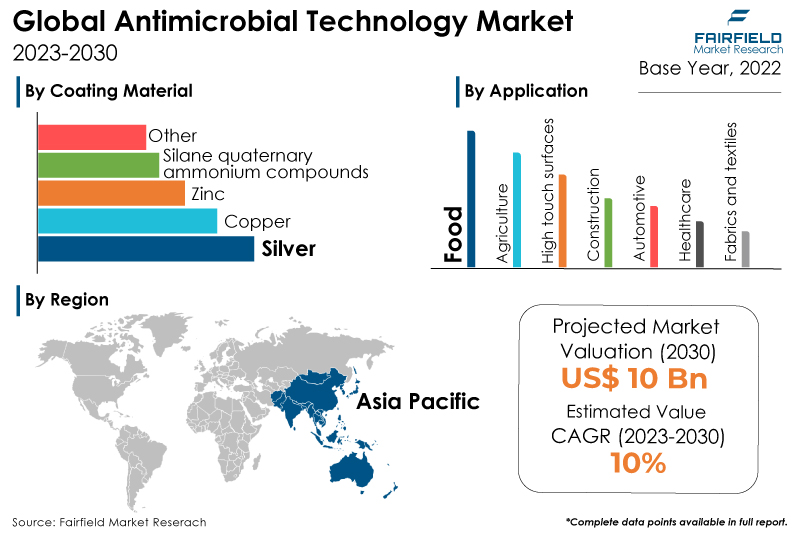

The global antimicrobial technology market will grow at a significant rate of around 10% CAGR between 2023 and 2030, reaching a market value of almost US$10 Bn by the end of 2030.

Market Analysis in Brief

The antimicrobial technology market defines a subsegment within the larger healthcare and technology sectors dedicated to creating, producing, and applying goods, components, or technologies intended to stop the transmission of viruses, and germs. The technologies created to prevent the growth and spread of microorganisms include viruses, bacteria, fungi, and algae. Over the years, the antiviral and antimicrobial technology market has experienced substantial growth and innovation, particularly during pandemics and outbreaks demanding a greater need for efficient infection control techniques. These technologies are essential for preserving public health, lowering healthcare-associated illnesses, and keeping surroundings clean. The opportunity to create eco-friendly antiviral and antimicrobial technologies with no negative influence on the ecosystem grows as environmental concerns develop. Antimicrobial products that are environmentally sustainable are likely to attract revenue in the years to come.

Key Report Findings

- The global antimicrobial technology market will expand at a significant rate around 10% CAGR between 2023 and 2030.

- The demand for antimicrobial technology is rising due to increasing consumer awareness.

- Demand for silver coating material remains higher in the antimicrobial technology market.

- Healthcare segment will hold a dominant revenue share of the antimicrobial technology market.

- Asia Pacific will continue to lead its way, whereas North American antimicrobial technology market will experience the strongest growth till 2030.

Growth Drivers

Increasing Consumer Awareness

Rising consumer awareness is the key factor driving the antiviral and antimicrobial technology market. The demand for goods and technologies with antiviral and antimicrobial qualities tends to increase as customers become more attentive to hygiene and health-related issues. Consumers are becoming increasingly concerned with keeping an atmosphere clean and hygienic, especially considering recent contagious diseases like COVID-19 outbreaks. They look for products that will lower their chance of infection and safeguard their health.

Antiviral and antimicrobial technologies are seen as preventive measures against the transmission of diseases in private and public environments, such as offices, homes, and public transportation, as well as retail settings like malls. There is an increasing demand for products in several industries, including antimicrobial textiles, home goods, personal care products, and consumer electronics. Consumer awareness of the significance of antiviral and antimicrobial technologies has increased due to increased media coverage and advertising initiatives emphasizing cleanliness and infection control.

Growing Industrial Applications

The growth of the antimicrobial technology market is significantly driven by expanding industrial applications. Industries are using antiviral and antimicrobial technologies more frequently due to the rising know-how and significance of infection management, halting the spread of infections, and upholding hygiene standards.

Major antimicrobial technology consumers include hospitals, clinics, and other medical facilities. These facilities must take strict infection control precautions to fight against healthcare-associated infections (HAIs) and protect patients and healthcare personnel. Preventing bacterial contamination, spoilage, and foodborne diseases is a concern for the food processing sector. Antimicrobial technologies are used in equipment, food processing surfaces, and packaging to ensure food safety and increase shelf-life. Antimicrobial technologies are used in agriculture to reduce crop loss and stop the spread of plant diseases. They are applied to agricultural products as additives, treatments, or coatings.

Growth Challenges

Pricing Pressure, and Stringent Certification and Testing Requisites

While manufacturing, and R&D of advanced antiviral and antimicrobial technology can be costly, these technologies can be more expensive for end users due to further expenses of involved in clinical trials, which would restrict their accessibility, especially in environments with few resources. The high cost of antimicrobial technologies will thus significantly hamper the antimicrobial technology market.

Consumers could be reluctant to purchase goods or services that use antimicrobial technologies if the price is much higher than non-antimicrobial alternatives. This is especially true when consumers prioritise cost-effectiveness during economic downturns or in price-sensitive marketplaces. Companies may experience pressure to maintain competitive prices in markets with intense competition, which may have an impact on the company's market share.

Antimicrobial technology must pass stringent tests and receive certificates to prove its effectiveness and security. These certification and testing procedures can be costly, raising the price of bringing products to market. High-priced antimicrobial technology can undergo criticism from businesses and customers that focus on environment-friendly options and affect the purchase decisions.

Overview of Key Segments

Silver Continues to be the Most Preferred Coating Material

The silver segment is expected to dominate the global antimicrobial technology market over the forecast period. Silver has been used extensively as an antimicrobial for many years and is still used extensively in current antiviral and antimicrobial technology. The capacity of silver to release silver ions (Ag+) when in contact with moisture or pathogens like bacteria and viruses gives silver its antibacterial capabilities. These silver ions disrupt the infections' biological functions and prevent them from growing and reproducing.

Silver nanoparticles are among the most popular silver materials utilised in antimicrobial technologies. They are effective against microorganisms because of their small size and huge surface area. They are utilised in textiles, paints, and coatings for long-lasting and robust antimicrobial characteristics. In consumer electronics, silver is used as an antibacterial compound on device surfaces to lower the risk of germ transmission by repeated touch.

Food Sector Contributes Highest to Demand Generation

The food segment is expected to be the fastest-growing antimicrobial technology market segment. Antiviral and antimicrobial technologies play an important role in the food business by resolving contamination issues, assuring food safety, and prolonging the shelf-life of food items. These technologies are used at different food processing and packaging phases to stop the growth and spread of pathogenic bacteria, viruses, and other microorganisms. Materials used in packaging may come into touch with food, making them possible contaminant sources. Food packaging materials, like films and wraps, use antimicrobial technologies to provide a barrier against bacteria and viruses, keeping the food safe for extended periods.

Fresh produce, like fruits and vegetables, is treated with antimicrobial washes and sprays to decrease the amount of surface germs and viruses. As a result, the product's quality and safety are maintained throughout the supply chain. Antimicrobial technologies are used in seafood processing to stop the growth of bacteria and pathogens that cause spoiling, maintaining the products' freshness and safety. The distribution of perishable food items occurs in an atmosphere kept clean via antimicrobial coatings or treatments applied to food transportation containers and vehicles.

Growth Opportunities Across Regions

Asia Pacific Eats up the Largest Share of the Pie

During the forecast period, Asia Pacific is expected to dominate the antimicrobial technology market. Infrastructural and technological investments in healthcare have increased from both public and private sources in the Asia Pacific region. As a result, hospitals, clinics, and medical equipment increasingly use antimicrobial coatings and treatments to improve infection control procedures.

The Asia Pacific region is leading the development of more precise and effective antimicrobial remedies due to advancements in nanotechnology. With improved antibacterial qualities, nanoparticle-based coatings and materials are becoming increasingly popular. There is an increasing need for antimicrobial fabrics. Antimicrobial fabrics are used in domestic textiles, athletic apparel, and healthcare facilities to prevent bacterial growth and uphold hygiene.

Rapid urbanisation in India and smart city projects offer opportunities to incorporate antimicrobial technology in public areas, infrastructure, and transportation to enhance overall hygienic conditions and safety. Companies may easily reach a larger consumer base with antimicrobial products and technology due to the rising popularity of e-commerce platforms and online sales channels in India.

North America Will be the Fastest Growing Market

The market for antimicrobial technology across North America will display a significant CAGR during the forecast period. The healthcare industry continues to be a prominent consumer of antimicrobial technologies in the US. Hospitals, clinics, and long-term care facilities continue to witness increased demand for this technology. Companies in North America are making major R&D investments to develop cutting-edge antiviral and antibacterial technologies, which will result in the release of revolutionary products.

There has been increased interest in integrating antimicrobial technologies with smart surfaces and the Internet of Things (IoT), enabling real-time monitoring and data-driven infection control tactics in the United States. Antimicrobial products are becoming more widely used in schools and colleges in the United States as educational institutions become aware of their value in maintaining hygienic and secure learning environments.

Antimicrobial Technology Market: Competitive Landscape

Some of the leading players at the forefront in the antimicrobial technology market space include Sherwin-Williams, Applied Silver, AkzoNobel N.V., Copptech, Dyphox, Goldshield Technologies, Inhibit Coatings, Innovotech, Nanosafe Solutions, Parx Materials, Quick-Med Technologies, Sciessent, SINTX Technologies, and Touchpoint Science.

Recent Notable Developments

In February 2022, PROTECTON Floor VK Clear used for floors, and PROTECTON Interior Wall VK Coat, two antiviral and antibacterial water-based paint solutions used for interior walls, were introduced by Nippon Paint Co., Ltd., a paint manufacturer with headquarters in Japan. These paints offer excellent durability and copper's antiviral and antibacterial properties, which reduce germs and viruses on the coating surface by 99% or more.

In July 2022, G6 Materials Corp. ("G6" or the "Company"), a high-tech company specialising in advanced materials and developing imaginative composites for a range of industrial applications, announced that the Breathe+ Pro Advanced Antimicrobial Graphene Air Filtration System was introduced and is now available.

In August 2022, PPG announced that two of its market-leading antimicrobial and antiviral products, COMEX VINIMEX TOTAL antiviral and antibacterial paint and COPPER ARMORTM antimicrobial paint by PPG with Corning Guardiant technology, had each won a 2022 R&D 100 Award in the mechanical/materials category.

In February 2023, a project named SUPREME, initiated by the University of Birmingham to develop sustainable antimicrobial surface coatings from advanced nanoparticles and naturally derived materials has been awarded £5.4M EU funding through the EU’s Horizon Europe programme and U.K. Research and Innovation (UKRI).

In May 2023, according to a research article by the American Chemical Society, an edible cannabidiol (CBD) and sodium alginate coating could extend the shelf-life of strawberries by creating antimicrobial coatings for food packaging.

The Global Antimicrobial Technology Market is Segmented as Below:

By Coating Material

- Silver

- Copper

- Zinc

- Silane quaternary ammonium compounds

- Other

By Application

- Food

- Agriculture

- High touch surfaces

- Construction

- Automotive

- Healthcare

- Fabrics and textiles

- Other

By Geography

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

Leading Companies

- Applied Silver, Inc.

- CleanCU

- Copptech

- Dyphox

- Goldshield Technologies

- Inhibit Coatings

- Innovotech

- Nanosafe Solutions

- Parx Materials N.V.

- Quick-Med Technologies

- Sciessent

- SINTX Technology Inc.

- Touchpoint Science

1. Executive Summary

1.1. Global Antimicrobial Technology Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Porter’s Five Forces Analysis

2.4. Covid-19 Impact Analysis

2.4.1. Supply

2.4.2. Demand

2.5. Impact of Ukraine-Russia Conflict

2.6. Economic Overview

2.6.1. World Economic Projections

2.7. PESTLE Analysis

3. Global Antimicrobial Technology Market Outlook, 2018 - 2030

3.1. Global Antimicrobial Technology Market Outlook, by Coating Material, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Silver

3.1.1.2. Copper

3.1.1.3. Zinc

3.1.1.4. Silane quaternary ammonium compounds

3.1.1.5. Other

3.2. Global Antimicrobial Technology Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Food

3.2.1.2. Agriculture

3.2.1.3. High touch surfaces

3.2.1.4. Construction

3.2.1.5. Automotive

3.2.1.6. Healthcare

3.2.1.7. Fabrics and textiles

3.2.1.8. Other

3.3. Global Antimicrobial Technology Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Antimicrobial Technology Market Outlook, 2018 - 2030

4.1. North America Antimicrobial Technology Market Outlook, by Coating Material, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Silver

4.1.1.2. Copper

4.1.1.3. Zinc

4.1.1.4. Silane quaternary ammonium compounds

4.1.1.5. Other Technologies

4.2. North America Antimicrobial Technology Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Food

4.2.1.2. Agriculture

4.2.1.3. High touch surfaces

4.2.1.4. Construction

4.2.1.5. Automotive

4.2.1.6. Healthcare

4.2.1.7. Fabrics and textiles

4.2.1.8. Other

4.2.2. Market Attractiveness Analysis

4.3. North America Antimicrobial Technology Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Antimicrobial Technology Market Outlook, 2018 - 2030

5.1. Europe Antimicrobial Technology Market Outlook, by Coating Material, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Silver

5.1.1.2. Copper

5.1.1.3. Zinc

5.1.1.4. Silane quaternary ammonium compounds

5.1.1.5. Other Technologies

5.2. Europe Antimicrobial Technology Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Food

5.2.1.2. Agriculture

5.2.1.3. High touch surfaces

5.2.1.4. Construction

5.2.1.5. Automotive

5.2.1.6. Healthcare

5.2.1.7. Fabrics and textiles

5.2.1.8. Other

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Antimicrobial Technology Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.9. Turkey Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

5.3.1.10. Turkey Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.11. Russia Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

5.3.1.12. Russia Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.13. Rest of Europe Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

5.3.1.14. Rest of Europe Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Antimicrobial Technology Market Outlook, 2018 - 2030

6.1. Asia Pacific Antimicrobial Technology Market Outlook, by Coating Material, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Silver

6.1.1.2. Copper

6.1.1.3. Zinc

6.1.1.4. Silane quaternary ammonium compounds

6.1.1.5. Other Technologies

6.2. Asia Pacific Antimicrobial Technology Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Food

6.2.1.2. Agriculture

6.2.1.3. High touch surfaces

6.2.1.4. Construction

6.2.1.5. Automotive

6.2.1.6. Healthcare

6.2.1.7. Fabrics and textiles

6.2.1.8. Other

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Antimicrobial Technology Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Antimicrobial Technology Market Outlook, 2018 - 2030

7.1. Latin America Antimicrobial Technology Market Outlook, by Coating Material, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Silver

7.1.1.2. Copper

7.1.1.3. Zinc

7.1.1.4. Silane quaternary ammonium compounds

7.1.1.5. Other Technologies

7.2. Latin America Antimicrobial Technology Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Food

7.2.1.2. Agriculture

7.2.1.3. High touch surfaces

7.2.1.4. Construction

7.2.1.5. Automotive

7.2.1.6. Healthcare

7.2.1.7. Fabrics and textiles

7.2.1.8. Other

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Antimicrobial Technology Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

7.3.1.5. Argentina Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

7.3.1.6. Argentina Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

7.3.1.7. Rest of Latin America Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

7.3.1.8. Rest of Latin America Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Antimicrobial Technology Market Outlook, 2018 - 2030

8.1. Middle East & Africa Antimicrobial Technology Market Outlook, by Coating Material, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Silver

8.1.1.2. Copper

8.1.1.3. Zinc

8.1.1.4. Silane quaternary ammonium compounds

8.1.1.5. Other Technologies

8.2. Middle East & Africa Antimicrobial Technology Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Food

8.2.1.2. Agriculture

8.2.1.3. High touch surfaces

8.2.1.4. Construction

8.2.1.5. Automotive

8.2.1.6. Healthcare

8.2.1.7. Fabrics and textiles

8.2.1.8. Other

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Antimicrobial Technology Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.5. Egypt Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

8.3.1.6. Egypt Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.7. Nigeria Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

8.3.1.8. Nigeria Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Antimicrobial Technology Market by Coating Material, Value (US$ Bn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Antimicrobial Technology Market Application, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Technology Heat Map

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Sherwin Williams

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Applied Silver, Inc.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Akzo Nobel N.V.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Copptech

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Dyphox

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Goldshield Technologies

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Inhibit Coatings

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Innovotech, Inc.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Nanosafe Solutions Pvt. Ltd.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Business Strategies and Development

9.4.10. Parx Materials N.V.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Quick-Med Technologies

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Sciessent

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. SINTX technologies

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Touchpoint Science

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Coating Material Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |