Global Ceramic Fiber Market Forecast

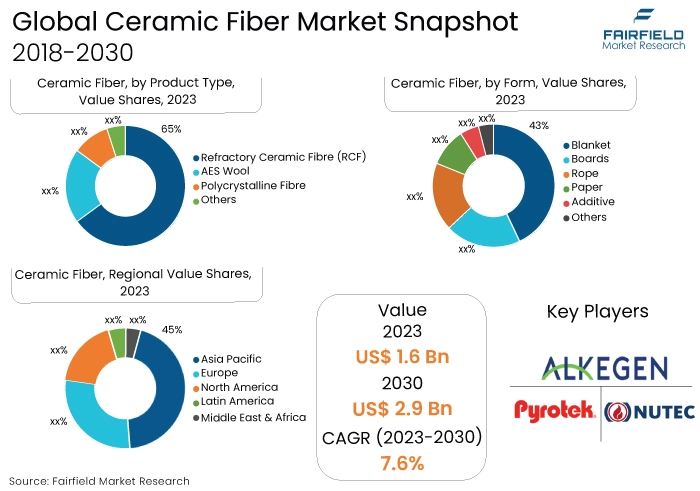

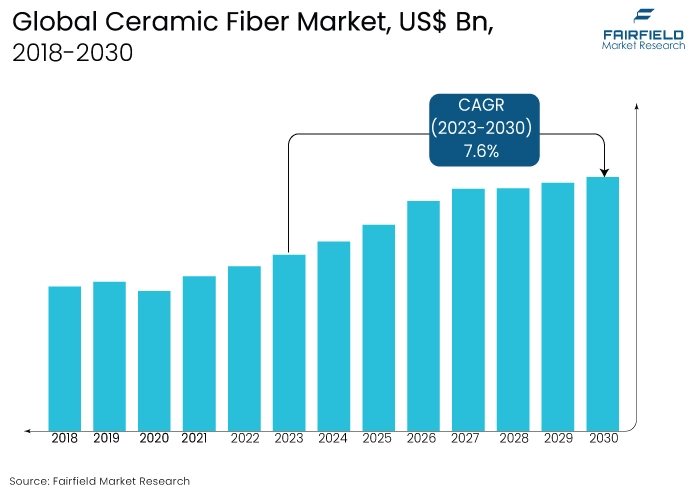

- Global ceramic fiber market size poised to reach US$2.9 Bn in 2030 from US$1.6 Bn registered in 2023

- Market for ceramic fibers eyes a robust CAGR of 7.6% during 2023 - 2030

Quick Report Digest

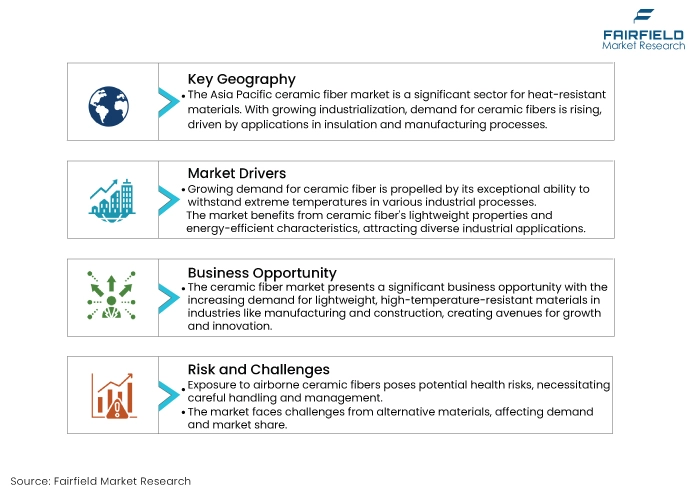

- The ceramic fiber market is witnessing robust growth driven by increasing demand across various industries. Key applications include aerospace, petrochemicals, and manufacturing, fostering market expansion.

- Continuous R&D efforts have led to innovations in ceramic fiber materials, enhancing their thermal insulation and mechanical properties. These advancements contribute to the material's versatility and broad application spectrum.

- Growing industrialisation in emerging economies amplifies the global demand for ceramic fiber, with Asia-Pacific emerging as a major market player due to its flourishing manufacturing sector.

- The ceramic fiber's role in promoting energy efficiency and reducing carbon footprints is a pivotal driver, aligning with global sustainability goals.

- Despite the market's positive trajectory, challenges such as volatile raw material prices and regulatory constraints pose potential obstacles to sustained growth.

- Intense competition prevails among key market players, prompting innovations and strategic collaborations to gain a competitive edge.

- Integration of advanced technologies, such as nanotechnology and smart materials, is influencing the ceramic fiber market's evolution, creating new growth opportunities.

- Stringent environmental and safety standards are influencing product development and market strategies, emphasizing the importance of eco-friendly and safe ceramic fiber solutions.

- The ceramic fiber market is poised for further expansion, driven by evolving industrial needs, technological breakthroughs, and a persistent focus on sustainable practices. Anticipated market trends include increased customisation and a surge in demand from the construction sector.

A Look Back and a Look Forward - Comparative Analysis

The current state of the ceramic fiber market reflects a dynamic landscape marked by sustained growth and technological advancements. In recent years, the market has experienced a surge in demand driven by its versatile applications across various industries. The aerospace, petrochemical, and manufacturing sectors are key contributors to the market's expansion.

Manufacturers continue to invest in research and development, leading to material innovations that enhance ceramic fiber's thermal insulation and mechanical properties. As a result, the material is increasingly favoured for its role in promoting energy efficiency and sustainability, aligning with global environmental goals.

Examining the historical trajectory of the ceramic fiber market reveals a pattern of steady growth with periodic spikes in demand. The market has evolved in response to industrialisation trends, with emerging economies in Asia Pacific playing a pivotal role in driving demand. Over the years, the industry has faced challenges such as fluctuations in raw material prices, and compliance with stringent safety and environmental standards.

Despite these challenges, the ceramic fiber market has demonstrated resilience, adapting to market dynamics through technological trends and strategic collaborations among key players. Looking ahead, the historical growth trend is expected to continue, fueled by ongoing technological advancements and a growing emphasis on eco-friendly solutions across industries.

Key Growth Determinants

- Growing Industrialisation, and Infrastructure Development

The ceramic fiber market is propelled by the relentless pace of global industrialisation and infrastructure development. As emerging economies invest heavily in construction, manufacturing, and energy projects, the demand for high-performance materials like ceramic fibers has surged.

These fibers find extensive use in insulation for high-temperature applications, lining for industrial furnaces, and other critical processes in sectors ranging from petrochemicals to power generation. The expansion of industries necessitates efficient and durable materials, positioning ceramic fibers as a key component in modern industrial applications.

- Increasing Emphasis on Energy Efficiency

In a world increasingly focused on sustainability and energy conservation, ceramic fibers emerge as vital contributors to enhanced energy efficiency. With exceptional thermal insulation properties, these fibers play a pivotal role in reducing heat loss across various industrial processes.

Governments, environmental agencies, and industries worldwide are actively promoting energy-efficient solutions. As a result, ceramic fibers are in high demand for applications where precise temperature management is essential. Their ability to minimise thermal conductivity and withstand high temperatures positions them as integral components in the pursuit of eco-friendly and energy-conserving industrial practices.

- Aerospace and Automotive Innovation

The ceramic fiber market experiences a substantial boost from continuous innovation in the aerospace and automotive industries. As these sectors evolve, there is a growing demand for advanced materials that contribute to lightweight, improved performance, and enhanced durability. Ceramic fibers, characterised by their high strength-to-weight ratio, exceptional thermal resistance, and resistance to chemical corrosion, align perfectly with the stringent requirements of aerospace and automotive applications.

The ongoing pursuit of innovation in these industries, driven by the need for fuel efficiency, reduced emissions, and enhanced functionality, ensures a sustained demand for ceramic fibers. These materials play a crucial role in the development of cutting-edge components for aircraft, automobiles, and other transportation systems.

Major Growth Barriers

- High Cost of Production and Raw Materials

One significant restraint in the ceramic fiber market is the high cost associated with both the production process and the raw materials used. The manufacturing of ceramic fibers involves advanced technologies and energy-intensive processes, contributing to elevated production costs.

Additionally, the raw materials required, such as alumina and silica, can be expensive. The overall cost structure poses challenges to market growth, especially in price-sensitive industries, limiting the widespread adoption of ceramic fibers.

- Health and Safety Concerns

Certain types of ceramic fibers, particularly those containing refractory ceramic fibers (RCFs), raise health and safety concerns. Prolonged exposure to airborne respirable fibers during handling and installation can potentially lead to respiratory issues, including lung diseases.

Occupational health and safety regulations in various regions impose strict guidelines on the handling, use, and disposal of these materials. Compliance with such regulations adds operational complexities and costs for industries utilising ceramic fibers, influencing decision-making and potentially hindering market expansion.

Key Trends and Opportunities to Look at

- Increasing Demand in the Renewable Energy Sector

The ceramic fiber market is witnessing a trend of growing demand in the renewable energy sector, particularly in applications related to solar power and energy storage. Ceramic fibers are valued for their high-temperature resistance and thermal insulation properties, making them suitable for use in components like solar panels and energy storage systems. As the renewable energy industry continues to expand, the demand for ceramic fibers in these applications is expected to rise.

- Advancements in Nanotechnology for Enhanced Properties

Ongoing research in nanotechnology is influencing the ceramic fiber market, with a focus on enhancing the properties of these fibers. Nanomaterials are being incorporated into ceramic fibers to improve strength, thermal conductivity, and other performance characteristics. This trend not only contributes to the development of more advanced ceramic fiber products but also opens up new possibilities for applications in cutting-edge technologies.

- Sustainable and Eco-friendly Products

The trend toward sustainability and eco-friendly practices is impacting the ceramic fiber market. Manufacturers are increasingly focusing on developing sustainable alternatives, such as bio-based or recycled ceramic fibers. This shift is driven by both regulatory pressures and consumer preferences for environmentally friendly products. As sustainability becomes a key consideration across industries, the adoption of eco-friendly ceramic fibers is likely to gain momentum.

How Does the Regulatory Scenario Shape this Industry?

The ceramic fiber market is significantly influenced by the regulatory landscape, as various regulations and standards impact the manufacturing, distribution, and application of ceramic fiber products. Regulatory bodies, such as the Occupational Safety and Health Administration (OSHA) in the United States and the European Chemicals Agency (ECHA) in the European Union, play a crucial role in setting guidelines for the safe production and use of ceramic fibers.

These regulations often focus on occupational health and safety, emission standards, and environmental considerations. For instance, OSHA provides guidelines on permissible exposure limits for airborne ceramic fibers to safeguard workers from potential health hazards. Compliance with such regulations necessitates manufacturers to adopt specific production processes and invest in safety measures.

Environmental regulations drive the industry toward sustainable practices and the development of eco-friendly products. Compliance with these regulations may involve adjustments in manufacturing processes, raw material sourcing, and waste management strategies.

The regulatory scenario also impacts international trade, as companies need to adhere to diverse standards across regions. Overall, the regulatory framework acts as a crucial factor in shaping the ceramic fiber industry, influencing innovation, product development, and market dynamics.

Fairfield’s Ranking Board

Top Segments

- Demand for RCF and AES Wool Highest

The dominating segment in the global ceramic fiber market is refractory ceramic fiber (RCF). RCF is widely used in high-temperature applications such as furnaces, kilns, and insulation due to its excellent thermal insulation properties, high-temperature resistance, and lightweight characteristics. Its ability to withstand extreme temperatures makes it highly sought after in industries such as steel, petrochemicals, and power generation.

Additionally, RCF offers good chemical stability and resistance to thermal shock, further enhancing its suitability for a wide range of industrial applications. As a result, RCF holds a significant market share compared to other ceramic fiber products.

The fastest-growing segment in the global ceramic fiber market is AES wool (alkaline earth silicate wool). AES Wool is experiencing rapid growth due to its superior thermal insulation properties, low thermal conductivity, and excellent resistance to high temperatures. Compared to traditional refractory ceramic fibers (RCF), AES Wool is considered safer and more environmentally friendly, as it does not contain potentially harmful components like RCF.

AES wool offers better energy efficiency and reduced heat loss, making it increasingly popular in various industrial applications such as automotive, aerospace, and construction. As industries prioritise sustainability and safety, the demand for AES Wool is expected to continue rising, driving its rapid growth in the ceramic fiber market.

- Blanket Forms in Demand

The dominating segment in the global ceramic fiber market by form is the blanket segment. Blankets are widely preferred due to their versatility, ease of installation, and excellent thermal insulation properties. They offer flexibility in application, allowing for seamless insulation of complex shapes and structures.

Additionally, blankets provide uniform heat distribution and high resistance to thermal shock, making them suitable for a wide range of industrial applications such as furnace lining, kiln insulation, and fire protection. Their lightweight nature and cost-effectiveness further contribute to their dominance in the ceramic fiber market, as they offer an optimal balance of performance and affordability for various end-users.

The fastest-growing segment in the global ceramic fiber market by form is the board segment. Boards offer unique advantages such as high compressive strength, excellent thermal stability, and resistance to chemical corrosion, making them ideal for demanding industrial applications. They provide structural support and insulation in high-temperature environments, including furnace linings, kiln walls, and combustion chambers.

Additionally, boards offer superior dimensional stability and durability compared to other forms, enhancing their appeal in industries requiring long-lasting and reliable insulation solutions. The increasing demand for lightweight and energy-efficient materials further drives the growth of the board segment in the ceramic fiber market.

- Refining and Petrochemical Industry Creates Substantial Demand

The dominating segment in the global ceramic fiber market by end use is the refining and petrochemical industry. This industry relies heavily on high-temperature insulation materials to maintain the integrity and efficiency of refining processes, such as cracking, distillation, and catalysis, which operate at extremely high temperatures.

Ceramic fibers offer exceptional thermal insulation properties, along with resistance to thermal shock and chemical corrosion, making them well-suited for applications in petrochemical plants and refineries. Additionally, the increasing demand for energy-efficient insulation solutions to reduce heat loss and improve process efficiency further drives the dominance of ceramic fibers in the refining and petrochemical sectors.

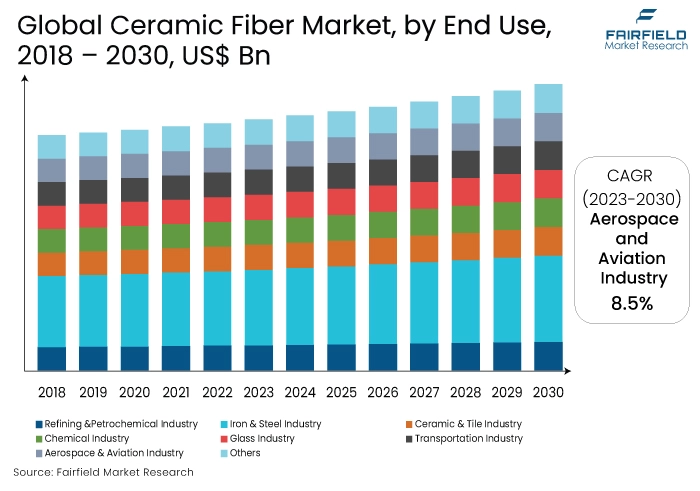

The fastest-growing segment in the global ceramic fiber market by end use is the aerospace and aviation industry. This growth can be attributed to the increasing demand for lightweight, high-temperature insulation materials in the aerospace sector. Ceramic fibers offer excellent thermal insulation properties while being lightweight, making them ideal for applications in aircraft engines, exhaust systems, and thermal protection systems.

With the aerospace industry's focus on fuel efficiency, performance optimisation, and environmental sustainability, there is a rising need for advanced materials like ceramic fibers to meet stringent requirements for thermal management and structural integrity, driving the rapid growth of this segment.

Regional Frontrunners

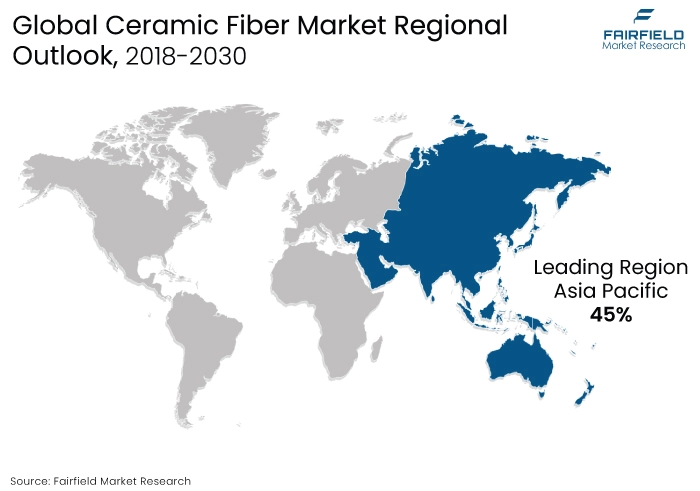

Asia Pacific Holds a Commanding Share

The Asia Pacific region continues to assert itself as the largest revenue-contributing region in the global ceramic fiber market. This dominance is driven by the region's robust industrial growth, particularly in sectors that heavily rely on ceramic fiber applications, such as manufacturing, construction, and petrochemicals.

In countries like China, and India, the expanding manufacturing and construction activities, coupled with a burgeoning petrochemical industry, have significantly increased the demand for ceramic fibers. These fibers, with their thermal insulation and high-temperature resistance properties, play a crucial role in supporting and enhancing the operational efficiency of various industrial processes.

The construction boom in the Asia Pacific region, driven by urbanisation and infrastructure development, has led to a substantial uptick in the use of ceramic fibers for applications like insulation in buildings and high-temperature materials in construction projects.

The region's strategic focus on technological advancements and innovation in industries such as aerospace and automotive further fuels the demand for advanced materials like ceramic fibers. As a result, the Asia Pacific region remains at the forefront of the global ceramic fiber market, with its economic dynamism and industrial expansion propelling continued revenue growth and market leadership.

North America Likely to Witness Significant Growth

The forecast for the ceramic fiber market in North America indicates a significant growth trajectory, underlining the region's potential for increased sales in the coming periods. This growth is attributed to several factors that contribute to the heightened demand and adoption of ceramic fiber products across various industries in North America.

One key driver is the region's emphasis on industrial innovation and technological advancements. As industries seek more efficient and high-performance materials, ceramic fibers, known for their thermal insulation and high-temperature resistance, become increasingly essential. Applications in sectors such as manufacturing, aerospace, and petrochemicals are likely to contribute to the surge in sales.

Additionally, stringent regulations related to workplace safety and environmental standards in North America are propelling industries to invest in advanced materials like ceramic fibers. The focus on creating safer working environments and reducing environmental impact is driving the adoption of ceramic fibers in applications where these materials can enhance both safety and efficiency.

The construction sector in North America is also a significant contributor to the demand for ceramic fibers, as they are widely used in insulation for buildings and high-temperature applications in construction projects.

Fairfield’s Competitive Landscape Analysis

The global ceramic fiber market is a consolidated market with few major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in Global Ceramic Fiber Space?

- Kumaran Shapes & Gaskets

- Morgan Advanced Materials plc

- Alkegen Corporation

- IBIDEN Co.Ltd

- Isolite Insulating Co., Ltd.

- Nutec Fibratech

- RATH Group

- Harbinson Walker International

- Fiber Cast Inc.

- Pyroteck Inc.

Significant Industry Developments

- In May 2023: Morgan advanced announced their commercial startup of 50+% Yixing factory expansion. Yixingplant manufacturers TJM Insulation Firebricks, this expansion will the company to fulfil customer needs from China and Asia in petrochemicals, iron and steel, aluminium, and cathode materials.

- In February 2023, Platinum Equity announced the acquisition of HarbisonWalker International. Platinum Equity is a Global Investment Company Firm with approximately USD 36 Billion of Assets under management and a portfolio of approximately 50

- In January 2021, Alkegen Corporation launched a new product. The Company offers the same benefits as previous fiberfrax blankets, now with physical properties enhanced to improve thermal performance, improved handling, and increased strength. These needles combine innovative proprietary technology with proven performance to create high-performance RCF blanket products.

An Expert’s Eye

Demand and Future Growth

The ceramic fiber market is experiencing robust demand driven by its versatile applications and unique properties. The increasing need for high-temperature-resistant materials in industries such as metal, petrochemical, and aerospace is a major factor propelling market growth.

Ceramic fibers, known for their lightweight nature, excellent thermal insulation, and resistance to corrosion, find extensive use in furnaces, kilns, and insulation applications. The construction sector also contributes to market demand as ceramic fibers are employed for fireproofing and thermal insulation in buildings.

Future growth in the ceramic fiber market is anticipated due to ongoing advancements in manufacturing technologies and the rising focus on energy efficiency across industries. Additionally, the expanding aerospace and automotive sectors are likely to drive demand for lightweight and durable materials, further augmenting the market. As regulations regarding energy conservation and safety become more stringent, the demand for ceramic fibers is expected to witness sustained growth, creating promising opportunities for market players.

Supply Side of the Market

According to our analysis, The supply side of the ceramic fiber market is characterised by the presence of manufacturers, raw material suppliers, and technological innovations. Manufacturers in this sector produce ceramic fiber products, focusing on enhancing product quality, optimising manufacturing processes, and meeting the diverse requirements of end-users in industries such as metal, petrochemical, and construction.

Raw material suppliers, providing key elements like alumina and silica, play a pivotal role in maintaining a stable supply chain. Ongoing technological innovations contribute to increased production efficiency and the expansion of application possibilities for ceramic fibers.

Efficient distribution channels, compliance with regulatory standards, and global trade dynamics also impact the supply side. Capacity expansions by manufacturers respond to rising market demand, ensuring a consistent and growing supply of ceramic fiber products. Overall, the supply-side dynamics are influenced by market trends, economic factors, and advancements in production technologies, collectively shaping the availability and competitiveness of ceramic fiber in the global market.

Global Ceramic Fiber Market is Segmented as Below:

By Product Type:

- Refractory Ceramic Fiber (RCF)

- AES Wool

- Polycrystalline Fiber

- Others

By Form:

- Blanket

- Boards

- Rope

- Paper

- Additive

- Others

By End Use:

- Refining &Petrochemical Industry

- Iron & Steel Industry

- Ceramic & Tile Industry

- Chemical Industry

- Glass Industry

- Transportation Industry

- Aerospace & Aviation Industry

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Ceramic Fiber Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Ceramic Fiber Market Outlook, 2018 - 2030

3.1. Global Ceramic Fiber Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Refractory Ceramic Fiber (RCF)

3.1.1.2. AES Wool

3.1.1.3. Polycrystalline Fiber

3.1.1.4. Others

3.2. Global Ceramic Fiber Market Outlook, by Form, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Blanket

3.2.1.2. Boards

3.2.1.3. Rope

3.2.1.4. Paper

3.2.1.5. Additive

3.2.1.6. Others

3.3. Global Ceramic Fiber Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Refining &Petrochemical Industry

3.3.1.2. Iron & Steel Industry

3.3.1.3. Ceramic & Tile Industry

3.3.1.4. Chemical Industry

3.3.1.5. Glass Industry

3.3.1.6. Transportation Industry

3.3.1.7. Aerospace & Aviation Industry

3.3.1.8. Others

3.4. Global Ceramic Fiber Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Ceramic Fiber Market Outlook, 2018 - 2030

4.1. North America Ceramic Fiber Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Refractory Ceramic Fiber (RCF)

4.1.1.2. AES Wool

4.1.1.3. Polycrystalline Fiber

4.1.1.4. Others

4.2. North America Ceramic Fiber Market Outlook, by Form, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Blanket

4.2.1.2. Boards

4.2.1.3. Rope

4.2.1.4. Paper

4.2.1.5. Additive

4.2.1.6. Others

4.3. North America Ceramic Fiber Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Refining &Petrochemical Industry

4.3.1.2. Iron & Steel Industry

4.3.1.3. Ceramic & Tile Industry

4.3.1.4. Chemical Industry

4.3.1.5. Glass Industry

4.3.1.6. Transportation Industry

4.3.1.7. Aerospace & Aviation Industry

4.3.1.8. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Ceramic Fiber Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

4.4.1.4. Canada Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Ceramic Fiber Market Outlook, 2018 - 2030

5.1. Europe Ceramic Fiber Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Refractory Ceramic Fiber (RCF)

5.1.1.2. AES Wool

5.1.1.3. Polycrystalline Fiber

5.1.1.4. Others

5.2. Europe Ceramic Fiber Market Outlook, by Form, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Blanket

5.2.1.2. Boards

5.2.1.3. Rope

5.2.1.4. Paper

5.2.1.5. Additive

5.2.1.6. Others

5.3. Europe Ceramic Fiber Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Refining &Petrochemical Industry

5.3.1.2. Iron & Steel Industry

5.3.1.3. Ceramic & Tile Industry

5.3.1.4. Chemical Industry

5.3.1.5. Glass Industry

5.3.1.6. Transportation Industry

5.3.1.7. Aerospace & Aviation Industry

5.3.1.8. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Ceramic Fiber Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

5.4.1.4. U.K. Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

5.4.1.7. France Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.8. France Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 20

5.4.1.9. France Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

5.4.1.10. Italy Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.11. Italy Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

5.4.1.12. Italy Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

5.4.1.13. Turkey Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.14. Turkey Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 20330

5.4.1.15. Turkey Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

5.4.1.16. Russia Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.17. Russia Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

5.4.1.18. Russia Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

5.4.1.19. Rest of Europe Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.20. Rest of Europe Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

5.4.1.21. Rest of Europe Guar Gum by End Use, Value (US$ Mn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Ceramic Fiber Market Outlook, 2018 - 2030

6.1. Asia Pacific Ceramic Fiber Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Refractory Ceramic Fiber (RCF)

6.1.1.2. AES Wool

6.1.1.3. Polycrystalline Fiber

6.1.1.4. Others

6.2. Asia Pacific Ceramic Fiber Market Outlook, by Form, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Blanket

6.2.1.2. Boards

6.2.1.3. Rope

6.2.1.4. Paper

6.2.1.5. Additive

6.2.1.6. Others

6.3. Asia Pacific Ceramic Fiber Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Refining &Petrochemical Industry

6.3.1.2. Iron & Steel Industry

6.3.1.3. Ceramic & Tile Industry

6.3.1.4. Chemical Industry

6.3.1.5. Glass Industry

6.3.1.6. Transportation Industry

6.3.1.7. Aerospace & Aviation Industry

6.3.1.8. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Ceramic Fiber Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

6.4.1.4. Japan Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

6.4.1.7. South Korea Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.8. South Korea Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

6.4.1.10. India Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.11. India Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

6.4.1.12. India Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

6.4.1.13. Southeast Asia Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.14. Southeast Asia Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

6.4.1.15. Southeast Asia Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Ceramic Fiber Market Outlook, 2018 - 2030

7.1. Latin America Ceramic Fiber Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Refractory Ceramic Fiber (RCF)

7.1.1.2. AES Wool

7.1.1.3. Polycrystalline Fiber

7.1.1.4. Others

7.2. Latin America Ceramic Fiber Market Outlook, by Form, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Blanket

7.2.1.2. Boards

7.2.1.3. Rope

7.2.1.4. Paper

7.2.1.5. Additive

7.2.1.6. Others

7.3. Latin America Ceramic Fiber Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Refining &Petrochemical Industry

7.3.1.2. Iron & Steel Industry

7.3.1.3. Ceramic & Tile Industry

7.3.1.4. Chemical Industry

7.3.1.5. Glass Industry

7.3.1.6. Transportation Industry

7.3.1.7. Aerospace & Aviation Industry

7.3.1.8. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Ceramic Fiber Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

7.4.1.4. Mexico Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

7.4.1.7. Argentina Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.8. Argentina Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

7.4.1.9. Argentina Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

7.4.1.10. Rest of Latin America Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.11. Rest of Latin America Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

7.4.1.12. Rest of Latin America Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Ceramic Fiber Market Outlook, 2018 - 2030

8.1. Middle East & Africa Ceramic Fiber Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Refractory Ceramic Fiber (RCF)

8.1.1.2. AES Wool

8.1.1.3. Polycrystalline Fiber

8.1.1.4. Others

8.2. Middle East & Africa Ceramic Fiber Market Outlook, by Form, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Blanket

8.2.1.2. Boards

8.2.1.3. Rope

8.2.1.4. Paper

8.2.1.5. Additive

8.2.1.6. Others

8.3. Middle East & Africa Ceramic Fiber Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Refining &Petrochemical Industry

8.3.1.2. Iron & Steel Industry

8.3.1.3. Ceramic & Tile Industry

8.3.1.4. Chemical Industry

8.3.1.5. Glass Industry

8.3.1.6. Transportation Industry

8.3.1.7. Aerospace & Aviation Industry

8.3.1.8. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Ceramic Fiber Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

8.4.1.4. South Africa Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

8.4.1.7. Egypt Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.8. Egypt Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

8.4.1.9. Egypt Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

8.4.1.10. Nigeria Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.11. Nigeria Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

8.4.1.12. Nigeria Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Ceramic Fiber Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Ceramic Fiber Market by Form, Value (US$ Mn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Ceramic Fiber Market by End Use, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Capacity vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Kumaran Shapes & Gaskets.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Morgan Advaned Materials plc

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Alkegen Corporation

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. IBIDEN Co.Ltd

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Isolite Insulating Co., Ltd

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Nutec Fibratech

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. RATH Group

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Harbinson Walker International

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Pyrotek

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Form Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |