Global ANZ Automotive Battery Market Forecast

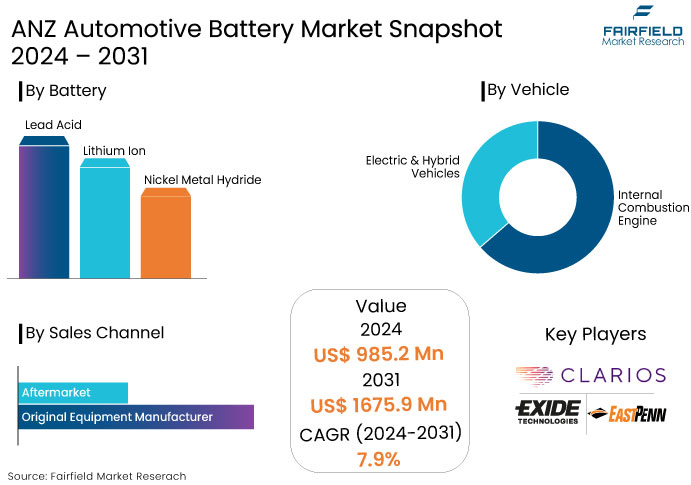

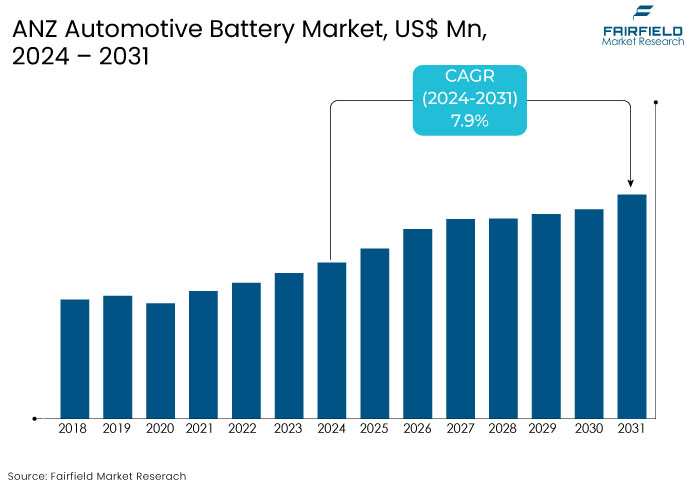

- The ANZ automotive battery market is estimated to be valued at US$1675.9 Mn by 2031, exhibiting significant growth from the US$985.2 Mn attained in 2024.

- The market for ANZ automotive battery is slated to show significant expansion rate, with an estimated CAGR of 7.9% from 2024 to 2031.

ANZ Automotive Battery Insights

- The growing shift toward electric vehicles (EVs) is driving demand for automotive batteries, with supportive government policies accelerating EV growth in Australia and New Zealand.

- Technological improvements in battery energy density, charge times, and lifespan are enhancing the performance and appeal of EVs, further boosting automotive battery demand.

- Government incentives such as rebates for EV buyers and the establishment of charging infrastructure are key enablers of EV adoption, positively impacting the automotive battery market.

- The ANZ automotive battery market is expected to grow significantly due to rising consumer acceptance of EVs, driven by economic and environmental benefits.

- Lithium-ion (Li-ion) batteries are the dominant technology in the market. It is due to their high energy density, fast charging speeds, and long lifespan than traditional lead-acid batteries.

- Substantial investment in EV charging infrastructure in Australia and New Zealand caters to the market growth.

- The aftermarket sales channel leads the market segment, with aging vehicle fleets creating replacement demand for conventional and EV batteries.

- Increasing environmental awareness and sustainability goals further push the shift from conventional to electric vehicles, enhancing the demand for EV batteries.

A Look Back and a Look Forward - Comparative Analysis

The ANZ automotive battery market experienced a CAGR of 4.5% during the period from 2019 to 2023 and is anticipated to expand at a CAGR of 7.9% from 2024 to 2031. The automotive battery market consistently grew from 2019 to 2023 due to increasing environmental concerns and rigorous vehicle emissions regulations in Australia and New Zealand.

The pandemic significantly affected automotive markets in Australia and New Zealand. In 2020, New Zealand experienced an approximate 19% decline in electric vehicle sales. The introduction of substantial innovations in the automotive sector has resulted in the expansion and continuous growth of the automotive industry, positively influencing the sales prognosis in 2022.

The market for electric vehicles is expected to increase due to enhanced infrastructure and increased consumer awareness in the post-pandemic years. The need for traditional vehicles, mainly commercial ones, will enhance the revenue of automotive market in the region. Such potential advancements are expected to substantially elevate the demand for automotive batteries in Australia and New Zealand, aiding the market growth.

Key Growth Determinants

- Increasing Utilization of Electric Vehicles (EVs)

The growing adoption of electric cars (EVs) is a key driving element for the ANZ automotive battery market. Australian and New Zealand government authorities are promoting the shift to electric vehicles through subsidies, tax incentives, and investments in charging infrastructure.

The National Electric Vehicle Strategy of Australia seeks to improve the adoption rate of electric vehicles in the country through a global initiative to reduce carbon emissions. Electric vehicle batteries, especially lithium-ion types, constitute a significant portion of the demand in this industry.

The increasing preference for sustainable and energy-efficient transportation has prompted automotive manufacturers to launch electric vehicle models. These are especially designed for Australia and New Zealand, enhancing the demand for advanced automotive batteries.

- Growing Demand for Batteries Surge the Sales of ANZ Automotive Battery

Customers are becoming more keen on using electric and hybrid batteries as they last longer and are efficient. As people choose electric and hybrid vehicles to lower their use of conventional vehicles, the demand for batteries has recently increased.

One of the main reasons for ANZ's automotive market growth is the sale of aftermarket batteries in the region. As a result of Australia and New Zealand's large automotive fleets and low vehicle production, the rate of aftermarket fitting goes up. The ANZ automotive battery market in Australia and New Zealand is predicted to proliferate owing to the need for lead-acid batteries in the aftermarket.

Rising sales of electric and hybrid vehicles and stringent government rules on vehicle emissions drive consumers' attention toward a sustainable and eco-friendly option. Hence, electric vehicles have been gaining much traction in recent years and eventually fostering the AnZ automotive battery market.

Key Growth Barriers

- Insufficient Charging and Recycling Infrastructure

One of the prominent challenges for the market is the underdeveloped charging and battery recycling infrastructure in Australia and New Zealand. EV adoption has been growing in recent times, but the expansion of charging stations in the region has not kept pace, creating range anxiety among potential buyers.

Limited recycling facilities for end-of-life batteries raise environmental concerns and hinder the sustainable growth of the automotive battery market. Without an efficient recycling ecosystem, the costs of disposing or repurposing batteries increase, discouraging investments in newer battery technologies. Such infrastructure gaps slow the transition to advanced battery solutions, impacting overall market growth.

- High Cost of Advanced Batteries

The substantially high cost of new vehicle batteries, especially lithium-ion and solid-state types, is a main limitation for the ANZ automotive battery market growth. High-end batteries integrated with the latest technologies provide exceptional performance, yet their cost poses a significant obstacle for numerous customers and fleet operators in price-sensitive markets.

The cost barrier is primarily relevant in Australia and New Zealand, where the adoption of electric vehicles remains at a developmental stage relative to global frontrunners. The absence of significant government subsidies for battery manufacturing and electric vehicle purchases has increased the financial burden on customers, which impedes market penetration.

Price-sensitive consumers of classic internal combustion engine (ICE) vehicles frequently select cost-effective, conventional lead-acid batteries, impeding the advancement of more valuable battery technologies.

ANZ Automotive Battery Trends and Opportunities

- Advancement in Battery Technology and Battery Recycling Capabilities

Automotive manufacturers are concentrating on minimizing the weight and dimensions of vehicle components to enhance performance. Battery manufacturers are now trying to produce high-end batteries with improved performance and portable designs for automotive applications.

The current designs include the development of novel bipolar batteries, in which cells are stacked in sandwich form. These batteries significantly diminish the dimensions and mass of batteries while enhancing their performance.

Battery manufacturers are advancing battery technologies to cater to the growing need for dynamic energy storage solutions that are maintenance-free, possess an extended lifespan, and exhibit energy efficiency. The recycling potential of car batteries will significantly influence market growth over the forecast period, as the car battery is recyclable and can be repurposed in the vehicle post-expiration.

The recycling of car batteries has a substantial opportunity for market participants to build advanced batteries with constrained raw materials, presenting potential opportunities for the market in the region.

- Integration of Energy Storage Systems with Automotive Batteries

The increasing synergy between car batteries and energy storage systems offers a transformative opportunity for the ANZ automotive battery market. With the rapid adoption of renewable energy in the region, especially solar and wind power, there is an increasing demand for efficient and dependable energy storage systems to manage inconsistent supply.

Automotive batteries, particularly those utilized in electric vehicles (EVs), are rapidly acknowledged for their capacity to fulfil dual functions. Upon concluding their usage capacity in vehicles, these batteries possess sufficient capacity to be repurposed as stationary energy storage systems for residential, commercial, and grid applications.

The integration offers substantial economic and environmental advantages. People may utilize recycled electric vehicle batteries to store solar energy during daylight hours and supply power to their residences at night, diminishing reliance on the grid and decreasing electricity expenses.

Recycled electric vehicle batteries serve as decentralized storage centres for the energy system, enhancing stability by holding surplus renewable energy during peak output and discharging it during periods of high demand. It follows the ANZ's renewable energy objectives and offers a cost-efficient method to enhance storage capacity without dependence on new materials or production processes.

Consumers are more inclined to invest in electric vehicles if they know the battery has a prolonged lifespan and can be employed beyond the automobile's lifespan. This method also mitigates environmental issues associated with battery waste, establishing a sustainable cycle in which batteries are recycled rather than disposed of.

How Does Regulatory Scenario Shape the Industry?

The regulatory environment in Australia and New Zealand is increasingly shaping the automotive battery market, aimed at accelerating the adoption of electric vehicles (EVs) and promoting sustainable practices. Both nations are implementing policies to reduce carbon emissions, aligning with global climate targets and directly influencing the demand for advanced automotive batteries.

The National Electric Vehicle Strategy in Australia emphasizes transitioning to zero-emission vehicles by addressing affordability and infrastructure challenges. The introduction of EV subsidies, reduced registration fees, and tax exemptions is encouraging the adoption of EVs, thereby driving the demand for lithium-ion batteries. Similarly, Australia’s Modern Manufacturing Strategy prioritizes building local battery production capacity and leveraging the country’s abundant lithium resources.

New Zealand has also launched incentives like the Clean Car Discount and a proposed vehicle emissions standard to encourage clean transportation. Its push for renewable energy integration is boosting the development of energy storage solutions, often linked with automotive battery technologies.

Regulatory attention toward battery recycling and disposal is growing in both countries. Governments are likely to introduce stringent policies requiring battery recycling to minimize environmental impact, fostering a circular economy and stimulating advancements in battery reuse and repurposing technologies.

Segments Covered in the Report

- Demand to Remain High for Lithium Ion Battery

Lithium-ion (Li-Ion) batteries to attain 34% of the market share in the years to come. These have become a cornerstone of the automotive battery market, particularly for electric vehicles (EVs). It is due to their numerous technological advantages addressing the growing demands for efficiency, performance, and sustainability.

Li-Ion batteries offer a high energy density compared to other battery types, such as lead-acid or nickel-metal hydride (NiMH). Due to this, they can store more energy in a small and light package, making them ideal for automotive applications where space and weight are critical.

Li-Ion batteries support rapid charging technology, enabling EVs to achieve ample charging within minutes rather than hours. The Li-Ion addresses a critical barrier to EV adoption by reducing downtime and making EVs more convenient for everyday use.

The huge energy storage capacity ensures consistent power delivery, even for high-performance applications. Also, the long service life of Li-Ion batteries reduces replacement frequency, providing economic benefits to both manufacturers and end users. Maintaining performance over many charge-discharge cycles ensures durability and reliability, which are essential for automotive applications.

- Aftermarket Sales Channel Maintains Dominance in the Market

Automobile batteries experience constant depletion. Despite the extended replacement cycles of these batteries, the continuous growth of aging vehicle fleets offers significant development opportunities for vendors in the automotive battery aftermarket.

The growth of automotive fleets and the limited production of vehicles in Australia and New Zealand have led to an increase in aftermarket installation rates. These factors contribute to significant sales through an aftermarket sales channel in the ANZ automobile battery market.

The aftermarket sales channel leads the revenue chart of the market due to the combination of an aging vehicle fleet, the relatively slow rate of new vehicle production, the extended replacement cycles of batteries, and the increasing demand for fleet maintenance.

As vehicle owners and fleet operators continue to rely on replacement batteries to keep their vehicles running efficiently, the aftermarket channel will continue to experience robust growth, contributing significantly to overall market revenue.

Regional Analysis

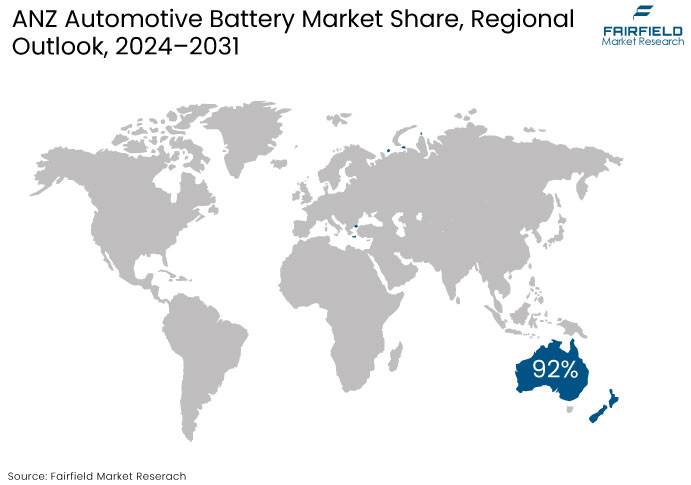

- Australia Accumulates Larger Share of the Market

Australia obtains 92% of the market share. The market in Australia is uplifted by the rising demand for electric cars and increasing government initiatives to promote electric vehicle adoption to mitigate pollution from fuel-based vehicles.

The Federal Chamber of Australia's Automotive Industries reported that new vehicle registrations reached 88,000 units in January 2023, reflecting a 12.4% rise compared to January 2022.

SUV sales totalled 574,632 units, reflecting an 8.1% increase. LCV sales reached 256,382 units, indicating a 1.2% increase; and MHCV sales amounted to 47,359 units, signifying a 9.3% increase compared to the prior year. The increase in vehicle demand accounts for the substantial market share of the country's automotive battery requirements.

- New Zealand Automotive Battery Market to Grow Notably

The New Zealand market is anticipated to expand at a remarkable CAGR of 8.5% due to the evolving automotive finance environment and the proliferation of electric vehicles in the nation. The demand for electric vehicles in the country is steadily increasing, bolstered by government subsidies for consumers intending to purchase an electric vehicle.

The average license holder owns more than one vehicle with 4.4 million light cars nationwide. New Zealand possesses one of the highest rates of automobile ownership per 1,000 individuals globally, which propels the market expansion of automotive batteries in the nation.

Fairfield’s Competitive Landscape Analysis

The ANZ automotive battery market is one of the moderately fragmented markets, in which tier-1 players account for roughly 25% of the market share. Approximately 75% of the market share is served by tier-2 or next-level competitors in Australia and New Zealand.

Leading market players are augmenting their production capabilities across Australia and New Zealand. Prominent market players in automotive batteries are focusing on business expansion via collaborations and alliances to enhance their domestic and international market position, alongside launching new products to broaden their offerings.

Key Market Companies

- GS Yuasa Corporation

- Exide Technologies

- East Penn Manufacturing Company

- Clarios Delkor Corporation

- ENERSYS

- Panasonic Corp.

- Supercharge Batteries

- Hankook AtlasBX Co. Ltd.

- FIAMM Energy Technology S.p.A.

- Marshall Batteries

Recent Industry Developments

- In February 2024, Volvo signed an acquisition deal with Proterra's battery to enhance its EV battery production capabilities and produce highly efficient batteries.

- In March 2024, Panasonic and LG Chem signed a collaboration deal to meet the rising demand for EV batteries with new technology and expanded production.

An Expert’s Eye

- A rising shift toward electric and hybrid vehicles propels demand for advanced battery types, particularly lithium-ion batteries.

- Government policies promoting clean transportation and increasing environmental consciousness among consumers are driving the market forward.

- Innovations in battery technology are improving energy density, charging speeds, and overall battery performance, making EVs more attractive.

- The expansion of battery manufacturing and ongoing research and development will be crucial for meeting future demand for EV batteries.

ANZ Automotive Battery Market is Segmented as-

By Battery Type

- Lead Acid

- Lithium Ion

- Nickel Metal Hydride

By Vehicle Type

- Internal Combustion Engine

- Electric & Hybrid Vehicles

By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Country

- Australia

- New Zealand

1. Executive Summary

1.1. ANZ Automotive Battery Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019 - 2023

3.1. ANZ Automotive Battery Market Production Output, by Country, Value (US$ Mn) and Volume (Million Units), 2019 - 2023

3.1.1. Australia

3.1.2. New Zealand

4. Price Analysis, 2019 - 2023

4.1. Average Price Analysis, by Vehicle Type/Battery Type, US$ Per Units, 2019 - 2023

4.2. Prominent Factor Affecting ANZ Automotive Battery Prices

4.3. Average Price Analysis, by Region, US$ Per Unit

5. ANZ Automotive Battery Market Outlook, 2019 - 2031

5.1. ANZ Automotive Battery Market Outlook, by Battery Type, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Lead Acid

5.1.1.1.1. Flooded

5.1.1.1.2. Absorbed Glass Mat

5.1.1.1.3. Gel Cell Battery

5.1.1.2. Lithium Ion

5.1.1.3. Nickel Metal Hydride (NiMH)

5.1.1.4. Others

5.2. ANZ Automotive Battery Market Outlook, by Vehicle Type, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Internal Combustion (IC) Engine

5.2.1.1.1. Two Wheelers

5.2.1.1.2. Passenger Cars

5.2.1.1.3. Light Commercial Vehicle (LCV)

5.2.1.1.4. Heavy Commercial Vehicle (HCV)

5.2.1.2. Electric and Hybrid Vehicles

5.2.1.2.1. Two Wheelers

5.2.1.2.2. Passenger Cars

5.2.1.2.3. Light Commercial Vehicle (LCV)

5.2.1.2.4. Heavy Commercial Vehicle (HCV)

5.3. ANZ Automotive Battery Market Outlook, by Sales Channel, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Original Equipment Manufacturer (OEM)

5.3.1.2. Aftermarket

5.4. ANZ Automotive Battery Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Australia Automotive Battery Market by Battery Type, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.4.1.2. Australia Automotive Battery Market by Vehicle Type, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.4.1.3. Australia Automotive Battery Market by Sales Channel, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.4.1.4. New Zealand ANZ Automotive Battery Market by Battery Type, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.4.1.5. New Zealand ANZ Automotive Battery Market by Vehicle Type, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.4.1.6. New Zealand ANZ Automotive Battery Market by Sales Channel, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Competitive Landscape

6.1. Product vs Indication Heatmap

6.2. Company Market Share Analysis, 2022

6.3. Competitive Dashboard

6.4. Company Profiles

6.4.1. GS Yuasa Corporation

6.4.1.1. Company Overview

6.4.1.2. Product Portfolio

6.4.1.3. Financial Overview

6.4.1.4. Business Strategies and Development

6.4.2. Exide Technologies

6.4.2.1. Company Overview

6.4.2.2. Product Portfolio

6.4.2.3. Financial Overview

6.4.2.4. Business Strategies and Development

6.4.3. East Penn Manufacturing Company

6.4.3.1. Company Overview

6.4.3.2. Product Portfolio

6.4.3.3. Financial Overview

6.4.3.4. Business Strategies and Development

6.4.4. Clarios Delkor Corporation

6.4.4.1. Company Overview

6.4.4.2. Product Portfolio

6.4.4.3. Financial Overview

6.4.4.4. Business Strategies and Development

6.4.5. ENERSYS

6.4.5.1. Company Overview

6.4.5.2. Product Portfolio

6.4.5.3. Financial Overview

6.4.5.4. Business Strategies and Development

6.4.6. Panasonic Corp.

6.4.6.1. Company Overview

6.4.6.2. Product Portfolio

6.4.6.3. Financial Overview

6.4.6.4. Business Strategies and Development

6.4.7. Supercharge Batteries

6.4.7.1. Company Overview

6.4.7.2. Product Portfolio

6.4.7.3. Financial Overview

6.4.7.4. Business Strategies and Development

6.4.8. Hankook AtlasBX Co. Ltd.

6.4.8.1. Company Overview

6.4.8.2. Product Portfolio

6.4.8.3. Financial Overview

6.4.8.4. Business Strategies and Development

6.4.9. FIAMM Energy Technology S.p.A.

6.4.9.1. Company Overview

6.4.9.2. Product Portfolio

6.4.9.3. Financial Overview

6.4.9.4. Business Strategies and Development

6.4.10. Marshall Batteries

6.4.10.1. Company Overview

6.4.10.2. Product Portfolio

6.4.10.3. Financial Overview

6.4.10.4. Business Strategies and Development

7. Appendix

7.1. Research Methodology

7.2. Report Assumptions

7.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Battery Coverage |

|

|

Vehicle Type Coverage |

|

|

Sales Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |