Global Crash Barrier Systems Market Forecast

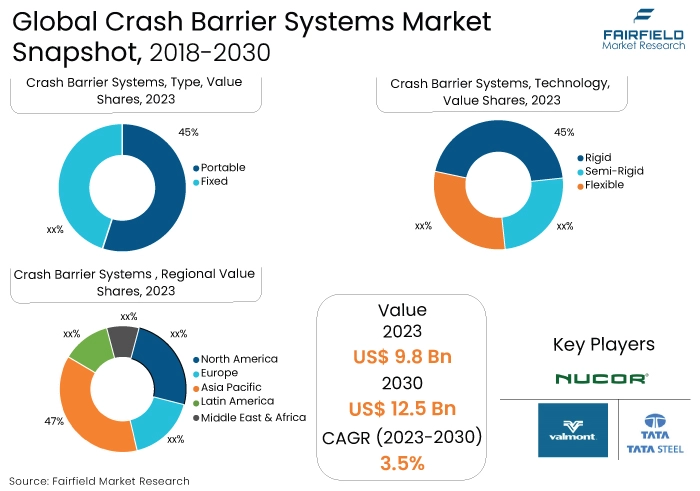

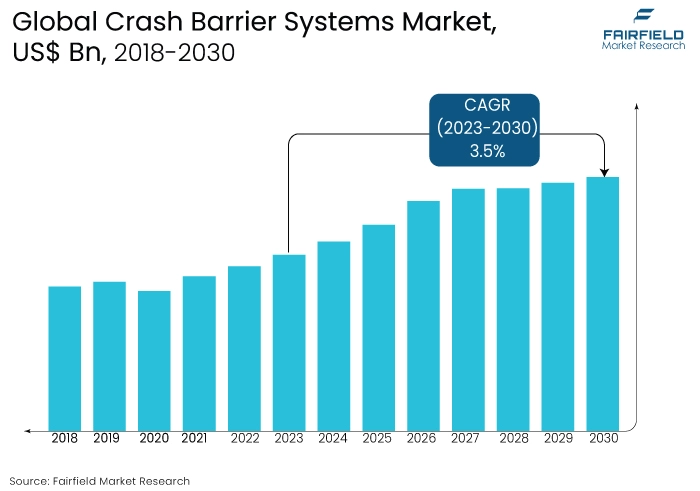

- The approximately US$9.8 Bn crash barrier systems market in 2023 poised to reach US$12.5 Bn by 2030-end

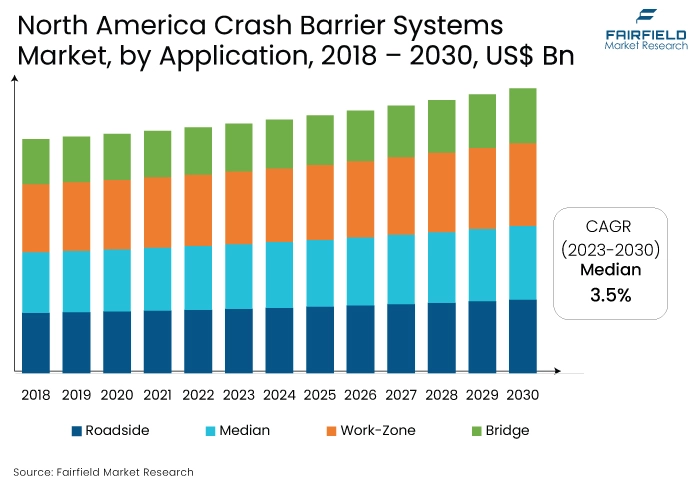

- Crash barrier systems market size likely to see 3.5% CAGR between 2023 and 2030

Major Report Findings - Fairfield's Perspective

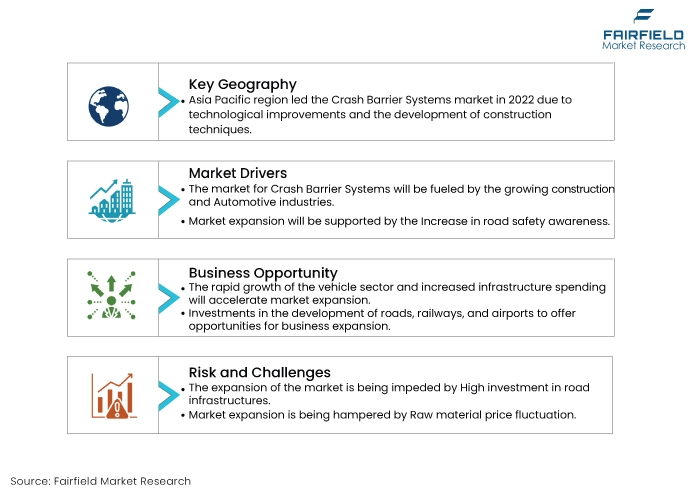

- The key trend anticipated to fuel the crash barrier systems market growth is the rapid expansion of the vehicle sector and heightened infrastructure investments, particularly in developing countries.

- Another major market trend expected to fuel the crash barrier systems market growth is the High expenditures in commercial infrastructure. Numerous government investments are directed towards infrastructure development, presenting opportunities for growth in the crash barrier systems market

- In 2023, the fixed barrier category dominated the industry. Fixed barriers absorb the most energy during collisions and keep the vehicle from swerving.

- In terms of market share for crash barrier systems globally, the Rigid segment is anticipated to dominate. Rigid barriers are commonly deployed at high-volume roadwork sites to safeguard road workers and other users.

- In 2023, the crash cushions category controlled the market. These devices are intended to absorb the angular momentum of a crashing car.

- The roadside category is highly prevalent in the market for crash barrier systems. Roadside barriers, composed of steel, concrete, or a blend of both materials, serve as sturdy protective barriers. They are affixed to road structures such as bridges, retaining walls, and building amenities.

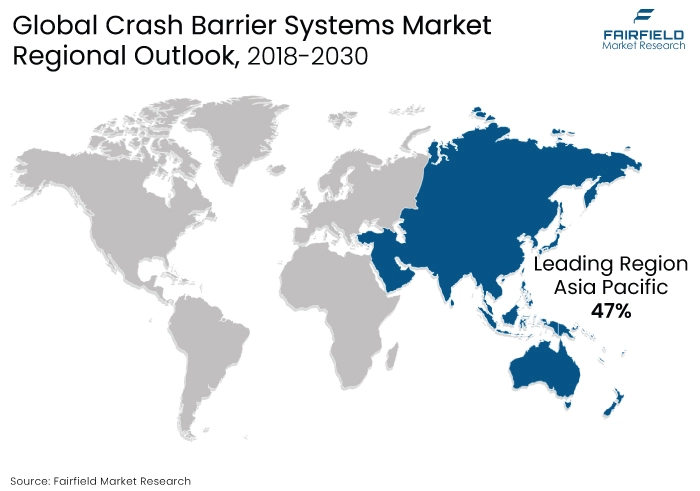

- The Asia Pacific region is anticipated to account for the largest share of the global crash barrier systems market, owing to The quickly rising population of the Asia Pacific region, as well as the growing need for safety mechanisms.

- The market for crash barrier systems is expanding in North America due to the increase in economic activities, the increasing need for public security, and the improvement in road infrastructure.

A Look Back and a Look Forward - Comparative Analysis

The implementation of crash barrier systems addresses increasing safety concerns for pedestrians and vehicles, thereby fueling growth in the global market. These systems are unlocking new growth avenues, particularly in emerging economies, with significant traction expected from the construction and automotive sectors.

The market witnessed staggered growth during the historical period 2018 – 2022. Several limitations and challenges may hinder the expansion of the market. Anticipated restrictions include concerns related to the high expenses associated with repairs and the fluctuating costs of raw materials utilised in the manufacturing of barrier systems. These factors could potentially constrain market growth and pose obstacles to industry players seeking to expand their market presence.

The increasing adoption of the product across various developing nations, particularly for applications in highways, flyovers, bridges, high embankments, airports, and railway stations, is fostering significant growth opportunities for the market. This trend reflects a growing recognition of the product's versatility and effectiveness in addressing safety and infrastructure needs across diverse settings.

As developing countries continue to invest in expanding and modernising their transportation and infrastructure networks, the demand for these products is expected to further escalate, providing a favourable landscape for market expansion and development.

Key Growth Determinants

- Unwavering Growth of Construction and Automotive Industries

The performance of the construction and automotive industries is expected to drive growth in the crash barrier systems market. In January 2023, the Federal Highway Administration (FHWA) announced a substantial expenditure of US$2.1 Bn for upgrades to bridge infrastructure, reflecting the government's commitment to repairing highway bridges nationwide. The increasing per capita income of the middle-class population has boosted their purchasing power, leading to a rise in vehicle ownership and the construction of new roads. Additionally, rural-to-urban migration in developing countries has spurred demand in the construction sector.

The Asia Pacific region, led by China, is anticipated to witness significant demand for new constructions. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), robust growth is projected in the automotive industries of India, Brazil, and South Africa, as well as several other countries including the US, Canada, Germany, Italy, and Australia, with a growth rate exceeding 10% over the next five years, driving demand for crash barrier products. Furthermore, the development of commercial real estate and the modernisation of transportation infrastructure globally are expected to further fuel market growth throughout the forecast period.

- Increasing Number of Road Accidents

In the coming years, the crash barrier systems market is anticipated to be propelled by factors such as the rising incidence of traffic accidents, increased instances of vehicle encroachment, and worsening traffic congestion. In 2022, a total of 461,312 road accidents were reported by States and Union Territories (UTs), resulting in 168,491 fatalities and injuries to 443,366 individuals.

Compared to the previous year, 2021, there was an 11.9% increase in the number of road accidents, along with a 9.4% rise in fatalities and a 15.3% increase in injuries. Furthermore, due to heightened investment in the automotive and transportation infrastructure sectors, coupled with manufacturers' adoption of advanced safety measures, the market is poised for growth in the coming years.

- Rapid Urbanisation, and Industrialisation Leading to Improved Standards of Living

The rapid pace of urbanisation, and industrialisation, coupled with improvements in the standard of living, is significantly impacting global demographics. According to the United Nations, it is projected that approximately 68% of the world's population will reside in urban areas by the year 2050. Notably, over the past decade, urbanisation has been particularly pronounced in developing regions, with Asia, and Oceania experiencing a notable increase from 44.0% in 2012 to 50.6% in 2022.

Similarly, Africa has witnessed a 4.6 percentage point rise during the same period. s cities expand and modernise, there is a growing need for the construction and maintenance of road networks, bridges, flyovers, and other transportation infrastructure. Crash barrier systems play a crucial role in ensuring the safety of these infrastructure projects, thereby driving demand for such safety measures.

Major Growth Barriers

- High Crash Severity Due to Barrier Collisions

Rigid barriers are commonly installed alongside roads to mitigate the severity of accidents following impact. In the United States, motorcycles represent just 3% of the vehicle fleet, yet they are involved in nearly half of all fatalities resulting from collisions with guardrails and 22% of fatalities from collisions with concrete barriers. Consequently, the use of rigid and semi-rigid barriers often leads to increased crash severity post-impact.

Rigid barriers prove less effective as they transmit a greater portion of the impact energy to vehicle occupants, resulting in more severe injuries. This phenomenon, known as ride-down in barrier crash testing, underscores the limitations of rigid barrier systems. Furthermore, the high cost of repairing barrier systems poses a significant challenge to the growth of the global crash barrier systems market.

Following a crash impact, barrier systems such as concrete blocks, wooden fences, and end treatments require substantial financial investment for reconstruction. Consequently, many highway authorities, including the European Union Road Federation (ERF), and the National Cooperative Highway Research Program (NCHRP), are increasingly opting for flexible crash barriers equipped with ropes and wires. These flexible barriers are designed to absorb a greater amount of energy during impact with vehicles, thereby reducing the severity of crashes.

- Volatility in Raw Material Prices

The crash barrier systems market heavily relies on raw materials for its production process. When these raw materials are readily available at reasonable prices, production operations proceed smoothly. However, the prices of raw materials are subject to high levels of volatility; if these prices experience an increase, production costs also rise, leading to inflated prices for the finished products that are passed on to end users.

Key raw materials utilised in crash barrier systems include steel and concrete. The outbreak of the COVID-19 pandemic globally exerted pressure on steel prices. For instance, the price of Chinese hot-rolled coil (HRC) was recorded at US$465 per metric ton in the fourth quarter of 2019 (pre-COVID-19), dropping to USD 440 in the second quarter of the subsequent year, before briefly approaching US$420.

However, by late December 2020, the price of Chinese HRC surged to US$775, marking an 85% increase. This substantial increase in steel prices eventually translated into higher costs for crash barriers. Additionally, zinc is utilised in the galvanisation process for crash barriers. The price of zinc has also experienced fluctuations, largely influenced by the pandemic situation. In 2020, the average London Metal Exchange price for zinc witnessed an 11% decline, reaching US$2,267 per ton compared to the previous year.

Key Trends and Opportunities to Look at

- Growing Opportunities in Developing and Emerging Regions

Asia Pacific is poised to witness a surge in new construction projects and infrastructure development activities in the foreseeable future. According to the World Health Organisation (WHO), there has been a significant increase in construction spending in countries like China, India, and Vietnam, with growth rates estimated at 7.3%, 7%, and 6.8%, respectively, from 2014 to 2019. This presents a promising opportunity for the expansion of the crash barrier systems market in these regions.

Moreover, countries in Latin America such as Brazil, Argentina, and Colombia, along with African nations like South Africa, have demonstrated notable signs of development in recent years. The rise in GDP and urbanisation rates in these countries indicates growing infrastructure needs. Consequently, they offer substantial opportunities for the growth of the crash barrier systems market.

- Increasing Government Investments

Government investments in infrastructure development are anticipated to catalyse opportunities for growth in the crash barrier systems market. For example, in 2019, the Government of Russia launched a 6-year modernisation plan aimed at enhancing infrastructure across various sectors, including airports, roads, railways, and other key areas.

With an investment of approximately $96 billion, such initiatives are poised to have a favourable impact on the market dynamics during the forecast period.

- Advancements in Both Technology and Manufacturing Material

According to World Bank data, global spending on research and development increased from 2.33% of GDP in 2019 to 2.63% in 2020. In response, companies are developing cleaner manufacturing solutions.

Solidia Technologies, for example, is revolutionising cement production, a process responsible for 5-7% of global carbon emissions, by offering two solutions, viz., cement manufacturing technology that reduces emissions by up to 40%, and concrete curing technology that utilises CO2 instead of water. This innovation not only reduces carbon footprint but also conserves water, potentially saving up to 3 trillion liters annually while actively capturing CO2 from the atmosphere.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, supportive measures aimed at enhancing road safety, including regulatory frameworks, traffic monitoring technologies, and enforcement efforts, are poised to fuel growth in the barrier systems market. For instance, the US federal government's Road to Zero initiative, aimed at eliminating traffic fatalities by 2050, is spearheaded by the National Safety Council.

This initiative promotes the adoption of modern safety measures to curb traffic-related deaths. Similarly, in India, the Ministry of Road Transport and Highways has implemented initiatives to bolster road safety and reduce accidents on National Highways. These proactive measures are expected to drive demand for barrier systems in the transportation sector throughout the forecast period.

Fairfield’s Ranking Board

Top Segments

- Fixed Barriers Remain Sought-After

The fixed barrier segment dominated the market in 2023. Fixed crash barriers serve as safety measures designed to prevent collisions and mitigate the risk of vehicles veering off the road or into ravines. For instance, in December 2019, Valmont Industries introduced the Highway Guard LDS, a steel safety barrier engineered to meet MASH 16 TL-3 standards.

Furthermore, the portable category is projected to experience the fastest market growth. A mobile crash barrier with wheels employs a hydraulically operated system powered by a rechargeable battery to detach the barrier from its carrier and lower it into position. This mechanism facilitates the raising of the barrier for routine or emergency purposes with notable efficiency. Control options for the barrier include built-in controls on the barrier itself, a stationary security post, or a handheld pressure release controller.

- Dominance of Rigid Barriers Prevails Through 2030

In 2023, the automatic category dominated the industry. When a vehicle collides with a rigid barrier, there is minimal dynamic deflection because the vehicle retains kinetic energy internally. Such barriers exhibit limited movement, yield, or distortion upon impact and are typically constructed from steel, concrete, or a combination of both materials. The demand for robust crash barriers has intensified in response to the escalating rate of accidents.

For instance, recent statistics from the National Crime Records Bureau indicate that in 2021, over 1.55 lakh individuals-an average of 426 per day or 18 per hour-lost their lives in road crashes in India. This underscores the importance of crash barrier systems in mitigating the impact of collisions. Consequently, many highway authorities, including ERF and NCHRP, have begun to develop flexible crash barriers composed of ropes, and wires. These barriers absorb a significant amount of energy upon collision with moving vehicles, thereby reducing the severity of accidents.

The semi-rigid category is anticipated to grow substantially throughout the projected period. Steel W-beam safety barriers, classified as semi-rigid, consist of steel rails affixed to posts engineered to break upon vehicle impact. Similarly, guardrail crash barriers offer semi-rigid shielding, safeguarding motorists from hazards near road edges.

- Crash cushion Likely to be the Leading Segment

The crash cushion segment dominated the market in 2023. A crash cushion or impact attenuator, also referred to as a cowboy pillow, is a device engineered to minimise the impact of vehicle collisions, reducing damage to structures, vehicles, and occupants. These devices are designed to absorb the angular momentum generated by a crashing vehicle and may also redirect the vehicle's trajectory away from hazards or roadside equipment and personnel.

Typically installed in front of permanent structures near roadways, such as crash barrier entrances, gore areas, or flyover supports, impact attenuators come in various forms, including temporary versions used in road construction projects.

The end treatments category is expected to experience the fastest growth within the forecast time frame. End treatments serve the purpose of preventing vehicles from bypassing or penetrating the barrier system, thereby decreasing the occurrence of severe accidents and injuries. They function by absorbing the kinetic energy generated by colliding vehicles, gradually dispersing it to lessen the impact force and mitigate damage to both vehicles and roadside infrastructure.

- Roadside Barriers Continue to March Ahead

In 2023, the roadside category led the market growth. These barriers, typically made of steel, concrete, or a combination of both, are installed along highways on structures like bridges, retaining walls, or building facilities. Their primary purpose is to prevent errant vehicles from veering off the roadway and to mitigate the severity of crashes.

Moreover, the median barriers category is expected to grow fastest in the crash barrier systems market during the forecast period. Median barriers, on the other hand, are longitudinal barriers installed to separate opposing traffic on divided highways. They are designed to redirect vehicles and reduce the likelihood of collisions with the barrier itself. These barriers are particularly effective in reducing cross-median crashes, which are common on high-speed divided highways and expressways.

Regional Frontrunners

Global Market Revenue Remains Concetrated in Asia Pacific

The significant population in countries like India, and China has led to the extensive construction of roads, bridges, and highways, necessitating advanced safety measures for drivers. According to data from the World Bank, India's population increased from 1.06 billion in 2000 to 1.39 billion in 2021, while China's population increased from 1.26 billion to 1.41 billion during the same period. India's economic growth is driving efforts to upgrade roads to meet higher standards.

Additionally, the growing reliance on road transportation for imports, exports, and e-commerce sales is driving the demand for crash barriers. The rise of e-commerce platforms and increased internet penetration further contributes to this trend. Moreover, the construction of flyovers in many areas to alleviate traffic congestion is expected to fuel market growth in the region.

NHAI, in collaboration with Maha Metro, set a Guinness World Record by building the longest Double Decker Viaduct measuring 3.14 kilometers. This innovative structure integrates a Highway Flyover, and Metro Rail, supported on a single column, spanning across three metro stations in Nagpur. Government initiatives, including funding for road projects aimed at reducing accidents and enhancing urban aesthetics by planting trees along roadsides, further support the installation of crash barriers.

North America’s Contrubition Remains Indispensable

The growth in the region can be attributed to several factors, including increased economic activities, stricter Environmental, Health, and Safety (EHS) regulations, a growing emphasis on public security, and enhancements in road infrastructure. Additionally, the rapid expansion of the automobile industry and increased investment in infrastructure are expected to accelerate the growth of the regional barrier systems market.

For example, in May 2019, Delta Scientific, a US-based manufacturer of vehicle access control equipment, introduced the self-contained MP5000 mobile development vehicle crash barriers. These barriers, weighing 7.5 tons, are capable of stopping vehicles traveling at speeds of up to 64 kph. They allow various types of vehicles to pass through checkpoints smoothly and safely. Such advancements in the region are anticipated to further propel market growth during the forecast period.

Fairfield’s Competitive Landscape Analysis

The global crash barrier systems market is a consolidated market with fewer major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence.

The cost-effectiveness, reusability, and recyclability of plastics, along with their low maintenance costs, serve as key drivers for major companies to prioritise the development of crash barrier systems made from plastic with distinctive and highly visible designs.

Additionally, manufacturers are directing their efforts toward the creation of high-tech crash barriers to address security and safety concerns. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in Global Crash Barrier Systems Space?

- Tata Steel Limited

- Nucor Corporation

- Valmont Industries, Inc.

- Hill & Smith Holdings PLC

- Arbus Limited

- Transpo Industries, Inc

- Lindsay Corporation

- Trinity Industries, Inc.

- Avon Barrier Corporation Ltd

- ATG Access Ltd.

Significant Industry Developments

New Product Launch

- March 2019: Nucor Corporation unveiled plans to construct a cutting-edge steel plate mill in Brandenburg, Kentucky, situated along the Ohio River southwest of Louisville. The company will invest approximately USD 1.35 billion in the construction of the mill, which will have a production capacity of 1.2 million tons per year of steel plate products. This new facility will significantly enhance Nucor's plate product portfolio.

- August 2019: Lindsay Corporation introduced ABSORB-M, a novel non-directive crash cushion system filled with water. The ABSORB-M has been tested to meet the American Association of State Highway and Transportation Officials (AASHTO) Manual for Assessing Safety Hardware (MASH) Test Level TL-2 and TL-3 standards, making it suitable for narrow areas where road and workspace are limited.

Distribution Agreement

- January 2021: Betafence announced a partnership with Master Halco, a wholesale distributor of fence security solutions, designating Master Halco as the exclusive supplier of Betafence's Prism 3-D welded wire products in North America. Through this collaboration, the companies aimed to offer customers top-notch security solutions.

- April 2023: RoadSafe Traffic Systems, Inc. acquired Highway Supply, LLC, a leading provider of traffic control products and services based in Albuquerque, New Mexico. Highway Supply's pavement marking and water blasting division also offers services for major heavy highway public works projects throughout the state.

- July 2021: Perimeter security company acquired Avon Barrier for an undisclosed sum. Avon Barrier is a prominent supplier of barriers for controlling vehicle and pedestrian access and securing perimeters. With this acquisition, the perimeter protection group aims to expand its presence in the crash barrier systems market.

An Expert’s Eye

Demand and Future Growth

The industry is poised for growth as investments in transportation infrastructure escalate worldwide. With growing populations, increasing purchasing power, and governments' initiatives to expand transportation infrastructure, especially roadways and highways, the Asia-Pacific region is expected to witness the swiftest expansion in the global crash barrier systems market.

Moreover, heightened consumer awareness regarding the significance and advantages of safety measures is anticipated to drive the growth of the global crash barrier systems market in the foreseeable future. Additionally, the heightened emphasis of key companies on enhancing the stiffness of barrier systems to maximise safety is projected to fuel the demand for crash barrier systems in the coming years.

Supply Side of the Market

According to our analysis, As innovative technologies emerge, manufacturers are embracing advanced techniques to enhance the safety of crash barriers. There is a growing interest in high-tech crash barriers among manufacturers, driven by security and safety considerations.

For example, in May 2019, Delta Scientific introduced the MP5000 mobile development vehicle crash barriers, which are self-contained and capable of providing a stopping power of 7.5 tons at 64 kph. Additionally, various government initiatives focused on improving infrastructure are expected to generate new market opportunities for crash barrier systems.

Global Crash Barrier Systems Market is Segmented as Below:

By Type:

- Portable

- Fixed

By Technology:

- Rigid

- Semi-Rigid

- Flexible

By Device:

- Crash Cushions

- End Treatments

- GEAT

By Application:

- Roadside

- Median

- Work-Zone

- Bridge

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Crash Barrier Systems Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Crash Barrier Systems Market Outlook, 2018 - 2030

3.1. Global Crash Barrier Systems Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Portable

3.1.1.2. Fixed

3.2. Global Crash Barrier Systems Market Outlook, by Technology, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Rigid

3.2.1.2. Semi-Rigid

3.2.1.3. Flexible

3.3. Global Crash Barrier Systems Market Outlook, by Device, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Crash Cushions

3.3.1.2. End Treatments

3.3.1.3. GEAT

3.4. Global Crash Barrier Systems Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights Snacks

3.4.1.1. Roadside

3.4.1.2. Median

3.4.1.3. Work-Zone

3.4.1.4. Bridge

3.5. Global Crash Barrier Systems Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Crash Barrier Systems Market Outlook, 2018 - 2030

4.1. North America Crash Barrier Systems Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Portable

4.1.1.2. Fixed

4.2. North America Crash Barrier Systems Market Outlook, by Technology, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Rigid

4.2.1.2. Semi-Rigid

4.2.1.3. Flexible

4.3. North America Crash Barrier Systems Market Outlook, by Device, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Crash Cushions

4.3.1.2. End Treatments

4.3.1.3. GEAT

4.4. North America Crash Barrier Systems Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights Snacks

4.4.1.1. Roadside

4.4.1.2. Median

4.4.1.3. Work-Zone

4.4.1.4. Bridge

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Crash Barrier Systems Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

4.5.1.2. U.S. Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

4.5.1.3. U.S. Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

4.5.1.4. U.S. Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

4.5.1.5. Canada Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

4.5.1.6. Canada Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

4.5.1.7. Canada Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

4.5.1.8. Canada Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Crash Barrier Systems Market Outlook, 2018 - 2030

5.1. Europe Crash Barrier Systems Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Portable

5.1.1.2. Fixed

5.2. Europe Crash Barrier Systems Market Outlook, by Technology, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Rigid

5.2.1.2. Semi-Rigid

5.2.1.3. Flexible

5.3. Europe Crash Barrier Systems Market Outlook, by Device, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Crash Cushions

5.3.1.2. End Treatments

5.3.1.3. GEAT

5.4. Europe Crash Barrier Systems Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights Snacks

5.4.1.1. Roadside

5.4.1.2. Median

5.4.1.3. Work-Zone

5.4.1.4. Bridge

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Crash Barrier Systems Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

5.5.1.2. Germany Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

5.5.1.3. Germany Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

5.5.1.4. Germany Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

5.5.1.5. U.K. Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

5.5.1.6. U.K. Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

5.5.1.7. U.K. Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

5.5.1.8. U.K. Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

5.5.1.9. France Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

5.5.1.10. France Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

5.5.1.11. France Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

5.5.1.12. France Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

5.5.1.13. Italy Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

5.5.1.14. Italy Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

5.5.1.15. Italy Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

5.5.1.16. Italy Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

5.5.1.17. Turkey Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

5.5.1.18. Turkey Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

5.5.1.19. Turkey Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

5.5.1.20. Turkey Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

5.5.1.21. Russia Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

5.5.1.22. Russia Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

5.5.1.23. Russia Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

5.5.1.24. Russia Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

5.5.1.25. Rest of Europe Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

5.5.1.26. Rest of Europe Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

5.5.1.27. Rest of Europe Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

5.5.1.28. Rest of Europe Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Crash Barrier Systems Market Outlook, 2018 - 2030

6.1. Asia Pacific Crash Barrier Systems Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Portable

6.1.1.2. Fixed

6.2. Asia Pacific Crash Barrier Systems Market Outlook, by Technology, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Rigid

6.2.1.2. Semi-Rigid

6.2.1.3. Flexible

6.3. Asia Pacific Crash Barrier Systems Market Outlook, by Device, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Crash Cushions

6.3.1.2. End Treatments

6.3.1.3. GEAT

6.4. Asia Pacific Crash Barrier Systems Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights Snacks

6.4.1.1. Roadside

6.4.1.2. Median

6.4.1.3. Work-Zone

6.4.1.4. Bridge

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Crash Barrier Systems Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

6.5.1.2. China Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

6.5.1.3. China Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

6.5.1.4. China Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

6.5.1.5. Japan Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

6.5.1.6. Japan Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

6.5.1.7. Japan Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

6.5.1.8. Japan Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

6.5.1.9. South Korea Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

6.5.1.10. South Korea Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

6.5.1.11. South Korea Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

6.5.1.12. South Korea Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

6.5.1.13. India Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

6.5.1.14. India Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

6.5.1.15. India Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

6.5.1.16. India Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

6.5.1.17. Southeast Asia Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

6.5.1.18. Southeast Asia Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

6.5.1.19. Southeast Asia Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

6.5.1.20. Southeast Asia Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Crash Barrier Systems Market Outlook, 2018 - 2030

7.1. Latin America Crash Barrier Systems Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Portable

7.1.1.2. Fixed

7.2. Latin America Crash Barrier Systems Market Outlook, by Technology, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Rigid

7.2.1.2. Semi-Rigid

7.2.1.3. Flexible

7.3. Latin America Crash Barrier Systems Market Outlook, by Device, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Crash Cushions

7.3.1.2. End Treatments

7.3.1.3. GEAT

7.4. Latin America Crash Barrier Systems Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights Snacks

7.4.1.1. Roadside

7.4.1.2. Median

7.4.1.3. Work-Zone

7.4.1.4. Bridge

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Crash Barrier Systems Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

7.5.1.2. Brazil Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

7.5.1.3. Brazil Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

7.5.1.4. Brazil Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

7.5.1.5. Mexico Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

7.5.1.6. Mexico Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

7.5.1.7. Mexico Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

7.5.1.8. Mexico Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

7.5.1.9. Argentina Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

7.5.1.10. Argentina Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

7.5.1.11. Argentina Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

7.5.1.12. Argentina Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

7.5.1.13. Rest of Latin America Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

7.5.1.14. Rest of Latin America Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

7.5.1.15. Rest of Latin America Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

7.5.1.16. Rest of Latin America Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Crash Barrier Systems Market Outlook, 2018 - 2030

8.1. Middle East & Africa Crash Barrier Systems Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Portable

8.1.1.2. Fixed

8.2. Middle East & Africa Crash Barrier Systems Market Outlook, by Technology, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Rigid

8.2.1.2. Semi-Rigid

8.2.1.3. Flexible

8.3. Middle East & Africa Crash Barrier Systems Market Outlook, by Device, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Crash Cushions

8.3.1.2. End Treatments

8.3.1.3. GEAT

8.4. Middle East & Africa Crash Barrier Systems Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights Snacks

8.4.1.1. Roadside

8.4.1.2. Median

8.4.1.3. Work-Zone

8.4.1.4. Bridge

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Crash Barrier Systems Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

8.5.1.2. GCC Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

8.5.1.3. GCC Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

8.5.1.4. GCC Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

8.5.1.5. South Africa Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

8.5.1.6. South Africa Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

8.5.1.7. South Africa Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

8.5.1.8. South Africa Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

8.5.1.9. Egypt Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

8.5.1.10. Egypt Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

8.5.1.11. Egypt Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

8.5.1.12. Egypt Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

8.5.1.13. Nigeria Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

8.5.1.14. Nigeria Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

8.5.1.15. Nigeria Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

8.5.1.16. Nigeria Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

8.5.1.17. Rest of Middle East & Africa Crash Barrier Systems Market by Type, Value (US$ Mn), 2018 - 2030

8.5.1.18. Rest of Middle East & Africa Crash Barrier Systems Market Technology, Value (US$ Mn), 2018 - 2030

8.5.1.19. Rest of Middle East & Africa Crash Barrier Systems Market Device, Value (US$ Mn), 2018 - 2030

8.5.1.20. Rest of Middle East & Africa Crash Barrier Systems Market Application, Value (US$ Mn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Device vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Tata Steel Limited

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Nucor Corporation

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Valmont Industries, Inc.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Hill & Smith Holdings PLC

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Arbus Limited

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Transpo Industries, Inc

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Lindsay Corporation

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Trinity Industries, Inc

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Avon Barrier Corporation Ltd

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Business Strategies and Development

9.5.10. ATG Access Ltd

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Technology Coverage |

|

|

Device Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |