Global Compression Socks Market Forecast

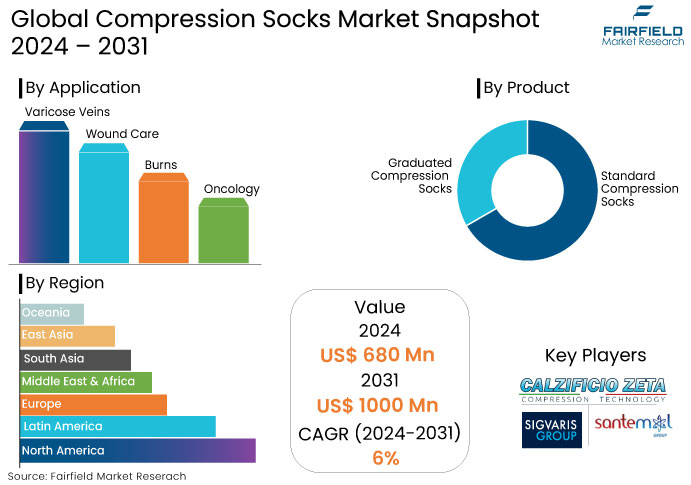

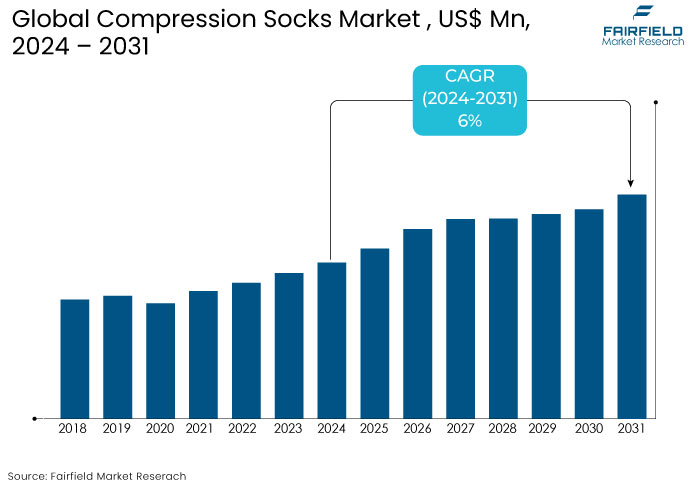

- The global compression socks market is projected to value at US$1000 Mn by 2031, showing significant growth from the US$680 Mn achieved in 2024.

- The market is anticipated to exhibit a CAGR of 6% during the forecast period from 2024 to 2031.

Compression Socks Market Insights

- Increased health awareness among consumers drives the demand for compression socks.

- E-commerce platforms have significantly impacted the market sales.

- Graduated compression socks are predicted to account for approximately 60.3% of the overall market in 2024.

- Technological advancements in fabric and design are revolutionizing the market.

- Varicose veins are expected to attain 48.13% share in the market in 2024.

- The rise in healthcare expenditure and government investments in innovative healthcare products fuels the industry demand.

- Germany is poised to emerge as the leading country in European market with a 27.13% market share in 2024.

- Online shopping provides a convenient avenue for purchasing compression garments.

A Look Back and a Look Forward - Comparative Analysis

The compression socks market analysis has shown notable growth trends both pre-2023 and is projected to continue evolving post-2024. Between 2019 and 2023, the market expanded at a CAGR of around 5.2%, driven by increasing awareness of health benefits associated with compression therapy. The pandemic further accelerated this trend as consumers became health-conscious and sought preventive measures for circulatory issues.

The market is projected to expand at a CAGR of 6% from 2024 to 2031. Key factors fueling this growth include the rising popularity of athleisure and sportswear, which has led to increased demand for performance-oriented compression socks.

Advancements in fabric technology such as moisture-wicking and breathable materials are enhancing product appeal. The expansion of e-commerce platforms is also making these products more accessible to a broader audience further driving compression socks market growth. As consumer preferences shift toward functional and fashionable options, the market is well-positioned for sustained expansion in the coming years.

Key Growth Determinants

- Increasing Health Awareness

Growing health awareness among consumers is a significant driver for the compression socks market growth. As many individuals become informed about the benefits of maintaining good circulation and preventing venous diseases, the demand for compression garments has surged.

People are increasingly recognizing the importance of proactive health measures, especially among populations at risk such as pregnant women, the elderly, and individuals with sedentary lifestyles. Consequently, there is a heightened interest in compression socks as a preventive solution. This awareness is not limited to medical applications; athletes are also adopting compression socks to enhance performance and recovery.

As consumers prioritize their health and wellness, the market is positioned for substantial growth driven by informed purchasing decisions.

- Expanding E-commerce Platforms

The rapid expansion of e-commerce platforms has significantly impacted compression socks market demand facilitating great accessibility for consumers. Online shopping provides a convenient avenue for purchasing compression garments allowing consumers to explore a diverse range of products from the comfort of their homes.

E-commerce platforms often feature detailed product descriptions, customer reviews, and comparison tools, empowering consumers to make informed choices. Moreover, the availability of subscription models and targeted marketing through social media has allowed brands to reach niche markets effectively. The ease of returning products and personalized recommendations also enhance the customer experience further driving sales.

- Technological Advancements in Fabric and Design

Technological advancements in fabric and design are revolutionizing the compression socks market expansion leading to enhanced product performance and consumer appeal. Innovations in materials such as moisture-wicking fabrics and breathable textiles have improved comfort and usability making compression socks appealing to a broad audience.

Advances in manufacturing techniques allow for seamless construction and ergonomic designs, reducing discomfort during extended wear. These improvements not only enhance the effectiveness of compression therapy but also encourage more consumers to incorporate these products into their daily routines.

As brands continue to invest in research and development, the integration of cutting-edge technologies will propel the growth of the market, meeting the evolving demands of health-conscious consumers.

Key Growth Barriers

- High Competition and Market Saturation

One of the primary restraints affecting the compression socks market sales is the high level of competition and market saturation. With numerous brands and products available, consumers often face an overwhelming array of choices, which can lead to decision fatigue.

Established brands dominate the market making it challenging for new entrants to gain traction. This intense competition can result in price wars, which may erode profit margins for manufacturers.

As the market matures, the differentiation between products becomes less pronounced, leading to a commoditization of compression socks. As a result, the market may experience slow growth rates in certain regions particularly where consumer preferences are already well-established.

- Limited Consumer Awareness and Misconceptions

Another significant restraint for the compression socks market is the limited consumer awareness and prevalent misconceptions regarding the benefits and uses of compression therapy. While health awareness is increasing, many consumers still lack a comprehensive understanding of how compression socks can aid in preventing and managing various health conditions.

Misconceptions about the discomfort associated with wearing compression socks can deter potential users from trying them. This lack of awareness can limit market penetration, particularly in demographics that could benefit from compression therapy such as the elderly or those with sedentary lifestyles.

Compression Socks Market Trends and Opportunities

- Integration of Advanced Fabric Technologies

A significant trend shaping the compression socks market is the integration of advanced fabric technologies. Manufacturers are increasingly utilizing innovative materials that enhance the functionality and comfort of compression socks. These advancements include moisture-wicking fabrics, antimicrobial treatments, and breathable designs that improve wearability during extended use.

Intelligent textiles that incorporate sensors to monitor health metrics, such as blood circulation and temperature, are emerging. This trend caters to the growing demand for performance-oriented products among athletes and addresses the needs of individuals with medical conditions requiring consistent monitoring. As consumers become more health-conscious and seek products that offer both therapeutic benefits and comfort, adopting these advanced technologies is expected to drive market growth.

- Expansion into Emerging Markets

Several compression socks market opportunities are opening up due to the expansion into emerging markets. As healthcare infrastructure improves and disposable incomes rise in Asia-Pacific, Latin America, and parts of Africa, there is a growing demand for health and wellness products including compression socks.

The increasing prevalence of lifestyle-related health issues such as obesity and diabetes is increasing awareness of the benefits of compression therapy. Moreover, the aging population in these regions is likely to contribute to a higher demand for products that promote leg health and prevent venous disorders. Companies can capitalize on this opportunity by tailoring their marketing strategies to educate consumers about the advantages of compression socks and by establishing distribution channels that make these products more accessible.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape plays a crucial role in shaping the compression socks market demand, influencing product development, safety standards, and market entry strategies. Regulatory bodies, such as the FDA in the United States and the European Medicines Agency in Europe, set stringent guidelines for the manufacturing and marketing of medical devices, including compression garments. These regulations ensure that products meet safety and efficacy standards, which is essential for consumer trust and market growth.

There has been an increasing focus on product compliance testing and market approvals in recent year. Companies are required to demonstrate that their compression socks provide the claimed therapeutic benefits such as improved circulation and reduced swelling. This has led to innovations in materials and design as manufacturers strive to meet regulatory requirements while enhancing product performance.

A few market trends include the rise in healthcare expenditure, and government investments in innovative healthcare products have further influenced the market. As awareness of the benefits of compression therapy grows, regulatory support for these products is likely to increase facilitating market expansion. Additionally, the evolving reimbursement landscape is encouraging healthcare providers to recommend compression socks, thereby boosting demand and shaping future market trends.

Segments Covered in the Report

- Graduated Compression Socks to Reach 60.3% Market Share

As per the compression socks market update, in 2024, the graduated compression socks segment is anticipated to account for approximately 60.3% of the overall market. These specialized socks are particularly popular among individuals with desk jobs, where prolonged sitting can lead to poor circulation.

In environments that require more standing than walking, many professionals opt for graduated compression socks to enhance comfort and support. Unlike standard compression socks, graduated options deliver varying levels of pressure, providing soft support around the lower leg while exerting the most pressure at the ankle. This targeted compression helps improve blood flow, reduce swelling, and promote overall leg health making them a favored choice for many.

- Varicose Veins Foreseen to Attain 48.13% Share in the Market

The varicose vein segment is predicted to attain substantial 48.13% share of the compression socks market. According to a report by the National Center for Biotechnology Information (NCBI), the prevalence of varicose vein disorders varies geographically, affecting an estimated 2% to 73% of the global population.

Several factors contribute to the development of varicose veins, including age, gender, pregnancy, family history, smoking, obesity, genetic predisposition, and a sedentary lifestyle. Given these widespread risk factors, the demand for effective management solutions such as compression products and socks is expected to rise significantly in the coming years.

Regional Analysis

- North America Poised to Lead the Market for Compression Socks

In 2024, the U.S. is expected to hold a remarkable 97.5% share of the North America compression socks market. This dominance is underscored by alarming health statistics, as over 900,000 Americans are diagnosed with deep vein thrombosis (DVT) annually.

The Centers for Disease Control and Prevention (CDC) reports that 30% to 50% of DVT patients may develop post-thrombotic syndrome, leading to chronic symptoms such as swelling, pain, discoloration, and skin peeling in the affected areas. These concerning figures are anticipated to drive significant demand for compression socks in the coming years, as individuals seek effective solutions to manage their symptoms and enhance overall leg health.

- Germany Set to Expand the Market with a 27.13% Share

Germany is predicted to emerge as the leading player in the Europe compression socks market in recent years capturing an impressive 27.13% market share. With approximately 2 million sports-related injuries reported annually, as noted in a 2021 study published by the Springer journal, the demand for compression socks is expected to rise significantly.

The increasing incidence of sports injuries highlights the need for effective recovery products. Additionally, heightened consumer awareness and the growing trend of online shopping are set to further bolster market expansion in Germany. The combination of these factors positions the country for continued growth in the compression socks sector.

Fairfield’s Competitive Landscape Analysis

The compression socks market is characterized by intense competition among several key players, each striving to innovate and capture market share. Notable companies include Nike, which has launched its Nike Pro Compression Socks since 2022, featuring advanced moisture-wicking technology and targeted compression zones designed for athletes. This product aims to enhance performance and recovery appealing to both professional and amateur sports enthusiasts.

Key Market Companies

- 3M Corporation

- SIGVARIS Group

- Medtronic Plc

- Essity

- Santemol Group Medikal

- Calzificio ZETA S.R.L.

- medi GmbH & Co KG

- Santemol Group Medikal

- Sanyleg Srl

- Therafirm

Recent Industry Developments

July 2024

Vim & Vigr, a maker of stylish compression socks, has partnered with neurosurgeon, mother, and educator Dr. Betsy Grunch to create limited-edition Big Brains socks. The socks feature Vim & Vigr's wellness-boosting graduated compression for increased leg health and a fun splash of style. Available in two compression levels, 15-20 mmHg and 20-30 mmHg, the socks feature a premium cotton blend for comfort and graduated compression from ankle to calf with a contoured leg and heel. Vim & Vigr designs and manufactures high-quality compression legwear to energize legs, reduce swelling, and alleviate achiness and heaviness.

August 2024

Crazy Compression, a compression socks company, has launched a wholesale program to make its socks accessible to retailers and businesses nationwide. The program offers a wide range of compression socks in various sizes and levels, crafted with advanced materials for improved circulation and recovery.

An Expert’s Eye

- Rising demand for health and wellness products, including compression socks fuels industry demand.

- Online shopping provides a convenient avenue for purchasing compression garments.

- Subscription models and targeted marketing through social media have allowed brands to reach niche markets effectively.

- Healthcare infrastructure improvement and rising disposable incomes drive demand for health and wellness products, including compression socks.

- Regulatory bodies set stringent guidelines for the manufacturing and marketing of medical devices.

Global Compression Socks Market is Segmented as-

By Product

- Standard Compression Socks

- Graduated Compression Socks

By Application

- Varicose Veins

- Wound Care

- Burns

- Oncology

- Others

By Region

- North America

- Latin America

- Europe

- Middle East & Africa

- South Asia

- East Asia

- Oceania

1. Executive Summary

1.1. Global Compression Socks Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Compression Socks Market Outlook, 2019 - 2031

3.1. Global Compression Socks Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Standard Compression Socks

3.1.1.2. Graduated Compression Socks

3.2. Global Compression Socks Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Varicose Veins

3.2.1.2. Wound Care

3.2.1.3. Burns

3.2.1.4. Oncology

3.2.1.5. Others

3.3. Global Compression Socks Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Hospitals

3.3.1.2. Ambulatory Surgical Centers

3.3.1.3. Clinics

3.3.1.4. Online Sales

3.3.1.5. Other Healthcare Facilities

3.4. Global Compression Socks Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Compression Socks Market Outlook, 2019 - 2031

4.1. North America Compression Socks Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Standard Compression Socks

4.1.1.2. Graduated Compression Socks

4.2. North America Compression Socks Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Varicose Veins

4.2.1.2. Wound Care

4.2.1.3. Burns

4.2.1.4. Oncology

4.2.1.5. Others

4.3. North America Compression Socks Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Hospitals

4.3.1.2. Ambulatory Surgical Centers

4.3.1.3. Clinics

4.3.1.4. Online Sales

4.3.1.5. Other Healthcare Facilities

4.4. North America Compression Socks Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

4.4.1.2. U.S. Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

4.4.1.3. U.S. Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

4.4.1.4. Canada Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

4.4.1.5. Canada Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

4.4.1.6. Canada Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Compression Socks Market Outlook, 2019 - 2031

5.1. Europe Compression Socks Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Standard Compression Socks

5.1.1.2. Graduated Compression Socks

5.2. Europe Compression Socks Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Varicose Veins

5.2.1.2. Wound Care

5.2.1.3. Burns

5.2.1.4. Oncology

5.2.1.5. Others

5.3. Europe Compression Socks Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Ambulatory Surgical Centers

5.3.1.3. Clinics

5.3.1.4. Online Sales

5.3.1.5. Other Healthcare Facilities

5.4. Europe Compression Socks Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.2. Germany Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.3. Germany Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.4. U.K. Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.5. U.K. Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.6. U.K. Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.7. France Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.8. France Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.9. France Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.10. Italy Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.11. Italy Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.12. Italy Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.13. Turkey Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.14. Turkey Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.15. Turkey Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.16. Russia Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.17. Russia Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.18. Russia Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.19. Rest of Europe Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.20. Rest of Europe Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.21. Rest of Europe Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Compression Socks Market Outlook, 2019 - 2031

6.1. Asia Pacific Compression Socks Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Standard Compression Socks

6.1.1.2. Graduated Compression Socks

6.2. Asia Pacific Compression Socks Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Varicose Veins

6.2.1.2. Wound Care

6.2.1.3. Burns

6.2.1.4. Oncology

6.2.1.5. Others

6.3. Asia Pacific Compression Socks Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Ambulatory Surgical Centers

6.3.1.3. Clinics

6.3.1.4. Online Sales

6.3.1.5. Other Healthcare Facilities

6.4. Asia Pacific Compression Socks Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. China Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.2. China Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

6.4.1.3. China Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.4. Japan Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.5. Japan Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

6.4.1.6. Japan Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.7. South Korea Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.8. South Korea Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

6.4.1.9. South Korea Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.10. India Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.11. India Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

6.4.1.12. India Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.13. Southeast Asia Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.14. Southeast Asia Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

6.4.1.15. Southeast Asia Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.16. Rest of Asia Pacific Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.17. Rest of Asia Pacific Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

6.4.1.18. Rest of Asia Pacific Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Compression Socks Market Outlook, 2019 - 2031

7.1. Latin America Compression Socks Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Standard Compression Socks

7.1.1.2. Graduated Compression Socks

7.2. Latin America Compression Socks Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Varicose Veins

7.2.1.2. Wound Care

7.2.1.3. Burns

7.2.1.4. Oncology

7.2.1.5. Others

7.3. Latin America Compression Socks Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Ambulatory Surgical Centers

7.3.1.3. Clinics

7.3.1.4. Online Sales

7.3.1.5. Other Healthcare Facilities

7.4. Latin America Compression Socks Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.2. Brazil Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

7.4.1.3. Brazil Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.4. Mexico Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.5. Mexico Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

7.4.1.6. Mexico Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.7. Argentina Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.8. Argentina Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

7.4.1.9. Argentina Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.10. Rest of Latin America Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.11. Rest of Latin America Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

7.4.1.12. Rest of Latin America Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Compression Socks Market Outlook, 2019 - 2031

8.1. Middle East & Africa Compression Socks Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Standard Compression Socks

8.1.1.2. Graduated Compression Socks

8.2. Middle East & Africa Compression Socks Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Varicose Veins

8.2.1.2. Wound Care

8.2.1.3. Burns

8.2.1.4. Oncology

8.2.1.5. Others

8.3. Middle East & Africa Compression Socks Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Ambulatory Surgical Centers

8.3.1.3. Clinics

8.3.1.4. Online Sales

8.3.1.5. Other Healthcare Facilities

8.4. Middle East & Africa Compression Socks Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.2. GCC Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

8.4.1.3. GCC Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.4. South Africa Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.5. South Africa Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

8.4.1.6. South Africa Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.7. Egypt Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.8. Egypt Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

8.4.1.9. Egypt Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.10. Nigeria Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.11. Nigeria Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

8.4.1.12. Nigeria Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.13. Rest of Middle East & Africa Compression Socks Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.14. Rest of Middle East & Africa Compression Socks Market by Application, Value (US$ Bn), 2019 - 2031

8.4.1.15. Rest of Middle East & Africa Compression Socks Market by End User, Value (US$ Bn), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Product vs Application Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Medtronic Plc

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Essity

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. 3M Corporation

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. SIGVARIS Group

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Santemol Group Medikal

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Calzificio ZETA S.R.L.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Sanyleg Srl

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Therafirm

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. medi GmbH & Co KG

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Santemol Group Medikal

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Application Coverage |

|

|

Product Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |