Global Automotive Kingpin Market Forecast

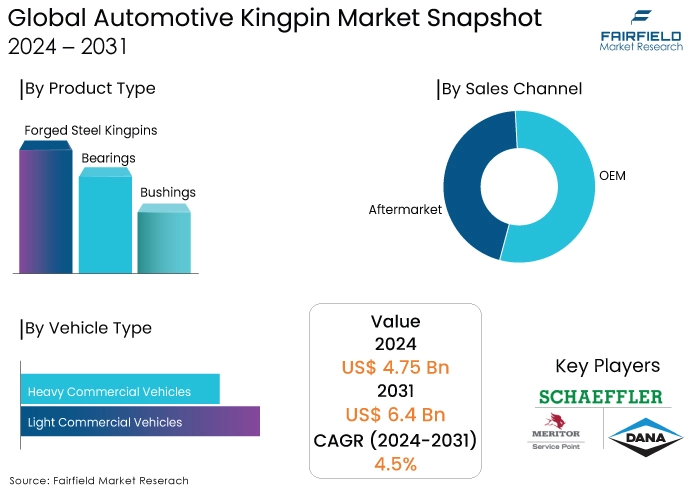

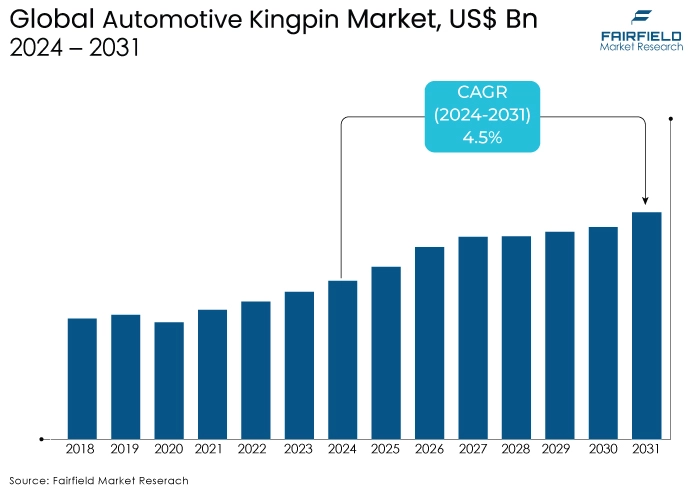

- The automotive kingpin market is estimated to reach a valuation of US$6.41 Bn by the year 2031, up from US$4.75 Bn attained in 2024

- Global market for automotive kingpin at a CAGR of 4.5%, during the forecast period 2024 to 2031.

Quick Report Digest

- The automotive kingpin market to be valued at US$6.7 Bn by 2031.

- The global automotive kingpin market to exhibit a health growth rate of 4.4% over the forecast period.

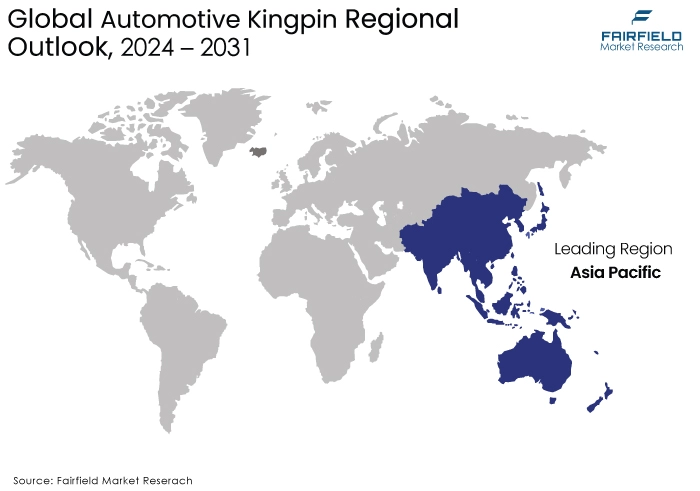

- Asia Pacific region to dominate the global market share accumulating almost 38% of the total market share.

- The rise in sales of heavy vehicles acts as a crucial market driving element for the global automotive kingpin market.

- Producers in this field focus on manufacturing durable and high-performing kingpins that meet the strict safety and quality standards set by regulatory authorities, and OEMs.

- Factors such as the global automobile manufacturing industry, the frequency at which fleets are updated, advancements in technology and design, maintenance needs, and regulatory standards for vehicle safety all influence the market for kingpins.

A Look Back and a Look Forward - Comparative Analysis

The global automotive kingpin market was valued at US$ 4.1bn in 2023, which was reached after the market expanded at 1.8% CAGR from 2019 to 2023. The automotive kingpin market is projected to grow steadily owing to increasing logistics and transportation industries and rising construction activities across the globe. Rising concerns over reliability about transportation and bad road conditions are anticipated to have a strong impact on automotive kingpin sales.

The increasing need for car rental and fleet management services, as well as the consistent increase of commercial vehicles on the roads for logistics, has resulted in sustained growth of vehicle repair activities. The development of new technologies in the automotive industry, which is resulting in longer vehicle lifespans, is further pushing demand for repair and maintenance services, which, in turn, is driving the sales of automotive kingpins in the aftermarket.

Usage of technologically advanced steering systems and linkages is estimated to impact the production of automotive kingpins, globally. Increasing repair and maintenance requirements are expected to create significant opportunities in the aftermarket during the forecast period.

Key Growth Determinants

Crucial Role in Stability and Manoeuvrability of Heavy-Duty Commercial Vehicles

The term automotive kingpin market refers to the sector of the automotive industry that focuses on the production, promotion, and supply of kingpins.

Kingpins are crucial components of the steering systems found in various types of vehicles, particularly heavy-duty commercial ones. Kingpins serve as the pivot point for the steering mechanism, enabling the front axle to rotate and ensuring smooth steering control.

Kingpins are crucial for ensuring the stability and manoeuvrability of trucks, buses, and other large vehicles. This product range largely caters to the automotive industry's requirements. The market for automotive kingpins encompasses all facets of the production and supply chain, including research and development, manufacturing processes, distribution systems, and post-sales services.

Rising Demand for Heavy and Commercial Vehicles

The increasing utilization of heavy-duty commercial vehicles (HCVs), light commercial vehicles (LCVs), and off-road vehicles is a major growth driver for the automotive kingpin market. These vehicles rely heavily on robust kingpins to ensure stability and control, particularly when carrying heavy loads or navigating challenging terrains. HCVs and off-road vehicles experience higher wear and tear due to their demanding operations. This leads to a frequent need for kingpin replacements, driving demand for aftermarket parts.

Fleet managers and owners are increasingly focusing on extending the lifespan of their commercial vehicles. This necessitates the use of high-quality, durable kingpins that can withstand extended use. The growing diversity of commercial vehicles, including electric trucks and construction equipment, requires specialized kingpin designs that cater to their unique weight distribution and performance requirements.

Increased Focus on Vehicle Safety

Stringent safety regulations imposed by governing bodies are a significant growth driver for the automotive kingpin market. These regulations mandate specific performance standards for kingpins, ensuring they can withstand various stresses and prevent accidents. Regulations emphasize the use of high-strength materials like forged steel for kingpins. This ensures they can handle heavy loads and resist wear and tear effectively.

Regulatory requirements necessitate the use of advanced manufacturing processes like heat treatment to enhance the strength and durability of kingpins.

Manufacturers are constantly innovating to develop kingpin designs that meet or exceed evolving safety standards. This can involve exploring lightweight yet robust materials or incorporating wear-resistant coatings.

Key Growth Barriers

Fluctuations in Raw Material Prices

The automotive kingpin market is susceptible to external factors beyond its direct control. Kingpins are typically manufactured from steel and other metals. Fluctuations in the prices of these raw materials can significantly impact the overall cost of production, potentially forcing manufacturers to raise prices or adjust profit margins.

Economic downturns can lead to decreased demand for commercial vehicles, directly impacting the demand for replacement and new kingpins. Reduced investment in infrastructure projects during economic slowdowns can further dampen market growth. Global disruptions like pandemics or geopolitical conflicts can disrupt supply chains for raw materials and finished kingpins, leading to shortages and price volatility.

Emergence of Alternative Designs

While kingpins have traditionally been the go-to choice for heavy-duty vehicles, advancements in suspension technology are presenting challenges. Ball joints offer greater freedom of movement compared to kingpins, potentially improving vehicle manoeuvrability. This can be advantageous for certain applications, particularly in lighter-duty vehicles.

Manufacturers are exploring alternative steering and suspension systems that may not require kingpins altogether. These innovations could potentially disrupt the market in the long term. In some cases, ball joints or alternative designs may be a more cost-effective option for manufacturers, particularly for lighter vehicles with less demanding weight requirements.

Key Trends and Opportunities to Look at

Technological Advancements

There is a growing trend towards lightweight materials in automotive manufacturing to improve fuel efficiency and reduce emissions. Automotive kingpins, traditionally made from steel, are increasingly being replaced or reinforced with materials like aluminium alloys and composites. This shift presents opportunities for manufacturers specializing in advanced materials to innovate and provide lightweight yet durable solutions.

With the rise of electric and hybrid vehicles (EVs), there is a demand for kingpin systems that can withstand different operational dynamics compared to traditional internal combustion engine vehicles. EVs require components that are lighter, more efficient, and capable of handling regenerative braking forces effectively. Industry participants can capitalize on this trend by developing specialized kingpin systems tailored to the unique needs of electric and hybrid vehicles.

Technologies such as additive manufacturing (3D printing) and precision machining are transforming the production of automotive components, including kingpins. These technologies enable complex geometries, customization, and cost-effective batch production. Companies investing in advanced manufacturing processes can streamline production, reduce lead times, and offer innovative kingpin solutions to meet evolving market demands.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape significantly shapes the dynamics of the automotive kingpin market in terms if safety, durability, emissions, and fuel efficiency. Stringent safety regulations mandate strong, reliable kingpins. This incentivizes manufacturers to use high-quality materials and robust designs, potentially increasing costs but enhancing overall vehicle safety. Additionally, regulations on component lifespans might push for kingpin designs that last longer, impacting replacement parts demand.

Regulations targeting emissions and fuel efficiency can influence kingpin design. Lighter weight kingpins made from advanced materials can contribute to overall vehicle weight reduction, improving fuel efficiency. Additionally, regulations on low-friction components might encourage the use of special coatings or lubricants for kingpins, impacting material choices and potentially creating a market for compliant solutions.

The regulations create a complex environment for kingpin manufacturers. They must balance safety and durability requirements with the need to optimize weight and friction for fuel efficiency. This can lead to innovation in materials, coatings, and kingpin design to meet all these demands and navigate the evolving regulatory landscape.

Fairfield’s Ranking Board

Top Segments

Forged Steel Kingpins Account for 65% Share of Market Revenue

Based on product type, the automotive kingpin market is further segmented into forged steel kingpins, bearings and bushings, where the forged steel kingpins segment dominates the market. Forged steel offers exceptional strength-to-weight ratio, making it ideal for withstanding the heavy loads and stresses experienced by commercial vehicles.

Compared to other materials like forged aluminium, forged steel provides a good balance between cost and performance, making it a practical choice for a wide range of applications. Forged steel kingpins can be manufactured in various sizes and designs to cater to the specific needs of different vehicle types and weight capacities.

OEMs Responsible for 62% of Total Sales

Based on sales channel, the global automotive kingpin market is further sub-segmented into OEM & aftermarket, where the OEM segment dominates the market. OEMs are forecasted to account for a major share of the market by 2031. OEMs prioritize the reliability and quality of the components utilized in their vehicles to maintain customer satisfaction and brand reputation. Therefore, more consumers generally prefer sourcing components, including automotive kingpins from reputable suppliers to ensure durability, quality, and compatibility with vehicles.

Regional Frontrunners

Asia Pacific’s Leadership Position Prevails

The Asia Pacific region, particularly China, and India, is witnessing a significant boom in the commercial vehicle industry. This surge in vehicle production translates to a high demand for kingpins for both new vehicles and replacements. Governments in Asia Pacific are investing heavily in infrastructure development projects, requiring large fleets of construction vehicles equipped with robust kingpins.

There is a rising focus on domestic manufacturing of commercial vehicles within Asia Pacific. This trend creates a strong demand for kingpins from local manufacturers to support their production lines. The dominance of Asia Pacific in the automotive kingpin market is likely to continue in the years to come due to its rapidly expanding commercial vehicle sector and infrastructure development. However, other regions present attractive growth opportunities as the global demand for reliable and efficient transportation solutions continues to rise.

North America, and Europe on a Steady Trail

The North American region boasts a well-established commercial vehicle industry, and stringent safety regulations, driving demand for high-quality kingpins. In the European region, while growth may be slower compared to Asia Pacific, Europe has a mature market with advanced technological capabilities in kingpin design and manufacturing.

Fairfield’s Competitive Landscape Analysis

The competitive dynamics in the automotive kingpin market are influenced by regulatory trends, technological advancements, and shifts in consumer preferences towards sustainability and performance. Manufacturers are adapting by leveraging their core competencies in engineering excellence, manufacturing efficiency, and strategic alliances to maintain competitiveness and drive innovation.

The global automotive kingpin market is characterized by intense competition and continuous innovation aimed at meeting evolving industry standards and customer expectations. Companies that successfully navigate these dynamics through innovation, strategic partnerships, and customer-centric strategies are poised to lead in this dynamic and vital segment of the automotive industry.

Who are Leading Companies in Automotive Kingpin Space?

- Meritor, Inc.

- Dana Limited

- Schaeffler Technologies Ag & Co. Kg

- Mulberry Fabrications Ltd.

- PE Automotive

- JG Automotive

- Elgin Industries

- Ferdinand Bilstein GmbH + Co. KG

- LE.MA S.r.L

- DIESEL Technic SE

- BELTON GROUP

- STEMCO Products Inc.

- ZheJiang GuanTong Autoparts Co., Ltd.

Recent Industry Developments

- In January 2024, Meritor, Inc. innovated with advanced friction materials and lubrication systems integrated into kingpin assemblies to enhance performance and longevity and collaborated with OEMs to develop customized kingpin solutions for electric and hybrid vehicles, addressing specific operational requirements.

- In September 2023, Dana Incorporated expanded its portfolio of heavy-duty kingpins for commercial vehicles, focusing on durability and reliability in harsh operating conditions and implemented smart manufacturing technologies to optimize production processes and reduce lead times for kingpin assemblies.

- In June 2023, ZF Friedrichshafen AG developed next-generation active suspension systems incorporating advanced kingpin technology for improved vehicle dynamics and comfort and introduced lightweight kingpin solutions using innovative materials to enhance fuel efficiency and reduce vehicle emissions.

Global Automotive Kingpin Market is Segmented as-

By Product Type

- Forged Steel Kingpins

- Bearings

- Bushings

By Vehicle Type

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Sales Channel

- OEM

- Aftermarket

By Region

- North America

- Latin America

- Europe

- South Asia & Oceania

- East Asia

- The Middle East & Africa

1. Executive Summary

1.1. Global Automotive Kingpin Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019-2023

3.1. Global Automotive Kingpin Market, Production Output, by Region, 2019-2023

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East & Africa

4. Price Trend Analysis, 2019-2031

4.1. Key Highlights

4.2. Global Average Price Analysis, by Product Type/Distribution Channel/Vehicle Type, US$ per Unit

4.3. Prominent Factors Affecting Automotive Kingpin Market Prices

4.4. Global Average Price Analysis, by Region, US$ per Unit

5. Global Automotive Kingpin Market Outlook, 2019-2031

5.1. Global Automotive Kingpin Market Outlook, by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

5.1.1. Key Highlights

5.1.1.1. Pins

5.1.1.2. Bearings

5.1.1.3. Bushings

5.1.1.4. Seals

5.1.1.5. Others

5.2. Global Automotive Kingpin Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

5.2.1. Key Highlights

5.2.1.1. OEM

5.2.1.2. Aftermarket

5.3. Global Automotive Kingpin Market Outlook, by Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

5.3.1. Key Highlights

5.3.1.1. Passenger Car

5.3.1.2. LCV

5.3.1.3. HCV

5.4. Global Automotive Kingpin Market Outlook, by Region, Value (US$ Bn) and Volume (Units), 2019-2031

5.4.1. Key Highlights

5.4.1.1. North America

5.4.1.2. Europe

5.4.1.3. Asia Pacific

5.4.1.4. Latin America

5.4.1.5. Middle East & Africa

6. North America Automotive Kingpin Market Outlook, 2019-2031

6.1. North America Automotive Kingpin Market Outlook, by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

6.1.1. Key Highlights

6.1.1.1. Pins

6.1.1.2. Bearings

6.1.1.3. Bushings

6.1.1.4. Seals

6.1.1.5. Others

6.2. North America Automotive Kingpin Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

6.2.1. Key Highlights

6.2.1.1. OEM

6.2.1.2. Aftermarket

6.3. North America Automotive Kingpin Market Outlook, by Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

6.3.1. Key Highlights

6.3.1.1. Passenger Car

6.3.1.2. LCV

6.3.1.3. HCV

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. North America Automotive Kingpin Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019-2031

6.4.1. Key Highlights

6.4.1.1. U.S. Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

6.4.1.2. U.S. Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

6.4.1.3. U.S. Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

6.4.1.4. Canada Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

6.4.1.5. Canada Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

6.4.1.6. Canada Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Automotive Kingpin Market Outlook, 2019-2031

7.1. Europe Automotive Kingpin Market Outlook, by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.1.1. Key Highlights

7.1.1.1. Pins

7.1.1.2. Bearings

7.1.1.3. Bushings

7.1.1.4. Seals

7.1.1.5. Others

7.2. Europe Automotive Kingpin Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

7.2.1. Key Highlights

7.2.1.1. OEM

7.2.1.2. Aftermarket

7.3. Europe Automotive Kingpin Market Outlook, by Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.3.1. Key Highlights

7.3.1.1. Passenger Car

7.3.1.2. LCV

7.3.1.3. HCV

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Europe Automotive Kingpin Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1. Key Highlights

7.4.1.1. Germany Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.2. Germany Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.3. Germany Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.4. U.K. Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.5. U.K. Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.6. U.K. Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.7. France Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.8. France Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.9. France Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.10. Italy Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.11. Italy Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.12. Italy Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.13. Turkey Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.14. Turkey Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.15. Turkey Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.16. Russia Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.17. Russia Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.18. Russia Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.19. Rest of Europe Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.20. Rest of Europe Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.21. Rest of Europe Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Automotive Kingpin Market Outlook, 2019-2031

8.1. Asia Pacific Automotive Kingpin Market Outlook, by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.1.1. Key Highlights

8.1.1.1. Pins

8.1.1.2. Bearings

8.1.1.3. Bushings

8.1.1.4. Seals

8.1.1.5. Others

8.2. Asia Pacific Automotive Kingpin Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

8.2.1. Key Highlights

8.2.1.1. OEM

8.2.1.2. Aftermarket

8.3. Asia Pacific Automotive Kingpin Market Outlook, by Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.3.1. Key Highlights

8.3.1.1. Passenger Car

8.3.1.2. LCV

8.3.1.3. HCV

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Asia Pacific Automotive Kingpin Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1. Key Highlights

8.4.1.1. China Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.2. China Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.3. China Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.4. Japan Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.5. Japan Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.6. Japan Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.7. South Korea Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.8. South Korea Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.9. South Korea Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.10. India Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.11. India Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.12. India Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.13. Southeast Asia Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.14. Southeast Asia Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.15. Southeast Asia Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.16. Rest of Asia Pacific Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.17. Rest of Asia Pacific Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.18. Rest of Asia Pacific Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Automotive Kingpin Market Outlook, 2019-2031

9.1. Latin America Automotive Kingpin Market Outlook, by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

9.1.1. Key Highlights

9.1.1.1. Pins

9.1.1.2. Bearings

9.1.1.3. Bushings

9.1.1.4. Seals

9.1.1.5. Others

9.2. Latin America Automotive Kingpin Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

9.2.1. Key Highlights

9.2.1.1. OEM

9.2.1.2. Aftermarket

9.3. Latin America Automotive Kingpin Market Outlook, by Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

9.3.1. Key Highlights

9.3.1.1. Passenger Car

9.3.1.2. LCV

9.3.1.3. HCV

9.3.2. BPS Analysis/Market Attractiveness Analysis

9.4. Latin America Automotive Kingpin Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1. Key Highlights

9.4.1.1. Brazil Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.2. Brazil Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.3. Brazil Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.4. Mexico Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.5. Mexico Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.6. Mexico Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.7. Argentina Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.8. Argentina Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.9. Argentina Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.10. Rest of Latin America Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.11. Rest of Latin America Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.12. Rest of Latin America Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Automotive Kingpin Market Outlook, 2019-2031

10.1. Middle East & Africa Automotive Kingpin Market Outlook, by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

10.1.1. Key Highlights

10.1.1.1. Pins

10.1.1.2. Bearings

10.1.1.3. Bushings

10.1.1.4. Seals

10.1.1.5. Others

10.2. Middle East & Africa Automotive Kingpin Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

10.2.1. Key Highlights

10.2.1.1. OEM

10.2.1.2. Aftermarket

10.3. Middle East & Africa Automotive Kingpin Market Outlook, by Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

10.3.1. Key Highlights

10.3.1.1. Passenger Car

10.3.1.2. LCV

10.3.1.3. HCV

10.3.2. BPS Analysis/Market Attractiveness Analysis

10.4. Middle East & Africa Automotive Kingpin Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1. Key Highlights

10.4.1.1. GCC Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.2. GCC Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.3. GCC Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.4. South Africa Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.5. South Africa Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.6. South Africa Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.7. Egypt Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.8. Egypt Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.9. Egypt Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.10. Nigeria Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.11. Nigeria Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.12. Nigeria Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.13. Rest of Middle East & Africa Automotive Kingpin Market by Product Type, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.14. Rest of Middle East & Africa Automotive Kingpin Market Distribution Channel, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.15. Rest of Middle East & Africa Automotive Kingpin Market Vehicle Type, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Vehicle Type vs Distribution Channel Heatmap

11.2. Manufacturer vs Distribution Channel Heatmap

11.3. Company Market Share Analysis, 2022

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Meritor, Inc.

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. Dana limited

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Schaeffler Technologies Ag & Co. Kg

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. PE Automotive

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. JG Automotive

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. Ferdinand Bilstein GmbH + Co. KG

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. BELTON GROUP

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. MULBERRY FABRICATIONS LTD.

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. Elgin Industries

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. ZheJiang GuanTong Autoparts Co., Ltd

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Vehicle Type Coverage |

|

|

Sales Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |