Global Biofilm Treatment Market Forecast

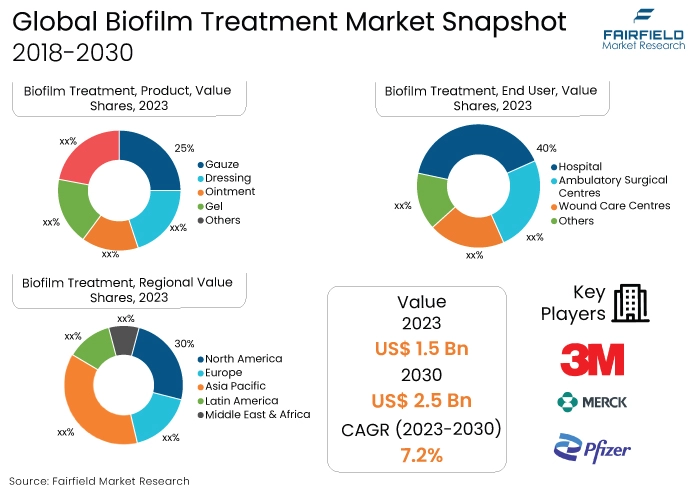

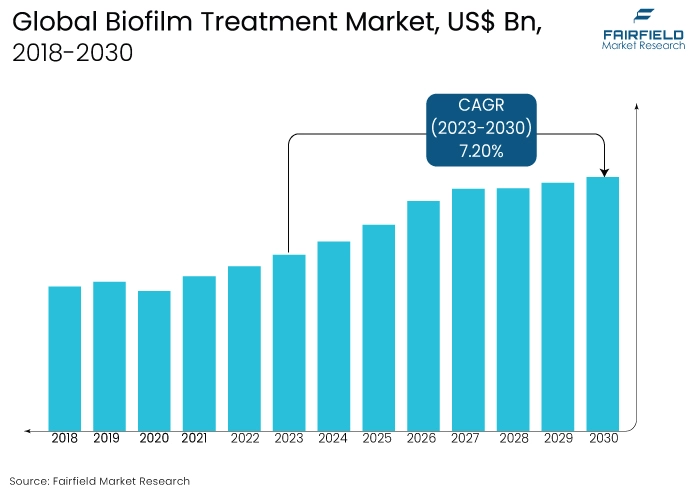

- Global biofilm treatment market size projected to reach US$2.5 Bn in 2030 from US$1.5 Bn attained in 2023

- Biofilm treatment market revenue poised to see 7.2% CAGR between 2023 and 2030

Quick Report Digest

- Growing demand for biodegradable carton-board packaging propels the biofilm treatment market, preferred for secondary packaging due to environmental considerations.

- The biofilm treatment market benefits from the expanding global fast-moving consumer goods (FMCG) industry, along with pharmaceutical and food and beverage sectors.

- The side load category, offering enhanced packaging output, dominated the 2023biofilm treatment market, categorised by case handling methods.

- The automatic biofilm treatment segment dominates globally, driven by improved productivity, cost-effectiveness, and enhanced product quality and safety.

- The 10 to 25 CPM category prevails, catering to industries with moderate production quantities, balancing speed and precision in case packing.

- Biofilm treatment finds substantial application in automating confectionery product packaging, ensuring effectiveness and uniformity in the market.

- The Asia-Pacific region claims the largest share, driven by food industry expansion, government initiatives, and consistent packaging technology advancements.

- North America experiences biofilm treatment market growth due to increased packaging needs in food, pharmaceuticals, and cosmetics, aligning with consumer preferences for convenience and value.

A Look Back and a Look Forward - Comparative Analysis

The global biofilm treatment market is experiencing robust growth, fueled by several key factors. The increasing demand for environmentally friendly packaging solutions, particularly biodegradable carton-board packaging, is a significant driver.

Biofilm treatment is in high demand, with the side load category dominating in 2022, offering enhanced packaging output and versatility. The market is benefiting from the expansion of the FMCG industry and the pharmaceutical and food and beverage sectors, indicating a diverse and expanding consumer base.

Looking at the historical market scenario, 2022 witnessed the dominance of the side load category, reflecting an industry shift towards more efficient and automated packaging solutions. The 10 to 25 CPM category played a crucial role in industries with moderate production quantities, finding a balance between speed and precision.

Automation in confectionery packaging has become a prevalent trend, contributing to market growth. The automatic segment's ascendancy globally has further strengthened the market's position, driven by increased productivity, cost-effectiveness, and improved product quality and safety.

In the future market scenario, the biofilm treatment market is poised for sustained growth. The Asia Pacific region is anticipated to maintain its leadership, driven by the expanding food industry, government initiatives promoting sustainable packaging, and continued advancements in packaging technology.

North America is expected to witness further expansion, driven by heightened packaging needs in the food and beverage, pharmaceutical, and cosmetics industries. The market's future trajectory suggests a continued emphasis on environmentally conscious packaging solutions and increased automation across various industries.

Key Growth Determinants

- The Growing Boom Around Environmental Sustainability and Biodegradability

The increasing global focus on environmental sustainability is a primary driver propelling the biofilm treatment market. The demand for packaging solutions that are environmentally friendly and contribute to waste reduction has led to a surge in the adoption of biofilm treatment.

The preference for biodegradable carton-board packaging is especially on the rise due to its total biodegradability. This aligns with consumer preferences for eco-friendly products and regulatory initiatives promoting sustainable practices. Biofilm treatment, with its ability to offer effective and sustainable packaging solutions, is thus positioned at the forefront of this growing market.

- FMCG Expansion

The rapid expansion of the FMCG industry serves as a significant driver for the biofilm treatment market. The FMCG sector, encompassing products with a short shelf life and high consumer demand, necessitates efficient and reliable packaging solutions.

Biofilm treatment finds extensive application in this industry, providing solutions that cater to diverse packaging needs. The market benefits from the constant demand for packaged goods in the FMCG sector, positioning Biofilm Treatment as a crucial component in supporting the growth and evolution of this dynamic industry.

- Technological Advancements, and Automation

Technological advancements and the increasing trend towards automation represent a key driver shaping the biofilm treatment market. The industry has witnessed a shift towards automatic biofilm treatment, driven by the advantages of enhanced productivity, lower costs, and improved product quality and safety.

Automation, particularly in the 10 to 25 CPM category, has proven essential for industries with moderate production quantities seeking a balance between speed and precision in case packing. As manufacturers across various sectors prioritise efficiency and operational excellence, the demand for technologically advanced and automated Biofilm Treatment is expected to continue driving market growth.

Major Growth Barriers

- Technological Complexity, and Implementation Challenges

The biofilm treatment market faces restraint due to the technological complexity of advanced treatments. Implementing these sophisticated solutions may pose challenges for companies, requiring substantial investments in training and system integration.

Smaller businesses, in particular, may find it challenging to navigate these complexities, limiting widespread adoption. Overcoming these implementation hurdles is crucial to unlocking the full potential of biofilm treatment in diverse industries.

- Regulatory Compliance and Certification Barriers

Stringent regulatory compliance and certification requirements act as significant restraints in the biofilm treatment market. Meeting standards for bio-based and biodegradable packaging demands rigorous testing and verification processes.

Navigating these regulatory landscapes can be time-consuming and costly, potentially hindering market growth. Streamlining certification processes and establishing clear industry standards will be essential to mitigate these challenges and foster a more conducive environment for biofilm treatment.

Key Trends and Opportunities to Look at

- Sustainable Packaging Surge

The global trend toward sustainable packaging is robust, with biofilm treatment gaining prominence for their biodegradability. This trend is universally popular, driven by environmental consciousness. Key companies are developing bio-based solutions, and industry leaders are investing in eco-friendly initiatives.

Brands are likely to leverage sustainable packaging to enhance their environmental credentials, meeting the rising consumer demand for green and responsible products across diverse regions.

- Smart Packaging Integration

The integration of smart technologies within biofilm treatment is experiencing rapid growth worldwide. This trend is pervasive across regions, with companies incorporating sensors and QR codes for enhanced functionality. Key developments include packaging innovations that improve traceability and quality control.

Brands are poised to leverage smart packaging for heightened supply chain visibility, product authenticity, and improved consumer engagement, responding to the global demand for intelligent and connected packaging solutions.

- Customisation and Versatility Trend

The trend towards customisation and versatility in biofilm treatment is gaining momentum globally. Companies are developing treatments that address diverse packaging requirements, with popularity across different regions.

Key developments include flexible solutions adaptable to changing market demands. Brands are expected to leverage customisation to differentiate their products, cater to specific consumer preferences, and maintain agility in responding to evolving market dynamics on a global scale.

How Does the Regulatory Scenario Shape this Industry?

The global biofilm treatment market operates within a regulatory framework shaped by various entities and guidelines to ensure the safety, efficacy, and environmental sustainability of bio-based packaging solutions. In the US, the Food and Drug Administration (FDA) oversees the safety and labeling of food packaging materials, including biofilm treatment.

The FDA guides substances that can be used in packaging and ensures compliance with the Federal Food, Drug, and Cosmetic Act. In the European Union, the European Food Safety Authority (EFSA) plays a crucial role in evaluating the safety of food contact materials, including bio-based packaging. The EU's Regulation (EC) No 1935/2004 establishes general safety requirements for materials intended to come into contact with food.

Region-specific regulatory changes impact the adoption and market dynamics of biofilm treatment. For instance, the EU's Single-Use Plastics Directive aims to reduce the environmental impact of certain plastic products, potentially driving the demand for bio-based and biodegradable alternatives. In Asia Pacific, countries like India are increasingly focusing on sustainable packaging, with regulatory bodies emphasizing the need for eco-friendly solutions, influencing market trends.

The influence of regulatory entities extends beyond safety considerations; they also guide the industry toward more sustainable practices. For instance, the Circular Economy Action Plan in the EU encourages the use of bio-based materials, fostering a regulatory environment conducive to the growth of the biofilm treatment market.

Fairfield’s Ranking Board

Top Segments

- Dressings Dominant over Gels

The dressings segment is the dominant category, showcasing their versatility and indispensability across various healthcare settings. Advanced wound dressings have become the cornerstone of effective wound management, offering a comprehensive array of specialised functionalities.

From regulating moisture levels and absorbing exudate to providing crucial protection against infections, these dressings play a vital role in promoting optimal wound healing outcomes. Their widespread use in hospitals, wound care centres, and home care settings underscores their universal applicability and trustworthiness among healthcare professionals and patients alike.

The gels are rapidly emerging as the fastest-growing category within the wound care market, driven by their unique attributes and efficacy in addressing biofilm-related wounds. With biofilms posing significant challenges to wound healing processes, especially in chronic and complex wounds, the demand for innovative solutions has surged.

Gel formulations, particularly those enriched with antimicrobial agents or biofilm disruptors, offer a promising avenue for combating biofilm-associated pathogens effectively. Their ability to penetrate wound beds and target biofilm structures directly enhances their therapeutic potential, making them increasingly favoured by healthcare providers seeking advanced wound care solutions.

As the understanding of biofilm-related wound management continues to evolve, gels are poised to play a pivotal role in shaping the future of wound care, driving innovation and improving patient outcomes in the process.

- Traumatic and Surgical Wounds Surge Ahead

Traumatic and surgical wounds emerge as the dominant category, driven by their prevalence and diverse origins. These wounds stem from various sources such as accidents, injuries, or surgical interventions, necessitating immediate and appropriate interventions to mitigate risks, prevent complications, and expedite the healing process.

Given their widespread occurrence and the critical need for prompt treatment, traumatic and surgical wounds hold a central position in wound care protocols across healthcare settings, demanding comprehensive and tailored approaches to address their diverse etiologies effectively.

Conversely, diabetic foot ulcers are witnessing the fastest growth within the wound care landscape, propelled by the escalating global incidence of diabetes. Diabetic foot ulcers pose unique challenges due to the underlying factors associated with diabetes, including neuropathy, vascular insufficiency, and impaired immune function, which predispose individuals to chronic wounds.

Moreover, diabetic foot ulcers are particularly susceptible to biofilm formation, complicating the healing process and increasing the risk of infections and chronicity. As a result, there is a burgeoning demand for specialised biofilm treatment strategies tailored explicitly to diabetic foot ulcers, emphasizing the critical need for innovative approaches and targeted interventions to address this burgeoning healthcare challenge effectively.

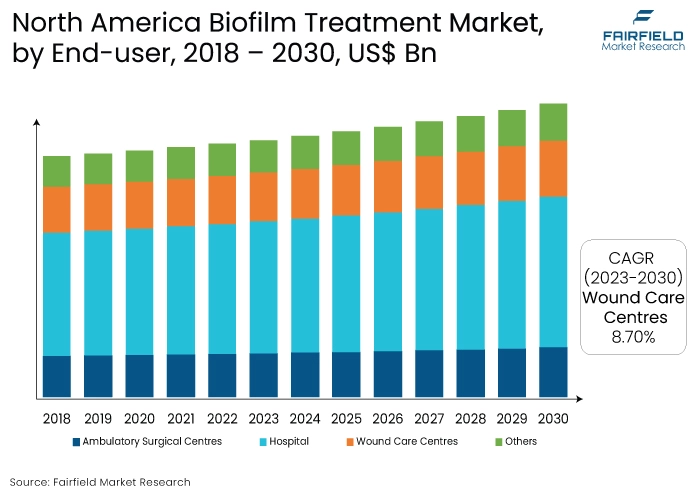

- Hospitals Spearhead Adoption

Hospitals stand out as the dominant end user in the realm of wound care, providing a broad spectrum of healthcare services, including specialised wound care, to a diverse patient population. As primary centres for acute care and wound management, hospitals serve as pivotal hubs for addressing a wide range of wounds, catering to the needs of both inpatients and outpatients.

The comprehensive facilities at hospitals, equipped with advanced medical technologies and skilled healthcare professionals, enable hospitals to deliver timely and effective wound care interventions, thereby playing a central role in promoting patient recovery and well-being.

Meanwhile, wound care centres are experiencing rapid growth and emerging as the fastest-growing category within the wound care landscape. These specialised facilities are dedicated to managing complex wounds and providing tailored treatment plans for challenging cases.

Offering multidisciplinary approaches to wound care, wound care centres integrate advanced treatments, specialised dressings, and expert consultations to address the diverse needs of patients with chronic or difficult-to-heal wounds. As awareness of the benefits of specialised wound care grows and the complexity of wound cases increases, wound care centres are increasingly sought after for their expertise and comprehensive services, positioning them as key players in the evolving landscape of wound management.

Regional Frontrunners

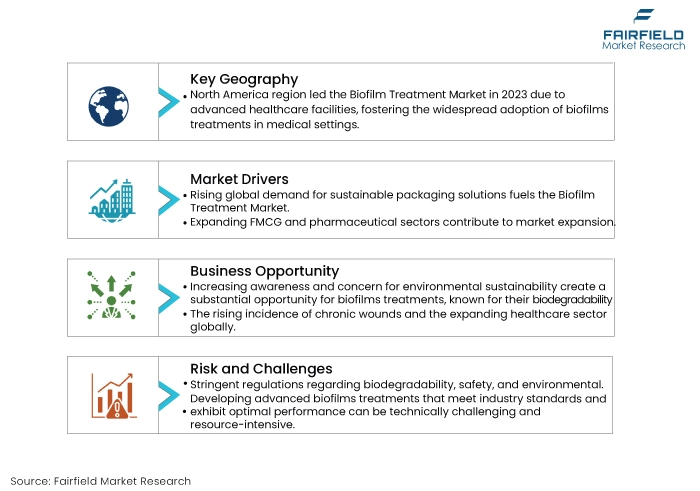

North America Enjoys the First Mover Advantage, Adoption of Advanced Wound Care Solutions Soars

North America stands as the largest regional market in the global biofilm treatment market. The region's dominance is attributed to its advanced healthcare infrastructure, high awareness levels regarding sustainable practices, and a significant prevalence of chronic diseases prompting the need for advanced wound care solutions.

The US plays a pivotal role, boasting robust research and development activities, substantial healthcare expenditure, and a strong presence of key industry players. Collaborations between market leaders and strategic initiatives contribute to North America's significant market share, making it a cornerstone in the global biofilm treatment landscape.

Asia Pacific Gears up for Fastest Growth

The Asia Pacific region emerges as the fastest growing market in the global biofilm treatment market. Factors driving this rapid growth include increasing healthcare investments, a burgeoning population with diverse healthcare needs, and heightened awareness of advanced wound care solutions. Government initiatives promoting sustainable packaging align with the market trends, fostering growth.

Key players are expanding their presence and adapting strategies to cater to the unique demands of the Asia Pacific market. With a dynamic healthcare landscape and rising demand for innovative treatments, the region showcases substantial growth potential, positioning itself as a key player in shaping the trajectory of the global biofilm treatment market.

Fairfield’s Competitive Landscape Analysis

The global biofilm treatment market exhibits a competitive landscape driven by key players such as Novozymes, 3M, and Pfizer. Innovation and sustainability are paramount, with companies focusing on developing advanced, eco-friendly solutions for diverse applications.

The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in Global Biofilm Treatment Space?

- Novozymes A/S

- 3M Company

- Pfizer Inc.

- Merck & Co. Inc.

- Sanofi

- Biofilm Inc.

- ConvaTec Group PLC

- Abbott Laboratories

- BioGaia AB

- Kane Biotech Inc.

- Others

Significant Company Developments

New Product Launch

- In 2021, Zimmer Biomet expanded its portfolio by acquiring A&E Medical, gaining access to a comprehensive range of sternal closure devices, including sutures, cable systems, and rigid fixation, alongside complementary temporary pacing wire and surgical punch products.

- In 2022, Integra LifeSciences successfully concluded its acquisition of Surgical Innovation Associates (SIA), a strategic move enhancing its position as a global leader in implant-based breast reconstruction procedures.

- In 2022, MiMedx Group, Inc. announced the expansion of its Wound & Surgical Product Pipeline. The company secured worldwide exclusive rights to Turn Therapeutics’ PermaFusion antimicrobial technology platform, aiming to develop innovative biologic products for wound and surgical recovery applications.

An Expert’s Eye

Demand and Future Growth

The global biofilm treatment market is witnessing robust demand driven by the escalating need for sustainable packaging solutions and the expanding healthcare sector. With increasing environmental awareness, biofilm treatment, known for its biodegradability, is gaining prominence.

The healthcare industry's continuous evolution and the rising incidence of chronic wounds further contribute to the market's growth. As innovation and eco-friendly practices become imperative, the biofilm treatment market is poised for significant future expansion, driven by heightened consumer consciousness and the industry's commitment to providing effective, environmentally friendly solutions.

Supply Side of the Market

The supply side of the global biofilm treatment market is characterised by a surge in production to meet the escalating demand for sustainable and biodegradable packaging solutions. Key industry players are investing in research and development to innovate biofilm treatment, ensuring diverse and effective product offerings. Strategic collaborations, mergers, and acquisitions enhance production capabilities, fostering market competitiveness.

Supply chain resilience is prioritised to navigate potential disruptions, ensuring a steady flow of raw materials. Overall, the supply side is dynamic, with a focus on innovation, scalability, and adaptability to meet the evolving needs of industries prioritising eco-friendly and advanced packaging solutions.

Global Biofilm Treatment Market is Segmented as Below:

By Product:

- Gauze

- Dressing

- Ointment

- Gel

- Others

By Wound:

- Diabetic Foot Ulcer

- Traumatic and Surgical Wounds

- Pressure Ulcers

- Venous Leg Ulcers

- Burns and Other Open Wounds

By End User:

- Hospital

- Ambulatory Surgical Centres

- Wound Care Centres

- Others

By Geographic Coverage:

- North America

- S.

- Canada

- Europe

- Germany

- K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Biofilm Treatment Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Biofilm Treatment Market Outlook, 2018 - 2030

3.1. Global Biofilm Treatment Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Gauze

3.1.1.2. Dressing

3.1.1.3. Ointment

3.1.1.4. Gel

3.1.1.5. Others

3.2. Global Biofilm Treatment Market Outlook, by Wound, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Diabetic Foot Ulcer

3.2.1.2. Traumatic and Surgical Wounds

3.2.1.3. Pressure Ulcers

3.2.1.4. Venous Leg Ulcers

3.2.1.5. Burns and Other Open Wounds

3.3. Global Biofilm Treatment Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Hospital

3.3.1.2. Ambulatory Surgical Centres

3.3.1.3. Wound Care Centres

3.3.1.4. Others

3.4. Global Biofilm Treatment Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Biofilm Treatment Market Outlook, 2018 - 2030

4.1. North America Biofilm Treatment Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Gauze

4.1.1.2. Dressing

4.1.1.3. Ointment

4.1.1.4. Gel

4.1.1.5. Others

4.2. North America Biofilm Treatment Market Outlook, by Wound, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Diabetic Foot Ulcer

4.2.1.2. Traumatic and Surgical Wounds

4.2.1.3. Pressure Ulcers

4.2.1.4. Venous Leg Ulcers

4.2.1.5. Burns and Other Open Wounds

4.3. North America Biofilm Treatment Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Hospital

4.3.1.2. Ambulatory Surgical Centres

4.3.1.3. Wound Care Centres

4.3.1.4. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Biofilm Treatment Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

4.4.1.4. U.S. Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

4.4.1.7. Canada Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

4.4.1.8. Canada Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Biofilm Treatment Market Outlook, 2018 - 2030

5.1. Europe Biofilm Treatment Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Gauze

5.1.1.2. Dressing

5.1.1.3. Ointment

5.1.1.4. Gel

5.1.1.5. Others

5.2. Europe Biofilm Treatment Market Outlook, by Wound, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Diabetic Foot Ulcer

5.2.1.2. Traumatic and Surgical Wounds

5.2.1.3. Pressure Ulcers

5.2.1.4. Venous Leg Ulcers

5.2.1.5. Burns and Other Open Wounds

5.3. Europe Biofilm Treatment Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Hospital

5.3.1.2. Ambulatory Surgical Centres

5.3.1.3. Wound Care Centres

5.3.1.4. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Biofilm Treatment Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.4. Germany Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

5.4.1.7. U.K. Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.8. U.K. Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

5.4.1.9. France Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

5.4.1.10. France Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

5.4.1.11. France Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.12. France Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

5.4.1.13. Italy Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

5.4.1.14. Italy Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

5.4.1.15. Italy Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.16. Italy Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

5.4.1.17. Turkey Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

5.4.1.18. Turkey Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

5.4.1.19. Turkey Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.20. Turkey Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

5.4.1.21. Russia Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

5.4.1.22. Russia Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

5.4.1.23. Russia Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.24. Russia Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

5.4.1.25. Rest of Europe Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

5.4.1.26. Rest of Europe Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

5.4.1.27. Rest of Europe Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.28. Rest of Europe Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Biofilm Treatment Market Outlook, 2018 - 2030

6.1. Asia Pacific Biofilm Treatment Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Gauze

6.1.1.2. Dressing

6.1.1.3. Ointment

6.1.1.4. Gel

6.1.1.5. Others

6.2. Asia Pacific Biofilm Treatment Market Outlook, by Wound, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Diabetic Foot Ulcer

6.2.1.2. Traumatic and Surgical Wounds

6.2.1.3. Pressure Ulcers

6.2.1.4. Venous Leg Ulcers

6.2.1.5. Burns and Other Open Wounds

6.3. Asia Pacific Biofilm Treatment Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Hospital

6.3.1.2. Ambulatory Surgical Centres

6.3.1.3. Wound Care Centres

6.3.1.4. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Biofilm Treatment Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.4. China Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

6.4.1.7. Japan Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.8. Japan Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

6.4.1.10. South Korea Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

6.4.1.11. South Korea Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.12. South Korea Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

6.4.1.13. India Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

6.4.1.14. India Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

6.4.1.15. India Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.16. India Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

6.4.1.17. Southeast Asia Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

6.4.1.18. Southeast Asia Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

6.4.1.19. Southeast Asia Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.20. Southeast Asia Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

6.4.1.21. Rest of Asia Pacific Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

6.4.1.22. Rest of Asia Pacific Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

6.4.1.23. Rest of Asia Pacific Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.24. Rest of Asia Pacific Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Biofilm Treatment Market Outlook, 2018 - 2030

7.1. Latin America Biofilm Treatment Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Gauze

7.1.1.2. Dressing

7.1.1.3. Ointment

7.1.1.4. Gel

7.1.1.5. Others

7.2. Latin America Biofilm Treatment Market Outlook, by Wound, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Diabetic Foot Ulcer

7.2.1.2. Traumatic and Surgical Wounds

7.2.1.3. Pressure Ulcers

7.2.1.4. Venous Leg Ulcers

7.2.1.5. Burns and Other Open Wounds

7.3. Latin America Biofilm Treatment Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Hospital

7.3.1.2. Ambulatory Surgical Centres

7.3.1.3. Wound Care Centres

7.3.1.4. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Biofilm Treatment Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.4. Brazil Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

7.4.1.7. Mexico Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.8. Mexico Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

7.4.1.9. Argentina Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

7.4.1.10. Argentina Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

7.4.1.11. Argentina Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.12. Argentina Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

7.4.1.13. Rest of Latin America Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

7.4.1.14. Rest of Latin America Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

7.4.1.15. Rest of Latin America Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.16. Rest of Latin America Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Biofilm Treatment Market Outlook, 2018 - 2030

8.1. Middle East & Africa Biofilm Treatment Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Gauze

8.1.1.2. Dressing

8.1.1.3. Ointment

8.1.1.4. Gel

8.1.1.5. Others

8.2. Middle East & Africa Biofilm Treatment Market Outlook, by Wound, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Diabetic Foot Ulcer

8.2.1.2. Traumatic and Surgical Wounds

8.2.1.3. Pressure Ulcers

8.2.1.4. Venous Leg Ulcers

8.2.1.5. Burns and Other Open Wounds

8.3. Middle East & Africa Biofilm Treatment Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Hospital

8.3.1.2. Ambulatory Surgical Centres

8.3.1.3. Wound Care Centres

8.3.1.4. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Biofilm Treatment Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.4. GCC Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

8.4.1.7. South Africa Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.8. South Africa Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

8.4.1.9. Egypt Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

8.4.1.10. Egypt Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

8.4.1.11. Egypt Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.12. Egypt Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

8.4.1.13. Nigeria Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

8.4.1.14. Nigeria Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

8.4.1.15. Nigeria Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.16. Nigeria Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

8.4.1.17. Rest of Middle East & Africa Biofilm Treatment Market by Product, Value (US$ Mn), 2018 - 2030

8.4.1.18. Rest of Middle East & Africa Biofilm Treatment Market Wound, Value (US$ Mn), 2018 - 2030

8.4.1.19. Rest of Middle East & Africa Biofilm Treatment Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.20. Rest of Middle East & Africa Biofilm Treatment Market End Use, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End User vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. BluePrint Wound

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Novozymes A/S

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. 3M Company

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Pfizer Inc.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Merck & Co. Inc.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Sanofi

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Biofilm Inc.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. ConvaTec Group PLC

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Abbott Laboratories

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. BioGaia AB

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Kane Biotech Inc.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Others

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Wound Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |