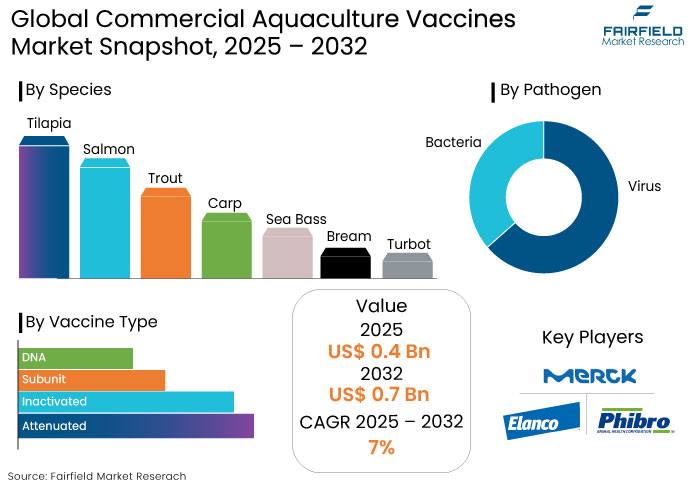

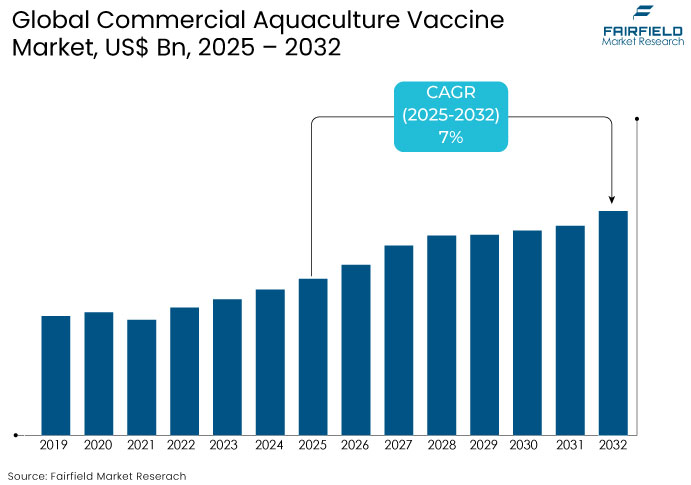

Global Commercial Aquaculture Vaccines Market Forecast

- The commercial aquaculture vaccines market is projected to be valued at US$ 0.7 Bn by 2032, exhibiting significant growth from the US$ 0.4 Bn achieved in 2025.

- The market for commercial aquaculture vaccines is estimated to show a significant expansion rate with a CAGR of 7% during the forecast period ranging between 2025 and 2032.

Commercial Aquaculture Vaccines Market Insights

- Increasing aquaculture production is likely to spur growth.

- Innovations in recombinant vaccines, DNA-based solutions, and oral formulations are shaping the future of aquaculture vaccines.

- Shift towards sustainable seafood production is propelling demand for vaccines to decrease antibiotic usage in aquaculture.

- Bacterial pathogen segment is likely to dominate as it addresses diseases like vibriosis and furunculosis in aquaculture.

- Europe is likely to emerge as the region owing to advanced aquaculture infrastructure, government policies, and consumer demand for sustainable practices.

- Developments in oral and submerged vaccine delivery techniques increase scalability while minimizing fish sensitivity during vaccination administration.

- Advancements in vaccine delivery methods, like oral and immersion, improve scalability and reduce stress in fish during vaccine administration.

A Look Back and a Look Forward - Comparative Analysis

The commercial aquaculture vaccines market growth was steady during the historical period owing to improvements in fish health care. Rising demand for sustainably produced seafood worldwide fostered demand.

As a preventive treatment against bacterial and viral infections in fish, the market moved away from standard antibiotics and toward vaccinations. Early vaccinations used injection and immersion as innovative methods of administration to combat common diseases like vibriosis and furunculosis.

Rising prevalence of aquaculture diseases, regulatory antibiotic restrictions, and consumer demand for safer seafood products fuelled growth. North America and Europe historically led the market owing to robust aquaculture practices and government support.

Expansion of aquaculture activities in China, India, and Vietnam, is likely o boost market expansion in Asia Pacific during the forecast period. Innovations in aquaculture vaccines is anticipated to open new growth opportunities.

Key Growth Determinants

- Increasing Aquaculture Production Fuels Vaccine Demand

The aquaculture industry is witnessing rapid global growth, driven by rising demand for fishery products.

- In June 2024, The Food and Agriculture Organization (FAO) revealed that aquaculture accounts for 44% of the world's total fish production, making it one of the fastest-growing segments of agriculture.

As fish are a prominent source of nourishment for over a billion people in developing nations, expanding aquaculture is important to supply the food and nutritional needs of the population.

To accommodate the world's growing seafood demand while maintaining sustainability, fish vaccinations are becoming crucial. This is predicted to drive a large increase in the commercial aquaculture vaccination market.

Vaccination is a crucial strategy in the fight against zoonotic diseases that can infect humans, fish, and other species. It is also essential to protect aquaculture operations and public health.

- The FAO has projected the global aquaculture production to reach 185 Mn tonnes in 2023.

- The Global Aquaculture Alliance forecasts a 40% rise in aquaculture production by 2030 to meet seafood demand. This underscores the need for robust disease management solutions, fuelling the expansion of commercial aquaculture vaccine market.

- Rising Incidence of Aquatic Animal Diseases

Increasing prevalence of infectious diseases among aquatic species is a significant growth driver for the commercial aquaculture vaccines market. Diseases like bacterial septicemia, vibriosis, and viral infections can severely impact fish health, leading to mass mortality and substantial financial losses for aquaculture operations.

Expansion in global fish farming to meet rising seafood demand is likely to intensify the risk of disease outbreaks, prompting the need for effective disease prevention measures. Vaccines offer a reliable and sustainable solution by enhancing the immunity of aquatic animals without the overuse of antibiotics, contributing to antimicrobial resistance. The shift towards proactive disease management in aquaculture drives research and development efforts in innovative vaccine formulations for fish species.

Key Growth Barriers

- Stringent Regulations for Vaccine Approval

Companies wanting to sell their vaccines internationally face considerable obstacles owing to lengthy regulatory approval procedures. Every nation has its own approval processes and regulatory bodies.

A few regulatory bodies maintain distinct clearance schedules, even though they adhere to rules established by significant regulatory agencies like the U.S. FDA. Vendors cannot release new or enhanced items until all required permits have been obtained due to this intricacy.

- A 2023 report by the Global Alliance for Vaccines in Aquaculture highlights that developing an aquaculture vaccine takes 8 to 12 years on average and costs over $30 million per vaccine.

Lengthy timelines and substantial expenses discourage smaller companies from entering the market, stifling innovation while slowing the introduction of new and effective vaccines. Companies are required to wait for regulatory clearances before distributing their products

Fragmented nature of the approval process increases distribution costs, often compelling providers to delay launches until all approvals are obtained. Such challenges significantly impede growth of the commercial aquaculture vaccine market.

Commercial Aquaculture Vaccines Market Trends and Opportunities

- Developed Economies to Witness Advancements in Aquaculture Sectors

Technological breakthroughs and a strong focus on innovation in the prevention and treatment of zoonotic illnesses is fostering the development of commercial aquaculture vaccines. Leading high-income nations, like the U.S., Norway, and the U.K., are using state-of-the-art technologies to aid in the creation of vaccines.

-

According to New Zealand Foreign Affairs & Trade, Norway’s aquaculture industry accounted for 73% of its seafood export value and 45% of total export volume in 2023. It benefits from advanced technologies like automated feeding systems and bio secure vaccine solutions.

Advancements in synthetic, systems biology, and next-generation sequencing is accelerating the development of vaccines. Sustained funding for multidisciplinary vaccine research improves development effectiveness while shortening the time it takes for new vaccines to reach the market. These developments foster innovation while assisting the expansion and sustainability of the global aquaculture sector by encouraging workable and sustainable solutions to aquaculture illnesses.

- Rising Demand for Sustainable Aquaculture

With global seafood consumption projected to reach 196 million tons by 2025, there is a growing shift towards sustainable farming practices that decreases environmental impact while minimizing antibiotic use.

Rise of organic aquaculture further bolsters the demand for the vaccine. Growth in the sector is likely to create opportunities for vaccine developers to meet the rising need for high-quality and antibiotic-free fish.

Increased consumer awareness regarding sustainability and health, especially in areas with stringent regulatory norms is encouraging aquaculture farms to focus on disease control techniques. Aquaculture companies can improve product quality and satisfy consumer demand for safer, cleaner, and sustainably produced seafood by concentrating on fish health without using antibiotics. Compatibility with international sustainability objectives emphasize how important vaccinations are to determine aquaculture's future.

How is Regulatory Scenario Shaping this Industry?

Regulatory scenario is a key factor shaping the commercial aquaculture vaccines market, influencing its growth and adoption across regions. Governments and regulatory bodies are focusing on decreasing antibiotic use in aquaculture owing to rising concerns about antimicrobial resistance and environmental sustainability.

Regulations, like the European Union's ban on antibiotic growth promoters, have accelerated the shift toward preventive measures like vaccines to ensure food safety. Streamlined regulatory frameworks are also fostering innovation in vaccine development.

Governments authorities of several countries are simplifying approval processes for new vaccines, enabling faster commercialization of advanced solutions. Regulatory agencies in prominent aquaculture markets, including the U.S., Europe, and Asia-Pacific, collaborate with researchers and vaccine manufacturers to set efficacy and safety testing guidelines.

Public and private funding initiatives support vaccination programs while ensuring compliance with regulatory standards, thereby encouraging vaccine adoption. These evolving policies create a supportive growth environment while promoting sustainable aquaculture practices.

Segments Covered in the Report

- Effectiveness of Inactivated Vaccine to Foster Demand

Inactivated vaccine is predicted to exhibit a CAGR of 5% through 2032. Demonstrated safety and effectiveness of inactivated vaccine type augment their growth. These vaccinations provide dependable protection against common illnesses like vibriosis and furunculosis by using organisms that have been destroyed. They are routinely used because of their durability, low risk of infection, and compatibility with different fish species.

Long-lasting protection is guaranteed by improved immunogenicity owing to advancements in formulation processes. The segment's expansion is further supported by regulatory preferences for safe and efficient aquaculture disease management technologies. The category continues to be a crucial part of the global market as it successfully meets the demands of industry as well as consumers.

- Prevention of Bacterial Diseases to Augment Demand

Bacteria is predicted to lead the pathogen category with a share of 70 % in 2025. This growth is attributed to the prevalence of bacterial diseases in aquaculture. Effective vaccinations are crucial as infectious bacteria like vibriosis and furunculosis pose serious risks to fish health and productivity.

Developments in vaccine formulations that target certain bacterial strains are enhancing the prevention and management of disease. Expanding emphasis on bacterial pathogens is supported by the aquaculture industry's growing requirement for disease management solutions, fostering dominance of the bacteria segment.

Regional Analysis

- Advanced Aquaculture Infrastructure in Europe to Propel Growth

The commercial aquaculture vaccines market in Europe is witnessing significant expansion owing to the presence of modern hatcheries, recirculating aquaculture systems (RAS), and bio-secure facilities. The regions’ sophisticated infrastructure supports effective operations and robust disease control.

Europe’s capacity to address intricate aquaculture issues is further strengthened by the incorporation of cutting-edge technologies like next-generation sequencing (NGS), CRISPR-based genome editing, and creative vaccine delivery methods, like carriers based on nanotechnology.

Supportive government regulations are essential for encouraging the creation of immunoprophylactic drugs, lowering the need for antibiotics, and providing funds for studies that promote sustainable aquaculture methods. Growing demand for responsibly produced and antibiotic devoid seafood is in line with Europe's stringent regulations. This includes following EU guidelines for food safety and animal welfare.

- North America

Growing awareness of health benefits of seafood, like rich in omega-3 fatty acids, is driving demand in North America. Canada witnessed a 7% annual growth in seafood consumption, especially for aquaculture products like salmon and trout.

- Per capita seafood consumption in the U.S. reached 19 pounds annually in 2023, with rising consumer preference for locally farmed and sustainably sourced fish.

The region has a highly developed aquaculture sector, focusing on species like salmon, trout, tilapia, and shellfish. North America is home to some of the largest aquaculture operations, particularly in regions like British Columbia (Canada) and Maine (U.S.).

- The U.S. aquaculture industry is predicted to reaching US$ 2.3 Bn by 2030.

Fairfield’s Competitive Landscape Analysis

According to Fairfield’s analysis, there is fierce competition between regional and international companies in the commercial aquaculture vaccination market. Leading players are focusing on product innovation and geographic expansion, like Elanco Animal Health, HIPRA, and Merck & Co. (MSD Animal Health).

Businesses are investing in research and development to create vaccines to fight new aquatic illnesses while adhering to strict legal requirements. To increase their market presence, companies are collaborating with feed and aquaculture farms.

Regional players also play an important role as they address disease concerns while promoting competitiveness. Innovation is accelerated by the expanding use of sophisticated vaccine delivery systems, like injectable and oral vaccinations. Price sensitivity and the growing global demand for sustainable aquaculture methods influence market dynamics.

Key Market Companies

- Merck & Co.

- Elanco Animal Health Incorporated

- Phibro Animal Health Corporation

- HIPRA

- Zoetis Animal Healthcare

- IDT Biologika

- Tecnovax S.A.

- AquaVet Health Inc/AQUAVET S.A.

- Nisseiken Co., Ltd.

- ICTYO, Virbac

Recent Industry Developments

- In January 2024, Moredun Research Institute received a funding of £1.5M from the Biotechnology and Biological Sciences Research Council (BBSRC) to develop an oral vaccine against salmon lice in farmed Atlantic salmon.

- In July 2024, Merck Animal Health, completed its acquisition of Elanco’s aqua business. This strengthens its position in aquaculture with solutions promoting fish health, welfare, and sustainability.

- In August 2024, Fischer Medical Ventures Ltd (Fischer MV) entered into a partnership with Bio Angle Vacs Sdn Bhd (BAV) to develop breakthrough vaccines for livestock and aquaculture into the Indian market.

- In October 2024, researchers at the University of Stirling received funding of £770,000 to aid the deployment of a new vaccine to tackle antimicrobial resistance (AMR) in Vietnamese catfish and bringing in significant advancements to the aquaculture industry.

An Expert’s Eye

- Experts highlight the continuous advancements in aquaculture vaccines, focusing on novel delivery systems and targeted formulations.

- Adherence to stringent regulatory standards remains a key factor influencing market dynamics.

- Collaboration with aquaculture farms and feed producers is essential for expansion.

- Growing demand for eco-friendly and sustainable aquaculture practices is shaping vaccine development.

Global Commercial Aquaculture Vaccines Market is Segmented as-

By Vaccine Type

- Attenuated

- Inactivated

- Subunit

- DNA

By Pathogen

- Virus

- Bacteria

By Species

- Tilapia

- Salmon

- Trout

- Carp

- Sea Bass

- Bream

- Turbot

- Others

By Route of Administration

- Intramuscular

- Intraperitoneal

- Oral

- Immersion

By End User

- Fish Veterinary Clinics

- Fish Farming Companies

- Aquatic Research Institutes

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Commercial Aquaculture Vaccines Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Economic Overview

2.6.1. World Economic Projections

2.7. PESTLE Analysis

2.8. Commercial Aquaculture Vaccines Market, Product Adoption

2.9. Regulatory Scenario by Region

2.10. Value Chain Analysis

3. Global Commercial Aquaculture Vaccines Market Outlook, 2019 - 2032

3.1. Global Commercial Aquaculture Vaccines Market Outlook, by Vaccine Type, Value (US$ Bn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Attenuated

3.1.1.2. Inactivated

3.1.1.3. Subunit

3.1.1.4. DNA

3.2. Global Commercial Aquaculture Vaccines Market Outlook, by Pathogen, Value (US$ Bn) and 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Virus

3.2.1.2. Bacteria

3.3. Global Commercial Aquaculture Vaccines Market Outlook, by Species, Value (US$ Bn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Tilapia

3.3.1.2. Salmon

3.3.1.3. Trout

3.3.1.4. Carp

3.3.1.5. Sea Bass

3.3.1.6. Bream

3.3.1.7. Turbot

3.3.1.8. Others

3.4. Global Commercial Aquaculture Vaccines Market Outlook, by Route of Administration, Value (US$ Bn), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. Intramuscular

3.4.1.2. Intraperitoneal

3.4.1.3. Oral

3.4.1.4. Immersion

3.5. Global Commercial Aquaculture Vaccines Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

3.5.1. Key Highlights

3.5.1.1. Fish Veterinary Clinics

3.5.1.2. Fish Farming Companies

3.5.1.3. Aquatic Research Institutes

3.6. Global Commercial Aquaculture Vaccines Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.6.1. Key Highlights

3.6.1.1. North America

3.6.1.2. Europe

3.6.1.3. Asia Pacific

3.6.1.4. Latin America

3.6.1.5. Middle East & Africa

4. North America Commercial Aquaculture Vaccines Market Outlook, 2019 - 2032

4.1. North America Commercial Aquaculture Vaccines Market Outlook, by Vaccine Type, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Attenuated

4.1.1.2. Inactivated

4.1.1.3. Subunit

4.1.1.4. DNA

4.2. North America Commercial Aquaculture Vaccines Market Outlook, by Pathogen, Value (US$ Bn) and 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Virus

4.2.1.2. Bacteria

4.3. North America Commercial Aquaculture Vaccines Market Outlook, by Species, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Tilapia

4.3.1.2. Salmon

4.3.1.3. Trout

4.3.1.4. Carp

4.3.1.5. Sea Bass

4.3.1.6. Bream

4.3.1.7. Turbot

4.3.1.8. Others

4.4. North America Commercial Aquaculture Vaccines Market Outlook, by Route of Administration, Value (US$ Bn), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. Intramuscular

4.4.1.2. Intraperitoneal

4.4.1.3. Oral

4.4.1.4. Immersion

4.5. North America Commercial Aquaculture Vaccines Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

4.5.1. Key Highlights

4.5.1.1. Fish Veterinary Clinics

4.5.1.2. Fish Farming Companies

4.5.1.3. Aquatic Research Institutes

4.6. North America Commercial Aquaculture Vaccines Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.6.1. Key Highlights

4.6.1.1. U.S. Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

4.6.1.2. U.S. Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

4.6.1.3. U.S. Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

4.6.1.4. U.S. Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

4.6.1.5. U.S. Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

4.6.1.6. Canada Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

4.6.1.7. Canada Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

4.6.1.8. Canada Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

4.6.1.9. Canada Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

4.6.1.10. Canada Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

5. Europe Commercial Aquaculture Vaccines Market Outlook, 2019 - 2032

5.1. Europe Commercial Aquaculture Vaccines Market Outlook, by Vaccine Type, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Attenuated

5.1.1.2. Inactivated

5.1.1.3. Subunit

5.1.1.4. DNA

5.2. Europe Commercial Aquaculture Vaccines Market Outlook, by Pathogen, Value (US$ Bn) and 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Virus

5.2.1.2. Bacteria

5.3. Europe Commercial Aquaculture Vaccines Market Outlook, by Species, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Tilapia

5.3.1.2. Salmon

5.3.1.3. Trout

5.3.1.4. Carp

5.3.1.5. Sea Bass

5.3.1.6. Bream

5.3.1.7. Turbot

5.3.1.8. Others

5.4. Europe Commercial Aquaculture Vaccines Market Outlook, by Route of Administration, Value (US$ Bn), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Intramuscular

5.4.1.2. Intraperitoneal

5.4.1.3. Oral

5.4.1.4. Immersion

5.5. Europe Commercial Aquaculture Vaccines Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

5.5.1. Key Highlights

5.5.1.1. Fish Veterinary Clinics

5.5.1.2. Fish Farming Companies

5.5.1.3. Aquatic Research Institutes

5.6. Europe Commercial Aquaculture Vaccines Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.6.1. Key Highlights

5.6.1.1. Norway Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

5.6.1.2. Norway Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

5.6.1.3. Norway Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

5.6.1.4. Norway Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.6.1.5. Norway Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

5.6.1.6. Germany Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

5.6.1.7. Germany Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

5.6.1.8. Germany Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

5.6.1.9. Germany Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.6.1.10. Germany Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

5.6.1.11. UK Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

5.6.1.12. UK Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

5.6.1.13. UK Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

5.6.1.14. UK Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.6.1.15. UK Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

5.6.1.16. France Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

5.6.1.17. France Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

5.6.1.18. France Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

5.6.1.19. France Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.6.1.20. France Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

5.6.1.21. Spain Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

5.6.1.22. Spain Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

5.6.1.23. Spain Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

5.6.1.24. Spain Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.6.1.25. Spain Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

5.6.1.26. Italy Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

5.6.1.27. Italy Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

5.6.1.28. Italy Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

5.6.1.29. Italy Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.6.1.30. Italy Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

5.6.1.31. Russia Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

5.6.1.32. Russia Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

5.6.1.33. Russia Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

5.6.1.34. Russia Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.6.1.35. Russia Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

5.6.1.36. Rest of Europe Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

5.6.1.37. Rest of Europe Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

5.6.1.38. Rest of Europe Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

5.6.1.39. Rest of Europe Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.6.1.40. Rest of Europe Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

6. Asia Pacific Commercial Aquaculture Vaccines Market Outlook, 2019 - 2032

6.1. Asia Pacific Commercial Aquaculture Vaccines Market Outlook, by Vaccine Type, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Attenuated

6.1.1.2. Inactivated

6.1.1.3. Subunit

6.1.1.4. DNA

6.2. Asia Pacific Commercial Aquaculture Vaccines Market Outlook, by Pathogen, Value (US$ Bn) and 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Virus

6.2.1.2. Bacteria

6.3. Asia Pacific Commercial Aquaculture Vaccines Market Outlook, by Species, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Tilapia

6.3.1.2. Salmon

6.3.1.3. Trout

6.3.1.4. Carp

6.3.1.5. Sea Bass

6.3.1.6. Bream

6.3.1.7. Turbot

6.3.1.8. Others

6.4. Asia Pacific Commercial Aquaculture Vaccines Market Outlook, by Route of Administration, Value (US$ Bn), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Intraperitoneal

6.4.1.2. Intramuscular

6.4.1.3. Immersion

6.4.1.4. Oral

6.5. Asia Pacific Commercial Aquaculture Vaccines Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

6.5.1. Key Highlights

6.5.1.1. Fish Farming companies

6.5.1.2. Fish veterinary clinics

6.5.1.3. Aquatic research Institutes

6.6. Asia Pacific Commercial Aquaculture Vaccines Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.6.1. Key Highlights

6.6.1.1. China Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

6.6.1.2. China Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

6.6.1.3. China Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

6.6.1.4. China Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

6.6.1.5. China Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

6.6.1.6. Japan Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

6.6.1.7. Japan Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

6.6.1.8. Japan Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

6.6.1.9. Japan Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

6.6.1.10. Japan Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

6.6.1.11. South Korea Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

6.6.1.12. South Korea Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

6.6.1.13. South Korea Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

6.6.1.14. South Korea Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

6.6.1.15. South Korea Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

6.6.1.16. India Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

6.6.1.17. India Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

6.6.1.18. India Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

6.6.1.19. India Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

6.6.1.20. India Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

6.6.1.21. Southeast Asia Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

6.6.1.22. Southeast Asia Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

6.6.1.23. Southeast Asia Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

6.6.1.24. Southeast Asia Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

6.6.1.25. Southeast Asia Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

6.6.1.26. Rest of Asia Pacific Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

6.6.1.27. Rest of Asia Pacific Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

6.6.1.28. Rest of Asia Pacific Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

6.6.1.29. Rest of Asia Pacific Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

6.6.1.30. Rest of Asia Pacific Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

6.6.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Commercial Aquaculture Vaccines Market Outlook, 2019 - 2032

7.1. Latin America Commercial Aquaculture Vaccines Market Outlook, by Vaccine Type, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Attenuated

7.1.1.2. Inactivated

7.1.1.3. Subunit

7.1.1.4. DNA

7.2. Latin America Commercial Aquaculture Vaccines Market Outlook, by Pathogen, Value (US$ Bn) and 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Virus

7.2.1.2. Bacteria

7.3. Latin America Commercial Aquaculture Vaccines Market Outlook, by Species, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Tilapia

7.3.1.2. Salmon

7.3.1.3. Trout

7.3.1.4. Carp

7.3.1.5. Sea Bass

7.3.1.6. Bream

7.3.1.7. Turbot

7.3.1.8. Others

7.4. Latin America Commercial Aquaculture Vaccines Market Outlook, by Route of Administration, Value (US$ Bn), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Intramuscular

7.4.1.2. Intraperitoneal

7.4.1.3. Oral

7.4.1.4. Immersion

7.5. Latin America Commercial Aquaculture Vaccines Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

7.5.1. Key Highlights

7.5.1.1. Fish Veterinary Clinics

7.5.1.2. Fish Farming Companies

7.5.1.3. Aquatic Research Institutes

7.6. Latin America Commercial Aquaculture Vaccines Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.6.1. Key Highlights

7.6.1.1. Brazil Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

7.6.1.2. Brazil Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

7.6.1.3. Brazil Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

7.6.1.4. Brazil Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

7.6.1.5. Brazil Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

7.6.1.6. Mexico Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

7.6.1.7. Mexico Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

7.6.1.8. Mexico Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

7.6.1.9. Mexico Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

7.6.1.10. Mexico Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

7.6.1.11. Rest of Latin America Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

7.6.1.12. Rest of Latin America Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

7.6.1.13. Rest of Latin America Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

7.6.1.14. Rest of Latin America Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

7.6.1.15. Rest of Latin America Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

8. Middle East & Africa Commercial Aquaculture Vaccines Market Outlook, 2019 - 2032

8.1. Middle East & Africa Commercial Aquaculture Vaccines Market Outlook, by Vaccine Type, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Attenuated

8.1.1.2. Inactivated

8.1.1.3. Subunit

8.1.1.4. DNA

8.2. Middle East & Africa Commercial Aquaculture Vaccines Market Outlook, by Pathogen, Value (US$ Bn) and 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Virus

8.2.1.2. Bacteria

8.3. Middle East & Africa Commercial Aquaculture Vaccines Market Outlook, by Species, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Tilapia

8.3.1.2. Salmon

8.3.1.3. Trout

8.3.1.4. Carp

8.3.1.5. Sea Bass

8.3.1.6. Bream

8.3.1.7. Turbot

8.3.1.8. Others

8.4. Middle East & Africa Commercial Aquaculture Vaccines Market Outlook, by Route of Administration, Value (US$ Bn), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Intramuscular

8.4.1.2. Intraperitoneal

8.4.1.3. Oral

8.4.1.4. Immersion

8.5. Middle East & Africa Commercial Aquaculture Vaccines Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

8.5.1. Key Highlights

8.5.1.1. Fish Veterinary Clinics

8.5.1.2. Fish Farming Companies

8.5.1.3. Aquatic Research Institutes

8.6. Middle East & Africa Commercial Aquaculture Vaccines Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.6.1. Key Highlights

8.6.1.1. GCC Countries Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

8.6.1.2. GCC Countries Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

8.6.1.3. GCC Countries Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

8.6.1.4. GCC Countries Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

8.6.1.5. GCC Countries Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

8.6.1.6. South Africa Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

8.6.1.7. South Africa Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

8.6.1.8. South Africa Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

8.6.1.9. South Africa Countries Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

8.6.1.10. South Africa Countries Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

8.6.1.11. Northern Africa Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

8.6.1.12. Northern Africa Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

8.6.1.13. Northern Africa Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

8.6.1.14. Northern Africa Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

8.6.1.15. Northern Africa Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

8.6.1.16. Rest of Middle East & Africa Commercial Aquaculture Vaccines Market by Vaccine Type, Value (US$ Bn), 2019 - 2032

8.6.1.17. Rest of Middle East & Africa Commercial Aquaculture Vaccines Market by Pathogen, Value (US$ Bn), 2019 - 2032

8.6.1.18. Rest of Middle East & Africa Commercial Aquaculture Vaccines Market by Species, Value (US$ Bn), 2019 - 2032

8.6.1.19. Rest of Middle East & Africa Commercial Aquaculture Vaccines Market by Route of Administration, Value (US$ Bn), 2019 - 2032

8.6.1.20. Rest of Middle East & Africa Commercial Aquaculture Vaccines Market by End User, Value (US$ Bn), 2019 - 2032

9. Competitive Landscape

9.1. By Vaccine Type vs by Pathogen Heatmap

9.2. Company Market Share Analysis, 2025

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Merck & Co.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Elanco Animal Health Incorporated

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Phibro Animal Health Corporation

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. HIPRA

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. IDT Biologika

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Tecnovax S.A.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. AquaVet Health Inc/AQUAVET S.A.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Nisseiken Co., Ltd.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. ICTYO

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Zoetis Animal Healthcare

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Vaccine Type |

|

|

Pathogen |

|

|

Species |

|

|

Route of Administration |

|

|

End User |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2023), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |