Global CATV System Market Forecast

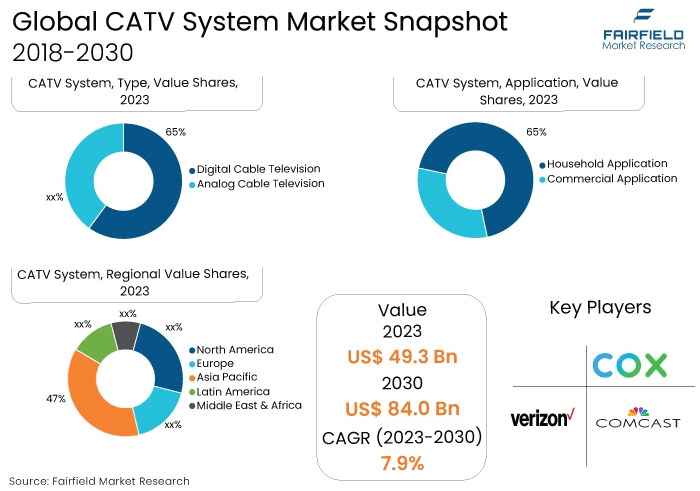

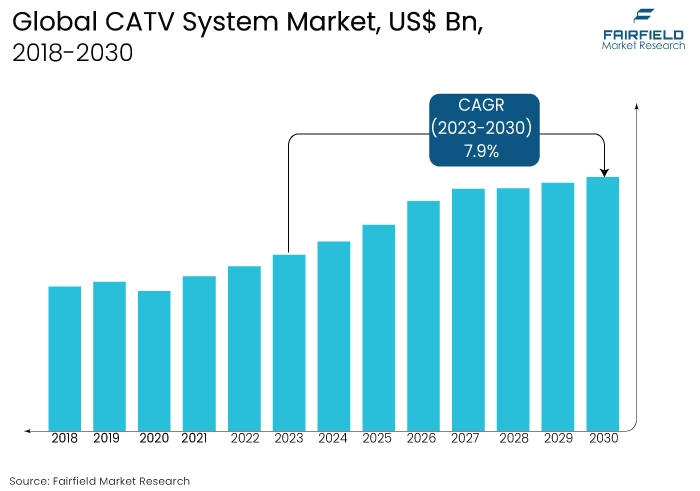

- The approximately US$49.3 Bn market for CATV systems (2023) to hit US$84.0 Bn (2030)

- Global CATV system market size to see expansion at a CAGR of 7.9% over 2023-2030

Quick Report Digest

- The CATV system market is growing due to increasing demand for high-quality content, the proliferation of broadband internet, technological advancements, and the integration of interactive and on-demand services. As consumers seek enhanced entertainment options, CATV systems play a crucial role in delivering diverse, high-speed content, contributing to the market's expansion.

- The escalating demand for high-quality content drives the CATV system market. Consumers' preference for superior video experiences, including high-definition and ultra-high-definition content, fuels the growth of CATV systems. To meet these expectations, operators invest in advanced technologies, enhancing the delivery of premium video content and contributing to the market's expansion.

- Growing broadband internet growth is a key driver for the CATV system market. The expansion of high-speed internet services enhances the delivery of data-intensive content through CATV systems. As broadband adoption rises, the demand for cable television services grows, creating synergies between broadband and CATV offerings and contributing to the overall market growth.

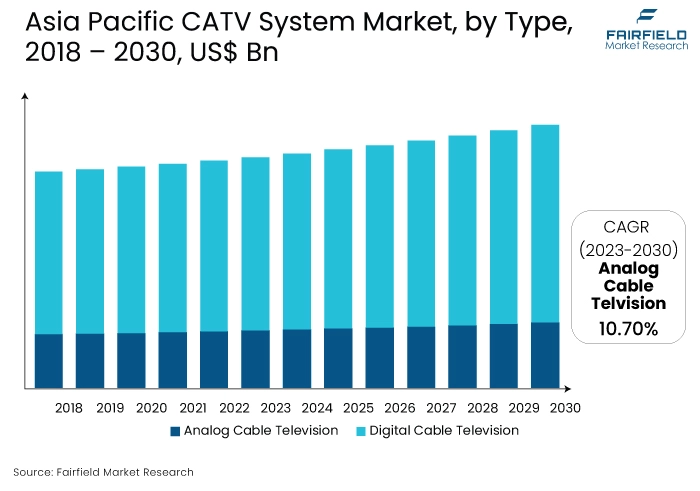

- Digital cable television captured the largest market share in the CATV system market due to superior picture and sound quality, increased channel capacity, and the ability to offer interactive features. Digital technology provides an enhanced viewing experience, meeting consumer expectations and driving widespread adoption of digital cable services.

- Household applications have captured the largest market share in the CATV system market because of the widespread adoption of cable television services in residential settings. The consistent demand for diverse programming and bundled services and the central role of cable TV in households contribute to its dominance in the market.

- High infrastructure costs pose a challenge to the CATV system market, demanding substantial investments in maintaining, upgrading, and expanding cable networks. The financial burden of continuous investment in advanced technologies and infrastructure can impact profit margins, requiring careful management and strategic decision-making by CATV operators to navigate this challenge successfully.

- Asia Pacific captured the largest market share in the CATV system market due to its vast population, increased urbanisation, and growing middle class. The region's demand for television and broadband services, coupled with government initiatives and technological advancements, contributes to its dominance in the CATV system market.

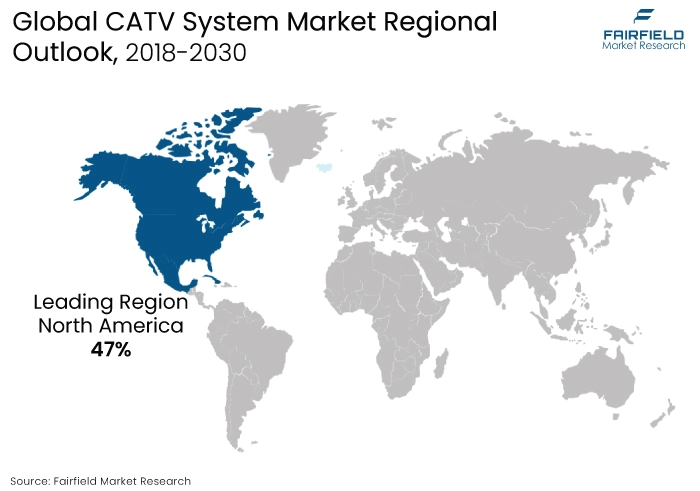

- North America is growing in the CATV system market due to factors such as technological advancements, a competitive market landscape, and increasing demand for high-quality content. The region's adoption of advanced cable television technologies and bundled services contributes to the sustained growth of the CATV system market in North America.

A Look Back and a Look Forward - Comparative Analysis

The CATV system market is experiencing growth due to increasing demand for high-quality video content, rising adoption of advanced technologies like fiber to the home (FTTH), and high-definition (H.D.) channels, and a growing number of internet users. Additionally, the expansion of broadband services, coupled with advancements in network infrastructure and the introduction of new interactive and on-demand services, contributes to the market's expansion as consumers seek enhanced and diverse entertainment options.

The market witnessed staggered growth during the historical period 2018 – 2022. This is due to the substantial growth of the major types, such as commercial applications, and household applications. However, in some types, the demand for CATV systems has increased, including analog able television, and digital cable television.

The future of the CATV system market is expected to be shaped by technological advancements, including the widespread deployment of 5G networks, increased demand for ultra-high-definition content, and the integration of interactive and on-demand services. Fibre-optic infrastructure and next-gen cable technologies will play a crucial role, offering higher bandwidth and faster connectivity. The market will likely evolve to provide more personalised and immersive content experiences, fostering continued growth and innovation in the industry.

Key Growth Determinants

- Increasing Demand for High-Quality Content

The increasing demand for high-quality content is a pivotal driver for the global CATV system market. Modern consumers have elevated expectations for superior video experiences, emphasizing high-definition and ultra-high-definition content. CATV systems play a crucial role in meeting this demand by providing reliable and efficient transmission of premium programming.

As consumers continue to prioritise enhanced viewing experiences, cable operators invest in advanced infrastructure and technologies to deliver superior video quality. This dynamic fuels the growth of the CATV market, fostering innovation in both content delivery and consumer viewing options. This trend also incentivises industry players to explore new technologies and services, ensuring the continued relevance and expansion of the CATV system market.

- Exploding Growth of Broadband Internet

Growing broadband internet growth is a key driver for the expansion of the market for CATV systems. As broadband adoption expands globally, CATV systems become integral for delivering high-speed data and supporting the increasing demand for seamless video streaming. Cable operators leverage their infrastructure to provide bundled services that include high-speed internet along with TV offerings.

The convergence of broadband and CATV services enhances connectivity and supports a broader range of content delivery options, including on-demand and interactive services. This synergy positions CATV systems as essential components of modern entertainment and information consumption, fostering market growth by catering to the evolving needs of consumers in an increasingly connected and digitalised world.

- Increasing Sports Broadcasting, and Live Events

The increasing popularity of sports broadcasting and live events serves as a significant driver for the CATV system market. Sports enthusiasts often prefer real-time viewing experiences, driving demand for cable services that offer comprehensive coverage of live events. CATV systems, with their capabilities for delivering high-quality, real-time content, become crucial for sports broadcasting.

Cable operators leverage this demand to attract subscribers seeking reliable access to live sports content, contributing to market growth. The ability of CATV systems to provide immersive sports experiences positions them as integral components in meeting the entertainment preferences of a broad consumer base.

Major Growth Barriers

- High Infrastructure Costs

High infrastructure costs pose a significant challenge to the CATV system market. The maintenance, expansion, and technological upgrades of cable networks demand substantial financial investments. CATV operators must continually invest in advanced equipment, fibre-optic networks, and system enhancements to meet evolving consumer expectations and competitive standards.

Balancing the need for capital expenditures with maintaining competitive pricing becomes a delicate challenge, impacting profit margins and long-term sustainability. Striking the right balance between infrastructure investment, and cost-effectiveness is crucial for CATV operators to navigate this challenge successfully in an environment where technological advancements and consumer demands continually evolve.

- Complex Regulatory Framework

Complex regulations present a challenge to the CATV system market. The telecommunications and broadcasting sectors are subject to evolving and intricate regulatory frameworks. Compliance with these regulations adds operational complexities and costs for CATV operators. Adapting to changing compliance requirements and licensing obligations and addressing legal considerations can be time-consuming and resource-intensive.

The dynamic nature of regulatory environments introduces uncertainties, impacting strategic planning. Navigating this complex landscape requires continuous monitoring, legal expertise, and proactive engagement to ensure that CATV operators comply with regulations while maintaining flexibility to adapt to industry shifts and innovations.

Key Trends and Opportunities to Look at

- DOCSIS 3.1 and 4.0

The data Over Cable Service Interface Specification (DOCSIS) standards, particularly DOCSIS 3.1 and the emerging DOCSIS 4.0 enable higher data speeds over existing cable infrastructure, enhancing the broadband capabilities of CATV systems.

- Fiber to the Home (FTTH)

The integration of fibre-optic technology into CATV networks, known as Fiber to the Home, improves bandwidth, reduces signal degradation, and supports the delivery of high-speed internet and high-quality video content.

- Interactive TV and Personalisation

CATV systems are incorporating interactive features and personalised content recommendations to enhance the user experience, providing viewers with more control over their content consumption.

How Does the Regulatory Scenario Shape this Industry?

Regulatory frameworks in the CATV system market globally, with specific entities and acts governing operations. In the United States, the Federal Communications Commission (FCC) regulates CATV services under the Communications Act. The Cable Television Consumer Protection and Competition Act (1992) and the Telecommunications Act (1996) also impact the industry, addressing issues like rate regulation and competition.

In Europe, regulations vary by country, with the Audiovisual Media Services Directive guiding CATV services. Region-specific changes often focus on consumer protection, competition, and technology standards, influencing market dynamics. Adapting to these regulatory environments requires compliance with local laws, addressing challenges such as licensing requirements, content restrictions, and evolving industry standards to ensure seamless operation within each region.

Fairfield’s Ranking Board

Top Segments

- The Analog Cable Television Category Retains Dominance by Type

Digital cable television has captured the largest market share in the CATV system market due to several key advantages. Digital technology enables superior picture and sound quality, supports interactive features, and allows for the efficient transmission of a greater number of channels. It offers enhanced services like video-on-demand, and interactive programming, meeting evolving consumer expectations.

The shift to digital also facilitates the integration of broadband services, enabling high-speed internet access over the same infrastructure. These factors, along with the global transition toward digital broadcasting standards, have propelled digital cable television to dominate the market, providing a more advanced and versatile viewing experience for consumers.

Analog cable television is developing lucrative potential due to analog being significantly cheaper than digital infrastructure, making it attractive in budget-conscious areas. Established analog networks in remote or rural regions might still need to justify the upgrade cost to digital. Analog might see pockets of growth for low-bandwidth applications like basic local channels in specific communities. In some regions, specific regulations or slow regulatory transitions might temporarily prop up analog.

- Household Sector Provides the Largest Application Area

Household applications have traditionally captured the largest market share in the CATV system market due to widespread consumer adoption of cable television services. As television remains a primary source of entertainment for households globally, cable TV services play a central role in delivering a variety of channels and content.

The demand for diverse programming, high-definition channels, and bundled services for households has contributed to the dominance of household applications. The continuous expansion of residential infrastructure and the increasing number of households seeking television services further solidify the household application's prominent market position.

Commercial application on the other hand is expected to rise high on account of factors like the increased demand for cable television services in commercial settings, such as businesses, hotels, and institutions, driven by the desire for diverse content offerings and improved in-house communication.

Regional Frontrunners

North America’s Top Ranking Position Prevails

North America has been the largest market for CATV system sales in the global market. This dominance clearly attributes to the region’s robust technological infrastructure, and the exceptionally high demand for advanced entertainment solutions. Strong presence of several globally leading companies like like Comcast, Charter Communications, and Cox Communications is another growth driving factor contributing to North America’s leadership in the market for CATV systems.

With the advent of streaming services, and exploding popularity of OTT platforms, the demand for CATV systems continues to be on the rise in the North American region – offering integrated solutions, including broadband Internet, and VoIP services. The enhanced user experience, and deepening market penetration will thus push the region’s dominance in global industry. Moreover, favourable regulatory frameworks, and supportive government initiatives targeting broadband connectivity expansion contribute to sustained market growth across North America.

Asia Pacific Holds Massive Opportunity

Asia Pacific is identified to be the highly attractive regional market for CATV systems and the key growth driving factors for growth in the region include the ongoing advancements in cable television technologies, and high demand for high-quality content. Rocketing adoption of bundled services also bolster market growth in the region.

In addition to the vast population across the Asian subcontinent, the ascending pace of urbanisation, and a growing middle class with rising disposable income. These demographic trends drive demand for television and broadband services. Additionally, government initiatives, technological advancements, and investments in digital infrastructure contribute to the growth of CATV systems in the region. Additionally, factors like increasing Internet penetration, and a competitive market landscape contribute substantially toward the expansion pace of the CATV system market across Asia Pacific.

Faifield’s Competitive Landscape Analysis

The competitive landscape of the CATV system market is characterised by major players such as Comcast Corporation, Charter Communications, and AT&T Inc. These companies dominate the market with extensive infrastructure and service offerings.

Emerging competition comes from innovative providers leveraging advanced technologies. The industry is dynamic, with continuous advancements in digital cable, broadband, and interactive services. Strategic partnerships, mergers, and acquisitions contribute to the evolving competitive dynamics in the CATV system market.

Who are the Leaders in the Global CATV System Space?

- Comcast Corporation

- Cox Communications

- Verizon Communications

- Altice USA Inc.

- Dish Network Corporation

- AT&T

- Midco

- Mediacom Communications Corporation

- Cable One Inc.

- RCN Corporation

- Suddenlink Communications

- Frontier Communications

- Consolidated Communications

- Rogers Communication

- WideOpen West

Significant Industry Developments

New Product Launch

- February 2022: ZTE Corporation, a leading global provider of telecommunications, enterprise, and consumer technology solutions for the mobile Internet, revealed plans to introduce an innovative 5G media gateway set-top box (STB) called ZXV10 B960GV1, featuring Android TV This announcement was made ahead of the Mobile World Congress (MWC) 2022 in Barcelona, Spain. The new-generation STB is poised to offer advanced capabilities and marks ZTE's commitment to staying at the forefront of technology in the rapidly evolving telecommunications and media industries.

- January 2022: Samsung Electronics Co., Ltd unveiled its newest MICRO LED, Neo QLED, and Lifestyle TVs in anticipation of CES 2022. These 2022 screens showcase progress in picture and sound quality, expanded screen size choices, customisable accessories, and an enhanced interface. The innovations align with the vision of 'Screens Everywhere, Screens for All,' promising realistic images, immersive sound, and highly personalised experiences. This development underscores Samsung's commitment to delivering cutting-edge technology and enhanced entertainment solutions in the ever-evolving landscape of visual and auditory experiences.

An Expert’s Eye

Demand and Future Growth

The CATV system market continues to experience robust demand driven by the increasing appetite for high-quality content, growing broadband internet penetration, and technological advancements. The future growth is anticipated as CATV systems evolve to meet consumer expectations for interactive and on-demand services.

Integration with advanced technologies like 5G, and fiber optics, coupled with expanding markets in emerging economies, further contributes to the positive outlook. The market's trajectory is characterised by a continual focus on enhancing user experiences, expanding service offerings, and adapting to the evolving landscape of media consumption.

Supply Side of the Market

The demand-supply dynamics in the CATV system market are influenced by a growing consumer demand for high-quality content and broadband services. The current pricing structure reflects competitive forces, technological advancements, and bundled service offerings. Pricing will likely impact long-term growth as operators balance affordability with investments in advanced infrastructure.

Major trends driving competition include the integration of interactive and on-demand services, technological innovation, and strategic partnerships. The supply chain analysis involves a complex network of hardware manufacturers, content providers, and service operators, with efficient supply chains supporting timely advancements.

Continuous adaptation to consumer preferences, regulatory developments, and advancements in cable and internet technologies will play key roles in shaping the market's future trajectory.

Global CATV System Market is Segmented as Below:

By Type:

- Analog Cable Television

- Digital Cable Television

By Application:

- Commercial Application

- Household Application

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global CATV System Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global CATV System Market Outlook, 2018 - 2030

3.1. Global CATV System Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Analog Cable Television

3.1.1.2. Digital Cable Television

3.2. Global CATV System Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Commercial Application

3.2.1.2. Household Application

3.3. Global CATV System Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America CATV System Market Outlook, 2018 - 2030

4.1. North America CATV System Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Analog Cable Television

4.1.1.2. Digital Cable Television

4.2. North America CATV System Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Commercial Application

4.2.1.2. Household Application

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America CATV System Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. CATV System Market by Type, Value (US$ Mn), 2018 - 2030

4.3.1.2. U.S. CATV System Market Application, Value (US$ Mn), 2018 - 2030

4.3.1.3. Canada CATV System Market by Type, Value (US$ Mn), 2018 - 2030

4.3.1.4. Canada CATV System Market Application, Value (US$ Mn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe CATV System Market Outlook, 2018 - 2030

5.1. Europe CATV System Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Analog Cable Television

5.1.1.2. Digital Cable Television

5.2. Europe CATV System Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Commercial Application

5.2.1.2. Household Application

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe CATV System Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany CATV System Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.2. Germany CATV System Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.3. U.K. CATV System Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.4. U.K. CATV System Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.5. France CATV System Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.6. France CATV System Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.7. Italy CATV System Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.8. Italy CATV System Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.9. Turkey CATV System Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.10. Turkey CATV System Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.11. Russia CATV System Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.12. Russia CATV System Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.13. Rest of Europe CATV System Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.14. Rest of Europe CATV System Market Application, Value (US$ Mn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific CATV System Market Outlook, 2018 - 2030

6.1. Asia Pacific CATV System Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Analog Cable Television

6.1.1.2. Digital Cable Television

6.2. Asia Pacific CATV System Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Commercial Application

6.2.1.2. Household Application

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific CATV System Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China CATV System Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.2. China CATV System Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.3. Japan CATV System Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.4. Japan CATV System Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.5. South Korea CATV System Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.6. South Korea CATV System Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.7. India CATV System Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.8. India CATV System Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.9. Southeast Asia CATV System Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.10. Southeast Asia CATV System Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific CATV System Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific CATV System Market Application, Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America CATV System Market Outlook, 2018 - 2030

7.1. Latin America CATV System Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Analog Cable Television

7.1.1.2. Digital Cable Television

7.2. Latin America CATV System Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Commercial Application

7.2.1.2. Household Application

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America CATV System Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil CATV System Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.2. Brazil CATV System Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.3. Mexico CATV System Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.4. Mexico CATV System Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.5. Argentina CATV System Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.6. Argentina CATV System Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.7. Rest of Latin America CATV System Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.8. Rest of Latin America CATV System Market Application, Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa CATV System Market Outlook, 2018 - 2030

8.1. Middle East & Africa CATV System Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Analog Cable Television

8.1.1.2. Digital Cable Television

8.2. Middle East & Africa CATV System Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Commercial Application

8.2.1.2. Household Application

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa CATV System Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC CATV System Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.2. GCC CATV System Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.3. South Africa CATV System Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.4. South Africa CATV System Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.5. Egypt CATV System Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.6. Egypt CATV System Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.7. Nigeria CATV System Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.8. Nigeria CATV System Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa CATV System Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa CATV System Market Application, Value (US$ Mn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Type vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Comcast Corporation

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Cox Communications

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Verizon Communications

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Altice USA Inc.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Dish Network Corporation

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. AT&T

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Midco

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Mediacom Communications Corporation

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Cable One Inc.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. RCN Corporation

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Suddenlink Communications

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Frontier Communications

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Consolidated Communications

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Rogers Communications

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. WideOpenWest (WOW!)

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |