Global Chillers Market Forecast

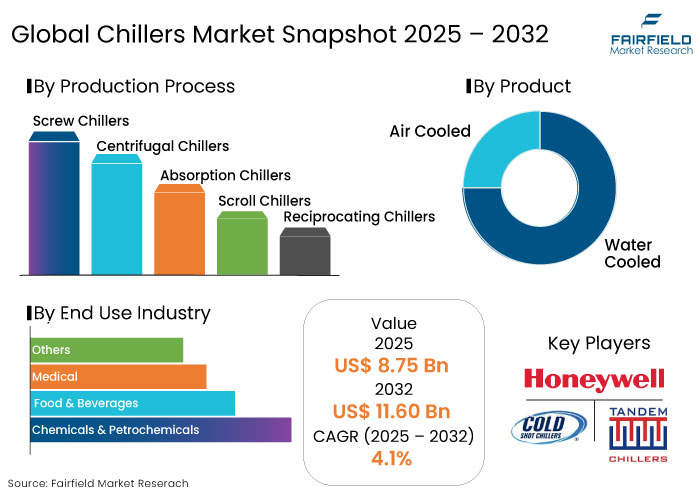

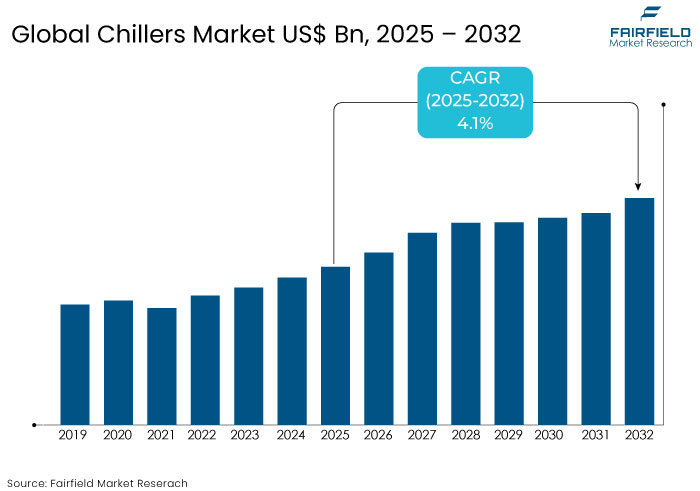

- The chillers market is projected to reach a size of US$ 11.60 Bn by 2032, showing significant growth from US$ 8.75 Bn achieved in 2025.

- The market for chillers is set to show a steady expansion rate, with a CAGR of 4.1% from 2025 to 2032.

Chillers Market Insights

- Demand for energy-efficient chillers is rising as businesses seek to reduce operational costs and meet sustainability goals.

- Rise of smart chiller systems with IoT integration allows for remote monitoring, predictive maintenance, and energy optimization.

- Demand for advanced cooling systems in data centers is booming due to growth of cloud computing and AI workloads.

- Modular chillers are gaining popularity for their scalability, ideal for extending industrial and commercial cooling needs.

- Petrochemicals and chemical industries continue to be leading drivers for adopting chillers due to temperature-sensitive processes.

- Increased government incentives and environmental regulations push industries to adopt eco-friendly chiller technologies.

- Asia Pacific chillers market is projected to lead the global market with 35% share in 2025 due to increased demand for sustainable cooling solutions.

- Water cooled chillers lead the product type segment with 60% of the market share in 2025.

Key Growth Determinants

- Government Support to Enhance Green Technology Bolsters Growth

As industries and businesses strive to meet sustainability goals, demand for energy-efficient chillers is growing rapidly. Energy costs are becoming a significant operational expense, prompting companies to seek cooling solutions that reduce energy consumption while maintaining optimal performance.

Chillers with Variable Frequency Drives (VFDs), smart IoT integration, and innovative refrigerants are leading the way in helping businesses save on energy bills. Governments across the globe are also tightening energy regulations, incentivizing the use of green technologies by offering rebates, tax benefits, and compliance standards. It is set to propel the chillers market.

In commercial sectors, businesses adopting green technologies are seeing an average 30 to 50% reduction in energy consumption. This is making energy-efficient chillers a key investment in eco-friendly building certifications like LEED.

- Shift toward Smart Systems to Achieve High Efficiency Propels Growth

Innovations in chiller technology are driving substantial growth in the chillers market. The shift toward modular chillers, liquid cooling, and smart systems has allowed industries to achieve higher efficiency, better temperature control, and system flexibility.

Modern chillers are now equipped with innovative sensors, AI-driven maintenance systems, and predictive analytics, making these much smarter than their predecessors. These systems can optimize performance in real-time, adjusting cooling output based on demand and reducing energy waste.

One of the most exciting technological trends is the development of IoT-enabled chillers, which allow for remote monitoring, diagnostics, and predictive maintenance. This means businesses can track their chiller’s performance from anywhere and anticipate failures before they happen, reducing unexpected downtime.

Key Growth Barriers

- Maintenance and Operational Challenges to Hinder Market Growth

Chillers, particularly the more complex and high-efficiency systems, require regular maintenance and proper operational management to maintain peak performance. The need for ongoing maintenance, repairs, and monitoring challenges companies, especially in remote or underdeveloped areas where skilled technicians may be in short supply. Water-cooled chillers often require regular checks to ensure water quality and prevent scaling, corrosion, and algae growth.

Air-cooled chillers must be kept free of dust and debris to maintain efficiency. The cost of maintenance, including hiring qualified professionals, ensuring the availability of parts, and addressing potential breakdowns, can add up over time. Downtime due to repairs can disrupt operations in critical industries such as pharmaceuticals, food & beverage, and data centers, leading to significant losses. Complexity of their maintenance and operational costs poses a challenge to sustained growth in the chillers market.

Chillers Market Trends and Opportunities

- Rise of Energy-efficient and Eco-friendly Chillers Boosts Market Prospects

With climate change concerns and rising electricity costs, industries are shifting toward energy-efficient and eco-friendly chillers to reduce their carbon footprint and operational expenses. Governments and regulatory bodies worldwide enforce strict standards, such as F-Gas Regulations (Europe), ASHRAE Standards (U.S.), and BREEAM & LEED Certifications.

Traditional refrigerants like R-22 and R-134a are being replaced with low-GWP alternatives such as R-32, R-290 (propane), and CO2-based cooling systems to comply with global emission norms. AI-driven predictive maintenance and automated temperature control make chillers smarter and more energy-efficient. IoT integration allows real-time performance tracking, reducing downtime and optimizing energy consumption. These factors are set to create new opportunities in the chillers market.

- Booming Demand from Data Centers to Create New Avenues

The boom of AI, cloud computing, and edge computing fuel the chillers market, making it one of the fastest-growing sectors for manufacturers. With AI-powered servers running at higher capacities, the need for efficient cooling is greater than ever.

Data centers generate immense heat, and overheating can reduce processing efficiency and cause hardware failures. Chillers, particularly liquid cooling systems, help maintain optimal temperatures and prevent downtime.

Data centers are responsible for around 1% of global electricity consumption, and cooling systems account for up to 40% of this energy use, highlighting the importance of efficient chillers in reducing energy consumption. Companies developing next-gen chillers tailored to AI-driven workloads and large-scale cloud computing will likely see massive growth. Partnering with tech firms and data center operators could be a game-changer in this sector.

Segments Covered in the Report

- Water Cooled Chillers to Lead Amid their Long Shelf Life and Energy Efficiency

Utilizing water as a cooling medium allows for superior heat transfer, resulting in higher energy efficiency than air-cooled systems. The compact design of these chillers makes them suitable for indoor installations where space is at a premium. With proper maintenance, water-cooled chillers often have a longer operational life due to stable operating conditions.

These are ideal for environments with high thermal output, such as chemical plants and manufacturing facilities, due to their broad cooling capacity ranging from 10 to 4,000 tons. Used in laboratories and cleanrooms where precise temperature control is critical, water-cooled chillers are leading in terms of the chillers market share.

- Chemicals and Petrochemicals Industry Seeks High-performance Chillers

Precise temperature regulation is essential in chemical and petrochemical processes to ensure product quality, safety, and process efficiency. Chillers play a pivotal role in maintaining these stringent temperature requirements.

Studies show that maintaining precise temperature regulation can increase the efficiency of chemical processes by 15 to 25% and improve product quality. The exothermic nature of several chemical reactions necessitates robust cooling solutions to manage heat generated during production, making chillers indispensable in these settings. Maintaining optimal temperatures prevents overheating, protects sensitive equipment, and extends its operational lifespan.

Regional Analysis

- Asia Pacific to Dominate Amid High Demand for Sustainable Cooling Solutions

Due to rapid industrialization, Asia Pacific is the leading region in the global chillers market. Growing need for energy-efficient and sustainable cooling solutions primarily caters to the market's growth. The region is set to hold 35% share in 2025.

The market growth is significantly enhanced by expansion of the food and beverage, pharmaceuticals, chemicals, and industrial industries. Rising development of data centers and commercial buildings has increased demand for air conditioning systems in the global market.

Elevated temperatures and variations in weather patterns throughout several nations in Asia Pacific need increased reliance on air-conditioning and cooling technologies. The accessibility of cost-effective manufacturing and the significance of sustainable cooling technologies position Asia Pacific as a pivotal market for chillers.

- North America to Move toward Eco-friendly Chillers to Comply with Norms

North America owns a substantial chillers market share and is predicted to witness the fastest growth, driven by increasing demand for energy-efficient cooling solutions in various industries. The U.S. and Canada lead the market, with Mexico emerging as an emerging player.

The U.S. Department of Energy (DOE) and the Environmental Protection Agency (EPA) have enforced strict efficiency standards, pushing industries to adopt low-GWP refrigerants and high-efficiency chillers. Regulations like the ASHRAE 90.1 and SEER ratings impact purchasing decisions.

The North American chillers industry is evolving with sustainability, smart technology, and industrial expansion augmenting demand. Companies that innovate in efficiency and eco-friendly solutions will gain a competitive edge, enhancing the region's market share over the forecast period.

Fairfield’s Competitive Landscape Analysis

The chillers market is highly competitive, driven by increasing demand from industries like HVAC, food & beverage, pharmaceuticals, and data centers. Key players in the industry, such as Johnson Controls, Trane Technologies, Carrier, Daikin, and Mitsubishi Electric, dominate the market with novel energy-efficient solutions.

With sustainability becoming a priority, companies focus on low-GWP refrigerants and smart cooling technologies to gain an edge. Emerging players from China and India are challenging established brands with cost-effective alternatives.

The market is also seeing a rise in modular and absorption chillers due to their efficiency and eco-friendly benefits. As businesses prioritize energy savings and regulatory compliance, innovation, and after-sales service are key differentiators in this competitive landscape.

Key Market Companies

- Honeywell International, Inc.

- Cold Shot Chillers

- Tandem Chillers

- Drake Refrigeration, Inc.

- Refra

- Carrier

- FRIGEL FIRENZE S.p.A.

- Midea

- Daikin Industries, Ltd.

- Johnson Controls

- Rite-Temp

- General Air Products

- ClimaCool Corp.

- Fluid Chillers, Inc.

- Trane

Recent Industry Developments

- In January 2024, Daikin UK signed an acquisition deal with Robert Heath Heating Ltd. to enhance its residential heating service network to facilitate Daikin's advancement of the U.K.'s transition to low-carbon solutions, particularly by improving the utilization of air-source heat pumps.

- In May 2024, Carrier India introduced the Made-in-India 30 RB Air-cooled Modular Scroll Chiller for railways and metros, among many industrial sectors in India.

Global Chillers Market is Segmented as-

By Product Type

- Water Cooled

- Air Cooled

By Form

- Commercial

- Corporate Offices

- Data Centers

- Public Buildings

- Mercantile & Service

- Healthcare

- Others

- Industrial

- Chemicals & Pharmaceuticals

- Food & Beverage

- Metal Manufacturing & Machining

- Medical & Pharmaceutical

- Plastics

- Others

- Residential

- Screw Chillers

- Centrifugal Chillers

- Absorption Chillers

- Scroll Chillers

- Reciprocating Chillers

By Production Process

- Screw Chillers

- Centrifugal Chillers

- Absorption Chillers

- Scroll Chillers

- Reciprocating Chillers

By Power Range

- Less than 50 kW

- 50-200 kW

- More than 200 kW

By End Use Industry

- Chemicals & Petrochemicals

- Food & Beverages

- Medical

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Chillers Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2025-2032

2.9.2. Price Impact Factors

3. Global Chillers Market Outlook, 2019 - 2032

3.1. Global Chillers Market Outlook, by Product Type, Value (US$ Bn) & Volume (Units), 2019 - 2032

3.1.1. Water Cooled

3.1.2. Air Cooled

3.2. Global Chillers Market Outlook, by Form, Value (US$ Bn) & Volume (Units), 2019 - 2032

3.2.1. Commercial

3.2.1.1. Corporate Offices

3.2.1.2. Data Centers

3.2.1.3. Public Buildings

3.2.1.4. Mercantile & Service

3.2.1.5. Healthcare

3.2.1.6. Others

3.2.2. Industrial

3.2.2.1. Chemicals & Pharmaceuticals

3.2.2.2. Food & Beverage

3.2.2.3. Metal Manufacturing & Machining

3.2.2.4. Medical & Pharmaceutical

3.2.2.5. Plastics

3.2.2.6. Others

3.2.3. Residential

3.3. Global Chillers Market Outlook, by Production Process, Value (US$ Bn) & Volume (Units), 2019 - 2032

3.3.1. Screw Chillers

3.3.2. Centrifugal Chillers

3.3.3. Absorption Chillers

3.3.4. Scroll Chillers

3.3.5. Reciprocating Chillers

3.4. Global Chillers Market Outlook, by Power Range, Value (US$ Bn) & Volume (Units), 2019 - 2032

3.4.1. Less than 50 kW

3.4.2. 50-200 kW

3.4.3. More than 200 kW

3.5. Global Chillers Market Outlook, by End Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2032

3.5.1. Chemicals & Petrochemicals

3.5.2. Food & Beverages

3.5.3. Medical

3.5.4. Others

3.6. Global Chillers Market Outlook, by Region, Value (US$ Bn) & Volume (Units), 2019 - 2032

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Latin America

3.6.5. Middle East & Africa

4. North America Chillers Market Outlook, 2019 - 2032

4.1. North America Chillers Market Outlook, by Product Type, Value (US$ Bn) & Volume (Units), 2019 - 2032

4.1.1. Water Cooled

4.1.2. Air Cooled

4.2. North America Chillers Market Outlook, by Form, Value (US$ Bn) & Volume (Units), 2019 - 2032

4.2.1. Commercial

4.2.1.1. Corporate Offices

4.2.1.2. Data Centers

4.2.1.3. Public Buildings

4.2.1.4. Mercantile & Service

4.2.1.5. Healthcare

4.2.1.6. Others

4.2.2. Industrial

4.2.2.1. Chemicals & Pharmaceuticals

4.2.2.2. Food & Beverage

4.2.2.3. Metal Manufacturing & Machining

4.2.2.4. Medical & Pharmaceutical

4.2.2.5. Plastics

4.2.2.6. Others

4.2.3. Residential

4.3. North America Chillers Market Outlook, by Production Process, Value (US$ Bn) & Volume (Units), 2019 - 2032

4.3.1. Screw Chillers

4.3.2. Centrifugal Chillers

4.3.3. Absorption Chillers

4.3.4. Scroll Chillers

4.3.5. Reciprocating Chillers

4.4. North America Chillers Market Outlook, by Power Range, Value (US$ Bn) & Volume (Units), 2019 - 2032

4.4.1. Less than 50 kW

4.4.2. 50-200 kW

4.4.3. More than 200 kW

4.5. North America Chillers Market Outlook, by End Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2032

4.5.1. Chemicals & petrochemicals

4.5.2. Food & beverages

4.5.3. Medical

4.5.4. Others

4.6. North America Chillers Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2032

4.6.1. U.S. Chillers Market Outlook, by Product Type, 2019 - 2032

4.6.2. U.S. Chillers Market Outlook, by Form, 2019 - 2032

4.6.3. U.S. Chillers Market Outlook, by Production Process, 2019 - 2032

4.6.4. U.S. Chillers Market Outlook, by Power Range, 2019 - 2032

4.6.5. U.S. Chillers Market Outlook, by End Use Industry, 2019 - 2032

4.6.6. Canada Chillers Market Outlook, by Product Type, 2019 - 2032

4.6.7. Canada Chillers Market Outlook, by Form, 2019 - 2032

4.6.8. Canada Chillers Market Outlook, by Production Process, 2019 - 2032

4.6.9. Canada Chillers Market Outlook, by Power Range, 2019 - 2032

4.6.10. Canada Chillers Market Outlook, by End Use Industry, 2019 - 2032

4.7. BPS Analysis/Market Attractiveness Analysis

5. Europe Chillers Market Outlook, 2019 - 2032

5.1. Europe Chillers Market Outlook, by Product Type, Value (US$ Bn) & Volume (Units), 2019 - 2032

5.1.1. Water Cooled

5.1.2. Air Cooled

5.2. Europe Chillers Market Outlook, by Form, Value (US$ Bn) & Volume (Units), 2019 - 2032

5.2.1. Commercial

5.2.1.1. Corporate Offices

5.2.1.2. Data Centers

5.2.1.3. Public Buildings

5.2.1.4. Mercantile & Service

5.2.1.5. Healthcare

5.2.1.6. Others

5.2.2. Industrial

5.2.2.1. Chemicals & Pharmaceuticals

5.2.2.2. Food & Beverage

5.2.2.3. Metal Manufacturing & Machining

5.2.2.4. Medical & Pharmaceutical

5.2.2.5. Plastics

5.2.2.6. Others

5.2.3. Residential

5.3. Europe Chillers Market Outlook, by Production Process, Value (US$ Bn) & Volume (Units), 2019 - 2032

5.3.1. Screw Chillers

5.3.2. Centrifugal Chillers

5.3.3. Absorption Chillers

5.3.4. Scroll Chillers

5.3.5. Reciprocating Chillers

5.4. Europe Chillers Market Outlook, by Power Range, Value (US$ Bn) & Volume (Units), 2019 - 2032

5.4.1. Less than 50 kW

5.4.2. 50-200 kW

5.4.3. More than 200 kW

5.5. Europe Chillers Market Outlook, by End Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2032

5.5.1. Chemicals & petrochemicals

5.5.2. Food & beverages

5.5.3. Medical

5.5.4. Others

5.6. Europe Chillers Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2032

5.6.1. Germany Chillers Market Outlook, by Product Type, 2019 - 2032

5.6.2. Germany Chillers Market Outlook, by Form, 2019 - 2032

5.6.3. Germany Chillers Market Outlook, by Production Process, 2019 - 2032

5.6.4. Germany Chillers Market Outlook, by Power Range, 2019 - 2032

5.6.5. Germany Chillers Market Outlook, by End Use Industry, 2019 - 2032

5.6.6. Italy Chillers Market Outlook, by Product Type, 2019 - 2032

5.6.7. Italy Chillers Market Outlook, by Form, 2019 - 2032

5.6.8. Italy Chillers Market Outlook, by Production Process, 2019 - 2032

5.6.9. Italy Chillers Market Outlook, by Power Range, 2019 - 2032

5.6.10. Italy Chillers Market Outlook, by End Use Industry, 2019 - 2032

5.6.11. France Chillers Market Outlook, by Product Type, 2019 - 2032

5.6.12. France Chillers Market Outlook, by Form, 2019 - 2032

5.6.13. France Chillers Market Outlook, by Production Process, 2019 - 2032

5.6.14. France Chillers Market Outlook, by Power Range, 2019 - 2032

5.6.15. France Chillers Market Outlook, by End Use Industry, 2019 - 2032

5.6.16. U.K. Chillers Market Outlook, by Product Type, 2019 - 2032

5.6.17. U.K. Chillers Market Outlook, by Form, 2019 - 2032

5.6.18. U.K. Chillers Market Outlook, by Production Process, 2019 - 2032

5.6.19. U.K. Chillers Market Outlook, by Power Range, 2019 - 2032

5.6.20. U.K. Chillers Market Outlook, by End Use Industry, 2019 - 2032

5.6.21. Spain Chillers Market Outlook, by Product Type, 2019 - 2032

5.6.22. Spain Chillers Market Outlook, by Form, 2019 - 2032

5.6.23. Spain Chillers Market Outlook, by Production Process, 2019 - 2032

5.6.24. Spain Chillers Market Outlook, by Power Range, 2019 - 2032

5.6.25. Spain Chillers Market Outlook, by End Use Industry, 2019 - 2032

5.6.26. Russia Chillers Market Outlook, by Product Type, 2019 - 2032

5.6.27. Russia Chillers Market Outlook, by Form, 2019 - 2032

5.6.28. Russia Chillers Market Outlook, by Production Process, 2019 - 2032

5.6.29. Russia Chillers Market Outlook, by Power Range, 2019 - 2032

5.6.30. Russia Chillers Market Outlook, by End Use Industry, 2019 - 2032

5.6.31. Rest of Europe Chillers Market Outlook, by Product Type, 2019 - 2032

5.6.32. Rest of Europe Chillers Market Outlook, by Form, 2019 - 2032

5.6.33. Rest of Europe Chillers Market Outlook, by Production Process, 2019 - 2032

5.6.34. Rest of Europe Chillers Market Outlook, by Power Range, 2019 - 2032

5.6.35. Rest of Europe Chillers Market Outlook, by End Use Industry, 2019 - 2032

5.7. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Chillers Market Outlook, 2019 - 2032

6.1. Asia Pacific Chillers Market Outlook, by Product Type, Value (US$ Bn) & Volume (Units), 2019 - 2032

6.1.1. Water Cooled

6.1.2. Air Cooled

6.2. Asia Pacific Chillers Market Outlook, by Form, Value (US$ Bn) & Volume (Units), 2019 - 2032

6.2.1. Commercial

6.2.1.1. Corporate Offices

6.2.1.2. Data Centers

6.2.1.3. Public Buildings

6.2.1.4. Mercantile & Service

6.2.1.5. Healthcare

6.2.1.6. Others

6.2.2. Industrial

6.2.2.1. Chemicals & Pharmaceuticals

6.2.2.2. Food & Beverage

6.2.2.3. Metal Manufacturing & Machining

6.2.2.4. Medical & Pharmaceutical

6.2.2.5. Plastics

6.2.2.6. Others

6.2.3. Residential

6.3. Asia Pacific Chillers Market Outlook, by Production Process, Value (US$ Bn) & Volume (Units), 2019 - 2032

6.3.1. Screw Chillers

6.3.2. Centrifugal Chillers

6.3.3. Absorption Chillers

6.3.4. Scroll Chillers

6.3.5. Reciprocating Chillers

6.4. Asia Pacific Chillers Market Outlook, by Power Range, Value (US$ Bn) & Volume (Units), 2019 - 2032

6.4.1. Less than 50 kW

6.4.2. 50-200 kW

6.4.3. More than 200 kW

6.5. Asia Pacific Chillers Market Outlook, by End Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2032

6.5.1. Chemicals & petrochemicals

6.5.2. Food & beverages

6.5.3. Medical

6.5.4. Others

6.6. Asia Pacific Chillers Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2032

6.6.1. China Chillers Market Outlook, by Product Type, 2019 - 2032

6.6.2. China Chillers Market Outlook, by Form, 2019 - 2032

6.6.3. China Chillers Market Outlook, by Production Process, 2019 - 2032

6.6.4. China Chillers Market Outlook, by Power Range, 2019 - 2032

6.6.5. China Chillers Market Outlook, by End Use Industry, 2019 - 2032

6.6.6. Japan Chillers Market Outlook, by Product Type, 2019 - 2032

6.6.7. Japan Chillers Market Outlook, by Form, 2019 - 2032

6.6.8. Japan Chillers Market Outlook, by Production Process, 2019 - 2032

6.6.9. Japan Chillers Market Outlook, by Power Range, 2019 - 2032

6.6.10. Japan Chillers Market Outlook, by End Use Industry, 2019 - 2032

6.6.11. South Korea Chillers Market Outlook, by Product Type, 2019 - 2032

6.6.12. South Korea Chillers Market Outlook, by Form, 2019 - 2032

6.6.13. South Korea Chillers Market Outlook, by Production Process, 2019 - 2032

6.6.14. South Korea Chillers Market Outlook, by Power Range, 2019 - 2032

6.6.15. South Korea Chillers Market Outlook, by End Use Industry, 2019 - 2032

6.6.16. India Chillers Market Outlook, by Product Type, 2019 - 2032

6.6.17. India Chillers Market Outlook, by Form, 2019 - 2032

6.6.18. India Chillers Market Outlook, by Production Process, 2019 - 2032

6.6.19. India Chillers Market Outlook, by Power Range, 2019 - 2032

6.6.20. India Chillers Market Outlook, by End Use Industry, 2019 - 2032

6.6.21. Southeast Asia Chillers Market Outlook, by Product Type, 2019 - 2032

6.6.22. Southeast Asia Chillers Market Outlook, by Form, 2019 - 2032

6.6.23. Southeast Asia Chillers Market Outlook, by Production Process, 2019 - 2032

6.6.24. Southeast Asia Chillers Market Outlook, by Power Range, 2019 - 2032

6.6.25. Southeast Asia Chillers Market Outlook, by End Use Industry, 2019 - 2032

6.6.26. Rest of SAO Chillers Market Outlook, by Product Type, 2019 - 2032

6.6.27. Rest of SAO Chillers Market Outlook, by Form, 2019 - 2032

6.6.28. Rest of SAO Chillers Market Outlook, by Production Process, 2019 - 2032

6.6.29. Rest of SAO Chillers Market Outlook, by Power Range, 2019 - 2032

6.6.30. Rest of SAO Chillers Market Outlook, by End Use Industry, 2019 - 2032

6.7. BPS Analysis/Market Attractiveness Analysis

7. Latin America Chillers Market Outlook, 2019 - 2032

7.1. Latin America Chillers Market Outlook, by Product Type, Value (US$ Bn) & Volume (Units), 2019 - 2032

7.1.1. Water Cooled

7.1.2. Air Cooled

7.2. Latin America Chillers Market Outlook, by Form, Value (US$ Bn) & Volume (Units), 2019 - 2032

7.2.1. Commercial

7.2.1.1. Corporate Offices

7.2.1.2. Data Centers

7.2.1.3. Public Buildings

7.2.1.4. Mercantile & Service

7.2.1.5. Healthcare

7.2.1.6. Others

7.2.2. Industrial

7.2.2.1. Chemicals & Pharmaceuticals

7.2.2.2. Food & Beverage

7.2.2.3. Metal Manufacturing & Machining

7.2.2.4. Medical & Pharmaceutical

7.2.2.5. Plastics

7.2.2.6. Others

7.2.3. Residential

7.3. Latin America Chillers Market Outlook, by Production Process, Value (US$ Bn) & Volume (Units), 2019 - 2032

7.3.1. Screw Chillers

7.3.2. Centrifugal Chillers

7.3.3. Absorption Chillers

7.3.4. Scroll Chillers

7.3.5. Reciprocating Chillers

7.4. Latin America Chillers Market Outlook, by Power Range, Value (US$ Bn) & Volume (Units), 2019 - 2032

7.4.1. Less than 50 kW

7.4.2. 50-200 kW

7.4.3. More than 200 kW

7.5. Latin America Chillers Market Outlook, by End Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2032

7.5.1. Chemicals & petrochemicals

7.5.2. Food & beverages

7.5.3. Medical

7.5.4. Others

7.6. Latin America Chillers Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2032

7.6.1. Brazil Chillers Market Outlook, by Product Type, 2019 - 2032

7.6.2. Brazil Chillers Market Outlook, by Form, 2019 - 2032

7.6.3. Brazil Chillers Market Outlook, by Production Process, 2019 - 2032

7.6.4. Brazil Chillers Market Outlook, by Power Range, 2019 - 2032

7.6.5. Brazil Chillers Market Outlook, by End Use Industry, 2019 - 2032

7.6.6. Mexico Chillers Market Outlook, by Product Type, 2019 - 2032

7.6.7. Mexico Chillers Market Outlook, by Form, 2019 - 2032

7.6.8. Mexico Chillers Market Outlook, by Production Process, 2019 - 2032

7.6.9. Mexico Chillers Market Outlook, by Power Range, 2019 - 2032

7.6.10. Mexico Chillers Market Outlook, by End Use Industry, 2019 - 2032

7.6.11. Argentina Chillers Market Outlook, by Product Type, 2019 - 2032

7.6.12. Argentina Chillers Market Outlook, by Form, 2019 - 2032

7.6.13. Argentina Chillers Market Outlook, by Production Process, 2019 - 2032

7.6.14. Argentina Chillers Market Outlook, by Power Range, 2019 - 2032

7.6.15. Argentina Chillers Market Outlook, by End Use Industry, 2019 - 2032

7.6.16. Rest of LATAM Chillers Market Outlook, by Product Type, 2019 - 2032

7.6.17. Rest of LATAM Chillers Market Outlook, by Form, 2019 - 2032

7.6.18. Rest of LATAM Chillers Market Outlook, by Production Process, 2019 - 2032

7.6.19. Rest of LATAM Chillers Market Outlook, by Power Range, 2019 - 2032

7.6.20. Rest of LATAM Chillers Market Outlook, by End Use Industry, 2019 - 2032

7.7. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Chillers Market Outlook, 2019 - 2032

8.1. Middle East & Africa Chillers Market Outlook, by Product Type, Value (US$ Bn) & Volume (Units), 2019 - 2032

8.1.1. Water Cooled

8.1.2. Air Cooled

8.2. Middle East & Africa Chillers Market Outlook, by Form, Value (US$ Bn) & Volume (Units), 2019 - 2032

8.2.1. Commercial

8.2.1.1. Corporate Offices

8.2.1.2. Data Centers

8.2.1.3. Public Buildings

8.2.1.4. Mercantile & Service

8.2.1.5. Healthcare

8.2.1.6. Others

8.2.2. Industrial

8.2.2.1. Chemicals & Pharmaceuticals

8.2.2.2. Food & Beverage

8.2.2.3. Metal Manufacturing & Machining

8.2.2.4. Medical & Pharmaceutical

8.2.2.5. Plastics

8.2.2.6. Others

8.2.3. Residential

8.3. Middle East & Africa Chillers Market Outlook, by Production Process, Value (US$ Bn) & Volume (Units), 2019 - 2032

8.3.1. Screw Chillers

8.3.2. Centrifugal Chillers

8.3.3. Absorption Chillers

8.3.4. Scroll Chillers

8.3.5. Reciprocating Chillers

8.4. Middle East & Africa Chillers Market Outlook, by Power Range, Value (US$ Bn) & Volume (Units), 2019 - 2032

8.4.1. Less than 50 kW

8.4.2. 50-200 kW

8.4.3. More than 200 kW

8.5. Middle East & Africa Chillers Market Outlook, by End Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2032

8.5.1. Chemicals & petrochemicals

8.5.2. Food & beverages

8.5.3. Medical

8.5.4. Others

8.6. Middle East & Africa Chillers Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2032

8.6.1. GCC Chillers Market Outlook, by Product Type, 2019 - 2032

8.6.2. GCC Chillers Market Outlook, by Form, 2019 - 2032

8.6.3. GCC Chillers Market Outlook, by Production Process, 2019 - 2032

8.6.4. GCC Chillers Market Outlook, by Power Range, 2019 - 2032

8.6.5. GCC Chillers Market Outlook, by End Use Industry, 2019 - 2032

8.6.6. South Africa Chillers Market Outlook, by Product Type, 2019 - 2032

8.6.7. South Africa Chillers Market Outlook, by Form, 2019 - 2032

8.6.8. South Africa Chillers Market Outlook, by Production Process, 2019 - 2032

8.6.9. South Africa Chillers Market Outlook, by Power Range, 2019 - 2032

8.6.10. South Africa Chillers Market Outlook, by End Use Industry, 2019 - 2032

8.6.11. Egypt Chillers Market Outlook, by Product Type, 2019 - 2032

8.6.12. Egypt Chillers Market Outlook, by Form, 2019 - 2032

8.6.13. Egypt Chillers Market Outlook, by Production Process, 2019 - 2032

8.6.14. Egypt Chillers Market Outlook, by Power Range, 2019 - 2032

8.6.15. Egypt Chillers Market Outlook, by End Use Industry, 2019 - 2032

8.6.16. Nigeria Chillers Market Outlook, by Product Type, 2019 - 2032

8.6.17. Nigeria Chillers Market Outlook, by Form, 2019 - 2032

8.6.18. Nigeria Chillers Market Outlook, by Production Process, 2019 - 2032

8.6.19. Nigeria Chillers Market Outlook, by Power Range, 2019 - 2032

8.6.20. Nigeria Chillers Market Outlook, by End Use Industry, 2019 - 2032

8.6.21. Rest of Middle East Chillers Market Outlook, by Product Type, 2019 - 2032

8.6.22. Rest of Middle East Chillers Market Outlook, by Form, 2019 - 2032

8.6.23. Rest of Middle East Chillers Market Outlook, by Production Process, 2019 - 2032

8.6.24. Rest of Middle East Chillers Market Outlook, by Power Range, 2019 - 2032

8.6.25. Rest of Middle East Chillers Market Outlook, by End Use Industry, 2019 - 2032

8.7. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Honeywell International, Inc.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Cold Shot Chillers

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Tandem Chillers

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Drake Refrigeration, Inc

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Refra

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Carrier

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. FRIGEL FIRENZE S.p.A.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Midea

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Daikin Industries, Ltd.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Johnson Controls

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

9.4.11. Rite-Temp

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Developments

9.4.12. General Air Products

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Developments

9.4.13. ClimaCool Corp.

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Developments

9.4.14. Fluid Chillers, Inc.

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Developments

9.4.15. Trane

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Form Coverage |

|

|

Production Process Coverage |

|

|

Power Range Coverage |

|

|

End Use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |