Global Building Integrated Photovoltaics (BIPV) Market Forecast

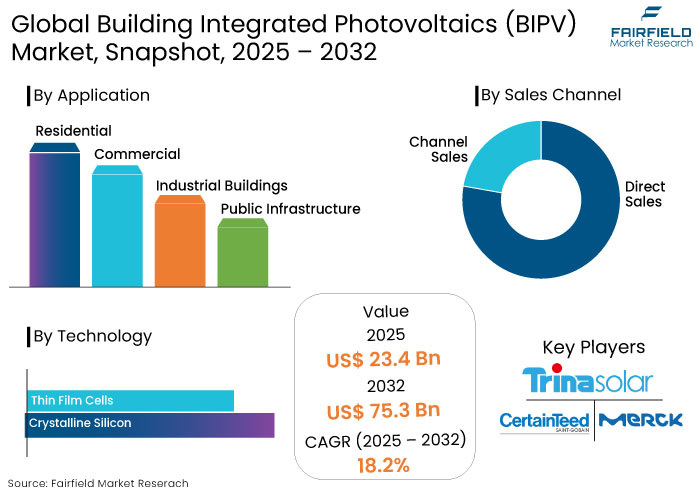

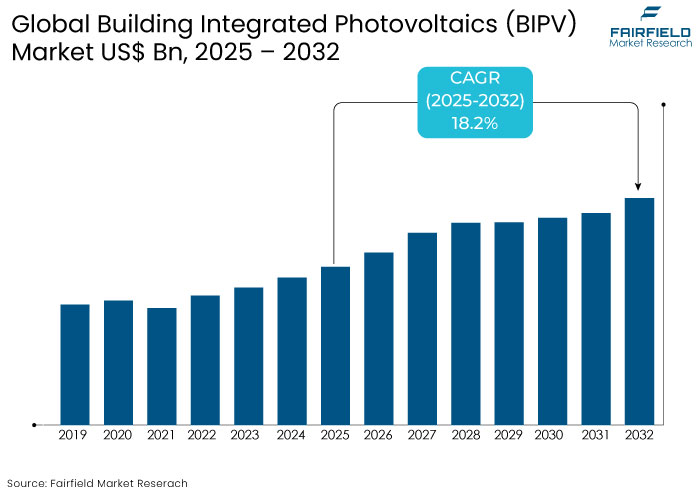

- The building integrated photovoltaics (BIPV) market is projected to reach a size of US$ 75.3 Bn by 2032, showing significant growth from the US$ 23.4 Bn achieved in 2025.

- The market for building integrated photovoltaics (BIPV) is expected to show a significant expansion rate, with an estimated CAGR of 18.2% from 2025 to 2032.

Building Integrated Photovoltaics (BIPV) Market Insights

- Innovations like transparent solar panels and flexible photovoltaics are expanding the application of BIPV in building facades, roofs, and windows.

- Government policies are boosting BIPV adoption through incentives and mandates.

- BIPV is gaining traction as a solution for achieving Net Zero Energy Buildings (NZEBs) and earning green certifications like LEED and BREEAM.

- According to reports, 68% of the global population is expected to live in cities by 2050, driving the need for energy-efficient and integrated solar solutions like BIPV.

- Integrating BIPV with smart energy management systems enhances energy optimization, providing real-time energy consumption and generation insights.

- BIPV systems can decrease a building’s energy consumption by 20% to 50%, significantly lowering energy bills and decreasing carbon footprints.

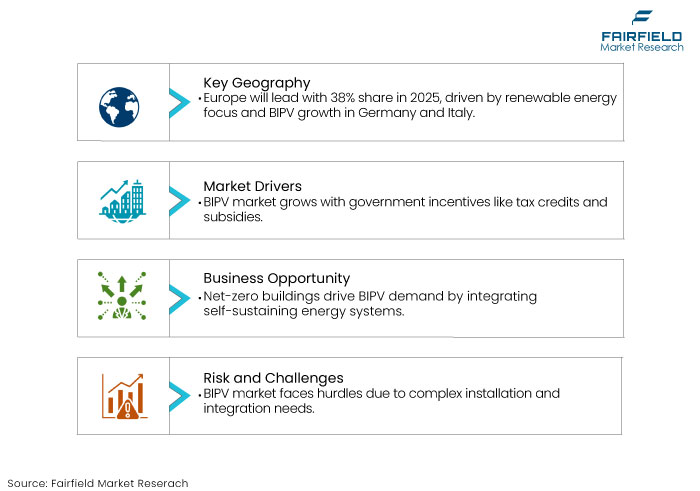

- Europe is anticipated to lead the global market, accumulating 38% of market share in 2025.

- Crystalline silicon is likely to dominate the technology segmentation, with a share of 70% in 2025

A Look Back and a Look Forward - Comparative Analysis

The building integrated photovoltaics market growth during the historical period gained momentum due to the intensified global focus on renewable energy solutions. Governments worldwide introduced subsidies and incentives to promote solar energy adoption, significantly boosting BIPV installations.

Technological advancements, like flexible solar panels and aesthetically pleasing designs, also played a vital role in increasing adoption. However, high initial costs and a lack of awareness regarding the benefits of BIPV limited growth, especially in developing regions.

Over the forecast period, the BIPV market is poised for exponential growth owing to declining solar panel costs. Advancements in materials like perovskite solar cells along with a growing demand for net-zero energy buildings are driving expansion.

Governments are strengthening renewable energy mandates, encouraging large-scale adoption. Rapid urbanization and favourable policies in countries like China and India, is likely to make Asia-Pacific a significant growth hub. The integration of smart energy management systems with BIPV further enhances potential.

Key Growth Determinants

- Beneficial Government Policies and Incentives

The BIPV market is witnessing substantial expansion owing to favourable governmental policies and financial incentives. Incentives like tax credits, grants, and subsidies improve the economic feasibility of renewable energy systems for developers and homeowners.

The Energy Performance of Buildings Directive (EPBD) in Europe advocates for practically zero-energy buildings (NZEBs), in which building-integrated photovoltaics (BIPV) are essential for meeting energy efficiency objectives. The Investment Tax Credit (ITC) in the U.S. has generated interest in solar technology, particularly Building-Integrated Photovoltaic (BIPV) systems.

Nations in the Asia Pacific, including China and India, offer subsidies and establish ambitious solar adoption objectives to promote BIPV integration. Such policies render BIPV a crucial element of sustainable construction initiatives, propelling expansion in developed and emerging regions.

China and India account for 60% of global solar panel installations, with both nations setting aggressive renewable energy targets. China aims to achieve 1,200 GW of solar and wind capacity by 2030, heavily incorporating BIPV solutions in urban and commercial projects.

- Demand for Sustainable Construction Practices

A primary catalyst for the BIPV industry is the increasing demand for sustainable and energy-efficient construction methodologies. Governments, enterprises, and consumers progressively emphasize environmentally sustainable solutions in reaction to climate change and escalating energy expenses.

BIPV systems effectively meet these objectives by generating clean and renewable energy while diminishing a building's carbon footprint. In contrast to conventional solar panels, BIPV is intricately incorporated in a building's architecture, obviating the necessity for distinct mounting frameworks.

The dual functionality renders it an appealing choice for architects and developers aiming to achieve green building certifications such as LEED and BREEAM. Rising urbanization and population increase is likely to propel the global use of building-integrated photovoltaics (BIPV) for sustainable infrastructure.

The LEED program worldwide has certified around 100,000 projects with the demand for green certifications expected to grow by 8% annually. BIPV integration can contribute up to 20% to 30% of the points required for these certifications, emphasizing its appeal to architects and developers.

Key Growth Barriers

- Complicated Installation and Integration

Complex installation and integration of building-integrated photovoltaics (BIPV) may hinder the expansion of the BIPV market. In contrast to conventional solar panels, BIPV systems necessitate meticulous planning and execution to incorporate photovoltaic technology in building components like facades, roofs, and windows.

The complex installation process necessitates skilled staff, resulting in elevated labor costs. It also frequently prolongs the project timeline.

The difficulty of incorporating BIPV systems discourages developers and property owners owing to the elevated perception of associated dangers and uncertainties. The hesitation to embrace BIPV technology is exacerbated by the lack of defined installation protocols and guidelines.

Building Integrated Photovoltaics (BIPV) Market Trends and Opportunities

- Rising Demand for Net-Zero Energy Buildings (NZEBs)

The global push for net-zero energy buildings is a game-changer for the BIPV market. NZEBs aim to generate as much energy as they consume, making BIPV systems an integral part of their design.

Regulatory mandates like Europe’s Energy Performance of Buildings Directive (EPBD) and the rising adoption of green building certifications, such as LEED and BREEAM, drive this trend.

The demand for NZEBs is expected to grow at a CAGR of over 20% through 2032, creating significant opportunities for BIPV manufacturers.

Countries like China and India are aggressively pursuing NZEB goals. China targets 70% of new urban buildings to meet green building standards by 2032, creating significant demand for BIPV solutions.

- Integration with Smart Building Technologies

Integrating BIPV with smart energy management systems represents a transformative opportunity in the market. BIPV is likely to be incorporated with IoT-enabled energy systems as buildings become more connected and automated.

It can optimize energy usage, monitor performance while providing real-time energy generation and consumption insights. The ability to store excess solar energy using battery solutions offers long-term energy independence, decreasing reliance on traditional grids. This trend aligns with the growing adoption of smart cities, further propelling BIPV demand.

According to reports, approximately 68% of the global population are likely to live in urban areas by 2050, while smart city projects are anticipated to see investments of over US$ 2.5 trillion by 2032.

How is Regulatory Scenario Shaping this Industry?

The regulatory landscape is pivotal in shaping the building integrated photovoltaics (BIPV) market, driving its adoption across residential, commercial, and industrial sectors.

Governments worldwide are introducing stringent energy efficiency and sustainability regulations, compelling builders and developers to incorporate renewable energy solutions like BIPV into construction projects.

In Europe, directives such as the EU Energy Performance of Buildings Directive (EPBD) are fostering the integration of BIPV by mandating nearly zero-energy buildings (NZEBs). The U.S. promotes renewable energy adoption through tax incentives like the Investment Tax Credit (ITC), which supports solar installations, including BIPV systems.

Asia-Pacific is also experiencing regulatory growth, with countries like China and India offering subsidies and favourable policies to accelerate solar adoption. Urban planning guidelines in these regions increasingly emphasize renewable energy integration in new constructions.

As regulatory frameworks continue to become stringent, they are anticipated to boost the adoption of BIPV, aligning with global goals to reduce carbon emissions and promote sustainable development.

Segment Covered in the Report

- Crystalline Silicon to Dominate Owing to their Efficiency

Based on technology, the crystalline silicon segment is anticipated to dominate the market with a share of 70% in 2025. Crystalline silicon cells can be integrated into building roofs by utilizing smart mounting systems. These systems substitute roof portions while preserving structural integrity. This form of integration neglects substantial investments while delivering tremendous efficiency.

An alternative method of integration involves substituting roof tiles with crystalline silicon cells. The market observes the application of anti-reflective coatings, which enhance solar energy absorption while delivering greater efficiency. Crystalline silicon exhibits the best energy conversion efficiency, with commercial modules converting 13% to 21% of incoming sunlight into electricity.

- Countries are Promoting the Implementation of BIPV in Residential Application

Numerous countries promote the implementation of BIPV and other renewable energy systems in residential structures through incentives, subsidies, and tax credits. It facilitates integrated photovoltaic construction, making it accessible and attractive for numerous homeowners.

The solar system configuration of a BIPV system is designed to integrate with residential building materials, offering an aesthetically pleasing alternative to traditional solar panels. It caters to the requirements of a homeowner seeking to preserve the aesthetics of their residence while transitioning to renewable energy.

Several people are increasingly concerned about achieving energy independence and security by generating their electricity. A BIPV system mitigates this reliance, safeguarding against power outages and fluctuations in electricity costs.

Regional Analysis

- Supportive Government Policies to Bolster Growth in Europe

Europe is predicted to dominate the market with a share of 38% in 2025. The positive perspective on renewable energy along with consumer awareness in European nations are anticipated to propel expansion through the forecast period. Germany and Italy are progressively prioritizing solar energy, leading to greater usage of BIPV.

The region has implemented regulations, including the Renewable Energy Directive 2009/28/EC, the National Renewable Energy Action Plan (NREAP), the Solar Europe Initiative, and the Energy Performance of Buildings Directive (EPBD).

The above-mentioned regulations, along with advanced products, aim to enticing consumers towards building integrated photovoltaics. The market in Germany has become a leading adopter of BIPV due to favorable government laws, including the German Renewable Energy Sources Act. This act has implemented a feed-in tariff mechanism that promotes solar electricity generation.

Government of France is progressively advocating for the adoption of solar panels by providing diverse incentives and tax credit opportunities. Individuals investing in solar energy facilities qualify for an income tax credit. A lower VAT rate applies to people who have installed photovoltaic systems on buildings.

- Growing Use of Solar Energy Systems in North America to Propel Demand

The BIPV market in North American is estimated to experience increasing use of visually appealing solar energy systems. High disposable incomes of consumers in the region, coupled with advancements in production methods of BIPV solar panels, are projected to drive demand.

The region has a growing preference for integrated installations in residential and commercial structures, thereby enhancing product demand. Rising innovation in the sector is projected to improve the operational efficiency of the product, fostering expansion.

Fairfield’s Competitive Landscape Analysis

The building integrated photovoltaics (BIPV) market is intensely competitive, with prominent companies emphasizing on driving innovation. Businesses are also engaging in strategic alliances to secure a competitive advantage.

Key organizations like Tesla, First Solar, AGC Solar, and Onyx Solar are predicted to lead the market by providing sophisticated BIPV solutions for commercial and residential uses. Start-ups and smaller enterprises present economical and visually appealing solutions to engage niche target segments.

The market observes a growing collaboration between BIPV producers and construction firms to easily incorporate solar solutions in architectural designs. Regional players, particularly in Europe and the Asia-Pacific, are utilizing governmental incentives and regulations to enhance their presence. Technological innovations, economic efficiencies, and sustainable designs are fuelling competitiveness in the sector.

Key Market Companies

- Merck KGaA

- Trina Solar

- CertainTeed, LLC. (Compagnie de Saint-Gobain SA)

- Tesla

- JA Solar

- Canadian Solar

- Changzhou Almaden Co. Ltd

- Waaree Energies Ltd.

- Hanergy Thin Film Power Group

- Kyocera Corp.

- Heliatek GmbH

- Onyx Solar Group LLC.

- MetSolar

- The Solaria Corporation

- Suntegra

Recent Industry Developments

- In March 2024, Fraunhofer ISE announced the creation of a standardized BIPV facade system to simplify the integration of photovoltaics into facades.

- In January 2024, Arctech announced its development in Turkey through a strategic relationship with Alpon Energy for Building-Integrated Photovoltaic (BIPV) solutions.

An Expert’s Eye

- Advancements in solar technology and increasing demand for sustainable construction solutions are likely to drive robust growth.

- BIPV's integration with smart energy management systems is anticipated to enhance its appeal, enabling real-time energy monitoring and optimization.

- Regulatory frameworks, such as Europe's Energy Performance of Buildings Directive (EPBD) and financial incentives like tax credits, are estimated to continue accelerating the adoption of BIPV technologies.

- As construction companies look for cost-effective, energy-efficient solutions, BIPV is predicted to offer a unique value proposition by delivering energy savings and aesthetic appeal in one package.

Global Building Integrated Photovoltaics (BIPV) Market is Segmented as-

By Technology

- Crystalline Silicon

- Thin Film Cells

By Application

- Residential

- Commercial

- Industrial Buildings

- Public Infrastructure

By Sales Channel

- Direct Sales

- Channel Sales

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Building Integrated Photovoltaics (BIPV) Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Building Integrated Photovoltaics (BIPV) Market Outlook, 2019 - 2032

3.1. Global Building Integrated Photovoltaics (BIPV) Market Outlook, by Technology, Value (US$ Bn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Crystalline Silicon

3.1.1.2. Thin Film Cells

3.2. Global Building Integrated Photovoltaics (BIPV) Market Outlook, By Application, Value (US$ Bn), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Residential

3.2.1.2. Commercial

3.2.1.3. Industrial Buildings

3.2.1.4. Public Infrastructure

3.3. Global Building Integrated Photovoltaics (BIPV) Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Direct Sales

3.3.1.2. Channel Sales

3.4. Global Building Integrated Photovoltaics (BIPV) Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Building Integrated Photovoltaics (BIPV) Market Outlook, 2019 - 2032

4.1. North America Building Integrated Photovoltaics (BIPV) Market Outlook, by Technology, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Crystalline Silicon

4.1.1.2. Thin Film Cells

4.2. North America Building Integrated Photovoltaics (BIPV) Market Outlook, By Application, Value (US$ Bn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Residential

4.2.1.2. Commercial

4.2.1.3. Industrial Buildings

4.2.1.4. Public Infrastructure

4.3. North America Building Integrated Photovoltaics (BIPV) Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Direct Sales

4.3.1.2. Channel Sales

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Building Integrated Photovoltaics (BIPV) Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. U.S. Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

4.4.1.2. U.S. Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

4.4.1.3. U.S. Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

4.4.1.4. Canada Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

4.4.1.5. Canada Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

4.4.1.6. Canada Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Building Integrated Photovoltaics (BIPV) Market Outlook, 2019 - 2032

5.1. Europe Building Integrated Photovoltaics (BIPV) Market Outlook, by Technology, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Crystalline Silicon

5.1.1.2. Thin Film Cells

5.2. Europe Building Integrated Photovoltaics (BIPV) Market Outlook, By Application, Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Residential

5.2.1.2. Commercial

5.2.1.3. Industrial Buildings

5.2.1.4. Public Infrastructure

5.3. Europe Building Integrated Photovoltaics (BIPV) Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Direct Sales

5.3.1.2. Channel Sales

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Building Integrated Photovoltaics (BIPV) Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Germany Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

5.4.1.2. Germany Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

5.4.1.3. Germany Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

5.4.1.4. U.K. Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

5.4.1.5. U.K. Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

5.4.1.6. U.K. Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

5.4.1.7. France Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

5.4.1.8. France Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

5.4.1.9. France Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

5.4.1.10. Italy Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

5.4.1.11. Italy Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

5.4.1.12. Italy Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

5.4.1.13. Turkey Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

5.4.1.14. Turkey Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

5.4.1.15. Turkey Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

5.4.1.16. Russia Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

5.4.1.17. Russia Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

5.4.1.18. Russia Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

5.4.1.19. Rest of Europe Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

5.4.1.20. Rest of Europe Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

5.4.1.21. Rest of Europe Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Building Integrated Photovoltaics (BIPV) Market Outlook, 2019 - 2032

6.1. Asia Pacific Building Integrated Photovoltaics (BIPV) Market Outlook, by Technology, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Crystalline Silicon

6.1.1.2. Thin Film Cells

6.2. Asia Pacific Building Integrated Photovoltaics (BIPV) Market Outlook, By Application, Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Residential

6.2.1.2. Commercial

6.2.1.3. Industrial Buildings

6.2.1.4. Public Infrastructure

6.3. Asia Pacific Building Integrated Photovoltaics (BIPV) Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Direct Sales

6.3.1.2. Channel Sales

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Building Integrated Photovoltaics (BIPV) Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. China Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

6.4.1.2. China Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

6.4.1.3. China Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

6.4.1.4. Japan Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

6.4.1.5. Japan Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

6.4.1.6. Japan Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

6.4.1.7. South Korea Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

6.4.1.8. South Korea Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

6.4.1.9. South Korea Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

6.4.1.10. India Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

6.4.1.11. India Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

6.4.1.12. India Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

6.4.1.13. Southeast Asia Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

6.4.1.14. Southeast Asia Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

6.4.1.15. Southeast Asia Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

6.4.1.16. Rest of Asia Pacific Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

6.4.1.17. Rest of Asia Pacific Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

6.4.1.18. Rest of Asia Pacific Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Building Integrated Photovoltaics (BIPV) Market Outlook, 2019 - 2032

7.1. Latin America Building Integrated Photovoltaics (BIPV) Market Outlook, by Technology, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Crystalline Silicon

7.1.1.2. Thin Film Cells

7.2. Latin America Building Integrated Photovoltaics (BIPV) Market Outlook, By Application, Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Residential

7.2.1.2. Commercial

7.2.1.3. Industrial Buildings

7.2.1.4. Public Infrastructure

7.3. Latin America Building Integrated Photovoltaics (BIPV) Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Direct Sales

7.3.1.2. Channel Sales

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Building Integrated Photovoltaics (BIPV) Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Brazil Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

7.4.1.2. Brazil Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

7.4.1.3. Brazil Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

7.4.1.4. Mexico Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

7.4.1.5. Mexico Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

7.4.1.6. Mexico Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

7.4.1.7. Argentina Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

7.4.1.8. Argentina Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

7.4.1.9. Argentina Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

7.4.1.10. Rest of Latin America Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

7.4.1.11. Rest of Latin America Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

7.4.1.12. Rest of Latin America Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Building Integrated Photovoltaics (BIPV) Market Outlook, 2019 - 2032

8.1. Middle East & Africa Building Integrated Photovoltaics (BIPV) Market Outlook, by Technology, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Crystalline Silicon

8.1.1.2. Thin Film Cells

8.2. Middle East & Africa Building Integrated Photovoltaics (BIPV) Market Outlook, By Application, Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Residential

8.2.1.2. Commercial

8.2.1.3. Industrial Buildings

8.2.1.4. Public Infrastructure

8.3. Middle East & Africa Building Integrated Photovoltaics (BIPV) Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Direct Sales

8.3.1.2. Channel Sales

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Building Integrated Photovoltaics (BIPV) Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. GCC Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

8.4.1.2. GCC Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

8.4.1.3. GCC Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

8.4.1.4. South Africa Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

8.4.1.5. South Africa Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

8.4.1.6. South Africa Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

8.4.1.7. Egypt Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

8.4.1.8. Egypt Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

8.4.1.9. Egypt Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

8.4.1.10. Nigeria Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

8.4.1.11. Nigeria Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

8.4.1.12. Nigeria Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

8.4.1.13. Rest of Middle East & Africa Building Integrated Photovoltaics (BIPV) Market by Technology, Value (US$ Bn), 2019 - 2032

8.4.1.14. Rest of Middle East & Africa Building Integrated Photovoltaics (BIPV) Market By Application, Value (US$ Bn), 2019 - 2032

8.4.1.15. Rest of Middle East & Africa Building Integrated Photovoltaics (BIPV) Market by Sales Channel, Value (US$ Bn), 2019 - 2032

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Market Share Analysis, 2025

9.2. Competitive Dashboard

9.3. Company Profiles

9.3.1. Merck KGaA

9.3.1.1. Company Overview

9.3.1.2. Product Portfolio

9.3.1.3. Financial Overview

9.3.1.4. Business Strategies and Development

9.3.2. Trina Solar

9.3.2.1. Company Overview

9.3.2.2. Product Portfolio

9.3.2.3. Financial Overview

9.3.2.4. Business Strategies and Development

9.3.3. CertainTeed, LLC. (Compagnie de Saint-Gobain SA)

9.3.3.1. Company Overview

9.3.3.2. Product Portfolio

9.3.3.3. Financial Overview

9.3.3.4. Business Strategies and Development

9.3.4. Tesla

9.3.4.1. Company Overview

9.3.4.2. Product Portfolio

9.3.4.3. Financial Overview

9.3.4.4. Business Strategies and Development

9.3.5. JA Solar

9.3.5.1. Company Overview

9.3.5.2. Product Portfolio

9.3.5.3. Financial Overview

9.3.5.4. Business Strategies and Development

9.3.6. Canadian Solar

9.3.6.1. Company Overview

9.3.6.2. Product Portfolio

9.3.6.3. Financial Overview

9.3.6.4. Business Strategies and Development

9.3.7. Changzhou Almaden Co. Ltd

9.3.7.1. Company Overview

9.3.7.2. Product Portfolio

9.3.7.3. Financial Overview

9.3.7.4. Business Strategies and Development

9.3.8. Waaree Energies Ltd.

9.3.8.1. Company Overview

9.3.8.2. Product Portfolio

9.3.8.3. Financial Overview

9.3.8.4. Business Strategies and Development

9.3.9. Hanergy Thin Film Power Group

9.3.9.1. Company Overview

9.3.9.2. Product Portfolio

9.3.9.3. Financial Overview

9.3.9.4. Business Strategies and Development

9.3.10. Kyocera Corp.

9.3.10.1. Company Overview

9.3.10.2. Product Portfolio

9.3.10.3. Financial Overview

9.3.10.4. Business Strategies and Development

9.3.11. Heliatek GmbH

9.3.11.1. Company Overview

9.3.11.2. Product Portfolio

9.3.11.3. Financial Overview

9.3.11.4. Business Strategies and Development

9.3.12. Onyx Solar Group LLC.

9.3.12.1. Company Overview

9.3.12.2. Product Portfolio

9.3.12.3. Financial Overview

9.3.12.4. Business Strategies and Development

9.3.13. MetSolar

9.3.13.1. Company Overview

9.3.13.2. Product Portfolio

9.3.13.3. Financial Overview

9.3.13.4. Business Strategies and Development

9.3.14. The Solaria Corporation

9.3.14.1. Company Overview

9.3.14.2. Product Portfolio

9.3.14.3. Financial Overview

9.3.14.4. Business Strategies and Development

9.3.15. Suntegra

9.3.15.1. Company Overview

9.3.15.2. Product Portfolio

9.3.15.3. Financial Overview

9.3.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Technology Coverage |

|

|

Application Coverage |

|

|

Sales Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |