Global Banana Puree Market Forecast

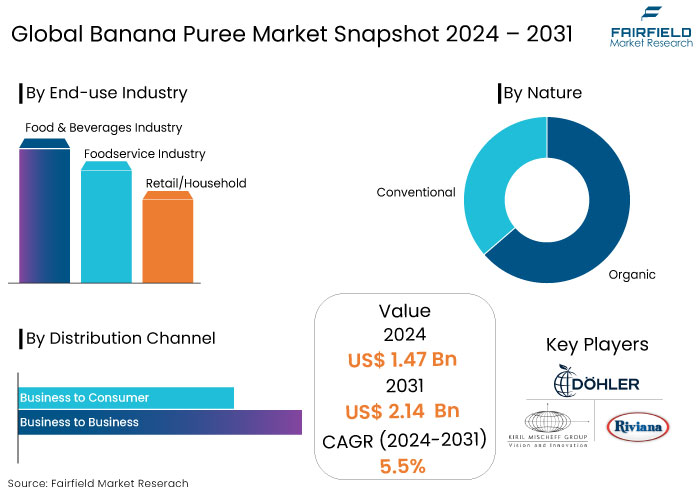

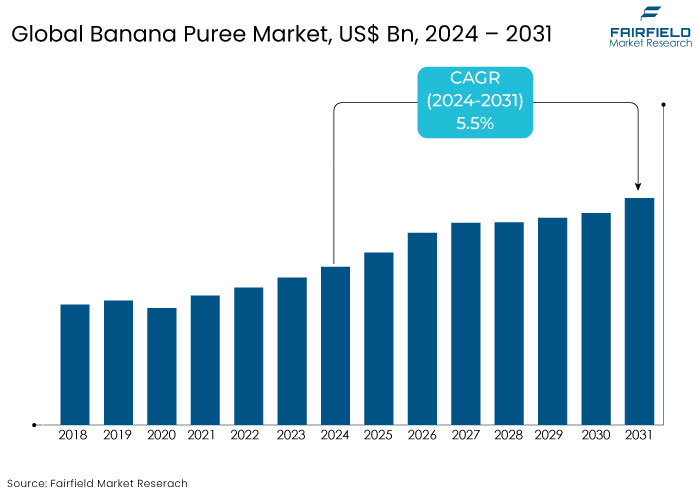

- The banana puree market would reach US$1.47 Bn in 2024 and is estimated to be value at US$2.14 Bn by the end of 2031.

- Demand for banana puree is expected to register a CAGR of 5.5% from 2024 to 2031.

Banana Puree Market Insights

- Banana puree is gaining popularity due to its numerous health benefits, including being rich in vitamins, minerals, and fiber, making it an attractive choice for health-conscious consumers.

- The rise in plant-based and vegan diets propels the demand for banana puree, often used as a dairy or egg substitute in various food products.

- Companies in the market are increasingly adopting sustainable practices, including eco-friendly packaging and responsible sourcing, to appeal to environmentally conscious consumers.

- A notable trend toward product innovation, with manufacturers introducing organic, flavored, and blended banana puree options to cater to diverse consumer preferences.

- The demand for banana puree varies by region, with significant growth reported in North America, Asia, and Latin America, reflecting changing dietary habits and increasing disposable incomes.

- Emerging markets, particularly in Asia, are expected to be key growth areas for banana puree, driven by rising population and growing health awareness.

- Shifting consumer preferences toward natural and clean-label products influences market dynamics, pushing manufacturers to adapt their offerings accordingly.

- The banana puree market faces challenges related to the threat of product waste and the short shelf life of bananas, impacting the overall supply

A Look Back and a Look Forward - Comparative Analysis

The banana puree market has shown robust growth trends leading up to 2023 and is projected to continue expanding significantly through the forecast period. In 2022, the market fueled by a surge in health-conscious consumer behaviour and the increasing popularity of plant-based diets.

The United States held the largest market share of 24% in the historical period. Significant growth was also observed in markets like China and India, primarily fueled by rising demand in applications such as infant food, beverages, and desserts.

The market is expected to reach around US$2.14 Bn in 2031, reflecting a CAGR of approximately 5.5%. Key drivers for this growth include the increasing demand for organic and flavoured products and a focus on health and wellness in food choices. Furthermore, emerging markets in Asia Pacific and Latin America present substantial opportunities as urbanization and disposable income rise.

Key Growth Determinants

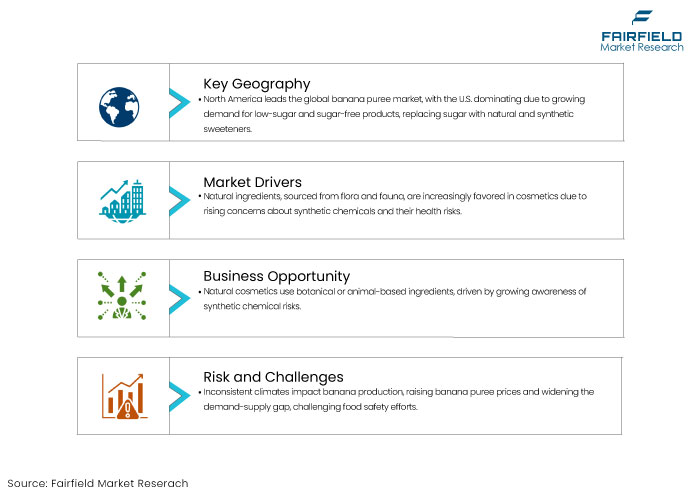

- Increasing Demand for Natural Ingredients in Cosmetics

Natural ingredients are unprocessed materials derived from flora or fauna employed in manufacturing personal care and cosmetic items. The rising public awareness of synthetic chemicals in cosmetics justifies the increased demand for natural ingredients. Consumers are apprehensive about the health risks of chemicals, resulting in a desire for cosmetics formulated from natural ingredients to avoid chemical usage.

Banana puree is linked to several health advantages and is recognized for its numerous benefits for skin and hair. Banana puree is a widely utilized raw ingredient in the formulation of cosmetic products for optimal nourishing of the skin and hair. Also, the notable antioxidant content of banana puree is recognized for its anti-aging benefits. The substance is additionally linked to benefits like skin hydration, oil regulation, dandruff management, hair development, and more.

- Advancement of Modernized Trade Channels to Enhance Banana Puree Sales

The emergence of e-commerce in the food and beverage sector has positively influenced consumers' daily purchase behaviours. Online retail channels have established themselves as a leading method of purchasing in contemporary society. Many prominent entities in the fruit processing sector are targeting e-commerce platforms for commercial expansion.

Manufacturers have commenced the distribution of their fruit purees via e-commerce platforms, including Alibaba, eBay, and Amazon. Puree manufacturers and suppliers predominantly employ Alibaba to distribute their products to remote areas.

The advent of e-commerce platforms enables manufacturers to provide banana puree at competitive pricing. Enhanced social media efforts promoting awareness of the various health advantages linked to fruit puree consumption have increased banana puree sales through online retail channels.

Key Growth Barriers

- Environmental Factors Influence Banana Puree Production

An essential element limiting market expansion is inconsistent environmental circumstances that significantly influence banana production rates, thus affecting the pricing of banana puree. Adverse climatic conditions have resulted in an expansion of the demand-supply gap, posing problems to the food safety initiatives of numerous countries.

Adverse climatic circumstances, including excessive or insufficient rainfall and harsh temperatures, impact fruit production, resulting in import price volatility and presenting challenges for banana puree manufacturers. The limited shelf life of bananas, the issue of browning, and difficulties in fruit processing are significant obstacles impeding the sales growth of banana puree. Moreover, the retail sales of banana puree goods are rather minimal, which is anticipated to impede market expansion over the forecast period.

- Short Shelf Life and Perishability

One of the primary challenges facing the banana puree market is its relatively short shelf life. Banana puree, being a natural product, is prone to spoilage and degradation over time due to its high moisture content and the natural ripening process of bananas.

Perishability necessitates stringent storage conditions and limits distribution options, particularly in regions lacking adequate cold chain logistics. As a result, manufacturers often face increased costs related to transportation and storage, which can hinder market expansion.

The short shelf life can lead to higher wastage rates, posing a significant concern for both producers and retailers. Companies must invest in innovative preservation techniques and packaging solutions to extend the product's viability, yet these solutions can also increase production costs, further impacting market growth

Banana Puree Market Trends and Opportunities

- Antioxidant Properties of Banana Puree Promoting Extensive Application in Skin Care Products

Natural constituents in personal care and cosmetics originate from botanical or animal sources. The increasing public knowledge of synthetic chemicals in cosmetics has intensified the need for natural alternatives.

Concerns regarding potential health hazards linked to chemicals have fostered a desire for cosmetics formulated with natural materials, such as banana puree. Banana puree is present in ample amounts of antioxidants, which help the body combat free radicals. When administered topically, antioxidants enhance the skin's defense against damage from free radicals, including protection against ultraviolet radiation.

It is essential to recognize that although bananas offer natural protection, they do not substitute for the necessity of frequent sunscreen application. Bananas include anti-inflammatory elements, including vitamin A, zinc, and manganese. Applying a banana peel to the face is said to diminish blemishes and address acne. All these reasons are leading to the expansion of the banana puree market.

How Does Regulatory Scenario Shape the Industry?

The regulatory landscape significantly influences the banana puree market by establishing food safety, quality, and labelling standards. Various regulations, such as the U.S. Food and Drug Administration (FDA) guidelines and European Union food safety standards, govern banana puree production, processing, and distribution. Manufacturers must comply with these regulations to ensure consumer safety and maintain market access.

Regulations concerning organic certification are shaping product offerings in the market. With an increasing demand for organic products, producers must adhere to strict sourcing, processing, and labelling guidelines to cater to health-conscious consumers.

Sustainability regulations are emerging as a crucial factor. Companies are encouraged to adopt eco-friendly practices in their production and packaging processes to align with consumer preferences and regulatory expectations. This focus on sustainability can lead to increased operational costs but also offers opportunities for differentiation in a competitive market.

Segments Covered in the Report

- Conventional Nature of Banana Puree to Accumulate Notable Market Share

Conventional banana puree is typically less expensive to produce than its organic counterparts, rendering it more accessible to consumers and food manufacturers. The traditional banana industry advantages itself through established supply chains and manufacturing procedures that provide dependable availability and uniform quality.

Traditional agricultural practices generally provide great yields than organic methods, ensuring a consistent supply to satisfy market requirements. Even with the increasing popularity of organic products, conventional banana puree continues to be favoured by a larger segment of price-sensitive consumers. It is widely employed in many food items, including baby food, baked goods, ice cream, and beverages, greatly enhancing its market share.

- Highest Sales Contributes Comes from Food & Beverages Industry

The food and beverage sector is projected to represent 42% of the banana puree market in 2024. Smoothies, drinks, and milkshakes are prepared with banana puree, which includes a unique, organic flavour and a robust texture. These items possess an unadulterated, natural flavour and exhibit a robust texture.

Banana puree is favoured in this context due to its handcrafted appearance, characterized by discernible banana fragments. Further, banana puree is frequently used in snacks and is particularly prevalent in baking and snacks. Consumer inclinations for a velvety texture and pronounced flavour have impacted the baking sector globally in both emerging and developed nations.

Regional Analysis

- North America Leads as the Most Promising Region for Banana Puree

North America dominates the global banana puree market owing to the rise of this region in banana cultivation. Further, the United States is projected to command a substantial market share in North America, driven by the rising popularity of low-sugar and sugar-free goods. Producers are substituting sugar with natural and synthetic sweeteners sourced from fruit.

Beverage and snack manufacturers often utilize bananas as a sweetening agent. The market in the United States is experiencing tremendous growth because of the increasing popularity of healthy beverages and smoothies. Individuals are progressively seeking healthier drink alternatives. Banana puree serves as a low-calorie and fat-free substitute for sugary beverages.

The market in the United States is experiencing tremendous growth owing to the increasing popularity of health beverages and smoothies. A rising number of individuals are seeking healthy beverage alternatives. Banana puree serves as an excellent substitute for sugary beverages due to its low calorie and fat content, which is one of the elements for the market growth over the forecast period.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the banana puree market is characterized by a mix of established players and emerging companies focused on product innovation and sustainability. Leading players include Dole Food Company, SunOpta, and Fruits & Roots, who dominate through extensive distribution networks and strong brand recognition.

Companies invest in research and development to enhance product quality and cater to growing consumer demands for organic and natural ingredients. Additionally, small and medium-sized enterprises are entering the market, offering niche products and unique blends, intensifying competition.

Pricing strategies and promotional activities are also key competitive factors. As the market evolves, companies increasingly adopt eco-friendly practices and transparent labelling to appeal to health-conscious consumers. This dynamic landscape requires ongoing adaptation and innovation from all market participants to maintain competitive advantage.

Key Market Companies

- Symrise AG (Cobel Ltd)

- Döhler GmbH

- Kiril Mischeff

- Riviana Foods Pty Ltd.

- Nestlé S.A

- The Hain Celestial Group, Inc.

- The Kraft Heinz Co.

- Ariza B.V.

- Newberry International Produce Limited

- Grünewald Fruchtsaft GmbH

- Tree Top Inc.

- Hiltfields Ltd.

- Shimla Hills Offerings Pvt. Ltd.

- Antigua Processors S.A.

- SunOpta Grains and Foods Inc.

- FructaCR S.A.

Recent Industry Developments

- In January 2024, Nestlé S.A. revealed plans to expand its banana puree distribution in Asia, targeting countries like China and India, where demand for banana-based products is increasing significantly.

- In September 2023, The Hain Celestial Group launched an initiative to use eco-friendly packaging for its banana puree products to reduce environmental impact and cater to the growing consumer demand for sustainable packaging.

An Expert’s Eye

- Increasing consumer health consciousness drives the demand for banana puree over the forecast period, appealing to health-focused consumers.

- The surge in plant-based and vegan diets significantly boosts the market revenue over the forecast period and the rising awareness of vegan diets.

- Banana puree serves as an excellent dairy or egg substitute in recipes, enhancing its market potential while key dairy companies import more banana puree.

- Companies are adopting eco-friendly practices and sustainable packaging to meet consumer expectations and differentiate themselves in a competitive market.

Global Banana Puree Market is Segmented as-

By Nature

- Organic

- Conventional

By End-use Industry

- Food & Beverages Industry

- Foodservice Industry

- Retail/Household

By Distribution Channel

- Business to Business

- Business to Consumer

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Banana Puree Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Price Analysis, 2019 - 2023

3.1. Global Average Price Analysis, by Nature, US$ Per Unit, 2019 - 2023

3.2. Prominent Factor Affecting Banana Puree Prices

3.3. Global Average Price Analysis, by Region, US$ Per Unit

4. Global Banana Puree Market Outlook, 2019 - 2031

4.1. Global Banana Puree Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Organic

4.1.1.2. Conventional

4.2. Global Banana Puree Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Food & Beverage Industry

4.2.1.1.1. Infant Food

4.2.1.1.2. Dairy and Desserts

4.2.1.1.3. Dressings and Sauces

4.2.1.1.4. Beverages

4.2.1.1.5. Bakery and Snacks

4.2.1.1.6. Others

4.2.1.2. Foodservice Industry

4.2.1.3. Retail/Household

4.3. Global Banana Puree Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Business to Business

4.3.1.2. Business to Consumer

4.3.1.2.1. Hypermarkets/Supermarkets

4.3.1.2.2. Convenience Stores

4.3.1.2.3. Online Retail

4.3.1.2.4. Other Retail Formats

4.4. Global Banana Puree Market Outlook, by Region, Value (US$ Bn) and Volume (Tons), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. North America

4.4.1.2. Europe

4.4.1.3. Asia Pacific

4.4.1.4. Latin America

4.4.1.5. Middle East & Africa

5. North America Banana Puree Market Outlook, 2019 - 2031

5.1. North America Banana Puree Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Organic

5.1.1.2. Conventional

5.2. North America Banana Puree Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Food & Beverage Industry

5.2.1.1.1. Infant Food

5.2.1.1.2. Dairy and Desserts

5.2.1.1.3. Dressings and Sauces

5.2.1.1.4. Beverages

5.2.1.1.5. Bakery and Snacks

5.2.1.1.6. Others

5.2.1.2. Foodservice Industry

5.2.1.3. Retail/Household

5.3. North America Banana Puree Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Business to Business

5.3.1.2. Business to Consumer

5.3.1.2.1. Hypermarkets/Supermarkets

5.3.1.2.2. Convenience Stores

5.3.1.2.3. Online Retail

5.3.1.2.4. Other Retail Formats

5.4. North America Banana Puree Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. U.S. Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.4.1.2. U.S. Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.4.1.3. U.S. Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.4.1.4. Canada Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.4.1.5. Canada Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.4.1.6. Canada Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Banana Puree Market Outlook, 2019 - 2031

6.1. Europe Banana Puree Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Organic

6.1.1.2. Conventional

6.2. Europe Banana Puree Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Food & Beverage Industry

6.2.1.1.1. Infant Food

6.2.1.1.2. Dairy and Desserts

6.2.1.1.3. Dressings and Sauces

6.2.1.1.4. Beverages

6.2.1.1.5. Bakery and Snacks

6.2.1.1.6. Others

6.2.1.2. Foodservice Industry

6.2.1.3. Retail/Household

6.3. Europe Banana Puree Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Business to Business

6.3.1.2. Business to Consumer

6.3.1.2.1. Hypermarkets/Supermarkets

6.3.1.2.2. Convenience Stores

6.3.1.2.3. Online Retail

6.3.1.2.4. Other Retail Formats

6.4. Europe Banana Puree Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Germany Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.2. Germany Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.3. Germany Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.4. U.K. Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.5. U.K. Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.6. U.K. Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.7. France Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.8. France Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.9. France Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.10. Italy Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.11. Italy Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.12. Italy Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.13. Turkey Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.14. Turkey Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.15. Turkey Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.16. Russia Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.17. Russia Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.18. Russia Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.19. Rest of Europe Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.20. Rest of Europe Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.21. Rest of Europe Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Banana Puree Market Outlook, 2019 - 2031

7.1. Asia Pacific Banana Puree Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Organic

7.1.1.2. Conventional

7.2. Asia Pacific Banana Puree Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Food & Beverage Industry

7.2.1.1.1. Infant Food

7.2.1.1.2. Dairy and Desserts

7.2.1.1.3. Dressings and Sauces

7.2.1.1.4. Beverages

7.2.1.1.5. Bakery and Snacks

7.2.1.1.6. Others

7.2.1.2. Foodservice Industry

7.2.1.3. Retail/Household

7.3. Asia Pacific Banana Puree Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Business to Business

7.3.1.2. Business to Consumer

7.3.1.2.1. Hypermarkets/Supermarkets

7.3.1.2.2. Convenience Stores

7.3.1.2.3. Online Retail

7.3.1.2.4. Other Retail Formats

7.4. Asia Pacific Banana Puree Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. China Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.2. China Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.3. China Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.4. Japan Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.5. Japan Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.6. Japan Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.7. South Korea Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.8. South Korea Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.9. South Korea Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.10. India Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.11. India Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.12. India Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.13. Southeast Asia Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.14. Southeast Asia Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.15. Southeast Asia Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.16. Rest of Asia Pacific Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.17. Rest of Asia Pacific Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.18. Rest of Asia Pacific Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Banana Puree Market Outlook, 2019 - 2031

8.1. Latin America Banana Puree Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Organic

8.1.1.2. Conventional

8.2. Latin America Banana Puree Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Food & Beverage Industry

8.2.1.1.1. Infant Food

8.2.1.1.2. Dairy and Desserts

8.2.1.1.3. Dressings and Sauces

8.2.1.1.4. Beverages

8.2.1.1.5. Bakery and Snacks

8.2.1.1.6. Others

8.2.1.2. Foodservice Industry

8.2.1.3. Retail/Household

8.3. Latin America Banana Puree Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Business to Business

8.3.1.2. Business to Consumer

8.3.1.2.1. Hypermarkets/Supermarkets

8.3.1.2.2. Convenience Stores

8.3.1.2.3. Online Retail

8.3.1.2.4. Other Retail Formats

8.4. Latin America Banana Puree Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Brazil Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.2. Brazil Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.3. Brazil Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.4. Mexico Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.5. Mexico Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.6. Mexico Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.7. Argentina Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.8. Argentina Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.9. Argentina Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.10. Rest of Latin America Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.11. Rest of Latin America Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.12. Rest of Latin America Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Banana Puree Market Outlook, 2019 - 2031

9.1. Middle East & Africa Banana Puree Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Organic

9.1.1.2. Conventional

9.2. Middle East & Africa Banana Puree Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Food & Beverage Industry

9.2.1.1.1. Infant Food

9.2.1.1.2. Dairy and Desserts

9.2.1.1.3. Dressings and Sauces

9.2.1.1.4. Beverages

9.2.1.1.5. Bakery and Snacks

9.2.1.1.6. Others

9.2.1.2. Foodservice Industry

9.2.1.3. Retail/Household

9.3. Middle East & Africa Banana Puree Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Business to Business

9.3.1.2. Business to Consumer

9.3.1.2.1. Hypermarkets/Supermarkets

9.3.1.2.2. Convenience Stores

9.3.1.2.3. Online Retail

9.3.1.2.4. Other Retail Formats

9.4. Middle East & Africa Banana Puree Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. GCC Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.2. GCC Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.3. GCC Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.4. South Africa Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.5. South Africa Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.6. South Africa Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.7. Egypt Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.8. Egypt Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.9. Egypt Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.10. Nigeria Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.11. Nigeria Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.12. Nigeria Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.13. Rest of Middle East & Africa Banana Puree Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.14. Rest of Middle East & Africa Banana Puree Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.15. Rest of Middle East & Africa Banana Puree Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. Nature vs End User Heatmap

10.2. Company Market Share Analysis, 2024

10.3. Competitive Dashboard

10.4. Company Profiles

10.4.1. Symrise AG (Cobel Ltd)

10.4.1.1. Company Overview

10.4.1.2. Product Portfolio

10.4.1.3. Financial Overview

10.4.1.4. Business Strategies and Development

10.4.2. Döhler GmbH

10.4.2.1. Company Overview

10.4.2.2. Product Portfolio

10.4.2.3. Financial Overview

10.4.2.4. Business Strategies and Development

10.4.3. Kiril Mischeff

10.4.3.1. Company Overview

10.4.3.2. Product Portfolio

10.4.3.3. Financial Overview

10.4.3.4. Business Strategies and Development

10.4.4. Riviana Foods Pty Ltd.

10.4.4.1. Company Overview

10.4.4.2. Product Portfolio

10.4.4.3. Financial Overview

10.4.4.4. Business Strategies and Development

10.4.5. Nestlé S.A

10.4.5.1. Company Overview

10.4.5.2. Product Portfolio

10.4.5.3. Financial Overview

10.4.5.4. Business Strategies and Development

10.4.6. The Hain Celestial Group, Inc.

10.4.6.1. Company Overview

10.4.6.2. Product Portfolio

10.4.6.3. Financial Overview

10.4.6.4. Business Strategies and Development

10.4.7. The Kraft Heinz Co.

10.4.7.1. Company Overview

10.4.7.2. Product Portfolio

10.4.7.3. Financial Overview

10.4.7.4. Business Strategies and Development

10.4.8. Ariza B.V.

10.4.8.1. Company Overview

10.4.8.2. Product Portfolio

10.4.8.3. Financial Overview

10.4.8.4. Business Strategies and Development

10.4.9. Newberry International Produce Limited

10.4.9.1. Company Overview

10.4.9.2. Product Portfolio

10.4.9.3. Financial Overview

10.4.9.4. Business Strategies and Development

10.4.10. Grünewald Fruchtsaft GmbH

10.4.10.1. Company Overview

10.4.10.2. Product Portfolio

10.4.10.3. Financial Overview

10.4.10.4. Business Strategies and Development

10.4.11. Tree Top Inc.

10.4.11.1. Company Overview

10.4.11.2. Product Portfolio

10.4.11.3. Financial Overview

10.4.11.4. Business Strategies and Development

10.4.12. Hiltfields Ltd.

10.4.12.1. Company Overview

10.4.12.2. Product Portfolio

10.4.12.3. Financial Overview

10.4.12.4. Business Strategies and Development

10.4.13. Shimla Hills Offerings Pvt. Ltd.

10.4.13.1. Company Overview

10.4.13.2. Product Portfolio

10.4.13.3. Financial Overview

10.4.13.4. Business Strategies and Development

10.4.14. Antigua Processors S.A.

10.4.14.1. Company Overview

10.4.14.2. Product Portfolio

10.4.14.3. Financial Overview

10.4.14.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Nature Coverage |

|

|

End-use Industry Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |