Global Commercial Property Insurance Market Forecast

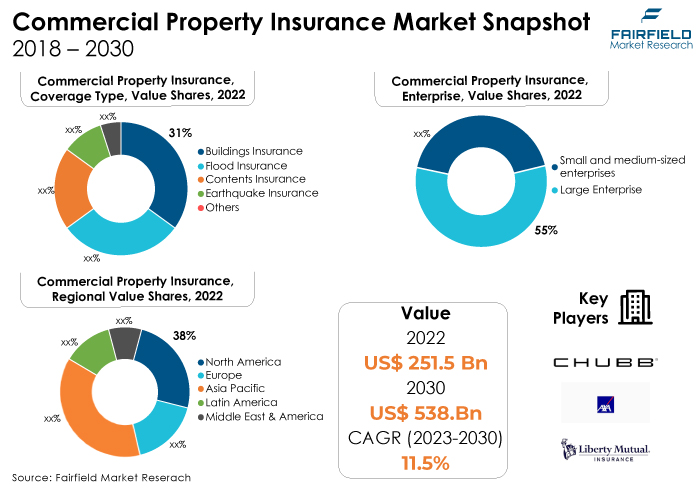

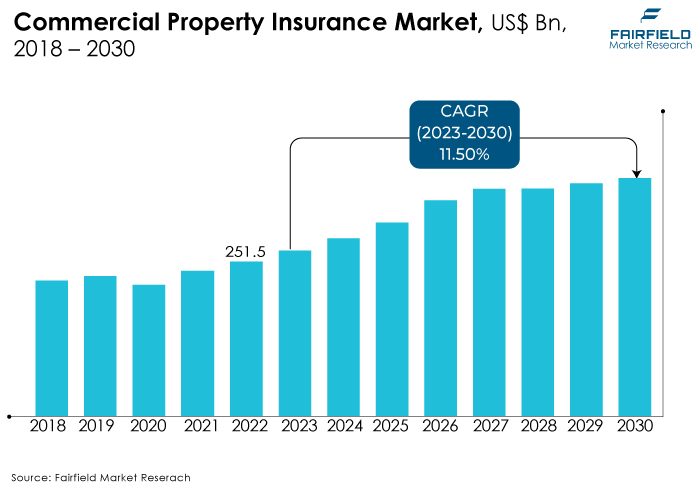

- The global commercial property insurance market size worth US$251.5 Bn in 2022 poised to reach US$538.8 Bn in 2030

- Market valuation anticipated to expand at a CAGR of 11.5% over 2023 - 2030

Quick Report Digest

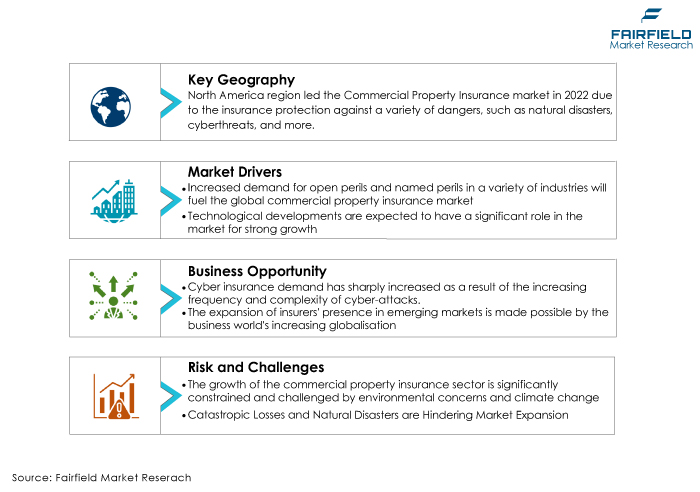

- The key trend anticipated to fuel the commercial property insurance market growth is an increase in occurrences of natural disasters such as hurricanes, floods, wildfires, and earthquakes can lead to higher insurance claims and premiums. Climate change is amplifying these risks, making insurers more cautious and affecting pricing strategies.

- Another major market trend expected to fuel the commercial property insurance market growth is the rapidly increasing global technology. To improve efficiency and accuracy, insurance companies are implementing cutting-edge technology, data analytics, and automation to expedite operations, underwriting procedures, and risk assessments.

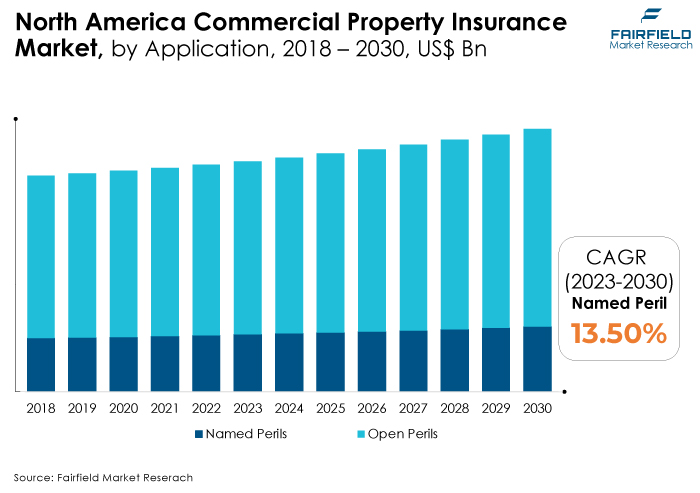

- In 2022, the open perils and named perils category dominated the industry. The strength of these categories comes from their capacity to provide customised solutions to commercial property owners with various risk appetites and preferences, striking a balance between comprehensive coverage and focused risk protection and therefore satisfying the market's variety of needs.

- In terms of market share for commercial property insurance globally, the agents and brokers segment is anticipated to dominate. Many firms favour them as their first choice due to their experience, knowledge of the sector, and attentive service. Although direct response and online channels have been expanding, historically, agents and brokers have dominated the market.

- In 2022, the small and medium-sized enterprises category controlled the market. They have a sizable requirement for complete protection and risk management, which drives demand in this market. Large businesses, however, also have significant insurance needs, particularly for complicated and expensive properties.

- The IT and telecom category is highly prevalent in the market for commercial property insurance market. Due to the vitality of their operations and the possible risks associated with technology infrastructure, IT and telecom enterprises frequently have significant insurance needs.

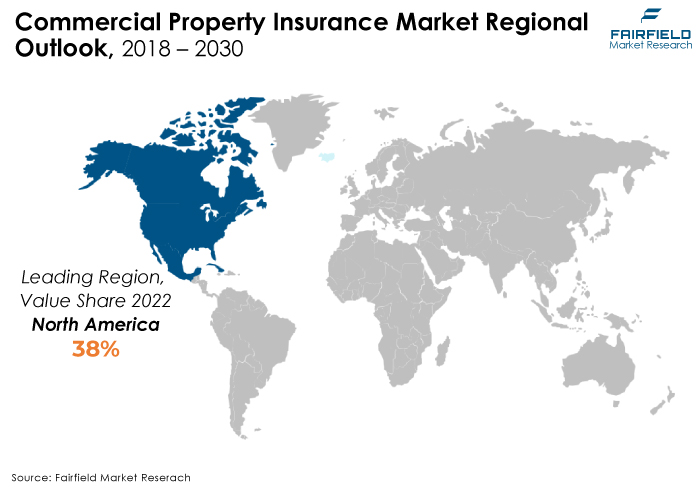

- The North American region is anticipated to account for the largest share of the global commercial property insurance market, owing to various factors such as economic conditions, natural catastrophes and climate change. The region's strong and diverse economy, which is characterised by a large number of businesses operating in a wide range of industries, has significantly increased the demand for commercial property insurance.

- The market for commercial property insurance is expanding in Asia Pacific due to the rapid economic growth and technological advancements. Additionally, a heightened awareness of risks associated with natural disasters, particularly in disaster-prone areas, has led to a greater emphasis on risk mitigation and insurance, further driving the growth of the commercial property insurance market in the Asia Pacific region.

A Look Back and a Look Forward - Comparative Analysis

The market for commercial property insurance has grown in popularity as a result of factors such as urbanisation, rising property values, and an increase in natural disasters are all contributing factors to the worldwide commercial property insurance market's continued expansion. Additionally, the integration of technologies like blockchain, data analytics, and artificial intelligence is speeding up the underwriting process, improving risk assessment, and enabling customised insurance products for customers.

The market witnessed staggered growth during the historical period 2018 – 2022. This is due to the Globalisation and technological integration significantly increased in the late 20th and early 21st centuries. Natural disasters and significant occurrences, including the 9/11 attacks and financial crises, have impacted underwriting strategies and risk evaluations. The risk environment has changed, and insurance companies have continually adjusted. Historical occurrences have prompted updated policy frameworks, coverage expansions, and a stronger emphasis on new concerns like cyber threats and climate change.

Advanced technologies like artificial intelligence, machine learning, and blockchain will underpin operations, enabling real-time risk assessment, tailored policy offerings, and faster claims processing. Climate change will drive a fundamental reshaping of risk models, necessitating innovative insurance solutions for extreme weather events and sustainable practices.

The rise of smart buildings and interconnected infrastructure will introduce new risks related to cyber threats and data privacy, demanding specialised coverage and risk management strategies. Moreover, evolving regulatory landscapes, especially regarding environmental and social governance, will push the industry towards more sustainable and responsible insurance practices.

Key Growth Determinants

- Open Perils, and Named Perils in a Variety of Industries

The global market for commercial property insurance is expected to experience significant expansion as a result of the rising demand for both open perils and named perils coverage choices across numerous industries. Because it provides comprehensive protection and covers a wide range of risks unless specifically excluded, open perils coverage, also known as all-risk coverage, is growing in favour.

Contrarily, named hazard coverage offers specialised defence against clearly defined risks, lining up with the risk preferences and requirements of certain enterprises. Industries that are aware of their main risk exposures prefer this focused strategy since it enables them to customise their insurance to their unique risk profiles.

- Expanding Presence of Agents and Brokers

The market for commercial property insurance is expected to increase significantly as a result of the growth of agents, and brokers. As key links between insurers and companies looking for insurance coverage, agents and brokers play a crucial role. They play a vital role in guiding businesses through the confusing world of commercial property insurance by providing information, guidance, and support.

These specialists can effectively engage with a wider range of firms, especially small and medium-sized enterprises (SMEs) that might need more dedicated risk management teams, as they broaden their reach and employ cutting-edge technical technologies.

In addition to increasing market penetration, this outreach also creates a better awareness of the insurance requirements of various industries, which ultimately results in a spike in policy sales.

- Technological Advancements

Technological developments are expected to have a significant role in the market for commercial property insurance's strong growth. The industry is undergoing a revolution thanks to the incorporation of cutting-edge technologies like Blockchain, Artificial Intelligence, machine learning, and data analytics. These developments are improving underwriting procedures, risk assessment precision, claims handling effectiveness, and operational agility in general.

By quickly analysing massive volumes of data to identify hazards, AI and machine learning algorithms enable insurers to customise policies and pricing based on accurate risk assessments. Digital platforms and IoT devices are also offering real-time property monitoring, enabling proactive risk management and allowing insurers to provide more flexible coverage alternatives.

Major Growth Barriers

- Climate Change, and Increasing Environmental Risks

The growth of the commercial property insurance sector is significantly constrained and challenged by environmental concerns and climate change. Extreme weather occurrences, such as hurricanes, floods, wildfires, and storms, are becoming more common and more severe, increasing the number and severity of insurance claims.

The capacity of insurers to offer coverage and preserve profitability is impacted by the greater payouts and probable financial losses brought on by this heightened risk. Furthermore, the long-term effects of climate change, such as sea level rise and altered weather patterns, are modifying risk assessment models, making it challenging to predict and value hazards.

- Catastrophic Losses, and Natural Disasters

Significant obstacles and limitations prevent the growth of the commercial property insurance market, including catastrophic losses and the rising frequency and severity of natural disasters. Events like hurricanes, earthquakes, floods, and wildfires cause an increase in insurance claims, which puts pressure on insurers' cash reserves and capability.

Large payouts from catastrophic occurrences may have an adverse effect on the viability and profitability of insurance providers, possibly resulting in stricter underwriting guidelines and higher premiums to cover losses. Additionally, insurers need more time to effectively estimate and price the risks due to the unpredictable nature of catastrophic failures and the rising costs associated with them, which restrains market expansion.

Key Trends and Opportunities to Look at

- Cyber Insurance Growth, and Risk Management

Cyber insurance demand has sharply increased as a result of the increasing frequency and complexity of cyber-attacks. Businesses from a variety of industries understand how crucial it is to protect their digital assets, sensitive data, and operations against cyber threats. As a result, insurance companies have a fantastic opportunity to diversify their product lines and build up thorough cyber risk coverage.

A variety of safeguards are included in cyber insurance, such as coverage for data breaches, ransomware attacks, business interruptions brought on by cyber catastrophes, legal costs, and administrative penalties. Insurance companies have the ability to design specialised policies that address certain sector risks and cyber threat environments.

- Global Expansion, and Emerging Markets

The expansion of insurers' presence in emerging markets is made possible by the business world's increasing globalisation. Businesses that grow globally confront a variety of hazards that call for specialised insurance coverage. The possibility for insurers to provide specialised insurance solutions that handle the distinct risks and problems related to doing business in various locations and nations.

Businesses frequently face unique risks in emerging markets due to political unpredictability, regulatory changes, currency volatility, and other region-specific issues. Insurance providers may create extensive coverage choices that reduce these risks, giving businesses the security they need to grow.

- Personalised and Usage-based Insurance Gains Traction

A tremendous opportunity for insurers to completely transform the way they deliver insurance solutions is presented by the integration of data analytics and IoT technologies. The adoption of use-based or behavior-based insurance models, where premiums are set in accordance with actual risk exposure and consumption patterns, is possible for insurers by utilising these technologies.

By better matching tips to substantial risk and usage, this change will ultimately benefit both the insurer and the insured. Insurance companies may gather a plethora of information on behavior, habits, and current conditions using IoT devices like telematics in cars, smart sensors in buildings, or wearables. The data can then be processed by advanced data analytics to reveal important information about the risk profile of a person or organisation.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, The regulatory environment has had a significant impact on how the commercial property insurance market develops. In order to ensure that insurers adhere to particular standards of financial stability, customer protection, and operational conduct, governing bodies produce regulations that specify the terms, conditions, and coverage needs of insurers.

To influence product offers, pricing, underwriting procedures, and risk assessment methodology, compliance with these regulations is essential. Additionally, by requiring new compliance standards, regulatory changes have a direct impact on insurers' ability to respond to emerging risks like climate change, cyber threats, or global health catastrophes.

Environmental, social, and governance (ESG) concerns are being incorporated by insurers into their operations and product offerings as rules supporting sustainable practices and socially conscious investing grow more prevalent.

Fairfield’s Ranking Board

Top Segments

- Buildings Insurance Sought-after

Buildings insurance primarily covers the physical structure of commercial properties. Since the building itself is a substantial and valuable asset, insuring it against various risks such as fire, natural disasters, vandalism, and other perils is crucial. The high value of commercial buildings contributes to the prominence of buildings insurance.

For businesses, the commercial property, including the building, is often a core asset. It houses operations, inventory, equipment, and sometimes even intellectual property. Protecting this asset is a fundamental concern for businesses, and buildings insurance provides financial protection in the event of damage or destruction.

Many lenders require businesses to have buildings insurance as a condition for obtaining a mortgage or other forms of financing. Lenders want to ensure that their investment is protected, and buildings insurance helps mitigate the financial risk associated with property damage.

- The Open Perils Category Takes the Charge, Specialised Coverage in Demand

In the insurance market, the open dangers category still dominates the named perils divisions. Open perils, also known as all-risk coverage, provide a greater and more thorough level of protection by including a wide variety of risks unless specifically excluded by the policy. Because it offers protection against unanticipated disasters that a specified perils policy might not cover, this flexibility is very appealing to businesses and property owners.

Alternatively, designated perils coverage expressly covers a specific risk, offering a more focused but less adaptable strategy. The desire for open perils persists despite organisations' growing awareness of the necessity of complete coverage and adaptability to changing hazards. Furthermore, the named perils category is projected to experience the fastest market growth. Named hazard insurance, which specifically covers certain risks, is becoming more popular for a number of reasons.

Businesses are becoming more risk-aware and are looking for specialised insurance coverage for dangers that have been recognised, such as cyberattacks, natural catastrophes, or other perils. With this focused approach, they can customise their insurance to their unique risk profiles and lower premiums by omitting hazards they believe to be less important.

- SMEs Continue to Register the Topmost Consumer Sector

The small and medium enterprises segment dominated the market in 2022. SMEs often need specialised, specialised insurance solutions to fully safeguard their operations and assets because of their size and resources. The number of SMEs rises as economies expand and entrepreneurship flourishes, which helps to fuel a growth in demand for commercial property insurance.

As a result of realising this trend, insurers have created specialised products that are tailored to the varying risk profiles and financial limits of SMEs. Additionally, SMEs are forced to seek insurance coverage as a result of changing regulatory environments that need specific insurance for firms to operate legally, which is fueling the expansion of this market sector.

The large enterprises category is expected to experience the fastest growth within the forecast time frame. Large enterprises often have complex operations, substantial assets, and a wide range of risks to manage. As these businesses recognise the importance of comprehensive insurance coverage to safeguard their extensive investments, they are increasingly seeking specialised and tailored insurance solutions.

- The IT and Telecom Industry Maintains a Dominant Share

In 2022, the IT and telecom category led the market growth. The IT and telecom industry is at the forefront of technical development and digitisation, which comes with a distinct set of hazards. This industry has sophisticated infrastructure and priceless digital assets and is very vulnerable to cyber threats and business interruptions.

Businesses in the IT and telecom sectors are becoming increasingly aware of the pressing need for comprehensive insurance coverage as a result of the frequency and sophistication of cyber-attacks.

Moreover, the healthcare category is expected to grow fastest in the commercial property insurance market during the forecast period. The healthcare industry, marked by its critical role in society and the ever-evolving landscape, necessitates tailored insurance solutions to address specific risks associated with medical facilities, equipment, and patient care.

Regional Frontrunners

North America Retains Supremacy on Account of an Established Enterprise Culture of Insurance Protection

In the industries, commercial property insurance adoption is anticipated to dominate in the North American region. A number of reasons contribute to the region's supremacy in income generation, including a thriving insurance market with a broad range of insurers providing specialised commercial property insurance products.

Furthermore, North American companies frequently have intricate operations and priceless assets, necessitating thorough insurance protection against a variety of dangers, such as natural disasters, cyber threats, and more. Additionally, North American legislative frameworks frequently require or encourage enterprises to carry insurance, which raises the price of commercial property insurance. The size of the market is significant in part because of the region's increased risk awareness, and culture of risk reduction.

IT Industry’s Explosion Uplifts Long-term Growth Outlook of Asia Pacific

The region of Asia Pacific is expected to experience tremendous growth in the IT and telecom sectors during the projection period, and this expectation is well-founded. Asia Pacific has become a hotspot for technology advancement, digital change, and quick urbanisation on a global scale.

The need for cutting-edge technical products, internet access, and IT services is being driven by the region's expanding middle class, which has growing purchasing power. The development of the IT and telecom sector is also being fueled by government programs and investments in digital infrastructure, smart cities, and Industry 4.0 technology.

Fairfield’s Competitive Landscape Analysis

The global commercial property insurance market is a consolidated market with fewer major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Commercial Property Insurance Space?

- Zurich Insurance Group

- American International Group, Inc.

- The Travelers Indemnity Company

- Allianz SE

- Chubb Limited

- Allstate Insurance Company

- Berkshire Hathaway Homestate Companies (BHHC)

- Progressive

- Liberty Mutual Insurance Company

- AXA Group

- AIG

- The Hartford

- Aon Plc

- Direct Line Group

- Aviva

Significant Company Developments

New Product Launch

- June 2022: As one go-to-market company providing insurance solutions for large businesses, specialised risks, and mid-sized businesses, Allianz Global Corporate & Specialty (AGCS) and local Allianz Property & Casualty (P&C) entities will start trading as "Allianz Commercial.

- July 2020: With great success, Covéa Insurance announced the release of a new online product called "Property Owners" for owners of both residential and commercial properties. The new product, which brokers will be using to sell it online, distinguishes itself by combining the best features of the Covéa residential property owners, commercial property owners, and packaged executive asset products into a single all-risks policy wording with a wider risk appetite, broader cover, and higher limits.

- November 2019: With the successful introduction of a new commercial property insurance product, AIG made New Zealand the first country in the Asia Pacific area to provide the product locally. Property Performance is created for medium-sized to big enterprises that have a variety of risk exposures. It includes enhanced coverage, loss prevention engineering services, and risk management solutions.

Distribution Agreement

- May 2021: For the markets in Australia, New Zealand, and the Pacific Islands, a collaboration between J.L. Lennard and Cama Group was established. J.L. Lennard is an exclusive distributor of tools, accessories, and life cycle services.

- February 2020: CT Pack grew its market share in Latin America. It has also developed solid client relationships and a potent sales team. Customers' ideal solutions have been its complete packaging systems for the food industry.

An Expert’s Eye

Demand and Future Growth

Slice's new service shows that there is both demand and room for expansion for on-demand insurance products in the specialty sector. There is an increasing need for flexible, customised insurance solutions as the landscape of business operations changes, particularly in the gig economy and small business sectors.

By offering adaptable protection when it's needed, on-demand insurance fills this gap. The need for such flexible insurance solutions is likely to grow as companies look for flexibility and cost-effectiveness. By addressing the particular needs of companies in various specialised categories, Slice's debut into the specialty market with an on-demand small business offering is in line with this demand trend.

Supply Side of the Market

According to our analysis, the supply side of the industry in the IT and telecom sectors is healthy and vibrant. An agile supply-side reaction is required due to the constantly changing landscape of technology and communication. To keep up with the growing demand for cutting-edge hardware, software, telecommunications tools, and services, businesses innovate constantly.

To meet future developments like 5G technology, artificial intelligence, edge computing, and the Internet of Things (IoT), major industry companies are heavily spending on research and development. Additionally, strategic alliances, mergers, purchases, and collaborations with titans of the business are reshaping the market, improving their capabilities, extending their reach, and promoting an innovative culture.

Global Commercial Property Insurance Market is Segmented as Below:

By Coverage Type:

- Buildings Insurance

- Contents Insurance

- Flood Insurance

- Earthquake Insurance

- Others

By Application:

- Open Perils

- Named Perils

By Enterprise Size:

- Filming & Large Enterprises

- Small and Medium-sized Enterprises

By Industry Vertical:

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Transportation and Logistics

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Commercial Property Insurance Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Commercial Property Insurance Market Outlook, 2018 - 2030

3.1. Global Commercial Property Insurance Market Outlook, by Coverage Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Buildings Insurance

3.1.1.2. Contents Insurance

3.1.1.3. Flood Insurance

3.1.1.4. Earthquake Insurance

3.1.1.5. Others

3.2. Global Commercial Property Insurance Market Outlook, by Application Channels, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Open Perils

3.2.1.2. Named Perils

3.3. Global Commercial Property Insurance Market Outlook, by Enterprise Size, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Large Enterprises

3.3.1.2. Small and Medium-sized Enterprises

3.4. Global Commercial Property Insurance Market Outlook, by Industry Vertical, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights Snacks

3.4.1.1. Manufacturing

3.4.1.2. Construction

3.4.1.3. IT and Telecom

3.4.1.4. Healthcare

3.4.1.5. Energy and Utilities

3.4.1.6. Transportation and Logistics

3.4.1.7. Others

3.5. Global Commercial Property Insurance Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Commercial Property Insurance Market Outlook, 2018 - 2030

4.1. North America Commercial Property Insurance Market Outlook, by Coverage Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Buildings Insurance

4.1.1.2. Contents Insurance

4.1.1.3. Flood Insurance

4.1.1.4. Earthquake Insurance

4.1.1.5. Others

4.2. North America Commercial Property Insurance Market Outlook, by Application Channels, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Open Perils

4.2.1.2. Named Perils

4.3. North America Commercial Property Insurance Market Outlook, by Enterprise Size, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Large Enterprises

4.3.1.2. Small and Medium-sized Enterprises

4.4. North America Commercial Property Insurance Market Outlook, by Industry Vertical, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. Manufacturing

4.4.1.2. Construction

4.4.1.3. IT and Telecom

4.4.1.4. Healthcare

4.4.1.5. Energy and Utilities

4.4.1.6. Transportation and Logistics

4.4.1.7. Others

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Commercial Property Insurance Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

4.5.1.2. U.S. Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

4.5.1.3. U.S. Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

4.5.1.4. U.S. Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

4.5.1.5. Canada Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

4.5.1.6. Canada Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

4.5.1.7. Canada Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

4.5.1.8. Canada Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Commercial Property Insurance Market Outlook, 2018 - 2030

5.1. Europe Commercial Property Insurance Market Outlook, by Coverage Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Buildings Insurance

5.1.1.2. Contents Insurance

5.1.1.3. Flood Insurance

5.1.1.4. Earthquake Insurance

5.1.1.5. Others

5.2. Europe Commercial Property Insurance Market Outlook, by Application Channels, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Open Perils

5.2.1.2. Named Perils

5.3. Europe Commercial Property Insurance Market Outlook, by Enterprise Size, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Large Enterprises

5.3.1.2. Small and Medium-sized Enterprises

5.4. Europe Commercial Property Insurance Market Outlook, by Industry Vertical, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Manufacturing

5.4.1.2. Construction

5.4.1.3. IT and Telecom

5.4.1.4. Healthcare

5.4.1.5. Energy and Utilities

5.4.1.6. Transportation and Logistics

5.4.1.7. Others

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Commercial Property Insurance Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

5.5.1.2. Germany Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

5.5.1.3. Germany Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

5.5.1.4. Germany Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

5.5.1.5. U.K. Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

5.5.1.6. U.K. Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

5.5.1.7. U.K. Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

5.5.1.8. U.K. Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

5.5.1.9. France Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

5.5.1.10. France Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

5.5.1.11. France Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

5.5.1.12. France Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

5.5.1.13. Italy Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

5.5.1.14. Italy Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

5.5.1.15. Italy Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

5.5.1.16. Italy Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

5.5.1.17. Turkey Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

5.5.1.18. Turkey Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

5.5.1.19. Turkey Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

5.5.1.20. Turkey Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

5.5.1.21. Russia Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

5.5.1.22. Russia Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

5.5.1.23. Russia Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

5.5.1.24. Russia Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

5.5.1.25. Rest of Europe Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

5.5.1.26. Rest of Europe Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

5.5.1.27. Rest of Europe Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

5.5.1.28. Rest of Europe Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Commercial Property Insurance Market Outlook, 2018 - 2030

6.1. Asia Pacific Commercial Property Insurance Market Outlook, by Coverage Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Buildings Insurance

6.1.1.2. Contents Insurance

6.1.1.3. Flood Insurance

6.1.1.4. Earthquake Insurance

6.1.1.5. Others

6.2. Asia Pacific Commercial Property Insurance Market Outlook, by Application Channels, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Open Perils

6.2.1.2. Named Perils

6.3. Asia Pacific Commercial Property Insurance Market Outlook, by Enterprise Size, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Large Enterprises

6.3.1.2. Small and Medium-sized Enterprises

6.4. Asia Pacific Commercial Property Insurance Market Outlook, by Industry Vertical, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. Manufacturing

6.4.1.2. Construction

6.4.1.3. IT and Telecom

6.4.1.4. Healthcare

6.4.1.5. Energy and Utilities

6.4.1.6. Transportation and Logistics

6.4.1.7. Others

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Commercial Property Insurance Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

6.5.1.2. China Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

6.5.1.3. China Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

6.5.1.4. China Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

6.5.1.5. Japan Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

6.5.1.6. Japan Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

6.5.1.7. Japan Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

6.5.1.8. Japan Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

6.5.1.9. South Korea Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

6.5.1.10. South Korea Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

6.5.1.11. South Korea Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

6.5.1.12. South Korea Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

6.5.1.13. India Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

6.5.1.14. India Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

6.5.1.15. India Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

6.5.1.16. India Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

6.5.1.17. Southeast Asia Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

6.5.1.18. Southeast Asia Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

6.5.1.19. Southeast Asia Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

6.5.1.20. Southeast Asia Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Commercial Property Insurance Market Outlook, 2018 - 2030

7.1. Latin America Commercial Property Insurance Market Outlook, by Coverage Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Buildings Insurance

7.1.1.2. Contents Insurance

7.1.1.3. Flood Insurance

7.1.1.4. Earthquake Insurance

7.1.1.5. Others

7.2. Latin America Commercial Property Insurance Market Outlook, by Application Channels, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Open Perils

7.2.1.2. Named Perils

7.3. Latin America Commercial Property Insurance Market Outlook, by Enterprise Size, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Large Enterprises

7.3.1.2. Small and Medium-sized Enterprises

7.4. Latin America Commercial Property Insurance Market Outlook, by Industry Vertical, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Manufacturing

7.4.1.2. Construction

7.4.1.3. IT and Telecom

7.4.1.4. Healthcare

7.4.1.5. Energy and Utilities

7.4.1.6. Transportation and Logistics

7.4.1.7. Others

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Commercial Property Insurance Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

7.5.1.2. Brazil Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

7.5.1.3. Brazil Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

7.5.1.4. Brazil Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

7.5.1.5. Mexico Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

7.5.1.6. Mexico Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

7.5.1.7. Mexico Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

7.5.1.8. Mexico Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

7.5.1.9. Argentina Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

7.5.1.10. Argentina Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

7.5.1.11. Argentina Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

7.5.1.12. Argentina Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

7.5.1.13. Rest of Latin America Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

7.5.1.14. Rest of Latin America Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

7.5.1.15. Rest of Latin America Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

7.5.1.16. Rest of Latin America Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Commercial Property Insurance Market Outlook, 2018 - 2030

8.1. Middle East & Africa Commercial Property Insurance Market Outlook, by Coverage Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Buildings Insurance

8.1.1.2. Contents Insurance

8.1.1.3. Flood Insurance

8.1.1.4. Earthquake Insurance

8.1.1.5. Others

8.2. Middle East & Africa Commercial Property Insurance Market Outlook, by Application Channels, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Open Perils

8.2.1.2. Named Perils

8.3. Middle East & Africa Commercial Property Insurance Market Outlook, by Enterprise Size, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Large Enterprises

8.3.1.2. Small and Medium-sized Enterprises

8.4. Middle East & Africa Commercial Property Insurance Market Outlook, by Industry Vertical, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. Manufacturing

8.4.1.2. Construction

8.4.1.3. IT and Telecom

8.4.1.4. Healthcare

8.4.1.5. Energy and Utilities

8.4.1.6. Transportation and Logistics

8.4.1.7. Others

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Commercial Property Insurance Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

8.5.1.2. GCC Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

8.5.1.3. GCC Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

8.5.1.4. GCC Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

8.5.1.5. South Africa Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

8.5.1.6. South Africa Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

8.5.1.7. South Africa Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

8.5.1.8. South Africa Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

8.5.1.9. Egypt Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

8.5.1.10. Egypt Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

8.5.1.11. Egypt Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

8.5.1.12. Egypt Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

8.5.1.13. Nigeria Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

8.5.1.14. Nigeria Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

8.5.1.15. Nigeria Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

8.5.1.16. Nigeria Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

8.5.1.17. Rest of Middle East & Africa Commercial Property Insurance Market by Coverage Type, Value (US$ Bn), 2018 - 2030

8.5.1.18. Rest of Middle East & Africa Commercial Property Insurance Market Application Channels, Value (US$ Bn), 2018 - 2030

8.5.1.19. Rest of Middle East & Africa Commercial Property Insurance Market Enterprise Size, Value (US$ Bn), 2018 - 2030

8.5.1.20. Rest of Middle East & Africa Commercial Property Insurance Market Industry Vertical, Value (US$ Bn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Application Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Zurich Insurance Group

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. American International Group Inc.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. The Travelers IndeBnity Company

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Allianz SE

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Chubb Limited

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Allstate Insurance Company

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Berkshire Hathaway Homestate Companies (BHHC)

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Progressive

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Liberty Mutual Insurance Company

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Business Strategies and Development

9.4.10. AXA Group

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. AIG

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. The Hartford

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Aon Plc

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Direct Line Group

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. Aviva

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Coverage Type Coverage |

|

|

Application Coverage |

|

|

Enterprise Size Coverage |

|

|

Industry Vertical Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |