Application Crowdtesting Services Market Forecast

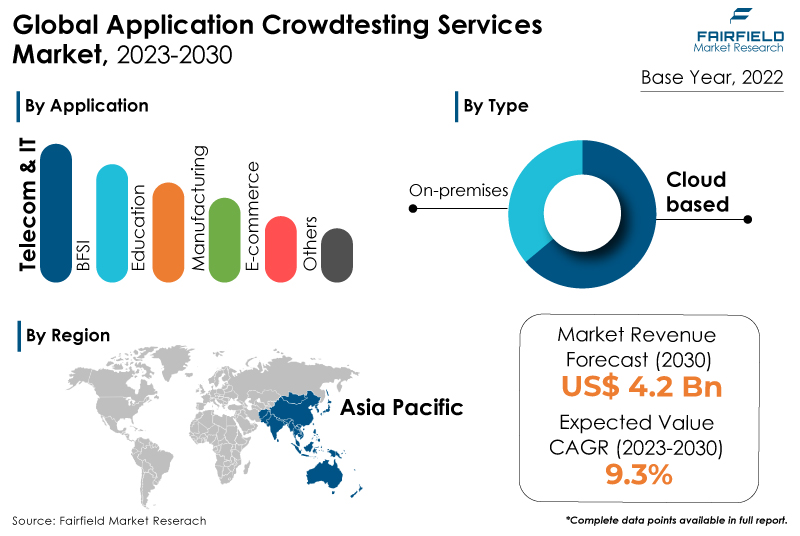

- Global application crowdtesting services market to rise high at 9.3% CAGR during the 2023 - 2030

- Application crowdtesting services market size to exceed the valuation of US$4.28 Bn at the end of 2030

Market Analysis in Brief

Application crowdtesting is a type of software testing where the quality and performance of software applications are examined and evaluated by a diverse population of testers, known as a crowd. It means utilising the strength of a global pool of testers from varied backgrounds who can provide insightful feedback from various perspectives on multiple devices and platforms. Establishing the scope and goals of the testing is the first step in the crowd-testing process, followed by creating test cases and scenarios. These test cases are subsequently made available to testers, who execute them using a variety of hardware, operating systems, and network setups. One of the important issues is the growing complexity and variety of software applications across various platforms, devices, and operating systems.

Organisations are having trouble ensuring the quality and interoperability of their apps across all of these factors due to the rapid advancement of technology. Crowdtesting services give users access to a huge tester community with testers using a variety of hardware, operating systems, and network configurations, enabling thorough and in-the-field testing. The need for speedy testing that is scalable and adaptable is another aspect. Traditional in-house testing teams could run into limitations regarding materials, equipment, and time. One element that can affect the consistency and dependability of results is the lack of control over the testing environment and tester credentials.

Key Report Findings

- The market for application crowdtesting services will demonstrate significant expansion in revenue over the next seven years, i.e., between 2023 and 2030.

- Application crowd-testing services are increasingly in demand because of the growing complexity of software applications, the need for scalability and adaptability, cost-effectiveness, and the chance to employ a variety of perspectives and experiences.

- Demand for cloud-based services remains higher in the application crowdtesting services market.

- The telecom & IT category held the highest application crowdtesting services market revenue share in 2022.

- Asia Pacific will continue to lead its way, whereas North America's application crowdtesting services market will experience significant growth till 2030.

Growth Drivers

Scaling Software Quality Assurance for Improved Customer Experience

The fast digitalisation over the past two decades has increased technology adoption among businesses. The quantity of digital goods and services is growing along with the level of digitisation. A 2016 research found that there were over 24,000 different Android devices. Companies are figuring out feasible, rational ways to plan the testing of their applications across all potential configurations of mobile devices and operating systems to give the greatest User Experience (UX). They make investments in cutting-edge end-user testing solutions such as application crowdtesting services to lessen the need for a feature-rich and customer-focused product offering. This product selection has become crucial in determining a product's success.

Between April and June 2021 alone, over 313 million tablets and smartphones were shipped, with Android powering over 80% of these new gadgets, according to InMobi. End user testing on applications in actual environments uses a variety of hardware, software, and operating systems to assist businesses in guaranteeing consistency in both quality and user experience. Due to the growing number of devices and growing digitalisation, organisations are predicted to utilize application crowdtesting services more frequently.

Swift Growth of IoT

IoT is a crucial approach to digital transformation and has given rise to several end-user applications. By 2027, 51% of cellular IoT connections will be made up of huge IoT, according to the Ericsson Mobility Report, 2021. As the globe becomes more connected, so does the number of companies offering IoT testing services. IoT solutions require extensive product engagement with customers and other IoT products and solutions. Due to this exponential growth, many IoT devices require greater user involvement.

System testing can be done effectively via application crowdtesting services. The problems associated with other multiple IoT connections can be resolved by employing application crowdtesting services for IoT solutions. There is a significant market opportunity for application crowdtesting services companies with the expansion of IoT devices.

Diverse Testing Expertise to Propel Market Growth

The market for application crowdtesting services has grown significantly in recent years, propelled by several reasons that have altered the software testing landscape. Application crowdtesting services are the practice of assigning work to a varied set of testers, frequently from various geographical places, to review software applications across a range of devices and situations.

Application crowdtesting services give users access to a huge pool of testers with various backgrounds and specialties. This diversity guarantees thorough test coverage and enables the discovery of faults and usability problems that conventional in-house testing teams might miss. Market participants are actively looking to offer novel solutions to improve clients' digital experiences. For instance, the Product Excellence Platform (PEP) was introduced by Applause App Quality, Inc. in February 2021. This platform allows businesses to access digital testing tools and specialists.

Overview of Key Segments

Cloud-based Services in Demand

The cloud sector acquired a major revenue share in the market for application crowdtesting services. The need for cloud-based platforms has grown recently due to advantages, including improved collaboration, the chance to share designs with stakeholders, little to no installation process, and an integrated data management system. In addition, businesses are quickly introducing cloud-based CAD software in the wake of the coronavirus pandemic, which gives staff members remote access to a tool for creating and editing technical drawings for ongoing projects.

Additionally, the on-premises sector experienced significant growth. The segment is driven by on-premises software's capacity to deliver improved data protection and consistent services without an internet connection. Additionally, on-premises software allows for flexible access to the system by multiple users without slowing down data transfer. However, additional hardware, such as servers, and costly license fees make on-premises software more expensive than cloud-based software. Because of this, different end-use businesses are turning more attention to cloud-based software, which impacts market data for the on-premises software category.

Telecom & IT Sector Remains the Leading Application Area

The telecom and IT segment accounted for the largest revenue share in the market for application crowdtesting services. The rise in demand for secure software testing services among IT & telecom firms is a factor in the market's expansion in this sector. Billing update systems, web-based platforms, and operations and maintenance platforms frequently use automated software solutions. The market's demand for application crowdtesting services would rise due to these platforms' need for a very secure and scalable interface.

The BFSI sector accounted for a sizeable portion of the market for application crowdtesting services. The BFSI industry has a considerable demand for application crowd-testing services. This business requires strong and secure software solutions due to its activities' sensitivity and regulated nature. Crowdtesting helps BFSI organisations learn about their apps in the real world and identify any potential flaws, security risks, and usability problems. Crowd-testing may help the BFSI sector's software solutions meet the sector's stringent requirements while improving their quality, dependability, and compliance.

Growth Opportunities Across Regions

Asia Pacific Continues Dominance

In Asia Pacific, the industry is predicted to expand at a substantial rate. The area benefits from its rising smartphone and internet usage and its burgeoning technology infrastructure. Due to its sizable population, Asia Pacific is seeing a surge in the use of mobile applications for various reasons, including online shopping and mobile banking services, thanks to its enormous population. As a result, there is a rising need in the area for effective apps that can work seamlessly across numerous platforms and devices in various industries. In this situation, application crowdtesting services are essential for improving the test lifecycle as a whole and the consumer experience.

Businesses may make sure that their applications satisfy the needs and expectations of customers in the area by utilising application crowdtesting services. In addition, the Indian application crowdtesting services market had the highest growth rate in Asia Pacific, while China's market had the largest market share.

North America Stores Ample Opportunity

In terms of market share, North America is predicted to acquire a significant market share in the application crowdtesting services sector. A sizable chunk of the market in this area is controlled by the US. A great user experience must be ensured across the broadest range of devices, underscoring the need for application crowdtesting services.

The US, and Canada are two key contributors to technology development in this region. For instance, a poll published in June 2019 found that the number of smartphone users in North America has doubled over the last five years, reaching 9.3 million. This is in line with the growing popularity of smartphones in the region. The QA for some of the biggest businesses in the world, like Facebook, Microsoft, and Warner Bros., is also powered by organisations like Global App Testing.

Worldwide app testing helps provide significantly higher quality applications by reducing the time and effort spent on testing while giving the above companies access to worldwide testers for real-world findings. The area demonstrates strong research and development (R&D) levels, technical advancements in mobile apps, and a supportive cloud ecosystem. These elements encourage the expansion of application development in the area, which in turn encourages the use of application crowdtesting services.

Application Crowdtesting Services Market: Competitive Landscape

Some of the leading players at the forefront in the application crowdtesting services market space include Infosys Limited, Cigniti Technologies, EPAM Systems, Inc., Digivante Ltd., Global App Testing, Cobalt Labs Inc., and Intigriti.

Recent Notable Developments

In January 2022, Testlio, the pioneer of networked testing, introduced fused testing. This innovative methodology combines professional human testing with the effectiveness of test automation, assisting engineers and product executives in meeting increased customer demands for excellent digital experiences. Fused testing combines automated and manual testing as a direct reaction to the tension in the software development process between quality, speed, and coverage.

In February 2021, Applause App Quality Inc., a crowdsourced testing solutions company, today announced the launch of its Product Excellent Platform, which will provide customers with enterprise-grade software-as-a-service infrastructure, digital testing solutions, and access to the world's largest community of digital experts. Applause wants to employ PEP to provide consumers and brands with the capacity to discover flaws in software before it is deployed and insight into quality for development pipelines across the full application development lifecycle.

Global Application Crowdtesting Services Market is Segmented as Below:

By Type

- Cloud-based

- On-premises

By Application

- BFSI

- Education

- Manufacturing

- Telecom & IT

- E-commerce

- Others

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Application Crowdtesting Services Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Application Crowdtesting Services Market Outlook, 2018 - 2030

3.1. Global Application Crowdtesting Services Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Cloud-Based

3.1.1.2. On-Premises

3.2. Global Application Crowdtesting Services Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. BFSI

3.2.1.2. Education

3.2.1.3. Manufacturing

3.2.1.4. Telecom & IT

3.2.1.5. E-Commerce

3.2.1.6. Others

3.3. Global Application Crowdtesting Services Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Application Crowdtesting Services Market Outlook, 2018 - 2030

4.1. North America Application Crowdtesting Services Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Cloud-Based

4.1.1.2. On-Premises

4.2. North America Application Crowdtesting Services Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. BFSI

4.2.1.2. Education

4.2.1.3. Manufacturing

4.2.1.4. Telecom & IT

4.2.1.5. E-Commerce

4.2.1.6. Others

4.2.2. Market Attractiveness Analysis

4.3. North America Application Crowdtesting Services Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Application Crowdtesting Services Market Outlook, 2018 - 2030

5.1. Europe Application Crowdtesting Services Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Cloud-Based

5.1.1.2. On-Premises

5.2. Europe Application Crowdtesting Services Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. BFSI

5.2.1.2. Education

5.2.1.3. Manufacturing

5.2.1.4. Telecom & IT

5.2.1.5. E-Commerce

5.2.1.6. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Application Crowdtesting Services Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

5.3.1.9. Russia Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.10. Russia Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

5.3.1.11. Rest of Europe Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.12. Rest of Europe Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Application Crowdtesting Services Market Outlook, 2018 - 2030

6.1. Asia Pacific Application Crowdtesting Services Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Cloud-Based

6.1.1.2. On-Premises

6.2. Asia Pacific Application Crowdtesting Services Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. BFSI

6.2.1.2. Education

6.2.1.3. Manufacturing

6.2.1.4. Telecom & IT

6.2.1.5. E-Commerce

6.2.1.6. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Application Crowdtesting Services Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Application Crowdtesting Services Market Outlook, 2018 - 2030

7.1. Latin America Application Crowdtesting Services Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Cloud-Based

7.1.1.2. On-Premises

7.2. Latin America Application Crowdtesting Services Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. BFSI

7.2.1.2. Education

7.2.1.3. Manufacturing

7.2.1.4. Telecom & IT

7.2.1.5. E-Commerce

7.2.1.6. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Application Crowdtesting Services Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

7.3.1.5. Rest of Latin America Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.6. Rest of Latin America Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Application Crowdtesting Services Market Outlook, 2018 - 2030

8.1. Middle East & Africa Application Crowdtesting Services Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Cloud-Based

8.1.1.2. On-Premises

8.2. Middle East & Africa Application Crowdtesting Services Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. BFSI

8.2.1.2. Education

8.2.1.3. Manufacturing

8.2.1.4. Telecom & IT

8.2.1.5. E-Commerce

8.2.1.6. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Application Crowdtesting Services Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

8.3.1.5. Rest of Middle East & Africa Application Crowdtesting Services Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.6. Rest of Middle East & Africa Application Crowdtesting Services Market by Application, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Market Share Analysis, 2022

9.2. Competitive Dashboard

9.3. Company Profiles

9.3.1. Infosys Limited

9.3.1.1. Company Overview

9.3.1.2. Product Portfolio

9.3.1.3. Financial Overview

9.3.1.4. Business Strategies and Development

9.3.2. Cigniti Technologies

9.3.2.1. Company Overview

9.3.2.2. Product Portfolio

9.3.2.3. Financial Overview

9.3.2.4. Business Strategies and Development

9.3.3. EPAM Systems Inc.

9.3.3.1. Company Overview

9.3.3.2. Product Portfolio

9.3.3.3. Financial Overview

9.3.3.4. Business Strategies and Development

9.3.4. YesWeHack

9.3.4.1. Company Overview

9.3.4.2. Product Portfolio

9.3.4.3. Financial Overview

9.3.4.4. Business Strategies and Development

9.3.5. HackerOne

9.3.5.1. Company Overview

9.3.5.2. Product Portfolio

9.3.5.3. Financial Overview

9.3.5.4. Business Strategies and Development

9.3.6. Digivante Ltd.

9.3.6.1. Company Overview

9.3.6.2. Product Portfolio

9.3.6.3. Financial Overview

9.3.6.4. Business Strategies and Development

9.3.7. Bugcrowd

9.3.7.1. Company Overview

9.3.7.2. Product Portfolio

9.3.7.3. Financial Overview

9.3.7.4. Business Strategies and Development

9.3.8. Global App Testing

9.3.8.1. Company Overview

9.3.8.2. Product Portfolio

9.3.8.3. Financial Overview

9.3.8.4. Business Strategies and Development

9.3.9. Cobalt Labs Inc.

9.3.9.1. Company Overview

9.3.9.2. Product Portfolio

9.3.9.3. Financial Overview

9.3.9.4. Business Strategies and Development

9.3.10. Intigriti

9.3.10.1. Company Overview

9.3.10.2. Product Portfolio

9.3.10.3. Financial Overview

9.3.10.4. Business Strategies and Development

9.3.11. Qualitrix

9.3.11.1. Company Overview

9.3.11.2. Product Portfolio

9.3.11.3. Financial Overview

9.3.11.4. Business Strategies and Development

9.3.12. Flatworld Solutions

9.3.12.1. Company Overview

9.3.12.2. Product Portfolio

9.3.12.3. Financial Overview

9.3.12.4. Business Strategies and Development

9.3.13. Synack

9.3.13.1. Company Overview

9.3.13.2. Product Portfolio

9.3.13.3. Financial Overview

9.3.13.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |