Global Biodegradable Tableware Market Forecast

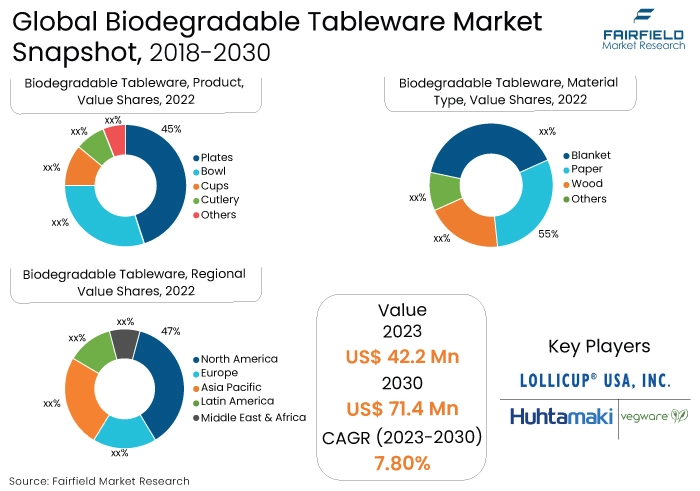

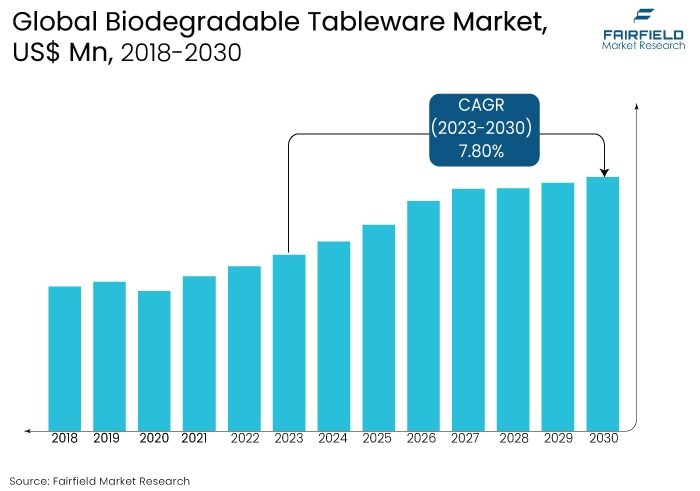

- Global biodegradable tableware to be worth US$71.4 Mn in 2030, up from US$42.2 Mn attained in 2023

- biodegradable tableware market size anticipated to expand at a CAGR of 7.8% during 2023-2030

Major Report Findings - Fairfield's Perspective

- Rising consumer demand for sustainable convenience is the key driver for biodegradable tableware. This includes both eco-conscious individuals seeking guilt-free disposables and businesses facing regulations and consumer pressure to reduce plastic waste. Expect innovation in bio-based materials, affordability, and functionality to fuel further market growth.

- Growing environmental concerns are expected to drive the biodegradable tableware market as consumers and businesses seek sustainable alternatives to reduce plastic waste. With increased awareness of environmental issues and stricter regulations, there is a rising demand for biodegradable tableware, contributing to market growth and adoption of eco-friendly solutions.

- Increasing consumer preference for eco-friendly products is expected to drive the biodegradable tableware market. As consumers become more environmentally conscious, they actively seek sustainable alternatives to traditional plastics. This growing preference for biodegradable tableware is anticipated to fuel market growth and drive adoption of eco-friendly dining solutions worldwide.

- The rise and shift in dining trends towards sustainable practices are expected to drive the biodegradable tableware market. With an increasing number of consumers opting for eco-friendly dining experiences, there is a growing demand for biodegradable tableware, driving market growth and adoption of environmentally conscious dining solutions globally.

- Plates reign supreme due to their versatility and widespread use. They cater to diverse needs, from casual picnics to restaurant takeout, making them a ubiquitous choice. Compared to bowls or cups with limited uses, plates adapt to various food types and occasions, driving higher demand and market share.

- The paper material type has captured the largest market share in the biodegradable tableware market due to its eco-friendliness, affordability, and versatility. Paper-based tableware offers a sustainable alternative to traditional plastics, appealing to environmentally conscious consumers and businesses seeking biodegradable solutions for food service and dining applications.

- The Asia Pacific region is experiencing significant growth in the biodegradable tableware market due to increasing environmental awareness, rapid urbanisation, and supportive government initiatives promoting sustainable practices. Rising disposable incomes and changing consumer preferences towards eco-friendly products are driving the adoption of biodegradable tableware across the region.

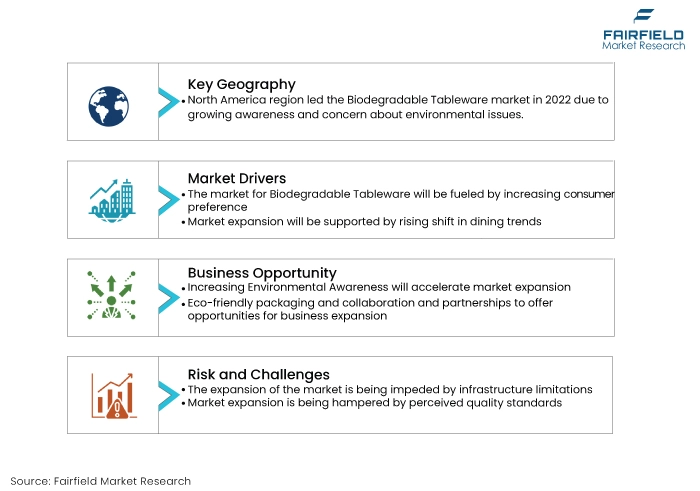

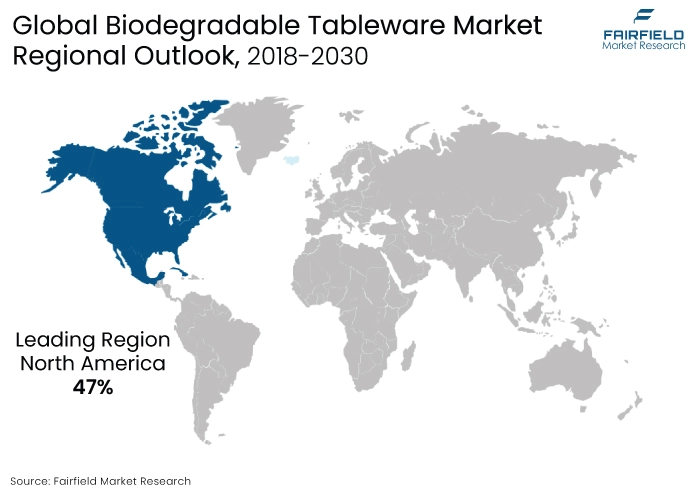

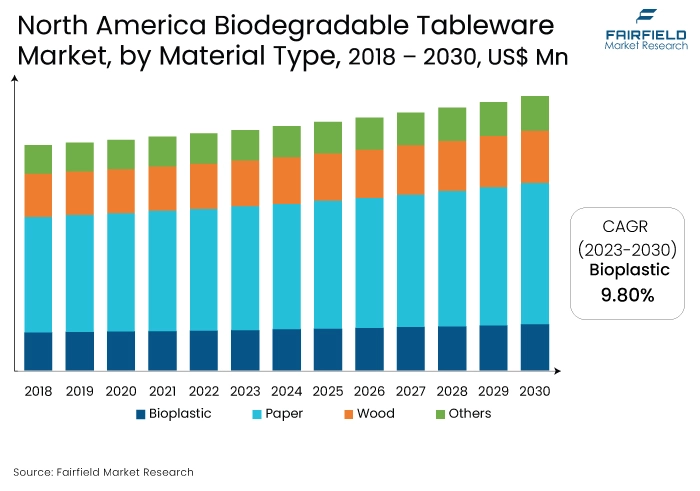

- North America is experiencing growth in the biodegradable tableware market due to stringent regulations against single-use plastics, rising environmental consciousness among consumers, and a strong emphasis on sustainability. This has led to increased demand for eco-friendly alternatives, driving the adoption of biodegradable tableware products in the region.

A Look Back and a Look Forward - Comparative Analysis

The biodegradable tableware market is growing due to increasing environmental awareness and a shift towards sustainable consumption. Consumers are opting for biodegradable alternatives to reduce plastic waste, leading to heightened demand for eco-friendly tableware. Government regulations promoting environmental sustainability further drive market growth.

Manufacturers responding to the demand for biodegradable solutions, coupled with changing consumer preferences, contribute to the market's expansion as it aligns with global efforts to address environmental concerns.

The growth of the biodegradable tableware market is driven by increasing demand from various applications, including food service establishments, catering events, and household use. Consumer awareness of environmental impact and a preference for sustainable alternatives contribute to the market's expansion.

Additionally, stringent regulations promoting eco-friendly practices in the food industry further boost the adoption of biodegradable tableware, making it a key choice for businesses and consumers aiming to reduce their ecological footprint.

The future of the biodegradable tableware market looks promising as sustainability becomes a central focus. With a rising shift towards eco-friendly alternatives, increased awareness of environmental issues, and stringent regulations, the market is expected to witness continued growth.

Innovations in materials and manufacturing processes, coupled with growing consumer preference for sustainable products, will likely drive the biodegradable tableware market, offering environmentally responsible choices for a wide range of applications.

Key Growth Determinants

- Growing Environmental Concerns

Growing environmental concerns are expected to be a primary driver of the biodegradable tableware market. As awareness of plastic pollution and environmental degradation increases, consumers and businesses seek sustainable alternatives to conventional plastic tableware. biodegradable tableware, made from materials like plant fibers- or starch-based plastics, provides an eco-friendly solution.

Government regulations targeting single-use plastics and encouraging sustainable practices further amplify the demand. The market is poised to benefit from the collective effort to reduce the environmental impact of disposable products, making biodegradable tableware an increasingly preferred choice for those seeking to minimise their ecological footprint and contribute to a more sustainable and environmentally friendly dining culture.

- Increasing Consumer Preference for Biodegradable Choices

Increasing consumer preference is a significant driver for the biodegradable tableware market. As environmental consciousness rises, consumers seek eco-friendly alternatives to traditional plastic tableware. The preference for biodegradable options is fuelled by a desire to make sustainable choices, reduce plastic waste, and contribute to environmental conservation. Consumers actively choose biodegradable tableware for its eco-friendly attributes, driving market demand.

Additionally, as more individuals prioritise ethical consumption, businesses respond by offering sustainable alternatives, thereby further boosting the adoption of biodegradable tableware. This trend is expected to persist and even grow, influencing purchasing decisions and contributing to the continued expansion of the biodegradable tableware market globally.

- Rising Shift in Dining Trends

The rise and shift in dining trends are expected to drive the biodegradable tableware market. With changing consumer habits and preferences, there is an increasing demand for sustainable dining solutions. Restaurants, catering services, and events are embracing eco-friendly practices, favouring biodegradable tableware over traditional options. The shift in dining trends toward more responsible and sustainable choices aligns with the growing environmental consciousness.

Consumers, seeking eco-friendly dining experiences, are influencing the market by encouraging the use of biodegradable tableware in various dining settings. This trend is likely to continue as the foodservice industry and consumers increasingly prioritise sustainability, driving the growth of the biodegradable tableware market in response to evolving dining preferences.

Major Growth Barriers

- Infrastructure Challenges

Infrastructure challenges pose a hurdle for the biodegradable tableware market, particularly in terms of waste disposal. Limited composting facilities and specific waste management systems hinder the proper disposal and decomposition of biodegradable tableware.

The lack of adequate infrastructure may lead to improper disposal practices, undermining the environmental benefits of biodegradable materials. Overcoming these challenges requires investments in waste management infrastructure and increased awareness to facilitate the effective and sustainable disposal of biodegradable tableware.

- Perceived Quality

Perceived quality is a challenge for the biodegradable tableware market, as some consumers may view biodegradable materials as less durable or of lower quality compared to traditional alternatives. Misconceptions about the performance of biodegradable tableware may impact purchasing decisions, hindering widespread adoption.

Overcoming this challenge involves educating consumers about the quality and functionality of biodegradable materials, emphasizing their positive attributes to change perceptions and encourage acceptance in the market.

Key Trends and Opportunities to Look at

- Increasing Environmental Awareness

Increasing environmental awareness is a significant trend in the biodegradable tableware market. As consumers become more conscious of environmental impact, there is a growing demand for eco-friendly alternatives to traditional plastic tableware. This trend is driving manufacturers to produce and market biodegradable options, addressing environmental concerns and promoting sustainable consumption practices.

- Eco-Friendly Packaging

Eco-friendly packaging is a key trend in the biodegradable tableware market. As sustainability gains prominence, the market is responding with biodegradable packaging solutions. This trend aligns with consumer preferences for environmentally conscious products and offers opportunities for market players to provide sustainable packaging alternatives in addition to biodegradable tableware items.

- Collaborations and Partnerships

Collaborations and partnerships are crucial in the biodegradable tableware market. By forming alliances with foodservice providers, retailers, and other stakeholders, manufacturers can create synergies, expand distribution networks, and collectively promote sustainable practices. These collaborations enable a broader market reach and contribute to the overall growth of the biodegradable tableware industry

How Does the Regulatory Scenario Shape this Industry?

The regulatory framework for the biodegradable tableware market varies globally. In the European Union, regulations such as the Single-Use Plastics Directive and waste management directives aim to reduce single-use plastics, influencing the adoption of biodegradable alternatives. The U.S. Food and Drug Administration (FDA) provides guidelines on the use of biodegradable materials in food contact applications.

Region-specific changes, like India's ban on certain single-use plastics, drive the adoption of biodegradable tableware. China's regulations on plastic waste imports impact global markets. Regulatory entities such as the European Chemicals Agency (ECHA) and national environmental agencies play crucial roles in setting standards. Compliance with these regulations is essential for manufacturers, influencing product development and market strategies to align with evolving environmental policies.

Fairfield’s Ranking Board

Top Segments

- Sales of Players Dominant, Extensive Demand Continues from Foodservice

Plates have captured the largest market share in the biodegradable tableware market due to their extensive use in various dining settings, events, and foodservice applications. Consumers and businesses, seeking sustainable alternatives for single-use items, prefer biodegradable plates as they offer a practical and eco-friendly solution.

The convenience and versatility of biodegradable plates for serving a wide range of food items contribute to their dominance in the market, making them a popular choice among environmentally conscious consumers and industries.

Bowls are however expected to see rapid growth in sales for their versatile use in diverse dining scenarios. As consumer preferences shift towards sustainable dining solutions, the demand for biodegradable bowls rises. Their suitability for various food types, coupled with eco-friendly attributes, positions biodegradable bowls as a popular choice.

The growth in takeaway and food delivery services also contributes to the increasing demand for biodegradable bowls, reflecting the broader trend of sustainable practices in the food industry.

- Paper Remains the Material of Choice Among End Users

Paper material type has captured the largest market share in the biodegradable tableware market due to its widespread acceptance, versatility, and eco-friendly attributes. biodegradable tableware made from paper is a popular choice for disposable plates, cups, and other items. It offers a sustainable alternative to traditional plastics, aligning with consumer preferences for environmentally conscious products.

The lightweight and customizable nature of paper-based biodegradable tableware further contribute to its dominance in the market, catering to a wide range of applications and dining scenarios.

On the other hand, the bioplastic material type is all set to record an exceptional CAGR owing to its eco-friendly nature, and versatility of usage. Bioplastics, derived from renewable resources, offer a sustainable alternative to traditional plastics.

Growing awareness of environmental issues and increased emphasis on sustainable materials contribute to the rising demand for bioplastic-based biodegradable tableware. As consumers and industries seek greener alternatives, bioplastic material types are at the forefront of this shift, driving their significant growth in the market.

Regional Frontrunners

Regulatory Framework Surrounding Single-Use Plastics to Keep North America at the Top

North America captured the largest market share in the biodegradable tableware market due to several factors. The region continues to witness growing awareness and concern about environmental issues, prompting consumers and businesses to seek more sustainable alternatives to traditional plastics. This will significantly contribute toward market expansion.

Additionally, stringent regulations and policies in North America regarding single-use plastics have accelerated the adoption of biodegradable tableware solutions. Moreover, the presence of well-established players and advanced infrastructure for manufacturing and distribution further bolstered the market in this region.

The emphasis on eco-friendly practices and the willingness of consumers to pay a premium for sustainable products have also contributed to the dominance of North America in the biodegradable tableware market.

Asia Pacific Likely to Develop a Lucrative Market as Sustainability Takes Centre Stage

The Asia Pacific region is experiencing the highest CAGR in the biodegradable tableware market due to several key factors. There is a significant shift towards eco-friendly alternatives driven by increasing environmental consciousness among consumers, and stringent regulations regarding single-use plastics.

Additionally, rapid urbanisation, and industrialisation in countries like China, and India are fuelling demand for sustainable products. Moreover, rising disposable incomes and changing lifestyles are driving the adoption of biodegradable tableware across the region, contributing to its rapid growth.

Fairfield’s Competitive Landscape Analysis

In the competitive landscape of the biodegradable tableware market, established players like Huhtamaki, and Dixie Consumer Products duke it out with innovative startups, all vying for a slice of the eco-conscious pie. Competition hinges on factors like material innovation, cost-effectiveness, product diversity, and regional reach.

Strategic partnerships and acquisitions are common as companies seek to expand their offerings and geographical footprint. Expect the battle to heat up further, with sustainability-focused initiatives and technological advancements driving the game.

Who are the Leaders in Global Biodegradable Tableware Space?

- Huhtamäki Oyj

- Lollicup USA Inc.

- Vegware Ltd.

- Dart Container Corporation

- Solia, Inc.

- Hefty

- Dixie Consumer Products LLC

- Duni AB

- Graphic Packaging International, LLC

- Pacovis AG

- Papstar GmbH

- Dispo International

- Genpak LLC

- Eco-Products

- Pappco Greenware

Significant Industry Developments

New Product Launch

- February 2022: Huhtamaki, a prominent international supplier of eco-friendly packaging solutions, partnered with Carte D'OR to revamp the packaging for its ice cream, transitioning to recyclable paper tubs and lids. This shift towards recyclable paper-based packaging is expected to enable the brand to eliminate over 900 tons of new plastic usage annually in the United Kingdom.

- December 2021: International Paper has revealed plans for the development of a cutting-edge corrugated packaging facility in Atglen, Pennsylvania. This initiative marks a significant expansion of the company's industrial packaging presence in the northeastern region of the United States. Scheduled to commence construction in the initial quarter of 2022, the plant is anticipated to become operational by the corresponding period in 2023.

An Expert’s Eye

Demand and Future Growth

The market demand for biodegradable tableware is poised for substantial growth due to increasing environmental concerns and regulations against single-use plastics.

Consumers and businesses are increasingly opting for sustainable alternatives, driving market expansion. With growing awareness and adoption of eco-friendly practices, the biodegradable tableware market is expected to witness significant future growth.

Factors such as innovation in materials, expanding distribution channels, and rising disposable incomes further contribute to this trend. As sustainability continues to gain importance, the biodegradable tableware market is forecasted to experience robust growth in response to evolving consumer preferences and regulatory mandates.

Supply Side of the Market

In the biodegradable tableware market, demand-supply dynamics are influenced by increasing consumer awareness of environmental issues, leading to greater demand for sustainable alternatives. The current pricing structure reflects the balance between production costs, demand levels, and competitive positioning among suppliers. Pricing will play a crucial role in long-term growth by incentivising innovation, cost efficiencies, and market penetration.

Major trends driving competition include product differentiation through material innovation, branding strategies emphasizing sustainability, and partnerships to expand distribution networks. Supply chain analysis reveals the importance of sourcing raw materials sustainably, efficient manufacturing processes, and reliable distribution channels to meet growing demand.

As consumer preferences continue to prioritise sustainability, companies that can effectively manage pricing, innovate, and optimise their supply chains will be well-positioned for long-term growth in the biodegradable tableware market.

Global Biodegradable Tableware Market is Segmented as Below:

By Product:

- Plates

- Bowls

- Cups

- Cutlery

- Others

By Material Type:

- Paper

- Bioplastic

- Wood

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Biodegradable Tableware Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Biodegradable Tableware Market Outlook, 2018 - 2030

3.1. Global Biodegradable Tableware Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Plates

3.1.1.2. Bowls

3.1.1.3. Cups

3.1.1.4. Cutlery

3.1.1.5. Others

3.2. Global Biodegradable Tableware Market Outlook, by Material Type, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Paper

3.2.1.2. Bioplastic

3.2.1.3. Wood

3.2.1.4. Others

3.3. Global Biodegradable Tableware Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Biodegradable Tableware Market Outlook, 2018 - 2030

4.1. North America Biodegradable Tableware Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Plates

4.1.1.2. Bowls

4.1.1.3. Cups

4.1.1.4. Cutlery

4.1.1.5. Others

4.2. North America Biodegradable Tableware Market Outlook, by Material Type, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Paper

4.2.1.2. Bioplastic

4.2.1.3. Wood

4.2.1.4. Others

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Biodegradable Tableware Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

4.3.1.2. U.S. Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

4.3.1.3. Canada Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

4.3.1.4. Canada Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Biodegradable Tableware Market Outlook, 2018 - 2030

5.1. Europe Biodegradable Tableware Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Plates

5.1.1.2. Bowls

5.1.1.3. Cups

5.1.1.4. Cutlery

5.1.1.5. Others

5.2. Europe Biodegradable Tableware Market Outlook, by Material Type, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Paper

5.2.1.2. Bioplastic

5.2.1.3. Wood

5.2.1.4. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Biodegradable Tableware Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

5.3.1.2. Germany Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

5.3.1.3. U.K. Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

5.3.1.4. U.K. Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

5.3.1.5. France Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

5.3.1.6. France Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

5.3.1.7. Italy Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

5.3.1.8. Italy Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

5.3.1.9. Turkey Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

5.3.1.10. Turkey Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

5.3.1.11. Russia Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

5.3.1.12. Russia Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

5.3.1.13. Rest of Europe Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

5.3.1.14. Rest of Europe Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Biodegradable Tableware Market Outlook, 2018 - 2030

6.1. Asia Pacific Biodegradable Tableware Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Plates

6.1.1.2. Bowls

6.1.1.3. Cups

6.1.1.4. Cutlery

6.1.1.5. Others

6.2. Asia Pacific Biodegradable Tableware Market Outlook, by Material Type, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Paper

6.2.1.2. Bioplastic

6.2.1.3. Wood

6.2.1.4. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Biodegradable Tableware Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

6.3.1.2. China Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

6.3.1.3. Japan Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

6.3.1.4. Japan Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

6.3.1.5. South Korea Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

6.3.1.6. South Korea Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

6.3.1.7. India Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

6.3.1.8. India Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

6.3.1.9. Southeast Asia Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

6.3.1.10. Southeast Asia Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Biodegradable Tableware Market Outlook, 2018 - 2030

7.1. Latin America Biodegradable Tableware Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Plates

7.1.1.2. Bowls

7.1.1.3. Cups

7.1.1.4. Cutlery

7.1.1.5. Others

7.2. Latin America Biodegradable Tableware Market Outlook, by Material Type, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Paper

7.2.1.2. Bioplastic

7.2.1.3. Wood

7.2.1.4. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Biodegradable Tableware Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

7.3.1.2. Brazil Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

7.3.1.3. Mexico Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

7.3.1.4. Mexico Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

7.3.1.5. Argentina Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

7.3.1.6. Argentina Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

7.3.1.7. Rest of Latin America Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

7.3.1.8. Rest of Latin America Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Biodegradable Tableware Market Outlook, 2018 - 2030

8.1. Middle East & Africa Biodegradable Tableware Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Plates

8.1.1.2. Bowls

8.1.1.3. Cups

8.1.1.4. Cutlery

8.1.1.5. Others

8.2. Middle East & Africa Biodegradable Tableware Market Outlook, by Material Type, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Paper

8.2.1.2. Bioplastic

8.2.1.3. Wood

8.2.1.4. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Biodegradable Tableware Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

8.3.1.2. GCC Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

8.3.1.3. South Africa Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

8.3.1.4. South Africa Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

8.3.1.5. Egypt Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

8.3.1.6. Egypt Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

8.3.1.7. Nigeria Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

8.3.1.8. Nigeria Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Biodegradable Tableware Market by Product, Value (US$ Mn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Biodegradable Tableware Market Material Type, Value (US$ Mn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Material Type vs Material Type Heatmap

9.2. Manufacturer vs Material Type Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Huhtamäki Oyj

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Lollicup USA Inc.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Vegware Ltd.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Dart Container Corporation

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Solia, Inc.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Hefty

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Dixie Consumer Products LLC

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Duni AB

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Graphic Packaging International, LLC

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Pacovis AG

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Papstar GmbH

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Dispo International

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Genpak LLC

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Eco-Products

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Pappco Greenware

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Material Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |