Global Corrugated Open-head Drum Market Forecast

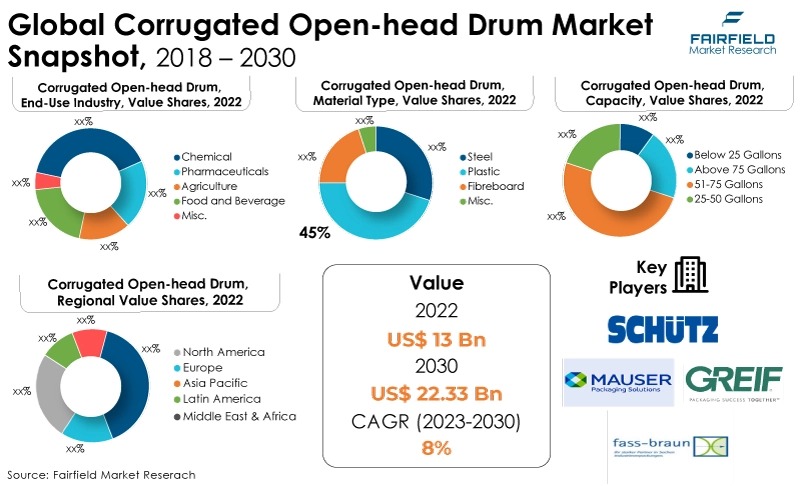

- The approximately US$13 Bn market for corrugated open-head drums to reach US$22.33 Bn by 2030-end

- Market valuation poised to witness a CAGR of 8% between 2023 and 2030

Quick Report Digest

- The key trend expected to drive growth in the corrugated open-head drum market is a growing focus on sustainability,customisation and branding, and circular economy initiatives.

- Another major market trend expected to fuel the corrugated open-head drum market growth is the rise in demand for innovative packaging strategies. This driver encompasses a spectrum of advancements in materials science and engineering, leading to the development of cutting-edge drum materials.

- In 2022, the plastic category dominated the material type segment as the focus on the scope of customisation became the driving force.

- In terms of market share for the corrugated open-head drum market globally, chemicals and fertilizer are anticipated to dominate.

- The North America region is anticipated to account for the largest share of the global corrugated open-head drum market, owing to various factors such as robust industrial and manufacturing sectors, encompassing chemicals, pharmaceuticals, food and beverages, agriculture, and hazardous materials transportation industries.

- The market for corrugated open-head drums market is expanding in the Asia Pacific region due to rapid industrialisation, particularly in emerging economies like China, and India.

A Look Back and a Look Forward - Comparative Analysis

At present, the corrugated open-head drum market is marked by several key trends. Sustainability remains a dominant theme, with businesses and industries increasingly adopting eco-friendly packaging solutions. Corrugated open-head drums, with their recyclable and reusable materials, are in high demand.

Moreover, customisation is on the rise, allowing businesses to tailor drum solutions to their specific needs. Regulatory compliance and safety continue to drive the market, especially in industries dealing with hazardous materials. Technological advancements are improving the production process and materials used in drum manufacturing, resulting in enhanced performance and cost efficiency.

Looking back at the historical trajectory of the corrugated open-head drum market, significant developments have occurred. Over the past few decades, there has been a notable shift towards sustainability and environmental responsibility. Drum materials have evolved to incorporate more eco-friendly options, reflecting changing consumer and regulatory expectations.

The market has witnessed steady growth, driven by the expansion of industries requiring reliable packaging solutions. Innovations in materials and manufacturing processes have contributed to the durability and versatility of corrugated open-head drums, making them indispensable across various sectors.

Several trends and factors are expected to shape the corrugated open-head drum market. Sustainability will remain a paramount concern, with a growing emphasis on circular economy practices, further promoting the recycling and reuse of drums. Technological integration, including smart drum solutions with monitoring capabilities, is likely to become more prevalent, enhancing supply chain visibility and efficiency.

Lightweight yet durable materials will continue to gain traction, reducing transportation costs and environmental impact. Customisation options will expand, catering to the specific needs of industries and applications. Overall, the corrugated open-head drum market is poised for growth, driven by evolving industry requirements, sustainability imperatives, and technological advancements.

Key Growth Determinants

- Circular Economy Principles

Circular economy initiatives are emerging as a potent market driver within the corrugated open-head drum industry. In an era marked by increasing environmental awareness and sustainability imperatives, these initiatives are reshaping the way businesses approach packaging solutions.

Corrugated open-head drums, known for their recyclability and reusability, align perfectly with the circular economy model. They are an integral part of the sustainable packaging landscape as they can be easily recycled or refurbished, reducing waste and conserving resources.

Circular economy practices promote the collection, recycling, and reintroduction of these drums into the supply chain, ensuring a more sustainable and closed-loop approach to packaging. Businesses are increasingly recognising the cost savings, regulatory compliance, and positive brand image associated with circular economy initiatives, making them a compelling driver for the corrugated open-head drum market.

As consumers and regulatory bodies continue to prioritise sustainability, manufacturers and businesses that champion these principles are poised to thrive in a market evolving toward greater environmental responsibility.

- Corrugated Open-head Drums at the Forefront of Material Innovation

Innovation in materials serves as a compelling driver within the corrugated open-head drum market, reshaping the landscape of packaging solutions. This driver encompasses a spectrum of advancements in materials science and engineering, leading to the development of cutting-edge drum materials.

One crucial facet of this innovation involves the creation of lightweight yet exceptionally durable materials. These materials offer the dual benefit of reducing transportation costs while maintaining the robustness required for secure product storage and transit.

Growing emphasis on environmental sustainability has encouraged the introduction of eco-friendly drum materials, including biodegradable and recyclable options. These materials not only align with stringent regulatory standards but also resonate with environmentally conscious consumers.

Innovations are also geared towards enhancing protective properties, granting materials resistance to moisture, chemicals, and impact.

Major Growth Barriers

- Alternative Packaging Solutions

The availability of alternative packaging solutions serves as a restraint within the corrugated open-head drum market. While these alternatives, such as bulk containers and flexible intermediate bulk containers (FIBCs), offer specific advantages in terms of cost-efficiency and handling, they can divert demand away from traditional corrugated open-head drums.

Businesses may opt for these alternatives, especially when seeking cost-effective packaging options or when dealing with non-hazardous materials.

This competition from alternative packaging solutions poses a challenge to the market's growth, necessitating that manufacturers differentiate their corrugated open-head drums by highlighting their unique benefits, such as recyclability, reusability, and suitability for specific applications, to maintain their market share.

- Customisation Constraints

Customisation options within the corrugated open-head drum market present a notable restraint. While customisation is a key driver, achieving tailored solutions can be challenging due to the intricate landscape of regulatory and safety standards.

Manufacturers must navigate a complex web of industry-specific requirements, making it difficult to meet diverse customer needs. This limitation can hinder the ability to offer highly specialised drum solutions that precisely fit the demands of various industries and applications.

As businesses seek packaging that aligns seamlessly with their unique requirements, the inability to provide comprehensive customisation may impact the market's ability to cater to specific industry niches and hamper growth opportunities.

Key Trends and Opportunities to Look at

- Popularity of Value-added Services for Customer Satisfaction

Value-added services present a significant opportunity within the corrugated open-head drum market. Beyond providing high-quality drums, businesses can offer complementary services such as drum cleaning, maintenance, and disposal solutions. These services not only enhance customer satisfaction but also create additional revenue streams.

Drum cleaning services ensure that containers are properly sanitised, meeting industry hygiene standards and regulatory compliance. Maintenance services can extend the lifespan of drums, reducing replacement costs for customers.

Disposal solutions, including recycling programs, align with sustainability goals, making them increasingly attractive to environmentally conscious businesses. By diversifying their offerings to include value-added services, manufacturers can strengthen customer relationships, foster loyalty, and differentiate themselves in a competitive market landscape.

- Diversification Tends

Diversification is a compelling opportunity within the corrugated open-head drum market. While these drums have traditionally found application in sectors like chemicals and pharmaceuticals, there is untapped potential in diversifying into new industries.

The food and beverages sector, for example, presents an opportunity for corrosion-resistant and food-grade open-head drums, addressing the unique packaging needs of this industry. Similarly, agriculture and the transport of bulk materials like grains and seeds offer growth potential.

By adapting drum designs and materials to suit the specific requirements of these diverse sectors, manufacturers can expand their market reach and reduce dependence on a single industry. Diversification mitigates risk and opens doors to new revenue streams and long-term growth prospects within the corrugated open-head drum market.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario exerts a profound influence on the corrugated open-head drum industry, shaping its dynamics and defining the parameters within which manufacturers operate. Safety and compliance regulations are paramount, establishing rigorous criteria for drum design, construction, labelling, and transportation, particularly when hazardous materials are involved.

The regulatory scenario in the corrugated open-head drum market is characterised by a combination of industry-specific regulations, environmental standards, and safety mandates. Depending on the contents they are designed to store and transport, these drums must comply with various regulations aimed at ensuring the safety of both the products and the environment.

For example, drums used for hazardous chemicals or materials must adhere to stringent safety and labelling requirements outlined by organisations like OSHA (Occupational Safety and Health Administration) and the EPA (Environmental Protection Agency). Additionally, there are international regulations governing the transport of hazardous materials, such as the UN Recommendations on the Transport of Dangerous Goods.

In recent years, environmental concerns have led to an increased focus on sustainability and the use of eco-friendly materials, prompting the development of regulations and standards encouraging the adoption of recyclable and reusable drum solutions. Manufacturers and businesses operating in the corrugated open-head drum market must navigate this complex regulatory landscape to ensure compliance while meeting evolving customer demands for sustainable packaging solutions.

Fairfield’s Ranking Board

Top Segments

- Plastic All Set to Retain Dominance

Plastic stands as the dominating material type in the corrugated open-head drum market for several compelling reasons. Plastic drums offer a versatile and lightweight alternative to traditional steel or fiberboard drums, making them easier to handle and transport. Their corrosion-resistant properties make them ideal for chemicals and hazardous materials industries.

Moreover, plastic drums can be manufactured in various sizes and capacities, catering to a wide range of applications across different industries. They are also well-suited for compliance with sustainability goals, as many plastic drums are recyclable and reusable.

As industries increasingly prioritise cost-efficiency, safety, and sustainability, plastic drums continue to gain prominence as the preferred material choice, contributing to their dominant position in the market.

- Chemicals and Fertilizers Tend to Lead the Way

The chemicals and fertilizers industry stands as the dominating end-user segment in the corrugated open-head drum market. These industries rely heavily on sturdy and compliant packaging solutions to store and transport a wide range of chemicals, including hazardous materials.

Corrugated open-head drums provide an ideal choice due to their durability, UN certification for hazardous materials transport, and corrosion resistance.

Additionally, the need for reliable packaging in these sectors is driven by strict safety regulations and the requirement for secure containment of potentially dangerous substances. As these industries continue to expand, especially in regions with significant agricultural and industrial activities, the demand for corrugated open-head drums remains robust, solidifying their dominant position in the market.

Regional Frontrunners

- North America Takes the Lead

North America is expected to have the largest share of the corrugated open-head drum market due to several key factors. Firstly, the region boasts a robust growth of industrial and manufacturing sectors, encompassing chemicals, pharmaceuticals, food and beverages, agriculture, and hazardous materials transportation industries, all of which heavily rely on these drums for safe and efficient packaging.

Additionally, North America has stringent regulations governing the transport of hazardous materials, leading to a high demand for certified and compliant drums. Furthermore, a growing emphasis on sustainability and environmental responsibility in North America aligns with the eco-friendly attributes of corrugated open-head drums, contributing to their popularity.

- Asia Pacific Poised for Exceptional Growth Through 2030

Asia Pacific is poised to witness the highest CAGR in the corrugated open-head drum market due to several compelling factors. Firstly, the region is experiencing rapid industrialisation, particularly in emerging economies like China, and India, which fuels the demand for industrial packaging solutions.

The increasing export activities from Asia Pacific countries drive the need for compliant and durable drums, especially for the transportation of hazardous materials.

As the middle-class population grows and consumer preferences evolve, the region is also experiencing a surge in environmental awareness, favouring sustainable packaging solutions like recyclable and reusable corrugated open-head drums.

All these factors combined create a conducive environment for significant market growth in Asia Pacific, making it a region to watch for industry expansion.

Fairfield’s Competitive Landscape Analysis

The global corrugated open-head drum market is characterised by a concentrated landscape, with a select group of major players dominating the industry on a global scale. These leading companies are actively introducing innovative products and focusing on expanding their distribution channels to bolster their international presence. Fairfield Market Research predicts that further consolidation within the market is on the horizon.

Who Are the Leaders in the Global Corrugated Open-head Drum Market Space?

- Schutz GmbH & Co.

- Greif Inc.

- Mauser Group B.V.

- DS Smith plc

- Mondi Group

- Fass-Braun GmbH.

- Anglo American Steel L.L.C.

- Al Fujairah Steel Barrels & Drums

- Pipeline packaging

- Smurfit Kappa Group

- Rehway Steel Drum Co., Inc.

- Skolnik Industries, Inc.

- DITI Resources

- Others

Significant Company Developments

Partnerships & Acquisitions

- September 2023: Greif announced it has acquired 51 percent of the ownership interest in ColePak, LLC. The acquisition is an all-cash transaction funded through Greif’s existing credit facility. ColePak is the second-largest supplier of paper partitions in North America and has a compelling future growth path in that unique product niche.

- May 2023: Global rigid container and life sciences packaging distributor, Novvia Group, acquired Rahway Steel Drum Company- Rahway, a New Jersey-based distributor of drums, pails, IBCs, and other rigid packaging solutions. Novvia is backed by Kelso & Company.

- July 2022: Anglo American and Nippon Steel Corporation signed a memorandum of understanding to work together to accelerate the transition to lower carbon steelmaking, building on the premium physical qualities of Anglo American’s iron ore to help drive emissions reduction.

An Expert’s Eye

Demand and Future Growth

The corrugated open-head drum market is currently valued at US$3 Bn in 2022, shows promising signs of future growth. Projections indicate that the market is poised to expand by approximately 8% during the forecast period. This robust growth trajectory can be attributed to several factors.

Firstly, corrugated open-head drums' versatile and durable nature makes them indispensable across various industries, including chemicals, pharmaceuticals, and hazardous waste management. Secondly, the increasing emphasis on safety, compliance, and sustainability is driving the demand for reliable packaging solutions like corrugated open-head drums.

Moreover, ongoing innovations in drum design and materials are further enhancing their performance, and cost efficiency. As global trade continues to flourish, the need for secure and efficient packaging solutions is on the rise, solidifying the positive outlook for the corrugated open-head drum market in the coming years.

Supply Side of the Market

The supply side of the corrugated open-head drum market encompasses a dynamic ecosystem of entities and processes that collectively work to provide these essential packaging solutions to various industries.

At the heart of the supply side are the manufacturers, responsible for the design, production, and assembly of corrugated open-head drums. They utilise materials such as steel, plastic, or fibreboard to craft these versatile containers.

Raw material suppliers play a critical role by providing the necessary inputs, including steel sheets, plastic resin, and fibreboard. Distribution and logistics entities ensure the efficient transportation of these drums from manufacturers to end-users, which may include businesses across diverse sectors. Retailers and distributors facilitate the accessibility of corrugated open-head drums to a wider audience.

Furthermore, research and development institutions contribute to the supply side through their efforts to enhance drum design, materials, and sustainability. Regulatory bodies establish standards and guidelines to ensure product safety and compliance, while industry associations offer support and knowledge-sharing platforms.

Recycling and sustainability initiatives play a growing role by promoting eco-friendly practices in the production and utilisation of corrugated open-head drums, aligning with the broader focus on environmental responsibility.

Together, these supply-side participants form a crucial part of the corrugated open-head drum market, ensuring that these containers meet the evolving needs of industries that rely on secure and efficient packaging solutions.

Global Corrugated Open-head Drum Market is Segmented as Below:

Material Type:

- Plastic

- Fiberboard

- Steel

- Miscellaneous

End-use Industry:

- Chemical

- Agriculture

- Pharmaceuticals

- Food and Beverage

- Miscellaneous

Capacity:

- Below 25 Gallons

- 25 - 50 Gallons

- 51 - 75 Gallons

- Above 75 Gallons

By Geographic Coverage:

- North America

- United States

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & and Africa

1.Executive Summary

1.1. Global Corrugated Open-head Drum Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2.Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6.I mpact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3.Global Corrugated Open-head Drum Market Outlook, 2018 - 2030

3.1. Global Corrugated Open-head Drum Market Outlook, by Material Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Plastic

3.1.1.2. Fiberboard

3.1.1.3. Steel

3.1.1.4. Misc.b

3.2.1. Key Highlights

3.2.1.1. Below 25 Gallons

3.2.1.2. 25-50 Gallons

3.2.1.3. 51-75 Gallons

3.2.1.4. Above 75 Gallons

3.3. Global Corrugated Open-head Drum Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

3.3.1.Key Highlights

3.3.1.1. Chemicals

3.3.1.2. Agriculture

3.3.1.3. Pharmaceuticals

3.3.1.4 .Food & Beverage

3.3.1.5. Misc.

3.4. Global Corrugated Open-head Drum Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5 .Middle East & Africa

4.North America Corrugated Open-head Drum Market Outlook, 2018 - 2030

4.1. North America Corrugated Open-head Drum Market Outlook, by Material Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Plastic

4.1.1.2. Fiberboard

4.1.1.3. Steel

4.1.1.4. Misc.

4.2. North America Corrugated Open-head Drum Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1 Below 25 Gallons

4.2.1.2. 25-50 Gallons

4.2.1.3. 51-75 Gallons

4.2.1.4. Above 75 Gallons

4.3. North America Corrugated Open-head Drum Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Chemicals

4.3.1.2. Agriculture

4.3.1.3. Pharmaceuticals

4.3.1.4. Food & Beverage

4.3.1.5. Misc.

4.4. North America Corrugated Open-head Drum Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

4.4.1.4. Canada Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

5.Europe Corrugated Open-head Drum Market Outlook, 2018 - 2030

5.1. Europe Corrugated Open-head Drum Market Outlook, by Material Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Plastic

5.1.1.2. Fiberboard

5.1.1.3. Steel

5.1.1.4. Misc.

5.2. Europe Corrugated Open-head Drum Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Below 25 Gallons

5.2.1.2. 25-50 Gallons

5.2.1.3. 51-75 Gallons

5.2.1.4 .Above 75 Gallons

5.3. Europe Corrugated Open-head Drum Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Chemicals

5.3.1.2. Agriculture

5.3.1.3. Pharmaceuticals

5.3.1.4. Food & Beverage

5.3.1.5. Misc.

5.4. Europe Corrugated Open-head Drum Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

6.Asia Pacific Corrugated Open-head Drum Market Outlook, 2018 - 2030

6.1. Asia Pacific Corrugated Open-head Drum Market Outlook, by Material Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1 .Plastic

6.1.1.2. Fiberboard

6.1.1.3. Steel

6.1.1.4. Misc.

6.2. Asia Pacific C orrugated Open-head Drum Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Below 25 Gallons

6.2.1.2. 25-50 Gallons

6.2.1.3. 51-75 Gallons

6.2.1.4. Above 75 Gallons

6.3. Asia Pacific Corrugated Open-head Drum Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Chemicals

6.3.1.2. Agriculture

6.3.1.3. Pharmaceuticals

6.3.1.4. Food & Beverage

6.3.1.5. Misc.

6.4. Asia Pacific Corrugated Open-head Drum Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.10. ndia Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

7.Latin America Corrugated Open-head Drum Market Outlook, 2018 - 2030

7.1. Latin America Corrugated Open-head Drum Market Outlook, by Material Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Plastic

7.1.1.2. Fiberboard

7.1.1.3. Steel

7.1.1.4. Misc.

7.2. Latin America Corrugated Open-head Drum Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Below 25 Gallons

7.2.1.2. 25-50 Gallons

7.2.1.3. 51-75 Gallons

7.2.1.4. Above 75 Gallons

7.3. Latin America Corrugated Open-head Drum Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1.Chemicals

7.3.1.2.Agriculture

7.3.1.3.Pharmaceuticals

7.3.1.4.Food & Beverage

7.3.1.5.Misc.

7.4. Latin America Corrugated Open-head Drum Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

7.4.1.9 .Argentina Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

8.Middle East & Africa Corrugated Open-head Drum Market Outlook, 2018 - 2030

8.1. Middle East & Africa Corrugated Open-head Drum Market Outlook, by Material Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Plastic

8.1.1.2. Fiberboard

8.1.1.3. Steel

8.1.1.4. Misc.

8.2. Middle East & Africa Corrugated Open-head Drum Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Below 25 Gallons

8.2.1.2. 25-50 Gallons

8.2.1.3. 51-75 Gallons

8.2.1.4. Above 75 Gallons

8.3. Middle East & Africa Corrugated Open-head Drum Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Chemicals

8.3.1.2. Agriculure

8.3.1.3. Pharmaceuticals

8.3.1.4. Food & Beverage

8.3.1.5. Misc.

8.4.Middle East & Africa Corrugated Open-head Drum Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Corrugated Open-head Drum Market by Material Type, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Corrugated Open-head Drum Market by Capacity, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Corrugated Open-head Drum Market by End-use Industry, Value (US$ Bn), 2018 - 2030

9.Competitive Landscape

9.1. Material Type vs End-use Industry Heatmap

9.2. Manufacturer vs End-use Industry Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Schutz GmbH & Co.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Greif Inc.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Mauser Group B.V.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. DS Smith plc

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Mondi Group

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Fass-Braun GmbH

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Anglo American Steel L.L.C

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Al Fujairah Steel Barrels & Drums

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Pipeline Packaging

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Smurfit Kappa Group

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Rehway Steel Drum Co. Inc.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Skolnik Industries Inc.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. DITI Resources

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

10.Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Material Type Coverage |

|

|

End-use Industry Coverage |

|

|

Capacity Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |