Global Battery Chemicals Market Forecast

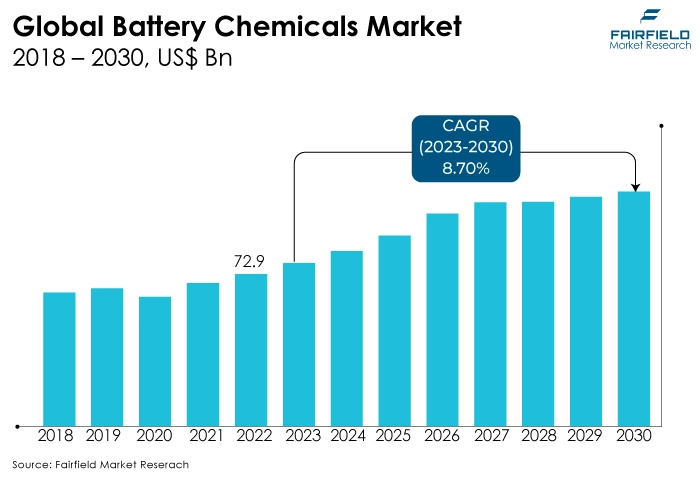

- Global battery chemicals market size to experience manifold growth in revenue - from US$72.9 Bn in 2022 to US$130.7 Bn in 2030

- Market valuation likely to witness an impressive CAGR of 8.7% during 2023 - 2030

Quick Report Digest

- The expanding use of electric cars and rising consumer awareness of green technology are the main factors projected to drive the growth of the global battery chemicals market.

- Another major market trend expected to fuel the growth is the global battery chemicals market, a rapidly expanding global automotive industry. The market is also predicted to profit from the expanding worldwide automotive industry.

- In 2022, Cathode chemicals, such as lithium cobalt oxide (LCO), and lithium iron phosphate (LFP), dominated the battery chemicals market due to their widespread use in lithium-ion batteries, which power most portable electronic devices and electric vehicles. Their stable performance, high energy density, and safety features have made them the preferred choice, securing the largest market share.

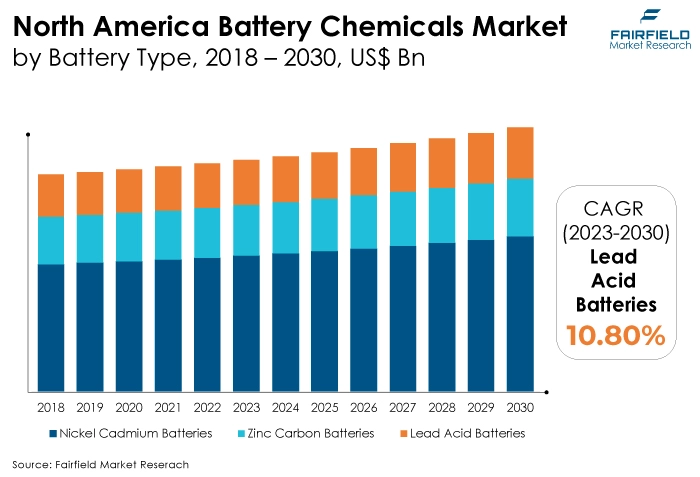

- Nickel-cadmium (NiCd) batteries once held a significant market share due to their early adoption in various applications. They offered reliable rechargeability, robustness, and high cycle life. However, their market share has declined with the emergence of more efficient and environmentally friendly battery chemistries like lithium-ion.

- The automotive sector secured the largest share in the battery chemicals market due to the growing demand for electric vehicles (EVs). EVs rely on advanced lithium-ion batteries, making the automotive industry a dominant consumer of battery chemicals for clean and sustainable transportation solutions.

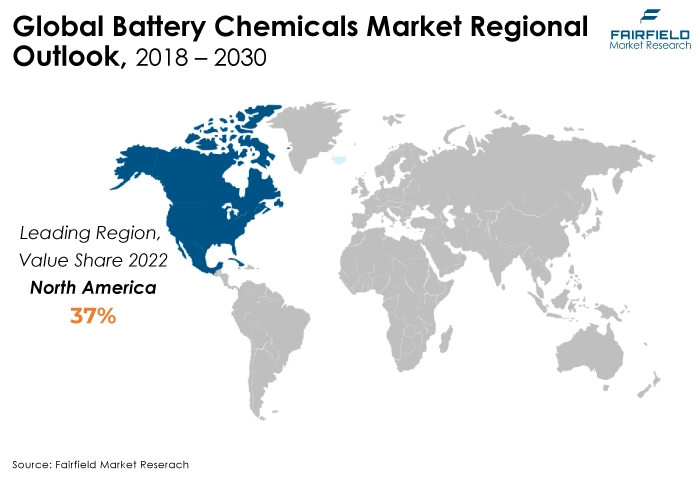

- North America dominated the battery chemicals market due to the rapid expansion of the electric vehicle (EV) industry, driven by government incentives and consumer demand for clean transportation. This region attracted significant investments and manufacturing, securing the largest market share.

- Due to the booming demand for electric cars, consumer electronics, and renewable energy storage, Asia Pacific is the area with the fastest-growing market for battery chemistry. Robust industrialisation, urbanisation, and government support for clean energy solutions have fueled this rapid growth.

- Regulatory compliance poses challenges in the battery chemicals market due to evolving environmental and safety regulations. Stricter standards demand cleaner and safer production processes, which can increase costs and affect supply chains, impacting the industry's competitiveness and growth.

A Look Back and a Look Forward - Comparative Analysis

The global battery chemicals market has grown in popularity due to increased applications across various industries, including automotive and consumer electronics, with increased usage generally in line with the global economy.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of the major end-use application sectors such as household appliances, security & monitoring systems, and utilities & backup power.

Household appliances are growing in the battery chemicals market due to consumers' increasing demand for cordless and energy-efficient devices. Advanced batteries power appliances like cordless vacuums and tools, enhancing convenience and sustainability, driving growth in this sector.

The future of the battery chemicals market appears promising. It is expected to grow significantly, driven by the increasing adoption of EVs, renewable energy storage systems, and the proliferation of portable electronics.

Advancements in battery chemistry, materials, and recycling technologies will further bolster the market. Moreover, sustainability concerns and government incentives for clean energy will likely fuel innovation and investment in this sector, making it a key player in transitioning to a greener, electrified world.

Key Growth Determinants

- Ballooning EV Industry

The expanding EV industry is a potent driver for the battery chemicals sector. EVs primarily rely on lithium-ion batteries, propelling demand for essential battery chemicals like lithium, cobalt, and nickel. The EV market continues to surge as the global shift toward cleaner transportation gains momentum due to environmental concerns and government incentives. This sustained growth fuels a perpetual need for battery production, stimulating innovation in battery chemistry and materials.

As EV adoption extends beyond developed markets to emerging economies, the demand for battery chemicals is poised for sustained expansion, making it a pivotal force in the battery chemicals market's ongoing growth and development.

- Growing Energy Transition

The desire to cut carbon emissions and switch to greener energy sources is driving the global energy transition, which is a significant market driver for battery chemistry. This transition necessitates increased energy storage capacity, which batteries provide.

Batteries are central to the transition, whether for renewable energy integration, grid stabilisation, or electric vehicle adoption.

Consequently, the growing demand for batteries, particularly lithium-ion variants, intensifies the need for key battery chemicals like lithium, cobalt, and nickel, bolstering the battery chemicals market as an essential enabler of the global energy shift.

- Growing Consumer Awareness

Growing consumer awareness of environmental concerns and the benefits of clean energy technologies is a significant driver for the battery chemicals market. Consumers increasingly opt for electric vehicles, renewable energy solutions, and portable electronic devices with longer-lasting batteries. This heightened demand for energy storage solutions fuels battery technology and chemistry innovation.

Manufacturers are pressured to develop more efficient and sustainable batteries, driving the need for advanced battery chemicals and materials. Consumer preferences for cleaner and more sustainable energy options continue to propel the growth of the battery chemicals market.

Major Growth Barriers

- Recycling and Sustainability Issues

Recycling and sustainability pose challenges to the battery chemicals market due to the need for efficient and environmentally responsible disposal and recycling of batteries. Developing cost-effective recycling methods for complex battery materials like lithium-ion presents technical and economic hurdles.

Additionally, ensuring a sustainable supply chain for raw materials, such as responsibly sourcing cobalt and lithium, is a continuous challenge. Meeting stringent environmental regulations and consumer demand for eco-friendly products further complicates the industry, making sustainability and recycling essential yet complex aspects of the battery chemicals market.

- Regulatory Compliance

Regulatory compliance is a significant challenge in the battery chemicals market due to evolving standards and environmental regulations. Batteries must meet safety, transportation, and disposal requirements, which vary globally.

Compliance with these standards demands substantial research, development, and testing investments. Keeping up with changing regulations can strain resources, and noncompliance can lead to fines or market exclusion. Manufacturers must navigate a complex landscape of regional and international rules, making regulatory compliance a demanding and dynamic aspect of the battery chemicals market.

Key Trends and Opportunities to Look at

- Cathode Material Innovations

Cathode material innovations in the battery chemicals market have focused on enhancing energy density, cycle life, and safety. The creation of materials like solid-state cathodes, lithium iron phosphate, and lithium nickel manganese cobalt oxide (NMC) are examples of advancements.

Such advancements aim to boost lithium-ion battery performance, making them more dependable and efficient for a range of uses, including electric cars and energy storage devices.

- Solid-state batteries

Solid-state batteries are a transformative technology in the battery chemicals market. Unlike traditional liquid electrolyte batteries, solid conductive materials offer advantages such as higher energy density, faster charging, longer cycle life, and improved safety.

Research and development efforts focus on commercialising solid-state batteries for applications like electric vehicles, portable electronics, and renewable energy storage, promising to revolutionise the energy storage landscape.

- NMC Chemistry Evolution

The evolution of NMC (lithium nickel manganese cobalt oxide) chemistry in the battery chemicals market is marked by efforts to reduce cobalt content while maintaining performance. This trend aims to lower production costs, minimise supply chain vulnerabilities associated with cobalt, and improve sustainability.

R&D ventures typcially focus on optimising NMC formulations to enhance energy density, cycle life, and safety. It is a crucial component in lithium-ion batteries of the future generation for a variety of uses, such as electric cars and energy storage devices.

How Does the Regulatory Scenario Shape this Industry?

The regulatory landscape in the battery chemicals market is complex and evolving, reflecting the growing importance of battery technologies in various applications, including electric vehicles and renewable energy. Governments worldwide are enacting environmental regulations to address the impact of battery production, use, and disposal. These regulations focus on reducing emissions during manufacturing, ensuring responsible disposal and recycling, and minimising environmental harm from battery materials mining.

Battery chemicals are subject to stringent safety standards to prevent thermal runaway events and fires. Organisations like the UN and IEC establish battery transportation and safety standards, impacting their design, packaging, and transportation. Many regions have introduced regulations mandating the recycling of batteries to reduce waste and recover valuable materials. These regulations require manufacturers to establish recycling programs or contribute to recycling infrastructure.

Batteries often require certification to meet safety and performance standards. Regulatory bodies and industry associations may oversee this certification process. Chemicals used in batteries like lithium, cobalt, and nickel are subject to chemical regulations like REACH in the European Union. Compliance with chemical restrictions and reporting requirements is essential.

Fairfield’s Ranking Board

Top Segments

- Cathode Chemical Dominant

For several compelling reasons, cathode chemical types have secured the largest market share in the battery chemicals market. They are the heart of lithium-ion batteries, which have become the go-to choice in various applications, ranging from electric vehicles to consumer electronics, due to their high energy density, efficiency, and dependable performance.

Ongoing research and development efforts have continually enhanced the energy storage capabilities of cathode materials, making them even more attractive. Additionally, well-established manufacturing processes ensure a steady and reliable supply chain. As a result, cathode chemicals have firmly established themselves as a pivotal component in the most widely adopted battery technologies, driving their dominance in the market.

Anode chemical types are experiencing rapid growth in the battery chemicals market due to their pivotal role in advancing battery technologies. Because they can store more energy than traditional graphite anodes, silicon anodes in particular are becoming more and more popular. This leads to batteries with improved energy densities and longer life cycles.

Manufacturers concentrate on enhancing anode materials to fulfil these changing demands as demand for electric cars and energy storage solutions rises. Furthermore, advancements in silicon anode technology are fostering greater efficiency and sustainability, making them a driving force in the industry's quest for high-performance, environmentally friendly energy storage solutions.

- Nickel-cadmium (NiCd) Batteries Steal the Limelight

Nickel-cadmium (NiCd) batteries once held a significant market share due to their early adoption and established presence. Thanks to their reliability and relatively long lifespan, they were one of the first rechargeable battery technologies widely used in various applications, from consumer electronics to industrial equipment.

However, their dominance has waned over time due to environmental concerns associated with cadmium, as well as advancements in alternative battery technologies like nickel-metal hydride (NiMH) and lithium-ion (Li-ion) batteries, which offer higher energy density and improved sustainability. As a result, NiCd batteries have gradually lost market share to more advanced and eco-friendly alternatives.

Lead-acid batteries are not typically considered the fastest-growing segment in the battery chemicals market. Instead, they are an older and well-established technology mainly used in automotive and standby power systems applications.

Li-ion batteries are often the fastest-growing market categories, driven mainly by the burgeoning electric car industry and rising demand for energy storage technologies. These newer battery technologies offer higher energy density, longer cycle life, and greater efficiency, making them more attractive for various applications than lead-acid batteries, which have limitations in energy density and weight.

- Automotive Industry Presents a Constant Stream of Demand Generation

Due to the growing demand for EVs and the continuous worldwide shift towards cleaner, more sustainable transportation choices, the automotive industry has dominated the battery chemicals market. Lithium-ion batteries, a key component of EVs, heavily rely on battery chemicals like lithium, cobalt, and nickel.

As governments and consumers prioritise reduced emissions and increased fuel efficiency, the automotive industry's shift toward electrification has driven substantial growth in the battery chemicals market, making it a dominant force.

Due to several factors, consumer electronics represent one of the fastest-growing segments in the battery chemicals market. The continuous evolution and widespread adoption of smartphones, laptops, wearables, and other portable devices have increased demand for smaller, lighter, and more efficient batteries.

The same trend drives battery chemistry and materials innovation to improve energy density, longevity, and charge/discharge rates. Manufacturers are developing advanced technology as consumers seek longer battery life and faster charging, making consumer electronics a dynamic and high-growth sector within the battery chemicals market.

Regional Frontrunners

North America - the Largest Revenue Contributor

North America, particularly the United States and Canada, has seen substantial growth in the electric vehicle market. EVs rely heavily on lithium-ion batteries, increasing the demand for lithium and other chemicals. The region has a growing renewable energy sector, with solar and wind power projects requiring energy storage solutions.

Batteries play a critical role in storing excess renewable energy, boosting the demand for battery chemicals. North America is home to some of the world's leading battery manufacturers and research institutions. This fosters innovation in battery chemistry and materials, driving the market forward.

Government incentives and subsidies to promote clean energy and EV adoption have bolstered the battery chemicals market. Tax credits for EV purchases and investments in research and development have stimulated growth. North America has a well-developed manufacturing infrastructure allows for efficient battery production and supply chain management.

Asia Pacific Set for the Fastest Growth

Asia Pacific is anticipated to exhibit the fastest CAGR in the battery chemicals market primarily due to its robust demand drivers. The region's rapid industrialisation, burgeoning electric vehicle market, and significant investments in renewable energy projects are key factors.

Asia Pacific's role as a global manufacturing hub for electronics and batteries further boosts demand. Supportive government policies and substantial research and development efforts in battery technology enhance growth prospects. With a large population and a focus on sustainability, Asia Pacific presents a dynamic market with the potential for rapid expansion, leading to a high projected CAGR.

Fairfield’s Competitive Landscape Analysis

The global battery chemicals market is a consolidated market with fewer major players present globally. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global Battery Chemicals Market space?

- Albemarle Corporation

- Umicore SA

- Sumitomo Metal Mining Co., Ltd.

- Mitsubishi Chemical Holdings Corporation

- Johnson Matthey PLC

- BASF SE

- 3M Company

- American Elements

- Nynas AB

- Asahi Kasei Corporation

- Eastman Chemical Company

- Shanshan Technology

- Cabot Corporation

- Showa Denko K.K.

- Novonix

Significant Company Developments

New Product Launch

- August 2022: MIT researchers have unveiled a groundbreaking innovation in cost-effective batteries. This novel battery design relies solely on abundant, cost-efficient materials. The architecture of this cutting-edge battery comprises aluminum and sulfur, serving as the two electrode materials, with a molten salt electrolyte sandwiched in between. The primary goal of this development is to offer economical backup storage solutions for renewable energy sources.

- February 2022: Panasonic Corporation disclosed plans for its Energy Company to inaugurate a manufacturing facility at its Wakayama Factory in western Japan. The facility's purpose is the production of large cylindrical lithium-ion batteries measuring 46 mm in width and 80 mm in height, specifically designed for electric vehicles (EVs).

Distribution Agreement

- January 2022: BYD and FAW intended to construct an EV battery production facility in the northeastern region of China. This facility was projected to have an annual production capacity of 45 GWh. To realise this endeavor, a collaborative effort took shape in the form of a joint venture named FAW FinDreams New Energy Technology, with a registered capital of EUR 140 million. In this partnership, BYD maintains a majority share of 51%, while FAW Group possesses the remaining ownership stake.

From the Analyst's Perspective

Demand and Future Growth

As per Fairfield’s Analysis, growth in metal is driving the market. The battery chemicals market is poised for strong demand and future growth. Rising adoption of electric vehicles, renewable energy storage solutions, and portable electronics is driving market demand.

Additionally, advancements in battery technologies and increased focus on sustainability are expected to fuel growth. The global push for clean energy and stringent environmental regulations will further expand the market. As a result, the battery chemicals market is set to play a pivotal role in the transition towards a more sustainable and electrified future.

Supply Side of the Market

Leading suppliers in the battery chemicals market vary by region and country. In the United States, companies like Albemarle Corporation and EnerSys are prominent players, offering chemicals and materials for battery manufacturing.

In Asia, Sumitomo Metal Mining Co. and LG Chem are key suppliers, catering to the growing demand for battery chemicals in the electric vehicle industry. In Europe, Umicore and Johnson Matthey are significant contributors, providing advanced materials for lithium-ion batteries. These companies specialise in supplying critical chemicals and materials to support the global battery industry's growth and innovation.

The battery chemicals market relies on several essential raw materials. Key components include lithium compounds (like lithium carbonate or lithium hydroxide), cobalt, nickel, graphite, and various electrolytes. One major supplier of raw materials for this market is Albemarle Corporation, a global leader in lithium production, supplying lithium compounds critical for lithium-ion batteries.

Additionally, companies like Glencore and Umicore are significant suppliers of cobalt and nickel, essential for cathode materials. These suppliers play a pivotal role in ensuring a stable supply of raw materials to meet the growing demand for batteries, particularly in the electric vehicle industry.

Global Battery Chemicals Market is Segmented as Below:

By Chemical Type:

- Cathode

- Anode

- Electrolyte

- Separator

By Battery Type:

- Nickel Cadmium Batteries

- Zinc Carbon Batteries

- Lead Acid Batteries

By End-use Industry:

- Automotive

- Consumer Electronics

- Household Appliances

- Security & Monitoring Systems

- Utilities & Backup Power

- Medical

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Battery Chemicals Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Battery Chemicals Market Outlook, 2018 - 2030

3.1. Global Battery Chemicals Market Outlook, by Chemical Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Cathode

3.1.1.2. Anode

3.1.1.3. Electrolyte

3.1.1.4. Separator

3.2. Global Battery Chemicals Market Outlook, by Battery Type, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Nickel Cadmium Batteries

3.2.1.2. Zinc Carbon Batteries

3.2.1.3. Lead Acid Batteries

3.3. Global Battery Chemicals Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Automotive

3.3.1.2. Consumer Electronics

3.3.1.3. Household Appliances

3.3.1.4. Security & Monitoring Systems

3.3.1.5. Utilities & Backup Power

3.3.1.6. Medical

3.4. Global Battery Chemicals Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Battery Chemicals Market Outlook, 2018 - 2030

4.1. North America Battery Chemicals Market Outlook, by Chemical Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Cathode

4.1.1.2. Anode

4.1.1.3. Electrolyte

4.1.1.4. Separator

4.2. North America Battery Chemicals Market Outlook, by Battery Type, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Nickel Cadmium Batteries

4.2.1.2. Zinc Carbon Batteries

4.2.1.3. Lead Acid Batteries

4.3. North America Battery Chemicals Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Automotive

4.3.1.2. Consumer Electronics

4.3.1.3. Household Appliances

4.3.1.4. Security & Monitoring Systems

4.3.1.5. Utilities & Backup Power

4.3.1.6. Medical

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Battery Chemicals Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

4.4.1.4. U.S. Battery Chemicals Market End Use, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

4.4.1.7. Canada Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

4.4.1.8. Canada Battery Chemicals Market End Use, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Battery Chemicals Market Outlook, 2018 - 2030

5.1. Europe Battery Chemicals Market Outlook, by Chemical Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Cathode

5.1.1.2. Anode

5.1.1.3. Electrolyte

5.1.1.4. Separator

5.2. Europe Battery Chemicals Market Outlook, by Battery Type, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Nickel Cadmium Batteries

5.2.1.2. Zinc Carbon Batteries

5.2.1.3. Lead Acid Batteries

5.3. Europe Battery Chemicals Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Automotive

5.3.1.2. Consumer Electronics

5.3.1.3. Household Appliances

5.3.1.4. Security & Monitoring Systems

5.3.1.5. Utilities & Backup Power

5.3.1.6. Medical

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Battery Chemicals Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.13. Russia Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

5.4.1.14. Russia Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.15. Russia Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.16. Rest of Europe Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

5.4.1.17. Rest of Europe Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.18. Rest of Europe Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Battery Chemicals Market Outlook, 2018 - 2030

6.1. Asia Pacific Battery Chemicals Market Outlook, by Chemical Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Cathode

6.1.1.2. Anode

6.1.1.3. Electrolyte

6.1.1.4. Separator

6.2. Asia Pacific Battery Chemicals Market Outlook, by Battery Type, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Nickel Cadmium Batteries

6.2.1.2. Zinc Carbon Batteries

6.2.1.3. Lead Acid Batteries

6.3. Asia Pacific Battery Chemicals Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Automotive

6.3.1.2. Consumer Electronics

6.3.1.3. Household Appliances

6.3.1.4. Security & Monitoring Systems

6.3.1.5. Utilities & Backup Power

6.3.1.6. Medical

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Battery Chemicals Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Battery Chemicals Market Outlook, 2018 - 2030

7.1. Latin America Battery Chemicals Market Outlook, by Chemical Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Cathode

7.1.1.2. Anode

7.1.1.3. Electrolyte

7.1.1.4. Separator

7.2. Latin America Battery Chemicals Market Outlook, by Battery Type, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Nickel Cadmium Batteries

7.2.1.2. Zinc Carbon Batteries

7.2.1.3. Lead Acid Batteries

7.3. Latin America Battery Chemicals Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Automotive

7.3.1.2. Consumer Electronics

7.3.1.3. Household Appliances

7.3.1.4. Security & Monitoring Systems

7.3.1.5. Utilities & Backup Power

7.3.1.6. Medical

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Battery Chemicals Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

7.4.1.7. Rest of Latin America Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

7.4.1.8. Rest of Latin America Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

7.4.1.9. Rest of Latin America Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Battery Chemicals Market Outlook, 2018 - 2030

8.1. Middle East & Africa Battery Chemicals Market Outlook, by Chemical Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Cathode

8.1.1.2. Anode

8.1.1.3. Electrolyte

8.1.1.4. Separator

8.2. Middle East & Africa Battery Chemicals Market Outlook, by Battery Type, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Nickel Cadmium Batteries

8.2.1.2. Zinc Carbon Batteries

8.2.1.3. Lead Acid Batteries

8.3. Middle East & Africa Battery Chemicals Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Automotive

8.3.1.2. Consumer Electronics

8.3.1.3. Household Appliances

8.3.1.4. Security & Monitoring Systems

8.3.1.5. Utilities & Backup Power

8.3.1.6. Medical

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Battery Chemicals Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

8.4.1.7. Rest of Middle East & Africa Battery Chemicals Market by Chemical Type, Value (US$ Bn), 2018 - 2030

8.4.1.8. Rest of Middle East & Africa Battery Chemicals Market Battery Type, Value (US$ Bn), 2018 - 2030

8.4.1.9. Rest of Middle East & Africa Battery Chemicals Market End-use Industry, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End-use Industry vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Albemarle Corporation

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Umicore SA

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Sumitomo Metal Mining

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Mitsubishi Chemical Holdings Corporation

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Johnson Matthey PLC

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. BASF SE

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. 3M Company

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. American Elements

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Nynas AB

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Asahi Kasei Corporation

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Eastman Chemical Company

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Shanshan Technology

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Cabot Corporation

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Showa Denko

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Novonix

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Chemical Type Coverage |

|

|

Battery Type Coverage |

|

|

End-use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country- wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |