Global Antimalarial Drugs Market Forecast

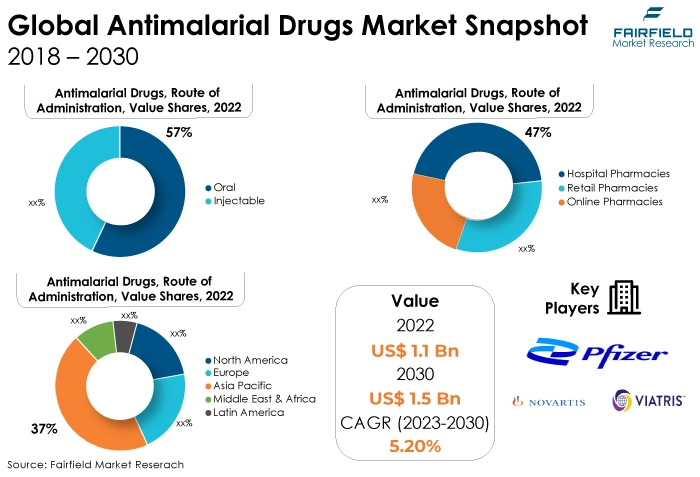

- Antimalarial drugs market size likely to be worth US$1.5 Bn by 2030, up from US$1.1 Bn recorded in 2022

- Market valuation projected to experience a promising CAGR of 5.2% between 2023 and 2030

Quick Report Digest

- The key trends anticipated to fuel the global antimalarial drugs market growth are the increasing malaria prevalence and the growing healthcare expenditure.

- Another major market trend expected to fuel the growth is the global antimalarial drugs market, a rapidly expanding global healthcare industry, rigorous research undertaking with combination therapies to fight against drug resistance challenge

- Aminoquinolines, such as chloroquine and hydroxychloroquine, are regaining relevance in the antimalarial drugs market due to their efficacy against certain malaria strains and affordability. Their resurgence comes as alternative drugs face increasing resistance, making aminoquinolines a vital component of malaria control efforts once again.

- Hospital pharmacies are expanding their focus on antimalarial drugs to provide customised, patient-specific formulations. This trend arises from the need for precise dosage control and individualised treatments, ensuring optimal medication delivery and therapeutic outcomes in clinical settings.

- The oral route of administration is highly preferred in the antimalarial drugs market due to its convenience, ease of patient compliance, and suitability for self-administration. These factors make oral antimalarial drugs a preferred choice for healthcare providers and patients, contributing to their continued growth in the market.

- Due to a high malaria incidence, significant investments in healthcare facilities, and a sizable population, Asia Pacific dominates the market for antimalarial drugs. Its overwhelming market share in the fight against malaria is a result of regional initiatives, rising healthcare costs, and research activity.

- Poor demand in underdeveloped regions presents a challenge in the antimalarial drugs market due to limited healthcare access, awareness, and affordability issues. This hinders the distribution of antimalarial drugs and impedes effective malaria control efforts in these areas, undermining market growth.

- The proliferation of counterfeit drugs poses a significant hindrance to the expansion of the antimalarial drugs market. Counterfeit medications not only jeopardize patient safety but also erode trust in genuine antimalarial products, impacting their adoption and distribution in regions affected by malaria.

A Look Back and a Look Forward - Comparative Analysis

Antimalarial drugs are experiencing significant growth due to several key factors. The antimalarial drugs market is growing due to several factors. The persistence of malaria in many regions, the emergence of drug-resistant strains, and the continuous demand for effective treatments drive market growth.

Ongoing research, development of new drugs, and international initiatives to combat malaria further stimulate the market. Additionally, expanding healthcare access and rising awareness contribute to the increasing demand for antimalarial drugs worldwide.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of the major end-use application sectors, such as hospital pharmacies, and retail pharmacies. Online pharmacies of antimalarial drugs are surging due to the convenience of eCommerce, wider product availability, and increased consumer trust in online pharmacies, offering a hassle-free way to access these products.

The prospects of the antimalarial drugs market look promising with ongoing research, development of novel therapies, and international efforts to combat malaria. Emerging technologies, increased funding, and growing awareness are expected to drive innovation and accessibility, ultimately contributing to better treatment outcomes and disease control.

However, challenges like drug resistance and healthcare inequalities must be addressed to ensure sustained progress in malaria management.

Key Growth Determinants

- Increasing Prevalence of Malaria

The increase in the prevalence of malaria is a significant driver of the antimalarial drugs market. Malaria remains a global health concern, particularly in tropical and subtropical regions. The rise in reported cases and drug-resistant malaria strains has created a pressing need for effective antimalarial drugs.

Pharmaceutical companies invest in research and development to formulate new, more potent antimalarial drugs and improve existing treatments.

Additionally, various governments and organisations collaborate to expand access to these drugs in affected regions, further boosting the market. Furthermore, the COVID-19 pandemic has drawn attention to the need for healthcare facilities, particularly antimalarial medications, in susceptible areas and the market potential for development as malaria control efforts ramp up.

- Multiple Pipeline Products

The presence of many pipeline products is a key driver of the antimalarial drugs market. pharmaceutical companies are actively developing and testing various potential antimalarial treatments, including novel drug and vaccine candidates. This robust pipeline underscores the industry's commitment to addressing the ongoing malaria challenge.

It promises new and improved therapies and fosters competition, potentially leading to more affordable and accessible antimalarial drugs, thereby driving market growth and ensuring a broader arsenal against this disease.

- Growing Healthcare Expenditure

The increasing global healthcare expenditure is a significant driver of the antimalarial drugs market. As countries allocate more resources to healthcare, there is a greater focus on combating diseases like malaria. This includes investments in research, development, and distribution of antimalarial drugs.

Moreover, expanding healthcare infrastructure and access in developing regions further propels market growth. As a result, the rising healthcare expenditure worldwide improves the overall healthcare system and augments the demand for antimalarial drugs, driving market expansion.

Major Growth Barriers

- Poor Demand in Underdeveloped Countries

Poor demand in underdeveloped countries significantly challenges the antimalarial drugs market. In these regions, limited healthcare access, awareness, and financial constraints often lead to insufficient demand for antimalarial medications.

Pharmaceutical companies may find investing in research and distribution networks in these areas economically challenging. This disparity in demand and access hinders market growth, highlighting the need for targeted efforts to address healthcare inequalities and promote antimalarial drug usage in underdeveloped countries to combat malaria effectively.

- Counterfeiting

The rising prevalence of counterfeit antimalarial drugs presents a significant challenge to the antimalarial drugs market. Counterfeit medications undermine treatment effectiveness and pose serious health risks to patients. These fake drugs often lack the active ingredients necessary to combat malaria, contributing to drug resistance and treatment failures.

Moreover, they erode trust in the pharmaceutical supply chain, making it difficult for patients and healthcare providers to distinguish genuine from counterfeit products. This challenge underscores the market need for robust quality control measures and regulatory enforcement.

Key Trends and Opportunities to Look at

- Increasing Adoption of Pharmacogenomics

Pharmacogenomics technology in the antimalarial drugs market involves analyzing an individual's genetic profile to personalize treatments.

Healthcare providers can prescribe the most effective and safe antimalarials for each patient by identifying genetic variations that influence drug metabolism and response.

This approach minimizes adverse reactions and enhances treatment outcomes, contributing to more efficient and targeted malaria management and reducing drug resistance development risk.

- Growing Adoption of Nanotechnology

Nanotechnology in the antimalarial drugs market leverages nanoparticles and nanoscale drug delivery systems. These technologies enhance drug solubility, stability, and targeted delivery to malaria parasites, improving treatment efficacy.

Nanoparticles can encapsulate antimalarial drugs, allowing for controlled release and prolonged drug circulation, reducing dosing frequency. This innovation enhances patient compliance and ensures more potent treatment while minimizing side effects.

Nanotechnology holds the potential to revolutionize antimalarial drug development and combat drug-resistant strains effectively.

- Rising Usage of Point-of-Care Diagnostics

Point-of-care diagnostics in the antimalarial drugs market involves portable, rapid diagnostic tests that can quickly detect malaria infections in remote or resource-limited settings. These tests typically use a small blood sample and provide results within minutes, enabling prompt and accurate diagnosis.

Point-of-care diagnostics facilitate timely treatment and reduce the risk of complications. This contributes to effective malaria management, especially in areas with limited access to laboratory facilities, improving patient outcomes and disease control efforts.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario in the antimalarial drugs market plays a crucial role in ensuring the safety, efficacy, and accessibility of antimalarial treatments. Regulatory agencies such as the World Health Organization (WHO), the U.S. Food and Drug Administration (FDA), and various national regulatory bodies establish guidelines and requirements for developing, approving, and distributing antimalarial drugs.

Regulatory authorities oversee clinical trials to evaluate the safety and effectiveness of new antimalarial drugs. Rigorous trials are necessary to gain approval for these treatments. Stringent quality control standards are enforced to ensure that antimalarial drugs meet established quality and safety criteria.

Regulatory agencies work to combat the proliferation of counterfeit antimalarial drugs, implementing measures to track and authenticate medications throughout the supply chain. Antimalarial drugs must undergo a thorough regulatory approval process before entering the market. This includes submitting comprehensive data on safety, efficacy, and manufacturing processes.

Regulatory bodies monitor and assess adverse events and side effects of antimalarial drugs once on the market, taking corrective actions when necessary. Regulatory policies can influence drug pricing and accessibility, with some agencies promoting affordable access to antimalarial treatments in low-income regions.

Fairfield’s Ranking Board

Top Segments

- Aminoquinolines Drug Class Spearheads

Aminoquinolines, particularly chloroquine and hydroxychloroquine, historically captured the largest market share in the antimalarial drugs market due to their effectiveness against various malaria strains, low cost, and extensive availability. They were widely used as first-line treatments in many regions.

However, their dominance has waned in recent years due to increasing drug resistance, leading to a shift in focus toward newer antimalarial drug classes like artemisinin-based combination therapies (ACTs), and other innovative treatments to combat resistant malaria strains more effectively.

Cinchona alkaloids are experiencing the fastest CAGR in the antimalarial drugs market due to their effectiveness against drug-resistant malaria strains. These alkaloids, including quinine and quinidine, have a long history of antimalarial use and are still considered essential components of treatment regimens.

The efficacy of these alkaloids against challenging malaria parasites such as Plasmodium falciparum, coupled with the limited availability of alternatives, positions cinchona alkaloids as a vital therapeutic option, driving their robust growth in the market.

- Oral Route of Administration Will Surge Ahead

The oral route of administration has captured the largest market share in the antimalarial drugs market due to several advantages. Oral medications are convenient, easy to administer, and well-tolerated by patients, making them suitable for self-administration, especially in resource-limited settings. They also facilitate accurate dosing and adherence to treatment regimens.

Additionally, many antimalarial drugs are available in oral formulations, including tablets and syrups, which contribute to their widespread use and dominance in the market over intravenous or other routes of administration.

Due to several factors, the injectable route of administration is experiencing the fastest CAGR in the antimalarial drugs market. Injectable antimalarials are favored in severe cases and for patients unable to take oral medications. They offer rapid onset of action and higher bioavailability, crucial in life-threatening malaria situations.

Additionally, the emergence of innovative injectable formulations with improved safety profiles and efficacy against drug-resistant strains has expanded their usage, contributing to their rapid growth in the market.

- Hospital Pharmacies Surge Ahead

Hospital pharmacies have captured the largest market share in the antimalarial drugs market due to their crucial role in managing severe and complicated malaria cases. hospitals are primary centers for treating severe malaria cases, and they stock a wide range of antimalarial drugs, including intravenous formulations, to ensure timely and effective treatment.

Hospitals often serve as reference centers for infectious diseases, making them pivotal in distributing and administering antimalarial drugs, further solidifying their dominant position in the market.

Online pharmacies are experiencing the fastest CAGR in the antimalarial drugs market due to increased accessibility and convenience. Online platforms provide a wide selection of antimalarial drugs, including prescription and over-the-counter options, allowing individuals to purchase medications from the comfort of their homes.

Moreover, the COVID-19 pandemic has accelerated the adoption of online healthcare services. This trend, coupled with the rising demand for easy medication access, has fueled the rapid growth of online pharmacies in the antimalarial drugs market.

Regional Frontrunners

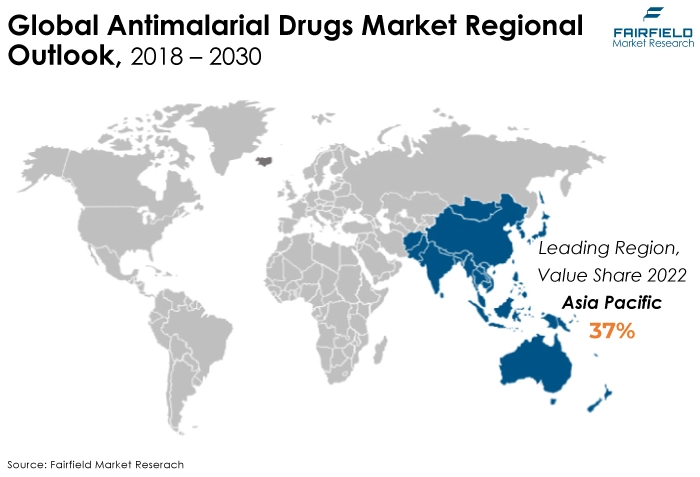

Asia Pacific in the Bandwagon

Asia Pacific has captured the largest market share in the antimalarial drugs market for several reasons. First, the region bears a significant burden of malaria cases, particularly in countries like India, and southeast Asian nations. The high prevalence necessitates a substantial supply of antimalarial drugs.

Asia Pacific has witnessed growing investments in healthcare infrastructure and pharmaceutical manufacturing, fostering drug production and distribution. Additionally, initiatives by governments and international organisations to combat malaria have boosted the market.

Finally, a large population and increasing healthcare expenditures increase drug demand. These factors, coupled with efforts to control malaria in this region, have positioned Asia Pacific as the dominant market player in the antimalarial drugs market.

Europe to Display a Notable Performance

Due to several factors, Europe is anticipated to exhibit the highest CAGR in the antimalarial drugs market. These include rising travelers to malaria-endemic regions, increasing immigration from such areas, and the potential for malaria re-emergence in some European countries.

Europe's robust healthcare infrastructure and research capabilities make it an attractive hub for antimalarial drug development and clinical trials. As a result, the demand for antimalarial drugs is expected to rise, fostering market growth and innovation in the region, particularly in areas with higher malaria risk.

Fairfield’s Competitive Landscape Analysis

The global global antimalarial drugs market is a consolidated market with fewer major players. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global Antimalarial Drugs Market Space?

- Pfizer Inc.

- Novartis AG

- Roche Holding AG

- Alvizia Healthcare Pvt. Ltd.

- Merck & Co

- Sanofi SA

- GlaxoSmithKline Plc

- Sun Pharmaceutical Industries Ltd.

- Viatris

- Guilin Pharmaceutical Co., Ltd.

- Ajanta Pharma Limited

- AbbVie Inc

- Bayer AG

- Cipla Limited

- Ipca Laboratories Ltd.

Significant Company Developments

New Product Launches

- August 2022: The British Heart Foundation intends to provide funding to support research at the University of Surrey investigating the effects of anti-malaria medications on cardiac rhythm. This study aims to gain insights into the influence of malaria treatment drugs on the human heart.

- March 2022: Tafenoquine, a novel medication effective against specific types of malaria, has received approval in Australia through collaboration between Medicines for Malaria Venture (MMV) and GlaxoSmithKline (GSK) for pediatric and adolescent use. This drug is administered alongside the conventional malaria treatment, chloroquine.

Distribution Agreement

- July 2022: Mosquirix, the world's first anti-malarial vaccine developed by GlaxoSmithKline (GSK), has been introduced in three African nations, Ghana, Kenya, and Malawi, as part of the Gavi vaccine initiative, with backing from the Gates Foundation

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, growth in healthcare is driving the market. The persistent global demand for effective malaria treatment and prevention drives the antimalarial drugs market. Factors such as increasing malaria prevalence, drug resistance, and the need for affordable, accessible therapies continue to fuel demand.

Future growth is expected due to ongoing research and development efforts, the introduction of novel drugs and therapies, and expanding access to healthcare in malaria-endemic regions.

Additionally, evolving regulatory frameworks and international initiatives to combat malaria are poised to stimulate market expansion, making the antimalarial drugs market a vital component of global healthcare efforts.

Supply Side of the Market

The production of antimalarial drugs requires various raw materials, including active pharmaceutical ingredients (APIs) like artemisinin and its derivatives, as well as various excipients, binders, and fillers for formulation. The major supplier of raw materials for the antimalarial drugs market is Sanofi.

Sanofi is a leading pharmaceutical company that has played a crucial role in the production and distribution of artemisinin-based antimalarial drugs. They have established partnerships and initiatives to ensure a stable supply of high-quality raw materials for the global fight against malaria, particularly in regions heavily affected by the disease. The production of antimalarial drugs requires key raw materials, including APIs like artemisinin and its derivatives, as well as excipients, fillers, and binders for formulation.

A major supplier of raw materials for the antimalarial drugs market is the pharmaceutical company Guilin Pharmaceutical. Guilin is renowned for producing high-quality artemisinin-based APIs and contributing significantly to the global supply of raw materials essential for the manufacturing of antimalarial medications, particularly in the fight against malaria in various regions worldwide.

Global Global Antimalarial Drugs Market is Segmented as Below:

By Drug Class:

- Aminoquinolines

- Quinoline-methanol (4-quinolinemethanols)

- Cinchona Alkaloids

- Biguanides

- Sulfonamides and Sulfones

- Artemisinin Derivatives

- Others

By Route of Administration:

- Oral

- Injectable

By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Other

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Antimalarial Drugs Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Antimalarial Drugs Market Outlook, 2018 - 2030

3.1. Global Antimalarial Drugs Market Outlook, by Drug Class, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Aminoquinolines

3.1.1.2. Quinoline-methanol (4-quinolinemethanols)

3.1.1.3. Cinchona Alkaloids

3.1.1.4. Biguanides

3.1.1.5. Sulfonamides and Sulfones

3.1.1.6. Artemisinin Derivatives

3.1.1.7. Others

3.2. Global Antimalarial Drugs Market Outlook, by Route of Administration, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Oral

3.2.1.2. Injectable

3.3. Global Antimalarial Drugs Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Hospital Pharmacies

3.3.1.2. Retail Pharmacies

3.3.1.3. Online Pharmacies

3.3.1.4. Other

3.4. Global Antimalarial Drugs Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Antimalarial Drugs Market Outlook, 2018 - 2030

4.1. North America Antimalarial Drugs Market Outlook, by Drug Class, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Aminoquinolines

4.1.1.2. Quinoline-methanol (4-quinolinemethanols)

4.1.1.3. Cinchona Alkaloids

4.1.1.4. Biguanides

4.1.1.5. Sulfonamides and Sulfones

4.1.1.6. Artemisinin Derivatives

4.1.1.7. Others

4.2. North America Antimalarial Drugs Market Outlook, by Route of Administration, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Oral

4.2.1.2. Injectable

4.3. North America Antimalarial Drugs Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Hospital Pharmacies

4.3.1.2. Retail Pharmacies

4.3.1.3. Online Pharmacies

4.3.1.4. Other

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Antimalarial Drugs Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

4.4.1.4. U.S. Antimalarial Drugs Market End Use, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

4.4.1.7. Canada Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

4.4.1.8. Canada Antimalarial Drugs Market End Use, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Antimalarial Drugs Market Outlook, 2018 - 2030

5.1. Europe Antimalarial Drugs Market Outlook, by Drug Class, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Aminoquinolines

5.1.1.2. Quinoline-methanol (4-quinolinemethanols)

5.1.1.3. Cinchona Alkaloids

5.1.1.4. Biguanides

5.1.1.5. Sulfonamides and Sulfones

5.1.1.6. Artemisinin Derivatives

5.1.1.7. Others

5.2. Europe Antimalarial Drugs Market Outlook, by Route of Administration, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Oral

5.2.1.2. Injectable

5.3. Europe Antimalarial Drugs Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Hospital Pharmacies

5.3.1.2. Retail Pharmacies

5.3.1.3. Online Pharmacies

5.3.1.4. Other

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Antimalarial Drugs Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Antimalarial Drugs Market Outlook, 2018 - 2030

6.1. Asia Pacific Antimalarial Drugs Market Outlook, by Drug Class, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Aminoquinolines

6.1.1.2. Quinoline-methanol (4-quinolinemethanols)

6.1.1.3. Cinchona Alkaloids

6.1.1.4. Biguanides

6.1.1.5. Sulfonamides and Sulfones

6.1.1.6. Artemisinin Derivatives

6.1.1.7. Others

6.2. Asia Pacific Antimalarial Drugs Market Outlook, by Route of Administration, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Oral

6.2.1.2. Injectable

6.3. Asia Pacific Antimalarial Drugs Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Hospital Pharmacies

6.3.1.2. Retail Pharmacies

6.3.1.3. Online Pharmacies

6.3.1.4. Other

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Antimalarial Drugs Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Antimalarial Drugs Market Outlook, 2018 - 2030

7.1. Latin America Antimalarial Drugs Market Outlook, by Drug Class, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Aminoquinolines

7.1.1.2. Quinoline-methanol (4-quinolinemethanols)

7.1.1.3. Cinchona Alkaloids

7.1.1.4. Biguanides

7.1.1.5. Sulfonamides and Sulfones

7.1.1.6. Artemisinin Derivatives

7.1.1.7. Others

7.2. Latin America Antimalarial Drugs Market Outlook, by Route of Administration, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Oral

7.2.1.2. Injectable

7.3. Latin America Antimalarial Drugs Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Hospital Pharmacies

7.3.1.2. Retail Pharmacies

7.3.1.3. Online Pharmacies

7.3.1.4. Other

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Antimalarial Drugs Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Antimalarial Drugs Market Outlook, 2018 - 2030

8.1. Middle East & Africa Antimalarial Drugs Market Outlook, by Drug Class, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Aminoquinolines

8.1.1.2. Quinoline-methanol (4-quinolinemethanols)

8.1.1.3. Cinchona Alkaloids

8.1.1.4. Biguanides

8.1.1.5. Sulfonamides and Sulfones

8.1.1.6. Artemisinin Derivatives

8.1.1.7. Others

8.2. Middle East & Africa Antimalarial Drugs Market Outlook, by Route of Administration, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Oral

8.2.1.2. Injectable

8.3. Middle East & Africa Antimalarial Drugs Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Hospital Pharmacies

8.3.1.2. Retail Pharmacies

8.3.1.3. Online Pharmacies

8.3.1.4. Other

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Antimalarial Drugs Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Antimalarial Drugs Market by Drug Class, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Antimalarial Drugs Market Route of Administration, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Antimalarial Drugs Market Distribution Channel, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Drug Class Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Pfizer Inc.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Novartis AG

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Roche Holding AG

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Johnson & Johnson

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Merck & Co., Inc

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Sanofi S.A.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. GlaxoSmithKline plc

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. AstraZeneca plc

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Eli Lilly and Company

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Bristol-Myers Squibb Company

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Gilead Sciences, Inc.

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. AbbVie Inc

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Bayer AG

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Biogen Inc.

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. Moderna, Inc.

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Drug Class Coverage |

|

|

Route of Administration Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country- wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |