Global Collagen Supplements Market Forecast

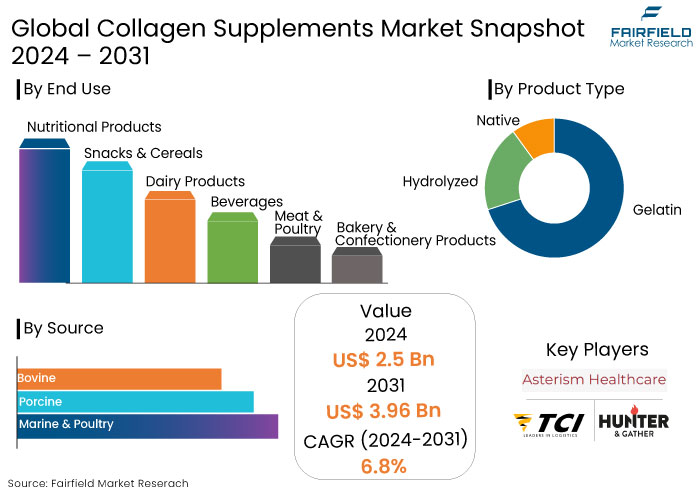

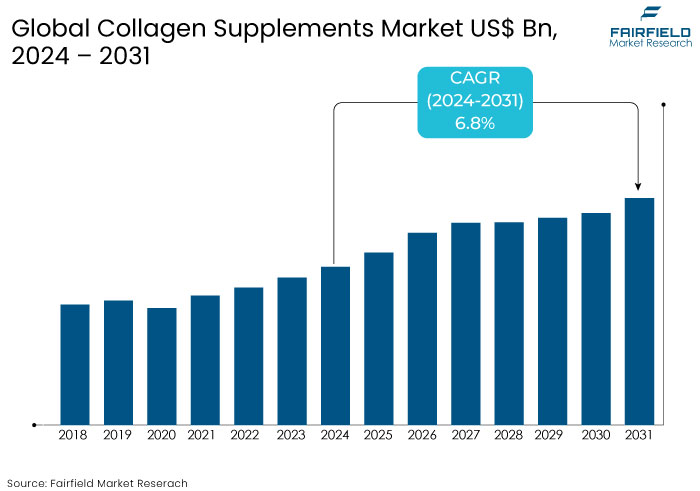

- The collagen supplements market is expected to reach a size of US$3.96 Bn by 2031, showing significant growth from US$2.5 Bn attained in 2024.

- The market valuation for collagen supplements is anticipated to expand at a CAGR of 6.8% from 2024 to 2031.

Collagen Supplements Market Insights

- Increasing consumer focus on health and wellness drives demand for collagen supplements globally.

- A growing elderly demographic boosts demand for collagen as a solution for skin aging and joint health.

- Marine and plant-based collagen alternatives are gaining popularity due to ethical and environmental concerns.

- Online platforms significantly enhance accessibility and visibility, driving collagen supplements market

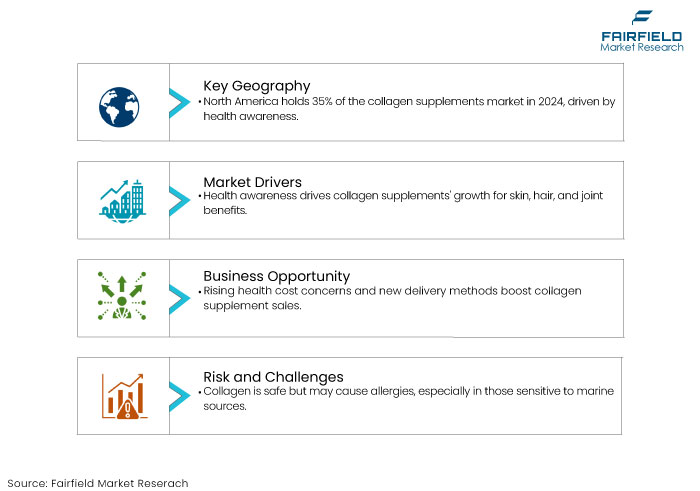

- North America leads the market, while Asia Pacific is the notably growing region, driven by beauty and health trends.

- Collagen supplements are increasingly marketed for their anti-aging and skin-enhancing benefits.

- Pills and gummies accumulate a 60% market share

- Bovine source collagen leads the market by source with a 34% of market share.

A Look Back and a Look Forward - Comparative Analysis

The collagen supplements market experienced steady growth during the period from 2019 to 2023, driven by the rising consumer awareness of health and wellness. Increasing demand for functional foods and beverages, coupled with the aging population's focus on joint health, skin elasticity, and overall vitality, played a significant role in market expansion.

The market witnessed notable uptake in regions like North America, Europe, and Asia Pacific, with powder and capsule forms dominating due to their convenience and efficacy. Over the forecast period, the market is projected to accelerate significantly, fueled by advancements in manufacturing technologies. These technologies include enhanced extraction methods and sustainable sourcing practices.

Growing acceptance of collagen supplements among young demographics, driven by the influence of social media and fitness trends is likely to expand the consumer base further. Plant-based and vegan collagen alternatives are anticipated to capture a growing share, addressing the demand for ethical and sustainable options.

Personalized nutrition trends and innovations in delivery formats, like gummies and ready-to-drink collagen beverages, will drive market expansion further.

Key Growth Determinants

- Increasing Focus on Health and Wellness

The increasing consumer focus on health and wellness is a primary growth driver for the collagen supplements market. People are becoming more aware of the benefits of collagen in improving skin elasticity, strengthening hair and nails, and promoting joint and bone health.

As the global population ages, the demand for products that combat aging effects, such as wrinkles and joint pain, has risen significantly. Collagen supplements are often marketed as anti-aging solutions, particularly for older demographics looking to maintain vitality and mobility.

Young consumers, influenced by fitness trends and social media, incorporate collagen into their routines to enhance workout recovery and boost muscle mass. The said broad appeal across age groups is expanding the consumer base of market.

- Innovation in Product Offerings and Delivery Formats Surges Sales

Advancements in product formulations and delivery methods are revolutionizing the collagen supplements market. Companies are developing innovative delivery formats, such as flavoured powders, gummies, and ready-to-drink beverages, making collagen supplements more appealing and convenient for on-the-go consumers.

Fortified products combining collagen with other nutrients, like vitamins and antioxidants, cater to the growing trend of functional foods. The availability of vegan and plant-based collagen alternatives, created through fermentation and bioengineering, addresses the needs of ethical and environmentally conscious consumers. Such innovations make collagen supplements more accessible and attractive, driving market penetration.

Key Growth Barriers

- Allergic Reactions to Collagen Compounds Generated from Animals

Although collagen is deemed safe for supplementation, certain individuals may exhibit allergies to collagen as an element in nutraceutical dietary supplements. A fraction of the consumers may experience allergies and intolerances related to collagen sourced from marine origins. Individuals with a history of fish allergy had anaphylaxis after consuming collagen products and marine-derived derivatives.

Collagen is available in supplement form; however, many of these supplements likely contain fillers and artificial chemicals that may provoke allergic reactions. Collagen supplements may cause adverse effects, including bloating, an unpleasant taste, diarrhoea, and skin rashes in certain individuals. These supplements can vary across individuals and may contain heavy metals and animal-derived components, consequently can result in skin sensitivities and rashes on body. This factor remains a key barrier for the collagen supplements market.

- Lack of Consumer Awareness and Skepticism

Despite increasing awareness, many consumers still need to become familiar with collagen supplements' specific benefits and applications. In regions with limited health education, the concept of functional supplements like collagen is still emerging.

Certain consumers are skeptical about the efficacy of collagen supplements, particularly when comparing them to topical beauty products or traditional dietary sources. Conflicting information and misleading claims in marketing also contribute to this skepticism, hindering consumer trust and adoption. Addressing these knowledge gaps and ensuring transparency in product benefits are critical challenges for the industry.

Collagen Supplements Market Trends and Opportunities

- Trend of Preventive Healthcare Approach

An increasing inclination toward supplements to mitigate healthcare expenses is expected to enhance the collagen supplements market. The emergence of novel delivery methods, empirical evidence substantiating the assertions, and increased consumer awareness are anticipated to drive the sales of collagen supplements.

The UN population data indicates that Europe possesses the high aging demographic globally, with one in four Europeans aged 60 and above. Italy, Germany, France, Denmark, and Spain are prominent nations in Europe with the largest proportions of elderly populations.

A poll of supplement users conducted by Swiss multinational Lonza and the Natural Marketing Institute (NMI) revealed that 70% of consumers in Germany, France, and Italy would contemplate acquiring a joint health product. Numerous health advantages, including bone, muscle, and joint health, along with cost-effectiveness, have led consumers to increasingly choose collagen supplements.

The use of collagen supplements mitigates the risk of bone problems such as osteoporosis. They can enhance bone mineral density (BMD) and reduce the concentration of substances in the blood that promote bone resorption.

- Expansion of Plant-Based and Vegan Collagen Alternatives Spurs Market Revenue

The growing demand for ethical and sustainable products presents a transformative opportunity in the collagen supplements market. Traditional collagen is sourced from animal products, which limits its appeal to vegan and environmentally conscious consumers.

Advances in biotechnology are enabling the development of plant-based and lab-engineered collagen alternatives. Such products mimic the structure and benefits of animal-derived collagen but are produced through fermentation or genetic engineering of microorganisms.

Such innovation broadens the consumer base of market, catering to vegans, vegetarians, and those seeking sustainable options. As awareness grows and production scales improve, plant-based collagen is poised to become a key growth segment.

How Does Regulatory Scenario Shape the Industry?

The regulatory landscape plays a crucial role in shaping the collagen supplements market by ensuring product safety, quality, and transparency. Governments and regulatory agencies globally, such as the FDA in the United States and the EFSA in Europe, have set strict guidelines for dietary supplements, including collagen products. These regulations cover sourcing, manufacturing practices, labelling, and health claims.

One significant regulatory influence is the requirement for clear and substantiated claims. Companies must provide scientific evidence to support statements about collagen’s benefits for skin, joints, and overall health. Regulations promoting clean labelling are driving manufacturers to use natural, allergen-free, and sustainably sourced ingredients.

Emerging standards around animal welfare and sustainability are also shaping the market. For instance, collagen derived from marine or grass-fed sources must comply with ethical and eco-friendly practices to meet consumer expectations and government standards.

The growing demand for vegan collagen alternatives has prompted regulatory bodies to establish guidelines for plant-based and lab-engineered products, further broadening market opportunities. The evolving regulatory environment fosters innovation while ensuring consumer safety and trust in collagen supplements.

Segments Covered in the Report

- Pills and Gummies Form of Collagens Take the Lead

Pills and gummies accumulated around 60% of the global market share in 2024. Consumers predominantly favour pills and gummies due to their simplicity as a collagen supplement. The rising demand for collagen supplements in pill and gummy form and the increased use of dietary supplements are driving this segment growth.

The rising consumer inclination toward using nutritional supplements and enhanced muscle growth post-exercise are projected to stimulate collagen supplements market expansion. Due to rising demand, the powder form is projected to exhibit the most significant growth during the forecast period.

The increasing need for collagen supplements, augmented disposable incomes, and evolving lifestyles are additional factors propelling the expansion of this category. The powdered form is the most used type of collagen supplement. It can be combined with water and many sorts of liquids. A variety of tastes is also available in the market.

The powdered collagen supplement aids in fortifying hair, bones, joints, and nails. It also aids in enhancing gastrointestinal health and digestive disorders. Its demand is anticipated to rise in the near future. The segment is projected to exhibit a rise over the projection period.

- Bovine Source Collagen Accumulates 34% of the Total Market Share

Bovine-sourced collagen, sourced primarily from cow hides, bones, and cartilage, is the dominant segment in the collagen supplements market. It is widely recognized for its versatility, affordability, and effectiveness, making it a preferred choice across multiple industries, including food, healthcare, and cosmetics.

Bovine collagen is high in these collagen types, which are essential for improving skin elasticity, joint health, and muscle repair. The abundant supply of cattle by products globally ensures steady raw material availability, contributing to its cost-effectiveness. It contains essential amino acids like glycine and proline, which are crucial for maintaining skin and bone health.

Bovine collagen is commonly used in powders, capsules, and beverages aimed at promoting anti-aging, joint mobility, and muscle recovery. Its skin-rejuvenating properties make it a key ingredient in anti-aging creams, serums, and supplements targeting skin elasticity and hydration. Bovine collagen is utilized in healthcare for wound healing, tissue regeneration, and orthopedic implants due to its biocompatibility.

Regional Analysis

- Large Consumer Base in North America to Bolster Regional Growth

North America leads the global collagen supplements market, accounting for a 35% of the market share as of 2024. A large consumer base with increased health awareness and substantial spending on nutritional supplements drives the dominance of regional market.

The United States, in particular, contributes significantly due to the presence of leading manufacturers and widespread product availability across diverse distribution channels, including pharmacies and online stores.

A strong emphasis on preventive healthcare and wellness drives demand for collagen supplements in North America. Consumers seek collagen for benefits like improved skin elasticity, joint health, and muscle recovery.

The rising number of aging individuals has increased the demand for anti-aging and joint support products, with collagen being a primary ingredient. Retail outlets, pharmacies, and e-commerce platforms ensure easy accessibility to collagen products in the region, which drives the market forward.

- Asia Pacific to Witness Notable Growth

Asia Pacific is emerging as the rapidly growing market for collagen supplements and is projected to experience a CAGR of 6.8% from 2024 to 2031. The growth of Asia pacific collagen supplements market is attributed to increasing disposable incomes in countries like China, India, and South Korea, coupled with a rising middle-class population.

The aging demographic in nations such as Japan and China also drives demand for collagen supplements for joint and bone health. Expanding e-commerce platforms and innovative marketing strategies enhance product accessibility and consumer engagement.

Increasing health consciousness and education about the benefits of collagen for skin, joints, and overall health are driving demand. Countries like Japan and China have significant aging populations, fuelling demand for collagen supplements to address age-related concerns like bone density and skin aging.

In countries like South Korea and Japan, collagen supplements are mainly promoted as beauty enhancers, aligning with the strong cultural emphasis on skincare and cosmetics. The expansion of online shopping platforms has made collagen products more accessible to consumers, especially in emerging markets like India and Southeast Asia.

Fairfield’s Competitive Landscape Analysis

The collagen supplements market is highly competitive, driven by innovation and expanding consumer demand. Key players like Vital Proteins, NeoCell, and Nature’s Bounty dominate the market with established brand recognition and diverse product portfolios.

Leading companies focus on research and development to introduce innovative formats such as gummies, ready-to-drink beverages, and vegan alternatives. Emerging players leverage e-commerce and social media to tap into young, health-conscious demographics. Partnerships, acquisitions, and sustainability initiatives are common strategies to expand market presence.

Regional players in Asia Pacific, such as Shiseido, cater to localized beauty trends, further intensifying competition. As the market evolves, technological advancements, clean-label trends, and ethical sourcing practices remain critical to gain a competitive edge.

Key Market Companies

- Further, Inc.

- Glanbia PLC

- Hunter & Gather Foods Ltd

- Tci Co., Ltd.

- The Bountiful Company

- The Clorox Company

- Shiseido Company Limited

- Amorepacific Corporation

- The Protein Drinks Co.

- Asterism Healthcare

- Hangzhou Nutrition Biotechnology Co., Ltd.

- Aneva Nutraceuticals Ltd.

- Bottled Science Ltd.

- Bauer Nutrition USA

- Wilmar Sugar Pty Ltd.

- Elavonne

- Optimum Nutrition, INC

- Vital Proteins LLC.

- Hunter&Gather

- Nature’S Bounty Co.

- Codeage LLC.

Recent Industry Developments

- In February 2024, L'Oréal launched the second version of their Age Perfect Collagen Royal Anti-Aging Face Cream, successfully entering China's burgeoning recombinant collagen industry.

- In November 2023, Elemis announced the launch of Pro-Collagen Skin Future Supplements in 2024. The product, which includes food-grade hyaluronic acid, an antioxidant blend, chlorella, and vitamins A&C.

An Expert’s Eye

- Rising consumer awareness of collagen's benefits for skin, joints, and overall health is a key driver for collagen supplements market.

- Introducing new delivery formats, such as gummies and beverages, expands market reach and caters to diverse consumer preferences.

- An aging global demographic is significantly boosting demand for collagen supplements as anti-aging and joint health solutions.

- The rise of online retail and social media marketing is transforming the market by enhancing product visibility and consumer engagement.

Global Collagen Supplements Market is Segmented as-

By Product Type

- Gelatin

- Hydrolyzed

- Native

By Form

- Pills & Gummies

- Powder

- Liquid/Drink

By Source

- Bovine

- Porcine

- Marine & Poultry

By End Use

- Nutritional Products

- Snacks & Cereals

- Dairy Products

- Beverages

- Meat & Poultry

- Bakery & Confectionery Products

By Sales Channel

- Pharmacies

- Specialty Outlets

- Supermarkets/Hypermarkets

- Convenience Stores

- E-Retailers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Collagen Supplements Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Collagen Supplements Market Outlook, 2019 - 2031

3.1. Global Collagen Supplements Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Gelatin

3.1.1.2. Hydrolyzed

3.1.1.3. Native

3.2. Global Collagen Supplements Market Outlook, by Type, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Type I Collagen

3.2.1.2. Type II Collagen

3.2.1.3. Type III Collagen

3.2.1.4. Type V/X Collagen

3.3. Global Collagen Supplements Market Outlook, by Form, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Pills & Gummies

3.3.1.2. Powder

3.3.1.3. Liquid/Drink

3.4. Global Collagen Supplements Market Outlook, by Source, Value (US$ Bn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. Bovine

3.4.1.2. Porcine

3.4.1.3. Marine & Poultry

3.5. Global Collagen Supplements Market Outlook, by End Use, Value (US$ Bn), 2019 - 2031

3.5.1. Key Highlights

3.5.1.1. Nutritional Products

3.5.1.2. Snacks & Cereals

3.5.1.3. Dairy Products

3.5.1.4. Beverages

3.5.1.5. Meat & Poultry

3.5.1.6. Bakery & Confectionery Products

3.6. Global Collagen Supplements Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2031

3.6.1. Key Highlights

3.6.1.1. Pharmacies

3.6.1.2. Specialty Outlets

3.6.1.3. Supermarkets/Hypermarkets

3.6.1.4. Convenience Stores

3.6.1.5. E-Retailers

3.6.1.6. Others

3.7. Global Collagen Supplements Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.7.1. Key Highlights

3.7.1.1. North America

3.7.1.2. Europe

3.7.1.3. Asia Pacific

3.7.1.4. Latin America

3.7.1.5. Middle East & Africa

4. North America Collagen Supplements Market Outlook, 2019 - 2031

4.1. North America Collagen Supplements Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Gelatin

4.1.1.2. Hydrolyzed

4.1.1.3. Native

4.2. North America Collagen Supplements Market Outlook, by Type, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Type I Collagen

4.2.1.2. Type II Collagen

4.2.1.3. Type III Collagen

4.2.1.4. Type V/X Collagen

4.3. North America Collagen Supplements Market Outlook, by Form, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Pills & Gummies

4.3.1.2. Powder

4.3.1.3. Liquid/Drink

4.4. North America Collagen Supplements Market Outlook, by Source, Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. Bovine

4.4.1.2. Porcine

4.4.1.3. Marine & Poultry

4.5. North America Collagen Supplements Market Outlook, by End Use, Value (US$ Bn), 2019 - 2031

4.5.1. Key Highlights

4.5.1.1. Nutritional Products

4.5.1.2. Snacks & Cereals

4.5.1.3. Dairy Products

4.5.1.4. Beverages

4.5.1.5. Meat & Poultry

4.5.1.6. Bakery & Confectionery Products

4.5.2. BPS Analysis/Market Attractiveness Analysis

4.6. North America Collagen Supplements Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2031

4.6.1. Key Highlights

4.6.1.1. Pharmacies

4.6.1.2. Specialty Outlets

4.6.1.3. Supermarkets/Hypermarkets

4.6.1.4. Convenience Stores

4.6.1.5. E-Retailers

4.6.1.6. Others

4.6.2. BPS Analysis/Market Attractiveness Analysis

4.7. North America Collagen Supplements Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.7.1. Key Highlights

4.7.1.1. U.S. Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

4.7.1.2. U.S. Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

4.7.1.3. U.S. Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

4.7.1.4. U.S. Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

4.7.1.5. U.S. Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

4.7.1.6. U.S. Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

4.7.1.7. Canada Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

4.7.1.8. Canada Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

4.7.1.9. Canada Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

4.7.1.10. Canada Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

4.7.1.11. Canada Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

4.7.1.12. Canada Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

4.7.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Collagen Supplements Market Outlook, 2019 - 2031

5.1. Europe Collagen Supplements Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Gelatin

5.1.1.2. Hydrolyzed

5.1.1.3. Native

5.2. Europe Collagen Supplements Market Outlook, by Type, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Type I Collagen

5.2.1.2. Type II Collagen

5.2.1.3. Type III Collagen

5.2.1.4. Type V/X Collagen

5.3. Europe Reusable Water Bottles Market Outlook, by Form, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Pills & Gummies

5.3.1.2. Powder

5.3.1.3. Liquid/Drink

5.4. Europe Collagen Supplements Market Outlook, by Source, Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Bovine

5.4.1.2. Porcine

5.4.1.3. Marine & Poultry

5.5. North America Collagen Supplements Market Outlook, by End Use, Value (US$ Bn), 2019 - 2031

5.5.1. Key Highlights

5.5.1.1. Nutritional Products

5.5.1.2. Snacks & Cereals

5.5.1.3. Dairy Products

5.5.1.4. Beverages

5.5.1.5. Meat & Poultry

5.5.1.6. Bakery & Confectionery Products

5.5.2. BPS Analysis/Market Attractiveness Analysis

5.6. North America Collagen Supplements Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2031

5.6.1. Key Highlights

5.6.1.1. Pharmacies

5.6.1.2. Specialty Outlets

5.6.1.3. Supermarkets/Hypermarkets

5.6.1.4. Convenience Stores

5.6.1.5. E-Retailers

5.6.1.6. Others

5.6.2. BPS Analysis/Market Attractiveness Analysis

5.7. Europe Collagen Supplements Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.7.1. Key Highlights

5.7.1.1. Germany Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

5.7.1.2. Germany Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

5.7.1.3. Germany Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

5.7.1.4. Germany Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

5.7.1.5. Germany Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

5.7.1.6. Germany Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.7.1.7. U.K. Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

5.7.1.8. U.K. Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

5.7.1.9. U.K. Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

5.7.1.10. U.K. Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

5.7.1.11. U.K. Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

5.7.1.12. U.K. Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.7.1.13. France Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

5.7.1.14. France Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

5.7.1.15. France Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

5.7.1.16. France Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

5.7.1.17. France Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

5.7.1.18. France Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.7.1.19. Italy Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

5.7.1.20. Italy Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

5.7.1.21. Italy Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

5.7.1.22. Italy Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

5.7.1.23. Italy Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

5.7.1.24. Italy Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.7.1.25. Turkey Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

5.7.1.26. Turkey Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

5.7.1.27. Turkey Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

5.7.1.28. Turkey Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

5.7.1.29. Turkey Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

5.7.1.30. Turkey Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.7.1.31. Russia Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

5.7.1.32. Russia Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

5.7.1.33. Russia Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

5.7.1.34. Russia Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

5.7.1.35. Russia Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

5.7.1.36. Russia Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.7.1.37. Rest of Europe Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

5.7.1.38. Rest of Europe Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

5.7.1.39. Rest of Europe Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

5.7.1.40. Rest of Europe Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

5.7.1.41. Rest of Europe Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

5.7.1.42. Rest of Europe Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.7.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Collagen Supplements Market Outlook, 2019 - 2031

6.1. Asia Pacific Collagen Supplements Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Gelatin

6.1.1.2. Hydrolyzed

6.1.1.3. Native

6.2. Asia Pacific Collagen Supplements Market Outlook, by Type, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Type I Collagen

6.2.1.2. Type II Collagen

6.2.1.3. Type III Collagen

6.2.1.4. Type V/X Collagen

6.3. Asia Pacific Collagen Supplements Market Outlook, by Form, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Pills & Gummies

6.3.1.2. Powder

6.3.1.3. Liquid/Drink

6.4. Asia Pacific Collagen Supplements Market Outlook, by Source, Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Bovine

6.4.1.2. Porcine

6.4.1.3. Marine & Poultry

6.5. Asia Pacific Collagen Supplements Market Outlook, by End Use, Value (US$ Bn), 2019 - 2031

6.5.1. Key Highlights

6.5.1.1. Nutritional Products

6.5.1.2. Snacks & Cereals

6.5.1.3. Dairy Products

6.5.1.4. Beverages

6.5.1.5. Meat & Poultry

6.5.1.6. Bakery & Confectionery Products

6.5.2. BPS Analysis/Market Attractiveness Analysis

6.6. Asia Pacific Collagen Supplements Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2031

6.6.1. Key Highlights

6.6.1.1. Pharmacies

6.6.1.2. Specialty Outlets

6.6.1.3. Supermarkets/Hypermarkets

6.6.1.4. Convenience Stores

6.6.1.5. E-Retailers

6.6.1.6. Others

6.6.2. BPS Analysis/Market Attractiveness Analysis

6.7. Asia Pacific Collagen Supplements Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.7.1. Key Highlights

6.7.1.1. China Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

6.7.1.2. China Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

6.7.1.3. China Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

6.7.1.4. China Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

6.7.1.5. China Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

6.7.1.6. China Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

6.7.1.7. Japan Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

6.7.1.8. Japan Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

6.7.1.9. Japan Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

6.7.1.10. Japan Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

6.7.1.11. Japan Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

6.7.1.12. Japan Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

6.7.1.13. South Korea Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

6.7.1.14. South Korea Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

6.7.1.15. South Korea Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

6.7.1.16. South Korea Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

6.7.1.17. South Korea Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

6.7.1.18. South Korea Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

6.7.1.19. India Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

6.7.1.20. India Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

6.7.1.21. India Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

6.7.1.22. India Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

6.7.1.23. India Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

6.7.1.24. India Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

6.7.1.25. Southeast Asia Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

6.7.1.26. Southeast Asia Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

6.7.1.27. Southeast Asia Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

6.7.1.28. Southeast Asia Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

6.7.1.29. Southeast Asia Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

6.7.1.30. Southeast Asia Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

6.7.1.31. Rest of Asia Pacific Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

6.7.1.32. Rest of Asia Pacific Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

6.7.1.33. Rest of Asia Pacific Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

6.7.1.34. Rest of Asia Pacific Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

6.7.1.35. Rest of Asia Pacific Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

6.7.1.36. Rest of Asia Pacific Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

6.7.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Collagen Supplements Market Outlook, 2019 - 2031

7.1. Latin America Collagen Supplements Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Gelatin

7.1.1.2. Hydrolyzed

7.1.1.3. Native

7.2. Latin America Collagen Supplements Market Outlook, by Type, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.2.1.1. Type I Collagen

7.2.1.2. Type II Collagen

7.2.1.3. Type III Collagen

7.2.1.4. Type V/X Collagen

7.3. Latin America Collagen Supplements Market Outlook, by Form, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Pills & Gummies

7.3.1.2. Powder

7.3.1.3. Liquid/Drink

7.4. Latin America Collagen Supplements Market Outlook, by Source, Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Bovine

7.4.1.2. Porcine

7.4.1.3. Marine & Poultry

7.5. Latin America Collagen Supplements Market Outlook, by End Use, Value (US$ Bn), 2019 - 2031

7.5.1. Key Highlights

7.5.1.1. Nutritional Products

7.5.1.2. Snacks & Cereals

7.5.1.3. Dairy Products

7.5.1.4. Beverages

7.5.1.5. Meat & Poultry

7.5.1.6. Bakery & Confectionery Products

7.5.2. BPS Analysis/Market Attractiveness Analysis

7.6. Latin America Collagen Supplements Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2031

7.6.1. Key Highlights

7.6.1.1. Pharmacies

7.6.1.2. Specialty Outlets

7.6.1.3. Supermarkets/Hypermarkets

7.6.1.4. Convenience Stores

7.6.1.5. E-Retailers

7.6.1.6. Others

7.6.2. BPS Analysis/Market Attractiveness Analysis

7.7. Latin America Collagen Supplements Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.7.1. Key Highlights

7.7.1.1. Brazil Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

7.7.1.2. Brazil Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

7.7.1.3. Brazil Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

7.7.1.4. Brazil Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

7.7.1.5. Brazil Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

7.7.1.6. Brazil Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

7.7.1.7. Mexico Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

7.7.1.8. Mexico Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

7.7.1.9. Mexico Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

7.7.1.10. Mexico Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

7.7.1.11. Mexico Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

7.7.1.12. Mexico Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

7.7.1.13. Argentina Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

7.7.1.14. Argentina Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

7.7.1.15. Argentina Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

7.7.1.16. Argentina Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

7.7.1.17. Argentina Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

7.7.1.18. Argentina Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

7.7.1.19. Rest of Latin America Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

7.7.1.20. Rest of Latin America Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

7.7.1.21. Rest of Latin America Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

7.7.1.22. Rest of Latin America Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

7.7.1.23. Rest of Latin America Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

7.7.1.24. Rest of Latin America Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

7.7.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Collagen Supplements Market Outlook, 2019 - 2031

8.1. Middle East & Africa Collagen Supplements Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Gelatin

8.1.1.2. Hydrolyzed

8.1.1.3. Native

8.2. Middle East & Africa Collagen Supplements Market Outlook, by Type, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Type I Collagen

8.2.1.2. Type II Collagen

8.2.1.3. Type III Collagen

8.2.1.4. Type V/X Collagen

8.3. Middle East & Africa Collagen Supplements Market Outlook, by Form, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Pills & Gummies

8.3.1.2. Powder

8.3.1.3. Liquid/Drink

8.4. Middle East & Africa Collagen Supplements Market Outlook, by Source, Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Bovine

8.4.1.2. Porcine

8.4.1.3. Marine & Poultry

8.5. Middle East & Africa Collagen Supplements Market Outlook, by End Use, Value (US$ Bn), 2019 - 2031

8.5.1. Key Highlights

8.5.1.1. Nutritional Products

8.5.1.2. Snacks & Cereals

8.5.1.3. Dairy Products

8.5.1.4. Beverages

8.5.1.5. Meat & Poultry

8.5.1.6. Bakery & Confectionery Products

8.5.2. BPS Analysis/Market Attractiveness Analysis

8.6. Middle East & Africa Collagen Supplements Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2031

8.6.1. Key Highlights

8.6.1.1. Pharmacies

8.6.1.2. Specialty Outlets

8.6.1.3. Supermarkets/Hypermarkets

8.6.1.4. Convenience Stores

8.6.1.5. E-Retailers

8.6.1.6. Others

8.6.2. BPS Analysis/Market Attractiveness Analysis

8.7. Middle East & Africa Collagen Supplements Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.7.1. Key Highlights

8.7.1.1. GCC Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

8.7.1.2. GCC Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

8.7.1.3. GCC Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

8.7.1.4. GCC Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

8.7.1.5. GCC Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

8.7.1.6. GCC Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

8.7.1.7. South Africa Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

8.7.1.8. South Africa Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

8.7.1.9. South Africa Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

8.7.1.10. South Africa Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

8.7.1.11. South Africa Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

8.7.1.12. South Africa Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

8.7.1.13. Egypt Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

8.7.1.14. Egypt Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

8.7.1.15. Egypt Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

8.7.1.16. Egypt Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

8.7.1.17. Egypt Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

8.7.1.18. Egypt Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

8.7.1.19. Nigeria Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

8.7.1.20. Nigeria Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

8.7.1.21. Nigeria Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

8.7.1.22. Nigeria Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

8.7.1.23. Nigeria Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

8.7.1.24. Nigeria Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

8.7.1.25. Rest of Middle East & Africa Collagen Supplements Market by Product Type, Value (US$ Bn), 2019 - 2031

8.7.1.26. Rest of Middle East & Africa Collagen Supplements Market by Type, Value (US$ Bn), 2019 - 2031

8.7.1.27. Rest of Middle East & Africa Collagen Supplements Market by Form, Value (US$ Bn), 2019 - 2031

8.7.1.28. Rest of Middle East & Africa Collagen Supplements Market by Source, Value (US$ Bn), 2019 - 2031

8.7.1.29. Rest of Middle East & Africa Collagen Supplements Market by End Use, Value (US$ Bn), 2019 - 2031

8.7.1.30. Rest of Middle East & Africa Collagen Supplements Market by Sales Channel, Value (US$ Bn), 2019 - 2031

8.7.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Form vs by Type Heat map

9.2. Manufacturer vs by Type Heat map

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Glanbia PLC

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Hunter & Gather Foods Ltd Tci Co., Ltd.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. The Bountiful Company

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. The Clorox Company

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Shiseido Company Limited

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Amorepacific Corporation

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. The Protein Drinks Co.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Asterism Healthcare

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Hangzhou Nutrition Biotechnology Co., Ltd.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Aneva Nutraceuticals Ltd.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Bottled Science Ltd.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. United Sports Brands

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Bauer Nutrition USA

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Wilmar Sugar Pty Ltd.

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Elavonne

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

9.5.16. Optimum Nutrition, INC

9.5.16.1. Company Overview

9.5.16.2. Product Portfolio

9.5.16.3. Financial Overview

9.5.16.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Form Coverage |

|

|

Source Coverage |

|

|

End Use Coverage |

|

|

Sales Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |