Global Battery Production Machine Market Forecast

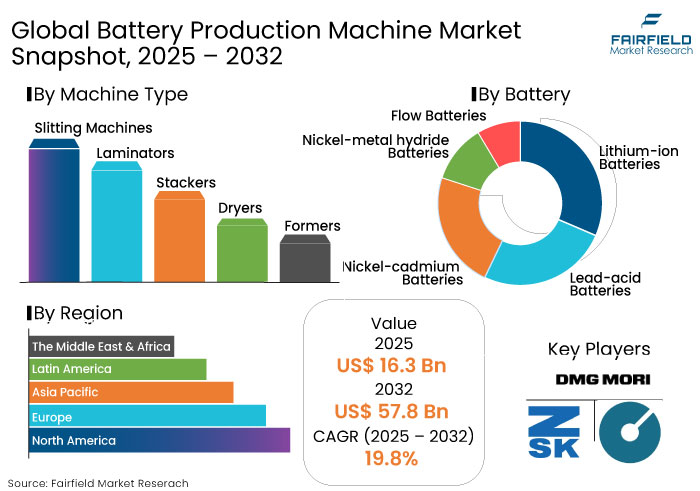

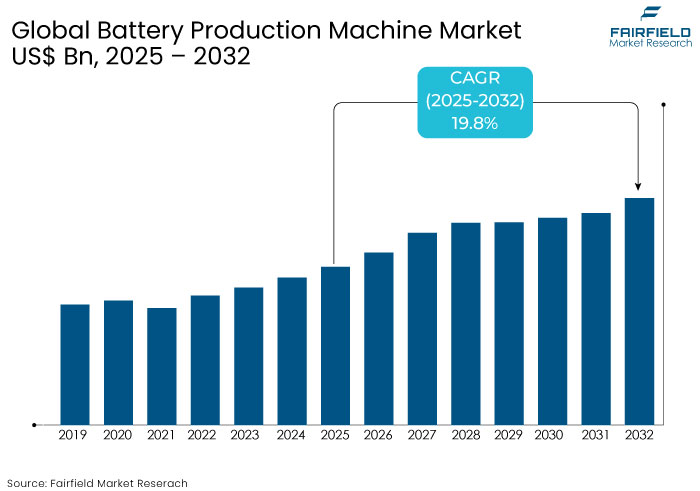

- The battery production machine market is projected to reach a size of US$ 57.8 Bn by 2032, showing significant growth from the US$ 16.3 Bn achieved in 2025.

- The market for battery production machines is set to show a considerable growth rate, with a CAGR of 19.8% from 2025 to 2032.

Battery Production Machine Market Insights

- Global push toward electric mobility is accelerating the need for unique battery production machinery that ensures efficiency, precision, and scalability.

- As companies seek long-lasting and fast-charging batteries, specialized machinery for handling lithium-sulfur and silicon-anode cells is in high demand.

- Subsidies, tax benefits, and localization mandates in areas like the U.S. and Europe are fueling the adoption of state-of-the-art battery manufacturing equipment.

- Strict environmental norms are driving demand for energy-efficient and low-waste production machines that reduce carbon footprints in gigafactories.

- As solid-state batteries move closer to commercialization, companies investing in next-gen equipment for precision layering stand to gain a competitive edge.

- Adoption of robotic arms, automated electrode stacking, and precision dispensing is revolutionizing battery manufacturing by reducing defects and enhancing efficiency.

- Dry electrode technology, which eliminates solvent-based coating, is gaining traction, pushing machinery manufacturers to innovate equipment for solvent-free production.

- Integration of AI-driven inspection and predictive maintenance in battery production lines presents immense opportunities for automation-driven machinery suppliers.

Key Growth Determinants

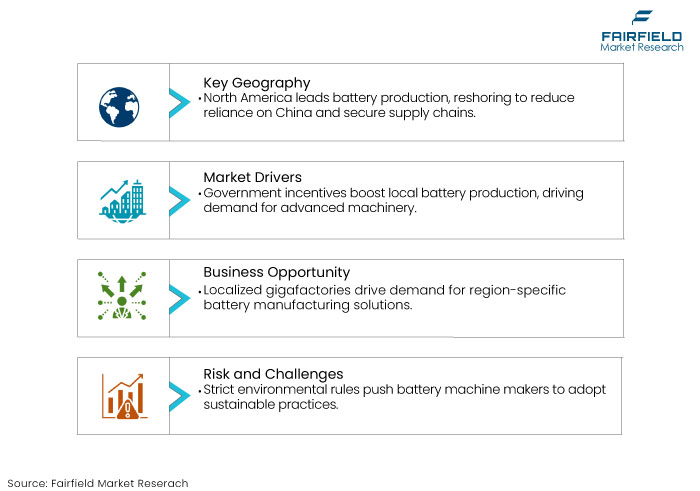

- Government Incentives for Domestic Battery Production

Governments worldwide are rolling out subsidies, tax benefits, and funding programs to accelerate domestic battery production, reducing reliance on imports and strengthening energy security. These incentives are fueling investments in innovative machinery, as companies rush to establish localized gigafactories and secure a share of the rapidly growing EV and energy storage markets. It is estimated that this factor will push the battery production machine market.

One of the most significant initiatives is the U.S. Inflation Reduction Act (IRA), which provides tax credits of up to US$ 35 per kWh for domestically produced battery cells and US$ 10 per kWh for battery modules. Additionally, manufacturers can receive production tax credits (PTCs) covering 10% of the cost of battery materials. This has triggered a wave of gigafactory announcements in the U.S., leading to a rising demand for automated, AI-driven battery production equipment to meet high-volume output and quality standards.

- Solid-state Battery Breakthroughs Open a Goldmine for Next-gen Equipment

The global race to commercialize Solid-State Batteries (SSBs) is creating a massive opportunity for next-generation battery production machine market players. Unlike traditional lithium-ion batteries, which use liquid electrolytes, solid-state batteries replace these with solid electrolytes, offering higher energy density, improved safety, and longer lifespan. However, transitioning from conventional lithium-ion production to solid-state technology requires an entirely new class of manufacturing machinery, opening a lucrative market for specialized equipment providers.

The development of high-speed, defect-free solid electrolyte manufacturing is a critical hurdle. Traditional lithium-ion battery production lines cannot handle solid-state materials efficiently, requiring new dry processing techniques and vacuum-based fabrication methods. Machinery manufacturers who innovate in scalable, high-yield solid-state processing solutions will have a significant first-mover advantage.

Key Growth Barriers

- Stringent Environmental Regulations May Negatively Affect Growth

The battery production machine market is increasingly facing strict environmental regulations as governments worldwide push for sustainable manufacturing practices in response to climate change and resource conservation concerns. Since battery production involves energy-intensive processes, hazardous chemicals, and significant material waste, regulatory bodies are tightening controls on carbon emissions, water consumption, and recycling standards, compelling machine manufacturers to adapt.

Traditional battery production relies on high-temperature sintering, solvent-based electrode coating, and extensive drying processes, which consume enormous amounts of energy. New regulations in regions like the EU Green Deal and China’s Dual-Carbon Goals are pressuring manufacturers to develop energy-efficient machines with lower carbon footprints.

Battery Production Machine Market Trends and Opportunities

- Localized Gigafactories to Spur Demand for Customizable Battery Solutions

Rapid expansion of localized gigafactories or large-scale battery production plants across key regions like North America, Europe, and Southeast Asia is augmenting the need for adaptable, region-specific manufacturing solutions. With governments pushing for domestic battery production to reduce supply chain dependencies and secure critical minerals, automakers and energy storage firms are investing heavily in localized production hubs. It is anticipated to create new opportunities in the battery production machine market.

However, each region comes with its own set of challenges, such as variations in labor costs, regulatory requirements, available raw materials, and energy infrastructure. As a result, battery manufacturers are seeking highly flexible and customizable machinery that can be tailored to their specific operational needs.

For instance, Europe-based gigafactories emphasize sustainability and are looking for machines with minimal energy consumption and recycling-friendly production processes. Factories in North America are focused on automation and AI-driven quality control to tackle rising labor costs.

- Rise of Battery Swapping Technology Propels Need for Mass Production

Growing adoption of battery swapping technology, especially in countries like China, India, and parts of Europe, is reshaping the battery manufacturing landscape, creating an urgent need for high-speed, high-precision production equipment. Unlike traditional EV charging models, where vehicles are plugged in for extended periods, battery swapping allows drivers to quickly exchange depleted batteries for fully charged ones at designated stations. This model significantly reduces vehicle downtime and is particularly popular for electric two-wheelers, three-wheelers, taxis, and fleet vehicles, where speed and efficiency are critical.

With governments and companies investing heavily in swapping infrastructure, particularly in Asia Pacific, battery manufacturers must ramp up production efficiency to meet the surging demand. As a result, manufacturers who can deliver ultra-fast, automated, and scalable solutions are poised to capitalize on this rapidly booming battery production machine market.

Segments Covered in the Report

- Slitting Machines Gain Traction Amid Demand for High-performance Batteries

Based on machine type, slitting machines are set to hold a share of 46.2% in 2025 in the battery production machine market. These are becoming increasingly crucial in battery manufacturing as demand for high-performance lithium-ion and solid-state batteries continues to rise.

The machines are used to precisely cut electrode sheets into uniform strips, which are later stacked or wound into battery cells. With the growth of EVs, renewable energy storage, and consumer electronics, manufacturers are prioritizing efficiency, precision, and defect-free production, making innovative slitting technology a key investment area.

- Lithium-ion Batteries to Lead with Increasing EV Production Worldwide

In terms of battery type, lithium-ion batteries are anticipated to hold a share of 28.7% in 2025 in the battery production machine market. The EV revolution is the biggest driver of lithium-ion battery dominance. Automakers worldwide, led by Tesla, BYD, and Volkswagen, are ramping up EV production to meet stringent zero-emission targets.

Since lithium-ion batteries power nearly all modern EVs, manufacturers are investing heavily in gigafactories that require high-speed, automated production machinery for tasks like electrode coating, slitting, stacking, and assembly. The growing number of EV battery plants is fueling demand for specialized lithium-ion battery manufacturing equipment.

Regional Analysis

- North America to Dominate as Domestic Gigafactory Investments Skyrocket

North America is projected to dominate the global battery production machine market in the forecast period. The region is reshoring battery production to reduce dependence on China and secure its EV and energy storage supply chain.

The COVID-19 pandemic and geopolitical tensions exposed vulnerabilities in relying on Asian imports, prompting the U.S. and Canada to accelerate domestic gigafactory investments. This shift has driven a surge in demand for localized battery production machines, including electrode coating, cell assembly, and testing equipment, as manufacturers build end-to-end domestic supply chains.

- Aisa Pacific Sees Production of Long-lasting and High-capacity Batteries

Asia Pacific is anticipated to remain in the second position in the battery production machine market in 2025. In Asia Pacific, China controls over 60% of global battery production, but fierce competition among manufacturers like CATL, BYD, and EVE Energy is forcing constant technological upgrades in production machinery.

As companies race to produce higher-capacity, longer-lasting batteries, they are investing in AI-driven manufacturing systems, ultra-fast electrode coating machines, and defect-detection technologies. They aim to maintain leadership in battery efficiency and yield rates.

Fairfield’s Competitive Landscape Analysis

Global industrial machinery giants like Hitachi High-Tech, Manz AG, Wuxi Lead Intelligent Equipment, and Shenzhen Yinghe Technology dominate the battery production machine market. These companies leverage their deep expertise in precision manufacturing and automation to supply high-speed electrode coating, slitting, stacking, and battery assembly machines to key battery manufacturers such as CATL, LG Energy Solution, and Panasonic.

China-based machinery companies are mainly broadening their footprint, challenging Europe- and Japan-based manufacturers with cost-effective yet highly innovative battery production machines. Firms like Shenzhen Yinghe Technology and Putailai are gaining global traction by offering customizable, high-speed battery manufacturing solutions at competitive prices.

Key Market Companies

- ZSK Stickmaschinen GmbH

- Manz AG

- DMG MORI AG

- Fristam Pumpen AG

- Hanwha Precision Machinery Co., Ltd

- Tesla, Inc.

- KUKA AG

- Fives Sylepse

- Giga Presse GmbH

- Arvigon AG

- Shibaura Machine Co. Ltd.

- Doosan Machine Tools

- Buhler AG

- Beijing Jiarui Hengfeng Technology Development Co., Ltd.

- KMT Waterjet Systems GmbH

Recent Industry Developments

- In February 2025, an unparalleled opportunity surged with US$ 82 Mn worth of advanced EV battery manufacturing equipment available in Belgium and South Korea. Manufactured by esteemed South Korea-based companies such as SLA and WuXi, these machines promise exceptional quality and innovation.

- In January 2025, Neuron Energy launched a cutting-edge 5-acre production facility in Chakan, Pune, during the Bharat Mobility Global Expo 2025. The new plant boasts an annual production capacity of 1.5 GWh of lithium-ion batteries and underscores the company’s dedication to fostering clean energy solutions in India.

- In December 2024, QuantumScape Corporation announced that next-generation heat treatment equipment for its separator production process, Cobra, has been developed, delivered, installed and released for initial separator processing. Cobra represents a significant innovation in ceramic solid-state separator production, benefiting both scalability and cost efficiency.

Global Battery Production Machine Market is Segmented as-

By Machine Type

- Slitting Machines

- Laminators

- Stackers

- Dryers

- Formers

By Battery Type

- Lithium-ion Batteries

- Lead-acid Batteries

- Nickel-cadmium Batteries

- Nickel-metal hydride Batteries

- Flow Batteries

By Application

- Automotive Industry

- Consumer Electronics

- Energy Storage

- Marine Applications

- Medical Devices

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Battery Production Machine Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Battery Production Machine Market Outlook, 2019 - 2032

3.1. Global Battery Production Machine Market Outlook, by Machine Type, Value (US$ Bn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Slitting Machines

3.1.1.2. Laminators

3.1.1.3. Stackers

3.1.1.4. Dryers

3.1.1.5. Formers

3.2. Global Battery Production Machine Market Outlook, by Battery Type, Value (US$ Bn), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Lithium-ion Batteries

3.2.1.2. Lead-acid Batteries

3.2.1.3. Nickel-cadmium Batteries

3.2.1.4. Nickel-metal hydride Batteries

3.2.1.5. Flow Batteries

3.3. Global Battery Production Machine Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Automotive Industry

3.3.1.2. Consumer Electronics

3.3.1.3. Energy Storage

3.3.1.4. Marine Applications

3.3.1.5. Medical Devices

3.4. Global Battery Production Machine Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Battery Production Machine Market Outlook, 2019 - 2032

4.1. North America Battery Production Machine Market Outlook, by Machine Type, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Slitting Machines

4.1.1.2. Laminators

4.1.1.3. Stackers

4.1.1.4. Dryers

4.1.1.5. Formers

4.2. North America Battery Production Machine Market Outlook, by Battery Type, Value (US$ Bn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Lithium-ion Batteries

4.2.1.2. Lead-acid Batteries

4.2.1.3. Nickel-cadmium Batteries

4.2.1.4. Nickel-metal hydride Batteries

4.2.1.5. Flow Batteries

4.3. North America Battery Production Machine Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Automotive Industry

4.3.1.2. Consumer Electronics

4.3.1.3. Energy Storage

4.3.1.4. Marine Applications

4.3.1.5. Medical Devices

4.4. North America Battery Production Machine Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. U.S. Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

4.4.1.2. U.S. Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

4.4.1.3. U.S. Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

4.4.1.4. Canada Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

4.4.1.5. Canada Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

4.4.1.6. Canada Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Battery Production Machine Market Outlook, 2019 - 2032

5.1. Europe Battery Production Machine Market Outlook, by Machine Type, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Slitting Machines

5.1.1.2. Laminators

5.1.1.3. Stackers

5.1.1.4. Dryers

5.1.1.5. Formers

5.2. Europe Battery Production Machine Market Outlook, by Battery Type, Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Lithium-ion Batteries

5.2.1.2. Lead-acid Batteries

5.2.1.3. Nickel-cadmium Batteries

5.2.1.4. Nickel-metal hydride Batteries

5.2.1.5. Flow Batteries

5.3. Europe Battery Production Machine Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Automotive Industry

5.3.1.2. Consumer Electronics

5.3.1.3. Energy Storage

5.3.1.4. Marine Applications

5.3.1.5. Medical Devices

5.4. Europe Battery Production Machine Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Germany Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

5.4.1.2. Germany Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

5.4.1.3. Germany Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

5.4.1.4. U.K. Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

5.4.1.5. U.K. Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

5.4.1.6. U.K. Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

5.4.1.7. France Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

5.4.1.8. France Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

5.4.1.9. France Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

5.4.1.10. Italy Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

5.4.1.11. Italy Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

5.4.1.12. Italy Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

5.4.1.13. Türkiye Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

5.4.1.14. Türkiye Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

5.4.1.15. Türkiye Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

5.4.1.16. Russia Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

5.4.1.17. Russia Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

5.4.1.18. Russia Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

5.4.1.19. Rest of Europe Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

5.4.1.20. Rest of Europe Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

5.4.1.21. Rest of Europe Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Battery Production Machine Market Outlook, 2019 - 2032

6.1. Asia Pacific Battery Production Machine Market Outlook, by Machine Type, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Slitting Machines

6.1.1.2. Laminators

6.1.1.3. Stackers

6.1.1.4. Dryers

6.1.1.5. Formers

6.2. Asia Pacific Battery Production Machine Market Outlook, by Battery Type, Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Lithium-ion Batteries

6.2.1.2. Lead-acid Batteries

6.2.1.3. Nickel-cadmium Batteries

6.2.1.4. Nickel-metal hydride Batteries

6.2.1.5. Flow Batteries

6.3. Asia Pacific Battery Production Machine Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Automotive Industry

6.3.1.2. Consumer Electronics

6.3.1.3. Energy Storage

6.3.1.4. Marine Applications

6.3.1.5. Medical Devices

6.4. Asia Pacific Battery Production Machine Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. China Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

6.4.1.2. China Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

6.4.1.3. China Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

6.4.1.4. Japan Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

6.4.1.5. Japan Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

6.4.1.6. Japan Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

6.4.1.7. South Korea Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

6.4.1.8. South Korea Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

6.4.1.9. South Korea Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

6.4.1.10. India Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

6.4.1.11. India Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

6.4.1.12. India Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

6.4.1.13. Southeast Asia Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

6.4.1.14. Southeast Asia Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

6.4.1.15. Southeast Asia Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

6.4.1.16. Rest of Asia Pacific Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

6.4.1.17. Rest of Asia Pacific Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

6.4.1.18. Rest of Asia Pacific Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Battery Production Machine Market Outlook, 2019 - 2032

7.1. Latin America Battery Production Machine Market Outlook, by Machine Type, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Slitting Machines

7.1.1.2. Laminators

7.1.1.3. Stackers

7.1.1.4. Dryers

7.1.1.5. Formers

7.2. Latin America Battery Production Machine Market Outlook, by Battery Type, Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Lithium-ion Batteries

7.2.1.2. Lead-acid Batteries

7.2.1.3. Nickel-cadmium Batteries

7.2.1.4. Nickel-metal hydride Batteries

7.2.1.5. Flow Batteries

7.3. Latin America Battery Production Machine Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Automotive Industry

7.3.1.2. Consumer Electronics

7.3.1.3. Energy Storage

7.3.1.4. Marine Applications

7.3.1.5. Medical Devices

7.4. Latin America Battery Production Machine Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Brazil Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

7.4.1.2. Brazil Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

7.4.1.3. Brazil Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

7.4.1.4. Mexico Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

7.4.1.5. Mexico Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

7.4.1.6. Mexico Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

7.4.1.7. Argentina Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

7.4.1.8. Argentina Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

7.4.1.9. Argentina Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

7.4.1.10. Rest of Latin America Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

7.4.1.11. Rest of Latin America Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

7.4.1.12. Rest of Latin America Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Battery Production Machine Market Outlook, 2019 - 2032

8.1. Middle East & Africa Battery Production Machine Market Outlook, by Machine Type, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Slitting Machines

8.1.1.2. Laminators

8.1.1.3. Stackers

8.1.1.4. Dryers

8.1.1.5. Formers

8.2. Middle East & Africa Battery Production Machine Market Outlook, by Battery Type, Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Lithium-ion Batteries

8.2.1.2. Lead-acid Batteries

8.2.1.3. Nickel-cadmium Batteries

8.2.1.4. Nickel-metal hydride Batteries

8.2.1.5. Flow Batteries

8.3. Middle East & Africa Battery Production Machine Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Automotive Industry

8.3.1.2. Consumer Electronics

8.3.1.3. Energy Storage

8.3.1.4. Marine Applications

8.3.1.5. Medical Devices

8.4. Middle East & Africa Battery Production Machine Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. GCC Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

8.4.1.2. GCC Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

8.4.1.3. GCC Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

8.4.1.4. South Africa Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

8.4.1.5. South Africa Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

8.4.1.6. South Africa Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

8.4.1.7. Egypt Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

8.4.1.8. Egypt Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

8.4.1.9. Egypt Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

8.4.1.10. Nigeria Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

8.4.1.11. Nigeria Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

8.4.1.12. Nigeria Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

8.4.1.13. Rest of Middle East & Africa Battery Production Machine Market by Machine Type, Value (US$ Bn), 2019 - 2032

8.4.1.14. Rest of Middle East & Africa Battery Production Machine Market by Battery Type, Value (US$ Bn), 2019 - 2032

8.4.1.15. Rest of Middle East & Africa Battery Production Machine Market by Application, Value (US$ Bn), 2019 - 2032

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. by Application vs by Battery Type Heat map

9.2. Manufacturer vs by Battery Type Heat map

9.3. Company Market Share Analysis, 2025

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. ZSK Stickmaschinen GmbH

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Manz AG

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. DMG MORI AG

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Fristam Pumpen AG

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Hanwha Precision Machinery Co., Ltd

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Tesla, Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. KUKA AG

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Fives Sylepse

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Giga Presse GmbH

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Arvigon AG

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Shibaura Machine Co. Ltd.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Doosan Machine Tools

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Buhler AG

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Beijing Jiarui Hengfeng Technology Development Co., Ltd.

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. KMT Waterjet Systems GmbH

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Machine Type Coverage |

|

|

Battery Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |