Global Breast Cancer Screening Tests Market Forecast

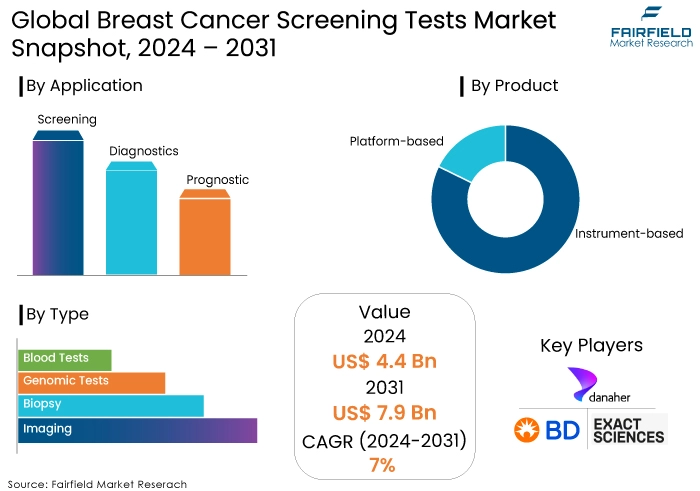

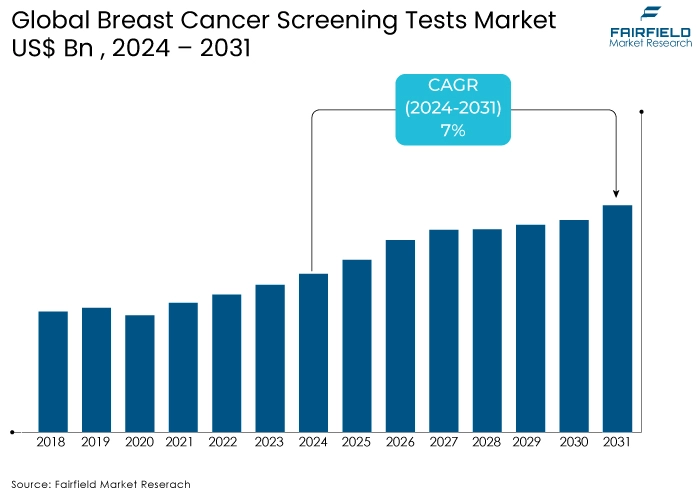

- Breast cancer screening tests market size poised to reach US$7.9 Bn in 2031, up from US$4.4 Bn estimated in 2024

- Global breast cancer screening tests market revenue projected to witness a CAGR of 7% during 2024-2031

Breast Cancer Screening Tests Market Insights

- The market experienced significant growth pre-2023 due to awareness, technological advancements, and early detection focus.

- Post-2024, market expected to accelerate driven by new technologies, personalized screening, and increased healthcare investment.

- Advanced screening technologies like 3D mammography, and AI are key growth drivers.

- Rising awareness and early detection initiatives boost market growth.

- High costs of advanced technologies and limited access in underserved regions are major barriers.

- AI integration in diagnostic imaging is a prominent trend in the breast cancer screening tests market.

- Expansion of screening programs in emerging markets offers significant growth opportunities.

- Imaging segment dominates the market with 52% share.

- Instrument-based products lead the market with 71.8% share.

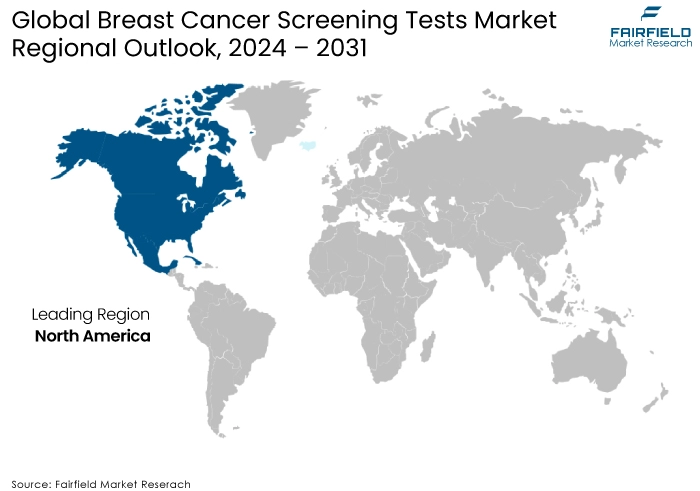

- North America holds the largest market share due to high breast cancer incidence and government initiatives.

A Look Back and a Look Forward - Comparative Analysis

The breast cancer screening tests market has seen substantial growth pre-2023, driven by increasing awareness of breast cancer, advancements in screening technologies, and a growing emphasis on early detection. Innovations in imaging technologies, such as 3D mammography (tomosynthesis) and enhanced ultrasound techniques, have improved the accuracy of screenings, leading to higher detection rates of early-stage cancers. Increased public awareness campaigns and healthcare initiatives have also contributed to more women participating in routine screenings. Additionally, the rise in breast cancer incidence rates, coupled with an aging population, has spurred demand for effective screening solutions.

Post-2024, the market is expected to experience accelerated growth due to several factors. The introduction of new, more advanced screening technologies, such as digital breast tomosynthesis and magnetic resonance imaging (MRI), promises to enhance diagnostic accuracy and patient outcomes. Personalized screening approaches, incorporating genetic risk factors and artificial intelligence (AI) for more precise assessments, are also anticipated to drive market expansion. Moreover, ongoing investments in healthcare infrastructure and increased funding for breast cancer research will further support market growth. The trend towards personalized medicine, precision diagnostics, and a growing focus on early intervention and prevention will likely sustain strong growth in the breast cancer screening tests market.

Key Growth Determinants

Advances in Screening Technology

Advancements in screening technology are a significant driver of growth in the breast cancer screening tests market. Innovations such as digital breast tomosynthesis (3D mammography), which provides more detailed images than traditional 2D mammography, have greatly improved the accuracy of screenings. This technology allows for better detection of small tumours and reduces the likelihood of false positives and false negatives.

Additionally, enhancements in ultrasound and magnetic resonance imaging (MRI) technologies offer more precise diagnostic capabilities, particularly in dense breast tissue where traditional mammograms may be less effective. The integration of artificial intelligence (AI) in analysing mammograms and other imaging modalities is further advancing the field by providing more accurate readings and identifying potential abnormalities with greater efficiency. These technological advancements not only enhance diagnostic accuracy but also improve patient outcomes, driving increased adoption and growth in the market.

Rising Awareness and Early Detection Initiatives

Rising awareness about breast cancer and the importance of early detection significantly drives the growth of the breast cancer screening tests market. Public health campaigns, educational programs, and advocacy efforts have heightened awareness about breast cancer risks and the benefits of regular screenings. This increased awareness encourages more women to undergo routine screenings, leading to earlier detection of cancer and better treatment outcomes.

Government and non-governmental organizations have also launched various initiatives to promote breast cancer screening, including subsidized or free screening programs for underserved populations. Additionally, the growing emphasis on preventive healthcare and early intervention in the medical community supports the widespread adoption of screening tests. As awareness continues to rise and more individuals recognize the importance of early detection, the demand for breast cancer screening tests is expected to increase, further fuelling market growth.

Major Growth Barriers

High Costs of Advanced Screening Technologies

The high cost of advanced screening technologies is a significant restraint for the breast cancer screening tests market. Technologies such as digital breast tomosynthesis (3D mammography) and MRI are more expensive than traditional 2D mammography, posing financial challenges for healthcare providers and patients. These costs can limit access to advanced screening methods, particularly in low-resource settings or among populations with limited insurance coverage.

The high cost of equipment and the need for specialized training to operate and interpret advanced technologies further contribute to the financial burden. Consequently, healthcare systems may be hesitant to adopt or widely implement these technologies, potentially restricting market growth. Addressing this restraint requires efforts to reduce costs through technological advancements, government subsidies, or insurance coverage expansions to make advanced screening technologies more accessible to a broader population.

Limited Access to Screening in Underserved Regions

Limited access to screening in underserved regions is a key restraint for the breast cancer screening tests market. Many areas, particularly in low-income and rural settings, lack adequate healthcare infrastructure and resources to provide regular breast cancer screenings. Barriers such as insufficient medical facilities, a shortage of trained healthcare professionals, and transportation challenges prevent women in these regions from accessing timely and effective screening services. This disparity in access can lead to late-stage diagnoses and poorer outcomes, affecting overall market growth.

To address this issue, efforts are needed to improve healthcare infrastructure, increase the availability of mobile screening units, and develop community outreach programs that bring screening services to underserved populations. Expanding access and raising awareness in these regions can help mitigate this restraint and drive growth in the breast cancer screening tests market.

Breast Cancer Screening Tests Market Trends and Opportunities

AI Integration in Diagnostic Imaging

A prominent trend in the breast cancer screening tests market is the integration of artificial intelligence (AI) in diagnostic imaging. AI technologies, including machine learning algorithms and deep learning models, are increasingly being used to enhance the accuracy and efficiency of breast cancer screening.

AI systems can analyse mammograms, ultrasounds, and MRI scans with high precision, identifying patterns and potential abnormalities that might be missed by human radiologists. These technologies improve diagnostic accuracy by reducing false positives and false negatives, leading to more reliable results and better patient outcomes.

AI also enables the automation of routine tasks, such as image analysis and reporting, which can streamline the workflow for radiologists and increase their productivity. The use of AI in screening processes can also lead to earlier detection of breast cancer, as these systems can identify subtle changes in breast tissue over time.

As AI technology continues to advance, its integration into breast cancer screening is expected to become more prevalent, driving market growth. This trend aligns with the broader movement towards precision medicine and data-driven healthcare, where technology plays a crucial role in enhancing diagnostic and treatment processes.

Expansion of Screening Programs in Emerging Markets

An important opportunity for the breast cancer screening tests market lies in the expansion of screening programs in emerging markets. Rapid economic development, increasing healthcare infrastructure, and a growing awareness of cancer prevention in regions such as Asia Pacific, Latin America, and the Middle East create significant growth potential.

In many of these regions, breast cancer incidence rates are rising, and there is an increasing need for effective screening solutions. Governments and non-governmental organizations are beginning to invest in and support breast cancer screening initiatives, which include subsidized screening programs and mobile mammography units to reach underserved populations.

Additionally, partnerships between local healthcare providers and international organizations can facilitate the introduction of advanced screening technologies and best practices. Expanding screening programs in emerging markets not only addresses the rising demand for breast cancer detection but also provides opportunities for companies to enter new markets and expand their global footprint. By focusing on these regions, companies can drive growth, improve healthcare outcomes, and contribute to the global effort in combating breast cancer.

How is Regulatory Scenario Shaping this Industry?

The regulatory framework significantly influences the breast cancer screening tests market. Bodies like the US FDA, EMA in Europe, and CDSCO in India play pivotal roles in approving new screening technologies and setting quality standards. These regulations ensure patient safety and efficacy. Top research institutes such as the National Cancer Institute (NCI) and the American Cancer Society conduct extensive research to inform regulatory decisions and guidelines. Statistical data from these institutions, coupled with epidemiological studies, help determine screening recommendations and target populations.

For instance, the US Preventive Services Task Force (USPSTF) issues guidelines on screening frequency based on age and risk factors. Adherence to these guidelines by healthcare providers is crucial. However, overregulation can sometimes hinder market entry for innovative technologies. Striking a balance between stringent regulations and fostering innovation is essential for the market's growth. It is imperative to note that the regulatory landscape is dynamic, with updates and changes occurring frequently. Market players must stay informed about these developments to ensure compliance and capitalize on emerging opportunities.

Segments Covered in Breast Cancer Screening Tests Market Report

- Imaging to be the Dominant Segment with 52% Market Share

The imaging segment of the breast cancer screening tests market held the largest market share, accounting for 52.74% of the total revenue. In 2023, the breast cancer diagnostics market had substantial growth because of the extensive utilization of imaging methods such as mammography, ultrasound, and MRI. Modalities such as MBI, CT, 3D breast tomosynthesis, and PET have become the key methods for diagnosing breast cancer. Additionally, these modern technologies have the potential to greatly enhance breast imaging capabilities.

- Instrument-based Tests Preferred Most Widely

The instrument-based products segment held the largest share of the breast cancer screening tests market, accounting for 71.8% of the total revenue. It is additionally divided into biopsy and imaging. The diagnosis of breast cancer mainly depends on commonly used procedures and products. Multiple groups, such as the National Breast Cancer Foundation, are now engaged in projects aimed at increasing awareness of breast cancer, encouraging early identification, and providing information about treatment choices. Imaging is the most favoured approach for screening breast cancer patients at a population level.

Regional Analysis

- North America Maintains the Largest Revenue Contribution

North America had the highest market share in terms of sales, accounting for 45%. The growth can be ascribed to the escalating incidence of breast cancer and the surging government endeavours to augment the rate of screening and diagnosis. According to the American Cancer Society, there were an estimated 49,290 deaths attributable to breast cancer in the US in 2021. Additionally, it is projected that there will be around 281,550 new instances of breast cancer diagnosed. The US currently dominates the breast cancer screening tests market in North America.

The growth can be ascribed to the escalating incidence of breast cancer and the increasing efforts by the government to improve screening and diagnosis rates in the country. The market is likely to increase in the forecast period due to an increasing demand for technologically upgraded products that provide enhanced accuracy, speed, and cost-effectiveness.

Fairfield’s Competitive Landscape Analysis

The breast cancer screening tests market is highly competitive, with key players leading the market through innovation, offering advanced technologies such as digital breast tomosynthesis and AI-enhanced imaging systems. Additionally, strategic partnerships, acquisitions, and collaborations are common, enabling companies to expand their product portfolios and market reach.

Emerging players and start-ups are also entering the market, often specializing in niche technologies or novel approaches to screening. This competitive landscape drives ongoing advancements and improvements, contributing to market growth and enhancing the overall effectiveness of breast cancer screening.

Key Market Players

- Genomic Health (Exact Sciences Corporation)

- BD

- Danaher

- Koninklijke Philips N.V.

- QIAGEN

- Thermo Fisher Scientific Inc.

- Myriad Genetics, Inc.

- Argon Medical Devices, Inc.

- Hoffmann-La Roche Ltd.

- Hologic Inc.

Recent Industry Developments

- In June 2023, Paige AI, Inc. introduced the "Paige Breast Suite," a collection of AI-driven tools designed to assist pathologists in diagnosing breast cancer.

- In May 2023, Thermo Fisher Scientific and Pfizer formed a strategic alliance to improve the worldwide accessibility of next-generation sequencing (NGS) diagnostics for individuals with cancer to increase the availability of advanced genetic diagnostics in certain regions, hence enhancing the ability of worldwide markets to provide precise cancer care.

- In February 2023, the HALO Breast Care Center introduced the HALO PathWay, a comprehensive breast cancer screening method that offers genetic testing and advanced imaging services in a single location.

An Expert’s Eye

- Strong market growth is expected due to rising breast cancer incidence, and aging populations worldwide.

- Advanced imaging and AI technologies drive the diagnostic accuracy, thereby boost market expansion.

- Increasing awareness about the advantage of early detection fuel the demand for screenings.

- Emerging markets indicate a higher number of significant growth opportunities.

- High technology costs, and regulatory hurdles tend to hinder market penetration to a considerable extent.

- Focus on cost-effective solutions will be crucial for wider market adoption.

- Precision medicine, and personalized screening will be the among the key trends to shape market dynamics.

- Public-private partnerships will be instrumental in overcoming existing challenges facing the market.

Global Breast Cancer Screening Tests Market is Segmented as Below -

By Type

- Imaging

- Biopsy

- Genomic Tests

- Blood Tests

By Product

- Platform-based

- Instrument-based

By Application

- Screening

- Diagnostics

- Prognostic

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Breast Cancer Screening Tests Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Breast Cancer Screening Tests Market Outlook, 2018 - 2031

3.1. Global Breast Cancer Screening Tests Market Outlook, by Various Tests, Value (US$ Bn), 2018 - 2031

3.1.1. Key Highlights

3.1.1.1. Physical Exam

3.1.1.2. Laboratory Tests

3.1.1.3. Imaging Tests

3.1.1.3.1. Mammogram or X-Ray

3.1.1.3.2. Breast Magnetic Resonance Imaging (MRI)

3.1.1.4. Genetic Tests

3.2. Global Breast Cancer Screening Tests Market Outlook, by End User, Value (US$ Bn), 2018 - 2031

3.2.1. Key Highlights

3.2.1.1. Research Labs

3.2.1.2. Cancer Institutes

3.2.1.3. Diagnostic Centres

3.2.1.4. Others

3.3. Global Breast Cancer Screening Tests Market Outlook, by Region, Value (US$ Bn), 2018 - 2031

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Breast Cancer Screening Tests Market Outlook, 2018 - 2031

4.1. North America Breast Cancer Screening Tests Market Outlook, by Various Tests, Value (US$ Bn), 2018 - 2031

4.1.1. Key Highlights

4.1.1.1. Physical Exam

4.1.1.2. Laboratory Tests

4.1.1.3. Imaging Tests

4.1.1.3.1. Mammogram or X-Ray

4.1.1.3.2. Breast Magnetic Resonance Imaging (MRI)

4.1.1.4. Genetic Tests

4.2. North America Breast Cancer Screening Tests Market Outlook, by End User, Value (US$ Bn), 2018 - 2031

4.2.1. Key Highlights

4.2.1.1. Research Labs

4.2.1.2. Cancer Institutes

4.2.1.3. Diagnostic Centres

4.2.1.4. Others

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Breast Cancer Screening Tests Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

4.3.1. Key Highlights

4.3.1.1. U.S. Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

4.3.1.2. U.S. Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

4.3.1.3. Canada Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

4.3.1.4. Canada Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Breast Cancer Screening Tests Market Outlook, 2018 - 2031

5.1. Europe Breast Cancer Screening Tests Market Outlook, by Various Tests, Value (US$ Bn), 2018 - 2031

5.1.1. Key Highlights

5.1.1.1. Physical Exam

5.1.1.2. Laboratory Tests

5.1.1.3. Imaging Tests

5.1.1.3.1. Mammogram or X-Ray

5.1.1.3.2. Breast Magnetic Resonance Imaging (MRI)

5.1.1.4. Genetic Tests

5.2. Europe Breast Cancer Screening Tests Market Outlook, by End User, Value (US$ Bn), 2018 - 2031

5.2.1. Key Highlights

5.2.1.1. Research Labs

5.2.1.2. Cancer Institutes

5.2.1.3. Diagnostic Centres

5.2.1.4. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Breast Cancer Screening Tests Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

5.3.1. Key Highlights

5.3.1.1. Germany Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

5.3.1.2. Germany Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

5.3.1.3. U.K. Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

5.3.1.4. U.K. Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

5.3.1.5. France Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

5.3.1.6. France Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

5.3.1.7. Italy Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

5.3.1.8. Italy Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

5.3.1.9. Turkey Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

5.3.1.10. Turkey Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

5.3.1.11. Russia Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

5.3.1.12. Russia Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

5.3.1.13. Rest of Europe Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

5.3.1.14. Rest of Europe Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Breast Cancer Screening Tests Market Outlook, 2018 - 2031

6.1. Asia Pacific Breast Cancer Screening Tests Market Outlook, by Various Tests, Value (US$ Bn), 2018 - 2031

6.1.1. Key Highlights

6.1.1.1. Physical Exam

6.1.1.2. Laboratory Tests

6.1.1.3. Imaging Tests

6.1.1.3.1. Mammogram or X-Ray

6.1.1.3.2. Breast Magnetic Resonance Imaging (MRI)

6.1.1.4. Genetic Tests

6.2. Asia Pacific Breast Cancer Screening Tests Market Outlook, by End User, Value (US$ Bn), 2018 - 2031

6.2.1. Key Highlights

6.2.1.1. Research Labs

6.2.1.2. Cancer Institutes

6.2.1.3. Diagnostic Centres

6.2.2. Others BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Breast Cancer Screening Tests Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

6.3.1. Key Highlights

6.3.1.1. China Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

6.3.1.2. China Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

6.3.1.3. Japan Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

6.3.1.4. Japan Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

6.3.1.5. South Korea Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

6.3.1.6. South Korea Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

6.3.1.7. India Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

6.3.1.8. India Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

6.3.1.9. Southeast Asia Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

6.3.1.10. Southeast Asia Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

6.3.1.11. Rest of Asia Pacific Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

6.3.1.12. Rest of Asia Pacific Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Breast Cancer Screening Tests Market Outlook, 2018 - 2031

7.1. Latin America Breast Cancer Screening Tests Market Outlook, by Various Tests, Value (US$ Bn), 2018 - 2031

7.1.1. Key Highlights

7.1.1.1. Physical Exam

7.1.1.2. Laboratory Tests

7.1.1.3. Imaging Tests

7.1.1.3.1. Mammogram or X-Ray

7.1.1.3.2. Breast Magnetic Resonance Imaging (MRI)

7.1.1.4. Genetic Tests

7.2. Latin America Breast Cancer Screening Tests Market Outlook, by End User, Value (US$ Bn), 2018 - 2031

7.2.1. Key Highlights

7.2.1.1. Research Labs

7.2.1.2. Cancer Institutes

7.2.1.3. Diagnostic Centres

7.2.1.4. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Breast Cancer Screening Tests Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

7.3.1. Key Highlights

7.3.1.1. Brazil Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

7.3.1.2. Brazil Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

7.3.1.3. Mexico Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

7.3.1.4. Mexico Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

7.3.1.5. Argentina Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

7.3.1.6. Argentina Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

7.3.1.7. Rest of Latin America Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

7.3.1.8. Rest of Latin America Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Breast Cancer Screening Tests Market Outlook, 2018 - 2031

8.1. Middle East & Africa Breast Cancer Screening Tests Market Outlook, by Various Tests, Value (US$ Bn), 2018 - 2031

8.1.1. Key Highlights

8.1.1.1. Physical Exam

8.1.1.2. Laboratory Tests

8.1.1.3. Imaging Tests

8.1.1.3.1. Mammogram or X-Ray

8.1.1.3.2. Breast Magnetic Resonance Imaging (MRI)

8.1.1.4. Genetic Tests

8.2. Middle East & Africa Breast Cancer Screening Tests Market Outlook, by End User, Value (US$ Bn), 2018 - 2031

8.2.1. Key Highlights

8.2.1.1. Research Labs

8.2.1.2. Cancer Institutes

8.2.1.3. Diagnostic Centres

8.2.1.4. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Breast Cancer Screening Tests Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

8.3.1. Key Highlights

8.3.1.1. GCC Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

8.3.1.2. GCC Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

8.3.1.3. South Africa Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

8.3.1.4. South Africa Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

8.3.1.5. Egypt Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

8.3.1.6. Egypt Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

8.3.1.7. Nigeria Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

8.3.1.8. Nigeria Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

8.3.1.9. Rest of Middle East & Africa Breast Cancer Screening Tests Market by Various Tests, Value (US$ Bn), 2018 - 2031

8.3.1.10. Rest of Middle East & Africa Breast Cancer Screening Tests Market by End User, Value (US$ Bn), 2018 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by End User Heatmap

9.2. Company Market Share Analysis, 2023

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. GE Healthcare

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Hologic Inc.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Siemens Healthcare GmbH

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Allengers Infotech,

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Carestream Health.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Philips Healthcare

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Shimadzu Corporation

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Toshiba Medical Systems Corporation

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Hitachi Medical Corporation

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Esaote

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Agilent Technologies

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Product Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |