Global Aquafaba Market Forecast

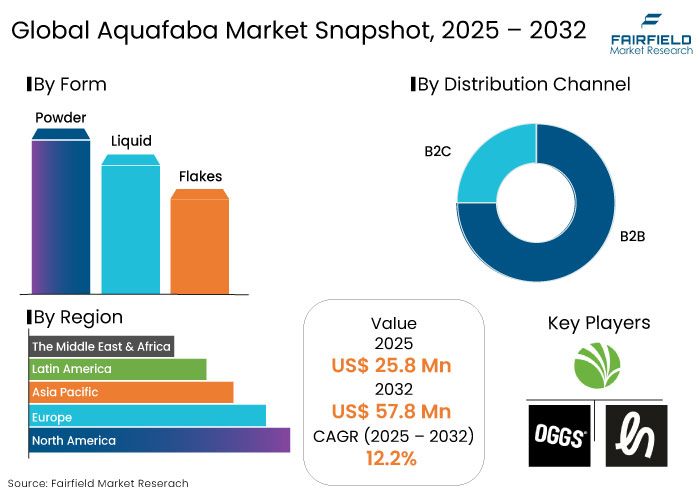

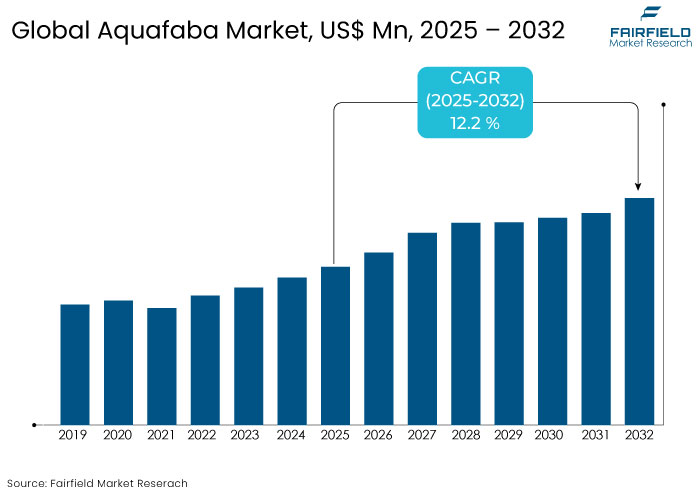

- The global aquafaba market is projected to be valued at US$ 57.8 Mn by 2032, exhibiting significant growth from the US$ 25.8 Mn achieved in 2025.

- The market for aquafaba is expected to expand significantly, with a CAGR of 12.2 % between 2025 and 2032.

Aquafaba Market Insights

- Aquafaba has emerged as a versatile and sustainable replacement for egg whites, gaining popularity in vegan, gluten-free, and allergen-friendly cooking and baking.

- Aquafaba significantly lowers the carbon footprint of products by up to 85% compared to traditional eggs, making it a critical ingredient for eco-conscious and ethical food production.

- Aquafaba enhances the nutritional profile of foods by reducing calories, fat, and salt, while addressing health-conscious consumer demands for lower cholesterol and heart-friendly options.

- Aquafaba is gaining traction across international markets, driven by the universal adoption of plant-based diets and the global shift toward sustainable food systems.

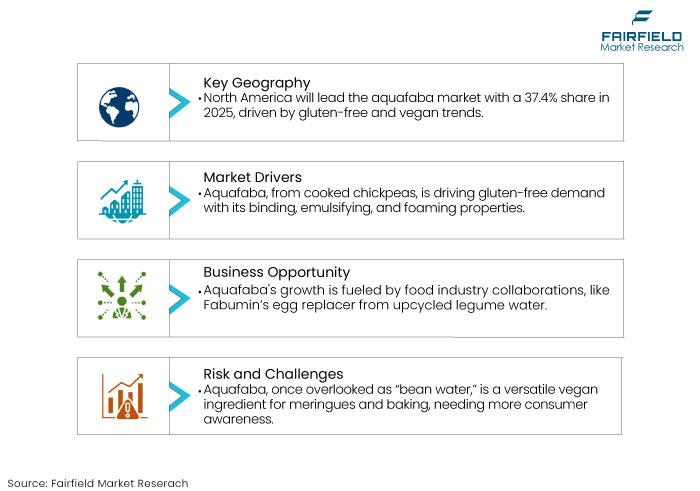

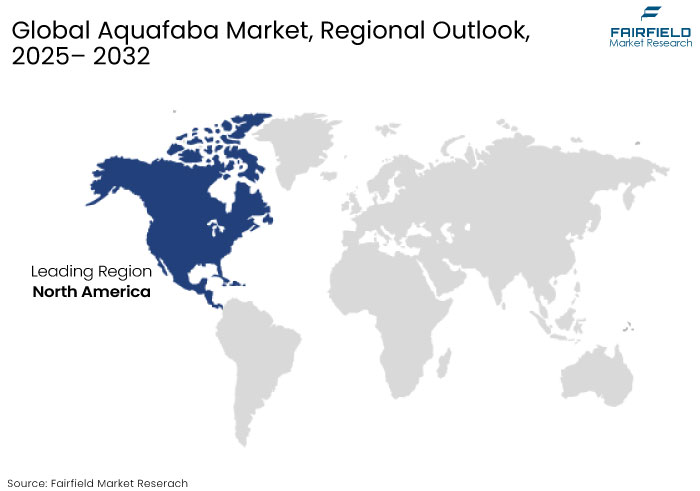

- In 2025, the aquafaba market in North America is projected to hold 37.4% market share, attributed to the rising incidence of and celiac disease and gluten allergies.

Key Growth Determinants

- Aquafaba’s Role in Meeting the Surge in Gluten-Free and Allergen-Friendly Demand

A key component of the rising demand for gluten-free and allergen-friendly food items brought on by heightened knowledge of dietary sensitivities and food allergies is aquafaba, which is made from cooked chickpeas and has the ability to bind, emulsify, and foam.

In gluten-free baking, aquafaba is a sustainable and natural ingredient that adds structure, moisture, and leavening without causing allergies. Cookies, cakes, muffins, sauces, drinks, and plant-based mayonnaise all include it. Innovation in the food and beverage sector is fueled by its capacity to satisfy gluten-free and allergy-friendly requirements, guaranteeing clean-label solutions and transparency.

- According to data from Beyond Celiac, Globally, about 1.4% of the population is affected by celiac disease, with significant regional differences. In the U.S., 1 in 133 people are affected, though up to 83% remain undiagnosed.

- Finland and Italy have higher prevalence rates, with 1.99% of Finland’s population and 1.6% of children in Italy affected. North Africa reports some of the highest global rates. Alongside celiac disease, millions suffer from non-celiac gluten sensitivity, increasing demand for gluten-free options.

- Rising Demand for Vegan Products Boost Utilization of Aquafaba

The unique qualities of aquafaba, a plant-based ingredient, such as emulsification, foaming, and binding, which replicate the functions of eggs, are making it more and more popular. This promotes sustainability and appeals to consumers who are sensitive to allergies and health issues.

Vegan mayonnaise has been developed by companies like Hellmann's and Follow Your Heart, while egg-free cakes and sweets have been introduced by Oggs. Additionally, businesses such as Vor Foods and Chickplease provide vegan macarons and meringues. Furthermore, aquafaba is used to create foam in drinks like whiskey sours. Its sustainability is further reinforced by its use in the manufacturing of pre-packaged goods and gluten-free bread.

Key Growth Barriers

- Limited Awareness Stalls Mainstream Adoption of Aquafaba

As the demand for plant-based and vegan cuisine expands, aquafaba is a little-known but incredibly valuable product. Often dismissed as unpleasant "bean water," this liquid from canned or cooked chickpeas has amazing uses, including making airy meringues and serving as a binding agent in baking. Aquafaba must educate customers about these advantages if it hopes to become popular among homes and businesses looking for environmentally friendly substitutes.

Misconceptions regarding its health and safety further impede acceptance. Concerns about BPA, excessive salt, and stomach discomfort can be addressed via education. The awareness gap is maintained because home chefs frequently avoid aquafaba in favor of more recognizable alternatives like flaxseed or applesauce. Clear usage rules and focused instructional programs are crucial to achieving aquafaba's full potential. Raising awareness will enable researchers to transform aquafaba from a specialized product into a commonly used mainstay in contemporary cookery.

- Aquafaba Market Trends and Opportunities

Collaborative Efforts Propel Aquafaba's Growth in the Food Industry

Strategic collaborations with food manufacturers are driving the rapid growth of aquafaba as a transformative ingredient in the food industry. An example is Fabumin, an Israeli startup that has developed a powdered egg replacer from upcycled legume water waste. This innovation has garnered interest from major food brands due to its functional properties and sustainability.

Fabumin’s powdered format offers greater stability and ease of handling than traditional liquid aquafaba, making it suitable for large-scale production. The drying process also recycles up to 80% of the water waste from legume processing, supporting sustainability goals. Fabumin’s partnerships enable aquafaba to replace eggs in items like cakes and sauces, providing a cost-effective, eco-friendly alternative.

Beyond food, aquafaba has potential applications in cosmetics, cultivated meat, and microbiome solutions. With increasing production, aquafaba is set to replace millions of eggs globally, conserving resources and meeting consumer demand for ethical, plant-based options. This collaborative approach underscores aquafaba’s role in sustainable innovation.

Segments Covered in the Report

- Liquid form holds the maximum share of the Aquafaba market

Liquid form is anticipated to dominate the global market with a CAGR of 11.8% from 2025 to 2032. The liquid form of aquafaba leads the market due to its convenience and versatility. Sourced from canned or cooked chickpeas, it’s ready to use without extra processing and mimics egg whites in texture, allowing for easy recipe substitutions.

Valued for its functional properties like emulsification, foaming, and binding, liquid aquafaba is ideal for baking, confectionery, and sauces. It is whipped into meringues, mousses, and macarons, achieving the airy quality of eggs, and is also a popular ingredient for vegan mayonnaise and salad dressings.

Brands like Haden’s Aquafaba and SOS Chefs offer pre-packaged options, making it accessible for both home cooks and food service industries. Its convenience, cost-effectiveness, and sustainability have solidified liquid aquafaba's dominant position across various food categories.

- Among End Use categories, baking and confectionery lead the aquafaba market.

The baking and confectionery industry dominates the aquafaba market because of its useful qualities, which enable goods that are free of dairy, eggs, and allergies. For cakes, cookies, macarons, meringues, and brownies, aquafaba is crucial because it offers structural integrity, moisture retention, and leavening properties. It whips into firm peaks in confections, giving vegan marshmallows, mousses, and meringues their airy textures.

Aquafaba is used by companies like Oggs and Vor Foods to simulate egg-based goods, making them acceptable to vegetarians and anyone with dietary restrictions. Further solidifying its place in the industry is the increasing demand for baked goods that are free of gluten and other allergens.

Regional Analysis

- North America Caters the Demand for Healthy Dietary Preferences

The aquafaba market in North America is set to dominate globally, holding a 37.4% market share in 2025, driven by the rising prevalence of celiac disease, gluten allergies, and vegan dietary preferences.

The Celiac Disease Foundation estimates that 1 in 133 Americans suffer from celiac disease, while 6% of the U.S. population has gluten sensitivity, increasing demand for plant-based and allergen-free alternatives. The region’s food innovation ecosystem, supported by major companies like Ingredion and The EVERY Company, facilitates the commercialization of aquafaba-based egg replacements.

The U.S. vegan population grew by 600% between 2014 and 2021, further fueling aquafaba’s popularity. Expanding retail and e-commerce channels, including Whole Foods and Amazon, make aquafaba more accessible to consumers. Additionally, sustainability concerns surrounding egg production and food waste reduction efforts have positioned aquafaba as an eco-friendly alternative. These factors contribute to North America’s leadership in the global aquafaba industry, promoting continued market expansion.

- Europe Presents Lucrative Avenues for Plant-Based Food Items

As the need for plant-based and allergy-free food options grows, the European aquafaba market is anticipated to maintain a sizable position in 2025. Since 9% of Europeans identify as vegetarians or vegans, there is a growing need for egg alternatives like aquafaba. Companies like Nestlé and Oggs are helping countries like Germany, the UK, and France lead the way in plant-based innovation.

Adoption is also being fueled by the EU's strict food sustainability laws as well as rising worries about carbon emissions and animal welfare. Europe is firmly establishing itself as a major market for aquafaba-based goods owing to its growing retail and food service applications, which include bread and confectionery.

Fairfield’s Competitive Landscape Analysis

The global aquafaba market is growing rapidly as demand for plant-based, allergen-free, and sustainable ingredients increases. Key players are innovating to develop new products that utilize aquafaba's versatility as an egg substitute in various food categories, including baking, sauces, and beverages.

Companies like Hellmann's and Follow Your Heart have created vegan mayonnaise using aquafaba, while Oggs has introduced cakes and cookies made entirely with it. Vor Foods and Chickplease have produced vegan meringues and macarons, capitalizing on aquafaba's foaming properties.

Additionally, Haden’s Aquafaba and SOS Chefs offer convenient pre-packaged aquafaba solutions for consumers. As more companies enter the market, competition is expected to intensify, driven by the need to meet the rising demand for plant-based food ingredients.

Key Market Companies

- OGGS

- Happy Dance

- Haden's Aquafaba

- Ingredion Incorporated

- Dasca Group

- The Very Food Co.

- Casa Amella Bio Food SLU

- EURO S.P.I.D. srl

- Symrise

- SOS Chefs

- Chickplease

- Saheli

Recent Industry Developments

- In November 2024, Fabumin received the award for 2024 Fi Europe Startup Challenge highlighting the innovation in the B2B ingredient space

- In September 2023, Symrise launched new chickpea and aquafaba-based ingredients aimed at enhancing plant-based products. These ingredients offer improved texture, emulsification, and foaming properties, making them ideal egg substitutes in vegan and clean-label foods.

Global Aquafaba Market is Segmented as -

By Form

- Powder

- Liquid

- Flakes

By End Use

- Sauces and Dressing

- Cocktails

- Baking and Confectionary

- Cakes and Pastries

- Cookies and Biscuits

- Breads and Muffins

- Others

By Distribution Channel

- B2B

- B2C

- Hypermarket/Supermarket

- Convenience Store

- Online Retail

- Other

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Aquafaba Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Edible Insects Market Outlook, 2019 - 2032

3.1. Global Aquafaba Market Outlook, by Form, Value (US$ Mn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Powder

3.1.1.2. Liquid

3.1.1.3. Flakes

3.2. Global Aquafaba Market Outlook, by End Use, Value (US$ Mn), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Sauces and Dressing

3.2.1.2. Cocktails

3.2.1.3. Baking and Confectionary

3.2.1.3.1. Cakes and Pastries

3.2.1.3.2. Cookies and Biscuits

3.2.1.3.3. Breads and Muffins

3.2.1.3.4. Others

3.3. Global Aquafaba Market Outlook, by Distribution Channel, Value (US$ Mn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. B2B

3.3.1.2. B2C

3.3.1.2.1. Hypermarket/Supermarket

3.3.1.2.2. Convenience Store

3.3.1.2.3. Online Retail

3.3.1.2.4. Other

3.4. Global Aquafaba Market Outlook, by Region, Value (US$ Mn), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Edible Insects Market Outlook, 2019 - 2032

4.1. North America Aquafaba Market Outlook, by Form, Value (US$ Mn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Powder

4.1.1.2. Liquid

4.1.1.3. Flakes

4.2. North America Aquafaba Market Outlook, by End Use, Value (US$ Mn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Sauces and Dressing

4.2.1.2. Cocktails

4.2.1.3. Baking and Confectionary

4.2.1.3.1. Cakes and Pastries

4.2.1.3.2. Cookies and Biscuits

4.2.1.3.3. Breads and Muffins

4.2.1.3.4. Others

4.3. North America Aquafaba Market Outlook, by Distribution Channel, Value (US$ Mn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. B2B

4.3.1.2. B2C

4.3.1.2.1. Hypermarket/Supermarket

4.3.1.2.2. Convenience Store

4.3.1.2.3. Online Retail

4.3.1.2.4. Other

4.4. North America Aquafaba Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. U.S. Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

4.4.1.2. U.S. Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

4.4.1.3. U.S. Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

4.4.1.4. Canada Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

4.4.1.5. Canada Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

4.4.1.6. Canada Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Edible Insects Market Outlook, 2019 - 2032

5.1. Europe Aquafaba Market Outlook, by Form, Value (US$ Mn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Powder

5.1.1.2. Liquid

5.1.1.3. Flakes

5.2. Europe Aquafaba Market Outlook, by End Use, Value (US$ Mn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Sauces and Dressing

5.2.1.2. Cocktails

5.2.1.3. Baking and Confectionary

5.2.1.3.1. Cakes and Pastries

5.2.1.3.2. Cookies and Biscuits

5.2.1.3.3. Breads and Muffins

5.2.1.3.4. Others

5.3. Europe Aquafaba Market Outlook, by Distribution Channel, Value (US$ Mn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. B2B

5.3.1.2. B2C

5.3.1.2.1. Hypermarket/Supermarket

5.3.1.2.2. Convenience Store

5.3.1.2.3. Online Retail

5.3.1.2.4. Other

5.4. Europe Aquafaba Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Germany Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

5.4.1.2. Germany Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

5.4.1.3. Germany Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

5.4.1.4. U.K. Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

5.4.1.5. U.K. Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

5.4.1.6. U.K. Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

5.4.1.7. France Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

5.4.1.8. France Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

5.4.1.9. France Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

5.4.1.10. Italy Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

5.4.1.11. Italy Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

5.4.1.12. Italy Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

5.4.1.13. Turkey Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

5.4.1.14. Turkey Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

5.4.1.15. Turkey Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

5.4.1.16. Russia Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

5.4.1.17. Russia Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

5.4.1.18. Russia Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

5.4.1.19. Rest of Europe Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

5.4.1.20. Rest of Europe Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

5.4.1.21. Rest of Europe Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Edible Insects Market Outlook, 2019 - 2032

6.1. Asia Pacific Aquafaba Market Outlook, by Form, Value (US$ Mn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Powder

6.1.1.2. Liquid

6.1.1.3. Flakes

6.2. Asia Pacific Aquafaba Market Outlook, by End Use, Value (US$ Mn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Sauces and Dressing

6.2.1.2. Cocktails

6.2.1.3. Baking and Confectionary

6.2.1.3.1. Cakes and Pastries

6.2.1.3.2. Cookies and Biscuits

6.2.1.3.3. Breads and Muffins

6.2.1.3.4. Others

6.3. Asia Pacific Aquafaba Market Outlook, by Distribution Channel, Value (US$ Mn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. B2B

6.3.1.2. B2C

6.3.1.2.1. Hypermarket/Supermarket

6.3.1.2.2. Convenience Store

6.3.1.2.3. Online Retail

6.3.1.2.4. Other

6.4. Asia Pacific Aquafaba Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. China Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

6.4.1.2. China Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

6.4.1.3. China Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

6.4.1.4. Japan Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

6.4.1.5. Japan Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

6.4.1.6. Japan Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

6.4.1.7. South Korea Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

6.4.1.8. South Korea Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

6.4.1.9. South Korea Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

6.4.1.10. India Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

6.4.1.11. India Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

6.4.1.12. India Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

6.4.1.13. Southeast Asia Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

6.4.1.14. Southeast Asia Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

6.4.1.15. Southeast Asia Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

6.4.1.16. Rest of Asia Pacific Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

6.4.1.17. Rest of Asia Pacific Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

6.4.1.18. Rest of Asia Pacific Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Edible Insects Market Outlook, 2019 - 2032

7.1. Latin America Aquafaba Market Outlook, by Form, Value (US$ Mn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Powder

7.1.1.2. Liquid

7.1.1.3. Flakes

7.2. Latin America Aquafaba Market Outlook, by End Use, Value (US$ Mn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Sauces and Dressing

7.2.1.2. Cocktails

7.2.1.3. Baking and Confectionary

7.2.1.3.1. Cakes and Pastries

7.2.1.3.2. Cookies and Biscuits

7.2.1.3.3. Breads and Muffins

7.2.1.3.4. Others

7.3. Latin America Aquafaba Market Outlook, by Distribution Channel, Value (US$ Mn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. B2B

7.3.1.2. B2C

7.3.1.2.1. Hypermarket/Supermarket

7.3.1.2.2. Convenience Store

7.3.1.2.3. Online Retail

7.3.1.2.4. Other

7.4. Latin America Aquafaba Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Brazil Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

7.4.1.2. Brazil Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

7.4.1.3. Brazil Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

7.4.1.4. Mexico Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

7.4.1.5. Mexico Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

7.4.1.6. Mexico Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

7.4.1.7. Argentina Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

7.4.1.8. Argentina Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

7.4.1.9. Argentina Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

7.4.1.10. Rest of Latin America Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

7.4.1.11. Rest of Latin America Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

7.4.1.12. Rest of Latin America Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Edible Insects Market Outlook, 2019 - 2032

8.1. Middle East & Africa Aquafaba Market Outlook, by Form, Value (US$ Mn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Powder

8.1.1.2. Liquid

8.1.1.3. Flakes

8.2. Middle East & Africa Aquafaba Market Outlook, by End Use, Value (US$ Mn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Sauces and Dressing

8.2.1.2. Cocktails

8.2.1.3. Baking and Confectionary

8.2.1.3.1. Cakes and Pastries

8.2.1.3.2. Cookies and Biscuits

8.2.1.3.3. Breads and Muffins

8.2.1.3.4. Others

8.3. Middle East & Africa Aquafaba Market Outlook, by Distribution Channel, Value (US$ Mn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. B2B

8.3.1.2. B2C

8.3.1.2.1. Hypermarket/Supermarket

8.3.1.2.2. Convenience Store

8.3.1.2.3. Online Retail

8.3.1.2.4. Other

8.4. Middle East & Africa Aquafaba Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. GCC Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

8.4.1.2. GCC Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

8.4.1.3. GCC Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

8.4.1.4. South Africa Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

8.4.1.5. South Africa Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

8.4.1.6. South Africa Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

8.4.1.7. Egypt Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

8.4.1.8. Egypt Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

8.4.1.9. Egypt Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

8.4.1.10. Nigeria Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

8.4.1.11. Nigeria Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

8.4.1.12. Nigeria Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

8.4.1.13. Rest of Middle East & Africa Aquafaba Market by Form, Value (US$ Mn), 2019 - 2032

8.4.1.14. Rest of Middle East & Africa Aquafaba Market by End Use, Value (US$ Mn), 2019 - 2032

8.4.1.15. Rest of Middle East & Africa Aquafaba Market by Distribution Channel, Value (US$ Mn), 2019 - 2032

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Market Share Analysis, 2024

9.2. Competitive Dashboard

9.3. Company Profiles

9.3.1. OGGS

9.3.1.1. Company Overview

9.3.1.2. Product Portfolio

9.3.1.3. Financial Overview

9.3.1.4. Business Strategies and Development

9.3.2. Happy Dance

9.3.2.1. Company Overview

9.3.2.2. Product Portfolio

9.3.2.3. Financial Overview

9.3.2.4. Business Strategies and Development

9.3.3. Haden's Aquafaba

9.3.3.1. Company Overview

9.3.3.2. Product Portfolio

9.3.3.3. Financial Overview

9.3.3.4. Business Strategies and Development

9.3.4. Ingredion Incorporated

9.3.4.1. Company Overview

9.3.4.2. Product Portfolio

9.3.4.3. Financial Overview

9.3.4.4. Business Strategies and Development

9.3.5. Dasca Group

9.3.5.1. Company Overview

9.3.5.2. Product Portfolio

9.3.5.3. Financial Overview

9.3.5.4. Business Strategies and Development

9.3.6. The Very Food Co.

9.3.6.1. Company Overview

9.3.6.2. Product Portfolio

9.3.6.3. Financial Overview

9.3.6.4. Business Strategies and Development

9.3.7. Casa Amella Bio Food SLU

9.3.7.1. Company Overview

9.3.7.2. Product Portfolio

9.3.7.3. Financial Overview

9.3.7.4. Business Strategies and Development

9.3.8. EURO S.P.I.D. srl

9.3.8.1. Company Overview

9.3.8.2. Product Portfolio

9.3.8.3. Financial Overview

9.3.8.4. Business Strategies and Development

9.3.9. Symrise

9.3.9.1. Company Overview

9.3.9.2. Product Portfolio

9.3.9.3. Financial Overview

9.3.9.4. Business Strategies and Development

9.3.10. SOS Chefs

9.3.10.1. Company Overview

9.3.10.2. Product Portfolio

9.3.10.3. Financial Overview

9.3.10.4. Business Strategies and Development

9.3.11. Chickplease

9.3.11.1. Company Overview

9.3.11.2. Product Portfolio

9.3.11.3. Financial Overview

9.3.11.4. Business Strategies and Development

9.3.12. Saheli

9.3.12.1. Company Overview

9.3.12.2. Product Portfolio

9.3.12.3. Financial Overview

9.3.12.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Form |

|

|

End Use |

|

|

Distribution Channel |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |