Global Basic Chemicals Market Forecast

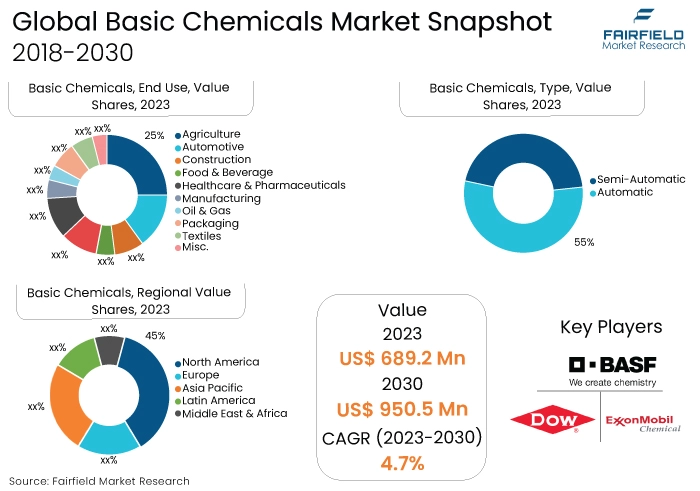

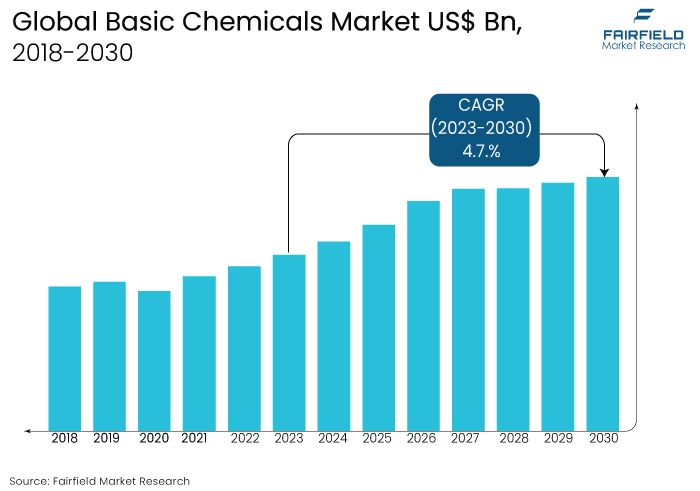

- Global market for basic chemicals to reach US$950.5 Bn in 2030, up from US$689.2 Mn attained in 2023

- Basic chemicals market size to witness expansion at a CAGR of 4.7% between 2023 and 2030

Quick Report Digest

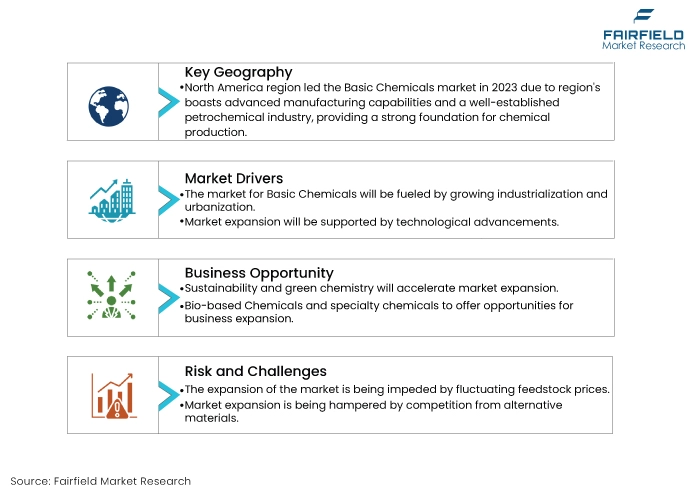

- The key trend driving the basic chemicals market is the increasing focus on sustainability. Companies are shifting towards eco-friendly production processes, renewable feedstocks, and the development of biodegradable products to meet evolving regulatory requirements and consumer preferences, fostering long-term growth and competitiveness in the market.

- Industrialisation and urbanisation drive the basic chemicals market by increasing demand for chemicals in manufacturing, construction, and infrastructure development. As industries expand and urban areas grow, there is a greater need for raw materials, plastics, and other chemical products, fueling growth in the market.

- Technological advancements are set to drive the basic chemicals market by enhancing production efficiency, reducing energy consumption, and fostering sustainable manufacturing practices. Innovations in material science, process technologies, and digitalisation are optimizing supply chain management, improving operational efficiencies, and propelling the development of novel chemical compounds with enhanced properties.

- Economic growth fuels demand for Basic Chemicals as it drives industrialisation, infrastructure development, and consumer spending. With growing economies, there's increased demand for chemicals in manufacturing, construction, and consumer goods production. This leads to higher consumption of Basic Chemicals, driving market growth.

- The organic type captures the largest market share in the basic chemicals market due to its versatility and wide-ranging applications across various industries. Organic chemicals serve as key building blocks for manufacturing a diverse array of products, including plastics, pharmaceuticals, fertilizers, and cosmetics, driving their prominence in the market.

- The agriculture end use segment captures the largest market share in the basic chemicals market due to the extensive use of chemicals in agricultural practices. Chemicals such as fertilizers, pesticides, and herbicides are essential for enhancing crop yields, protecting crops from pests and diseases, and maintaining soil fertility, driving their dominance in the market.

- The Asia Pacific region is experiencing growth in the basic chemicals market due to robust industrialisation, rapid urbanisation, and increasing manufacturing activities. The burgeoning population, rising disposable incomes, and a focus on technological advancements are driving demand for basic chemicals across diverse sectors, contributing to the region's market growth.

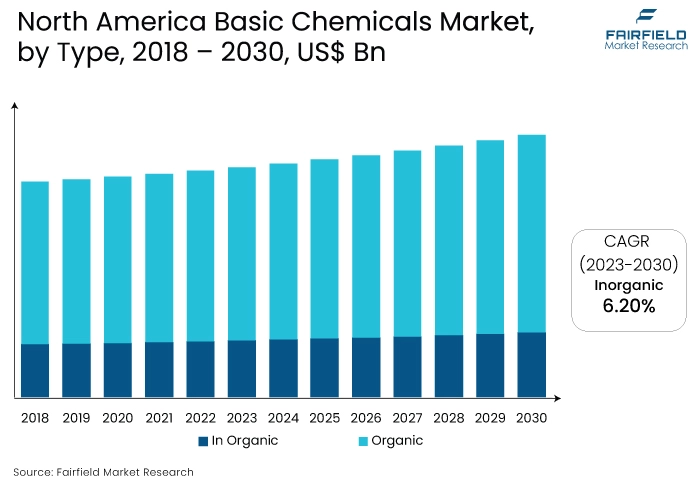

- The North America region is growing in the basic chemicals market due to its advanced manufacturing capabilities, abundant shale gas reserves providing cost-effective feedstocks, and robust demand from key industries such as automotive, construction, and consumer goods, fostering growth and competitiveness in the market.

A Look Back and a Look Forward - Comparative Analysis

The basic chemicals market is growing due to several factors. Firstly, increasing industrialisation and urbanisation worldwide drive demand for basic chemicals in various industries such as construction, automotive, and consumer goods manufacturing. Additionally, advancements in production technologies enhance efficiency and reduce costs, making basic chemicals more accessible. Furthermore, growing awareness of sustainability encourages the use of basic chemicals in eco-friendly applications, further fueling market growth.

The growth of the basic chemicals market is primarily driven by applications in various sectors. These include the rising demand for fertilizers to support agricultural activities, the increasing need for basic chemicals in the manufacturing of plastics, and the expanding usage of chemicals in pharmaceuticals and personal care products. Additionally, the construction industry's reliance on basic chemicals for coatings, adhesives, and sealants further propels market growth.

The future of the basic chemicals market looks promising, with continued growth expected driven by increasing industrialisation, urbanisation, and demand for consumer goods worldwide. Additionally, advancements in production technologies and growing emphasis on sustainability are likely to shape the market landscape. Moreover, evolving regulations and shifting consumer preferences towards eco-friendly products are expected to drive innovation and investment in the Basic Chemicals sector, further fueling its growth.

Key Growth Determinants

- Growing Industrialisation, and Urbanisation

Industrialisation and urbanisation are expected to be significant drivers of the basic chemicals market. As countries undergo industrialisation, there is a surge in construction activities, infrastructure development, and manufacturing sectors, leading to increased demand for basic chemicals used in various applications such as adhesives, coatings, plastics, and fertilizers.

Additionally, rapid urbanisation results in the expansion of urban infrastructure, housing, and consumer goods industries, further driving demand for basic chemicals. Moreover, urbanisation leads to higher consumption of consumer goods, including personal care products, detergents, and plastics, all of which rely on basic chemicals as raw materials. As a result, the growth of industrialisation and urbanisation is expected to fuel sustained demand for basic chemicals globally, driving market growth in the coming years.

- Pacing Technological Advancements

Technological advancements drive significant growth in the basic chemicals market. Innovations in production processes, such as catalysis, process intensification, and renewable energy integration, enhance efficiency, reduce energy consumption, and minimise environmental impact. Furthermore, advancements in molecular engineering and materials science enable the development of novel chemicals with enhanced properties and functionalities, expanding their applications across various industries.

Moreover, digitalisation and automation technologies optimise production operations, improve supply chain management, and enable real-time monitoring and control, enhancing productivity and competitiveness. Additionally, breakthroughs in biotechnology and green chemistry facilitate the development of sustainable and eco-friendly alternatives to traditional chemical processes, addressing growing environmental concerns and regulatory requirements. Overall, technological advancements play a pivotal role in driving innovation, improving sustainability, and unlocking new growth opportunities in the basic chemicals market.

- Economic Growth

Economic growth is poised to drive the basic chemicals market through increased industrial activities and consumer spending. As economies expand, there is a surge in construction projects, automobile manufacturing, and infrastructure development, all of which rely heavily on basic chemicals for materials such as plastics, coatings, and adhesives.

Moreover, rising disposable income levels lead to greater demand for consumer goods, driving the need for basic chemicals in the production of items like packaging materials, textiles, and personal care products.

Furthermore, economic growth fosters agricultural advancements, increasing the demand for fertilizers and agrochemicals to support higher crop yields and improved agricultural practices. Additionally, as emerging markets continue to develop, the demand for basic chemicals used in various industrial processes is expected to rise, further propelling market growth.

Major Growth Barriers

- Competitive Pressures

Competitive pressures pose significant challenges in the basic chemicals market by exerting downward pressure on prices, limiting profit margins, and intensifying competition among manufacturers. In commoditised segments of the market, companies face challenges in maintaining market share and differentiation.

Additionally, aggressive pricing strategies and cost-cutting measures by competitors can further erode profitability. Moreover, the presence of numerous players vying for market share increases competitive intensity, making it challenging for companies to sustain growth and profitability.

- Shifts in Consumer Preferences

Shifts in consumer preferences present challenges in the basic chemicals market by necessitating adjustments to product offerings and manufacturing processes. Increasingly, consumers prefer eco-friendly and sustainable products, prompting manufacturers to invest in greener alternatives and modify existing production methods.

Meeting these evolving preferences requires significant investments in research and development, as well as changes to supply chain logistics. Failure to adapt to changing consumer demands can result in lost market share and diminished competitiveness in the industry.

Key Trends and Opportunities to Look at

- Sustainability, and Green Chemistry

In the basic chemicals market, sustainability and green chemistry initiatives focus on reducing environmental impact through the development of eco-friendly production processes, renewable feedstocks, and biodegradable products. Companies invest in sustainable practices to meet regulatory requirements, address consumer preferences, and enhance long-term competitiveness.

- Bio-Based Chemicals

Bio-based chemicals are gaining traction in the basic chemicals market due to their renewable and sustainable nature. These chemicals, derived from biological feedstocks, offer eco-friendly alternatives to traditional petrochemical-based products, aligning with the growing demand for environmentally responsible solutions across various industries, including plastics, polymers, and specialty chemicals.

- Specialty Chemicals

Specialty chemicals in the basic chemicals market refer to high-value, niche products designed for specific applications or industries. These chemicals offer unique properties, performance advantages, and customisation options, catering to diverse sectors such as electronics, pharmaceuticals, agriculture, and personal care, driving demand for specialised and tailored solutions.

How Does the Regulatory Scenario Shape this Industry?

The regulatory framework governing the basic chemicals market varies by region and includes legislation, standards, and guidelines aimed at ensuring product safety, environmental protection, and public health. Important regulatory entities include the Environmental Protection Agency (EPA) in the United States, the European Chemicals Agency (ECHA) in the European Union, and the Ministry of Environment (MoE) in various countries.

Key regulations impacting the basic chemicals market include Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) in the EU, which mandates the registration and assessment of chemical substances, and the Toxic Substances Control Act (TSCA) in the US, which regulates the production and use of chemicals. Region-specific regulatory changes, such as stricter emission standards, bans on certain substances, and requirements for product labeling and safety data sheets, influence market dynamics and drive innovation towards more sustainable and compliant solutions.

Fairfield’s Ranking Board

Top Segments

- Organic Chemicals Continue to Dominate

The organic type captures the largest market share in the basic chemicals market due to its versatility and wide-ranging applications across various industries. Organic chemicals serve as key building blocks for manufacturing a diverse array of products, including plastics, pharmaceuticals, fertilizers, and cosmetics. Additionally, the growing demand for bio-based and environmentally friendly alternatives contributes to the prominence of organic chemicals, as they can be derived from renewable biomass sources, aligning with sustainability goals.

Inorganic chemicals are experiencing the highest CAGR in the basic chemicals market due to their extensive applications in diverse industries such as construction, electronics, and automotive. With increasing urbanisation and infrastructure development, the demand for inorganic chemicals like sulfuric acid, ammonia, and titanium dioxide is escalating. Additionally, these chemicals play a vital role in electronics manufacturing and water treatment, further propelling their market growth, leading to the highest CAGR in the sector.

- Agriculture to be the Top End-Use Industry

The agriculture end-use segment captures the largest market share in the basic chemicals market due to the extensive use of chemicals in agricultural practices. Basic chemicals such as fertilizers, pesticides, and herbicides are essential for enhancing crop yields, protecting crops from pests and diseases, and maintaining soil fertility. With increasing global food demand driven by population growth and changing dietary habits, the demand for agricultural chemicals remains robust, driving growth in this segment.

The automotive end-use segment is experiencing the highest CAGR in the basic chemicals market due to the expanding global automotive industry, which demands a wide array of chemicals for applications such as adhesives, coatings, and plastics. With the rise in vehicle production and the increasing need for lightweight materials and sustainable solutions, the demand for basic chemicals within the automotive sector is rapidly growing, contributing to its highest CAGR.

Regional Frontrunners

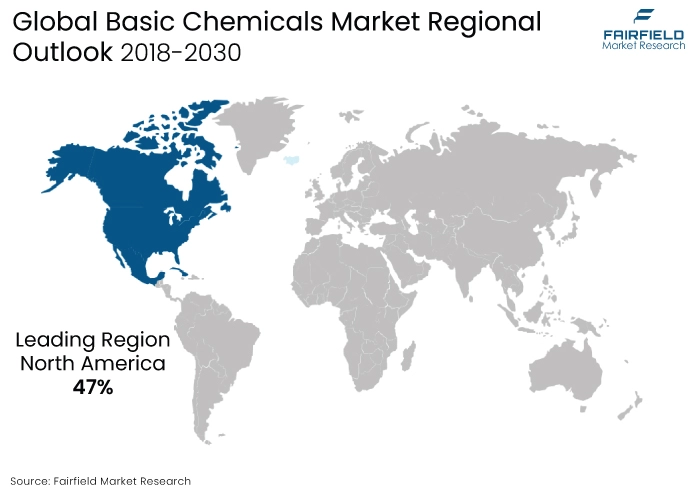

North America’s Revenue Contribution Remains Pivotal

The North America region captures the largest market share in the basic chemicals market due to several factors. The region boasts advanced manufacturing capabilities and a well-established petrochemical industry, providing a strong foundation for chemical production. Additionally, abundant shale gas reserves offer a cost-effective source of feedstock for chemical manufacturing, enhancing competitiveness.

Moreover, robust demand from key end-use industries such as automotive, construction, and consumer goods drives market growth. Furthermore, favourable regulatory policies and technological advancements further bolster the market in North America, attracting investments and fostering innovation. Overall, these factors contribute to the region's dominant position in the basic chemicals market.

Asia Pacific Poised to Demonstrate Rapid Expansion

The Asia Pacific basic chemicals market is on the brink of robust growh on the back of rapid industrialisation, urbanisation, and economic development that drive increased demand for basic chemicals across various industries. Additionally, favourable government policies, investments in infrastructure, and expanding manufacturing capabilities further fuel market growth. Moreover, the region's burgeoning population and rising disposable incomes contribute to robust consumption of consumer goods and industrial products, boosting demand for basic chemicals.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the basic chemicals market is characterised by the presence of several key players such as BASF SE, Dow Inc., SABIC, and ExxonMobil Chemical. These companies compete based on factors such as product quality, pricing, innovation, and market reach.

Additionally, mergers, acquisitions, and partnerships are common strategies employed by companies to strengthen their market position. The market is dynamic, with intense competition driving companies to continuously innovate and adapt to changing market dynamics.

Who are the Leaders in Global Basic Chemicals Space?

- BASF SE

- Dow, Inc.

- ExxonMobil Chemical

- SABIC

- INEOS Group

- LyondellBasell Industries

- Formosa Plastics Corporation

- Mitsubishi Chemical Corporation

- Sinopec

- AkzoNobel

- DuPont

- LG Chem

- Sumitomo Chemical Company

- Eastman Chemical Company

- Borealis AG

Significant Company Developments

New Product Launch

- December 2022: Clariant AG disclosed its plans to enhance its presence in China and enlarge its care chemicals facility within the country, catering to various sectors such as pharmaceuticals, personal care, home care, and industrial applications. The company offers care chemicals as part of its specialty segment.

- March 2022: BASF SE introduced a new product line called Pepto Vitae, designed to address a wide range of skin issues. Initially launched in Asia, the Pepto Vitae series will gradually roll out its new bioactive ingredients to other regions throughout 2022.

An Expert’s Eye

Demand and Future Growth

The basic chemicals market is experiencing demand driven by the expanding manufacturing, construction, and automotive sectors globally. Future growth is anticipated due to increasing urbanisation, industrialisation, and technological advancements. Moreover, the market is poised for expansion as emerging economies continue to develop, leading to greater demand for basic chemicals in various applications.

Additionally, the growing focus on sustainable and eco-friendly solutions is expected to fuel the demand for bio-based chemicals. Overall, the market's future growth is influenced by evolving consumer needs, technological innovation, and a shift towards environmentally conscious practices.

Supply Side of the Market

The demand-supply dynamics in the basic chemicals market are influenced by various factors. Increasing industrial activities and urbanisation drive demand, while advancements in production technologies enhance supply capabilities. The current pricing structure is shaped by factors such as raw material costs, market demand, and competitive dynamics. Pricing plays a crucial role in influencing long-term growth, as competitive pricing strategies can impact market share and profitability.

Major trends driving competition in the basic chemicals market include sustainability initiatives, technological advancements, and product innovation. Supply chain analysis is critical, with companies focusing on optimising logistics, ensuring raw material availability, and streamlining distribution channels to meet market demand efficiently. Collaboration along the supply chain, including partnerships with suppliers and distributors, helps enhance operational efficiency and ensure timely delivery of products to customers, contributing to market competitiveness.

Global Basic Chemicals Market is Segmented as Below:

By Type:

- Organic

- Inorganic

By End Use:

- Agriculture

- Automotive

- Construction

- Electronics

- Food & Beverage

- Healthcare & Pharmaceuticals

- Manufacturing

- Oil & Gas

- Packaging

- Textiles

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Basic Chemicals Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Basic Chemicals Market Outlook, 2018 - 2030

3.1. Global Basic Chemicals Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Organic

3.1.1.2. In organic

3.2. Global Basic Chemicals Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Agriculture

3.2.1.2. Automotive

3.2.1.3. Construction

3.2.1.4. Electronics

3.2.1.5. Food & Beverage

3.2.1.6. Healthcare & Pharmaceuticals

3.2.1.7. Manufacturing

3.2.1.8. Oil & Gas

3.2.1.9. Packaging

3.2.1.10. Textiles

3.2.1.11. Misc.

3.3. Global Basic Chemicals Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Basic Chemicals Market Outlook, 2018 - 2030

4.1. North America Basic Chemicals Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Organic

4.1.1.2. In organic

4.2. North America Basic Chemicals Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Agriculture

4.2.1.2. Automotive

4.2.1.3. Construction

4.2.1.4. Electronics

4.2.1.5. Food & Beverage

4.2.1.6. Healthcare & Pharmaceuticals

4.2.1.7. Manufacturing

4.2.1.8. Oil & Gas

4.2.1.9. Packaging

4.2.1.10. Textiles

4.2.1.11. Misc.

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Basic Chemicals Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

4.3.1.2. U.S. Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

4.3.1.3. Canada Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

4.3.1.4. Canada Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Basic Chemicals Market Outlook, 2018 - 2030

5.1. Europe Basic Chemicals Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Organic

5.1.1.2. In organic

5.2. Europe Basic Chemicals Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Agriculture

5.2.1.2. Automotive

5.2.1.3. Construction

5.2.1.4. Electronics

5.2.1.5. Food & Beverage

5.2.1.6. Healthcare & Pharmaceuticals

5.2.1.7. Manufacturing

5.2.1.8. Oil & Gas

5.2.1.9. Packaging

5.2.1.10. Textiles

5.2.1.11. Misc.

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Basic Chemicals Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.2. Germany Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

5.3.1.3. U.K. Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.4. U.K. Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

5.3.1.5. France Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.6. France Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

5.3.1.7. Italy Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.8. Italy Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

5.3.1.9. Turkey Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.10. Turkey Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

5.3.1.11. Russia Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.12. Russia Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

5.3.1.13. Rest of Europe Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.14. Rest of Europe Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Basic Chemicals Market Outlook, 2018 - 2030

6.1. Asia Pacific Basic Chemicals Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Organic

6.1.1.2. In organic

6.2. Asia Pacific Basic Chemicals Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Agriculture

6.2.1.2. Automotive

6.2.1.3. Construction

6.2.1.4. Electronics

6.2.1.5. Food & Beverage

6.2.1.6. Healthcare & Pharmaceuticals

6.2.1.7. Manufacturing

6.2.1.8. Oil & Gas

6.2.1.9. Packaging

6.2.1.10. Textiles

6.2.1.11. Misc.

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Basic Chemicals Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.2. China Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

6.3.1.3. Japan Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.4. Japan Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

6.3.1.5. South Korea Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.6. South Korea Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

6.3.1.7. India Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.8. India Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

6.3.1.9. Southeast Asia Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.10. Southeast Asia Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Basic Chemicals Market Outlook, 2018 - 2030

7.1. Latin America Basic Chemicals Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Organic

7.1.1.2. In organic

7.2. Latin America Basic Chemicals Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Agriculture

7.2.1.2. Automotive

7.2.1.3. Construction

7.2.1.4. Electronics

7.2.1.5. Food & Beverage

7.2.1.6. Healthcare & Pharmaceuticals

7.2.1.7. Manufacturing

7.2.1.8. Oil & Gas

7.2.1.9. Packaging

7.2.1.10. Textiles

7.2.1.11. Misc.

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Basic Chemicals Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.2. Brazil Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

7.3.1.3. Mexico Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.4. Mexico Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

7.3.1.5. Argentina Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.6. Argentina Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

7.3.1.7. Rest of Latin America Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.8. Rest of Latin America Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Basic Chemicals Market Outlook, 2018 - 2030

8.1. Middle East & Africa Basic Chemicals Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Organic

8.1.1.2. In organic

8.2. Middle East & Africa Basic Chemicals Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Agriculture

8.2.1.2. Automotive

8.2.1.3. Construction

8.2.1.4. Electronics

8.2.1.5. Food & Beverage

8.2.1.6. Healthcare & Pharmaceuticals

8.2.1.7. Manufacturing

8.2.1.8. Oil & Gas

8.2.1.9. Packaging

8.2.1.10. Textiles

8.2.1.11. Misc.

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Basic Chemicals Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.2. GCC Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

8.3.1.3. South Africa Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.4. South Africa Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

8.3.1.5. Egypt Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.6. Egypt Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

8.3.1.7. Nigeria Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.8. Nigeria Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Basic Chemicals Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Basic Chemicals Market End Use, Value (US$ Mn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End Use vs End Use Heatmap

9.2. Manufacturer vs End Use Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. BASF SE

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Dow, Inc.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. ExxonMobil Chemical

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. SABIC

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. INEOS Group

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. LyondellBasell Industries

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Formosa Plastics Corporation

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Mitsubishi Chemical Corporation

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Sinopec

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. AkzoNobel

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. DuPont

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. LG Chem

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Sumitomo Chemical Company

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Eastman Chemical Company

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Borealis AG

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |