Global Cryogenic Fuels Market Forecast

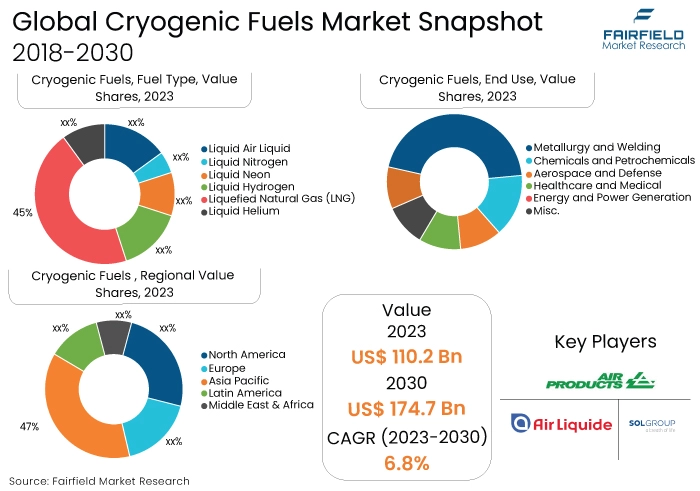

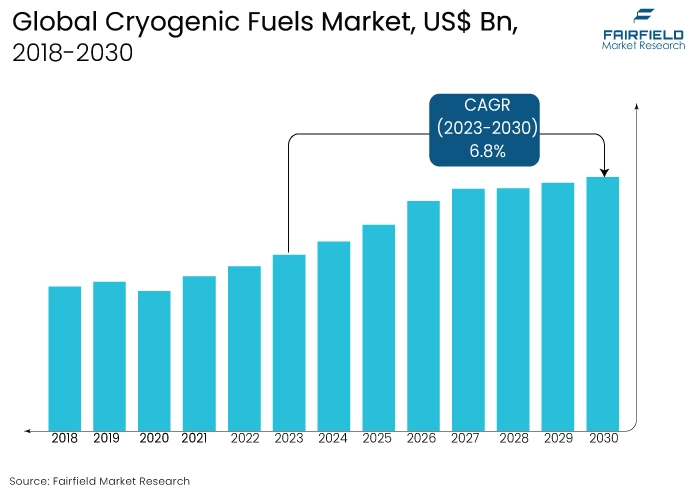

- Global cryogenic fuels market size likely to reach US$174.7 Bn in 2030, up from US$110.2 Bn attained in 2023

- Cryogenic fuels market revenue poised to see 6.8% CAGR between 2023 and 2030

Quick Report Digest

- The key trend anticipated to fuel the cryogenic fuels market growth is the surge in demand for cryogenic fuels worldwide is primarily fuelled by increased needs across sectors such as energy/power generation, manufacturing, aerospace, biomedical & healthcare, and chemical industries.

- Another major market trend expected to fuel the cryogenic fuels market growth is the increase in research and testing facilities, particularly within the pharmaceuticals and biotechnology sectors, which is expected to drive the demand for cryogenic gases used in freezing biotechnology products.

- The global industry is expected to be driven by the deman for technical gases across various sectors to achieve specific temperature levels

- With the growing concerns over environmental sustainability and the need to reduce greenhouse gas emissions, there is a rising demand for cleaner and greener energy solutions

- In 2023, the liquefied natural gas (LNG) category dominated the industry. LNG stands as the predominant cryogenic fuel choice owing to its high energy density, minimal emissions, and convenient transportability.

- In terms of market share for cryogenic fuels globally, the Metallurgy and welding segment is anticipated to dominate due to the widespread utilisation of argon, oxygen, and nitrogen gases in the metallurgy industry.

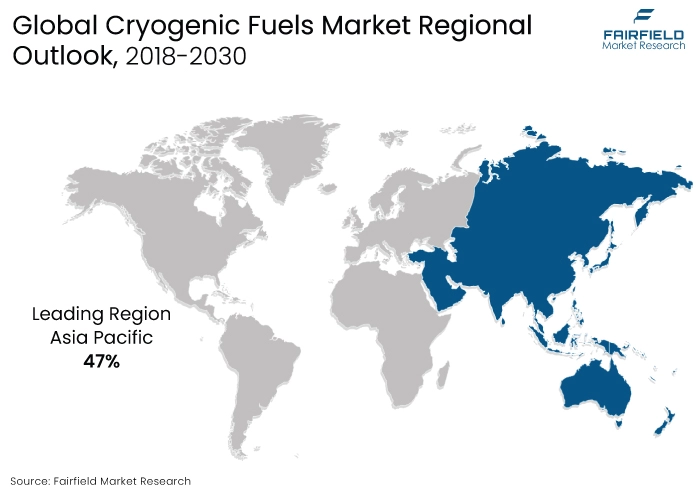

- The Asia Pacific region is anticipated to account for the largest share of the global cryogenic fuels market, owing to due to rising investment in space exploration activities and the existence of government support for renewable energy in the region.

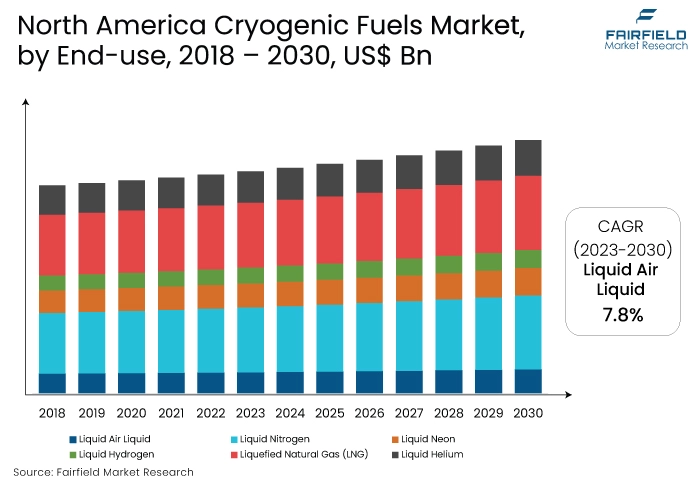

- The market for cryogenic fuels is expanding in North America due to the rising demand for natural gas as a more environmentally friendly substitute for traditional fuels.

A Look Back and a Look Forward - Comparative Analysis

The market for cryogenic fuels has grown in popularity due to improvements in the medical field. This sector has a substantial need for industrial gases, including liquid hydrogen, oxygen, and nitrogen, among others. Liquid nitrogen, in particular, plays a vital role in transplant procedures, particularly for the cryogenic preservation of bodily organs. Moreover, the economic progression observed in developing nations is poised to lead to the establishment of novel research facilities and institutions in the foreseeable future.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of the major end-use application sectors such as chemicals and petrochemicals, healthcare, and medical. However, in some applications, the demand for cryogenic fuels has increased, including aerospace and defense, energy and power generation, metallurgy, and welding.

The expanding number of space and satellite missions worldwide is anticipated to present growth prospects for the cryogenic fuels market. As per the Space Foundation, the global space economy reached $469 billion in 2021, with the commercial space sector experiencing a 6.4% revenue increase since 2020. Additionally, 1,022 spacecraft were deployed into orbit during the initial six months of 2022.

Key Growth Determinants

- Increased Demand from Multiple Industries

The global demand for cryogenic fuels is being primarily propelled by a surge in demand across multiple industries, including energy/power generation, manufacturing, aerospace, biomedical & healthcare, and chemical sectors. According to the Ministry of Power, the electricity generation target for the year 2023-24 is set at 1750 Billion Units (BU), representing a growth of approximately 7.2% over the previous year's actual generation of 1624.158 BU in 2022-23.

The aviation market in India is forecasted to become the world's third-largest by 2024, as per estimates by IBEF and IATA. Investments and developments in the aviation sector were evident in 2021, with Tata Sons acquiring state-run Air India for INR 18,000 crore (USD 2.4 billion) in October 2021.

The healthcare sector exhibits a significant demand for industrial gases like oxygen, liquid oxygen, nitrogen, liquid nitrogen, nitrous oxide, laser mixes, specialty gases, compressed air, and helium. These gases have various applications, including blood bank storage, transplant procedures, and cryogenic storage of body organs. Additionally, the economic growth of emerging countries is expected to drive the establishment of new research facilities and institutes over the next few years.

- Growing Demand for LNG Worldwide

The surge in LNG demand can be attributed to the increasing use of gas-based power plants and the adoption of LNG as a fuel in locomotives and marine transport. The rising energy needs from LNG-powered plants significantly drive market growth. Over the past decade, there has been a notable increase in natural gas consumption globally, with consumption reaching 4,037.5 billion cubic meters in 2021, up from 3,319.4 billion cubic meters in 2012.

According to the World LNG Report 2022, LNG now connects 40 importing countries with 19 export markets, with global liquefaction capacity reaching 459.9 MTPA in 2021. Africa shows substantial potential for LNG development, with 123.9 MTPA of proposed liquefaction awaiting final investment decisions (FID). Consequently, the demand for cryogenic products such as oil tankers, valves, vaporizers, pumps, and refrigerators in the oil and gas sector is on the rise.

- Rising Need for Clean Energy Sources

The increasing demand for clean energy sources is expected to drive market growth in the coming years. India ranked as the 3rd largest energy-consuming country globally, holds the 4th position in renewable energy installed capacity, including wind and solar power. With a target set at COP26 to achieve 500 GW of non-fossil fuel-based energy by 2030, India is making significant strides in renewable energy adoption.

Similarly, the United States installed 17 gigawatts (GWac) of solar photovoltaic (PV) capacity in 2022, reaching a total installed capacity of 110.1 GWdc. The transportation, storage, and regasification applications for generating clean energy show promising potential for market growth.

Furthermore, developments in the healthcare sector in emerging economies and substantial investments in the metallurgical, chemical, and petrochemical industries are expected to drive demand for cryogenic equipment. Consequently, the increasing global awareness of adopting clean energy sources is poised to boost the demand for such equipment in the foreseeable future.

Major Growth Barriers

- Volatile Pricing of Raw Material and Metals, and Significant Competition from Gray Market Players

Cryogenic equipment is crafted from a range of materials, including stainless steel, bronze, carbon steel, and specialised alloys. Recent years have witnessed a notable escalation in the prices of raw materials such as iron ore and other ores, resulting in a consistent upward trajectory in global metal prices, particularly for stainless steel.

China, as the largest producer and exporter of steel, has experienced fluctuations in processed metal prices, impacting various industries. The production of cryogenic equipment necessitates high-quality raw materials, and the escalating costs of these materials have intensified competition among leading cryogenic equipment manufacturers. The surge in prices for cryogenic equipment has also led to a preference for smaller-scale manufacturers in the informal market, notably in countries like China, and India.

Consequently, the fluctuating prices of metals have emerged as a significant challenge for the market. Additionally, alongside major raw material suppliers, the presence of numerous local and regional providers offering materials meeting international standards at competitive prices provides manufacturers with procurement alternatives. This dynamic fosters the existence of unregulated gray market players, further hindering the market's growth.

- Supply Chain Disruption amid Russia-Ukraine Unrest

The conflict between Russia, and Ukraine has exerted a significant influence on the worldwide LNG market, resulting in a surge in prices and disruption of supply chains. Europe, in particular, has faced substantial challenges, given its historical dependence on Russian pipeline gas. In response to the conflict, European nations have urgently sought to diversify their gas sources, with LNG emerging as a crucial alternative.

Before the outbreak of hostilities, approximately 40% of Europe's natural gas was sourced from Russia. However, in the aftermath of the invasion, European countries have taken steps to lessen their reliance on Russian gas, leading to a notable increase in LNG imports. In 2022, European LNG imports witnessed a 60% rise compared to the previous year.

This surge in European demand for LNG has had ripple effects on global LNG prices, which have skyrocketed to unprecedented levels. By March 2022, the benchmark European LNG price had surpassed USD 80 per million British thermal units (MMBtu), marking a more than fourfold increase from the beginning of the year. Moreover, the conflict has also impacted Asian LNG demand.

Key Trends and Opportunities to Look at

- Evolving Applications of Cryogenic Electronics

Cryogenic gases are essential components in the manufacturing and testing processes of semiconductors. Liquid nitrogen, in particular, serves as a widely utilised coolant for dissipating heat generated during manufacturing. By employing extremely low temperatures, which can approach absolute zero, electronics can be developed with heightened performance, reduced noise, and enhanced efficiency.

Additionally, subjecting electronics to cryogenic treatment helps minimise gaps within their metallic components, thereby improving thermal and electrical conductivity while reducing operating power requirements, consequently enhancing reliability. The applications of cryogenic electronics are expanding, notably in the realm of quantum computing development. Quantum bits (qubits) demand precise temperature control near absolute zero to mitigate environmental interference, which cryogenic electronic systems facilitate.

Similarly, cryogenic electronics play pivotal roles in low-noise amplifiers (LNAs) for radio astronomy and astrophysics, as well as in medical imaging devices like magnetic resonance imaging (MRI). By lowering temperatures to extremely low levels, electronic noise is reduced, thereby enhancing device sensitivity and improving data acquisition quality.

- Rising Improvements in Medical Field

The advancement of medical technologies is contributing to the expansion of the cryogenic fuels market. This sector exhibits a robust demand for industrial gases such as liquid hydrogen, oxygen, and nitrogen. Liquid nitrogen, in particular, plays a crucial role in transplant procedures, particularly in the cryogenic storage of body organs.

Moreover, the economic growth observed in developing nations is poised to foster the establishment of new research institutions and facilities shortly. This anticipated growth in research and testing facilities, especially within biotechnology and pharmaceuticals, is projected to drive the demand for cryogenic gases for the freezing of biotechnology products, consequently supporting the growth of the cryogenic fuel market.

Additionally, increased government funding in the medical sector, as evidenced by federal funding initiatives such as the national Medicare program for adults aged 65 and older, veterans' programs, and Medicaid, is expected to further stimulate market growth.

- Increasing Number of Space Missions, and Innovations in Cryo-Electronics

The liquid propulsion systems centre (LPSC) at Valiyamala recently held a press conference during the "Engineers Conclave 2022." At the event, the Centre unveiled its plans to incorporate semi-cryogenic technology into its rockets, aiming to enhance performance while reducing costs. This innovative approach may pave the way for the development of reusable rockets.

The space industry is evolving with the adoption of new technologies such as reusable launch vehicles, semi-cryogenic engines, and two-stage-to-orbit rocket launch vehicles, opening up new opportunities for advancement.

How Does the Regulatory Scenario Shape this Industry?

The European Union is committed to achieving climate neutrality by significantly reducing emissions of Sulfur and Nitrogen Oxides (SOx, NOx), carbon dioxide (CO2), and greenhouse gases (GHGs) to foster environmentally friendly industries (European Commission, 2019a, b). The shipping industry, operating within European waters, must adhere to stringent regulations aligned with international standards set by the International Maritime Organization (IMO) (IMO, 2008).

To mitigate hazardous emissions from ships, new technologies focusing on alternative low-flashpoint fuels are being explored. Among the most promising alternatives are low-carbon fuels such as LNG, LPG, and methanol, which can deliver mid-term benefits by leveraging existing technologies and infrastructure. Furthermore, ammonia, hydrogen, and electrification are emerging as long-term solutions that aim to facilitate a transition towards a zero-carbon shipping industry in the future.

Fairfield’s Ranking Board

Top Segmentats

- Liquefied Natural Gas (LNG) Category Continues to Dominate over Top Fuel Type Segments

The liquefied natural gas (LNG) segment dominated the market in 2023. The expansion of the cryogenic industry is spurring advancements in cryogenic technology, leading to the development of more efficient and cost-effective solutions for storage and transportation. According to the International Energy Agency (IEA), the global trade value of Liquefied Natural Gas (LNG) surged to an unprecedented high of US$450 Bn in 2022, doubling from the previous year.

LNG played a pivotal role in mitigating the impact of Russia's substantial reduction in pipeline gas supplies to the European Union (EU) in 2022, helping to avert a shortage of gas supply. Intense competition for flexible LNG shipments between Asia, and Europe exerted significant upward pressure on hub and LNG spot prices throughout the year. Transporting and storing natural gas as LNG involves maintaining temperatures as low as -162°C (-260°F), necessitating specialised cryogenic equipment to uphold these extremely low temperatures.

Furthermore, the liquid air liquid category is projected to experience the fastest market growth. Recent technological advancements in utilising liquid air have propelled market growth. Liquid air is now employed in rocket propellants for launching satellites dedicated to broadcast, communication, and meteorology into space.

Additionally, major companies are investing in research and development endeavors to enhance methods for producing and distributing liquid air worldwide. These factors are poised to stimulate global demand for liquid air in the foreseeable future. However, the COVID-19 pandemic has dampened both the demand and production of liquid air due to slowdowns in commercial, transportation, and industrial activities. This trend is expected to persist until government-imposed lockdown measures are lifted and industrial activities resume.

- Metallurgy and Welding Segment will Surge Ahead

In 2023, the metallurgy and welding category dominated the industry. Nitrogen finds extensive applications in metallurgy, serving purposes such as annealing, neutral hardening, sintering, cyanidation, and blast furnace operations. The growing metallurgical sector and increasing demand for technical gases are driving growth in this segment. Furthermore, the food and beverage segment is expected to experience significant expansion in the forecast period.

The increasing popularity and demand for frozen food products have led to substantial growth in the food and beverage industries. Moreover, the promotion of environmentally friendly products to reduce carbon footprints has influenced the adoption of freesing technology and the enactment of legislation governing the food and beverage sector.

The chemical and petrochemical category is anticipated to grow substantially throughout the projected period. Significant growth is anticipated in the chemical and petrochemical industry due to its utilisation in oxidation processes, coal gasification, sulfur recovery units, catalyst regeneration, reactor cooling, and various other applications.

Regional Frontrunners

Asia Pacific Remains the Largest Revenue Contributing Region

Asia Pacific is poised for significant growth in the global cryogenic fuels market, driven by increasing investments in space exploration activities, advancing technological capabilities, and growing demand for iron and steel across various industries in the region. The rise in investment in space exploration is a key factor propelling market expansion.

For example, as reported by Economics Times on June 6th, 2018, the government pledged Rs 10,469 crore to the Indian Space Agency to construct 40 rockets over the ensuing five years, including ten heavy rockets such as the Geo Synchronous Satellite Launch Vehicle (GSLVMk-III) designed to launch 4-tonne communication satellites into space.

Furthermore, the escalating pace of technological advancements is also contributing to market growth in this region. As evidenced by Skyroot's successful test firing of India's first privately developed cryogenic rocket engine on November 29th, 2021, technological breakthroughs are playing a significant role in advancing the market.

North America at the Forefront of LNG Exports

In North America, the US, and Canada present substantial potential for LNG exports. As coal resources diminish, LNG-based power plants are gaining market share, creating growth opportunities for cryogenic equipment and driving market expansion. The demand for gas is anticipated to rise in the coming years, largely driven by growth in the industrial and power sectors.

The US government's plan to add 18 GW of new gas-based power plants by 2020, expected to be completed by 2022, underscores this trend. Additionally, the US is prioritising the manufacturing and processing industry, including machinery and primary metals production, which collectively contribute to 11% of the US economy.

Fairfield’s Competitive Landscape Analysis

The global cryogenic fuels market is a consolidated market with fewer major players present across the globe. With the increasing demand for clean energy sources and advanced cryogenic technologies, the competition in the global cryogenic fuels market is anticipated to remain intense. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in Global Cryogenic Fuels Space?

- Air Liquide

- Linde plc (formerly known as Praxair)

- Air Products and Chemicals, Inc.

- Chart Industries

- Messer Group

- Praxair

- Wessington Cryogenics

- VRV S.p.A.

- Inoxcva

- Messer Group GmbH

- SOL Group

Significant Company Developments

New Product Launch

- July 2021: Inox India unveiled the inauguration of a new manufacturing facility in the United States aimed at producing cryogenic equipment and components tailored to the North American market. Collaborating with various partners, Inox India has also been actively involved in the development of novel cryogenic applications across healthcare, transportation, and energy sectors.

- July 2023: Chart Industries inaugurated its second facility in Alabama, geared towards fabricating the largest shop-built cryogenic tanks ever manufactured worldwide. These tanks, anticipated to be 70% larger than previous models, are scheduled for production commencement in the first quarter of 2024. The tanks manufactured at this facility will serve as propellant storage solutions in the aerospace industry, as well as hydrogen and LNG storage solutions in the marine industry, among various other applications in the sciences and decarbonisation sectors.

- November 2019: Ampco Pumps introduced Cryo-pump technology tailored for low-temperature processing applications. These pumps are meticulously designed with highly specialised internal seals for both centrifugal and positive displacement pumps, enabling processing at temperatures as low as -70°F / -56°C.

Distribution Agreement

- April 2023: Linde entered into an agreement with Evonik, a leading specialty chemicals company, to provide green hydrogen in Singapore. As per the terms of the agreement, Linde will construct, own, and operate a nine-megawatt alkaline electrolyzer plant located on Jurong Island, Singapore. The plant's primary function will be to produce green hydrogen, which Evonik will utilise in the manufacturing of methionine, a vital ingredient in animal feed.

- March 2023: Air Products and Chemicals, Inc. partnered with Shaanxi LNG Reserves & Logistics Company to sign a deal aimed at supplying its exclusive liquefied natural gas (LNG) process technology and equipment to Technip Energies for the Xi'An LNG Emergency Reserve & Peak Regulation Project, situated in ShaanXi Province, China.

An Expert’s Eye

Demand and Future Growth

Major economies worldwide are dedicating a substantial portion of their GDP towards space exploration endeavors and the deployment of new satellites. Competition among space agencies has remained notably intense over several decades. Presently, numerous nations are making significant investments in space launch initiatives to achieve significant milestones in space exploration and advance research and development to potentially lead in pioneering new space technologies.

For instance, NASA allocated over $22,630.0 million towards space exploration activities in 2019, while China's CNSA (China National Space Administration) received a budget exceeding $11,000.0 million for the same year. However, the Cryogenic Fuels market is expected to face considerable challenges because of limited availability.

Supply Side of the Market

According to our analysis, investments in the energy sector have surged, resulting in a significant demand for cryogenic fuels in the region. This region is evolving into the fastest-growing end-market for energy, power, and associated technologies. Additionally, substantial growth in related industries such as aerospace, chemical manufacturing, food and beverages, and energy & power is further driving the expansion of the cryogenic fuels market.

Moreover, major economies such as the U.S., China, and India are making substantial investments in space exploration activities. This is attributed to the presence of ambitious space programs slated for the coming years, including ISRO’s Chandrayaan-3 and the Gaganyaan mission in 2021, as well as JAXA’s mission to send its rover to the lunar surface in 2021, among others. These projects from various space agencies are anticipated to attract significant investments into the space launch industry, consequently boosting the demand for cryogenic fuels.

Global Cryogenic Fuels Market is Segmented as Below:

By Fuel Type:

- Liquid Air Liquid

- Liquid Nitrogen

- Liquid Neon

- Liquid Hydrogen

- Liquefied Natural Gas (LNG)

- Liquid Helium

By End Use:

- Aerospace and Defense

- Healthcare and Medical

- Energy and Power Generation

- Metallurgy and Welding

- Chemicals and Petrochemicals

By Geographic Coverage:

- North America

- The U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Cryogenic Fuels Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Cryogenic Fuels Market Outlook, 2018 - 2030

3.1. Global Cryogenic Fuels Market Outlook, by Fuel Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Liquid Air Liquid

3.1.1.2. Liquid Nitrogen

3.1.1.3. Liquid Neon

3.1.1.4. Liquid Hydrogen

3.1.1.5. Liquefied Natural Gas (LNG)

3.1.1.6. Liquid Helium

3.2. Global Cryogenic Fuels Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Aerospace and Défense

3.2.1.2. Healthcare and Medical

3.2.1.3. Energy and Power Generation

3.2.1.4. Metallurgy and Welding

3.2.1.5. Chemicals and Petrochemicals

3.2.1.6. Misc.

3.3. Global Cryogenic Fuels Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Cryogenic Fuels Market Outlook, 2018 - 2030

4.1. North America Cryogenic Fuels Market Outlook, by Fuel Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Liquid Air Liquid

4.1.1.2. Liquid Nitrogen

4.1.1.3. Liquid Neon

4.1.1.4. Liquid Hydrogen

4.1.1.5. Liquefied Natural Gas (LNG)

4.1.1.6. Liquid Helium

4.2. North America Cryogenic Fuels Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Aerospace and Défense

4.2.1.2. Healthcare and Medical

4.2.1.3. Energy and Power Generation

4.2.1.4. Metallurgy and Welding

4.2.1.5. Chemicals and Petrochemicals

4.2.1.6. Misc.

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Cryogenic Fuels Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

4.3.1.2. U.S. Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

4.3.1.3. Canada Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

4.3.1.4. Canada Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Cryogenic Fuels Market Outlook, 2018 - 2030

5.1. Europe Cryogenic Fuels Market Outlook, by Fuel Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Liquid Air Liquid

5.1.1.2. Liquid Nitrogen

5.1.1.3. Liquid Neon

5.1.1.4. Liquid Hydrogen

5.1.1.5. Liquefied Natural Gas (LNG)

5.1.1.6. Liquid Helium

5.2. Europe Cryogenic Fuels Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Aerospace and Défense

5.2.1.2. Healthcare and Medical

5.2.1.3. Energy and Power Generation

5.2.1.4. Metallurgy and Welding

5.2.1.5. Chemicals and Petrochemicals

5.2.1.6. Misc.

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Cryogenic Fuels Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

5.3.1.2. Germany Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

5.3.1.3. U.K. Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

5.3.1.4. U.K. Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

5.3.1.5. France Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

5.3.1.6. France Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

5.3.1.7. Italy Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

5.3.1.8. Italy Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

5.3.1.9. Turkey Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

5.3.1.10. Turkey Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

5.3.1.11. Russia Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

5.3.1.12. Russia Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

5.3.1.13. Rest of Europe Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

5.3.1.14. Rest of Europe Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Cryogenic Fuels Market Outlook, 2018 - 2030

6.1. Asia Pacific Cryogenic Fuels Market Outlook, by Fuel Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Liquid Air Liquid

6.1.1.2. Liquid Nitrogen

6.1.1.3. Liquid Neon

6.1.1.4. Liquid Hydrogen

6.1.1.5. Liquefied Natural Gas (LNG)

6.1.1.6. Liquid Helium

6.2. Asia Pacific Cryogenic Fuels Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Aerospace and Défense

6.2.1.2. Healthcare and Medical

6.2.1.3. Energy and Power Generation

6.2.1.4. Metallurgy and Welding

6.2.1.5. Chemicals and Petrochemicals

6.2.1.6. Misc.

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Cryogenic Fuels Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

6.3.1.2. China Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

6.3.1.3. Japan Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

6.3.1.4. Japan Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

6.3.1.5. South Korea Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

6.3.1.6. South Korea Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

6.3.1.7. India Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

6.3.1.8. India Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

6.3.1.9. Southeast Asia Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

6.3.1.10. Southeast Asia Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Cryogenic Fuels Market Outlook, 2018 - 2030

7.1. Latin America Cryogenic Fuels Market Outlook, by Fuel Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Liquid Air Liquid

7.1.1.2. Liquid Nitrogen

7.1.1.3. Liquid Neon

7.1.1.4. Liquid Hydrogen

7.1.1.5. Liquefied Natural Gas (LNG)

7.1.1.6. Liquid Helium

7.2. Latin America Cryogenic Fuels Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Aerospace and Défense

7.2.1.2. Healthcare and Medical

7.2.1.3. Energy and Power Generation

7.2.1.4. Metallurgy and Welding

7.2.1.5. Chemicals and Petrochemicals

7.2.1.6. Misc.

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Cryogenic Fuels Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

7.3.1.2. Brazil Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

7.3.1.3. Mexico Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

7.3.1.4. Mexico Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

7.3.1.5. Argentina Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

7.3.1.6. Argentina Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

7.3.1.7. Rest of Latin America Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

7.3.1.8. Rest of Latin America Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Cryogenic Fuels Market Outlook, 2018 - 2030

8.1. Middle East & Africa Cryogenic Fuels Market Outlook, by Fuel Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Liquid Air Liquid

8.1.1.2. Liquid Nitrogen

8.1.1.3. Liquid Neon

8.1.1.4. Liquid Hydrogen

8.1.1.5. Liquefied Natural Gas (LNG)

8.1.1.6. Liquid Helium

8.2. Middle East & Africa Cryogenic Fuels Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Aerospace and Défense

8.2.1.2. Healthcare and Medical

8.2.1.3. Energy and Power Generation

8.2.1.4. Metallurgy and Welding

8.2.1.5. Chemicals and Petrochemicals

8.2.1.6. Misc.

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Cryogenic Fuels Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

8.3.1.2. GCC Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

8.3.1.3. South Africa Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

8.3.1.4. South Africa Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

8.3.1.5. Egypt Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

8.3.1.6. Egypt Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

8.3.1.7. Nigeria Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

8.3.1.8. Nigeria Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Cryogenic Fuels Market by Fuel Type, Value (US$ Mn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Cryogenic Fuels Market End Use, Value (US$ Mn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Capacity vs End Use Heatmap

9.2. Manufacturer vs End Use Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Air Liquide

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Linde plc (formerly known as Praxair)

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Air Products and Chemicals, Inc.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Chart Industries

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Messer Group

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Praxair

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Wessington Cryogenics

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. VRV S.p.A

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Inoxcva

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Business Strategies and Development

9.5.10. Messser Garoup GmbH

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. SOL Group

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.11.5.

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Fuel Type Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |