Global Construction Aggregates Market Forecast

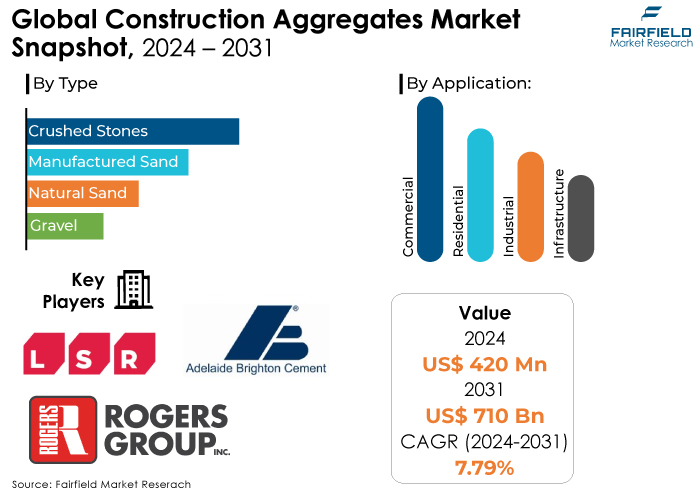

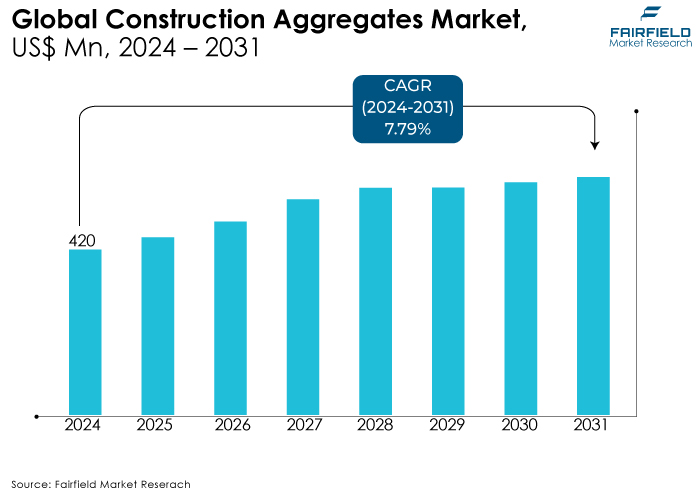

- Global Construction Aggregates market revenue poised to witness an impressive CAGR of 7.79% during 2024 - 2031

- Market size likely to reach US$ 710 Bn in 2031, up from US$ 420 Bn recorded in 2024

Quick Report Digest

- The global Construction Aggregates market is forecasted to grow at a CAGR of 7.79% from 2024 to 2031, reaching a market size of US$ 710 billion in 2031 from US$ 420 billion in 2024.

- Key growth drivers include rapid urbanisation and infrastructure development in emerging economies, increasing demand for sustainable and eco-friendly construction materials, and technological advancements in aggregate production.

- The market has faced challenges such as volatile raw material prices and stringent environmental regulations aimed at reducing the impact of quarrying and processing activities.

- Opportunities for growth are seen in the rising investments in renewable energy infrastructure and the growing focus on sustainable construction practices, including the use of recycled and manufactured aggregates.

- Potential market headwinds include disruptions in global supply chains and geopolitical instability affecting raw material availability and costs.

- Crushed stone, sand and gravel, and recycled aggregates are identified as top-performing segments, driven by their extensive use in construction and increasing environmental concerns.

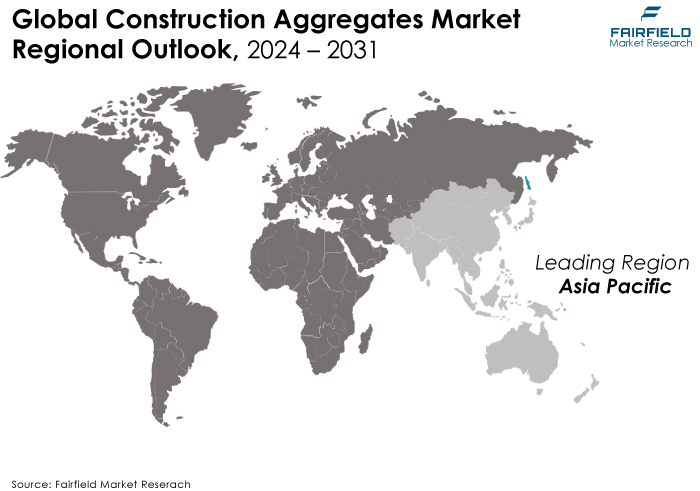

- Asia Pacific and North America are highlighted as regional frontrunners due to their constant demand for construction aggregates fuelled by urbanisation, infrastructure development, and environmental sustainability initiatives.

- Leading market players include Vulcan Materials Company, LafargeHolcim, HeidelbergCement AG, CRH plc, and Martin Marietta Materials, Inc., with strategies focused on mergers and acquisitions, R&D for sustainable products, and expansion into emerging markets.

- Recent developments in the market include new product launches by HeidelbergCement and LafargeHolcim focused on eco-friendly aggregates and strategic distribution agreements by Vulcan Materials Company and Martin Marietta Materials to enhance market reach.

- The market is segmented by type into crushed stones, manufactured sand, natural sand, gravel, recycled aggregates, and other aggregates, and by application into commercial, residential, industrial, and infrastructure, with a comprehensive geographic breakdown covering North America, South America, Europe, CIS, ANZ, Middle East, Africa, India, China, and Rest of Asia Pacific.

A Look Back and a Look Forward - Comparative Analysis

The construction aggregates market enjoyed a period of consistent growth from 2019 to 2023, fuelled by a thriving residential and non-residential construction sector. This growth was further bolstered by increasing urbanisation and ambitious infrastructure development projects, particularly in emerging economies. However, the industry also grappled with challenges like volatile raw material prices and stricter environmental regulations that aimed to limit the impact of quarrying and processing.

Looking towards the 2024-2031 forecast period, analysts predict a continuation of the positive growth trajectory for the construction aggregates market. There are several reasons for this optimism. Rising investments in renewable energy infrastructure, such as wind and solar farms, will necessitate large quantities of aggregates for construction. Additionally, a growing focus on sustainable construction practices is creating a demand for recycled and manufactured aggregates, which can help to reduce reliance on traditional quarrying methods.

Despite this positive outlook, the construction aggregates market also faces potential headwinds in the coming years. Disruptions in global supply chains and geopolitical instability could lead to fluctuations in the availability and cost of raw materials. Overall, the construction aggregates market appears poised for continued growth, but navigating these challenges will be crucial for industry stakeholders.

Key Growth Determinants

- Urbanisation and Infrastructure Development

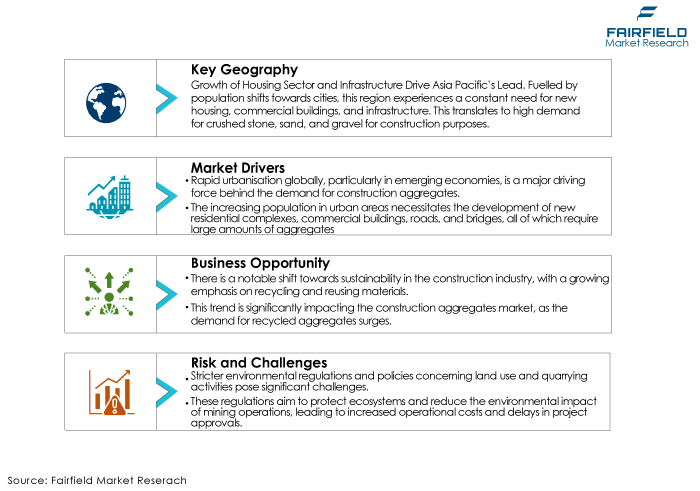

Rapid urbanisation globally, particularly in emerging economies, is a major driving force behind the demand for construction aggregates. The increasing population in urban areas necessitates the development of new residential complexes, commercial buildings, roads, and bridges, all of which require large amounts of aggregates. Governments are also investing heavily in infrastructure projects, including highways, railways, and airports, further boosting the demand for aggregates.

- Sustainable and Green Construction Practices

There is a growing emphasis on sustainability within the construction industry, driving the demand for recycled aggregates and materials that have a lower environmental impact. The use of recycled aggregates helps in reducing landfill waste and conserving natural resources, aligning with global sustainability goals. This trend is expected to continue, with more companies adopting green construction practices and materials.

- Technological Advancements in Aggregate Production

Technological improvements in the methods of producing, sorting, and recycling aggregates have made the production process more efficient and cost-effective. Innovations such as automated sorting and processing systems, and advancements in crushing technology, are enhancing the quality and grading of aggregates. These technological advancements enable the construction industry to meet the increasing demand for high-quality aggregates, contributing to the market's growth.

Major Growth Barriers

- Environmental Regulations, and Land Use Policies

Stricter environmental regulations and policies concerning land use and quarrying activities pose significant challenges. These regulations aim to protect ecosystems and reduce the environmental impact of mining operations, leading to increased operational costs and delays in project approvals. This can limit the availability of natural aggregates and increase the costs for producers.

- Supply Chain Disruptions

The market is susceptible to supply chain disruptions caused by factors such as geopolitical tensions, trade disputes, and natural disasters. These disruptions can lead to fluctuations in the availability and cost of raw materials, affecting the overall market stability and growth.

- Volatility in Construction Demand

The demand for construction aggregates is closely tied to the construction sector, which is influenced by economic cycles. Economic downturns or slowdowns in construction activities can lead to decreased demand for aggregates, impacting the market's growth potential. This volatility makes it challenging for aggregate producers to forecast demand and plan accordingly.

Key Trends and Opportunities to Look at

- Increased Use of Recycled Aggregates

There is a notable shift towards sustainability in the construction industry, with a growing emphasis on recycling and reusing materials. This trend is significantly impacting the construction aggregates market, as the demand for recycled aggregates surges. Recycled aggregates, derived from construction and demolition waste, are being increasingly used in various construction projects.

The scenario not only helps in reducing the environmental impact associated with the extraction of virgin materials but also addresses the issue of waste management. The adoption of recycled aggregates is being further propelled by advancements in recycling technologies, making it a cost-effective and eco-friendly alternative to natural aggregates.

- Adoption of Innovative Technologies

The construction aggregates market is witnessing the integration of innovative technologies in quarrying and aggregate production processes. Technologies such as drone surveying, automated equipment, and advanced crushing and screening systems are becoming more prevalent. These technologies enhance operational efficiency, improve the quality of aggregates, and reduce production costs.

Moreover, digital platforms and IoT (Internet of Things) applications are being adopted for better supply chain management and to streamline operations, from extraction to delivery, optimising the overall productivity and minimising environmental impact.

- Expansion in Emerging Markets

Emerging economies present significant opportunities for market players, fuelled by rapid urbanisation, infrastructural developments, and industrialisation. Countries in Asia, Africa, and South America are witnessing substantial investments in construction projects, from residential buildings to large-scale infrastructure such as roads, bridges, and airports.

Market players can capitalise on these opportunities by establishing or expanding their operations in these regions, potentially partnering with local firms or governments to meet the growing demand for construction aggregates.

- Innovation in Sustainable Products

There is a growing demand for sustainable and environmentally friendly construction materials. This opens a plethora of opportunities for companies to innovate and develop new aggregate products that are eco-friendly, such as aggregates from alternative or recycled materials. These products not only cater to the green construction trend but also offer a competitive edge in the market.

Furthermore, investing in research and development to enhance the efficiency and sustainability of aggregate production processes can help companies to meet stringent environmental regulations and appeal to a broader market base.

How Does the Regulatory Scenario Shape this Industry?

The regulatory environment significantly shapes the construction aggregates industry. Stricter environmental regulations regarding dust, emissions, and land reclamation raise production costs but also drive innovation in extraction and promote recycled materials. Permitting processes for new quarries can be lengthy, limiting production capacity.

Zoning restrictions can further limit development near populated areas, forcing longer transportation distances for aggregates. However, regulations promoting recycled and manufactured aggregates create new markets and reduce environmental impact, although they might require investments in new processing facilities.

Overall, regulations act as a double-edged sword, presenting challenges but also pushing the industry towards sustainable practices and responsible resource management. Effective navigation of this regulatory landscape is essential for long-term success in the construction aggregates market.

Fairfield’s Ranking Board

Top Segments

- Demand for Crushed Stone Contributes the Maximum Revenue Share

The crushed stone segment is a leading contributor to the construction aggregates market. This dominance is primarily due to its widespread use in construction applications, including as a base material for roads, as aggregate in concrete, and for landscaping purposes. Crushed stone's versatility, availability, and durability make it a preferred choice for a wide range of construction projects.

Moreover, infrastructure development projects, particularly in emerging economies, have led to increased demand for crushed stone. The segment benefits from investments in transportation infrastructure, urban development, and new construction projects, driving its growth.

- Sand and Gravel Uptake Accelerates as Sustainability Takes Centre Stage

Sand and gravel constitute a significant part of the construction aggregates market, catering to the demand from residential, commercial, and infrastructure construction projects. Their natural abundance, and cost-effectiveness make sand and gravel essential for concrete production, road construction, and as a component in asphalt.

The increasing number of infrastructure projects globally, coupled with the growth in the housing sector, especially in developing countries, fuels the demand for sand and gravel. However, environmental regulations regarding river sand mining and the depletion of natural resources have prompted the industry to shift towards more sustainable practices and alternatives, influencing market dynamics.

- Recycled Aggregates Rise High on the Back of Green Building Standards

The recycled aggregates segment is rapidly gaining traction within the construction aggregates market, driven by growing environmental concerns and the push for sustainable construction practices. Recycled aggregates are sourced from the demolition of buildings and roads, providing an eco-friendly alternative to natural aggregates. This segment addresses the dual challenges of waste management and resource scarcity by recycling construction and demolition waste into usable aggregates.

The increasing adoption of green building standards, along with government initiatives to promote recycling, presents significant growth opportunities for this segment. As technology improves and awareness increases, recycled aggregates are becoming more accepted, opening new avenues for market expansion.

Regional Frontrunners

- Growth of Housing Sector and Infrastructure Drive Asia Pacific’s Lead

Fuelled by population shifts towards cities, this region experiences a constant need for new housing, commercial buildings, and infrastructure. This translates to high demand for crushed stone, sand, and gravel for construction purposes.

China, and India are developing the economic powerhouses leading the regional market with massive infrastructure development projects like high-speed rail networks and urban transportation systems, requiring vast quantities of aggregates.

Moreover, the green construction trend, driven by the growing environmental awareness is pushing the use of recycled aggregates in construction, creating new market opportunities alongside traditional quarrying methods.

- Sustained Expansion Prevails in North America

The US, and Canada have a long history of construction activity with a well-developed infrastructure. This translates to consistent demand for aggregates in both residential (homes, apartments), and non-residential projects (commercial buildings, factories).

Government investments in upgrading roads, bridges, and other ageing infrastructure further stimulate the construction aggregates market, requiring materials for repairs and expansions.

Stricter environmental regulations regarding dust control and quarry reclamation can increase production costs for companies in North America. However, this also pushes for innovative extraction techniques, and a focus on sustainability.

- Governments Instrument Market Expansion in MEA

This region presents exciting opportunities due to large-scale government investments in infrastructure development plans. The Gulf Cooperation Council (GCC) countries are pouring resources into diversifying their economies beyond oil, leading to a surge in construction activity.

While traditional quarrying methods remain dominant, a growing awareness of environmental concerns is prompting some countries to explore recycled aggregates as a viable alternative.

Fairfield’s Competitive Landscape Analysis

The competition landscape in the Construction Aggregates Market is characterised by a mix of global and regional players, making it moderately fragmented. Leading players include Vulcan Materials Company, LafargeHolcim, HeidelbergCement AG, CRH plc, and Martin Marietta Materials, Inc., among others. These companies hold significant market shares and have a strong presence worldwide, thanks to their extensive distribution networks, diverse product portfolios, and strategic global operations.

To capture growth and expand their market presence, key companies are adopting several strategies. Mergers and acquisitions stand out as a primary strategy, allowing companies to enhance their product offerings and extend their geographic reach. Furthermore, investing in research and development for sustainable and innovative aggregate solutions is another significant approach, catering to the increasing demand for eco-friendly construction materials.

Additionally, strategic partnerships with local firms, especially in emerging economies, are being pursued to leverage local market insights and strengthen supply chains, underlining the dynamic and strategic efforts to dominate in the construction aggregates sector.

Who are the Leaders in Global Construction Aggregates Space?

- LSR Group

- Adelaide Brighton Cement

- Rogers Group Inc.

- Martin Marietta Materials, Inc.

- CEMEX

- Heidelberg Materials

- Taiheiyo Cement Corporation

- Breedon Group PLC

- Holcim

- Vulcan Materials Company

- Eurocement Group

Significant Company Developments

Product launch

March 2023: HeidelbergCement launched a new line of eco-friendly construction aggregates designed to reduce the carbon footprint of building projects. This product line, introduced in March 2023, incorporates recycled materials and innovative processing techniques to ensure high durability and performance while promoting sustainability in construction practices. This launch aligns with the growing demand for green construction materials and represents HeidelbergCement's commitment to environmental responsibility.

February 2023: In February 2023, LafargeHolcim introduced advanced concrete aggregates specifically engineered for high-strength and durability requirements. These aggregates are optimised for use in large-scale infrastructure projects, such as bridges and highways, and are the result of extensive research and development efforts. The product launch aims to meet the evolving needs of the construction industry for materials that offer superior performance and longevity.

Distribution Agreement

January 2023: Vulcan Materials Company expanded its distribution network in January 2023 through a strategic agreement with a leading logistics firm. This partnership is designed to enhance the availability of Vulcan's construction aggregates across remote and underserved markets, particularly in the Asia-Pacific region. The agreement underscores Vulcan's strategy to leverage logistics and distribution networks to meet the growing global demand for construction materials.

April 2023: Martin Marietta Materials announced a strategic distribution agreement in April 2023 with a regional distributor in South America. This move aims to extend the company's reach into South American markets, enhancing the accessibility of its high-quality aggregates to new customer bases. The partnership is part of Martin Marietta's broader strategy to strengthen its international presence and capitalise on the construction boom in emerging economies.

An Expert’s Eye

- Rapid Urbanisation and Infrastructural Development: Analysts point out that the ongoing rapid urbanisation, especially in emerging economies, coupled with substantial investments in infrastructure development worldwide, is a major growth driver. The demand for construction aggregates is directly linked to these activities, as aggregates are essential for building and construction projects.

- Sustainability and Eco-friendly Materials Demand: There is an increasing demand for sustainable and environmentally friendly construction materials. Experts believe this trend will continue to grow, driving the development and adoption of recycled and alternative aggregates. Companies focusing on eco-friendly production methods are expected to gain a competitive edge and capture significant market share.

- Technological Advancements: The introduction of innovative technologies in quarrying and aggregate production is enhancing efficiency and product quality. Analysts predict that companies investing in technology to improve operations and reduce environmental impact will be well-positioned for growth.

- Market Expansion Opportunities: The potential for expansion into new markets, particularly in Asia, Africa, and South America, where construction activities are booming, is seen as a significant opportunity for growth. Analysts emphasize the importance of strategic partnerships and local operations in tapping into these emerging markets.

Global Construction Aggregates Market is Segmented as Below:

By Type:

- Crushed Stones

- Manufactured Sand

- Natural Sand

- Gravel

- Recycled Aggregates

- Other Aggregates

By Application:

- Commercial

- Residential

- Industrial

- Infrastructure

By Region:

- North America

- Europe

- Middle East & Africa

- Asia Pacific

- Latin America

1. Executive Summary

1.1. Global Construction Aggregates Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, By Volume, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.8. PESTLE Analysis

3. Production Output and Trade Statistics

3.1. Key Highlights

3.2. Global Construction Aggregates Production, By Region

3.2.1. North America

3.2.2. Europe

3.2.3. Asia Pacific

3.2.4. Latin America

3.2.5. Middle East & Africa

4. Price Trends Analysis and Future Projects, 2019 - 2031

4.1. Global Average Price Analysis, By Product Type

4.2. Prominent Factors Affecting Construction Aggregates Prices

4.3. Global Average Price Analysis, By Region

5. Global Construction Aggregates Market Outlook, 2019 - 2031

5.1. Global Construction Aggregates Market Outlook, By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Crushed Stone

5.1.1.2. Gravel

5.1.1.3. Manufactured Sand

5.1.1.4. Natural Sand

5.1.1.5. Recycled Aggregate

5.1.1.6. Others

5.2. Global Construction Aggregates Market Outlook, By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Residential

5.2.1.2. Commercial

5.2.1.3. Industrial

5.2.1.4. Infrastructure

5.3. Global Construction Aggregates Market Outlook, By Region, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. North America

5.3.1.2. Europe

5.3.1.3. Asia Pacific

5.3.1.4. Latin America

5.3.1.5. Middle East & Africa

6. North America Construction Aggregates Market Outlook, 2019 - 2031

6.1. North America Construction Aggregates Market Outlook, By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Crushed Stone

6.1.1.2. Gravel

6.1.1.3. Manufactured Sand

6.1.1.4. Natural Sand

6.1.1.5. Recycled Aggregate

6.1.1.6. Others

6.2. North America Construction Aggregates Market Outlook, By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Residential

6.2.1.2. Commercial

6.2.1.3. Industrial

6.2.1.4. Infrastructure

6.3. North America Construction Aggregates Market Outlook, By Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. U.S. Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.2. U.S. Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.3. Canada Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.4. Canada Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Construction Aggregates Market Outlook, 2019 - 2031

7.1. Europe Construction Aggregates Market Outlook, By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Crushed Stone

7.1.1.2. Gravel

7.1.1.3. Manufactured Sand

7.1.1.4. Natural Sand

7.1.1.5. Recycled Aggregate

7.1.1.6. Others

7.2. Europe Construction Aggregates Market Outlook, By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Residential

7.2.1.2. Commercial

7.2.1.3. Industrial

7.2.1.4. Infrastructure

7.3. Europe Construction Aggregates Market Outlook, By Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Germany Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.2. Germany Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.3. U.K. Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.4. U.K. Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.5. France Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.6. France Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.7. Italy Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.8. Italy Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.9. Russia Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.10. Russia Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.11. Rest of Europe Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.12. Rest of Europe Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Construction Aggregates Market Outlook, 2019 - 2031

8.1. Asia Pacific Construction Aggregates Market Outlook, By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Crushed Stone

8.1.1.2. Gravel

8.1.1.3. Manufactured Sand

8.1.1.4. Natural Sand

8.1.1.5. Recycled Aggregate

8.1.1.6. Others

8.2. Asia Pacific Construction Aggregates Market Outlook, By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Residential

8.2.1.2. Commercial

8.2.1.3. Industrial

8.2.1.4. Infrastructure

8.3. Asia Pacific Construction Aggregates Market Outlook, By Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. China Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.2. China Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.3. Japan Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.4. Japan Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.5. South Korea Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.6. South Korea Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.7. India Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.8. India Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.9. Southeast Asia Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.10. Southeast Asia Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.11. Rest of Asia Pacific Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.12. Rest of Asia Pacific Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Construction Aggregates Market Outlook, 2019 - 2031

9.1. Latin America Construction Aggregates Market Outlook, By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Crushed Stone

9.1.1.2. Gravel

9.1.1.3. Manufactured Sand

9.1.1.4. Natural Sand

9.1.1.5. Recycled Aggregate

9.1.1.6. Others

9.2. Latin America Construction Aggregates Market Outlook, By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Residential

9.2.1.2. Commercial

9.2.1.3. Industrial

9.2.1.4. Infrastructure

9.3. Latin America Construction Aggregates Market Outlook, By Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Brazil Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.2. Brazil Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.3. Mexico Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.4. Mexico Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.5. Rest of Latin America Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.6. Rest of Latin America Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Construction Aggregates Market Outlook, 2019 - 2031

10.1. Middle East & Africa Construction Aggregates Market Outlook, By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. Crushed Stone

10.1.1.2. Gravel

10.1.1.3. Manufactured Sand

10.1.1.4. Natural Sand

10.1.1.5. Recycled Aggregate

10.1.1.6. Others

10.2. Middle East & Africa Construction Aggregates Market Outlook, By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. Residential

10.2.1.2. Commercial

10.2.1.3. Industrial

10.2.1.4. Infrastructure

10.3. Middle East & Africa Construction Aggregates Market Outlook, By Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. GCC Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.3.1.2. GCC Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.3.1.3. South Africa Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.3.1.4. South Africa Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.3.1.5. Egypt Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.3.1.6. Egypt Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.3.1.7. Rest of Middle East & Africa Construction Aggregates Market By Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.3.1.8. Rest of Middle East & Africa Construction Aggregates Market By Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Product vs Application Heatmap

11.2. Manufacturer vs Application Heatmap

11.3. Company Market Share Analysis, 2023

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. LSR Group

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. Adelaide Brighton Cement.

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Rogers Group Inc.

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Martin Marietta Materials, Inc.

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. CEMEX

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. Heidelberg Materials

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Taiheiyo Cement Corporation

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. Breedon Group plc

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Business Strategies and Development

11.5.9. Holicim

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. Vulcan Materials Company

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

11.5.11. EUROCEMENT Group

11.5.11.1. Company Overview

11.5.11.2. Product Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. CRH PLC

11.5.12.1. Company Overview

11.5.12.2. Product Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

11.5.13. CEMENTIR HOLDING N.V.

11.5.13.1. Company Overview

11.5.13.2. Product Portfolio

11.5.13.3. Financial Overview

11.5.13.4. Business Strategies and Development

11.5.14. Ducon Industries

11.5.14.1. Company Overview

11.5.14.2. Product Portfolio

11.5.14.3. Financial Overview

11.5.14.4. Business Strategies and Development

11.5.15. PPC

11.5.15.1. Company Overview

11.5.15.2. Product Portfolio

11.5.15.3. Financial Overview

11.5.15.4. Business Strategies and Development

11.5.16. InterCement

11.5.16.1. Company Overview

11.5.16.2. Product Portfolio

11.5.16.3. Financial Overview

11.5.16.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2019 - 2022 |

2024 - 2031 |

Value: US$ Billion Volume: TONS |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |