Global Companion Animal Diagnostics Market Forecast

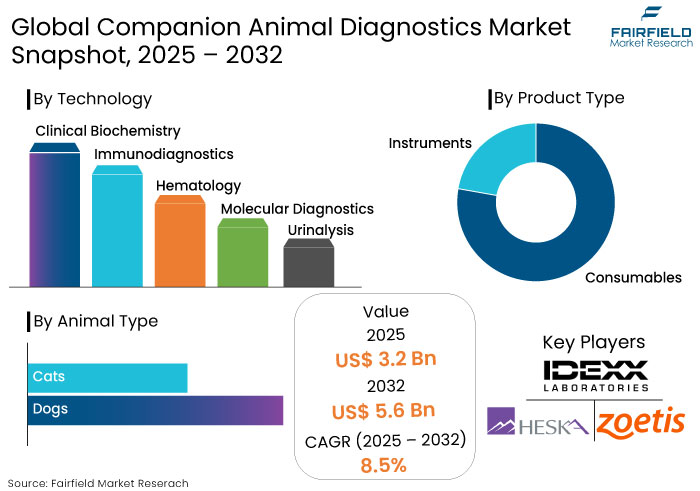

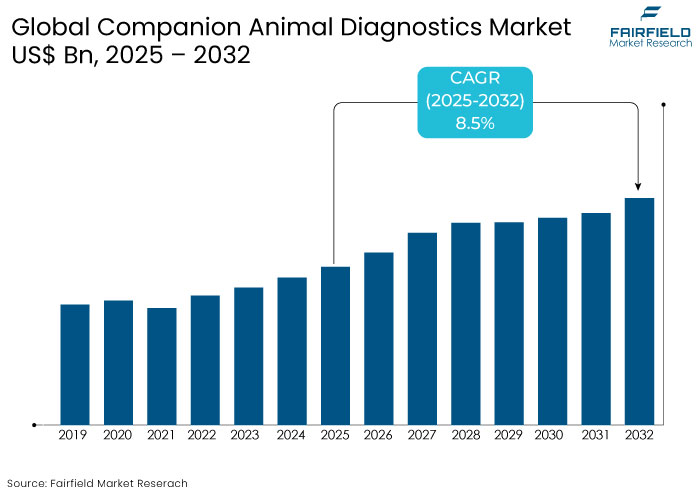

- The companion animal diagnostics market is projected to reach a size of US$ 5.6 Bn by 2032, showing significant growth from the US$ 3.2 Bn achieved in 2025.

- The market for companion animal diagnostics is expected to show a significant expansion rate, with an estimated CAGR of 8.5% from 2025 to 2032.

Companion Animal Diagnostics Market Insights

- Increasing adoption of pets and the rising demand for advanced diagnostic solutions is driving growth.

- Innovations such as point-of-care testing, AI-based diagnostics, and molecular diagnostics are revolutionizing veterinary practices.

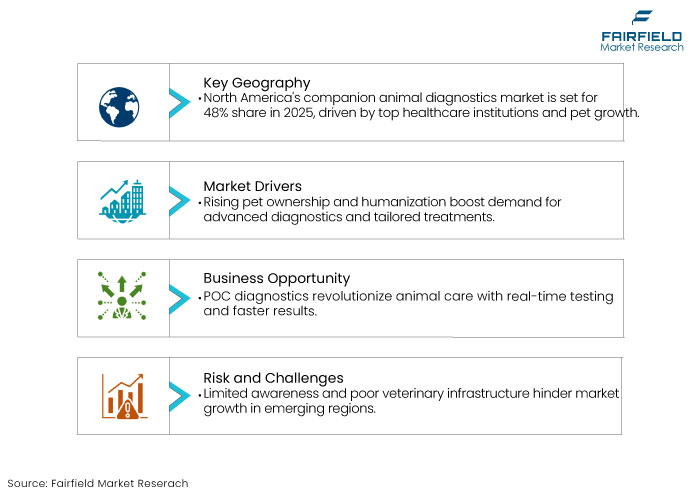

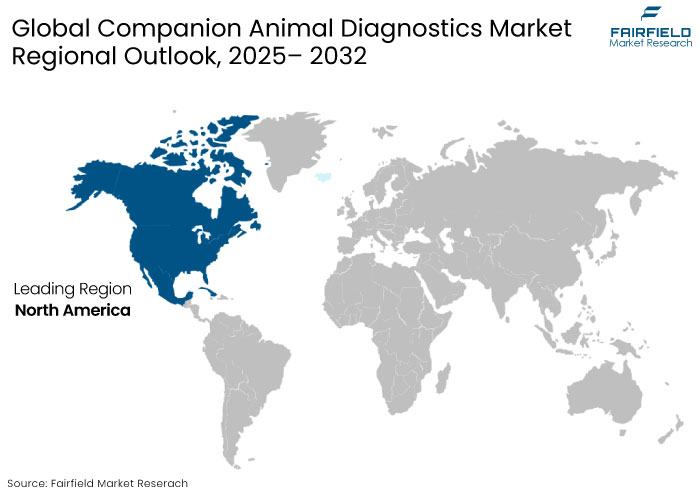

- North America is anticipated to dominate the market, with a share of 48% in 2025 due to high pet ownership rates and advanced veterinary infrastructure in the region.

- Rising awareness about preventive healthcare among pet owners is boosting demand for routine diagnostic tests like wellness panels and blood tests.

- Growing focus on eco-friendly diagnostic tools and practices is influencing product development in the market.

- Increasing cases of chronic diseases like diabetes, arthritis, and cancer in pets are driving the demand for specialized diagnostic solutions.

- Clinical biochemistry is anticipated to lead the technology segment of the market owing to the increasing incidence of zoonotic illnesses.

- Based on animal type, dogs are projected to hold a prominent share of 45% in 2025.

A Look Back and a Look Forward - Comparative Analysis

The companion animal diagnostics market growth during the historical period was attributed to the increasing adoption of pets, especially in developed regions like North America and Europe. Rising disposable incomes and a growing awareness of animal health fueled the demand for advanced diagnostic tools during the period.

Technologies like point-of-care (POC) testing, real-time PCR, and immunoassays have gained traction for their accuracy and efficiency in diagnosing diseases. The COVID-19 pandemic highlighted the importance of zoonotic disease management, further boosting growth. High diagnostic procedure costs and limited infrastructure in emerging regions posed challenges during this period.

Technological advancements like AI-powered diagnostic tools and portable devices for POC testing are anticipated to drive growth during the forecast period. Increasing prevalence of chronic conditions in companion animals, such as diabetes and cancer, are further predicted to drive the demand for animal diagnostics.

Regulatory support for animal welfare along with the rising adoption of preventive healthcare practices is likely to strengthen growth. Focus on sustainability and eco-friendly diagnostic tools is projected to shape the future of the industry, as companies innovate to align with the global environmental goals.

Key Growth Determinants

- Rising Pet Ownership and Humanisation of Pets

Worldwide increase in pet ownership and the escalating tendency of pet humanization have augmented the demand for companion animal diagnostics. Pets are now considered family members, thereby increasing costs linked to their care, particularly in healthcare. This emphasizes the development of precise diagnostics and tailored treatment programs for pets.

According to the American Pet Products Association (APPA), 67% of U.S. households, with around 85 million families owned a pet as of 2021. This surge in pet ownership drives the demand for veterinary care and diagnostics.

In developed regions like North America and Europe, pet owners emphasize preventive care, choosing routine health assessments and early diagnosis to safeguard their pets' health. Emerging regions such as Asia Pacific are witnessing accelerated adoption of dogs as companions owing to the evolving societal norms, increasing disposable incomes, and urbanization.

These factors play a crucial role in generating a rapidly expanding market for sophisticated diagnostic instruments, including blood assays, imaging modalities, and genetic analyses. Awareness campaigns by veterinary organizations and governments regarding disease prevention further amplify the importance of diagnostics.

- Increasing Incidence of Zoonotic Diseases and Chronic Illnesses

Rising incidence of zoonotic infections, including rabies, leptospirosis, and Lyme disease, underscores the essential function of diagnostics in companion animal healthcare. Such diseases provide considerable public health hazards, highlighting the need for precise and timely detection to avert transmission from animals to humans.

- The World Health Organization (WHO) reported that 60% of emerging infectious diseases in humans are zoonotic, with many originating from companion animals.

PCR-based tests and immunoassays are essential to identify and manage zoonotic infections. Chronic ailments like diabetes, arthritis, and cancer are increasingly prevalent in dogs, owing to their extended lifespans and altered diets.

Government actions and legislation aimed at zoonotic disease prevention and awareness campaigns are enhancing the adoption of veterinary diagnostics. Simultaneous emphasis on mitigating public health threats and addressing chronic diseases guarantees a continuous need for diagnostic solutions, establishing it as a pivotal catalyst for market expansion.

- Lyme disease has seen a significant rise, with 300,000 new cases reported annually in the U.S., often linked to pets carrying ticks.

Key Growth Barriers

- Limited Awareness and Veterinary Infrastructure in Developing Markets

In numerous emerging regions, the companion animal diagnostics market encounters obstacles from insufficient awareness of modern diagnostic alternatives and inadequate veterinary infrastructure.

Pet owners in remote or underdeveloped regions frequently depend on fundamental veterinarian services and may not emphasize routine pet health assessments. Lack of specialist veterinary clinics with advanced diagnostic equipment intensifies the problem.

Governments and commercial entities are making an effort to enhance access to veterinary care in such areas. Absence of developed infrastructure and awareness constrains the market's penetration and acceptance of advanced diagnostics, presenting a considerable impediment to the industry's growth.

Companion Animal Diagnostics Market Trends and Opportunities

- Rising Adoption of Point-of-Care (POC) Diagnostics in Veterinary Practices

Growing adoption of point-of-care (POC) diagnostics is emerging as a transformative trend in the companion animal diagnostics market. POC technologies enable real-time testing and rapid results, enhancing the efficiency of veterinary practices.

- According to a survey by VetFolio, 55% of veterinarians reported using POC diagnostic tools regularly in their practices, with portable blood analyzers and handheld imaging devices being the most commonly adopted.

Products like portable blood analysers, handheld imaging devices, and in-clinic rapid test kits are gaining popularity owing to their convenience and reliability. The shift toward POC diagnostics is driven by technological advancements, including microfluidics, biosensors, and integrated data management systems, making these devices more accurate and user-friendly.

POC tools also decrease the dependency on external laboratories, enabling veterinarians to offer comprehensive care under one roof. This trend is particularly impactful in regions having limited access to centralized labs, like rural or remote areas, as it bridges the gap in diagnostic capabilities.

Rising demand for preventive care has amplified the adoption of POC diagnostics for regular health monitoring. This trend is predicted to redefine the way veterinary diagnostics are delivered, enhancing speed and quality of care.

- Augmentation of Preventive Care Initiatives Creates Growth Opportunities

Preventive treatment is swiftly becoming profitable in the companion animal diagnostics market. As pets are perceived as family members, owners are anticipated to spend on their routine health examinations for the early identification of any health concerns.

- According to the American Pet Products Association (APPA), 55% of pet owners in the U.S. now prioritize preventive care for their pets, contributing to a steady increase in expenditure.

Preventive diagnostics, including routine blood tests, fecal examinations, and wellness panels, are experiencing increased demand. This is because they facilitate the early identification of illnesses like diabetes, heart disease, and parasitic infections before they escalate.

- The U.S. pet industry was projected to spend US$ 32.6 billion on pet healthcare in 2024, with a significant portion dedicated to routine diagnostics and wellness check-ups.

Emerging economies in the Asia-Pacific and Latin America are positioned for growth in pet care expenditure owing to the rising disposable incomes and urbanization. Innovations in diagnostic technology, including artificial intelligence (AI) and telemedicine integration, are likely to enhance the accessibility and efficiency of preventive diagnostics.

AI-driven solutions can forecast health hazards utilizing diagnostic data, whereas telemedicine platforms enable veterinarians to evaluate and oversee dogs remotely. The augmentation of preventative care programs improves pet health outcomes while creating new business opportunities for diagnostic manufacturers and veterinary clinics.

How is Regulatory Scenario Shaping this Industry?

The regulatory landscape plays a critical role in shaping the market, driving innovation, product development, and adoption while ensuring safety and efficacy. Regulatory bodies like the U.S. FDA and the European Medicines Agency (EMA) enforce strict guidelines for diagnostic products, ensuring they meet safety and accuracy standards. This drives companies to invest in advanced technologies and high-quality solutions to comply with these regulations.

- Organizations like the World Organisation for Animal Health (OIE) promote uniform diagnostic protocols, fostering growth by encouraging global trade and standardization.

Government authorities across the globe have introduced policies emphasizing animal health and welfare, like mandatory vaccination programs and disease surveillance initiatives. This further creates a demand for diagnostic tools.

- For instance, the EU Animal Health Law supports regular health checks and diagnostics for pets to control zoonotic diseases.

Segment Covered in the Report

- Increasing Incidence of Zoonotic Illnesses to drive Growth in Clinical Biochemistry

Pet owners have acknowledged the advantages of clinical biochemistry in diagnosing and monitoring diverse health issues in companion animals. These examinations yield information regarding organ functionality, metabolic conditions, and disease.

Availability of several commercial reagents and consumables for clinical biochemistry has enhanced its significance. The precision of these analysers has motivated pet owners and doctors to use them swiftly and effectively.

The urinalysis diagnosis further enables veterinarians to swiftly evaluate renal function, identify urinary tract infections, and oversee general health. Advancements in urinalysis apparatus, like automated analysers and dipstick tests, streamline the procedure and facilitate prompt diagnosis.

- As Individuals Embrace Dogs as Family Members, they are Prioritizing their Healthcare

Dogs are anticipated to constitute 45% of share in the animal type segment. Researching common dog disorders, including heart disease, cancer, diabetes, and infectious conditions, has enhanced diagnostic methods for early identification and improved treatment strategies.

Increased utilization of dog diagnostic services, encompassing normal health assessments and costly examinations for breed-specific ailments expand prospects for this application. A large number of individuals are embracing dogs as family members and therefore prioritizing their health care.

Individuals are also motivated to explore health improvements through veterinary diagnostics. Enhanced comprehension of dog health along with the rising demand for niche-specific diagnostic solutions significantly contribute to dogs becoming the largest animal type.

Regional Analysis

- Prevalence of Chronic Diseases Among the Pet Population of North America to Augment Growth

The companion animal diagnostics market in North America is anticipated to account for a share of 48% in 2025. Growth in the region is anticipated to be driven by the existence of prominent animal healthcare institutions and the rising population of companion animals.

Animal diagnostics companies are aiming to introduce technologically advanced medical equipment in the region to address the increasing need for animal disease diagnostic tools and therapies. The U.S. companion animal diagnostics sector commands a significant market share of 85% in North America. This growth is attributed to the increasing prevalence of chronic diseases, including diabetes, cancer, and skin problems among the pet population in the country.

The market has shown a rise in in-house testing practices with the commercial availability of diagnostic and therapeutic items. Increasing disposable incomes have prompted pet owners to allocate resources towards pet healthcare, elevating the need for veterinary clinics, pharmaceuticals, and therapies in the region.

- Pet Owners in Asia Pacific are Recognizing the Necessity of Proactive Health Management

The Asia Pacific companion animal diagnostics market is projected to exhibit a CAGR of 7.5% through the forecast period. Growth in the region is primarily driven by rapid urbanization and rising pet ownership rates.

As people relocate to metropolitan areas, veterinary clinics and diagnostic services are becoming more accessible, thereby facilitating a convenient healthcare-seeking experience for pet owners. Urban migration underscores the significance of pet health, as pet owners increasingly recognize the necessity of proactive health management and diagnostic opportunities.

Diagnostic testing is anticipated to witness a surge in utilization as individuals become more educated about the timing and methods for early disease detection. Pet owners are estimated to continue to spend on resources, especially in growing markets like China and India, to being enhancements in veterinarian services.

Fairfield’s Competitive Landscape Analysis

The companion animal diagnostics market is highly competitive. Global and regional players are focused on innovation and are working on expanding their reach. Leading companies in the industry include IDEXX Laboratories, Zoetis Inc., Heska Corporation, Thermo Fisher Scientific, and Virbac. These businesses dominate the market through extensive product portfolios, advanced diagnostic solutions, and strong distribution networks.

Emerging players are emphasizing on cost-effective solutions while targeting underpenetrated markets, particularly in Asia Pacific and Latin America. Technological advancements, like AI-driven diagnostic tools and real-time PCR, further intensify competition. Rising demand for personalized diagnostics and preventive care is prompting companies to invest in innovation and regional expansion.

Key Market Companies

- IDEXX Laboratories, Inc.

- Zoetis Inc.

- Heska Corporation

- Thermo Fisher Scientific Inc.

- Virbac

- Bayer Animal Health

- Neogen Corporation

- Fujifilm Holdings Corporation

- Indical Bioscience GmbH

- Idvet

- Randax Laboratories

- Bionote Inc.

- Skyla Coproration

- Urit Medical Electronic Co., Ltd.

- Nova Biomedical

- Swissavans AG

- Alvedia

- Megacor Veterinary Diagnostics

- Biopanda Reagents Ltd.

- Anipoc Ltd.

- Ring Biotechnology Co Ltd.

Recent Industry Developments

- In June 2024, IDEXX Laboratories, Inc. introduced the Catalyst Pancreatic Lipase Test, a single-slide diagnostic tool for dogs and cats afflicted with pancreatitis.

- In January 2024, Zoetis announced the improvement of its diagnostic platform, Vetscan Imagyst, enhanced with a novel function for AI Urine Sediment analysis.

An Expert’s Eye

- Innovations in diagnostic tools are transforming the market by making diagnostics faster, accessible, and accurate.

- Experts note that pet owners are now more proactive about routine check-ups and early disease detection, thereby boosting the demand for diagnostic services.

- Rising disposable incomes in Asia Pacific and Latin America are anticipated to make these regions key markets, with increasing pet ownership and demand for diagnostic services.

- Veterinary clinics are predicted to remain the primary adopters of diagnostic technologies, with rising investments in new diagnostic equipment and technologies essential for maintaining competitive advantage.

Global Companion Animal Diagnostics Market is Segmented as-

By Product Type

- Consumables

- Instruments

By Technology

- Clinical Biochemistry

- Immunodiagnostics

- Hematology

- Molecular Diagnostics

- Urinalysis

- Others

By Application

- Bacteriology

- Clinical Pathology

- Virology

- Parasitology

- Others

By Animal Type

- Dogs

- Cats

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Companion Animal Diagnostics Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact Of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. Pestle Analysis

3. Price Analysis, 2019 - 2032

3.1. Global Average Price Analysis, by Product Type, US$ Per Unit, 2019 - 2032

3.2. Prominent Factor Affecting Companion Animal Diagnostics Prices

3.3. Global Average Price Analysis, by Region, US$ Per Unit, 2019 - 2032

4. Global Companion Animal Diagnostics Market Outlook, 2019 - 2032

4.1. Global Companion Animal Diagnostics Market Outlook, by Product Type, Value (US$ Bn) 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Consumables

4.1.1.2. Instruments

4.2. Global Companion Animal Diagnostics Market Outlook, by Technology, Value (US$ Bn) 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Clinical Biochemistry

4.2.1.2. Immunodiagnostics

4.2.1.3. Hematology

4.2.1.4. Molecular Diagnostics

4.2.1.5. Urinalysis

4.2.1.6. Others

4.3. Global Companion Animal Diagnostics Market Outlook, by Application, Value (US$ Bn) 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Bacteriology

4.3.1.2. Clinical Pathology

4.3.1.3. Virology

4.3.1.4. Parasitology

4.3.1.5. Others

4.4. Global Companion Animal Diagnostics Market Outlook, by Animal Type, Value (US$ Bn) 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. Dogs

4.4.1.2. Cats

4.4.1.3. Others

4.5. Global Companion Animal Diagnostics Market Outlook, by Region, Value (US$ Bn) 2019 - 2032

4.5.1. Key Highlights

4.5.1.1. North America

4.5.1.2. Europe

4.5.1.3. Asia Pacific

4.5.1.4. Latin America

4.5.1.5. Middle East & Africa

5. North America Companion Animal Diagnostics Market Outlook, 2019 - 2032

5.1. North America Companion Animal Diagnostics Market Outlook, by Product Type, Value (US$ Bn) 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Consumables

5.1.1.2. Instruments

5.2. North America Companion Animal Diagnostics Market Outlook, by Technology, Value (US$ Bn) 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Clinical Biochemistry

5.2.1.2. Immunodiagnostics

5.2.1.3. Hematology

5.2.1.4. Molecular Diagnostics

5.2.1.5. Urinalysis

5.2.1.6. Others

5.3. North America Companion Animal Diagnostics Market Outlook, by Application, Value (US$ Bn) 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Bacteriology

5.3.1.2. Clinical Pathology

5.3.1.3. Virology

5.3.1.4. Parasitology

5.3.1.5. Others

5.4. North America Companion Animal Diagnostics Market Outlook, by Animal Type, Value (US$ Bn) 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Dogs

5.4.1.2. Cats

5.4.1.3. Others

5.5. North America Companion Animal Diagnostics Market Outlook, by Country, Value (US$ Bn) 2019 - 2032

5.5.1. Key Highlights

5.5.1.1. U.S. Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

5.5.1.2. U.S. Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

5.5.1.3. U.S. Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

5.5.1.4. U.S. Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

5.5.1.5. Canada Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

5.5.1.6. Canada Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

5.5.1.7. Canada Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

5.5.1.8. Canada Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Companion Animal Diagnostics Market Outlook, 2019 - 2032

6.1. Europe Companion Animal Diagnostics Market Outlook, by Product Type, Value (US$ Bn) 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Consumables

6.1.1.2. Instruments

6.2. Europe Companion Animal Diagnostics Market Outlook, by Technology, Value (US$ Bn) 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Clinical Biochemistry

6.2.1.2. Immunodiagnostics

6.2.1.3. Hematology

6.2.1.4. Molecular Diagnostics

6.2.1.5. Urinalysis

6.2.1.6. Others

6.3. Europe Companion Animal Diagnostics Market Outlook, by Application, Value (US$ Bn) 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Bacteriology

6.3.1.2. Clinical Pathology

6.3.1.3. Virology

6.3.1.4. Parasitology

6.3.1.5. Others

6.4. Europe Companion Animal Diagnostics Market Outlook, by Animal Type, Value (US$ Bn) 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Dogs

6.4.1.2. Cats

6.4.1.3. Others

6.5. Europe Companion Animal Diagnostics Market Outlook, by Country, Value (US$ Bn) 2019 - 2032

6.5.1. Key Highlights

6.5.1.1. Germany Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

6.5.1.2. Germany Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

6.5.1.3. Germany Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

6.5.1.4. Germany Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

6.5.1.5. U.K. Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

6.5.1.6. U.K. Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

6.5.1.7. U.K. Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

6.5.1.8. U.K. Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

6.5.1.9. France Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

6.5.1.10. France Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

6.5.1.11. France Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

6.5.1.12. France Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

6.5.1.13. Italy Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

6.5.1.14. Italy Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

6.5.1.15. Italy Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

6.5.1.16. Italy Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

6.5.1.17. Turkey Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

6.5.1.18. Turkey Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

6.5.1.19. Turkey Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

6.5.1.20. Turkey Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

6.5.1.21. Russia Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

6.5.1.22. Russia Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

6.5.1.23. Russia Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

6.5.1.24. Russia Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

6.5.1.25. Rest Of Europe Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

6.5.1.26. Rest Of Europe Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

6.5.1.27. Rest Of Europe Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

6.5.1.28. Rest of Europe Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Companion Animal Diagnostics Market Outlook, 2019 - 2032

7.1. Asia Pacific Companion Animal Diagnostics Market Outlook, by Product Type, Value (US$ Bn) 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Consumables

7.1.1.2. Instruments

7.2. Asia Pacific Companion Animal Diagnostics Market Outlook, by Technology, Value (US$ Bn) 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Clinical Biochemistry

7.2.1.2. Immunodiagnostics

7.2.1.3. Hematology

7.2.1.4. Molecular Diagnostics

7.2.1.5. Urinalysis

7.2.1.6. Others

7.3. Asia Pacific Companion Animal Diagnostics Market Outlook, by Application, Value (US$ Bn) 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Bacteriology

7.3.1.2. Clinical Pathology

7.3.1.3. Virology

7.3.1.4. Parasitology

7.3.1.5. Others

7.4. Asia Pacific Companion Animal Diagnostics Market Outlook, by Animal Type, Value (US$ Bn) 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Dogs

7.4.1.2. Cats

7.4.1.3. Others

7.5. Asia Pacific Companion Animal Diagnostics Market Outlook, by Country, Value (US$ Bn) 2019 - 2032

7.5.1. Key Highlights

7.5.1.1. China Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

7.5.1.2. China Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

7.5.1.3. China Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

7.5.1.4. China Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

7.5.1.5. Japan Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

7.5.1.6. Japan Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

7.5.1.7. Japan Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

7.5.1.8. Japan Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

7.5.1.9. South Korea Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

7.5.1.10. South Korea Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

7.5.1.11. South Korea Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

7.5.1.12. South Korea Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

7.5.1.13. India Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

7.5.1.14. India Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

7.5.1.15. India Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

7.5.1.16. India Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

7.5.1.17. Southeast Asia Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

7.5.1.18. Southeast Asia Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

7.5.1.19. Southeast Asia Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

7.5.1.20. Southeast Asia Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

7.5.1.21. Rest Of Asia Pacific Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

7.5.1.22. Rest Of Asia Pacific Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

7.5.1.23. Rest Of Asia Pacific Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

7.5.1.24. Rest of Asia Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Companion Animal Diagnostics Market Outlook, 2019 - 2032

8.1. Latin America Companion Animal Diagnostics Market Outlook, by Product Type, Value (US$ Bn) 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Consumables

8.1.1.2. Instruments

8.2. Latin America Companion Animal Diagnostics Market Outlook, by Technology, Value (US$ Bn) 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Clinical Biochemistry

8.2.1.2. Immunodiagnostics

8.2.1.3. Hematology

8.2.1.4. Molecular Diagnostics

8.2.1.5. Urinalysis

8.2.1.6. Others

8.3. Latin America Companion Animal Diagnostics Market Outlook, by Application, Value (US$ Bn) 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Bacteriology

8.3.1.2. Clinical Pathology

8.3.1.3. Virology

8.3.1.4. Parasitology

8.3.1.5. Others

8.4. Latin America Companion Animal Diagnostics Market Outlook, by Animal Type, Value (US$ Bn) 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Dogs

8.4.1.2. Cats

8.4.1.3. Others

8.5. Latin America Companion Animal Diagnostics Market Outlook, by Country, Value (US$ Bn) 2019 - 2032

8.5.1. Key Highlights

8.5.1.1. Brazil Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

8.5.1.2. Brazil Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

8.5.1.3. Brazil Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

8.5.1.4. Brazil Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

8.5.1.5. Mexico Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

8.5.1.6. Mexico Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

8.5.1.7. Mexico Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

8.5.1.8. Mexico Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

8.5.1.9. Argentina Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

8.5.1.10. Argentina Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

8.5.1.11. Argentina Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

8.5.1.12. Argentina Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

8.5.1.13. Rest Of Latin America Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

8.5.1.14. Rest Of Latin America Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

8.5.1.15. Rest Of Latin America Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

8.5.1.16. Rest of Latin America Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Companion Animal Diagnostics Market Outlook, 2019 - 2032

9.1. Middle East & Africa Companion Animal Diagnostics Market Outlook, by Product Type, Value (US$ Bn) 2019 - 2032

9.1.1. Key Highlights

9.1.1.1. Consumables

9.1.1.2. Instruments

9.2. Middle East & Africa Companion Animal Diagnostics Market Outlook, by Technology, Value (US$ Bn) 2019 - 2032

9.2.1. Key Highlights

9.2.1.1. Clinical Biochemistry

9.2.1.2. Immunodiagnostics

9.2.1.3. Hematology

9.2.1.4. Molecular Diagnostics

9.2.1.5. Urinalysis

9.2.1.6. Others

9.3. Middle East & Africa Companion Animal Diagnostics Market Outlook, by Application, Value (US$ Bn) 2019 - 2032

9.3.1. Key Highlights

9.3.1.1. Bacteriology

9.3.1.2. Clinical Pathology

9.3.1.3. Virology

9.3.1.4. Parasitology

9.3.1.5. Others

9.4. Middle East & Africa Companion Animal Diagnostics Market Outlook, by Animal Type, Value (US$ Bn) 2019 - 2032

9.4.1. Key Highlights

9.4.1.1. Dogs

9.4.1.2. Cats

9.4.1.3. Others

9.5. Middle East & Africa Companion Animal Diagnostics Market Outlook, by Country, Value (US$ Bn) 2019 - 2032

9.5.1. Key Highlights

9.5.1.1. GCC Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

9.5.1.2. GCC Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

9.5.1.3. GCC Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

9.5.1.4. GCC Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

9.5.1.5. South Africa Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

9.5.1.6. South Africa Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

9.5.1.7. South Africa Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

9.5.1.8. South Africa Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

9.5.1.9. Egypt Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

9.5.1.10. Egypt Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

9.5.1.11. Egypt Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

9.5.1.12. Egypt Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

9.5.1.13. Nigeria Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

9.5.1.14. Nigeria Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

9.5.1.15. Nigeria Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

9.5.1.16. Nigeria Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

9.5.1.17. Rest Of Middle East & Africa Companion Animal Diagnostics Market by Product Type, Value (US$ Bn) 2019 - 2032

9.5.1.18. Rest Of Middle East & Africa Companion Animal Diagnostics Market by Technology, Value (US$ Bn) 2019 - 2032

9.5.1.19. Rest Of Middle East & Africa Companion Animal Diagnostics Market by Application, Value (US$ Bn) 2019 - 2032

9.5.1.20. Rest of Middle East & Africa Companion Animal Diagnostics Market by Animal Type, Value (US$ Bn) 2019 - 2032

9.5.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. By Application Vs by Technology Heat Map

10.2. Manufacturer Vs by Technology Heatmap

10.3. Company Market Share Analysis, 2022

10.4. Competitive Dashboard

10.5. Company Profiles

10.5.1. IDEXX Laboratories, Inc.

10.5.1.1. Company Overview

10.5.1.2. Product Type Portfolio

10.5.1.3. Financial Overview

10.5.1.4. Business Strategies and Development

10.5.2. Zoetis Inc.

10.5.2.1. Company Overview

10.5.2.2. Product Type Portfolio

10.5.2.3. Financial Overview

10.5.2.4. Business Strategies and Development

10.5.3. Heska Corporation

10.5.3.1. Company Overview

10.5.3.2. Product Type Portfolio

10.5.3.3. Financial Overview

10.5.3.4. Business Strategies and Development

10.5.4. Thermo Fisher Scientific Inc.

10.5.4.1. Company Overview

10.5.4.2. Product Type Portfolio

10.5.4.3. Financial Overview

10.5.4.4. Business Strategies and Development

10.5.5. Virbac

10.5.5.1. Company Overview

10.5.5.2. Product Type Portfolio

10.5.5.3. Financial Overview

10.5.5.4. Business Strategies and Development

10.5.6. Bayer Animal Health

10.5.6.1. Company Overview

10.5.6.2. Product Type Portfolio

10.5.6.3. Financial Overview

10.5.6.4. Business Strategies and Development

10.5.7. Neogen Corporation

10.5.7.1. Company Overview

10.5.7.2. Product Type Portfolio

10.5.7.3. Financial Overview

10.5.7.4. Business Strategies and Development

10.5.8. Fujifilm Holdings Corporation

10.5.8.1. Company Overview

10.5.8.2. Product Type Portfolio

10.5.8.3. Financial Overview

10.5.8.4. Business Strategies and Development

10.5.9. Indical Bioscience GmbH

10.5.9.1. Company Overview

10.5.9.2. Product Type Portfolio

10.5.9.3. Financial Overview

10.5.9.4. Business Strategies and Development

10.5.10. Idvet

10.5.10.1. Company Overview

10.5.10.2. Product Type Portfolio

10.5.10.3. Financial Overview

10.5.10.4. Business Strategies and Development

10.5.11. Randax Laboratories

10.5.11.1. Company Overview

10.5.11.2. Product Type Portfolio

10.5.11.3. Financial Overview

10.5.11.4. Business Strategies and Development

10.5.12. Bionote Inc.

10.5.12.1. Company Overview

10.5.12.2. Product Type Portfolio

10.5.12.3. Financial Overview

10.5.12.4. Business Strategies and Development

10.5.13. Skyla Coproration

10.5.13.1. Company Overview

10.5.13.2. Product Type Portfolio

10.5.13.3. Financial Overview

10.5.13.4. Business Strategies and Development

10.5.14. Urit Medical Electronic Co., Ltd

10.5.14.1. Company Overview

10.5.14.2. Product Type Portfolio

10.5.14.3. Financial Overview

10.5.14.4. Business Strategies and Development

10.5.15. Nova Biomedical

10.5.15.1. Company Overview

10.5.15.2. Product Type Portfolio

10.5.15.3. Financial Overview

10.5.15.4. Business Strategies and Development

10.5.16. Swissavans AG

10.5.16.1. Company Overview

10.5.16.2. Product Type Portfolio

10.5.16.3. Financial Overview

10.5.16.4. Business Strategies and Development

10.5.17. Alvedia

10.5.17.1. Company Overview

10.5.17.2. Product Type Portfolio

10.5.17.3. Financial Overview

10.5.17.4. Business Strategies and Development

10.5.18. Megacor Veterinary Diagnostics

10.5.18.1. Company Overview

10.5.18.2. Product Type Portfolio

10.5.18.3. Financial Overview

10.5.18.4. Business Strategies and Development

10.5.19. Biopanda Reagents Ltd

10.5.19.1. Company Overview

10.5.19.2. Product Type Portfolio

10.5.19.3. Financial Overview

10.5.19.4. Business Strategies and Development

10.5.20. Anipoc Ltd

10.5.20.1. Company Overview

10.5.20.2. Product Type Portfolio

10.5.20.3. Financial Overview

10.5.20.4. Business Strategies and Development

10.5.21. Ring Biotechnology Co Ltd

10.5.21.1. Company Overview

10.5.21.2. Product Type Portfolio

10.5.21.3. Financial Overview

10.5.21.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms And Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Technology Coverage |

|

|

Application Coverage |

|

|

Animal Type Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |