Global Casting Resin Market Forecast

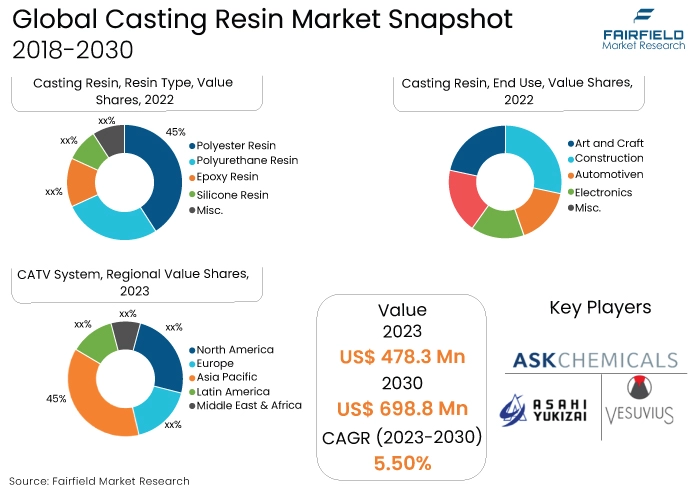

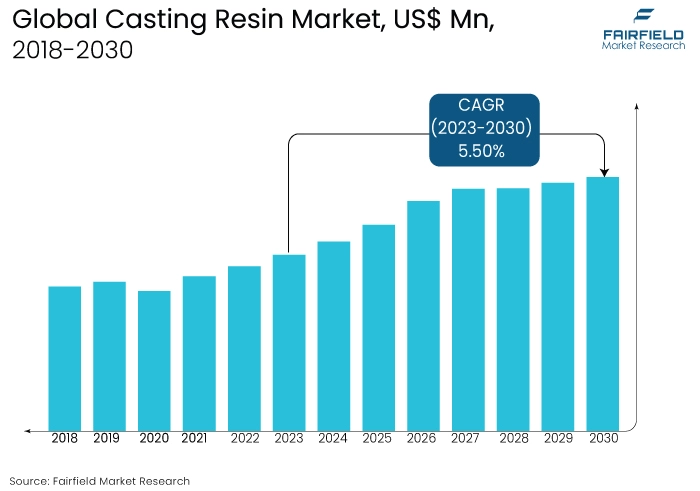

- Casting resin market size to take a leap from US$478.3 Mn in 2022 to US$695.8 Mn by 2030

- Global market for casting resins poised to witness a CAGR of 5.5% between 2023 and 2030

Quick Report Digest

- The key trend anticipated to fuel the casting resin market growth is an increase in the demand in various sectors. The demand for casting resins is rising in the construction, electronics, and automotive industries due to their versatility. They enable lightweight parts and intricate designs in cars, and they offer structural enhancement, protection, and insulation in electronics and construction, demonstrating their adaptability and increasing industry awareness.

- The increased interest in do-it-yourself projects, especially in arts and crafts, is driving up demand for casting resins for smaller projects like jewelry and décor. The demand for intricate and customisable resin art is fuelling the market's expansion, reflecting a shift in consumer preferences toward hands-on, creative activities.

- Casting resins are becoming more and more used in buildings and architecture to create long-lasting and aesthetically pleasing pieces like furniture and flooring. The growing need for durable and aesthetically pleasing building materials is the primary driver of the market's substantial growth potential.

- Casting resins are essential to additive manufacturing as 3D printing advances because of their versatility in producing complex objects. The industry is in step with the growing need for advanced and versatile 3D printing solutions.

- In 2022, the polyester resin market segment held a dominant position. Polyester casting resin is the most widely used type. When an ester is used in this casting, MEK peroxide acts as the catalyst.

- Due to the growing need for strong and aesthetically pleasing materials, the construction industry led the casting resin market in 2022. Casting resins are widely used in flooring, furniture, and architectural applications, meeting the industry's demand for both practicality and style.

- The building, arts, and industrialisation sectors are driving the explosion of the casting resin market in Asia Pacific. Expansion is fuelled by eco-friendly trends, economic growth, and innovation, and R&D expenditures boost competitiveness in the face of expanding manufacturing.

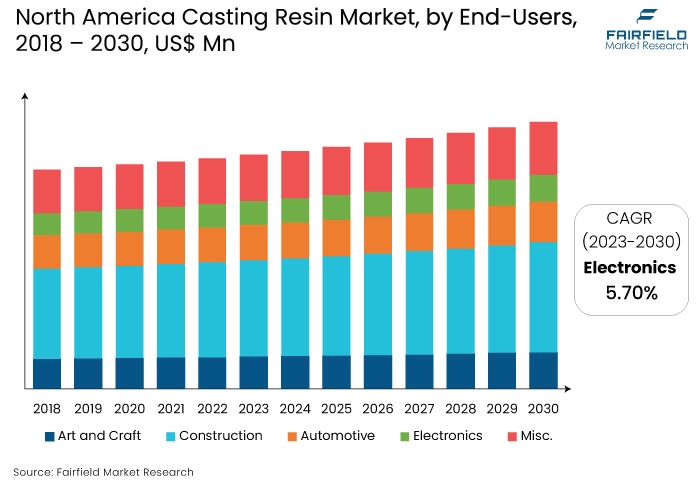

- For several reasons, casting resin sales are anticipated to increase dramatically in North America during the projected period. The region's thriving construction and automotive industries fuel demand for these resins in applications like decorative elements and prototyping.

A Look Back and a Look Forward - Comparative Analysis

The market for casting resin is expanding rapidly due to rising demand from several industries, including the construction, electronics, and automotive sectors. Sustainable materials are becoming more and more popular, such as bio-based and environmentally friendly resins. Product performance is being improved and application areas are being expanded by technological advancements in resin formulations and manufacturing processes.

Since epoxy resins are so versatile, the market for casting resins has changed over time. Concerns about the environment led to a shift towards more environmentally friendly formulations. During the COVID-19 pandemic, the industry adjusted, and demand began to rebound. Polyurethane and polyester resin diversification demonstrated continuous evolution and adaptability to shifting consumer preferences.

With a predicted focus on innovations like 3D printing resins and sophisticated composite materials, the casting resin market is expected to have a bright future. The market environment may be further shaped by the growing adoption of sustainable alternatives due to growing environmental concerns. The market for casting resin is expected to grow steadily in the future due to changes in consumer preferences and technological advancements.

Key Growth Determinants

- Rise in Demand from Several Industries

The demand for casting resins is rising in various industries, such as electronics, construction, and the automotive sector, because of their many uses. In the car industry, resins are used to create complex designs and lightweight parts. These are used in electronics as encapsulating materials that offer insulation and protection for small components.

Architectural components can be made more creative and structurally improved with the use of casting resins in construction. A major reason for the rise in demand for these resins is their adaptability to different industries, which is a result of growing awareness of their performance and adaptability in a variety of settings.

- Growing Number of DIY Projects

The growing popularity of do-it-yourself (DIY) projects, especially in the arts and crafts, is a major factor driving up demand for casting resins for smaller-scale projects. Casting resins is becoming more and more popular among enthusiasts and hobbyists who want to make elaborate and customised jewelry, decorations, and resin art.

Casting resins' versatility and ease of use encourage people to explore their creativity, which is fuelling the growth of the market for smaller-scale applications. By leveraging a wide range of artistic and creative endeavors, this trend not only reflects a shift in consumer preferences towards hands-on activities but also helps to expand the casting resin market overall.

- Technological Advancements

The industry is undergoing a revolution thanks to ongoing advancements in casting resin formulations and manufacturing techniques. These developments are not only meeting the specific needs of various industries but they are also enhancing the overall performance of casting resins.

By optimising resin compositions, one can achieve optimal performance in a variety of applications, including construction, electronics, and automotive. This is achieved through increased flexibility, durability, and superior adhesive properties.

This dynamic evolution provides cutting-edge solutions that drive efficiency and effectiveness across a wide range of industrial and commercial processes, not only addressing the specific needs of various sectors but also driving overall market growth.

Major Growth Barriers

- Regulatory Compliance

Strict rules and compliance requirements, especially those about health and safety, can present difficulties for casting resin producers, which requires adherence to particular protocols and possibly restricting specific formulations.

- Fluctuating Raw Material Prices

The cost of raw materials, such as polymers and additives, has an impact on the market for casting resin. Price fluctuations for raw materials can affect manufacturing costs, profit margins, and casting resin manufacturers' overall competitiveness.

Key Trends and Opportunities to Look at

- Increasing Need for Infrastructure and Construction

To create durable and aesthetically pleasing elements such as flooring, furniture, and decorative items, casting resins are being used more and more in architecture and construction.

The market for casting resin has tremendous growth potential due to the rising demand for aesthetically beautiful building materials. It is well-positioned to satisfy the growing demand for construction materials that are both durable and aesthetically pleasing.

- Expanding Demand Scope within the Craft and Art Sector

Intricate patterns, sculptures, and decorative objects can be made with casting resins, which are becoming increasingly popular in arts and crafts. The DIY movement and growing customer demand for customised crafts drive the market segment's significant expansion. Casting resins' adaptability satisfies the need for originality and personalisation in artistic pursuits.

- The Rise of 3D Printing Trend

As 3D printing technology develops, casting resins become more and more essential to additive manufacturing procedures. By using resins' versatility to create complex and detailed objects, the casting resin market can benefit from the growing 3D printing industry and meet consumer demand for sophisticated, adaptable additive manufacturing solutions.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, sustainable packaging standards have mostly focused on plastic case packing. Eighty-three percent of the legal measures linked to sustainable packaging worldwide, with 147 measures found, focus on plastics. The European Union, and Asia have the most plastic rules, with France and India ranking first and second, respectively. Although it has changed over the years in response to some lessons learned, the system in the United States for regulating food contact materials and food packaging is pretty well established.

All compounds that are intended to become parts of food must acquire premarket approval from the Food and Drug Administration (FDA), unless they are covered by a particular exemption, according to the Federal Food, Drug, and Cosmetic Act (the Act), which was amended to include food additives in 1958. Furthermore, the Federal Food, Drug, and Cosmetic Act was amended in 1998 to allow food contact notifications (FCNs) to be submitted instead of food additive petitions for compounds that come into contact with food. The FDA supported this amendment.

Fairfield’s Ranking Board

Top Segments

- Polyester Resin Category Retains Dominance

In 2022, the polyester resin segment dominated the casting resin industry. Its dominance is attributed to a combination of factors such as versatility, cost-effectiveness, and ease of use. Polyester resin finds extensive applications across various industries, including construction, automotive, and marine, driving its widespread adoption and market dominance.

The polyurethane resin category is anticipated to grow substantially throughout the projected period. Its increasing popularity is fuelled by attributes like durability, flexibility, and resistance to abrasion and chemicals. Polyurethane resin's versatility and performance make it a preferred choice in diverse applications, contributing to its projected significant growth in the casting resin market.

- Construction Sector Leads Demand Generation

In 2022, the construction segment dominated the casting resin industry. This dominance is driven by the widespread use of casting resin in construction applications, including decorative elements, countertops, and architectural features. The demand is fuelled by its versatility, durability, and the ability to create intricate designs, establishing construction as the leading end-use segment.

The electronics category is anticipated to grow substantially throughout the projected period. The increasing use of casting resin for electronic encapsulation and insulation applications, driven by its excellent electrical properties, thermal stability, and protection against environmental factors, positions electronics as the fastest-growing category in the casting resin market.

Regional Frontrunners

Asia Pacific at the Forefront of Revenue Contribution

The Asia Pacific casting resin market is expanding rapidly due to rising demand from a variety of industries. The market is growing due to rapid industrialisation, rising construction activity, and a thriving arts and crafts sector. The market dynamics are further propelled by the region's economic development, increasing emphasis on product innovation, and technological advancements in resin formulations.

Strategic investments in R&D by major players are promoting market competitiveness. Furthermore, the developing manufacturing sector in the Asia Pacific and the growing inclination towards environmentally friendly and sustainable resin solutions are reshaping the industry and indicating continued growth shortly.

North America Gains Largely from the Flourishing 3D Printing Trend

The sale of casting resin is expected to rise significantly in North America over the forecast period for several reasons. The demand for these resins in applications like decorative elements, and prototyping is driven by the region's robust construction and automotive industries. Additionally, the expanding market is aided by the growing trend of 3D printing, in which casting resins are essential.

Furthermore, strict environmental laws encourage the use of environmentally friendly resins, supporting the region's sustainability objectives. North America is positioned to be a major market for casting resin growth in the years to come due to its diverse industrial landscape, technological advancements, and environmental concerns.

Fairfield’s Competitive Landscape Analysis

The casting resin industry is characterised by a competitive environment where major players pursue strategic alliances, product development, and innovation. Organisations concentrate on broadening their range of products to cater to various application requirements, utilising cutting-edge technologies to secure a competitive advantage. Continuous improvements and a push for sustainable solutions shape market dynamics.

Who are the Leaders in the Global Casting Resin Space?

- ASK Chemicals

- Suzhou Xingye

- HA-International

- Jinan Shengquan

- Vesuvius

- ASAHI YUKIZAI

- REFCOTEC

- United Erie

- Innovative Resins Pvt. Ltd.

- Huntsman Corporation

- Dow Chemical Company

- BASF SE

- Ashland Global Holding Inc.

- Hexion Inc.

- Solvay SA

Significant Industry Developments

New Product Launch

- October 2023: ASK Chemicals, a supplier of high-performance resins and a world leader in chemical solutions for the casting industry, introduces its new line of industrial resins under the RELIANCE brand. ASK Chemicals is entering new markets with a new range of phenolic resin products, building on its experience in phenolic resins from its work in the foundry and industrial resin industries.

Distribution Agreement

- May 2023: The world's largest manufacturer of epoxy resins and hardeners, Kukdo Chemical Co., Ltd., with production facilities in China and South Korea, and Faber&VanderEnde GmbH have announced a new distribution agreement.

- September 2023: Faber & VanderEnde BV and Helios Resins have inked a distribution deal for the Benelux region. The company Helios, situated in Slovenia, manufactures coating and composite resins.

An Expert’s Eye

Demand and Future Growth

The market for casting resin is expected to experience consistent demand from a variety of industries, including manufacturing, art, and construction. The prospects for growth in the future are bright, thanks to developments in technology and new products.

Notwithstanding, the market could be impacted by obstacles like fluctuating raw material prices and environmental concerns. The industry is generally ready for growth, with an emphasis on resolving issues and seizing new chances for long-term success.

Supply Side of the Market

According to our analysis, The casting resin market's supply side exhibits a dynamic landscape shaped by various strategic initiatives. Technological advancements play a pivotal role as manufacturers invest significantly in research and development to enhance production processes, improve material properties, and introduce innovative formulations tailored to diverse applications.

Efficient raw material procurement is prioritised, with companies strategically securing reliable and sustainable sources, fostering a stable supply chain. Environmental sustainability is a key focus, leading to the development of bio-based and renewable casting resins in response to the growing demand for eco-friendly products.

Logistics and distribution networks are optimised to ensure a responsive supply chain. This involves investments in advanced logistics and strategic partnerships with distribution channels to streamline transportation and reduce lead times.

Customisation and innovation are central themes, with manufacturers developing specialised casting resins for specific applications such as construction, arts and crafts, and electronics. This commitment to customisation allows for a diverse product portfolio that caters to the evolving needs of various industries.

Global Casting Resin Market is Segmented as Below:

By Resin Type:

- Polyester Resin

- Polyurethane Resin

- Epoxy Resin

- Silicone Resin

By End-User Sector:

- Art and Craft

- Construction

- Automotive

- Electronics

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Casting Resin Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Casting Resin Market Outlook, 2018 - 2030

3.1. Global Casting Resin Market Outlook, by Resin Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Polyester Resin

3.1.1.2. Polyurethane Resin

3.1.1.3. Epoxy Resin

3.1.1.4. Silicone Resin

3.1.1.5. Misc.

3.2. Global Casting Resin Market Outlook, by End-Users, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Art and Craft

3.2.1.2. Construction

3.2.1.3. Automotive

3.2.1.4. Electronics

3.2.1.5. Misc.

3.3. Global Casting Resin Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Casting Resin Market Outlook, 2018 - 2030

4.1. North America Casting Resin Market Outlook, by Resin Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Polyester Resin

4.1.1.2. Polyurethane Resin

4.1.1.3. Epoxy Resin

4.1.1.4. Silicone Resin

4.1.1.5. Misc.

4.2. North America Casting Resin Market Outlook, by End-Users, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Art and Craft

4.2.1.2. Construction

4.2.1.3. Automotive

4.2.1.4. Electronics

4.2.1.5. Misc.

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Casting Resin Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

4.3.1.2. U.S. Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

4.3.1.3. Canada Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

4.3.1.4. Canada Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Casting Resin Market Outlook, 2018 - 2030

5.1. Europe Casting Resin Market Outlook, by Resin Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Polyester Resin

5.1.1.2. Polyurethane Resin

5.1.1.3. Epoxy Resin

5.1.1.4. Silicone Resin

5.1.1.5. Misc.

5.2. Europe Casting Resin Market Outlook, by End-Users, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Art and Craft

5.2.1.2. Construction

5.2.1.3. Automotive

5.2.1.4. Electronics

5.2.1.5. Misc.

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Casting Resin Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

5.3.1.2. Germany Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

5.3.1.3. U.K. Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

5.3.1.4. U.K. Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

5.3.1.5. France Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

5.3.1.6. France Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

5.3.1.7. Italy Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

5.3.1.8. Italy Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

5.3.1.9. Turkey Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

5.3.1.10. Turkey Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

5.3.1.11. Russia Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

5.3.1.12. Russia Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

5.3.1.13. Rest of Europe Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

5.3.1.14. Rest of Europe Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Casting Resin Market Outlook, 2018 - 2030

6.1. Asia Pacific Casting Resin Market Outlook, by Resin Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Polyester Resin

6.1.1.2. Polyurethane Resin

6.1.1.3. Epoxy Resin

6.1.1.4. Silicone Resin

6.1.1.5. Misc.

6.2. Asia Pacific Casting Resin Market Outlook, by End-Users, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Art and Craft

6.2.1.2. Construction

6.2.1.3. Automotive

6.2.1.4. Electronics

6.2.1.5. Misc.

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Casting Resin Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

6.3.1.2. China Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

6.3.1.3. Japan Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

6.3.1.4. Japan Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

6.3.1.5. South Korea Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

6.3.1.6. South Korea Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

6.3.1.7. India Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

6.3.1.8. India Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

6.3.1.9. Southeast Asia Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

6.3.1.10. Southeast Asia Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Casting Resin Market Outlook, 2018 - 2030

7.1. Latin America Casting Resin Market Outlook, by Resin Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Polyester Resin

7.1.1.2. Polyurethane Resin

7.1.1.3. Epoxy Resin

7.1.1.4. Silicone Resin

7.1.1.5. Misc.

7.2. Latin America Casting Resin Market Outlook, by End-Users, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Art and Craft

7.2.1.2. Construction

7.2.1.3. Automotive

7.2.1.4. Electronics

7.2.1.5. Misc.

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Casting Resin Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

7.3.1.2. Brazil Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

7.3.1.3. Mexico Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

7.3.1.4. Mexico Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

7.3.1.5. Argentina Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

7.3.1.6. Argentina Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

7.3.1.7. Rest of Latin America Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

7.3.1.8. Rest of Latin America Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Casting Resin Market Outlook, 2018 - 2030

8.1. Middle East & Africa Casting Resin Market Outlook, by Resin Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Polyester Resin

8.1.1.2. Polyurethane Resin

8.1.1.3. Epoxy Resin

8.1.1.4. Silicone Resin

8.1.1.5. Misc.

8.2. Middle East & Africa Casting Resin Market Outlook, by End-Users, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Art and Craft

8.2.1.2. Construction

8.2.1.3. Automotive

8.2.1.4. Electronics

8.2.1.5. Misc.

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Casting Resin Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

8.3.1.2. GCC Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

8.3.1.3. South Africa Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

8.3.1.4. South Africa Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

8.3.1.5. Egypt Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

8.3.1.6. Egypt Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

8.3.1.7. Nigeria Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

8.3.1.8. Nigeria Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Casting Resin Market by Resin Type, Value (US$ Mn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Casting Resin Market End-Users, Value (US$ Mn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Capacity vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. ASK Chemicals

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Suzhou Xingye

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. HA-International

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Delkor Systems Inc.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Delkor Systems, Inc.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Vesuvius

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. ASAHI YUKIZAI

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. REFCOTEC

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. United Erie

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Innovative Resins Pvt. Ltd.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Huntsman Corporation

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Dow Chemical Company

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. BASF SE

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Ashland Global holding Inc.

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Hexion Inc.

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

9.5.16. Solvay SA

9.5.16.1. Company Overview

9.5.16.2. Product Portfolio

9.5.16.3. Financial Overview

9.5.16.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Resin Type Coverage |

|

|

End-Use Sector Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |