Global Barium Sulfate Market Forecast

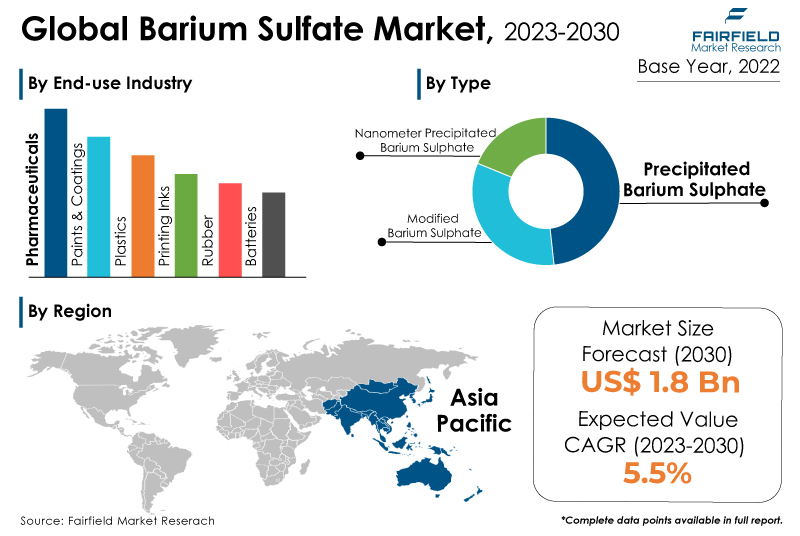

- Global barium sulfate market revenue to ascend at a CAGR of 5.5% over 2023 - 2030

- Market size slated to reach a valuation of US$1.8 Bn by the end of 2030

Market Analysis in Brief

Barium sulfate, often known as BaSO4, is a white crystalline solid with numerous uses in various industries. An inorganic substance known as barium sulfate is odorless and insoluble in water. Barium sulfate is an extraordinary radiocontrast agent employed as barium meal in diagnostic procedures due to its limited solubility and high level of clearance from the body. As a lake pigment, barium sulfate, a white transparent pigment, is also used in cosmetics and personal care items.

Barium sulfate has several exceptional chemical qualities that make it appropriate for usage in various applications, such as being soluble in conjugated acids. Barium sulfate is widely utilised as an X-ray contrast agent in the medical industry, in radiation shields, and in well-drilling fluids, which is projected to propel the market. Barium sulfate is also used as a filler in plastic, catalyst support, paints, and pigments.

As a result, the barium sulfate market is expected to expand over the forecast period. Despite being a non-toxic substance, barium sulfate has several benefits. However, exposure to its dust can harm the eyes, throat, and respiratory systems when inhaled, which can seriously impair human organs. In addition, barium sulfate can paralyze people.

Key Report Findings

- The growth of the paint industry and a rise in demand for insoluble pigment dispersions due to environmental compliance regulations like RoHS (Restriction on Hazardous Substances) are two factors influencing this market's expansion.

- Demand for precipitated barium sulfate remains higher in the barium sulfate market.

- Paints & coatings industry is set to record the fastest growth in creating demand for barium sulfate.

- Asia Pacific will continue to lead its way, whereas North America's barium sulfate market will experience significant growth till 2030.

Growth Drivers

Growing Demand from Paints and Coatings Industry

Due to its high opacity and chemical inertness, barium sulfate, often known as barite, is a mineral frequently used in producing paints and coatings. Due to the rising need for premium paints and coatings across numerous industries, including construction, automotive, and aerospace, barium sulfate demand has increased dramatically globally in recent years. Barium sulfate is used as a filler ingredient in the paint and coatings industry because it has a high scratch resistance and smooth finish, enhancing coatings' performance.

Barium sulfate is also used to make powder coatings, which are widely employed in the automotive industry due to their outstanding durability and corrosion resistance. The expanding use of barium sulfate as a weighing ingredient in drilling fluids in the oil and gas industry is another factor fueling the expansion of the global barium sulfate market. Due to its expanding applications across numerous industries, the market is anticipated to expand gradually during the next years.

Rising Applications in Plastics and Rubber

The rising applications in the plastics and rubber sectors are expected to drive significant expansion in the worldwide barium sulfate market. Barium sulfate, which offers excellent levels of stiffness, durability, and heat resistance, is utilised as a filler material in producing plastics and rubber. Its attributes also enhance plastic and rubber items' mechanical functionality and aesthetics.

Thus, the market for barium sulfate is anticipated to increase due to the rising demand for plastic and rubber goods across several industries, including automotive, construction, and packaging. Increased demand for paints and coatings, which use barium sulfate as a pigment and an extender, is another factor driving the market. However, the health hazards connected to exposure to barium sulfate and the fact that there are only a few sources of it can limit market expansion.

Growth Challenges

Potential Adverse Effects

The human body experiences some negative effects from barium sulfate, some of which can be fatal. Ingesting barium sulfate for medicinal reasons may also have unfavorable effects, including weakness, diarrhea/constipation, severe stomach discomfort, chest pain, difficulty breathing, and blue skin. Humans can become paralysed from the usage of barium sulfate.

Barium compounds that dissolve easily in very high numbers when consumed or drunk might alter the cardiac rhythm, cause paralysis, and even result in death. Long-term use of barium causes kidney damage, weight loss, and even death in some animals.

Lung injury has been documented in certain studies of experimental humans and animals exposed to barium in the air. As a result, barium sulfate should only be taken occasionally and under a doctor's supervision. One major challenge stopping the barium sulfate market from growing is this.

Overview of Key Segments

Precipitated Barium Sulphate Continues to Garner Traction

In the barium sulfate market, the category of precipitated barium sulfate held the biggest share. White plastic raw materials are made with precipitated barium sulfate, including resin pellets and translucent, opaque reflection sheets. Consumers and other end-use sectors' increasing use and preference for plastic products drive the need for precipitated barium sulfate.

In 2019, Europe produced 50.7 million tonnes of plastic, with 6.2% of that demand coming from the electrical and electronics industry and 20% from the building and construction sector, according to recent research published by Plastics Europe in 2020. This stimulates the precipitated barium sulfate segment even more.

Due to the development of the building and construction sectors and the quickening pace of technological improvement in the production of industrial chemicals, the precipitated barium sulfate market will grow.

Additionally, the modified barium sulfate segment witnessed the fastest growth. Modified barium sulfate is a product that has undergone chemical modification to enhance performance. It has exceptional hiding power, gloss, and color strength and is utilised as a coating pigment in the printing industry.

Compared to other barium sulfate pigments, modified barium sulfate also provides improved fading resistance. It comes in three forms: uncoated, coated, and precipitated. Uncoated modified barium sulfate is created by processing natural barite with sulfuric acid and neutralising the resultant solution with ammonia.

Pharmaceutical Industry Largest Demand Generator

In 2022, the pharmaceutical industry accounted for the largest share of the global barium sulfate market revenue. A radiocontrast agent used in diagnostic procedures also contains barium sulfate. The demand for treatments like MRI scanning, X-ray, CT scanning, and other diagnostic procedures is rising due to the rise in ailments like heart disorders, brain-related diseases, and other diseases worldwide. Due to this, there is an increase in the demand for radiocontrast materials, which in turn fuels the market demand for barium sulfate.

The World Health Organisation (WHO) estimates that there will be 50 million dementia sufferers worldwide by 2020, with 10 million new cases occurring each year. Additionally, in 2019 there were estimated to be 50 million patients with epilepsy, a brain-related central nervous system illness. This will boost the market for barium sulfate by increasing the need for radiocontrast agents.

The industry that is expected to grow fastest is paints and coatings. To improve the qualities and look of the finished product, barium sulfate is frequently employed as an addition in paint and coating formulas. It aids in giving paints and coatings high gloss, whiteness, and opacity so they can be used in various industrial, automotive, and architectural applications. Due to growing consumer interest in high-performance coatings and growing demand from numerous end-use industries, the paints and coatings sector is anticipated to grow.

Using barium sulfate as a filler reduces the need for pricey colors while keeping the intended aesthetic and concealing the coating's power. Barium sulfate is preferred in the coatings sector in addition to its technical benefits due to its affordability. Compared to other pigments and fillers, it offers a less expensive option that performs as well as or better.

Growth Opportunities Across Regions

Asia Pacific Represents the Largest Market

Urbanisation and industrialisation are accelerating significantly in the Asia Pacific, driving demand for barium sulfate in the building and automotive sectors. Barium sulfate has become more popular as a filler material due to the rising need for plastic items like packaging, toys, and consumer goods.

Due to its expanding economy and quick industrialisation, China is the biggest market in the Asia Pacific and the world's top producer of barium sulfate. The nation exports barium sulfate to other nations and is the top producer of the substance. Due to the rising need for paints and coatings, which is anticipated to increase the demand for barium sulfate in the region, India is another emerging market for barium sulfate in addition to China.

The expanding use of barium sulfate in X-ray contrast agents and other medical applications is causing the market to expand. The Asia Pacific region currently holds a dominant position in the worldwide barium sulfate market due to rising demand from different sectors, the presence of significant market players, and favourable governmental policies toward industrialisation and urbanisation.

North America Reflects High Potential

High disposable income in North America is correlated with market growth, which raises demand for rubber goods. Due to its widespread use in tires, sports mats, and other products, North American nations like the United States are among the major centres for rubber products. Over the past year, there has been an increase in health and hygiene awareness.

The number of fitness centres in the area has increased as a result. These fitness centres frequently use rubber gym mats, which contributes to increased product demand. One of the main factors anticipated to support the market's growth in the area over the forecast period is healthy usage across various industries in North America, including chemical manufacturing, ceramics, glass, and metal industries.

Due to the development and expansion of end-use verticals, the country's rich supply of raw materials, and the rapid increase in the building of smart cities, the region may continue to experience significant advantages throughout this time.

To meet consumer demand, car parts producers are expanding their commercial activities. Due to its superior chemical qualities, including rheology and compatibility with other available pigments, barium sulfate has seen increased demand. The substance is used to coat and manufacture plastic materials.

Barium Sulfate Market: Competitive Landscape

Some of the leading players at the forefront in the barium sulfate market space include Solvay S.A, Sakai Chemical Industry Co. Ltd., Venator Materials PLC, Anglo Pacific Minerals, Nippon Chemical Industrial, Vishnu Chemicals Ltd., Cimbar Performance Minerals, and Fengchen Group.

Recent Notable Developments

In March 2022, Cimbar Performance Minerals Inc acquired TOR Minerals International Inc's aluminum trihydrate (ATH) and barium sulfate (Barite) businesses. Cimbar was able to extend its product and presence due to the acquisition. TOR Minerals is headquartered in Corpus Christi, Texas, and includes manufacturing and regional offices in the United States, the Netherlands, and Malaysia.

Similarly, in November 2020, Shaanxi Fuhua Chemical Co., Ltd. established an R&D specialist division to improve the company's barium sulfate product quality. Establishing the R&D division aims to maximize revenue by providing customers with best-in-class products. Shaanxi Fuhua Chemical Co., Ltd. manufactures and sells chemicals. The company makes and sells precipitated barium sulfate, low iron sodium sulfide, and other items. Shaanxi Fuhua Chemical also exports chemicals.

Global Barium Sulfate Market is Segmented as Below:

By Type

- Precipitated Barium Sulphate

- Modified Barium Sulphate

- Nanometer Precipitated Barium Sulphate

By Grade

- Industrial Grade

- Pharmaceutical Grade

By End-use Industry

- Paints & Coatings

- Pharmaceuticals

- Plastics

- Printing Inks

- Rubber

- Batteries

- Miscellaneous

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Barium Sulfate Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Volume/Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics

3.1. Global Barium Sulfate Production, 2018 - 2022

3.2. Barium Sulfate Import Statistics, 2018 - 2022

3.3. Barium Sulfate Export Statistics, 2018 - 2022

4. Price Trends Analysis and Future Projects, 2018 - 2030

4.1. Global Average Price Analysis, by Type, US$ per Kg

4.2. Global Average Price Analysis, by Grade, US$ per Kg

4.3. Global Average Price Analysis, by End-Use Industry, US$ per Kg

4.4. Prominent Factors Affecting Barium Sulfate Prices

4.5. Global Average Price Analysis, by Region, US$ per Kg

5. Global Barium Sulfate Market Outlook, 2018 - 2030

5.1. Global Barium Sulfate Market Outlook, by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Precipitated Barium Sulphate

5.1.1.2. Modified Barium Sulphate

5.1.1.3. Nanometer Precipitated Barium Sulphate

5.2. Global Barium Sulfate Market Outlook, by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Industrial Grade

5.2.1.2. Pharmaceutical Grade

5.3. Global Barium Sulfate Market Outlook, by End-Use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Paints & Coatings

5.3.1.2. Pharmaceuticals

5.3.1.3. Plastics

5.3.1.4. Printing Inks

5.3.1.5. Rubber

5.3.1.6. Batteries

5.3.1.7. Misc.

5.4. Global Barium Sulfate Market Outlook, by Region, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. North America

5.4.1.2. Europe

5.4.1.3. Asia Pacific

5.4.1.4. Latin America

5.4.1.5. Middle East & Africa

6. North America Barium Sulfate Market Outlook, 2018 - 2030

6.1. North America Barium Sulfate Market Outlook, by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Precipitated Barium Sulphate

6.1.1.2. Modified Barium Sulphate

6.1.1.3. Nanometer Precipitated Barium Sulphate

6.2. North America Barium Sulfate Market Outlook, by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Industrial Grade

6.2.1.2. Pharmaceutical Grade

6.3. North America Barium Sulfate Market Outlook, by End-Use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Paints & Coatings

6.3.1.2. Pharmaceuticals

6.3.1.3. Plastics

6.3.1.4. Printing Inks

6.3.1.5. Rubber

6.3.1.6. Batteries

6.3.1.7. Misc.

6.3.2. Market Attractiveness Analysis

6.4. North America Barium Sulfate Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. U.S. Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

6.4.1.2. U.S. Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

6.4.1.3. U.S. Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

6.4.1.4. Canada Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

6.4.1.5. Canada Barium Sulfate Market by Manufacturing Process, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

6.4.1.6. Canada Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

6.4.1.7. Canada Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Barium Sulfate Market Outlook, 2018 - 2030

7.1. Europe Barium Sulfate Market Outlook, by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Precipitated Barium Sulphate

7.1.1.2. Modified Barium Sulphate

7.1.1.3. Nanometer Precipitated Barium Sulphate

7.2. Europe Barium Sulfate Market Outlook, by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Industrial Grade

7.2.1.2. Pharmaceutical Grade

7.3. Europe Barium Sulfate Market Outlook, by End-Use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Paints & Coatings

7.3.1.2. Pharmaceuticals

7.3.1.3. Plastics

7.3.1.4. Printing Inks

7.3.1.5. Rubber

7.3.1.6. Batteries

7.3.1.7. Misc.

7.4. Europe Barium Sulfate Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Germany Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.1.2. Germany Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.1.3. Germany Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.1.4. U.K. Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.1.5. U.K. Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.1.6. U.K. Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.1.7. France Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.1.8. France Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.1.9. France Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.1.10. Italy Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.1.11. Italy Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.1.12. Italy Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.1.13. Russia Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.1.14. Russia Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.1.15. Russia Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.1.16. Rest of Europe Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.1.17. Rest of Europe Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.1.18. Rest of Europe Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Barium Sulfate Market Outlook, 2018 - 2030

8.1. Asia Pacific Barium Sulfate Market Outlook, by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Precipitated Barium Sulphate

8.1.1.2. Modified Barium Sulphate

8.1.1.3. Nanometer Precipitated Barium Sulphate

8.2. Asia Pacific Barium Sulfate Market Outlook, by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Industrial Grade

8.2.1.2. Pharmaceutical Grade

8.3. Asia Pacific Barium Sulfate Market Outlook, by End-Use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Paints & Coatings

8.3.1.2. Pharmaceuticals

8.3.1.3. Plastics

8.3.1.4. Printing Inks

8.3.1.5. Rubber

8.3.1.6. Batteries

8.3.1.7. Misc.

8.4. Asia Pacific Barium Sulfate Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. China Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.1.2. China Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.1.3. China Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.1.4. Japan Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.1.5. Japan Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.1.6. Japan Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.1.7. South Korea Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.1.8. South Korea Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.1.9. South Korea Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.1.10. India Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.1.11. India Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.1.12. India Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.1.13. Southeast Asia Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.1.14. Southeast Asia Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.1.15. Southeast Asia Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.1.16. Rest of Asia Pacific Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.1.17. Rest of Asia Pacific Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.1.18. Rest of Asia Pacific Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Barium Sulfate Market Outlook, 2018 - 2030

9.1. Latin America Barium Sulfate Market Outlook, by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.1.1. Key Highlights

9.1.1.1. Precipitated Barium Sulphate

9.1.1.2. Modified Barium Sulphate

9.1.1.3. Nanometer Precipitated Barium Sulphate

9.2. Latin America Barium Sulfate Market Outlook, by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.2.1. Key Highlights

9.2.1.1. Industrial Grade

9.2.1.2. Pharmaceutical Grade

9.3. Latin America Barium Sulfate Market Outlook, by End-Use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.3.1. Key Highlights

9.3.1.1. Paints & Coatings

9.3.1.2. Pharmaceuticals

9.3.1.3. Plastics

9.3.1.4. Printing Inks

9.3.1.5. Rubber

9.3.1.6. Batteries

9.3.1.7. Misc.

9.4. Latin America Barium Sulfate Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.4.1. Key Highlights

9.4.1.1. Brazil Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.4.1.2. Brazil Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.4.1.3. Brazil Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.4.1.4. Mexico Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.4.1.5. Mexico Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.4.1.6. Mexico Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.4.1.7. Rest of Latin America Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.4.1.8. Rest of Latin America Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.4.1.9. Rest of Latin America Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Barium Sulfate Market Outlook, 2018 - 2030

10.1. Middle East & Africa Barium Sulfate Market Outlook, by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.1.1. Key Highlights

10.1.1.1. Precipitated Barium Sulphate

10.1.1.2. Modified Barium Sulphate

10.1.1.3. Nanometer Precipitated Barium Sulphate

10.2. Middle East & Africa Barium Sulfate Market Outlook, by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.2.1. Key Highlights

10.2.1.1. Industrial Grade

10.2.1.2. Pharmaceutical Grade

10.3. Middle East & Africa Barium Sulfate Market Outlook, by End-Use Industry, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.3.1. Key Highlights

10.3.1.1. Paints & Coatings

10.3.1.2. Pharmaceuticals

10.3.1.3. Plastics

10.3.1.4. Printing Inks

10.3.1.5. Rubber

10.3.1.6. Batteries

10.3.1.7. Misc.

10.4. Middle East & Africa Barium Sulfate Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.4.1. Key Highlights

10.4.1.1. GCC Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.4.1.2. GCC Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.4.1.3. GCC Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.4.1.4. South Africa Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.4.1.5. South Africa Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.4.1.6. South Africa Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.4.1.7. Rest of Middle East & Africa Barium Sulfate Market by Type, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.4.1.8. Rest of Middle East & Africa Barium Sulfate Market by Grade, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.4.1.9. Rest of Middle East & Africa Barium Sulfate Market by End-user, Volume (Kilo Tons) and Value (US$ Bn), 2018 - 2030

10.4.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Product vs Application Heatmap

11.2. Manufacturer vs Application Heatmap

11.3. Company Market Share Analysis, 2022

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Solvay Chemicals Inc

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. Sakai Chemical Industry Co. Ltd.

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Fengchen Group

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Venator Materials PLC

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. Cimbar Resources Inc.

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. Anglo Pacific Minerals

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Nippon Chemical Industrial

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. Sakai Chemical Industry Co. Ltd.

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. Shaanxi Fuhua Chemical Co., Ltd.

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. Vishnu Chemical Ltd.

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

11.5.11. Gemme Corp.

11.5.11.1. Company Overview

11.5.11.2. Product Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. Shanghai Titanos Industry Co., Ltd.

11.5.12.1. Company Overview

11.5.12.2. Product Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

11.5.13. Xuri International Group Co. Ltd

11.5.13.1. Company Overview

11.5.13.2. Product Portfolio

11.5.13.3. Financial Overview

11.5.13.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Grade Coverage |

|

|

End-use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |