Global Autonomous Driving Software Market Forecast

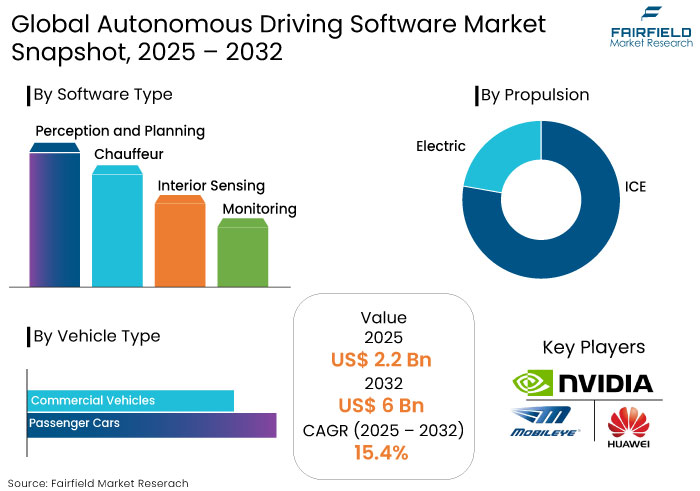

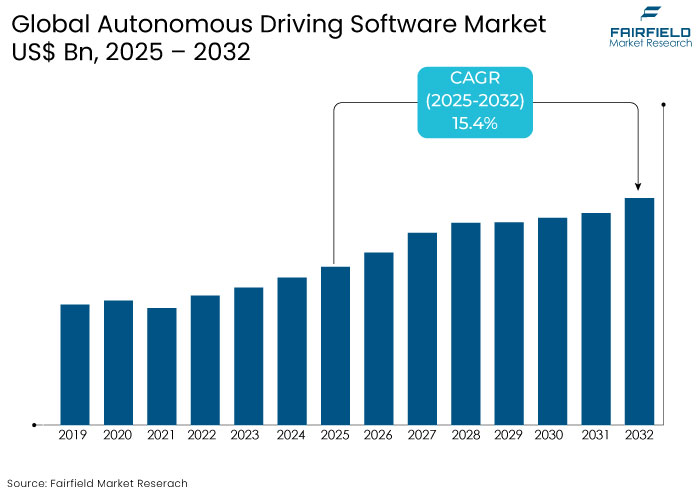

- The autonomous driving software market is projected to reach a size of US$ 6 Bn by 2032, showcasing significant growth from US$ 2.2 Bn achieved in 2025.

- The market for autonomous driving software is estimated to show a significant expansion rate, with an estimated CAGR of 15.4% from 2025 to 2032.

Autonomous Driving Software Market Insights

- Continuous innovation in AI, machine learning, and sensor technologies is accelerating the development of autonomous driving software.

- Significant capital flow from traditional automotive manufacturers and tech giants is fuelling the development of autonomous systems.

- Autonomous driving is closely linked with electric vehicles, offering a promising future for sustainable and self-driving transportation.

- Both passenger vehicles and commercial applications are rapidly adopting autonomous driving software.

- As these systems become more reliable, the market is estimated to witness exponential growth.

- As autonomous driving regulations become more mature, the software is anticipated to see rising adoption owing to increased passenger safety.

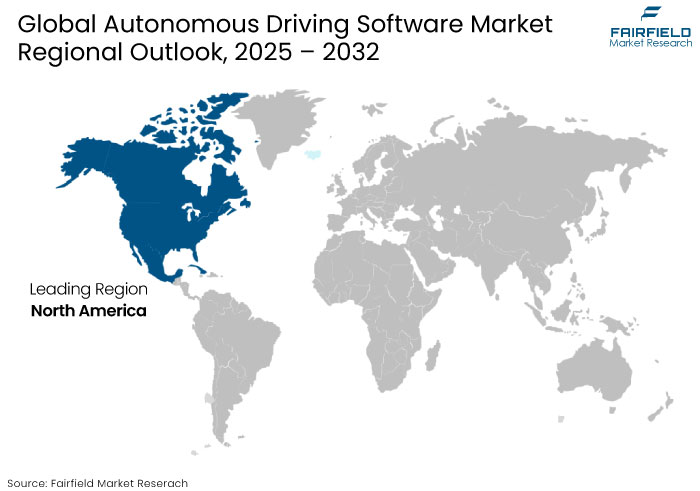

- North America is predicted to dominate the global market with a share of 38% in 2025.

- Passenger vehicles is anticipated to emerge as the leading vehicle type segment with a share of 55% in 2025.

- Based on the level of autonomy, the L2+ level of autonomy is likely to witness growth.

A Look Back and a Look Forward - Comparative Analysis

The autonomous driving software market growth during the historical period was primarily driven by advancements in AI, sensor technology, and growing investments from automotive giants. Early adoption of autonomous driving software was prominent in developed regions where governments promoted self-driving technology through supportive policies and infrastructure.

The market is set to show rapid growth over the forecast period, fuelled by significant breakthroughs in AI algorithms, 5G connectivity, and machine learning capabilities. With companies like Tesla, Waymo, and Baidu intensifying their research and development efforts, Level 4 and Level 5 automation are closer to reality.

Rising demand for electric vehicles (EVs) is creating synergies as autonomous software integrates seamlessly with EV platforms. Growth in public awareness and trust, coupled with favourable regulations, poses the market to redefine the future of mobility, creating safer and efficient transportation systems.

Key Growth Determinants

- Advancements in ADAS Technology

Rapid evolution of advanced driver assistance systems (ADAS) has significantly boosted the demand for cutting-edge autonomous driving software in the automotive industry. ADAS technologies, such as adaptive cruise control and lane-keeping assistance, have transformed vehicle safety and automation.

- In February 2024, Plus launched the Open Platform for Autonomy, a modular software platform that supports all levels of autonomous driving.

- Tesla reports that vehicles operating with Autopilot have fewer accidents than those without. For instance, in Q2 2023, Tesla recorded one accident per 6.18 million miles driven with Autopilot, compared to one accident per 1.46 million miles without it.

Active lane keeping assistance is one of the key innovations in the automotive industry. It assists and alerts drivers when they drift out of lanes and helps realign the vehicle to maintain lane discipline.

The evolution of such features boosts the demand for high-performance software for autonomous vehicles. The software processes vast amounts of data generated by ADAS sensors, enabling real-time decision-making for safer driving.

- Rising Commercial Applications

Numerous companies are redirecting their focus from passenger vehicles to autonomous solutions for logistics, delivery services, and ridesharing.

- In December 2022, Baidu, Inc., a leading AI company with a strong internet infrastructure, obtained permission to test autonomous vehicles on public highways without any human driver or safety operator in the vehicle.

Strategic alliances and partnerships among conventional automotive manufacturers, technology firms, and start-ups are becoming increasingly common. These alliances and partnerships seek to utilize complementary strengths and expedite the advancement and implementation of autonomous technologies.

Key Growth Barriers

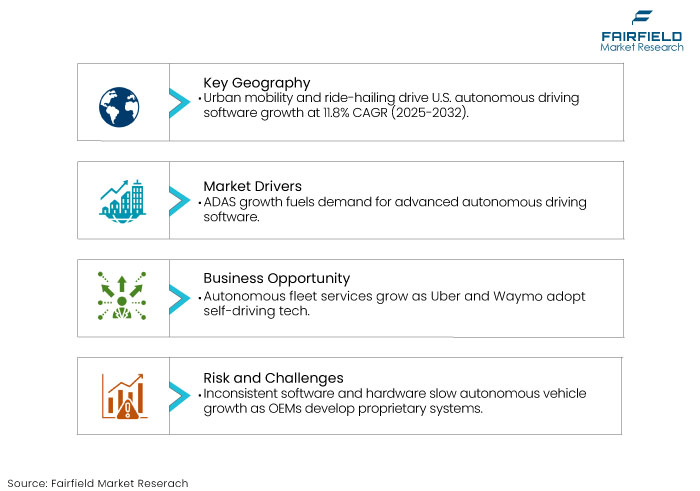

- Challenges in Standardization

The lack of uniformity in autonomous driving software and hardware platforms is likely to hinder growth. Leading automotive OEMs and technology companies are developing their proprietary software for autonomous vehicles.

The development of such high-end software comes with adverse discrepancies, leading to issues with interoperability and compatibility across systems. Companies rely on a mix of algorithms, programming languages, and development frameworks. The diversity hampers collaboration and slows down innovation, complicating the entire process of unifying systems for seamless deployment.

Key Growth Opportunities

- Expansion of Autonomous Fleet Services

Rise of autonomous fleet services, particularly in the shared mobility sector is facilitating immense growth. Industry leaders like Uber and Waymo are exploring the use of automated driving software to manage autonomous vehicle fleets.

The shift towards automotive fleets presents a major opportunity to transform the traditional vehicle ownership model, offering consumers more convenient, cost-effective, and eco-friendly transportation options.

- Waymo, a subsidiary of Alphabet Inc., has surpassed 100,000 weekly fares in select U.S. cities, demonstrating the growing demand for autonomous ride-hailing services.

The autonomous driving software in these fleets plays a critical role in ensuring the safe and efficient operation of self-driving vehicles. As cities transition into smarter and connected environments, the demand for shared transportation services is likely to continue to rise.

Autonomous fleets are poised to become an integral part of city transportation systems, with the ability to streamline fleet management and improve service efficiency, thereby fueling growth.

- In China, over 32,000 km of roads have been opened for robotaxi services, with companies like Baidu, WeRide, and Pony.ai leading the way.

- Integration of Artificial Intelligence and Machine Learning

Advancements in AI and ML are predicted to empower autonomous systems to evaluate complex real-time data and render accurate decisions on the road. AI and ML technologies enable vehicles to assimilate information from their surroundings and enhance performance.

Self-driving cars integrated with AI can effectively function through varying weather conditions, detect impediments, and anticipate the actions of pedestrians or other vehicles. The capacity to adjust to diverse driving situations is likely to improve the dependability and safety of autonomous vehicles.

How is Regulatory Scenario Shaping this Industry?

The regulatory landscape plays a crucial role in developing and deploying autonomous driving software. As self-driving vehicles become a reality, governments and regulatory bodies are working to create frameworks that balance innovation with safety, security, and public acceptance. Such regulations are shaping the growth and direction of the autonomous driving software market.

Regulatory bodies are exploring liability laws regarding software failures or miscalculations by automated driving software. By defining clear accountability structures, these regulations provide a transparent framework for manufacturers and consumers.

Segment Covered in the Report

- Widespread Adoption by Automotive Manufacturers to Foster Growth in L2+ Level

The L2+ level of autonomy includes advanced driver-assistance systems (ADAS) that provide features like adaptive cruise control and lane-keeping assistance. Vehicle manufacturers like Tesla, Audi, and BMW have already integrated advanced features in several production models.

Key features include like enhanced adaptive cruise control, automated lane-keeping, and limited hands-free driving capabilities. Such systems rely on hardware as well as the integration of autonomous driving software to allow the vehicle to manage specific driving tasks.

The dominant position of L2+ automation reflects a balance between technological feasibility and consumer adoption. These systems enhance driving safety, comfort, and convenience while maintaining human oversight. L2+ automation is likely to witness exponential growth as it strikes a balance between advanced technology and practical usability.

- Consumer Desire for Safety and Convenience Propel Growth in Passenger Vehicles

Technical developments, consumer desire for safety and convenience, and expenditures in research and development primarily drive the passenger vehicle segment's growth. Urbanization, economic advantages, technical infrastructure, and increased consumer awareness propel expansion. The effective implementation and favorable experiences with autonomous functions in passenger vehicles foster consumer confidence while promoting increased adoption.

Regional Analysis

- High Investments from Government Authorities in North America Support Growth

Expansion of urban mobility solutions and ride-hailing services generates a need for autonomous vehicles to improve transportation efficiency and alleviate congestion in the area. The U.S. autonomous driving software industry is projected to expand at a CAGR of 11.8% from 2025 to 2032.

Increased consumer interest in ADAS and autonomous driving capabilities is likely to push the demand for autonomous driving software. Substantial investment from venture capital and established automotive firms is likely to enhance the development and implementation of autonomous driving technologies.

North America has made significant investments in autonomous driving software from the public and corporate sectors. The region attracts venture capitalists, investors, and government entities that endorse autonomous vehicle development, establishing it as a centre for innovation.

- Rising Demand for Innovative Transportation Solutions to Facilitate Growth in Asia Pacific

Asia Pacific particularly countries like China, Japan, and South Korea, are home to some of the world's largest automotive manufacturers, including Toyota, Honda, Hyundai, and BYD. The region's expertise in mass manufacturing and advancements in autonomous technology positions it as a driver of innovation.

Asia Pacific is experiencing an increased demand for innovative transportation solutions owing to fast urbanization and population growth in nations like China and India. Autonomous driving software is integral to the transition towards smart mobility, offering a sustainable and convenient alternative to urban commuters. Expansion of ride-hailing services generates significant demand for autonomous fleets, intensifying the necessity for autonomous vehicle software.

Fairfield’s Competitive Landscape Analysis

The autonomous driving software market is witnessing rapid evolution owing to technological advancements and increasing demand for self-driving vehicles. The growing trend of smart mobility further bolsters growth.

The market's competitive landscape is dynamic as companies focus on key strategies to strengthen their market position. Companies like Waymo and Aurora are integrating cutting-edge AI and machine learning algorithms in their autonomous driving software to enable vehicles to interpret complex data in real-time and make intelligent decisions.

Key Market Companies

- NVIDIA Corporation

- Mobileye

- Huawei Technologies Co, Ltd

- Aurora Innovation Inc.

- Qualcomm Technologies, Inc.

- Navista

- Aptiv

- Autoliv

- Baidu

- Bosch

- Continental

- Daimler Truck

- General Motors

Recent Industry Developments

- In May 2024, PlusAI, Inc. introduced PlusProtect, an AI technology designed to improve safety systems.

- In June 2024, Rivian and Volkswagen Group signed a joint venture for the development of sophisticated car software technology.

An Expert’s Eye

- Continuous development of AI and machine learning is critical for the growth of the market.

- Significant investments in research and development are accelerating the development of reliable, safe, and scalable autonomous driving systems.

- Autonomous driving is increasingly integrated with electric vehicle (EV) technologies, enhancing the potential for seamless and eco-friendly transportation systems.

Global Autonomous Driving Software Market is Segmented as-

By Level of Autonomy

- L2+

- L3

- L4

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Propulsion

- ICE

- Electric

By Software Type

- Perception and Planning

- Chauffeur

- Interior Sensing

- Monitoring

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Autonomous Driving Software Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Autonomous Driving Software Market Outlook, 2019 - 2032

3.1. Global Autonomous Driving Software Market Outlook, by Level of Autonomy, Value (US$ Bn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. L2+

3.1.1.2. L3

3.1.1.3. L4

3.2. Global Autonomous Driving Software Market Outlook, by Vehicle Type, Value (US$ Bn), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Passenger Cars

3.2.1.2. Commercial Vehicle

3.3. Global Autonomous Driving Software Market Outlook, by Propulsion, Value (US$ Bn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. ICE

3.3.1.2. Electric

3.4. Global Autonomous Driving Software Market Outlook, by Software Type, Value (US$ Bn), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. Perception and Planning

3.4.1.2. Chauffeur

3.4.1.3. Interior Sensing

3.4.1.4. Monitoring

3.4.1.5. Others

3.5. Global Autonomous Driving Software Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Autonomous Driving Software Market Outlook, 2019 - 2032

4.1. North America Autonomous Driving Software Market Outlook, by Level of Autonomy, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. L2+

4.1.1.2. L3

4.1.1.3. L4

4.2. North America Autonomous Driving Software Market Outlook, by Vehicle Type, Value (US$ Bn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Passenger Cars

4.2.1.2. Commercial Vehicle

4.3. North America Autonomous Driving Software Market Outlook, by Propulsion, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. ICE

4.3.1.2. Electric

4.4. North America Autonomous Driving Software Market Outlook, by Software Type, Value (US$ Bn), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. Perception and Planning

4.4.1.2. Chauffeur

4.4.1.3. Interior Sensing

4.4.1.4. Monitoring

4.4.1.5. Others

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Autonomous Driving Software Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.5.1. Key Highlights

4.5.1.1. U.S. Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

4.5.1.2. U.S. Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

4.5.1.3. U.S. Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

4.5.1.4. U.S. Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

4.5.1.5. Canada Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

4.5.1.6. Canada Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

4.5.1.7. Canada Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

4.5.1.8. Canada Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Autonomous Driving Software Market Outlook, 2019 - 2032

5.1. Europe Autonomous Driving Software Market Outlook, by Level of Autonomy, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. L2+

5.1.1.2. L3

5.1.1.3. L4

5.2. Europe Autonomous Driving Software Market Outlook, by Vehicle Type, Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Passenger Cars

5.2.1.2. Commercial Vehicle

5.3. Europe Autonomous Driving Software Market Outlook, by Propulsion, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. ICE

5.3.1.2. Electric

5.4. Europe Autonomous Driving Software Market Outlook, by Software Type, Value (US$ Bn), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Perception and Planning

5.4.1.2. Chauffeur

5.4.1.3. Interior Sensing

5.4.1.4. Monitoring

5.4.1.5. Others

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Autonomous Driving Software Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.5.1. Key Highlights

5.5.1.1. Germany Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

5.5.1.2. Germany Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

5.5.1.3. Germany Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

5.5.1.4. Germany Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

5.5.1.5. U.K. Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

5.5.1.6. U.K. Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

5.5.1.7. U.K. Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

5.5.1.8. U.K. Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

5.5.1.9. France Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

5.5.1.10. France Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

5.5.1.11. France Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

5.5.1.12. France Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

5.5.1.13. Italy Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

5.5.1.14. Italy Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

5.5.1.15. Italy Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

5.5.1.16. Italy Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

5.5.1.17. Turkey Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

5.5.1.18. Turkey Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

5.5.1.19. Turkey Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

5.5.1.20. Turkey Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

5.5.1.21. Russia Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

5.5.1.22. Russia Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

5.5.1.23. Russia Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

5.5.1.24. Russia Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

5.5.1.25. Rest of Europe Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

5.5.1.26. Rest of Europe Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

5.5.1.27. Rest of Europe Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

5.5.1.28. Rest of Europe Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Autonomous Driving Software Market Outlook, 2019 - 2032

6.1. Asia Pacific Autonomous Driving Software Market Outlook, by Level of Autonomy, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. L2+

6.1.1.2. L3

6.1.1.3. L4

6.2. Asia Pacific Autonomous Driving Software Market Outlook, by Vehicle Type, Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Passenger Cars

6.2.1.2. Commercial Vehicle

6.3. Asia Pacific Autonomous Driving Software Market Outlook, by Propulsion, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. ICE

6.3.1.2. Electric

6.4. Asia Pacific Autonomous Driving Software Market Outlook, by Software Type, Value (US$ Bn), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Perception and Planning

6.4.1.2. Chauffeur

6.4.1.3. Interior Sensing

6.4.1.4. Monitoring

6.4.1.5. Others

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Autonomous Driving Software Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.5.1. Key Highlights

6.5.1.1. China Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

6.5.1.2. China Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

6.5.1.3. China Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

6.5.1.4. China Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

6.5.1.5. Japan Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

6.5.1.6. Japan Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

6.5.1.7. Japan Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

6.5.1.8. Japan Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

6.5.1.9. South Korea Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

6.5.1.10. South Korea Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

6.5.1.11. South Korea Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

6.5.1.12. South Korea Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

6.5.1.13. India Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

6.5.1.14. India Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

6.5.1.15. India Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

6.5.1.16. India Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

6.5.1.17. Southeast Asia Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

6.5.1.18. Southeast Asia Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

6.5.1.19. Southeast Asia Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

6.5.1.20. Southeast Asia Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

6.5.1.21. Rest of Asia Pacific Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

6.5.1.22. Rest of Asia Pacific Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

6.5.1.23. Rest of Asia Pacific Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

6.5.1.24. Rest of Asia Pacific Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Autonomous Driving Software Market Outlook, 2019 - 2032

7.1. Latin America Autonomous Driving Software Market Outlook, by Level of Autonomy, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. L2+

7.1.1.2. L3

7.1.1.3. L4

7.2. Latin America Autonomous Driving Software Market Outlook, by Vehicle Type, Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Passenger Cars

7.2.1.2. Commercial Vehicle

7.3. Latin America Autonomous Driving Software Market Outlook, by Propulsion, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. ICE

7.3.1.2. Electric

7.4. Latin America Autonomous Driving Software Market Outlook, by Software Type, Value (US$ Bn), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Perception and Planning

7.4.1.2. Chauffeur

7.4.1.3. Interior Sensing

7.4.1.4. Monitoring

7.4.1.5. Others

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Autonomous Driving Software Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.5.1. Key Highlights

7.5.1.1. Brazil Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

7.5.1.2. Brazil Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

7.5.1.3. Brazil Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

7.5.1.4. Brazil Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

7.5.1.5. Mexico Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

7.5.1.6. Mexico Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

7.5.1.7. Mexico Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

7.5.1.8. Mexico Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

7.5.1.9. Argentina Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

7.5.1.10. Argentina Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

7.5.1.11. Argentina Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

7.5.1.12. Argentina Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

7.5.1.13. Rest of Latin America Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

7.5.1.14. Rest of Latin America Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

7.5.1.15. Rest of Latin America Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

7.5.1.16. Rest of Latin America Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Autonomous Driving Software Market Outlook, 2019 - 2032

8.1. Middle East & Africa Autonomous Driving Software Market Outlook, by Level of Autonomy, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. L2+

8.1.1.2. L3

8.1.1.3. L4

8.2. Middle East & Africa Autonomous Driving Software Market Outlook, by Vehicle Type, Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Passenger Cars

8.2.1.2. Commercial Vehicle

8.3. Middle East & Africa Autonomous Driving Software Market Outlook, by Propulsion, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. ICE

8.3.1.2. Electric

8.4. Middle East & Africa Autonomous Driving Software Market Outlook, by Software Type, Value (US$ Bn), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Perception and Planning

8.4.1.2. Chauffeur

8.4.1.3. Interior Sensing

8.4.1.4. Monitoring

8.4.1.5. Others

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Autonomous Driving Software Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.5.1. Key Highlights

8.5.1.1. GCC Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

8.5.1.2. GCC Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

8.5.1.3. GCC Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

8.5.1.4. GCC Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

8.5.1.5. South Africa Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

8.5.1.6. South Africa Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

8.5.1.7. South Africa Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

8.5.1.8. South Africa Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

8.5.1.9. Egypt Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

8.5.1.10. Egypt Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

8.5.1.11. Egypt Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

8.5.1.12. Egypt Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

8.5.1.13. Nigeria Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

8.5.1.14. Nigeria Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

8.5.1.15. Nigeria Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

8.5.1.16. Nigeria Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

8.5.1.17. Rest of Middle East & Africa Autonomous Driving Software Market by Level of Autonomy, Value (US$ Bn), 2019 - 2032

8.5.1.18. Rest of Middle East & Africa Autonomous Driving Software Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

8.5.1.19. Rest of Middle East & Africa Autonomous Driving Software Market by Propulsion, Value (US$ Bn), 2019 - 2032

8.5.1.20. Rest of Middle East & Africa Autonomous Driving Software Market by Software Type, Value (US$ Bn), 2019 - 2032

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by Vehicle Type Heatmap

9.2. Company Market Share Analysis, 2025

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. NVIDIA Corporation

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Mobileye

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Huawei Technologies Co, Ltd

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Aurora Innovation Inc.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Qualcomm Technologies, Inc.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Navista

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Aptiv

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Autoliv

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Baidu

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Bosch

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Continental

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Daimler Truck

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. General Motors

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Level of Autonomy Coverage |

|

|

Vehicle Type Coverage |

|

|

Propulsion Coverage |

|

|

Software Type Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |