Global Automatic Lubrication Systems Market Forecast

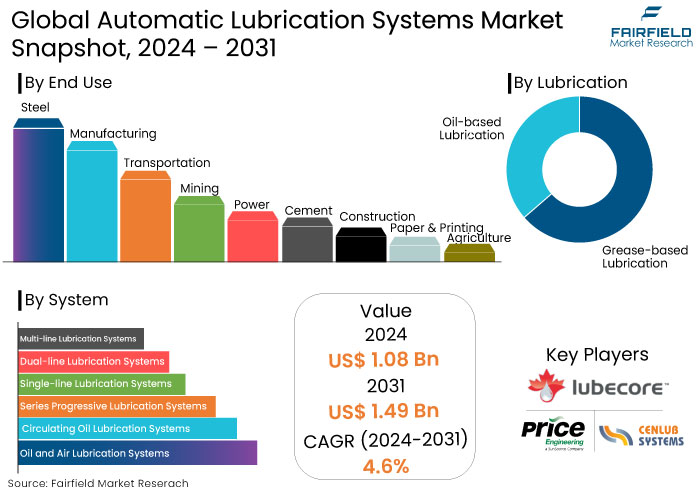

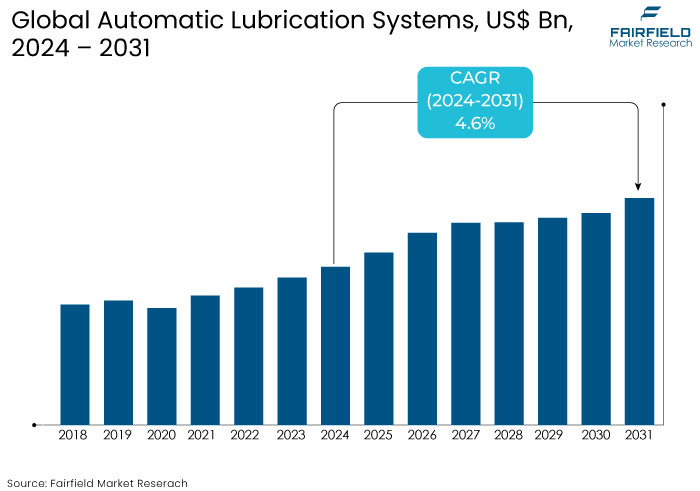

- The automatic lubrication systems market size is projected to reach a value of US$1.49 Bn by 2031, exhibiting significant growth from the US$1.08 Bn achieved in 2024.

- The market for automatic lubrication systems market is likely to secure a significant expansion rate, with a projected CAGR of 4.6% through 2031.

Automatic Lubrication Systems Market Insights

- The automatic lubrication systems market is projected to grow significantly, driven by industrial automation and efficiency demands.

- IoT-enabled lubrication systems are gaining traction, allowing real-time monitoring and predictive maintenance to reduce downtime.

- High adoption rates in industries like mining, manufacturing, and construction, where continuous operation is critical.

- Growing focus on eco-friendly solutions, as automatic systems reduce lubricant waste and align with strict environmental standards.

- Automatic lubrication reduces labour costs and maintenance expenses by delivering precise lubrication and extending machinery life.

- There is rapid growth in emerging markets particularly in Asia Pacific and Latin America due to industrial expansion and infrastructure projects.

- Automated systems enhance workplace safety by reducing the need for manual lubrication in hazardous environments.

- Continuous innovation in delivery methods, including smart sensors and nanotechnology transforms lubrication efficiency.

A Look Back and a Look Forward - Comparative Analysis

The automatic lubrication systems market experienced steady growth during the period from 2019 to 2023, driven by increased industrial automation and the need for efficient machinery maintenance. Sectors such as mining, manufacturing, and construction adopted automatic lubrication to minimize manual intervention, reduce downtime, and enhance equipment lifespan.

Rising labour costs and safety concerns also contributed to the adoption of automated lubrication solutions, as they offered a reliable and safe alternative to manual lubrication, especially in hazardous environments. North America and Europe were leading markets due to their advanced industrial infrastructure, while adoption in emerging markets was slower due to cost constraints and limited awareness.

The market is expected to accelerate, driven by advancements in IoT-enabled lubrication systems and predictive maintenance technologies over the forecast period. IoT integration allows real-time monitoring of lubrication needs, improving efficiency and minimizing wear on critical components. Consequently, it is increasingly attractive to industries prioritizing asset longevity.

Emerging economies in Asia Pacific, Latin America, and Africa are anticipated to see a significant uptake due to rising industrial activities and infrastructure developments. The demand for eco-friendly and energy-efficient systems is also expected to boost the market as companies aim to align with sustainability goals. Such advancements position the automatic lubrication systems market for robust and sustained growth globally.

Key Growth Determinants

- Benefits of Automatic Lubrication System Blended with Industry 4.0 Trends

One of the key driving elements for the automatic lubrication systems market is the growing knowledge of the advantages of using automatic lubrication systems with industrial automation. Everything in this era of Industry 4.0 is designed and produced to streamline the process.

In keeping with the general trend, the manufacturing sector is progressively moving from manual lubrication methods toward automated lubrication. Growing uses in many end-use sectors and the shift from manual to automatic lubrication are driving demand for automatic lubrication systems.

From steel, mining, paper, agriculture, food and beverages, packaging, and mobile off-road and on-road vehicles, automatic lubrication systems find employment in various industrial settings. Various benefits of automated lubrication are fueling demand for these systems.

A few advantages that automatic lubrication systems provide are low noise levels, less wear & tear, less power consumption, improved dependability, higher productivity, better machine life, suitable oil usage, elimination of human mistakes, and generally higher profitability.

- Rising Automation Trend to Support Market Players in Bode Well

The global automatic lubrication systems market has also been driven by the increasing adoption of multiline lubrication systems and automation in certain industrial sectors. Rising industrial automation has improved the acceptance of sophisticated equipment and machinery.

Advanced technology and machinery are increasing the output of several sectors. Since they lower the danger of accidents by up to 90%, automatic lubrication systems are shown to be the ideal option for maintaining this equipment. Likewise, a reasonably affordable and user-friendly solution for the centralized automatic lubrication systems of several places in equipment or machines is multiline lubricators, sometimes known as radial lubricators.

Combining numerous pumps into one unit, sharing a common reservoir and motor, is what multiline lubrication systems do. Stone crushers, forging hammers, cement plants, sugar mills, rolling mills, hydro-turbines, calendaring machines, and batch mixers are the most often used multiline lubrication systems.

Key Growth Barriers

- High Initial Investment and Maintenance Costs

One of the primary restraints for the automatic lubrication systems market is the high upfront cost associated with installing these systems. For many small- to medium-sized enterprises (SMEs), the initial expense of acquiring and installing automatic lubrication equipment can be prohibitive.

Systems often require regular maintenance and occasional software upgrades, which add to operational costs. While automatic lubrication systems are cost-effective in the long term, providing reduced downtime and extended equipment lifespan, the initial investment can be a significant barrier to adoption. For companies in emerging economies or industries with limited budgets, these high costs hinder widespread adoption, limiting market growth potential.

- Lack of Awareness and Technical Knowledge

Some restraints affecting automatic lubrication systems market growth are the lack of awareness and technical knowledge regarding the benefits and operation of automatic lubrication systems. In many regions, particularly in emerging markets, industrial managers and operators may not be fully aware of the advantages of automated lubrication over manual methods.

Implementing and managing these automated systems often requires a certain level of technical expertise to ensure optimal functionality and integration with existing machinery. The absence of skilled personnel and sufficient training can lead to operational inefficiencies, system misuse, or even system failure, deterring companies from investing in automatic lubrication systems.

Automatic Lubrication Systems Market Trends and Opportunities

- Integration with IoT and Predictive Maintenance

The integration of Internet of Things (IoT) technology presents a significant opportunity for the automatic lubrication systems market. By embedding IoT sensors in lubrication systems, companies can enable real-time monitoring and data collection, allowing for predictive maintenance.

The integration helps identify issues like clogged lubricant lines or inadequate lubrication levels before they lead to equipment failure. IoT-enabled lubrication systems provide actionable insights, enhancing equipment reliability and reducing unplanned downtime.

Industries such as mining, manufacturing, and transportation, where machinery uptime is critical, stand to benefit significantly from predictive maintenance. It also aligns with the broader shift toward Industry 4.0, where smart technology is transforming industrial processes.

- Increased Demand for Eco-Friendly Lubrication Solutions

There is an increasing demand for eco-friendly lubrication solutions with growing environmental regulations and a push for sustainable practices. Automatic lubrication systems can be configured to use precisely the amount of lubricant required, reducing waste and minimizing environmental impact.

Advancements in biodegradable and low-toxicity lubricants enhance sustainability while meeting performance needs. Companies are investing in lubrication solutions, which is expected to create growth opportunities as eco-friendly automatic lubrication systems become a preferred choice for environmentally conscious businesses.

How Does Regulatory Scenario Shape the Industry?

The regulatory scenario is increasingly shaping the automatic lubrication systems market, particularly with regard to environmental and safety standards. Governments and regulatory bodies worldwide are emphasizing sustainability and the reduction of environmental impact in industrial operations.

Regulations targeting emissions, waste reduction, and energy efficiency have prompted companies to adopt automatic lubrication systems, as these systems help ensure precise lubrication, minimize waste, and reduce the risk of oil leaks and spills.

Safety regulations play a significant role. Workplace safety agencies, like OSHA in the United States and EU-OSHA in Europe have strict guidelines to minimize worker injuries, especially in hazardous industrial environments. Automatic lubrication systems reduce the need for manual lubrication in risky areas, thereby lowering the risk of workplace accidents.

As regulatory frameworks become stricter, companies are more inclined to adopt automatic lubrication systems to meet these requirements, driving market growth. Compliance with these evolving regulations provides a competitive advantage, making regulatory alignment a key factor shaping market dynamics.

Segments Covered in the Report

- Series Progressive Lubrication Systems Top System Type Segmentation

Series progressive lubrication systems are predicted to dominate the system type segmentation accounting for a market share of around 28%. Continuous lubrication is made possible by series progressive systems for as long as the pump remains in the process condition.

Once the pump stops functioning, the pistons of the progressive metering system will remain in the places they were in before the pump stopped working. Once the pump resumes its supply of oil, the pistons continue their work from the point where they had previously stopped.

Utilizing the technology offers several additional advantages, including continuous lubrication, dependable monitoring and control, and efficiency in difficult situations. As a result of all of these variables, series progressive lubrication systems are the most readily available on the market.

- Oil-Based Lubrication System Takes the Lead

Oil-based lubrication is anticipated to accumulate around 64% of the global automatic lubrication systems market over the forecast period. Oil-based lubrication is favoured over grease-based lubrication in the majority of mechanical applications.

Oil-based lubrication has numerous advantages, including superior cooling qualities, since it effectively dissipates excess heat and is free from thickeners, eliminating the risk of incompatible thickener interactions.

Oil is cleaner than grease because it effectively removes contaminants and allows for easy regulation of lubricant quantity. The oil in lubrication systems can be readily replaced without disassembling the machinery. Owing to these advantageous aspects, oil-based lubrication has the notable growth potential in the forecast years.

Regional Analysis

- Advanced Industrial Infrastructure Fueling Demand in North America

North America holds a significant share of the market, driven by advanced industrial infrastructure and a strong focus on automation. The United States and Canada are leading adopters, particularly in the manufacturing, mining, and construction sectors.

The emphasis on reducing maintenance costs and enhancing equipment efficiency propels region's demand for automatic lubrication systems. North America is at the forefront of industrial automation, with sectors like manufacturing, automotive, construction, and mining mainly relying on automated systems to streamline operations.

Automatic lubrication systems align with this trend by providing maintenance solutions that minimize downtime and reduce the need for manual intervention. North America's focus on Industry 4.0 further supports the integration of smart lubrication systems that can monitor and adjust lubrication needs in real time.

North America is expected to remain a leading region for automatic lubrication systems, with growth anticipated due to increased investment in IoT-enabled lubrication systems and predictive maintenance. As more companies adopt smart solutions that integrate with broad industrial automation frameworks, the demand for advanced lubrication technologies will likely expand.

- Europe Provides the most Favorable Growth Environment

Europe automatic lubrication systems market is driven by a well-established industrial base, and high technological adoption rates, especially in sectors such as automotive, manufacturing, and heavy machinery.

Leading market growth contributors in Europe include Germany, France, the United Kingdom, and Italy, each with strong industrial infrastructure and regulatory frameworks supporting advanced automation technologies.

Europe’s strong focus on environmental protection and sustainability significantly influences the automatic lubrication systems market. The European Union enforces strict regulations to reduce industrial emissions, waste, and environmental impact, compelling companies to adopt eco-friendly lubrication systems.

Automatic lubrication helps meet these standards by reducing lubricant consumption and minimizing spill risks. Additionally, the EU’s Green Deal and carbon-neutral goals are prompting companies to integrate efficient, sustainable solutions, including automated lubrication, to align with environmental targets.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the automatic lubrication systems market features a mix of global giants and specialized providers focusing on advanced lubrication solutions. Key players like SKF, Timken, Graco, and Bijur Delimon lead the market with extensive product portfolios and strong global distribution networks.

Companies emphasize technological innovations, such as IoT-enabled lubrication systems to enhance operational efficiency and predictive maintenance capabilities. Specialized firms like DropsA and Lincoln Industrial also hold significant shares, especially in niche markets and specific industrial applications.

Strategic mergers, acquisitions, and collaborations are common as companies aim to expand market reach and integrate advanced technologies. Growing demand across manufacturing, automotive, and mining sectors intensifies competition, driving continuous innovation and market expansion.

Key Market Companies

- Lubrication Engineers

- Graco Inc.

- DropsA USA, Inc.

- Price Engineering

- Cenlub Systems

- Lubecore International Inc.

- H-T-L perma

- Digilube Systems, Inc.

- Sloan Lubrication Systems

- Acumen Technologies Inc.

- ALLFETT

- Mountain Regional Equipment Solutions

- Groeneveld-BEKA

- Industrial Autolube International Inc.

Recent Industry Developments

- In January 2024,

Shell plc's subsidiary, Shell Lubricants, purchased MIDEL and MIVOLT from M&I Materials Ltd. It is a firm based in Manchester to include the MIDEL and MIVOLT product lines in Shell's worldwide lubricants portfolio, thereby augmenting its manufacturing, distribution, and marketing capabilities.

- In October 2023,

NTN Europe launched the DRIVE BOOSTER single-point automatic lubricator, a novel gadget that improves worker safety by facilitating remote installation. Hence minimizing direct connection with machinery, and offers potential cost savings of up to 25% through automatic lubrication features.

An Expert’s Eye

- Automatic lubrication systems reduce downtime and maintenance costs by ensuring optimal lubrication and extending equipment lifespan.

- IoT integration is a game-changer, allowing real-time monitoring and predictive maintenance. It is expected to drive demand across industries focused on automation and productivity.

- Experts see significant growth potential in emerging markets as industrial sectors expand and awareness of automation benefits increases.

- Industries like mining, construction, and manufacturing are increasingly adopting automatic lubrication systems to handle tough operational demands and maintain continuous operations.

Global Automatic Lubrication Systems Market is Segmented as-

By System Type

- Oil and Air Lubrication Systems

- Circulating Oil Lubrication Systems

- Series Progressive Lubrication Systems

- Single-line Lubrication Systems

- Dual-line Lubrication Systems

- Multi-line Lubrication Systems

By Lubrication Type

- Oil-based Lubrication

- Grease-based Lubrication

By End Use

- Steel

- Manufacturing

- Transportation

- Mining

- Power

- Cement

- Construction

- Paper & Printing

- Agriculture

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Automatic Lubrication Systems Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Price Analysis, 2019 - 2023

3.1. Global Average Price Analysis, by System Type, US$ Per Unit, 2019 - 2023

3.2. Prominent Factor Affecting Automatic Lubrication Systems Prices

3.3. Global Average Price Analysis, by Region, US$ Per Unit

4. Global Automatic Lubrication Systems Market Outlook, 2019 - 2031

4.1. Global Automatic Lubrication Systems Market Outlook, by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Oil and Air Lubrication Systems

4.1.1.2. Circulating Oil Lubrication Systems

4.1.1.3. Series Progressive Lubrication Systems

4.1.1.4. Single-line Lubrication Systems

4.1.1.5. Dual-line Lubrication Systems

4.1.1.6. Multi-line Lubrication Systems

4.2. Global Automatic Lubrication Systems Market Outlook, by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Oil-based Lubrication

4.2.1.2. Grease-based Lubrication

4.3. Global Automatic Lubrication Systems Market Outlook, by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Steel

4.3.1.2. Manufacturing

4.3.1.3. Transportation

4.3.1.4. Mining

4.3.1.5. Power

4.3.1.6. Cement

4.3.1.7. Construction

4.3.1.8. Paper & Printing

4.3.1.9. Agriculture

4.4. Global Automatic Lubrication Systems Market Outlook, by Region, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. North America

4.4.1.2. Europe

4.4.1.3. Asia Pacific

4.4.1.4. Latin America

4.4.1.5. Middle East & Africa

5. North America Automatic Lubrication Systems Market Outlook, 2019 - 2031

5.1. North America Automatic Lubrication Systems Market Outlook, by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Oil and Air Lubrication Systems

5.1.1.2. Circulating Oil Lubrication Systems

5.1.1.3. Series Progressive Lubrication Systems

5.1.1.4. Single-line Lubrication Systems

5.1.1.5. Dual-line Lubrication Systems

5.1.1.6. Multi-line Lubrication Systems

5.2. North America Automatic Lubrication Systems Market Outlook, by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Oil-based Lubrication

5.2.1.2. Grease-based Lubrication

5.3. North America Automatic Lubrication Systems Market Outlook, by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Steel

5.3.1.2. Manufacturing

5.3.1.3. Transportation

5.3.1.4. Mining

5.3.1.5. Power

5.3.1.6. Cement

5.3.1.7. Construction

5.3.1.8. Paper & Printing

5.3.1.9. Agriculture

5.4. North America Automatic Lubrication Systems Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. U.S. Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.4.1.2. U.S. Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.4.1.3. U.S. Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.4.1.4. Canada Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.4.1.5. Canada Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.4.1.6. Canada Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Automatic Lubrication Systems Market Outlook, 2019 - 2031

6.1. Europe Automatic Lubrication Systems Market Outlook, by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Oil and Air Lubrication Systems

6.1.1.2. Circulating Oil Lubrication Systems

6.1.1.3. Series Progressive Lubrication Systems

6.1.1.4. Single-line Lubrication Systems

6.1.1.5. Dual-line Lubrication Systems

6.1.1.6. Multi-line Lubrication Systems

6.2. Europe Automatic Lubrication Systems Market Outlook, by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Oil-based Lubrication

6.2.1.2. Grease-based Lubrication

6.3. Europe Automatic Lubrication Systems Market Outlook, by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Steel

6.3.1.2. Manufacturing

6.3.1.3. Transportation

6.3.1.4. Mining

6.3.1.5. Power

6.3.1.6. Cement

6.3.1.7. Construction

6.3.1.8. Paper & Printing

6.3.1.9. Agriculture

6.4. Europe Automatic Lubrication Systems Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Germany Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.2. Germany Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.3. Germany Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.4. U.K. Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.5. U.K. Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.6. U.K. Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.7. France Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.8. France Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.9. France Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.10. Italy Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.11. Italy Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.12. Italy Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.13. Turkey Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.14. Turkey Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.15. Turkey Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.16. Russia Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.17. Russia Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.18. Russia Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.19. Rest of Europe Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.20. Rest of Europe Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.21. Rest of Europe Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Automatic Lubrication Systems Market Outlook, 2019 - 2031

7.1. Asia Pacific Automatic Lubrication Systems Market Outlook, by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Oil and Air Lubrication Systems

7.1.1.2. Circulating Oil Lubrication Systems

7.1.1.3. Series Progressive Lubrication Systems

7.1.1.4. Single-line Lubrication Systems

7.1.1.5. Dual-line Lubrication Systems

7.1.1.6. Multi-line Lubrication Systems

7.2. Asia Pacific Automatic Lubrication Systems Market Outlook, by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Oil-based Lubrication

7.2.1.2. Grease-based Lubrication

7.3. Asia Pacific Automatic Lubrication Systems Market Outlook, by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Steel

7.3.1.2. Manufacturing

7.3.1.3. Transportation

7.3.1.4. Mining

7.3.1.5. Power

7.3.1.6. Cement

7.3.1.7. Construction

7.3.1.8. Paper & Printing

7.3.1.9. Agriculture

7.4. Asia Pacific Automatic Lubrication Systems Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. China Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.2. China Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.3. China Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.4. Japan Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.5. Japan Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.6. Japan Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.7. South Korea Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.8. South Korea Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.9. South Korea Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.10. India Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.11. India Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.12. India Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.13. Southeast Asia Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.14. Southeast Asia Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.15. Southeast Asia Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.16. Rest of Asia Pacific Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.17. Rest of Asia Pacific Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.18. Rest of Asia Pacific Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Automatic Lubrication Systems Market Outlook, 2019 - 2031

8.1. Latin America Automatic Lubrication Systems Market Outlook, by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Oil and Air Lubrication Systems

8.1.1.2. Circulating Oil Lubrication Systems

8.1.1.3. Series Progressive Lubrication Systems

8.1.1.4. Single-line Lubrication Systems

8.1.1.5. Dual-line Lubrication Systems

8.1.1.6. Multi-line Lubrication Systems

8.2. Latin America Automatic Lubrication Systems Market Outlook, by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Oil-based Lubrication

8.2.1.2. Grease-based Lubrication

8.3. Latin America Automatic Lubrication Systems Market Outlook, by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Steel

8.3.1.2. Manufacturing

8.3.1.3. Transportation

8.3.1.4. Mining

8.3.1.5. Power

8.3.1.6. Cement

8.3.1.7. Construction

8.3.1.8. Paper & Printing

8.3.1.9. Agriculture

8.4. Latin America Automatic Lubrication Systems Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Brazil Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.2. Brazil Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.3. Brazil Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.4. Mexico Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.5. Mexico Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.6. Mexico Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.7. Argentina Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.8. Argentina Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.9. Argentina Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.10. Rest of Latin America Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.11. Rest of Latin America Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.12. Rest of Latin America Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Automatic Lubrication Systems Market Outlook, 2019 - 2031

9.1. Middle East & Africa Automatic Lubrication Systems Market Outlook, by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Oil and Air Lubrication Systems

9.1.1.2. Circulating Oil Lubrication Systems

9.1.1.3. Series Progressive Lubrication Systems

9.1.1.4. Single-line Lubrication Systems

9.1.1.5. Dual-line Lubrication Systems

9.1.1.6. Multi-line Lubrication Systems

9.2. Middle East & Africa Automatic Lubrication Systems Market Outlook, by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Oil-based Lubrication

9.2.1.2. Grease-based Lubrication

9.3. Middle East & Africa Automatic Lubrication Systems Market Outlook, by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Steel

9.3.1.2. Manufacturing

9.3.1.3. Transportation

9.3.1.4. Mining

9.3.1.5. Power

9.3.1.6. Cement

9.3.1.7. Construction

9.3.1.8. Paper & Printing

9.3.1.9. Agriculture

9.4. Middle East & Africa Automatic Lubrication Systems Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. GCC Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.2. GCC Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.3. GCC Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.4. South Africa Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.5. South Africa Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.6. South Africa Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.7. Egypt Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.8. Egypt Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.9. Egypt Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.10. Nigeria Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.11. Nigeria Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.12. Nigeria Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.13. Rest of Middle East & Africa Automatic Lubrication Systems Market by System Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.14. Rest of Middle East & Africa Automatic Lubrication Systems Market by Lubrication Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.15. Rest of Middle East & Africa Automatic Lubrication Systems Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. System Type vs Lubrication Type Heatmap

10.2. Company Market Share Analysis, 2024

10.3. Competitive Dashboard

10.4. Company Profiles

10.4.1. Lubrication Engineers

10.4.1.1. Company Overview

10.4.1.2. Product Portfolio

10.4.1.3. Financial Overview

10.4.1.4. Business Strategies and Development

10.4.2. Graco Inc.

10.4.2.1. Company Overview

10.4.2.2. Product Portfolio

10.4.2.3. Financial Overview

10.4.2.4. Business Strategies and Development

10.4.3. DropsA USA, Inc.

10.4.3.1. Company Overview

10.4.3.2. Product Portfolio

10.4.3.3. Financial Overview

10.4.3.4. Business Strategies and Development

10.4.4. Application Equipment

10.4.4.1. Company Overview

10.4.4.2. Product Portfolio

10.4.4.3. Financial Overview

10.4.4.4. Business Strategies and Development

10.4.5. a division of Price Engineering

10.4.5.1. Company Overview

10.4.5.2. Product Portfolio

10.4.5.3. Financial Overview

10.4.5.4. Business Strategies and Development

10.4.6. Cenlub Systems

10.4.6.1. Company Overview

10.4.6.2. Product Portfolio

10.4.6.3. Financial Overview

10.4.6.4. Business Strategies and Development

10.4.7. Lubecore International Inc.

10.4.7.1. Company Overview

10.4.7.2. Product Portfolio

10.4.7.3. Financial Overview

10.4.7.4. Business Strategies and Development

10.4.8. H-T-L perma

10.4.8.1. Company Overview

10.4.8.2. Product Portfolio

10.4.8.3. Financial Overview

10.4.8.4. Business Strategies and Development

10.4.9. Digilube Systems, Inc.

10.4.9.1. Company Overview

10.4.9.2. Product Portfolio

10.4.9.3. Financial Overview

10.4.9.4. Business Strategies and Development

10.4.10. Sloan Lubrication Systems

10.4.10.1. Company Overview

10.4.10.2. Product Portfolio

10.4.10.3. Financial Overview

10.4.10.4. Business Strategies and Development

10.4.11. Acumen Technologies Inc.

10.4.11.1. Company Overview

10.4.11.2. Product Portfolio

10.4.11.3. Financial Overview

10.4.11.4. Business Strategies and Development

10.4.12. ALLFETT

10.4.12.1. Company Overview

10.4.12.2. Product Portfolio

10.4.12.3. Financial Overview

10.4.12.4. Business Strategies and Development

10.4.13. Mountain Regional Equipment Solutions

10.4.13.1. Company Overview

10.4.13.2. Product Portfolio

10.4.13.3. Financial Overview

10.4.13.4. Business Strategies and Development

10.4.14. Groeneveld-BEKA

10.4.14.1. Company Overview

10.4.14.2. Product Portfolio

10.4.14.3. Financial Overview

10.4.14.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

System Type Coverage |

|

|

Lubrication Type Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |