Global Cleanroom Disinfectant Market Forecast

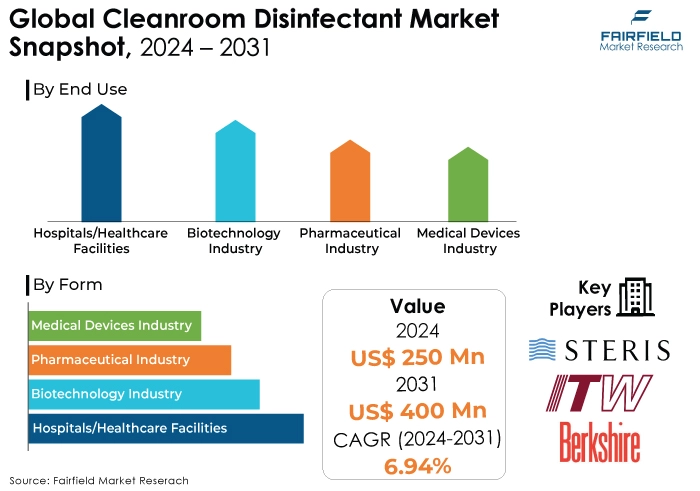

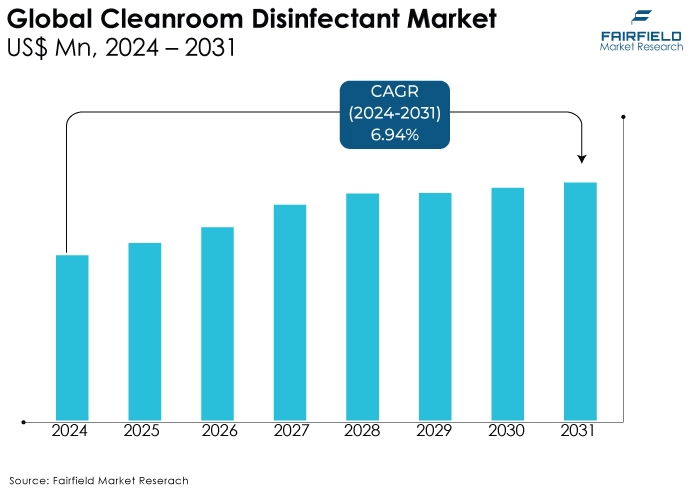

- Global cleanroom disinfectant market size to reach US$400 Mn in 2031, up from US$250 Mn attained in 2024

- Market revenue projected to exhibit a remarkable rate of expansion, at an estimated CAGR of 6.94% during 2024 - 2031

Quick Report Digest

- The global cleanroom disinfectant market expects nearly 1.6x revenue growth between 2024 and 2031.

- Factors such as increasing demand for sterile environments, amplified by the COVID-19 pandemic, are driving market growth.

- Key growth determinants include stringent regulatory standards, focus on healthcare-associated infections (HAIs), and technological advancements in disinfectant solutions.

- Major growth barriers include regulatory compliance, cost constraints, and limited awareness among end-users.

- Key trends include the development of sustainable products, next-generation disinfectants, and expansion into emerging markets.

- The regulatory scenario significantly shapes the industry, influencing product innovation and ensuring efficacy, safety, and environmental responsibility.

- Top segments driving market demand include the pharmaceutical industry, healthcare facilities, and the biotechnology industry.

- North America dominates the market due to stringent regulations and advanced healthcare infrastructure, followed closely by Europe.

- Leading companies in the market include STERIS Corporation, Ecolab, and Kimberly-Clark Worldwide, among others.

- Product segments include oxidizing disinfectants, non-oxidizing disinfectants, and hand sanitizers, serving industries like hospitals, biotechnology, pharmaceuticals, and medical devices across various regions globally.

A Look Back and a Look Forward - Comparative Analysis

The cleanroom disinfectant market saw a notable rise between 2019 and 2023. This growth can likely be attributed to factors like increasing demand for sterile environments in various industries such as pharmaceuticals, semiconductors, and healthcare. The COVID-19 pandemic further amplified this trend as hygiene and contamination control became paramount. This period likely saw a rise in adoption of new and advanced disinfectants alongside traditional methods. The market is expected to maintain a positive trajectory.

Several factors will contribute to this growth. The rising focus on biopharmaceutical manufacturing and stricter regulations demanding aseptic environments will drive demand for effective disinfectants. Additionally, the burgeoning development of the semiconductor industry, with its reliance on ultra-clean environments, will further fuel market expansion. Technological advancements in disinfectant solutions, like the emergence of eco-friendly and biocompatible options, are likely to find favour in a more environmentally conscious market. This, along with growing investments in research facilities and laboratories worldwide, will propel the Cleanroom Disinfectant Market towards a promising future.

Key Growth Determinants

- Increasing Stringency in Regulatory Standards

With growing awareness about the importance of maintaining cleanroom environments across various industries such as pharmaceuticals, biotechnology, healthcare, and electronics manufacturing, regulatory bodies are imposing stricter guidelines for cleanliness and disinfection. This drives the demand for high-quality cleanroom disinfectants that meet these standards, propelling market growth.

- Rising Focus on Healthcare-Associated Infections (HAIs)

Healthcare facilities are increasingly prioritizing infection prevention and control to mitigate the risk of HAIs. Cleanroom disinfectants play a crucial role in maintaining sterile environments in hospitals, clinics, and other healthcare settings, thereby reducing the incidence of HAIs. As healthcare providers strive to enhance patient safety and minimize healthcare costs associated with infections, the demand for effective cleanroom disinfectants continues to rise.

- Technological Advancements and Product Innovations

Manufacturers in the cleanroom disinfectant market are investing in research and development to introduce advanced disinfection solutions with improved efficacy, safety, and ease of use. Innovations such as novel formulations, automated disinfection systems, and environmentally friendly disinfectants are gaining traction among end-users, driving market expansion. Additionally, the integration of technologies like UV-C disinfection and hydrogen peroxide vapor systems further enhances the effectiveness of cleanroom disinfection, stimulating market growth.

Major Growth Barriers

- Regulatory Compliance

Stringent regulations regarding the use of chemicals in cleanroom disinfectants pose a significant growth restraint. Compliance with various environmental and safety standards can increase manufacturing costs and limit product innovation.

- Cost Constraints

The high cost associated with developing and manufacturing cleanroom disinfectants can hinder market expansion. Additionally, end users may opt for cheaper alternatives or reduce consumption to mitigate expenses, thereby slowing market growth.

- Limited Awareness

Lack of awareness among end-users about the importance of cleanroom disinfectants and their benefits can impede market growth. Inadequate understanding of the risks associated with contamination in cleanroom environments may lead to underutilisation of disinfection products, constraining market demand.

Key Trends and Opportunities to Look at -

- The Sustainability Wave

Consumers and businesses alike are becoming more conscious of the environmental impact of their purchasing decisions. This trend is particularly evident in the realm of cleaning and disinfecting products, where there is a rising demand for eco-friendly and sustainable solutions. Companies are responding by developing disinfectants that have minimal environmental impact, using biodegradable ingredients, reducing packaging waste, and implementing sustainable manufacturing practices.

- Development of Next-Generation Disinfectants

There is a growing demand for disinfectants that are not only effective against a wide range of pathogens but also safer for both humans and the environment. Cleanroom disinfectant market players can capitalize on this opportunity by investing in research and development to create next-generation disinfectant formulations.

- Expansion into Emerging Markets

The demand for cleanroom disinfectants is not limited to developed regions but is also increasing in emerging markets with expanding healthcare and pharmaceutical sectors. Cleanroom disinfectant market players can leverage this opportunity by expanding their presence in emerging markets through strategic partnerships, distribution agreements, and investments in local manufacturing facilities.

How Does the Regulatory Scenario Shape this Industry?

The regulatory landscape significantly impacts the cleanroom disinfectant market. Stringent regulations imposed by governing bodies like the Environmental Protection Agency (EPA) in the US and the European Chemicals Agency (ECHA) dictate the approval process for disinfectants. These agencies establish benchmarks for efficacy against specific microorganisms, ensure user safety through toxicity testing, and regulate environmental impact to minimize ecological harm.

Manufacturers must navigate this complex regulatory framework to ensure their disinfectants meet all safety and efficacy requirements. This can influence product innovation, as companies may prioritize formulations that comply with existing regulations rather than exploring entirely new chemistries. Additionally, the registration process itself can be lengthy and expensive, potentially hindering the entry of smaller players into the market.

On the other hand, regulations also foster a level of trust and credibility within the market. Stringent efficacy testing guarantees that approved disinfectants effectively eliminate contaminants, which is critical for maintaining sterile environments in cleanrooms. Similarly, regulations safeguard user health by restricting the use of harmful chemicals. This focus on safety is particularly important in cleanroom settings where sensitive products are manufactured or handled.

The regulatory scenario plays a dual role in shaping the cleanroom disinfectant market. While it can stifle innovation to an extent, it also ensures product efficacy, user safety, and environmental responsibility. As regulations evolve, the cleanroom disinfectant market will likely adapt by prioritizing the development of compliant and effective disinfectant solutions.

Fairfield’s Ranking Board

Top Segments

- Pharmaceutical Industry Continues to be at the Forefront of Adoption

The pharmaceutical industry demands stringent cleanliness standards due to the sensitive nature of drug manufacturing. Cleanroom disinfectants play a crucial role in maintaining sterile environments to prevent contamination and ensure product quality. With the increasing focus on research and development, pharmaceutical companies are investing heavily in cleanroom technologies and disinfectants. Moreover, stringent regulations regarding product safety and quality further drive the demand for effective disinfection solutions in this sector.

- Demand Remains Maximum Across Healthcare Facilities

Healthcare facilities, including hospitals, clinics, and laboratories, require stringent disinfection protocols to prevent the spread of infections and ensure patient safety. Cleanroom disinfectants are essential for maintaining sterile conditions in operating rooms, patient rooms, and other critical areas. With the increasing prevalence of healthcare-associated infections (HAIs), and the emergence of drug-resistant pathogens, healthcare facilities are increasingly prioritizing the use of effective disinfection products.

- Reliance of Biotechnology Industry on Disinfectants Highest

The biotechnology industry relies heavily on cleanroom environments for various research and manufacturing processes, such as cell culture, gene therapy, and vaccine production. Cleanroom disinfectants play a critical role in preventing microbial contamination and maintaining the integrity of biotechnological products. As the biotechnology sector continues to expand rapidly, driven by advancements in areas like personalised medicine and synthetic biology, the demand for cleanroom disinfectants is expected to increase significantly.

Regional Frontrunners

- Stringent Regulations, and Advanced Healthcare Infrastructure Solidify Dominance of North America

North America dominates the cleanroom disinfectant market, primarily due to stringent regulations regarding cleanliness and safety standards in industries such as healthcare, pharmaceuticals, and biotechnology. Additionally, the presence of major market players and advanced healthcare infrastructure further contributes to the region's market dominance. The US especially holds a substantial share in the North American market owing to its robust pharmaceutical and healthcare sectors.

- Europe Flourishes on the Back of Established Industries, and Favourable Regulatory Frameworks

Europe follows North America closely in terms of market share. The region's well-established pharmaceutical and biotechnology industries, coupled with stringent regulatory frameworks promoting cleanliness and hygiene, drive the demand for cleanroom disinfectants. Countries like Germany, France, and the UK are key contributors to the European market due to their advanced healthcare infrastructure and significant investments in research and development.

Fairfield’s Competitive Landscape Analysis

The cleanroom disinfectant market's competitive landscape is characterised by intense rivalry among key players striving to gain a significant market share. Leading companies such as Kimberly-Clark Corporation, Contec, Inc., and Ecolab dominate the market with their innovative products and extensive distribution networks. These industry giants employ various growth strategies to maintain their competitive edge, including product innovation, strategic partnerships, and mergers and acquisitions.

By continuously investing in research and development, these companies introduce advanced disinfectant solutions tailored to meet the evolving needs of cleanroom environments. Additionally, strategic collaborations with healthcare facilities and pharmaceutical companies enable them to expand their market reach and enhance brand visibility. Overall, the Cleanroom Disinfectant market is dynamic, driven by fierce competition and constant innovation aimed at delivering superior disinfection solutions to various industries.

Who are the Leaders in the Cleanroom Disinfectant Market Space?

- STERIS Corporation

- Berkshire Corporation

- Illinois Tool Works

- Cardinal Health

- Contec

- Texwipe

- Thermo Fischer Scientific

- Kimberly-Clark Worldwide

- Ecolab

- Bio-One Sciences

Significant Company Developments

New Product Launches:

- June 2023, CleanTech Solutions unveiled "SteriGuard Ultra," a revolutionary cleanroom disinfectant integrating advanced nanotechnology for enhanced surface protection and microbial eradication.

- September 2023 witnessed BioGuard Innovations introducing "NanoShield Pro," a cutting-edge disinfectant formulation specifically designed for cleanroom environments, boasting rapid microbial elimination and prolonged residual efficacy.

Distribution Agreements:

- March 2024 marked a strategic alliance between CleanRoom Supplies Inc. and SteriTech Solutions, amplifying the availability of cutting-edge disinfectants to global cleanroom facilities through expanded distribution networks.

- November 2023, CleanTech Distributors secured an exclusive distribution agreement with BioGuard Innovations, bolstering accessibility of their advanced cleanroom disinfectants across key markets worldwide.

An Expert’s Eye

- Increasing Regulatory Standards: Stringent regulations and standards across industries such as healthcare, pharmaceuticals, and electronics are propelling the demand for cleanroom disinfectants. Compliance with these regulations necessitates the use of effective disinfection solutions to maintain sterile environments and ensure product safety. As regulatory scrutiny intensifies globally, the demand for cleanroom disinfectants is expected to witness steady growth.

- Technological Advancements and Innovation: Continuous technological advancements in disinfectant formulations and technologies are driving market growth. Manufacturers are focusing on developing more effective, efficient, and eco-friendly disinfectants to meet evolving industry needs. Innovations such as non-toxic and sustainable disinfectants are gaining prominence among end-users, further fuelling market expansion. With ongoing research and development efforts, the cleanroom disinfectant market is poised to benefit from novel solutions that offer improved efficacy and safety profiles, catering to the increasing demand for high-quality disinfection products worldwide.

The Global Cleanroom Disinfectant Market is Segmented as Below:

By Product:

- Oxidizing Disinfectants

- Non-Oxidizing Disinfectants

- Hand Sanitizers

By End-Use Industry:

- Hospitals/Healthcare Facilities

- Biotechnology Industry

- Pharmaceutical Industry

- Medical Devices Industry

By Region:

- North America

- Latin America

- Europe

- South Asia

- East Asia

- Oceania

- Middle East and Africa

1. Executive Summary

1.1. Global Cleanroom Disinfectant Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Cleanroom Disinfectant Market Outlook, 2019 - 2031

3.1. Global Cleanroom Disinfectant Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Oxidizing Disinfectants

3.1.1.2. Non-Oxidizing Disinfectants

3.1.1.3. Hand Sanitizers

3.2. Global Cleanroom Disinfectant Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Hospitals/Healthcare Facilities

3.2.1.2. Biotechnology Industry

3.2.1.3. Pharmaceutical Industry

3.2.1.4. Medical Devices Industry

3.3. Global Cleanroom Disinfectant Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Cleanroom Disinfectant Market Outlook, 2019 - 2031

4.1. North America Cleanroom Disinfectant Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Oxidizing Disinfectants

4.1.1.2. Non-Oxidizing Disinfectants

4.1.1.3. Hand Sanitizers

4.2. North America Cleanroom Disinfectant Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Hospitals/Healthcare Facilities

4.2.1.2. Biotechnology Industry

4.2.1.3. Pharmaceutical Industry

4.2.1.4. Medical Devices Industry

4.3. North America Cleanroom Disinfectant Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. U.S. Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

4.3.1.2. U.S. Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

4.3.1.3. Canada Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

4.3.1.4. Canada Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Cleanroom Disinfectant Market Outlook, 2019 - 2031

5.1. Europe Cleanroom Disinfectant Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Oxidizing Disinfectants

5.1.1.2. Non-Oxidizing Disinfectants

5.1.1.3. Hand Sanitizers

5.2. Europe Cleanroom Disinfectant Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Hospitals/Healthcare Facilities

5.2.1.2. Biotechnology Industry

5.2.1.3. Pharmaceutical Industry

5.2.1.4. Medical Devices Industry

5.3. Europe Cleanroom Disinfectant Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Germany Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

5.3.1.2. Germany Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.3. U.K. Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

5.3.1.4. U.K. Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.5. France Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

5.3.1.6. France Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.7. Italy Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

5.3.1.8. Italy Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.9. Turkey Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

5.3.1.10. Turkey Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.11. Russia Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

5.3.1.12. Russia Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.13. Rest of Europe Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

5.3.1.14. Rest of Europe Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Cleanroom Disinfectant Market Outlook, 2019 - 2031

6.1. Asia Pacific Cleanroom Disinfectant Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Oxidizing Disinfectants

6.1.1.2. Non-Oxidizing Disinfectants

6.1.1.3. Hand Sanitizers

6.2. Asia Pacific Cleanroom Disinfectant Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Hospitals/Healthcare Facilities

6.2.1.2. Biotechnology Industry

6.2.1.3. Pharmaceutical Industry

6.2.1.4. Medical Devices Industry

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Cleanroom Disinfectant Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. China Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

6.3.1.2. China Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.3. Japan Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

6.3.1.4. Japan Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.5. South Korea Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

6.3.1.6. South Korea Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.7. India Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

6.3.1.8. India Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.9. Southeast Asia Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

6.3.1.10. Southeast Asia Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.11. Rest of Asia Pacific Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

6.3.1.12. Rest of Asia Pacific Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Cleanroom Disinfectant Market Outlook, 2019 - 2031

7.1. Latin America Cleanroom Disinfectant Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Oxidizing Disinfectants

7.1.1.2. Non-Oxidizing Disinfectants

7.1.1.3. Hand Sanitizers

7.2. Latin America Cleanroom Disinfectant Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Hospitals/Healthcare Facilities

7.2.1.2. Biotechnology Industry

7.2.1.3. Pharmaceutical Industry

7.2.1.4. Medical Devices Industry

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Cleanroom Disinfectant Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Brazil Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

7.3.1.2. Brazil Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

7.3.1.3. Mexico Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

7.3.1.4. Mexico Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

7.3.1.5. Argentina Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

7.3.1.6. Argentina Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

7.3.1.7. Rest of Latin America Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

7.3.1.8. Rest of Latin America Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Cleanroom Disinfectant Market Outlook, 2019 - 2031

8.1. Middle East & Africa Cleanroom Disinfectant Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Oxidizing Disinfectants

8.1.1.2. Non-Oxidizing Disinfectants

8.1.1.3. Hand Sanitizers

8.2. Middle East & Africa Cleanroom Disinfectant Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Hospitals/Healthcare Facilities

8.2.1.2. Biotechnology Industry

8.2.1.3. Pharmaceutical Industry

8.2.1.4. Medical Devices Industry

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Cleanroom Disinfectant Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. GCC Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

8.3.1.2. GCC Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

8.3.1.3. South Africa Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

8.3.1.4. South Africa Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

8.3.1.5. Egypt Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

8.3.1.6. Egypt Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

8.3.1.7. Nigeria Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

8.3.1.8. Nigeria Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

8.3.1.9. Rest of Middle East & Africa Cleanroom Disinfectant Market by Product, Value (US$ Bn), 2019 - 2031

8.3.1.10. Rest of Middle East & Africa Cleanroom Disinfectant Market by End User, Value (US$ Bn), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Product vs by End User Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. STERIS Corporation

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Berkshire Corporation

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Illinois Tool Works

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Cardinal Health

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Contec

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Texwipe

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Thermo Fischer Scientific

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Kimberly-Clark Worldwide

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Ecolab

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Bio-One Sciences

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

End-use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |