6.2.1.6. Endocrine Diseases

6.2.1.7. Diabetes

6.2.1.8. Others

6.3. Asia Pacific Antibody Testing Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Academic and Research Institutes

6.3.1.3. Diagnostic Laboratories

6.3.1.4. Biopharmaceutical Companies

6.3.1.5. Homecare Settings

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Antibody Testing Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. China Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.2. China Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.3. China Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.4. Japan Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.5. Japan Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.6. Japan Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.7. South Korea Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.8. South Korea Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.9. South Korea Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.10. India Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.11. India Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.12. India Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.13. Southeast Asia Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.14. Southeast Asia Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.15. Southeast Asia Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.16. Rest of Asia Pacific Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.17. Rest of Asia Pacific Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.18. Rest of Asia Pacific Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Antibody Testing Market Outlook, 2019 - 2031

7.1. Latin America Antibody Testing Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Serological Test Kits

7.1.1.1.1. Serological Assay Test Kits

7.1.1.1.2. Serological Rapid Assay Kits

7.1.1.2. Immunoglobulin Kits

7.1.1.2.1. Immunoglobulin Assay Test Kits

7.1.1.2.2. Immunoglobulin Rapid Assay Kits

7.1.1.3. Lateral Flow Assay Kits

7.1.1.3.1. Lateral Flow Assay Test Kits

7.1.1.3.2. Lateral Flow Rapid Assay Kits

7.1.1.4. Chemical and Reagents

7.1.1.5. Consumables

7.2. Latin America Antibody Testing Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Pregnancy

7.2.1.2. Cardiovascular Diseases

7.2.1.3. Autoimmune Diseases

7.2.1.4. Infectious Diseases

7.2.1.5. Oncology

7.2.1.6. Endocrine Diseases

7.2.1.7. Diabetes

7.2.1.8. Others

7.3. Latin America Antibody Testing Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Academic and Research Institutes

7.3.1.3. Diagnostic Laboratories

7.3.1.4. Biopharmaceutical Companies

7.3.1.5. Homecare Settings

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Antibody Testing Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.2. Brazil Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.3. Brazil Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.4. Mexico Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.5. Mexico Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.6. Mexico Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.7. Argentina Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.8. Argentina Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.9. Argentina Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.10. Rest of Latin America Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.11. Rest of Latin America Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.12. Rest of Latin America Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Antibody Testing Market Outlook, 2019 - 2031

8.1. Middle East & Africa Antibody Testing Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Serological Test Kits

8.1.1.1.1. Serological Assay Test Kits

8.1.1.1.2. Serological Rapid Assay Kits

8.1.1.2. Immunoglobulin Kits

8.1.1.2.1. Immunoglobulin Assay Test Kits

8.1.1.2.2. Immunoglobulin Rapid Assay Kits

8.1.1.3. Lateral Flow Assay Kits

8.1.1.3.1. Lateral Flow Assay Test Kits

8.1.1.3.2. Lateral Flow Rapid Assay Kits

8.1.1.4. Chemical and Reagents

8.1.1.5. Consumables

8.2. Middle East & Africa Antibody Testing Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Pregnancy

8.2.1.2. Cardiovascular Diseases

8.2.1.3. Autoimmune Diseases

8.2.1.4. Infectious Diseases

8.2.1.5. Oncology

8.2.1.6. Endocrine Diseases

8.2.1.7. Diabetes

8.2.1.8. Others

8.3. Middle East & Africa Antibody Testing Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Academic and Research Institutes

8.3.1.3. Diagnostic Laboratories

8.3.1.4. Biopharmaceutical Companies

8.3.1.5. Homecare Settings

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Antibody Testing Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.2. GCC Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.3. GCC Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.4. South Africa Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.5. South Africa Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.6. South Africa Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.7. Egypt Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.8. Egypt Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.9. Egypt Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.10. Nigeria Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.11. Nigeria Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.12. Nigeria Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.13. Rest of Middle East & Africa Antibody Testing Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.14. Rest of Middle East & Africa Antibody Testing Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.15. Rest of Middle East & Africa Antibody Testing Market by End User, Value (US$ Bn), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Segment 3 vs by Indication Heat map

9.2. Manufacturer vs by Indication Heatmap

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Thermo Fisher Scientific.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Abbott Laboratories

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Beckton, Dickinson and Company

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. F. Hoffmann-La Roche

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Agilent Technologies

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. DiaSorin

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Zeus Scientific

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Abcam PLC

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Trinity Biotech

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Werfen (Biokit)

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Promega

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. BioLegend

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Meridian Bioscience

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Bio-Techne (R&D Systems)

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Indication Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |