Global Compression Therapy Devices Market Forecast

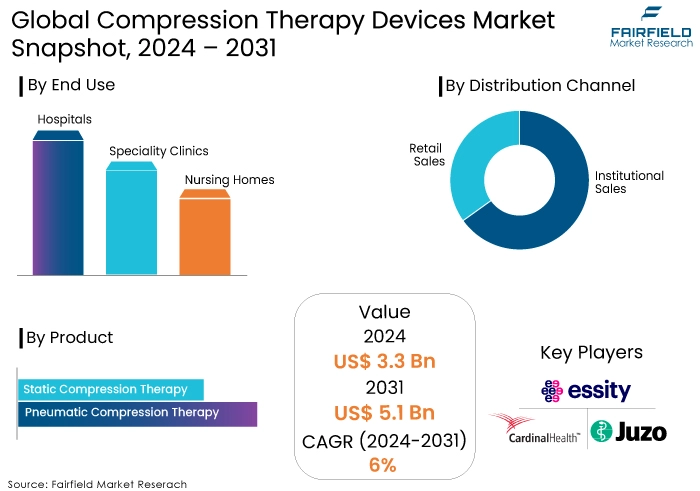

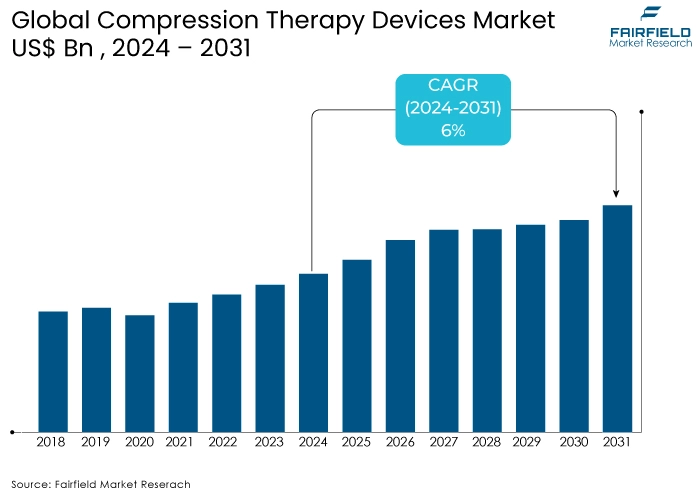

- Compression therapy devices market size poised to reach US$5.1 Bn in 2031, up from US$3.3 Bn projected in 2024

- Global compression therapy devices market revenue likely to witness a CAGR of 6% during 2024-2031

Compression Therapy Devices Market Insights

- The market experienced moderate but consistent growth until 2023.

- Technological advancements and the rising prevalence of chronic conditions were primary drivers of market growth.

- High costs of advanced devices and regulatory and reimbursement challenges hindered market expansion.

- The integration of smart technologies and expansion into developing markets are significant market trends.

- Collaborations with healthcare providers and a focus on developing markets present substantial opportunities.

- Static compression therapy held the largest market share, followed by hospitals in terms of demand generation.

- Institutional sales dominated the distribution channel compared to retail.

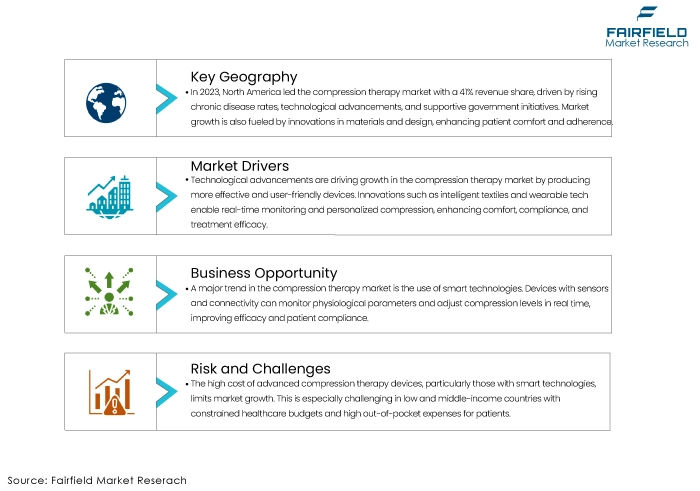

- North America has been the leading region in the compression therapy devices market.

- The market is highly competitive with established players and emerging regional competitors.

- Strategic focus on technological innovation, product differentiation, and market expansion through partnerships is crucial for success.

A Look Back and a Look Forward - Comparative Analysis

The compression therapy devices market witnessed moderate yet consistent growth up to 2023. This growth was driven by the increasing prevalence of chronic conditions such as lymphedema, venous leg ulcers, and deep vein thrombosis, which heightened the demand for effective treatment options. Technological advancements led to the development of more comfortable and efficient compression garments and devices, enhancing patient compliance and outcomes.

Increased awareness and education about the benefits of compression therapy among healthcare professionals and patients further propelled market growth.

However, market penetration varied significantly across different regions, with developed markets like North America, and Europe showing higher adoption rates than emerging markets. Challenges such as reimbursement issues and the high cost of advanced devices posed limitations to market expansion.

Key Growth Determinants

- Technological Advancements

Technological advancements are a primary growth driver for the compression therapy devices market. Innovations in materials and design have led to the development of more effective and user-friendly compression garments and devices. For instance, integrating intelligent textiles and wearable technology has created compression products that monitor physiological parameters and provide real-time feedback to users and healthcare providers. These advancements improve patient compliance by offering greater comfort and ease of use and enhancing treatment efficacy through personalized and adaptive compression levels.

Additionally, digital health technologies that enable remote monitoring and telehealth services are becoming increasingly integrated with compression therapy, offering better management and follow-up care for patients with chronic conditions. As these technologies continue to evolve, they are expected to drive significant growth in the market by meeting the diverse needs of patients and healthcare systems globally.

- Increasing Prevalence of Chronic Conditions

The rising prevalence of chronic conditions such as lymphedema, venous leg ulcers, and deep vein thrombosis is another key growth driver for the compression therapy devices market. These conditions often require long-term management, making compression therapy an essential component of treatment.

The aging population, more susceptible to chronic venous diseases, further exacerbates the demand for effective compression solutions.

Moreover, increasing rates of obesity and sedentary lifestyles contribute to the incidence of venous disorders, driving the need for compression therapy. As awareness of these conditions grows among patients and healthcare providers, there is a greater emphasis on early diagnosis and intervention, including compression therapy. Public health initiatives and educational campaigns are also crucial in promoting compression therapy's benefits, thereby expanding the market.

This trend is expected to continue as the global burden of chronic conditions rises, fuelling sustained demand for compression therapy devices.

Key Growth Barriers

- High Cost of Advanced Devices

One of the primary restraints on the growth of the compression therapy devices market is the high cost of advanced devices. Compression therapy products, especially those incorporating the latest technologies like intelligent textiles and digital health integration, can be prohibitively expensive for many patients.

This is particularly challenging in low and middle-income countries, where healthcare budgets are limited and out-of-pocket expenses for patients are high.

The cost can be a barrier even in developed regions, mainly for uninsured or underinsured patients. This financial burden often leads to lower adoption rates and adherence to prescribed therapies, as patients may seek alternative, less costly treatments. The high cost of these devices also affects healthcare providers and systems, which may be reluctant to invest in expensive technologies without clear and immediate cost-benefit evidence. As a result, the market's growth is constrained by the economic limitations that consumers and healthcare systems face.

- Regulatory and Reimbursement Challenges

Regulatory and reimbursement challenges also significantly restrain the growth of the compression therapy devices market. Obtaining regulatory approval for new compression devices can be lengthy and complex, varying significantly across different regions. Stringent regulations ensure safety and efficacy but can delay the introduction of innovative products to the market. Additionally, the need for standardized regulations globally complicates manufacturers' entry into new markets.

Reimbursement policies are another critical issue; in many regions, insurance does not fully cover compression therapy devices, placing a financial burden on patients. Inconsistent reimbursement rates and policies can deter manufacturers and patients as the out-of-pocket costs become prohibitive. These challenges can limit market penetration and slow the adoption of new technologies. Addressing these regulatory and reimbursement hurdles is crucial for facilitating market growth and ensuring patients can access the latest and most effective compression therapy solutions.

Compression Therapy Devices Market Trends and Opportunities

- Integration of Smart Technologies

One of the most significant trends in the compression therapy devices market is the integration of smart technologies. This trend is revolutionizing how compression therapy is delivered and monitored, enhancing efficacy and patient compliance. Smart compression garments and devices with sensors and connectivity features can monitor a patient’s physiological parameters, such as blood flow, pressure, and movement. These devices can provide real-time feedback and adjust the compression levels accordingly, ensuring optimal therapeutic outcomes.

Additionally, the data collected can be transmitted to healthcare providers, allowing for remote monitoring and timely intervention if needed. The rise of wearable technology and the Internet of Things (IoT) has facilitated the development of these advanced compression devices. Patients can now benefit from personalized treatment plans that adapt to their specific needs and conditions. For instance, a smart compression device can alert a patient to adjust their activity levels or position to improve circulation, thereby preventing complications.

Moreover, these devices can track adherence to prescribed therapy, providing valuable insights to healthcare providers on patient compliance and the effectiveness of the treatment. This trend is not only improving patient outcomes but also enhancing the patient experience by making compression therapy more convenient and user-friendly. As technology continues to advance, the integration of artificial intelligence (AI) and machine learning (ML) into compression therapy devices is expected to further refine and personalize treatment protocols. This market trend is likely to drive significant growth in the market as patients and healthcare providers increasingly adopt these smart solutions to improve chronic condition management and overall quality of care.

- Opportunities in Developing Markets

The expansion into developing markets presents a substantial opportunity for the compression therapy devices market. Countries in regions such as Asia, Africa, and Latin America are experiencing rapid economic growth, improved healthcare infrastructure, and increasing healthcare expenditure. These factors create a fertile ground for the adoption of advanced medical technologies, including compression therapy devices.

Developing regional markets have a large and growing population with a significant burden of chronic conditions like diabetes, obesity, and venous diseases, which can benefit greatly from compression therapy. As awareness about these conditions and their management increases, so does the demand for effective treatment options. Manufacturers and healthcare providers can tap into this opportunity by developing and distributing cost-effective compression therapy solutions tailored to the needs of these populations.

- Alliances with Local Healthcare Providers

Strategic partnerships and collaborations with local healthcare providers, distributors, and governments can facilitate market entry and expansion. Initiatives aimed at educating healthcare professionals and patients about the benefits of compression therapy are crucial. Such educational programs can help dispel misconceptions and promote the adoption of these devices. Additionally, leveraging mobile health (mHealth) technologies can enhance the reach and impact of compression therapy, particularly in remote and underserved areas.

Furthermore, localized manufacturing and distribution can help reduce costs and make these devices more affordable for a broader segment of the population. By investing in research and development tailored to the specific needs and conditions prevalent in emerging markets, companies can create innovative solutions that are both effective and economically viable. This approach not only addresses the immediate healthcare needs but also establishes a strong market presence and brand loyalty in these rapidly growing regions. The expansion into emerging markets represents a significant growth opportunity, potentially leading to increased market share and revenue for companies in the compression therapy devices market.

How is Regulatory Scenario Shaping this Industry?

The compression therapy devices industry is significantly influenced by regulatory frameworks. Bodies like FDA in the U.S., EMA in Europe, and equivalent authorities in other regions set stringent standards for device safety, efficacy, and manufacturing processes. These regulations ensure product quality and patient safety. Compliance with these norms is essential for market entry and sustained growth.

On the other hand, regulatory hurdles can increase development costs and time-to-market. However, a clear understanding of these requirements can help companies innovate within regulatory boundaries. Moreover, strong regulatory oversight can boost consumer confidence, driving market growth. Overall, the growth trajectory of the compression therapy devices market is intertwined with the evolving regulatory landscape.

Segments Covered in Compression Therapy Devices Market Report

- Preference for Static Compression Therapy Accounts for over 68% Share

In 2023, the static compression therapy segment dominated the compression therapy devices market with a significant revenue share of 68%, primarily due to technological advancements. Static compression therapy entails the application of uniform pressure to afflicted regions to enhance blood circulation and diminish edema, this technique employs compression garments, such as stockings, bandages, or wraps, which are well-known for their convenience and efficacy in treating disorders such as varicose veins, deep vein thrombosis (DVT), and lymphedema.

The therapy is highly regarded for its user-friendly nature and convenience, making it a favorite option for patients and clinicians. It efficiently alleviates pressure and pain, causes rapid restoration of functionality, and decreases swelling, all essential for treating diverse sports injuries and disorders.

Static compression devices are not one-size-fits-all. They're adaptable, suitable for various medical ailments, and provide different degrees of compression, giving you confidence in their versatility. Static compression therapy is not only practical but also a smart financial choice. These devices are comparatively less expensive than dynamic compression devices, making them a cost-efficient choice for consumers and healthcare professionals, particularly in areas with constrained healthcare resources.

- Hospitals Register More than 32% of Total Demand Generation

Hospitals are favoured above other healthcare facilities because they can offer complete care to patients with intricate medical requirements. Hospitals possess the essential infrastructure, medical proficiency, and resources to oversee and supervise patients' circumstances efficiently, guaranteeing favourable treatment results. Furthermore, they benefit from offering prompt access to sophisticated medical treatment for any difficulties or crises.

Hospitals commonly utilize compression therapy devices to treat various medical ailments, such as venous diseases, lymphedema, and post-surgical rehabilitation. The utilization of these items in medical facilities has escalated due to their demonstrated effectiveness in treating ailments, minimizing problems, and enhancing patient results. This will keep the demand at hospitals afloat, in the compression therapy devices market.

-

Institutional Sales Dominate Other Distribution Channels

The institutional sales segment dominated the market with the highest revenue share of 60%, as determined by its distribution channel. In the global market, institutional sales involve the distribution of products through channels such as hospitals, clinics, and nursing homes. These sales offer numerous advantages over retail sales. These benefits include the potential to establish long-term business relationships with crucial institutional customers, reduced marketing costs, and the ability to sell products in larger quantities.

The growing demand for these products in healthcare settings is why institutional sales dominate the compression therapy devices market. The demand for compression therapy solutions to address conditions such as chronic venous insufficiency, lymphedema, and DVT is increasing as the global population ages. Institutional sales provide a reliable and efficient method of supplying these products to healthcare providers who require them.

Regional Analysis

- North America’s Prime Position Prevails

In 2023, North America held most of the compression therapy market, with a revenue share of 41%, owing to the combination of factors, including the increasing prevalence of chronic diseases, technological advancements, and government initiatives. The expansion of the compression therapy devices market is further supported by advancements in compression therapy technology, including the development of innovative materials and enhanced designs that improve patient comfort and compliance.

The market growth is considerably influenced by the rising prevalence of chronic diseases, such as diabetes and obesity, which frequently result in circulatory issues. Chronic venous disease (CVD) is a prevalent health condition, as over 25 million individuals in the US are affected by varicose veins, and over 6 million suffer from severe venous disease, according to the National Institutes of Health.

Fairfield’s Competitive Landscape Analysis

The compression therapy devices market is highly competitive, with several key players dominating the industry, and is also characterized by the presence of numerous regional and local players, particularly in emerging markets. Strategic collaborations, mergers, and acquisitions are common as companies seek to enhance their market presence and expand globally. Additionally, technological advancements and product differentiation are critical competitive strategies, with firms focusing on smart compression devices and personalized therapy solutions to gain a competitive edge.

Key Market Companies

- Essity Aktiebolag (publ)

- Cardinal Health

- Julius Zorn GmbH

- Hartmann AG

- Medi GmbH & Co.

- SIGVARIS

- BSN Medical GmbH

- ArjoHuntleigh

- 3M Health Care

- Spectrum Healthcare

- Bio Compression Systems, Inc.

- Stryker

- Gottfried Medical

- Tactile Medical

Recent Industry Developments

- In October 2023, MediWound fortified its alliance in the medical sector by announcing its strategic partnership with 3M Health Care for EscharEx's Phase III Clinical Trial.

- In September 2023, Tactile Medical was granted a patent for a novel compression garment system. This system employs adjustable pressure to transport bodily fluids to specialized cells that assist in their management.

- In June 2023, Medi GmbH & Co. introduced new medical compression offerings, including circular and flat-knit variants, to meet the diverse requirements and preferences of the healthcare sector.

An Expert’s Eye

- The industry is poised for substantial growth due to increasing prevalence of chronic diseases like diabetes and obesity, leading to higher demand for compression therapy. Technological advancements are also driving innovation and market expansion.

- While regulatory oversight ensures product safety, it can also hinder market entry and product development. Navigating complex regulatory landscapes is crucial for industry players to succeed.

Global Compression Therapy Devices Market is Segmented as Below -

By Product

- Pneumatic Compression Therapy

- Static Compression Therapy

By End Use

- Hospitals

- Speciality Clinics

- Nursing Homes

By Distribution Channel

- Institutional Sales

- Retail Sales

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Compression Therapy Devices Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Volume and Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact Of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. Pestle Analysis

3. Production Output and Trade Statistics, 2019 - 2023

3.1. Global Compression Therapy Devices Market Production Output, by Region, Value (US$ Bn) and Volume (Million Units) and Volume (Million Units), 2019 - 2023

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East and Africa

4. Price Analysis, 2019 - 2023

4.1. Global Average Price Analysis, by Product/ Material, US$ Per Unit, 2019 - 2023

4.2. Prominent Factor Affecting Compression Therapy Devices Prices

4.3. Global Average Price Analysis, by Region, US$ Per Unit, 2019 - 2023

5. Global Compression Therapy Devices Market Outlook, 2019 - 2031

5.1. Global Compression Therapy Devices Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Pneumatic Compression Therapy

5.1.1.2. Static Compression Therapy

5.1.1.2.1. Anti embolism/Compression Stockings

5.1.1.2.2. Compression Bandages

5.1.1.2.3. Compression Garments

5.1.1.2.3.1. Lower Compression Garments

5.1.1.2.3.2. Upper Compression Garments

5.2. Global Compression Therapy Devices Market Outlook, by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. 18-21 mmHg

5.2.1.2. 23-32 mmHg

5.2.1.3. 34-49 mmHg

5.2.1.4. more than 50 mmHg

5.3. Global Compression Therapy Devices Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Institutional Sales

5.3.1.1.1. Hospitals

5.3.1.1.2. Clinics

5.3.1.1.3. Ambulatory Surgical Centers

5.3.1.1.4. Nursing Facilities

5.3.1.2. Retail Sales

5.3.1.2.1. Hospital Pharmacies

5.3.1.2.2. Retail Pharmacies

5.3.1.2.3. Online Sales

5.3.1.2.4. Specialized Orthopedic Stores

5.4. Global Compression Therapy Devices Market Outlook, by Region, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. North America

5.4.1.2. Europe

5.4.1.3. Asia Pacific

5.4.1.4. Latin America

5.4.1.5. Middle East & Africa

6. North America Compression Therapy Devices Market Outlook, 2019 - 2031

6.1. North America Compression Therapy Devices Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Pneumatic Compression Therapy

6.1.1.2. Static Compression Therapy

6.1.1.2.1. Anti embolism/Compression Stockings

6.1.1.2.2. Compression Bandages

6.1.1.2.3. Compression Garments

6.1.1.2.3.1. Lower Compression Garments

6.1.1.2.3.2. Upper Compression Garments

6.2. North America Compression Therapy Devices Market Outlook, by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. 18-21 mmHg

6.2.1.2. 23-32 mmHg

6.2.1.3. 34-49 mmHg

6.2.1.4. more than 50 mmHg

6.3. North America Compression Therapy Devices Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Academics & Research Institute

6.3.1.3. Ambulatory Surgical Centers

6.3.1.4. Diagnostic Centers

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. North America Compression Therapy Devices Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. U.S. Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.2. U.S. Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.3. U.S. Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.4. Canada Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.5. Canada Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.6. Canada Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Compression Therapy Devices Market Outlook, 2019 - 2031

7.1. Europe Compression Therapy Devices Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Pneumatic Compression Therapy

7.1.1.2. Static Compression Therapy

7.1.1.2.1. Anti embolism/Compression Stockings

7.1.1.2.2. Compression Bandages

7.1.1.2.3. Compression Garments

7.1.1.2.3.1. Lower Compression Garments

7.1.1.2.3.2. Upper Compression Garments

7.2. Europe Compression Therapy Devices Market Outlook, by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. 18-21 mmHg

7.2.1.2. 23-32 mmHg

7.2.1.3. 34-49 mmHg

7.2.1.4. more than 50 mmHg

7.3. Europe Compression Therapy Devices Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Academics & Research Institute

7.3.1.3. Ambulatory Surgical Centers

7.3.1.4. Diagnostic Centers

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Europe Compression Therapy Devices Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Germany Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.2. Germany Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.3. Germany Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.4. U.K. Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.5. U.K. Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.6. U.K. Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.7. France Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.8. France Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.9. France Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.10. Italy Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.11. Italy Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.12. Italy Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.13. Turkey Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.14. Turkey Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.15. Turkey Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.16. Russia Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.17. Russia Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.18. Russia Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.19. Rest Of Europe Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.20. Rest Of Europe Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.21. Rest Of Europe Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Compression Therapy Devices Market Outlook, 2019 - 2031

8.1. Asia Pacific Compression Therapy Devices Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Pneumatic Compression Therapy

8.1.1.2. Static Compression Therapy

8.1.1.2.1. Anti embolism/Compression Stockings

8.1.1.2.2. Compression Bandages

8.1.1.2.3. Compression Garments

8.1.1.2.3.1. Lower Compression Garments

8.1.1.2.3.2. Upper Compression Garments

8.2. Asia Pacific Compression Therapy Devices Market Outlook, by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. 18-21 mmHg

8.2.1.2. 23-32 mmHg

8.2.1.3. 34-49 mmHg

8.2.1.4. more than 50 mmHg

8.3. Asia Pacific Compression Therapy Devices Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Academics & Research Institute

8.3.1.3. Ambulatory Surgical Centers

8.3.1.4. Diagnostic Centers

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Asia Pacific Compression Therapy Devices Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. China Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.2. China Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.3. China Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.4. Japan Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.5. Japan Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.6. Japan Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.7. South Korea Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.8. South Korea Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.9. South Korea Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.10. India Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.11. India Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.12. India Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.13. Southeast Asia Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.14. Southeast Asia Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.15. Southeast Asia Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.16. Rest Of Asia Pacific Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.17. Rest Of Asia Pacific Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.18. Rest Of Asia Pacific Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Compression Therapy Devices Market Outlook, 2019 - 2031

9.1. Latin America Compression Therapy Devices Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Pneumatic Compression Therapy

9.1.1.2. Static Compression Therapy

9.1.1.2.1. Anti embolism/Compression Stockings

9.1.1.2.2. Compression Bandages

9.1.1.2.3. Compression Garments

9.1.1.2.3.1. Lower Compression Garments

9.1.1.2.3.2. Upper Compression Garments

9.2. Latin America Compression Therapy Devices Market Outlook, by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. 18-21 mmHg

9.2.1.2. 23-32 mmHg

9.2.1.3. 34-49 mmHg

9.2.1.4. more than 50 mmHg

9.3. Latin America Compression Therapy Devices Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Hospitals

9.3.1.2. Academics & Research Institute

9.3.1.3. Ambulatory Surgical Centers

9.3.1.4. Diagnostic Centers

9.3.2. BPS Analysis/Market Attractiveness Analysis

9.4. Latin America Compression Therapy Devices Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. Brazil Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.2. Brazil Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.3. Brazil Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.4. Mexico Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.5. Mexico Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.6. Mexico Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.7. Argentina Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.8. Argentina Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.9. Argentina Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.10. Rest Of Latin America Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.11. Rest Of Latin America Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.12. Rest Of Latin America Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.2. Bps Analysis/Market Attractiveness Analysis

10. Middle East & Africa Compression Therapy Devices Market Outlook, 2019 - 2031

10.1. Middle East & Africa Compression Therapy Devices Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. Pneumatic Compression Therapy

10.1.1.2. Static Compression Therapy

10.1.1.2.1. Anti embolism/Compression Stockings

10.1.1.2.2. Compression Bandages

10.1.1.2.3. Compression Garments

10.1.1.2.3.1. Lower Compression Garments

10.1.1.2.3.2. Upper Compression Garments

10.2. Middle East & Africa Compression Therapy Devices Market Outlook, by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. 18-21 mmHg

10.2.1.2. 23-32 mmHg

10.2.1.3. 34-49 mmHg

10.2.1.4. more than 50 mmHg

10.3. Middle East & Africa Compression Therapy Devices Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. Hospitals

10.3.1.2. Academics & Research Institute

10.3.1.3. Ambulatory Surgical Centers

10.3.1.4. Diagnostic Centers

10.3.2. BPS Analysis/Market Attractiveness Analysis

10.4. Middle East & Africa Compression Therapy Devices Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.4.1. Key Highlights

10.4.1.1. GCC Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.4.1.2. GCC Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.4.1.3. GCC Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.4.1.4. South Africa Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.4.1.5. South Africa Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.4.1.6. South Africa Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.4.1.7. Egypt Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.4.1.8. Egypt Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.4.1.9. Egypt Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.4.1.10. Nigeria Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.4.1.11. Nigeria Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.4.1.12. Nigeria Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.4.1.13. Rest Of Middle East & Africa Compression Therapy Devices Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.4.1.14. Rest Of Middle East & Africa Compression Therapy Devices Market by Compression Class, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.4.1.15. Rest Of Middle East & Africa Compression Therapy Devices Market by Distribution Channel, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

10.4.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. By Distribution Channel Vs by Compression Class Heat Map

11.2. Manufacturer Vs by Compression Class Heatmap

11.3. Company Market Share Analysis, 2022

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Mölnlycke Health Care AB

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. 3M

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Arjo (Huntleigh Healthcare Limited)

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Brownmed, Inc.

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. Essity Aktiebolag (publ) (BSN Medical Inc.,)

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. Cardinal Health.

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Daesung Maref Co., Ltd

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. AIROS Medical, Inc. (Devon Medical Products)

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. Enovis (DJO Global, Inc)

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. FlowAid Medical Technologices

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

11.5.11. Avanos Medical, Inc., (Game Ready)

11.5.11.1. Company Overview

11.5.11.2. Product Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. Julius Zorn, Inc.

11.5.12.1. Company Overview

11.5.12.2. Product Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

11.5.13. Lohmann & Rauscher GmbH & Co. KG

11.5.13.1. Company Overview

11.5.13.2. Product Portfolio

11.5.13.3. Financial Overview

11.5.13.4. Business Strategies and Development

11.5.14. medi GmbH & Co. KG

11.5.14.1. Company Overview

11.5.14.2. Product Portfolio

11.5.14.3. Financial Overview

11.5.14.4. Business Strategies and Development

11.5.15. TONUS ELAST SIASwoop Aero Pt. Ltd.

11.5.15.1. Company Overview

11.5.15.2. Product Portfolio

11.5.15.3. Financial Overview

11.5.15.4. Business Strategies and Development

11.5.16. Medline Industries, Inc.

11.5.16.1. Company Overview

11.5.16.2. Product Portfolio

11.5.16.3. Financial Overview

11.5.16.4. Business Strategies and Development

11.5.17. Paul Hartmann AG

11.5.17.1. Company Overview

11.5.17.2. Product Portfolio

11.5.17.3. Financial Overview

11.5.17.4. Business Strategies and Development

11.5.18. SIGVARIS GROUP

11.5.18.1. Company Overview

11.5.18.2. Product Portfolio

11.5.18.3. Financial Overview

11.5.18.4. Business Strategies and Development

11.5.19. Smith & Nephew

11.5.19.1. Company Overview

11.5.19.2. Product Portfolio

11.5.19.3. Financial Overview

11.5.19.4. Business Strategies and Development

11.5.20. Stryker

11.5.20.1. Company Overview

11.5.20.2. Product Portfolio

11.5.20.3. Financial Overview

11.5.20.4. Business Strategies and Development

11.5.21. Tactile Medical

11.5.21.1. Company Overview

11.5.21.2. Product Portfolio

11.5.21.3. Financial Overview

11.5.21.4. Business Strategies and Development

11.5.22. Thuasne SAS

11.5.22.1. Company Overview

11.5.22.2. Product Portfolio

11.5.22.3. Financial Overview

11.5.22.4. Business Strategies and Development

11.5.23. Zimmer Biomet (Medical Compression Systems (DBN) Ltd.)

11.5.23.1. Company Overview

11.5.23.2. Product Portfolio

11.5.23.3. Financial Overview

11.5.23.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms And Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

End Use Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |